Global Pet Insect Repellent Market Outlook to 2030

Region:Global

Author(s):Yogita Sahu

Product Code:KROD5088

December 2024

93

About the Report

Global Pet Insect Repellent Market Overview

- The Global Pet Insect Repellent Market, is valued at USD 3.4 billion. This valuation reflects the increasing awareness among pet owners about vector-borne diseases and the rising demand for advanced repellents. Growth is fueled by advancements in product formulations, such as natural and organic options, and the convenience of application, which appeals to modern pet owners.

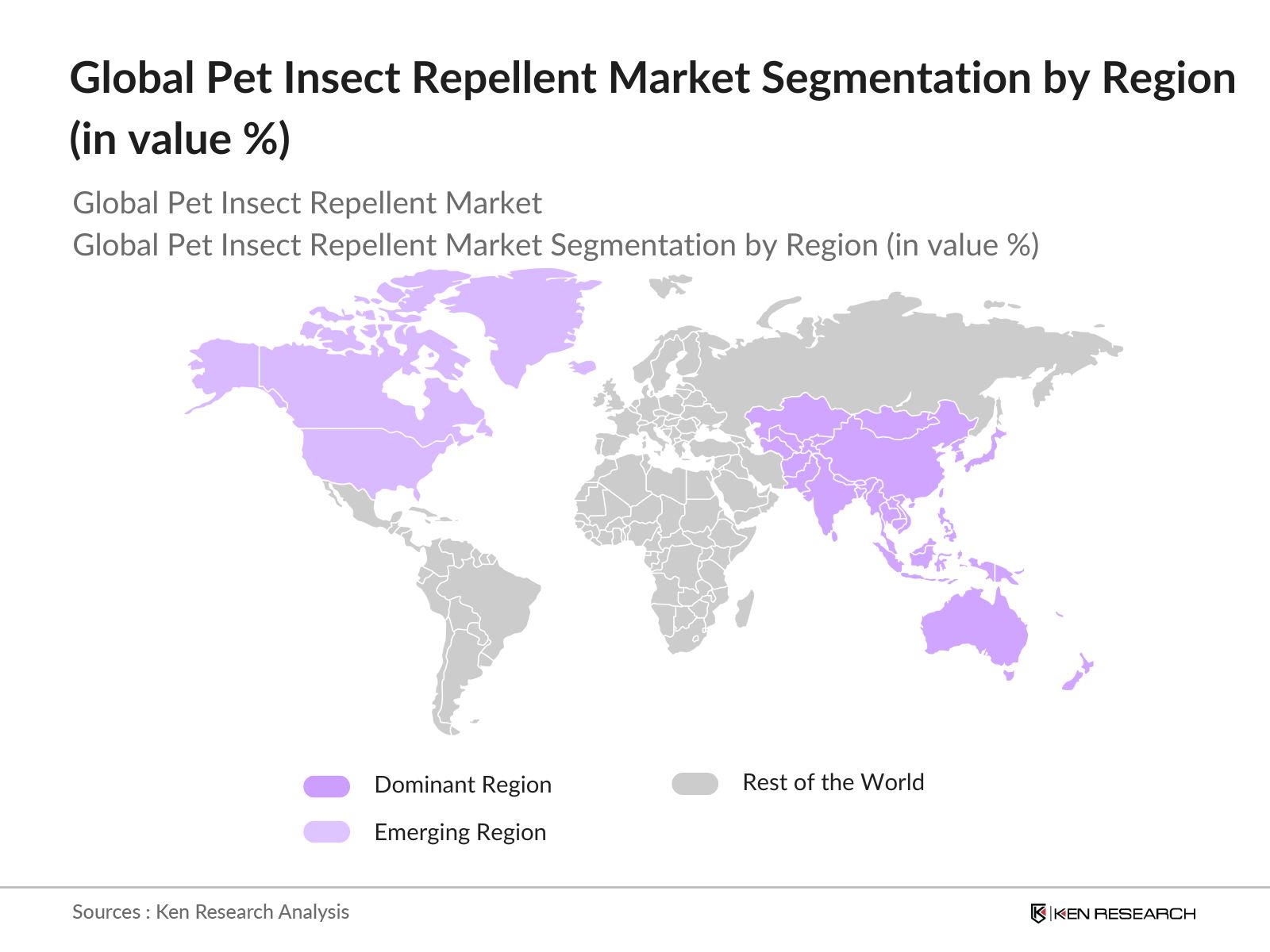

- North America and Europe dominate the market. North America's dominance stems from high pet ownership rates and advanced pet care infrastructure, while Europe benefits from stringent regulatory frameworks encouraging the use of natural repellents. Additionally, both regions see significant influence from e-commerce platforms, enabling wide product availability and adoption.

