Global Pet Care Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD10734

December 2024

86

About the Report

Global Pet Care Market Overview

- The Global Pet Care Market is valued at USD 246.5 billion, with growth driven by rising pet ownership and an increasing awareness of pet health and well-being. This robust expansion is attributed to factors such as product innovations, particularly in premium and organic food options, as well as advanced veterinary healthcare services. Additionally, the integration of digital platforms for pet care services has amplified the convenience and accessibility of pet care solutions, fostering steady market growth.

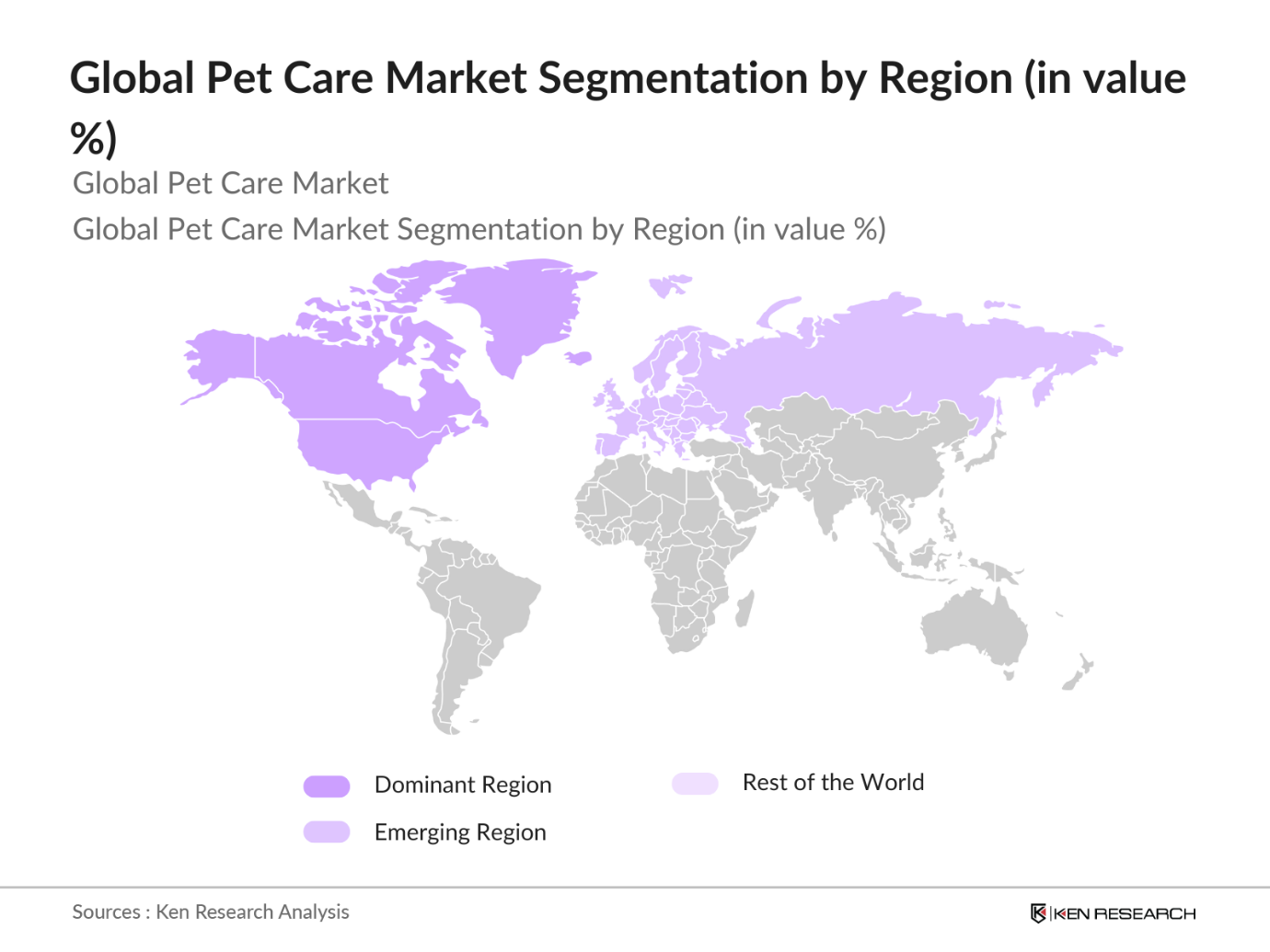

- North America, specifically the United States, dominates the pet care market due to high pet ownership rates, strong consumer spending on premium products, and a significant presence of key industry players. Europe follows closely, led by countries like Germany and the UK, where a well-established pet culture and regulatory support for quality pet products contribute to sustained demand. In Asia-Pacific, Japan and China are emerging markets due to growing disposable incomes and a shift towards pet humanization.

- Animal welfare is increasingly codified into law, with countries like Germany and the U.K. implementing stricter protections for pets in 2024. These laws mandate humane treatment and prevent cruelty, influencing product design and promoting cruelty-free practices in the pet care industry. Global companies are aligning with these regulations, with many pledging to adopt ethical sourcing and cruelty-free testing, enhancing their market positioning amidst changing regulatory landscapes.

