Global Personalized Nutrient Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD2293

December 2024

89

About the Report

Global Personalized Nutrient Market Overview

- In 2023, the global personalized nutrient market was valued at USD 12 billion, driven by increasing consumer demand for tailored nutritional solutions. Consumers are increasingly seeking personalized health and wellness products that cater to their individual needs, influenced by factors such as genetic testing, lifestyle analysis, and chronic disease management. The integration of technology, such as AI and data analytics, has also made it easier to develop customized nutritional products, further propelling the market growth.

- Major players in the global personalized nutrient market include Nutrigenomix, Care/of, Amway, Persona Nutrition, and DNAfit. These companies have established themselves by offering a range of tailored vitamins, minerals, and supplements based on genetic testing, health assessments, and consumer preferences. Nutrigenomix, in particular, has leveraged advanced DNA testing to create personalized nutrition plans, making it a leader in the space alongside traditional supplement brands like Amway.

- In 2023, the European Commission launched the "Personalized Nutrition for Health" initiative, aimed at promoting research and development in the field of personalized nutrition. With a funding pool of USD 150 million, this initiative is expected to support advancements in technology and data integration, facilitating the growth of the personalized nutrient market. The initiative also aims to address nutritional needs across different population demographics, supporting the uptake of personalized solutions across the EU.

- The global personalized nutrient market is dominated by urban hubs in North America, Europe, and parts of Asia. Cities like New York, London, and Tokyo lead the market due to high consumer awareness, robust healthcare infrastructure, and the presence of leading companies in the personalized health sector.

Global Personalized Nutrient Market Segmentation

By Product Type: The personalized nutrient market is segmented by product type into vitamins and minerals, probiotics, and macronutrients. In 2023, vitamins and minerals dominate the market share in this segment, driven by the increasing use of genetic testing to personalize these supplements based on individual health needs. Consumers are increasingly looking for products that address specific deficiencies or support wellness goals, which has been further encouraged by personalized online platforms offering tailored vitamin packs.