- The Centers for Disease Control and Prevention (CDC) allocates over USD 100 million annually to vector-borne disease prevention programs. These initiatives indirectly boost the pet insect repellent market by raising awareness about the importance of protecting pets from vectors like ticks and mosquitoes.

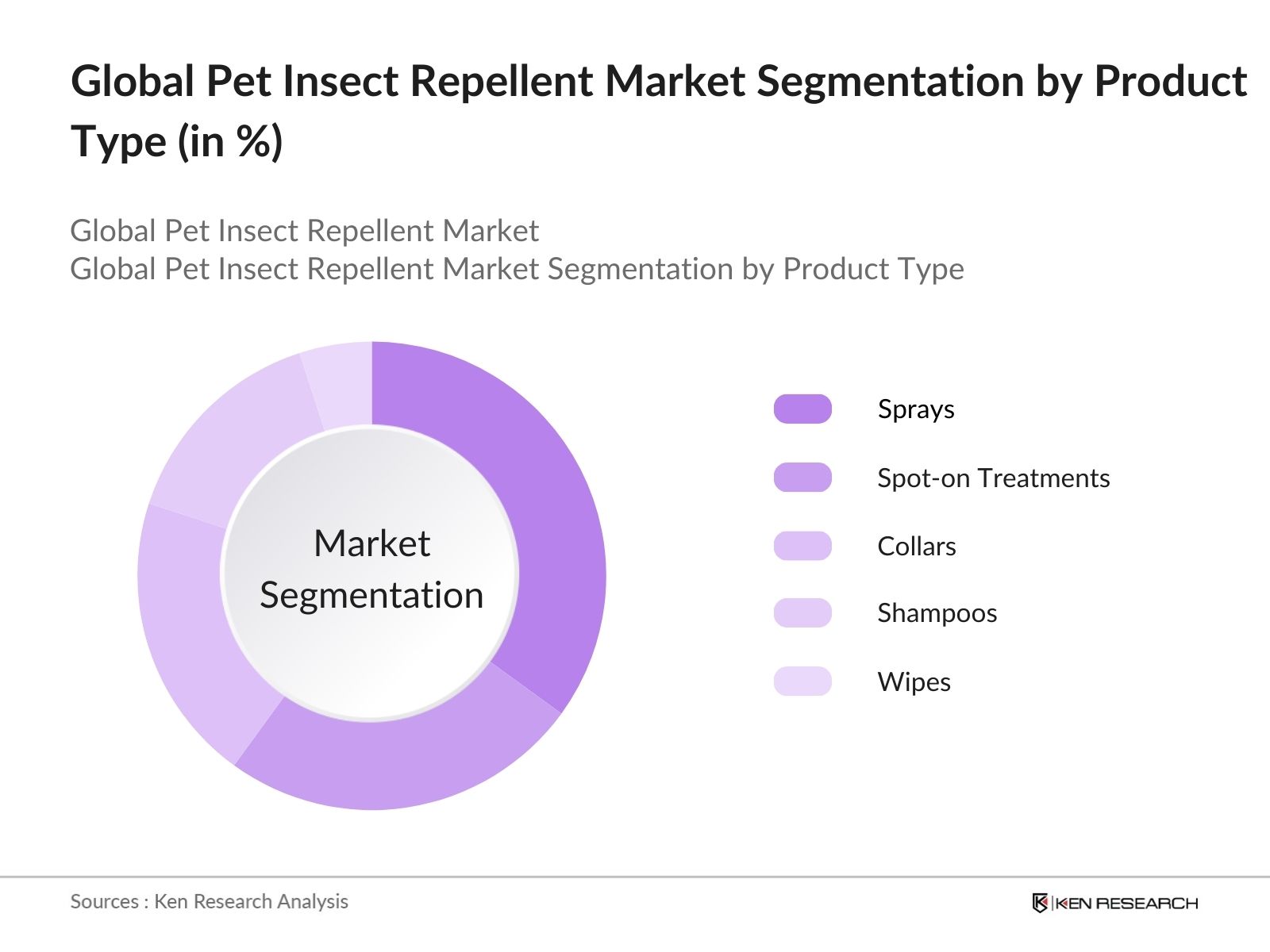

Global Pet Insect Repellent Market Segmentation

By Product Type: The market is segmented by product type into sprays, spot-on treatments, collars, shampoos, and wipes. Recently, sprays have a dominant market share due to their ease of application and effectiveness against various insect types. Leading brands offer formulations that are not only highly effective but also safe for pets and their surroundings, making sprays a preferred choice among pet owners.