Global Pet Care Market Segmentation

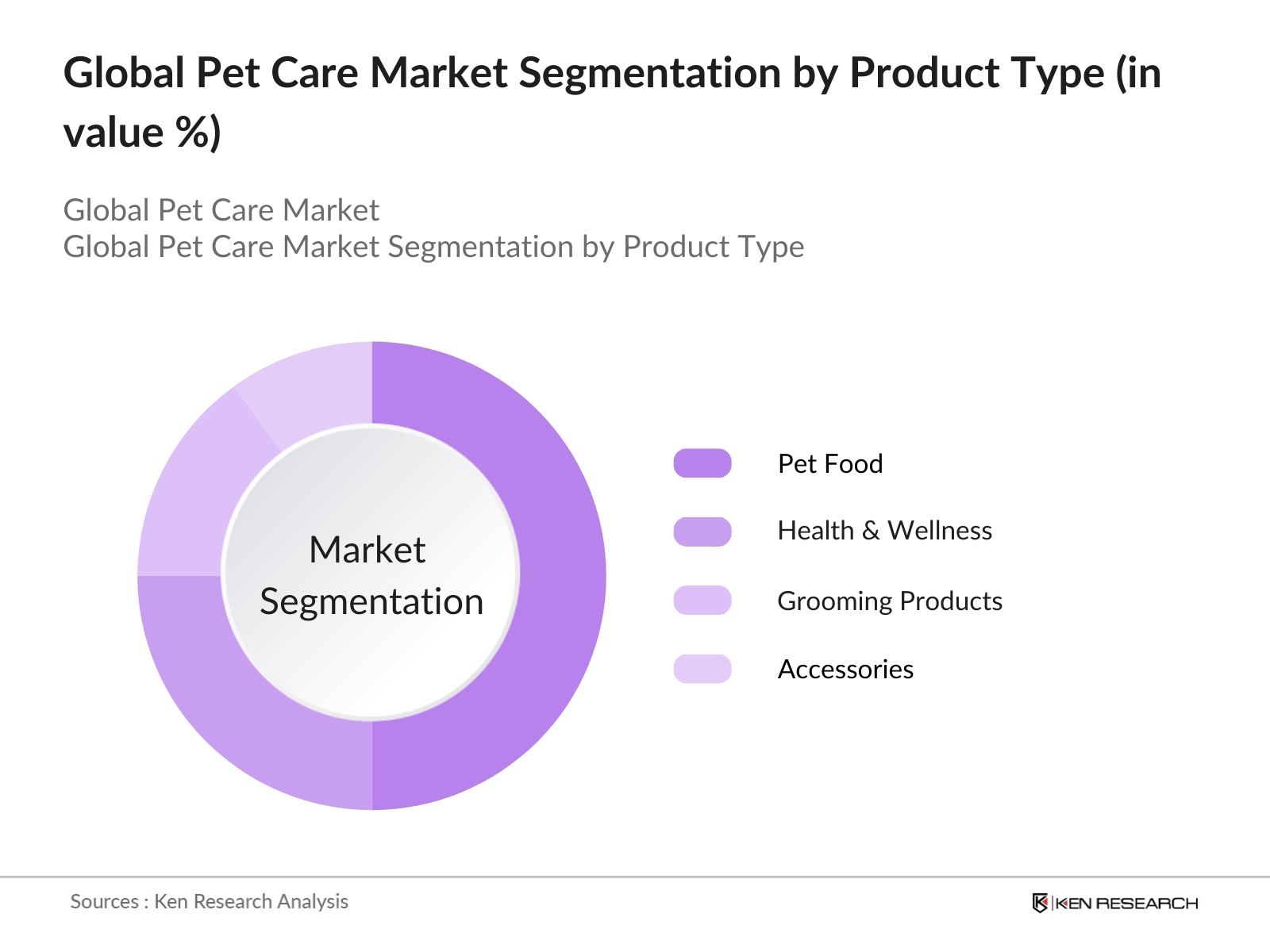

By Product Type: The Global Pet Care Market is segmented by product type into pet food, pet health & wellness products, grooming products, accessories, and pet services. Recently, the pet food segment has a dominant market share, largely due to the continuous popularity and increasing demand for premium, organic, and customized food options for pets. Brands like Nestl Purina and Mars Petcare offer an extensive range of products that cater to diverse dietary preferences, contributing to the segment's leadership.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds a significant share of the market, mainly driven by high pet ownership and consumer spending on premium pet products. Asia-Pacific is the fastest-growing region, with increasing pet adoption rates and rising disposable incomes in countries like China and Japan, leading to higher spending on pet care services and products.

By Pet Type: The market is segmented by pet type, covering dogs, cats, fish, birds, and other exotic pets. Dogs are the leading pet type, accounting for the highest share due to strong cultural associations and the popularity of canine companionship. The growth of dog-related products and services, such as health supplements and grooming, is largely driven by owners' desire to provide enhanced care and well-being.

