Global Pet Clothing Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD7437

December 2024

93

About the Report

Global Pet Clothing Market Overview

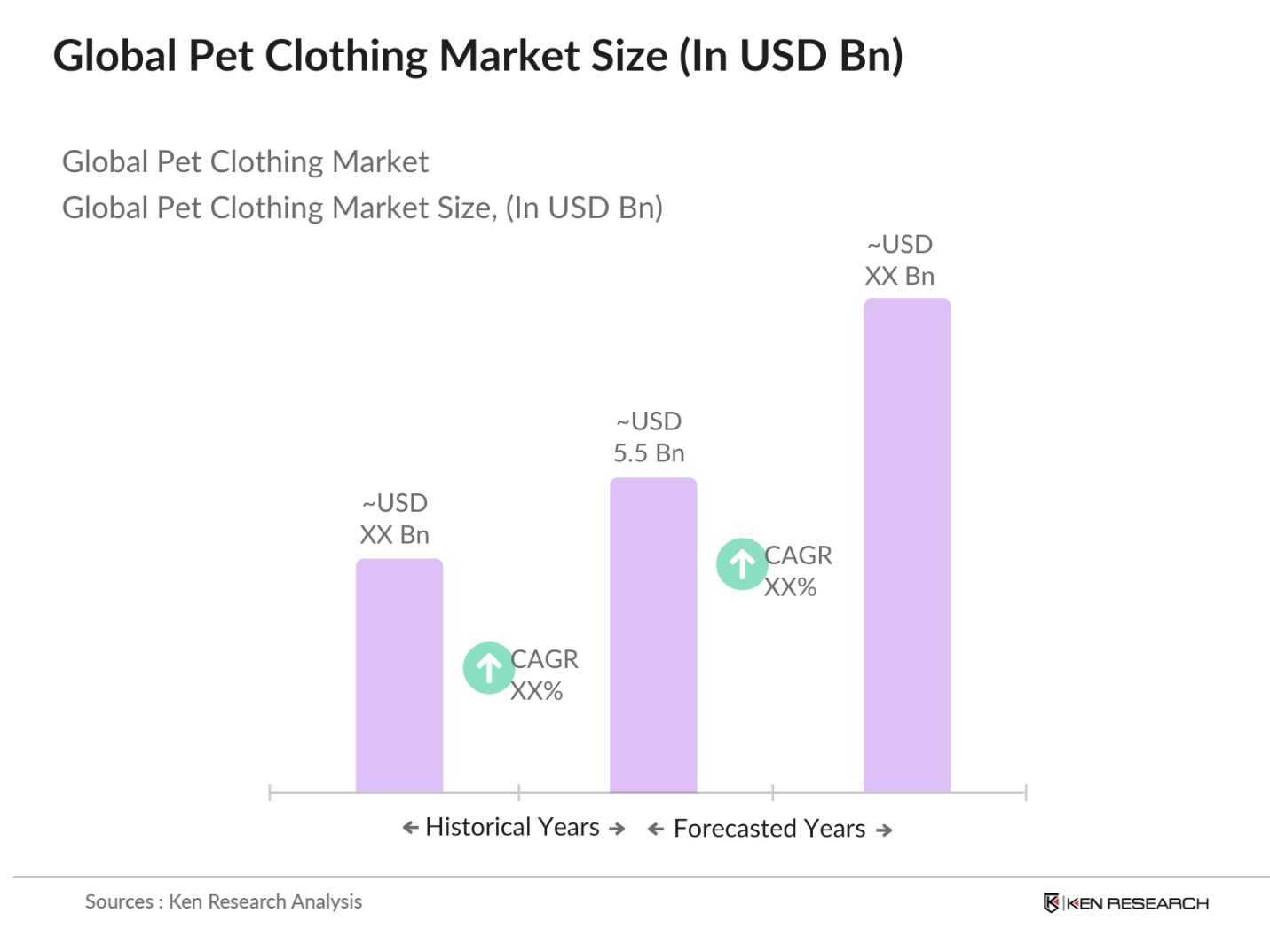

- The global pet clothing market, valued at USD 5.5 billion, based on a historical five-year analysis, is experiencing significant growth driven by the increasing trend of pet humanization. Pet owners today treat their pets as family members, leading to a surge in demand for pet fashion and functional clothing. This trend is further enhanced by the growing popularity of premium and luxury pet products, as well as innovations in functional pet wear such as weather-resistant clothing, pet boots, and smart clothing with integrated technology. The demand is also bolstered by the rise of e-commerce platforms, which make a wide range of pet clothing easily accessible to a global consumer base.

