Global Pet Diabetes Care Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD5091

December 2024

92

About the Report

Global Pet Diabetes Care Market Outlook 2028

Global Pet Diabetes Care Market Overview

- The Global Pet Diabetes Care Market is valued at USD 2.3 billion, with increasing demand for pet healthcare services and innovations in diabetes management technologies driving the market. A growing awareness among pet owners about diabetes symptoms and advanced diagnostic tools is contributing to the demand for glucose monitoring devices and insulin delivery systems. Rising disposable incomes, particularly in developed markets like North America and Europe, also fuel this market, as pet owners are more willing to spend on advanced medical care for their pets.

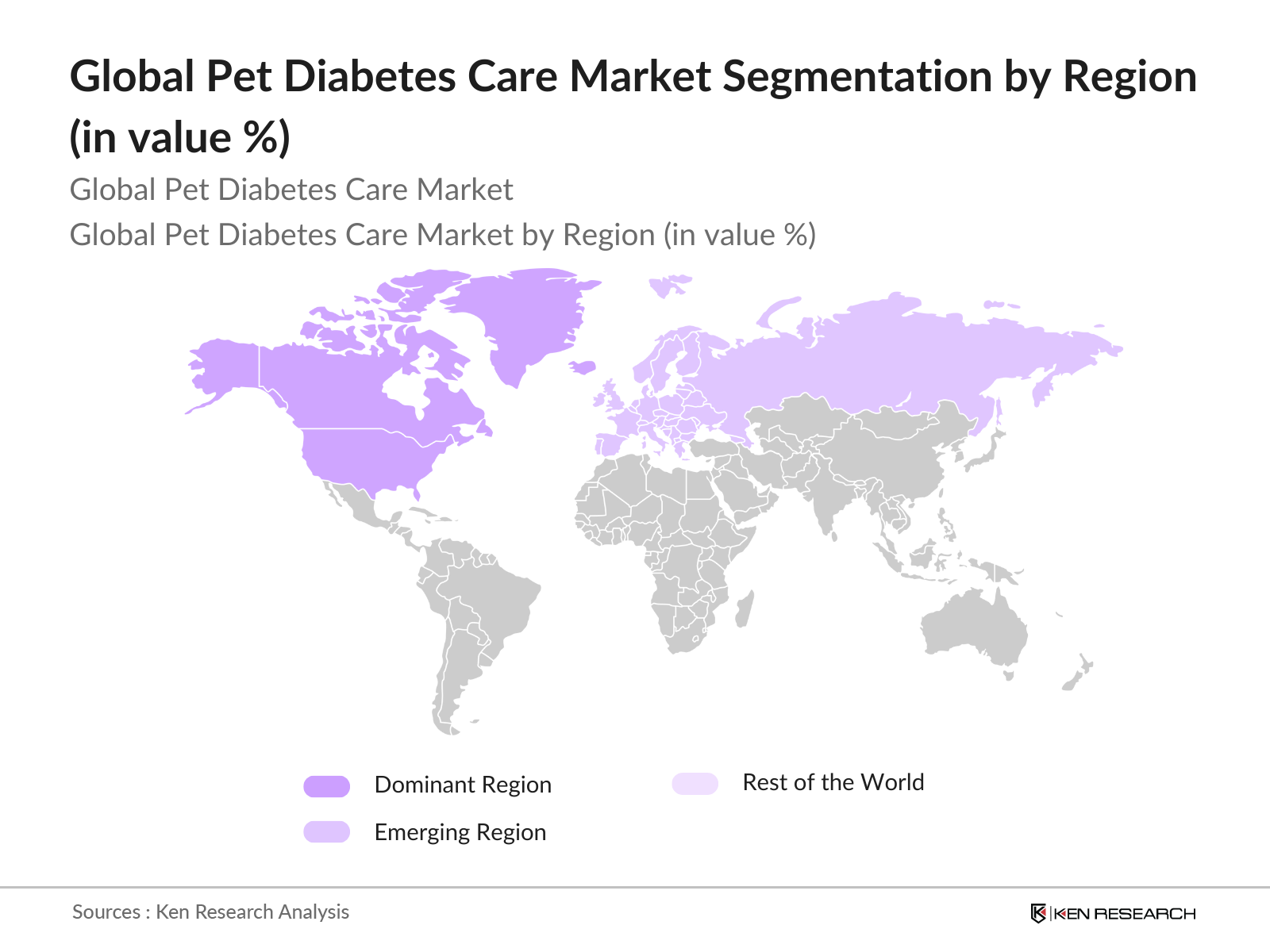

- North America, particularly the United States, dominates the pet diabetes care market. The high rate of pet ownership, advanced veterinary infrastructure, and a proactive approach to pet healthcare drive the market's dominance in this region. Additionally, countries like Germany and the United Kingdom are key players in the European market due to their well-established veterinary care systems and growing consumer awareness of pet diabetes care products.