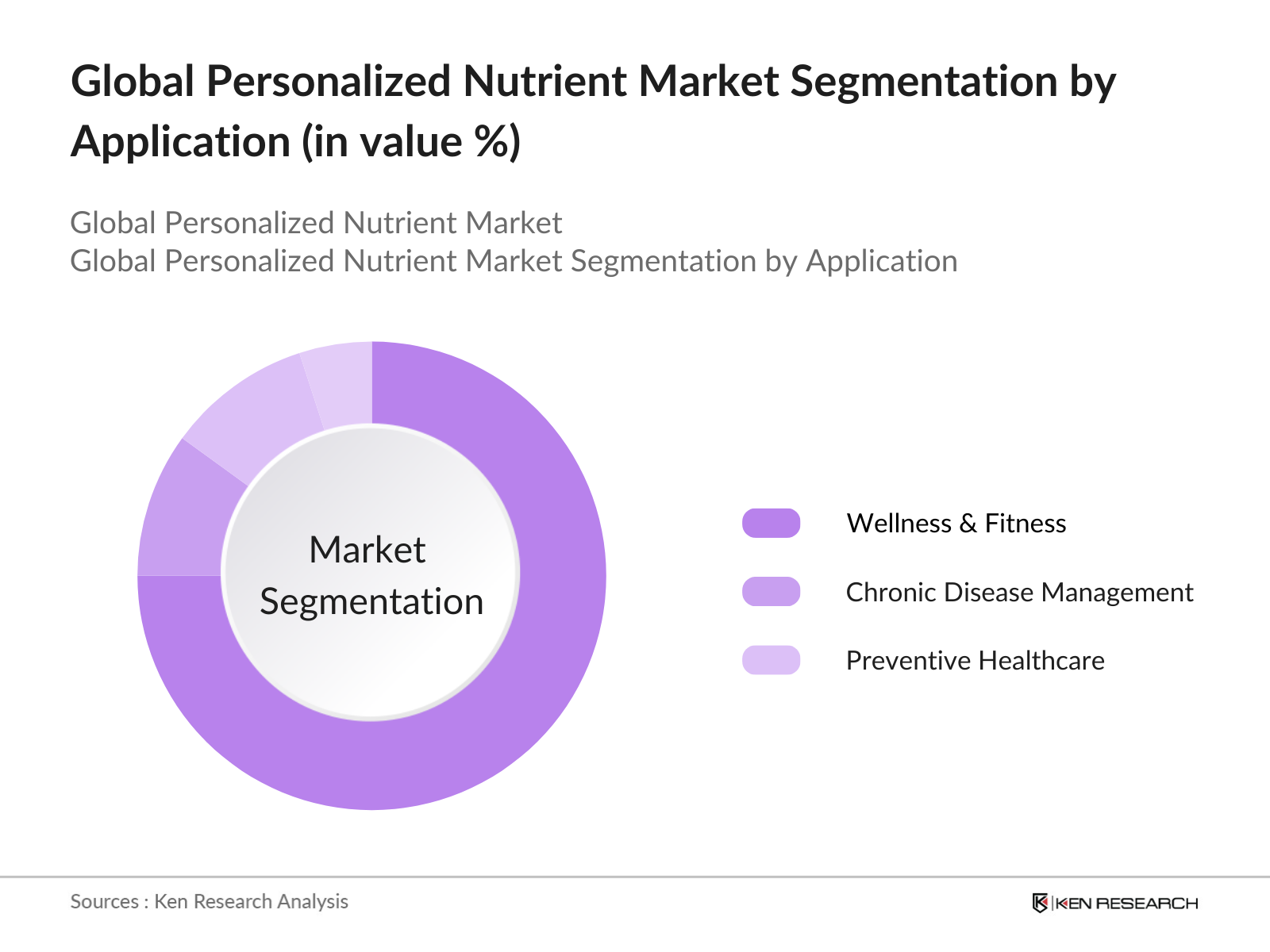

By Application: The market is further segmented by application into wellness & fitness, chronic disease management, and preventive healthcare. In 2023, the wellness & fitness segment holds a dominant position due to the rising trend of personalized nutrition plans for enhancing athletic performance and overall wellness. The segment has witnessed a boom due to the increased adoption of wearable devices and mobile health applications that provide real-time data on nutrient requirements, particularly among fitness-conscious consumers.

By Region: The personalized nutrient market is segmented regionally into North America, Europe, APAC, MEA, and Latin America. In 2023, North America held a dominant market share in this segment, driven by a high level of consumer awareness about health and wellness, advanced healthcare infrastructure, and a strong presence of personalized nutrition companies. The region has seen rapid adoption of genetic testing and data-driven health solutions, particularly in the U.S. and Canada. Furthermore, North America has become a hub for innovation in health technologies and startups focusing on personalized nutrition, significantly contributing to the growth of the market in this region.

Global Personalized Nutrient Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Nutrigenomix |

2012 |

Toronto, Canada |

|

Care/of |

2016 |

New York, USA |

|

Persona Nutrition |

2017 |

Seattle, USA |

|

DNAfit |

2013 |

London, UK |

|

Amway |

1959 |

Michigan, USA |

- Nutrigenomix: In 2023, Nutrigenomix launched a new DNA-based nutrition test specifically designed to cater to pregnant women, helping them optimize their diets during pregnancy. The test includes over 40 genetic markers related to nutrient metabolism, making it a significant innovation in personalized maternal health. This expansion comes at a time when more consumers are turning to genetic testing to tailor their diets for health and wellness.

- Care/of: In June 2024, Care/of expanded its business by launching a subscription-based personalized nutrition service in Japan, capitalizing on the growing demand for health supplements in Asia. The company invested USD 50 million in this expansion and collaborated with local healthcare providers to offer DNA-based nutritional recommendations, targeting the wellness-conscious population in Japan.

Global Personalized Nutrient Market Analysis

Growth Drivers

- Increasing Consumer Demand for Personalized Health Solutions: The rising consumer awareness about the role of personalized nutrition in preventive healthcare has driven market demand significantly. According to a 2023 survey conducted by the European Commission, approximately 68 million consumers across Europe were actively seeking customized nutrition solutions, with many opting for products aligned with their genetic profiles and lifestyles. This trend is most pronounced in countries with advanced healthcare systems, where personalized wellness programs are becoming mainstream. By the end of 2024, it is expected that consumer spending on personalized nutrition in the US alone will reach USD 7.2 billion, demonstrating a steady uptake driven by lifestyle-oriented health management.

- Technological Advancements in Genetic Testing and Data Analytics: The integration of technologies such as DNA sequencing, artificial intelligence (AI), and big data analytics has revolutionized the personalized nutrient market. In 2023, the global expenditure on genetic testing technologies was valued at USD 5.1 billion, and more than 50 companies worldwide offered direct-to-consumer genetic testing kits. The availability of this data enables the development of personalized supplements and dietary plans, creating substantial growth opportunities for companies that specialize in tailored nutrition

- Increasing Prevalence of Chronic Diseases: The rise in chronic diseases such as diabetes, cardiovascular disorders, and obesity is driving the need for personalized nutritional solutions. In 2023, there were more than 530 million people globally diagnosed with diabetes, and personalized nutrition is being adopted as part of disease management strategies. Healthcare providers are now incorporating nutrigenomics into routine care for patients with chronic illnesses, further propelling the market.