By Pet Type: The market is segmented by pet type into dogs, cats, birds, and other animals. Dogs hold the largest share, driven by their high ownership rates globally and greater susceptibility to insect-related conditions. Dog-specific products are widely available and tailored to cater to their varying needs, ensuring their dominance in this segment.

By Region: Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market, driven by high pet ownership, robust distribution networks, and advanced product development. Innovations in pet care and a strong focus on sustainability in product ingredients further enhance the region's dominance.

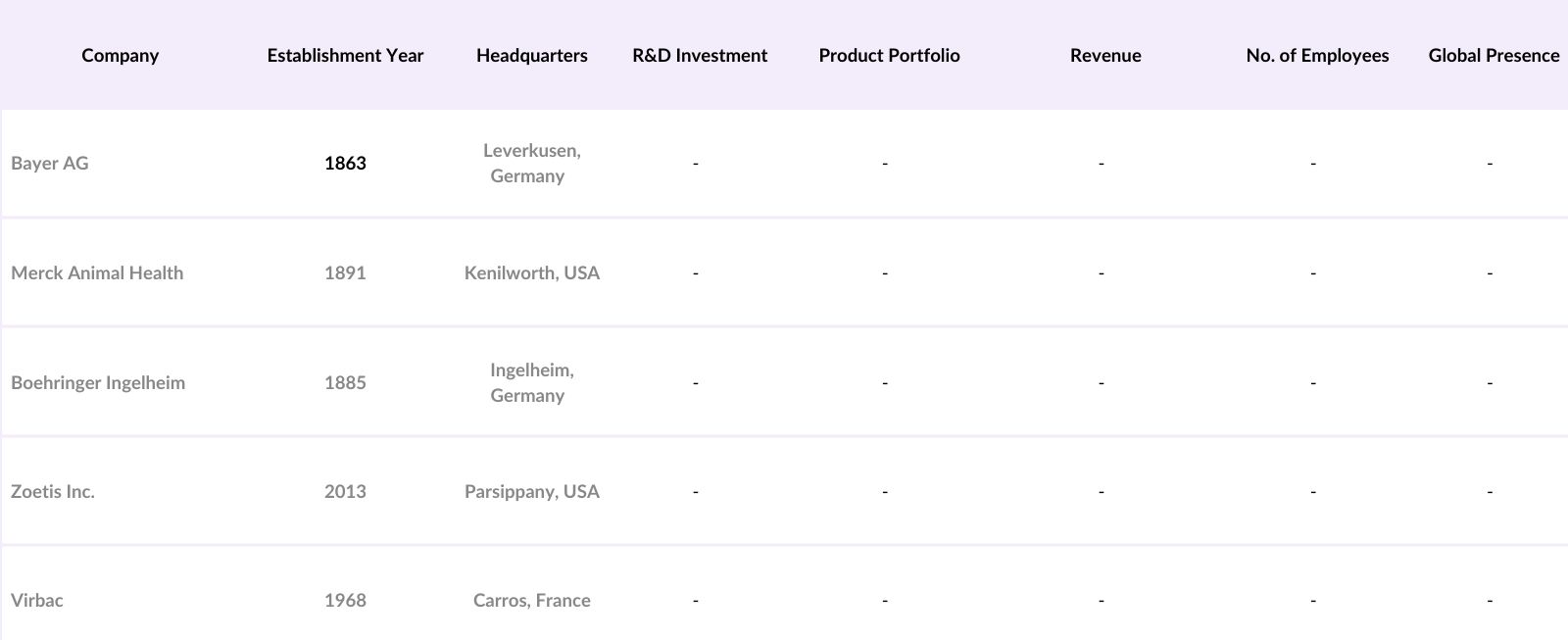

Global Pet Insect Repellent Market Competitive Landscape

The market is dominated by established players with robust product portfolios, extensive distribution networks, and strong brand recognition. Major players continually innovate to meet evolving consumer demands for safer and more sustainable products. consolidate their market presence.