- Governments in several countries have launched national veterinary health programs aimed at improving animal healthcare, including diabetes management in pets. For instance, the U.S. Department of Agriculture (USDA) has implemented various initiatives under the National Animal Health Monitoring System (NAHMS) to track pet health data, including chronic diseases like diabetes. These programs help monitor trends and provide necessary resources to veterinarians and pet owners. In 2023, NAHMS reported significant funding increases for veterinary research, supporting initiatives for better disease control and management in pets.

Global Pet Diabetes Care Market Segmentation

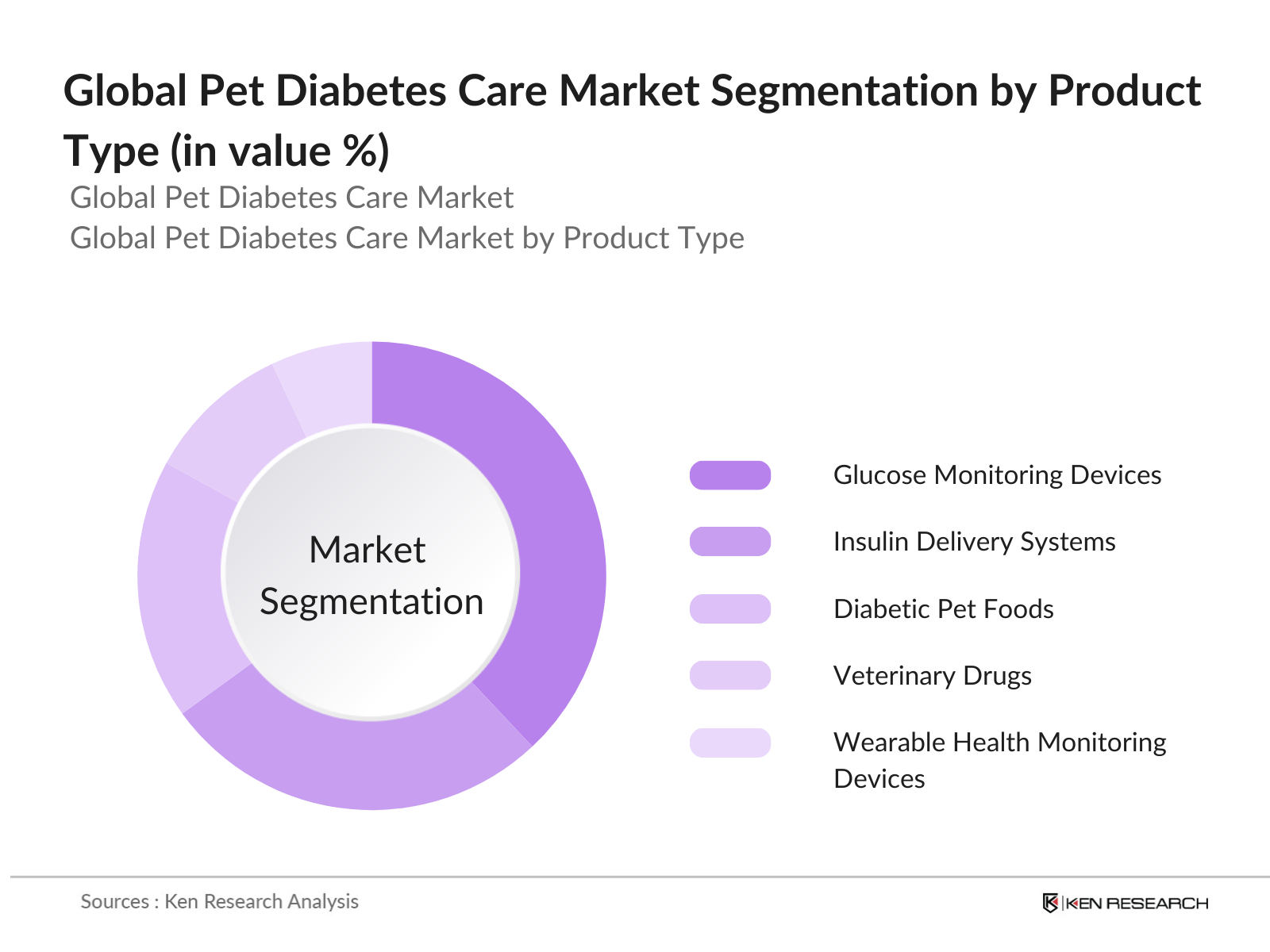

By Product Type: The Global Pet Diabetes Care Market is segmented by product type into glucose monitoring devices, insulin delivery systems, diabetic pet foods, veterinary drugs, and wearable health monitoring devices. Recently, glucose monitoring devices hold a dominant market share due to their widespread use in diagnosing and managing pet diabetes. These devices, including continuous glucose monitors, are gaining traction as they allow for real-time monitoring and improved disease management, which enhances pet care quality. The increasing number of diabetic pets worldwide and innovations in user-friendly devices contribute to this dominance.

By Region: The Global Pet Diabetes Care Market is also segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share due to its advanced veterinary healthcare infrastructure, high pet ownership rates, and strong awareness regarding pet diabetes. The presence of key industry players and increased spending on pet healthcare further support the market in this region. Europe follows closely, driven by a growing focus on pet wellness, robust veterinary services, and increasing consumer demand for innovative pet healthcare products.

Global Pet Diabetes Care Market Competitive Landscape

The Global Pet Diabetes Care Market is dominated by a few key players that are continuously innovating and expanding their product portfolios. The competitive landscape is characterized by the presence of multinational corporations and veterinary pharmaceutical companies. These companies invest heavily in research and development, focusing on launching new and improved diabetes care products for pets.

|

Company Name |

Year of Establishment |

Headquarters |

No. of Employees |

R&D Spending (USD Mn) |

Product Range |