- The market is predominantly led by North America, particularly the United States, due to high disposable incomes, strong pet ownership culture, and consumer awareness about pet well-being. Other dominant regions include Europe, especially countries like the UK and Germany, where pet humanization and high spending on pet care products are prevalent. These regions are also home to several key pet clothing brands that cater to various pet owners' preferences, ranging from everyday pet wear to designer and functional attire. Meanwhile, markets in Asia-Pacific, led by Japan and China, are expanding rapidly, driven by a growing pet-loving population and urbanization.

- Government regulations on textile safety are critical to the pet clothing market. In 2023, the European Commission introduced stricter safety standards for textiles used in pet products, including limits on harmful chemicals such as phthalates and formaldehyde. Similar regulations are being adopted in the U.S. under the Consumer Product Safety Commission (CPSC). These regulations are designed to protect pets from harmful substances, which are increasingly being scrutinized in pet clothing manufacturing.

Global Pet Clothing Market Segmentation

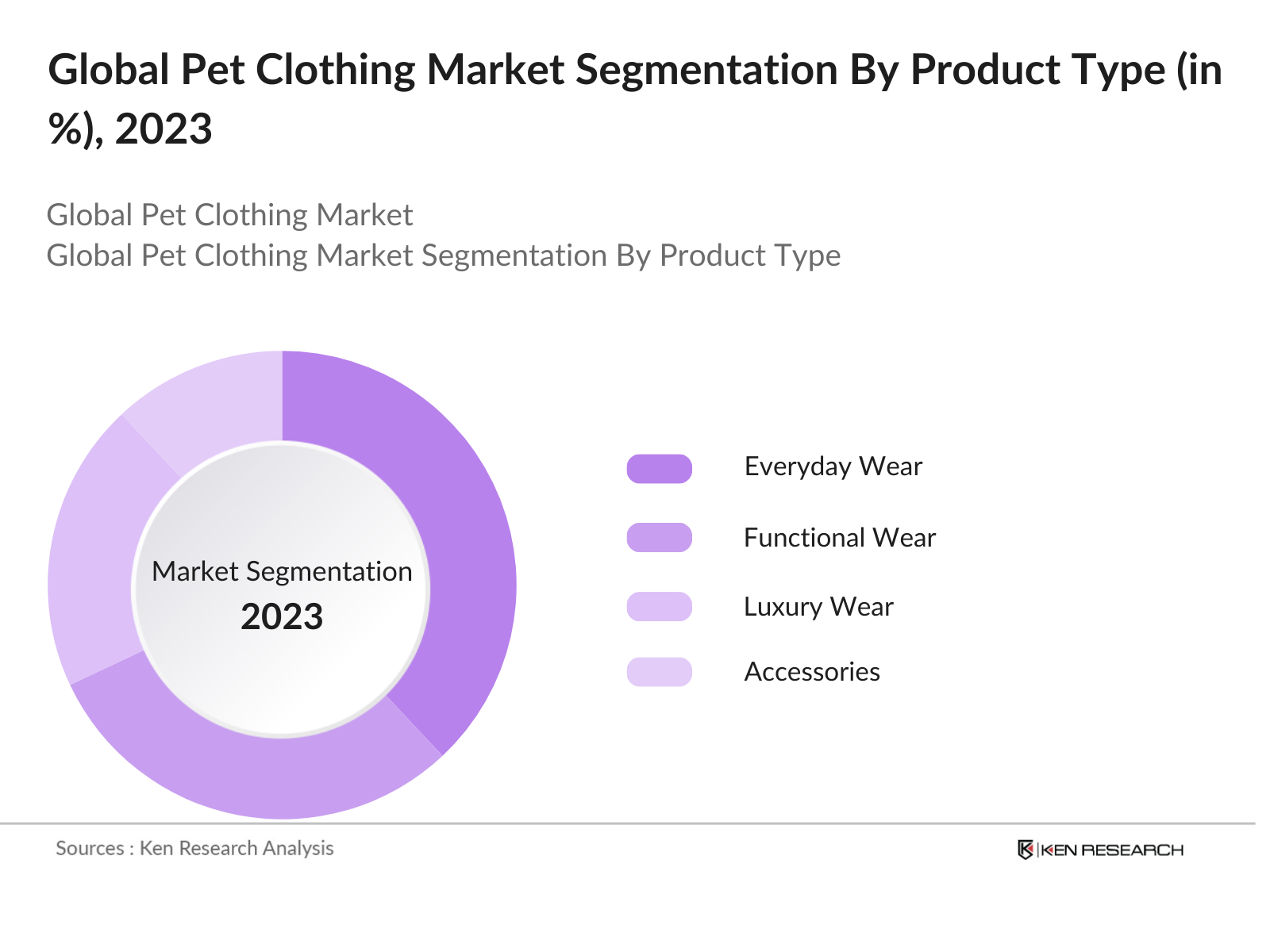

By Product Type: The pet clothing market is segmented by product type into everyday wear, functional wear, luxury wear, and accessories.Everyday wear holds a dominant share in the pet clothing market, accounting for 38% of the market in 2023. This segment includes t-shirts, hoodies, and sweaters, which are widely popular among pet owners for regular use. The rise in casual pet clothing is attributed to affordability, comfort, and ease of access, with major brands offering a diverse range of fashionable and functional daily wear. In addition, this category is bolstered by pet owners' desire to match outfits with their pets, driving demand for everyday pet apparel.