Global Pet Insect Repellent Market Analysis

Market Growth Drivers

- Increasing Pet Ownership: The global pet population has been on the rise, with the United States alone housing over 89 million dogs and 94 million cats as of 2024. This surge in pet ownership amplifies the demand for pet care products, including insect repellents, as owners seek to protect their animals from pests and related diseases.

- Rising Incidence of Vector-Borne Diseases: The World Health Organization reports that vector-borne diseases account for more than 17% of all infectious diseases, causing over 700,000 deaths annually. Pets are susceptible to diseases like Lyme disease and heartworm, transmitted by ticks and mosquitoes, respectively. This elevates the necessity for effective insect repellents to safeguard pet health.

- Advancements in Veterinary Healthcare: The veterinary services market is, indicating a robust growth trajectory. This expansion reflects increased spending on pet health, including preventive measures like insect repellents, as owners become more proactive in ensuring their pets' well-being.

Market Challenges

- Regulatory Hurdles: The U.S. Environmental Protection Agency (EPA) regulates pet insect repellents, requiring rigorous testing and approval processes. These stringent regulations can delay product launches and increase compliance costs for manufacturers.

- Potential Side Effects: Reports from the U.S. Food and Drug Administration (FDA) indicate that certain insect repellent products have been associated with adverse reactions in pets, including skin irritations and neurological issues. Such incidents can erode consumer trust and impact market growth.

Global Pet Insect Repellent Market Future Outlook

Over the next five years, the Global Pet Insect Repellent industry is poised for robust growth, driven by increased awareness of pet health, the introduction of innovative natural and organic repellents, and the proliferation of e-commerce channels.

Future Market Opportunities

- Expansion into Emerging Markets: Emerging markets in Asia-Pacific and Latin America are projected to experience rapid growth in pet ownership, with over 300 million pets expected across these regions by the end of 2025. This trend will create significant opportunities for manufacturers to establish a strong presence and tap into the increasing demand for pet insect repellents in these areas.

- Focus on Sustainable Packaging: The global push towards sustainability is expected to influence the pet insect repellent market. Companies will likely adopt biodegradable and recyclable packaging materials, aligning with consumer preferences for eco-friendly products. This trend is supported by increasing government regulations on plastic usage, which compel manufacturers to innovate in packaging solutions.

Scope of the Report

|

Product Type |

Sprays Spot-on Treatments Collars Shampoos Wipes |

|

Pet Type |

Dogs Cats Birds Other Animals |

|

Insect Type |

Fleas Ticks Mosquitoes Flies Other Insects |

|

Distribution Channel |

Specialty Pet Stores Veterinary Clinics Online Retail Supermarkets Others |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Veterinary Clinics and Hospitals

Specialty Pet Retailers

E-commerce Platforms

Pet Care Product Manufacturers

Pet Owners

Government and Regulatory Bodies (e.g., FDA, USDA)

Investor and Venture Capitalist Firms

R&D Organizations in Animal Health

Companies

Players Mentioned in the Report:

Bayer AG

Merck Animal Health

Boehringer Ingelheim

Elanco Animal Health

Zoetis Inc.

Virbac

Ceva Sant Animale

Vetoquinol

PetIQ Inc.

NexGard

Table of Contents

1. Global Pet Insect Repellent Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Pet Insect Repellent Market Size (USD Billion)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Pet Insect Repellent Market Analysis