Global Reach |

Market Share (%) |

Strategic Initiatives |

|

Zoetis Inc. |

1952 |

Parsippany, USA |

- |

- |

- |

- |

- |

- |

|

Merck Animal Health |

1891 |

Kenilworth, USA |

- |

- |

- |

- |

- |

- |

|

Boehringer Ingelheim |

1885 |

Ingelheim, Germany |

- |

- |

- |

- |

- |

- |

|

Eli Lilly and Company |

1876 |

Indianapolis, USA |

- |

- |

- |

- |

- |

- |

|

Vetoquinol S.A. |

1933 |

Lure, France |

- |

- |

- |

- |

- |

- |

Global Pet Diabetes Care Market Analysis

Market Growth Drivers

- Rising Incidence of Diabetes in Pets (Diabetes Prevalence Rates in Pets): The prevalence of diabetes in pets has increased significantly, with approximately 1 in 300 dogs and 1 in 230 cats diagnosed with diabetes, according to a 2024 report by the AVMA (American Veterinary Medical Association). This increasing trend mirrors that of human diabetes and is driven by factors such as aging pet populations, obesity, and genetic predispositions. With over 120 million pets in the U.S. alone, the rising number of diabetes cases is escalating demand for advanced diabetes care solutions in veterinary healthcare.

- Technological Advancements in Pet Healthcare (Device Innovation, Insulin Delivery): Technological advancements in pet healthcare, such as continuous glucose monitoring systems and automated insulin delivery devices, are rapidly transforming the pet diabetes care market. For instance, the development of wearable glucose monitors, akin to those used in humans, has enabled more precise and convenient management of pet diabetes. By 2024, companies like Zoetis have introduced products that allow real-time glucose monitoring, enhancing treatment efficacy. These innovations provide veterinarians and pet owners with more accurate tools for managing pet health, supporting market growth.

- Growing Awareness About Pet Health (Consumer Awareness Campaigns): With global campaigns such as "Pet Diabetes Month" (November) and increased veterinarian-led outreach, awareness of pet diabetes and its treatment options has surged. For instance, campaigns in 2022 reached over 5 million pet owners across the U.S. and Europe, educating them about the early detection and treatment of diabetes in pets. This growing awareness, coupled with higher pet health insurance enrollments (which covered around 4 million pets in the U.S. in 2023), is driving market growth by increasing the demand for comprehensive diabetes care solutions for pets.