Challenges

- High Costs Associated with Personalized Nutrition: Despite the growing popularity, the high cost of personalized nutrition products and services remains a significant challenge. Genetic testing kits, which form the backbone of personalized nutrient programs, can cost up to USD 250 per consumer. Furthermore, tailored supplements tend to be priced higher than generic products due to their customized nature, limiting accessibility for low- to middle-income consumers. A 2023 report by the US National Institutes of Health revealed that only 30% of individuals who undergo genetic testing for personalized nutrition recommendations continue to purchase such supplements due to the high costs associated with them.

- Lack of Standardization and Regulatory Oversight: The personalized nutrient market faces regulatory challenges, especially concerning the standardization of products and services. In many countries, there is a lack of a unified framework for evaluating the safety and efficacy of personalized supplements. For example, the US Food and Drug Administration (FDA) has not yet developed specific guidelines for regulating DNA-based nutritional products.

Government Initiatives

- European Commissions "Personalized Nutrition for Health" Initiative (2023): In 2023, the European Commission launched the "Personalized Nutrition for Health" initiative, aimed at advancing research in personalized dietary solutions and integrating them into national healthcare systems across the EU. The initiative allocated USD 150 million for funding research in personalized nutrition technologies, with the goal of improving public health outcomes. The program emphasizes collaboration between governments, healthcare providers, and private companies to ensure that personalized nutrition products meet safety and efficacy standards.

- US FDA's Modernization of Nutrigenomics Guidelines (2024): In response to the growing demand for personalized dietary products, the US Food and Drug Administration (FDA) updated its guidelines for the nutrigenomics industry in 2024. This regulatory change aims to provide a clearer framework for companies developing genetic-based dietary supplements, ensuring that products are backed by scientific evidence and meet stringent safety criteria. The initiative, valued at USD 25 million in research and regulatory reform, aims to enhance consumer protection and foster innovation in the personalized nutrition sector.

Global Personalized Nutrient Market Future Outlook

The future outlook for the global personalized nutrient market looks promising, with significant growth expected in the next five years. Advances in genetic testing, AI, and data analytics will continue to shape the market, making personalized nutrition more accessible to the global population. As consumers become more health-conscious and demand for tailored solutions increases, companies in this space will be better positioned to capture market share. Governments worldwide are also expected to play a more active role in promoting personalized health solutions, as part of their public health initiatives, further driving the markets expansion.

Future Trends

- Expansion of AI-Based Nutritional Platforms: AI-powered platforms will become more prevalent in the personalized nutrient market, enabling companies to offer highly accurate dietary recommendations based on real-time data. These platforms will use advanced algorithms to analyze consumer health data, such as genetic tests and lifestyle factors, to deliver personalized nutrient plans that can adapt dynamically to changing health conditions.

- Integration of Wearable Technology in Personalized Nutrition: Wearable devices that track biometric data, such as glucose levels, heart rate, and activity levels, will play a crucial role in the future of personalized nutrition. These devices will provide real-time feedback to consumers and nutritionists, allowing for more precise adjustments to dietary plans based on an individuals immediate health needs. This trend will be particularly impactful in managing chronic diseases.

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Nutraceutical Companies

Healthcare Providers and Hospitals

Pharmaceutical Manufacturers

Dietary Supplement Manufacturers

Health and Wellness Platforms

Genetic Testing Companies

Insurance Providers

Fitness and Wellness Centers

Digital Health Solution Providers

Government and Regulatory Bodies (European Commission, FDA)

Investors and Venture Capitalist Firms

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Nutrigenomix

Care/of

Persona Nutrition

DNAfit

Amway

Thorne Research

Vitagene

Nutritional Genomics Institute

Baze

Rootine

Genopalate

Viome

Herbalife Nutrition

LifecodeGX

Sun Genomics

Table of Contents

1. Global Personalized Nutrient Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Global Market Growth Rate (CAGR and Market Size)

