Global Pet Services Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD5092

December 2024

99

About the Report

Global Pet Services Market Overview

- The global pet services market is valued at USD 28.5 billion, driven by a combination of rising pet ownership and the increasing demand for pet care services. Factors such as pet humanization, where pets are considered part of the family, have boosted spending on grooming, boarding, veterinary care, and other services. Additionally, consumers are opting for premium services, ranging from pet insurance to specialized grooming, contributing to the market's growth. The consistent increase in disposable income and the emotional bond people have with their pets are key drivers for the market.

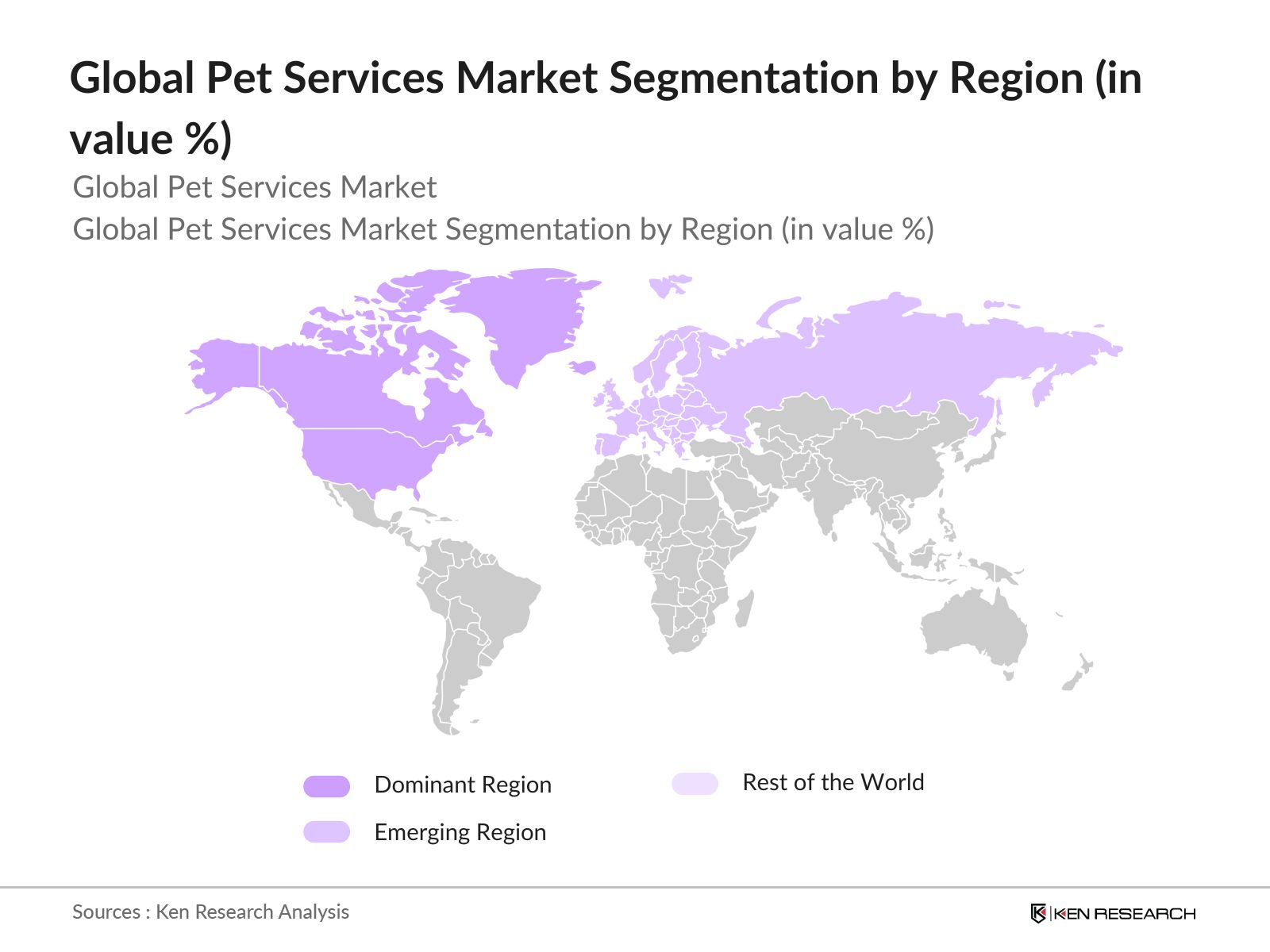

- In terms of geographical dominance, North America and Europe lead the market. In North America, particularly in the United States and Canada, high disposable income and the strong cultural inclination toward pet ownership contribute to the market's strength. Europe follows closely, with the UK, Germany, and France playing pivotal roles due to their advanced veterinary infrastructure, rising adoption rates, and emphasis on pet wellness. These regions maintain their lead due to robust economic support and societal trends that favour increased pet care.

- Animal welfare laws play a critical role in shaping the global pet services market. In the U.S., the Animal Welfare Act (AWA) mandates specific standards for pet grooming, boarding, and veterinary services, impacting over 10,000 pet service providers by 2023. Compliance with these laws is mandatory for businesses, ensuring ethical treatment of pets in care facilities. The European Union also enforces strict regulations under the European Convention for the Protection of Pet Animals, affecting over 8,000 pet businesses across member states. These laws not only protect animals but also elevate industry standards.

Global Pet Services Market Segmentation

- By Service Type: The global pet services market is segmented by service type into pet grooming, pet boarding & daycare, veterinary services, and pet insurance. Pet grooming services have taken a dominant market share in 2023, driven by the growing trend of pet humanization and the desire for premium services. Increasing disposable incomes have encouraged pet owners to invest in the wellness and appearance of their pets, leading to frequent grooming sessions. Brands and local service providers offer an array of grooming services, which are considered essential for maintaining pets' health and well-being.