Market Challenges:

- High Cost of Pet Diabetes Treatment (Cost Constraints): The high cost of diabetes care remains a major barrier to market growth. Insulin treatment for pets can cost upwards of $2,000 annually per pet, placing a financial burden on many pet owners. Furthermore, the additional costs of monitoring devices, regular veterinary consultations, and specialized diets exacerbate the overall treatment expense. While insurance plans cover some of these costs, many pet owners struggle with the financial commitment, limiting the adoption of advanced diabetes care solutions. These cost constraints slow the potential growth in markets with low pet insurance penetration rates.

- Regulatory Barriers in Veterinary Health Products (Regulatory Compliance): The stringent regulatory requirements for veterinary health products pose significant challenges for market players. Pet healthcare products, especially those involving insulin delivery or monitoring systems, must comply with varying regulations across different regions. For example, products in the U.S. require FDA approval, while those in Europe must meet EMA standards. This complex approval process, which can take years and incur substantial costs, slows product launches and hinders market expansion, particularly in emerging markets.

Global Pet Diabetes Care Market Future Outlook

The Global Pet Diabetes Care Market is expected to witness significant growth over the next five years, driven by advances in glucose monitoring technology, increasing awareness of pet diabetes, and rising pet healthcare spending. Additionally, technological integration in healthcare, such as AI-based glucose monitors and telemedicine services, is anticipated to fuel market growth. As more pet owners seek to manage their pets diabetes more effectively, demand for innovative healthcare solutions will rise.

Market Opportunities:

- Telemedicine in Pet Healthcare (Remote Monitoring and Consultations): Telemedicine has gained momentum in pet healthcare, particularly for diabetes management. In 2023, veterinary telemedicine platforms recorded over 7 million consultations globally, a significant rise from pre-pandemic levels. Telemedicine enables pet owners to consult with veterinarians remotely, making it easier to manage chronic conditions like diabetes. This convenience, combined with the adoption of remote glucose monitoring technologies, is driving the growth of telemedicine in the pet diabetes care market.

- Use of Wearable Devices for Glucose Monitoring (Wearable Technology Adoption): Wearable devices for pets, specifically glucose monitoring devices, have seen widespread adoption in recent years. In 2023, over 200,000 wearable glucose monitors were sold globally, primarily in the U.S. and Europe. These devices provide continuous, real-time monitoring of glucose levels, significantly enhancing diabetes management for pets. With increasing consumer interest in tech-enabled healthcare solutions, wearable devices are becoming a key trend in the pet diabetes care market, offering both convenience and improved health outcomes.

Scope of the Report

|

By Product Type |

Glucose Monitoring Devices Insulin Delivery Systems Diabetic Pet Foods Veterinary Drugs and Insulin Wearable Health Monitoring Devices |

|

By Animal Type |

Dogs Cats Other Companion Animals) |

|

By Treatment Type |

Insulin Therapy Oral Medications Diet Management Glucose Monitoring |

|

By End-User |

Veterinary Clinics Animal Hospitals Homecare Settings |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Veterinary Clinics and Hospitals

Pet Owners

Pharmaceutical Companies

Insulin and Glucose Monitor Manufacturers

Government Agencies (FDA, EMA)

Veterinary Associations

Investment and Venture Capitalist Firms

Government and Regulatory Bodies (USDA, European Medicines Agency)

Companies

Players Mention in the Report

Zoetis Inc.

Merck Animal Health

Boehringer Ingelheim Animal Health

Eli Lilly and Company

Bayer AG

Novo Nordisk

Ceva Sant Animale

Vetoquinol S.A.

IDEXX Laboratories, Inc.

Virbac

Elanco Animal Health

Dechra Pharmaceuticals

Henry Schein, Inc.

Abbott Laboratories

Trupanion

Table of Contents

01. Global Pet Diabetes Care Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Pet Diabetes Care Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Pet Diabetes Care Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Pet Ownership (Pet Population Growth)