1.5. Market Segmentation Overview

1.6. Value Chain Analysis

1.7. Stakeholder Mapping (Suppliers, Manufacturers, Distributors, Consumers)

2. Global Personalized Nutrient Market Size (in USD Million)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

2.4. Financial and Operational Metrics (Revenue, Net Profit, Margins)

2.5. Future Market Projections

3. Global Personalized Nutrient Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Prevalence of Chronic Diseases

3.1.2. Consumer Demand for Tailored Health Solutions

3.1.3. Technological Advancements in Genetic Testing and AI

3.2. Market Restraints

3.2.1. High Cost of Personalized Supplements

3.2.2. Regulatory Uncertainty

3.2.3. Data Privacy Concerns

3.3. Market Opportunities

3.3.1. Expansion into Emerging Markets (APAC, Latin America)

3.3.2. Integration of Wearables and Digital Health Platforms

3.3.3. Innovations in Nutrigenomics

3.4. Key Trends

3.4.1. Rise in Preventive Healthcare Adoption

3.4.2. Mergers and Acquisitions by Leading Players

3.4.3. Growth of Subscription-Based Supplement Services

3.5. Government Regulations and Policy

3.5.1. European Commissions "Personalized Nutrition for Health" Initiative

3.5.2. US FDA Nutrigenomics Guidelines

3.5.3. Japanese "Personalized Nutrition and Wellness" Strategy

3.6. SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7. Competitive Landscape Overview

4. Global Personalized Nutrient Market Segmentation

4.1. By Product Type (in value %)

4.1.1. Vitamins & Minerals

4.1.2. Probiotics

4.1.3. Macronutrients

4.1.4. Functional Beverages

4.2. By Application (in value %)

4.2.1. Wellness & Fitness

4.2.2. Chronic Disease Management

4.2.3. Preventive Healthcare

4.3. By Distribution Channel (in value %)

4.3.1. Online Platforms

4.3.2. Healthcare Providers and Clinics

4.3.3. Retail Pharmacies

4.4. By Technology (in value %)

4.4.1. Genetic Testing

4.4.2. AI-based Nutrition Platforms

4.4.3. Wearable Device Integration

4.5. By Region (in value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific (APAC)

4.5.4. Middle East & Africa (MEA)

4.5.5. Latin America

5. Global Personalized Nutrient Market Competitor Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Nutrigenomix

5.1.2. Care/of

5.1.3. Persona Nutrition

5.1.4. DNAfit

5.1.5. Amway

5.1.6. Thorne Research

5.1.7. Vitagene

5.1.8. Nutritional Genomics Institute

5.1.9. Baze

5.1.10. Rootine

5.1.11. Genopalate

5.1.12. Viome

5.1.13. Herbalife Nutrition

5.1.14. LifecodeGX

5.1.15. Sun Genomics

5.2. Cross Comparison Parameters (Revenue, Headquarters, Inception Year, No. of Employees)

5.3. Market Share Analysis (Top 5 Companies)

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Financial Performance Analysis

6. Global Personalized Nutrient Market Competitive Landscape

6.1. Market Competition Overview

6.2. Key Competitive Strategies (Partnerships, Expansions, New Product Launches)

6.3. Innovation and R&D Focus

6.4. Investment and Funding Analysis

6.4.1. Venture Capital Funding

6.4.2. Private Equity Investments

6.4.3. Government Grants and Subsidies

7. Global Personalized Nutrient Market Regulatory Framework

7.1. Regulatory Overview (FDA, EMA, APAC)

7.2. Compliance and Certification Requirements

7.3. Ethical and Legal Considerations in Genetic Testing

7.4. Cross-Country Regulatory Analysis (North America, Europe, APAC, MEA, Latin America)

8. Global Personalized Nutrient Market Future Projections

8.1. Market Size Projections (USD Million)

8.2. Key Factors Driving Future Growth

8.3. Projected Industry Transformations (2024-2028)

9. Global Personalized Nutrient Market Analyst Insights and Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2. Customer Behavior and Preferences Analysis

9.3. Market Penetration Strategies

9.4. White Space Opportunity Analysis

9.5. Investment Recommendations

10. Global Personalized Nutrient Market Technological Innovations

10.1. Advances in Nutrigenomics and DNA Sequencing

10.2. Role of AI and Big Data in Personalization

10.3. Integration of Wearable Devices and Mobile Health Applications

11. Global Personalized Nutrient Market Ecosystem Mapping

11.1. Key Stakeholders (Manufacturers, Healthcare Providers, Genetic Testing Labs)

11.2. Value Chain Analysis

11.3. Partner Ecosystem and Collaborations

12. Appendices

13. Disclaimer

14. Contact Us

Frequently Asked Questions

01. How big is the global personalized nutrient market?

The global personalized nutrient market was valued at USD 12 billion in 2023. It is driven by consumer demand for customized health solutions and innovations in genetic testing and data analytics that enable tailored nutritional products.

02. What are the challenges in the global personalized nutrient market?

The challenges in the global personalized nutrient market include high costs associated with personalized nutrition products, lack of standardization and regulatory frameworks, and consumer concerns over data privacy, especially with genetic testing.

03. Who are the major players in the global personalized nutrient market?

Major players in the global personalized nutrient market include Nutrigenomix, Care/of, Persona Nutrition, DNAfit, and Amway. These companies lead the market by offering customized supplements and personalized health solutions based on genetic and lifestyle data.

04. What are the growth drivers of the global personalized nutrient market?

Key growth drivers include increasing consumer awareness of personalized health, technological advancements in genetic testing, and the growing prevalence of chronic diseases such as diabetes and cardiovascular disorders, which drive demand for tailored nutrition solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.