3.1. Growth Drivers

3.1.1. Rising Pet Ownership

3.1.2. Increased Awareness of Vector-Borne Diseases

3.1.3. Advancements in Repellent Technologies

3.1.4. Expansion of Pet Care Expenditure

3.2. Market Challenges

3.2.1. Regulatory Hurdles

3.2.2. Potential Side Effects on Pets

3.2.3. Market Fragmentation

3.3. Opportunities

3.3.1. Development of Natural and Organic Products

3.3.2. Expansion into Emerging Markets

3.3.3. Strategic Partnerships and Collaborations

3.4. Trends

3.4.1. Shift Towards Natural Ingredients

3.4.2. Integration of IoT in Pet Care Products

3.4.3. Growth of E-commerce Channels

3.5. Regulatory Landscape

3.5.1. International Standards and Compliance

3.5.2. Regional Regulatory Frameworks

3.5.3. Impact of Regulations on Product Development

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter's Five Forces Analysis

3.9. Competitive Landscape

4. Global Pet Insect Repellent Market Segmentation

4.1. By Product Type (Value %)

4.1.1. Sprays

4.1.2. Spot-on Treatments

4.1.3. Collars

4.1.4. Shampoos

4.1.5. Wipes

4.2. By Pet Type (Value %)

4.2.1. Dogs

4.2.2. Cats

4.2.3. Birds

4.2.4. Other Animals

4.3. By Insect Type (Value %)

4.3.1. Fleas

4.3.2. Ticks

4.3.3. Mosquitoes

4.3.4. Flies

4.3.5. Other Insects

4.4. By Distribution Channel (Value %)

4.4.1. Specialty Pet Stores

4.4.2. Veterinary Clinics

4.4.3. Online Retail

4.4.4. Supermarkets/Hypermarkets

4.4.5. Others

4.5. By Region (Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Pet Insect Repellent Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Bayer AG

5.1.2. Merck Animal Health

5.1.3. Boehringer Ingelheim

5.1.4. Elanco Animal Health

5.1.5. Zoetis Inc.

5.1.6. Virbac

5.1.7. Ceva Sant Animale

5.1.8. Vetoquinol

5.1.9. Ecto Development Corporation

5.1.10. PetIQ Inc.

5.1.11. Natural Chemistry

5.1.12. Earth Animal

5.1.13. NexGard

5.1.14. Perrigo Company plc

5.1.15. Frontline Plus

5.2. Cross-Comparison Parameters (Revenue, Headquarters, Inception Year, No. of Employees, Market Presence, Product Portfolio, Distribution Network, R&D Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Subsidies

5.8. Private Equity Investments

6. Global Pet Insect Repellent Market Regulatory Framework

6.1. Regional Regulatory Requirements

6.2. Certification Processes

6.3. International Compliance Standards

7. Global Pet Insect Repellent Future Market Size (USD Billion)

7.1. Projections Based on Growth Drivers

7.2. Key Influencing Factors

8. Global Pet Insect Repellent Future Market Segmentation

8.1. By Product Type

8.2. By Pet Type

8.3. By Insect Type

8.4. By Distribution Channel

8.5. By Region

9. Global Pet Insect Repellent Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Strategy

9.3. Marketing and Distribution Optimization

9.4. White Space Opportunities

Research Methodology

Step 1: Identification of Key Variables

The research begins with mapping the ecosystem, identifying stakeholders such as manufacturers, distributors, and end-users. A combination of proprietary databases and secondary sources is used to gather comprehensive market data, focusing on key variables like product adoption rates and sales channels.

Step 2: Market Analysis and Construction

Historical data is compiled to analyze penetration rates, sales distribution, and revenue generation. This phase also assesses service quality metrics to ensure the reliability of market insights and projections.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts using structured interviews. These insights provide operational and financial data that enrich the analysis.

Step 4: Research Synthesis and Final Output

The final phase integrates data from multiple stakeholders, including manufacturers and distributors. This synthesis ensures a detailed, accurate, and validated understanding of market trends, consumer behavior, and competitive dynamics.

Frequently Asked Questions

01. How big is the Global Pet Insect Repellent Market?

The Global Pet Insect Repellent Market is valued at USD 3.4 billion, driven by rising pet ownership, awareness of insect-borne diseases, and innovations in product formulations.

02. What are the challenges in the Global Pet Insect Repellent Market?

Challenges in the Global Pet Insect Repellent Market include stringent regulatory requirements, potential side effects on pets, and competition from local unregulated products.

03. Who are the major players in the Global Pet Insect Repellent Market?

Key players in the Global Pet Insect Repellent Market include Bayer AG, Zoetis Inc., Merck Animal Health, Boehringer Ingelheim, and Elanco Animal Health, among others.

04. What are the growth drivers for the Global Pet Insect Repellent Market?

Growth in the Global Pet Insect Repellent Market is propelled by increasing pet care expenditure, advancements in product formulations, and the growing prevalence of vector-borne diseases.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.