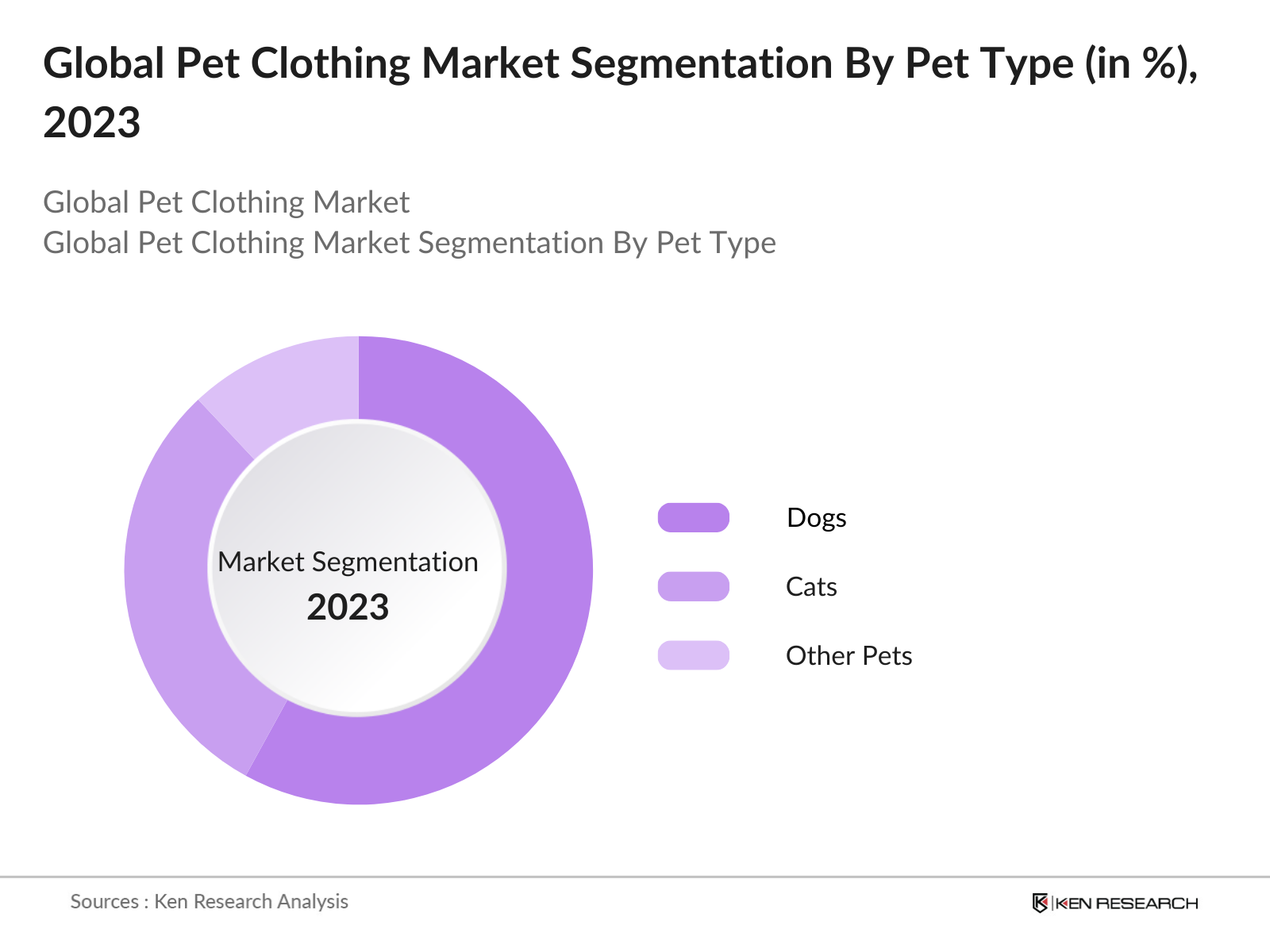

By Pet Type: The market is segmented by pet type into dogs, cats, and other pets. Dogs dominate the pet clothing market with a market share of 58% in 2023. The higher number of dog owners globally, coupled with a wide variety of clothing designed specifically for dogs, is the primary driver of this segment. From casual wear to weather-specific outfits and luxury apparel, dog clothing has seen significant innovation and variety. Additionally, dog owners are more inclined to spend on clothing due to the functional and fashion aspects available for different dog breeds and sizes.

Global Pet Clothing Market Competitive Landscape

The global pet clothing market is dominated by a mix of well-established international companies and emerging brands that cater to niche segments. Leading players are leveraging innovative designs, premium materials, and sustainable production practices to differentiate themselves in the market.The major companies in the market include Ruffwear, Hurtta, and Canada Pooch, known for their robust product lines focusing on both functionality and fashion. Newer brands like Mungo & Maud and Pawsome Couture are gaining traction by targeting luxury and eco-conscious pet owners.

|

Company |

Year Established |

Headquarters |

Product Portfolio |

Revenue (USD) |

Regional Presence |

Brand Loyalty |

Sustainability Initiatives |

Partnerships |

Innovation Index |

|

Ruffwear |

1994 |

Bend, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Hurtta |

2002 |

Helsinki, Finland |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Canada Pooch |

2011 |

Toronto, Canada |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Mungo & Maud |

2005 |

London, UK |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Pawsome Couture |

2016 |

Sydney, Australia |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

Global Pet Clothing Industry Analysis

Growth Drivers