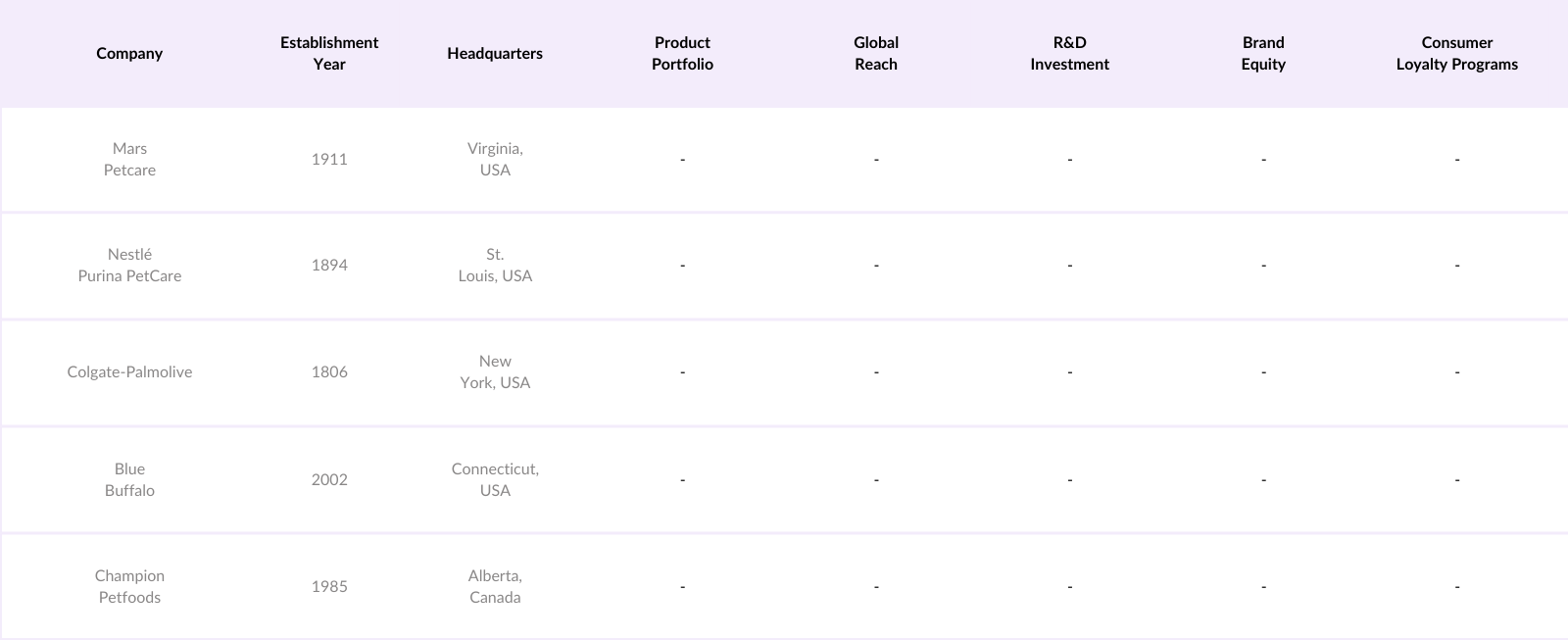

Global Pet Care Market Competitive Landscape

The Global Pet Care Market is characterized by a mix of multinational corporations and emerging players, each contributing to the diverse offerings and innovation in the industry. Major players like Mars Petcare and Nestl Purina are known for their extensive product portfolios and strong distribution networks, while niche companies focus on organic and specialized products.

Global Pet Care Industry Analysis

Growth Drivers

- Increasing Pet Ownership (Urbanization and Lifestyle Changes): With urbanization accelerating, pet ownership has risen sharply, especially in developed economies where urban dwellers have doubled over the past decade, reaching nearly 4.4 billion people globally by 2024. The U.S. Census Bureau reported that over 67 million households owned at least one pet in 2024. In parallel, cities like Tokyo and London have seen marked increases in single-person households, correlating with an uptick in pet ownership as a lifestyle choice for companionship. Pets are seen as family members, fueling a surge in pet-related spending.

- Growing Health Awareness (Focus on Pet Well-being): Health awareness among pet owners has increased, with the U.S. National Pet Owners Survey indicating that 62% of pet owners are concerned about their pets' diet and well-being in 2024. Nutritionally balanced and high-quality pet food sales, encompassing both organic and preservative-free options, are becoming mainstream. The economic and social benefits of owning a healthy pet contribute to a reduction in healthcare costs for owners. Studies from the American Heart Association cite pets as beneficial for reducing stress and anxiety, influencing consumer preferences for health-focused products.

- Technological Advancements (Digital Pet Care Platforms): The rise in digital adoption has driven growth in telemedicine and pet health apps, with 1.8 million downloads of pet care apps recorded in the first quarter of 2024 in the U.S. Wearable pet technology is also becoming popular, with nearly 900,000 pet wearables projected for adoption by the end of the year, enabling real-time health monitoring. These tools enable remote consultations and facilitate health monitoring, catering to busy, urban lifestyles, which align with pet owners' growing health-conscious choices for their pets.

Market Restraints

- Regulatory Constraints (Pet Food Standards): Strict regulatory standards in the pet food industry can challenge market growth. In the European Union, pet food imports must adhere to rigorous standards under the EU Animal Feed Regulations, with inspections increasing by over 30% in 2024. These regulations ensure that pet food products meet safety and quality standards, though they raise compliance costs for manufacturers. As such, international players must navigate complex regulatory landscapes in developed and emerging markets, impacting pricing and market entry.