3.1.2. Rising Incidence of Diabetes in Pets (Diabetes Prevalence Rates in Pets)

3.1.3. Technological Advancements in Pet Healthcare (Device Innovation, Insulin Delivery)

3.1.4. Growing Awareness About Pet Health (Consumer Awareness Campaigns)

3.2. Market Challenges

3.2.1. High Cost of Pet Diabetes Treatment (Cost Constraints)

3.2.2. Lack of Awareness Among Pet Owners (Education Gap)

3.2.3. Regulatory Barriers in Veterinary Health Products (Regulatory Compliance)

3.3. Opportunities

3.3.1. Expansion in Emerging Markets (Regional Growth Opportunities)

3.3.2. Integration of AI in Diabetes Management (AI-Based Solutions)

3.3.3. Development of New Insulin Formulations (Product Innovation)

3.4. Trends

3.4.1. Telemedicine in Pet Healthcare (Remote Monitoring and Consultations)

3.4.2. Use of Wearable Devices for Glucose Monitoring (Wearable Technology Adoption)

3.4.3. Subscription-Based Healthcare Models for Pets (Service Subscription Models)

3.5. Regulatory Framework

3.5.1. Veterinary Medical Device Regulations

3.5.2. FDA and EMA Approvals for Veterinary Products

3.5.3. Animal Welfare Laws and Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

04. Global Pet Diabetes Care Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Glucose Monitoring Devices

4.1.2. Insulin Delivery Systems

4.1.3. Diabetic Pet Foods

4.1.4. Veterinary Drugs and Insulin

4.1.5. Wearable Health Monitoring Devices

4.2. By Animal Type (In Value %)

4.2.1. Dogs

4.2.2. Cats

4.2.3. Other Companion Animals

4.3. By Treatment Type (In Value %)

4.3.1. Insulin Therapy

4.3.2. Oral Medications

4.3.3. Diet Management

4.3.4. Glucose Monitoring

4.4. By End-User (In Value %)

4.4.1. Veterinary Clinics

4.4.2. Animal Hospitals

4.4.3. Homecare Settings

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global Pet Diabetes Care Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Zoetis Inc.

5.1.2. Merck Animal Health

5.1.3. Boehringer Ingelheim Animal Health

5.1.4. Eli Lilly and Company

5.1.5. Bayer AG

5.1.6. Novo Nordisk

5.1.7. Ceva Sant Animale

5.1.8. Vetoquinol S.A.

5.1.9. IDEXX Laboratories, Inc.

5.1.10. Virbac

5.1.11. Elanco Animal Health

5.1.12. Dechra Pharmaceuticals

5.1.13. Henry Schein, Inc.

5.1.14. Abbott Laboratories

5.1.15. Trupanion

5.2. Cross Comparison Parameters (Headquarters, No. of Employees, Revenue, Inception Year, Market Share, Product Portfolio, Market Reach, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Global Pet Diabetes Care Market Regulatory Framework

6.1. Veterinary Medical Device Certifications

6.2. Compliance and Regulatory Requirements

6.3. Standards for Diabetic Care Products

07. Global Pet Diabetes Care Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Pet Diabetes Care Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Animal Type (In Value %)

8.3. By Treatment Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

09. Global Pet Diabetes Care Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Pet Healthcare Expenditure Analysis

9.3. Customer Segmentation Analysis

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first phase involves creating a comprehensive map of the Global Pet Diabetes Care Market. Extensive desk research and proprietary databases are employed to capture critical factors like market size, growth drivers, and product availability.

Step 2: Market Analysis and Construction

This step involves analyzing historical and current market data, identifying key players, and evaluating product demand. Product penetration and revenue generation are assessed across different regions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated using interviews with industry experts. These consultations provide valuable insights into operational challenges, financial outlook, and market dynamics.

Step 4: Research Synthesis and Final Output

The final phase includes direct engagement with leading companies to verify and enhance collected data. The analysis is then synthesized into actionable insights for the market report.

Frequently Asked Questions

01. How big is the Global Pet Diabetes Care Market?

The Global Pet Diabetes Care Market is valued at USD 2.3 billion, driven by technological advancements in glucose monitoring and insulin delivery systems for pets, alongside increased awareness of pet diabetes among pet owners.

02. What are the challenges in the Global Pet Diabetes Care Market?

Key challenges include the high cost of diabetes care products, lack of awareness among pet owners in emerging markets, and the regulatory barriers surrounding veterinary medical products.

03. Who are the major players in the Global Pet Diabetes Care Market?

Leading companies in this market include Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, Eli Lilly and Company, and Novo Nordisk, all of which have strong global presence and innovative product portfolios.

04. What are the growth drivers of the Global Pet Diabetes Care Market?

Growth drivers include increasing pet ownership, technological advancements in diagnostic tools, and the rising prevalence of diabetes in pets, particularly in developed markets like North America and Europe.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.