- Increased Pet Ownership: Urbanization has led to significant growth in pet ownership, particularly in regions experiencing high urban migration. In 2024, over 56% of households in urban areas across the U.S. and Europe have pets, with similar trends seen in developing economies like Brazil and India (World Bank). This shift is linked to changing demographics, such as a rise in single-person households and childless couples, where pets serve as companions. The global urban population now exceeds 4.4 billion, and with pet ownership increasing alongside this, the demand for pet-related products, including clothing, is growing rapidly.

- Rise of Pet Humanization: Pet humanization is becoming a major cultural trend, where pets are treated as family members, driving demand for luxury pet products like premium clothing. For instance, in countries such as the U.S., Japan, and Germany, households spend significantly on pet products, with the average pet expenditure surpassing $1,200 annually (IMF). Emotional connections with pets further influence this trend, as 63% of pet owners report purchasing high-quality products to enhance their pets' well-being. This is especially prevalent in regions where disposable income per capita is high, contributing to growth in premium pet clothing.

- Growth of E-Commerce: E-commerce platforms have transformed the way consumers purchase pet products. Online retail sales in pet-related items have increased dramatically, with major platforms such as Amazon and Chewy seeing strong growth in subscription-based services. According to data from the International Telecommunication Union (ITU), global internet users exceeded 5.3 billion in 2023, which correlates with a rise in pet clothing sales through online channels. This digital shift, particularly in North America and Europe, supports the growth of small and niche pet clothing brands, as they can reach global customers more easily.