- Limited Access in Emerging Markets: Emerging economies face infrastructural and logistical challenges in providing wide access to pet care products. In India, for example, only 15% of pet owners have access to advanced pet care services in rural areas, limiting product reach and consumer awareness. Similar issues exist in parts of Africa and Southeast Asia, where the lack of specialized pet stores or e-commerce facilities restricts market growth. These limitations create regional disparities and impact the expansion efforts of global pet care brands.

Global Pet Care Market Future Outlook

Over the next five years, the Global Pet Care Market is expected to demonstrate substantial growth driven by the increasing trend of pet humanization, product innovation in pet health and wellness, and the expansion of digital platforms for pet care services. Additionally, heightened awareness of pet health and a rising inclination toward natural and organic products are anticipated to shape market dynamics positively.

Market Opportunities

- Expansion into E-commerce Channels: Online sales of pet care products have grown significantly, with platforms like Amazon reporting over 28 million pet product transactions in Q2 2024. E-commerce offers a robust channel for reaching remote regions, especially where physical stores are limited. The shift to online shopping for pet products enables brands to tap into markets that were previously inaccessible, bolstered by strategic partnerships with logistics companies that ensure timely delivery.

- Growth of Pet Insurance Market: Pet insurance is gaining traction as pet owners prioritize their pets health and unexpected medical expenses. In 2024, over 5 million pets are insured in the U.S., representing a significant increase in the adoption of pet insurance. This growth provides an opportunity for insurers to introduce flexible and affordable policies that cover various pet-related services, alleviating owners financial burdens and promoting comprehensive pet healthcare services.

Scope of the Report

|

Product Type |

Pet Food Pet Health & Wellness Products Grooming Products Accessories Pet Services |

|

Pet Type |

Dogs Cats Fish Birds Other Exotic Pets |

|

Distribution Channel |

Specialty Stores Supermarkets & Hypermarkets Online Retail Veterinary Clinics Others |

|

Health & Wellness |

Therapeutic Foods Dietary Supplements Veterinary Services Preventive Health Products |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Pet Food Manufacturers

Veterinary Healthcare Providers

Pet Accessories Manufacturers

E-commerce Platforms and Retailers

Pet Grooming and Boarding Service Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., USDA, FDA)

Health and Wellness Product Suppliers

Companies

Players Mentioned in the Report:

Mars Petcare

Nestl Purina PetCare

Colgate-Palmolive (Hill's Pet Nutrition)

J.M. Smucker Company (Big Heart Pet Brands)

Royal Canin

Petco Animal Supplies Inc.

Pets at Home Group Plc

Central Garden & Pet Company

Blue Buffalo Co., Ltd.

Unicharm Corporation

Champion Petfoods

Elanco Animal Health

Zoetis Inc.

Deuerer GmbH

Spectrum Brands (United Pet Group)

Table of Contents

1. Global Pet Care Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Pet Care Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Pet Care Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Pet Ownership (Urbanization and Lifestyle Changes)

3.1.2 Growing Health Awareness (Focus on Pet Well-being)

3.1.3 Technological Advancements (Digital Pet Care Platforms)

3.1.4 Product Innovation (Organic and Natural Pet Products)

3.2 Market Challenges

3.2.1 High Costs (Pet Healthcare and Premium Products)

3.2.2 Regulatory Constraints (Pet Food Standards)

3.2.3 Limited Access in Emerging Markets

3.3 Opportunities

3.3.1 Expansion into E-commerce Channels

3.3.2 Growth of Pet Insurance Market

3.3.3 Rise in Adoption of Exotic Pets

3.4 Trends

3.4.1 Humanization of Pets (Premiumization in Pet Care Products)

3.4.2 Rise in Subscription Services for Pet Products

3.4.3 Increased Demand for Pet Supplements

3.5 Government Regulations

3.5.1 Food and Drug Safety Standards

3.5.2 Import and Export Compliance (Pet Products)

3.5.3 Animal Welfare and Protection Laws

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Veterinarians, Pet Owners, Retailers)

3.8 Porters Five Forces

3.9 Competition Ecosystem (Distribution, Product Innovation)

4. Global Pet Care Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Pet Food (Dry, Wet, Treats)

4.1.2 Pet Health & Wellness Products (Supplements, Dental Care)

4.1.3 Grooming Products (Shampoos, Brushes)

4.1.4 Accessories (Leashes, Toys)

4.1.5 Pet Services (Veterinary, Boarding, Training)

4.2 By Pet Type (In Value %)

4.2.1 Dogs

4.2.2 Cats

4.2.3 Fish

4.2.4 Birds

4.2.5 Other Exotic Pets

4.3 By Distribution Channel (In Value %)

4.3.1 Specialty Stores

4.3.2 Supermarkets & Hypermarkets

4.3.3 Online Retail

4.3.4 Veterinary Clinics

4.3.5 Others

4.4 By Health and Wellness Segment (In Value %)

4.4.1 Therapeutic Foods

4.4.2 Dietary Supplements

4.4.3 Veterinary Services

4.4.4 Preventive Health Products

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Pet Care Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Mars Petcare Inc.

5.1.2 Nestl Purina PetCare

5.1.3 Colgate-Palmolive (Hill's Pet Nutrition)

5.1.4 J.M. Smucker Company (Big Heart Pet Brands)

5.1.5 Royal Canin

5.1.6 Petco Animal Supplies Inc.

5.1.7 Pets at Home Group Plc

5.1.8 Central Garden & Pet Company

5.1.9 Blue Buffalo Co., Ltd.

5.1.10 Unicharm Corporation

5.1.11 Champion Petfoods

5.1.12 Elanco Animal Health

5.1.13 Zoetis Inc.

5.1.14 Deuerer GmbH

5.1.15 Spectrum Brands (United Pet Group)

5.2 Cross Comparison Parameters (Revenue, Market Share, Regional Presence, Product Portfolio, R&D Investment, Market Strategy, Brand Equity, Consumer Loyalty Programs)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants and Funding

5.9 Private Equity Investments

6. Global Pet Care Market Regulatory Framework

6.1 Food and Drug Safety Standards

6.2 Import and Export Compliance (Pet Products)

6.3 Certification Processes

6.4 Environmental Regulations (Sustainability in Pet Products)

7. Global Pet Care Market Future Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Pet Care Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By Pet Type (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Health and Wellness Segment (In Value %)

8.5 By Region (In Value %)

9. Global Pet Care Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step involves an initial construction of an ecosystem map for the Global Pet Care Market. Extensive desk research and proprietary data sources are employed to collect information on key industry variables and stakeholder roles.

Step 2: Market Analysis and Construction

Historical data on the market is gathered, analyzed, and verified. This step includes evaluating pet care spending patterns and regional demand, which helps refine revenue estimations and insights.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are formed based on initial findings and subsequently validated through consultations with industry professionals, offering practical insights into market operations and consumer behavior.

Step 4: Research Synthesis and Final Output

Final outputs are compiled by synthesizing insights from pet product manufacturers, retailers, and service providers to ensure a holistic analysis, validated through bottom-up and top-down methodologies.

Frequently Asked Questions

01. How big is the Global Pet Care Market?

The global pet care market was valued at USD 246.5 billion, reflecting robust growth due to increased spending on premium products and services for pet well-being.

02. What are the challenges in the Global Pet Care Market?

Challenges include regulatory standards, premium product costs, and limited access in emerging markets, which can hinder market expansion, especially for niche and innovative brands.

03. Who are the major players in the Global Pet Care Market?

Leading companies include Mars Petcare, Nestl Purina, and Colgate-Palmolive, with a stronghold due to extensive distribution networks, diverse product portfolios, and brand loyalty.

04. What are the growth drivers in the Global Pet Care Market?

Major growth drivers include the humanization of pets, digitalization in pet care services, and rising consumer preference for natural and organic products, fostering significant market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.