Market Challenges

- High Costs of Premium Pet Clothing: One of the key challenges in the global pet clothing market is the high cost of premium products. In regions like North America and Europe, the average price of pet clothing has surged due to rising material and production costs. According to the International Labour Organization (ILO), the cost of textile production has risen by nearly 9% in 2023 due to supply chain disruptions and inflation. These higher costs are transferred to consumers, making premium pet clothing less accessible to budget-conscious households, particularly in emerging markets.

- Lack of Uniform Regulations: The pet clothing market lacks globally uniform safety regulations, which poses a significant challenge for manufacturers and consumers alike. Countries like the U.S. and those in the European Union have implemented textile safety standards for human apparel, but similar regulations for pet clothing are inconsistent. For example, in 2023, the World Trade Organization (WTO) noted that only 35% of nations have clear safety standards for pet apparel, which can lead to quality control issues and hinder market growth, especially in cross-border trade.

Global Pet Clothing Market Future Outlook

The global pet clothing market is poised for substantial growth in the coming years, driven by increasing consumer demand for pet wellness and lifestyle products. Pet owners are expected to continue spending on both functional and fashionable apparel for their pets, especially with the rising trend of pet humanization.The shift towards eco-friendly and sustainable products will play a crucial role in shaping the future of the market, with brands likely to innovate in terms of sustainable materials and ethical production practices. In addition, technological advancements in pet clothing, such as smart wearables and health-monitoring apparel, are expected to further expand market opportunities.

Opportunities

- Technological Integration: Technological advancements in wearable tech and smart textiles present a major opportunity in the pet clothing market. Innovations such as GPS-enabled pet jackets and health-monitoring fabrics are gaining popularity. According to a report by the International Telecommunications Union (ITU), global spending on wearable technology exceeded $100 billion in 2023. This trend, which includes smart textiles for pets, is expected to expand further as more pet owners seek functional clothing that enhances their pets' safety and well-being.

- Expansion into Emerging Markets: The pet clothing market is seeing increasing opportunities in emerging markets, particularly in Asia-Pacific and Latin America, where urbanization and middle-class growth are driving demand. According to the World Bank, Asia-Pacific added more than 200 million people to its middle class between 2018 and 2023, significantly boosting consumer spending. Similarly, Latin Americas pet market is expanding due to rising disposable incomes. The expanding pet population in these regions presents a fertile ground for the growth of the pet clothing sector, especially for affordable, stylish products.

Scope of the Report

|

Product Type |

Everyday Wear Functional Wear Luxury Wear Accessories |

|

Pet Type |

Dogs Cats Other Pets |

|

Distribution Channel |

Online Retailers Offline Retailers Veterinary Clinics |

|

Material |

Cotton Wool Polyester Eco-friendly Materials |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Pet Clothing Manufacturing Companies

E-Commerce Platforms Companies

Veterinary Clinics and Hospitals

Pet Care Service Companies

Textile and Fabric Suppliers for Pet Apparel

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Companies

Players Mentioned in the Report

Ruffwear

Hurtta

Canada Pooch

Mungo & Maud

PetRageous Designs

Kurgo

Pawsome Couture

Fashion Pet (Ethical Products, Inc.)

Blueberry Pet

Pets So Good

Table of Contents

1. Global Pet Clothing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, YOY growth, Market Maturity Stages)

1.4. Market Segmentation Overview

2. Global Pet Clothing Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Pet Clothing Market Analysis

3.1. Growth Drivers

3.1.1. Increased Pet Ownership

3.1.2. Rise of Pet Humanization

3.1.3. Growth of E-Commerce

3.1.4. Expansion of Pet Health Awareness

3.2. Market Challenges

3.2.1. High Costs of Premium Pet Clothing

3.2.2. Lack of Uniform Regulations

3.2.3. Counterfeit Products

3.3. Opportunities

3.3.1. Technological Integration

3.3.2. Expansion into Emerging Markets

3.3.3. Rise in Sustainable Pet Clothing

3.4. Trends

3.4.1. Customization & Personalization of Pet Clothing

3.4.2. Growth of Seasonal & Festive Pet Fashion

3.4.3. Celebrity-Endorsed Pet Clothing Brands

3.5. Government Regulations

3.5.1. Textile and Material Safety Standards

3.5.2. Labeling Requirements

3.5.3. Import & Export Tariff Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Pet Clothing Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Everyday Wear (T-Shirts, Hoodies)

4.1.2. Functional Wear (Winter Jackets, Raincoats, Boots)

4.1.3. Luxury Wear (Designer Outfits, Formal Wear)

4.1.4. Accessories (Scarves, Bandanas, Hats)

4.2. By Pet Type (In Value %)

4.2.1. Dogs

4.2.2. Cats

4.2.3. Other Pets (Rabbits, Birds, Exotic Pets)

4.3. By Distribution Channel (In Value %)

4.3.1. Online Retailers (E-Commerce Platforms, Brand Websites)

4.3.2. Offline Retailers (Pet Stores, Department Stores, Specialty Boutiques)

4.3.3. Veterinary Clinics

4.4. By Material (In Value %)

4.4.1. Cotton

4.4.2. Wool

4.4.3. Polyester

4.4.4. Eco-friendly Materials (Recycled Fabrics, Organic Cotton)

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Pet Clothing Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ruffwear

5.1.2. Hurtta

5.1.3. Canada Pooch

5.1.4. Mungo & Maud

5.1.5. PetRageous Designs

5.1.6. Kurgo

5.1.7. Pawsome Couture

5.1.8. Fashion Pet (Ethical Products, Inc.)

5.1.9. Blueberry Pet

5.1.10. Pets So Good

5.1.11. Petmate

5.1.12. Wagwear

5.1.13. Lucy & Co.

5.1.14. Dog & Co.

5.1.15. Zee.Dog

5.2. Cross Comparison Parameters (Revenue, Product Portfolio, Regional Presence, Innovation Index, Customer Loyalty, Market Share, Growth Strategy, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, New Product Launches, Marketing Campaigns)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity and Venture Capital Funding

5.8. Government Grants & Incentives

6. Global Pet Clothing Market Regulatory Framework

6.1. Animal Welfare & Protection Regulations (PETA, Other Organizations)

6.2. Product Certification & Standards (Safety Certifications, Material Compliance)

6.3. Import & Export Policies (Tariff Structures, Free Trade Agreements)

7. Global Pet Clothing Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Pet Clothing Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Pet Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Material (In Value %)

8.5. By Region (In Value %)

9. Global Pet Clothing Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Behavior Insights (Pet Owner Trends, Purchase Drivers)

9.3. Brand Positioning & Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process starts with mapping the pet clothing industry ecosystem, identifying key stakeholders, and defining market variables such as product type, pet type, and distribution channels. A combination of proprietary databases, industry reports, and government publications is used to compile preliminary market data.

Step 2: Market Analysis and Construction

This step involves analyzing historical data, including sales trends, growth drivers, and competitive positioning. Revenue generation models and market penetration rates are calculated using both qualitative and quantitative methods, ensuring a comprehensive view of the market's past performance.

Step 3: Hypothesis Validation and Expert Consultation

Consultations are conducted with industry experts, including executives from major pet clothing companies, to validate market assumptions. This step ensures that market hypotheses are grounded in real-world insights and reflect current industry conditions.

Step 4: Research Synthesis and Final Output

The final synthesis combines bottom-up and top-down approaches, integrating insights from interviews with key industry stakeholders. This ensures that the final report provides an accurate, data-driven analysis of the pet clothing market, with actionable insights for key market participants.

Frequently Asked Questions

01. How big is the Global Pet Clothing Market?

The global pet clothing market was valued at USD 5.5 billion, driven by growing pet ownership, increasing humanization of pets, and the rise in luxury pet products.

02. What are the challenges in the Global Pet Clothing Market?

Challenges include the high cost of premium pet clothing, lack of uniform regulations, and the growing issue of counterfeit products, which undermine consumer trust.

03. Who are the major players in the Global Pet Clothing Market?

Key players include Ruffwear, Hurtta, Canada Pooch, Mungo & Maud, and Pawsome Couture, each dominating the market with their extensive product offerings and strong brand presence.

04. What are the growth drivers of the Global Pet Clothing Market?

The market is driven by the increasing trend of pet humanization, rising demand for functional pet wear, and innovations in sustainable and smart pet clothing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.