- By Animal Type: The market is also segmented by animal type into dogs, cats, small pets (rabbits, hamsters, etc.), and exotic pets (birds, reptiles). Dogs dominate the global pet services market, holding the largest share in 2023. This is largely due to the higher ownership rates of dogs compared to other pets, as well as their larger need for care services such as grooming, veterinary visits, and boarding. Dogs require consistent care, driving up demand for all types of services, from premium grooming to specialized healthcare.

- By Region: Geographically, the global pet services market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America holds the dominant position in the market, capturing the largest share in 2023. This dominance is attributed to the region's cultural inclination towards pets, the high expenditure on premium services, and a well-established pet care infrastructure. Pet ownership rates in the U.S. and Canada remain among the highest globally, contributing to the market's growth.

Global Pet Services Market Competitive Landscape

The global pet services market is dominated by a few key players who have built extensive networks and a strong market presence. Major companies focus on providing a wide range of services, including grooming, veterinary care, boarding, and insurance. The presence of global players such as Mars Petcare and regional specialists like Petco contributes to the markets competitive nature. Consolidation is evident in the industry, with many companies offering integrated services that cover all aspects of pet care.

|

Company Name |

Year Established |

Headquarters |

Revenue (USD Bn) |

Number of Employees |

Global Presence |

Number of Outlets |

Customer Ratings |

Acquisition History |

|

Mars Petcare |

1911 |

Virginia, USA |

- |

- |

- |

- |

- |

- |

|

Petco Animal Supplies |

1965 |

San Diego, USA |

- |

- |

- |

- |

- |

- |

|

Rover |

2011 |

Seattle, USA |

- |

- |

- |

- |

- |

- |

|

Banfield Pet Hospital |

1955 |

Oregon, USA |

- |

- |

- |

- |

- |

- |

|

VCA Animal Hospitals |

1986 |

California, USA |

- |

- |

- |

- |

- |

- |

Global Pet Services Market Analysis

Global Pet Services Market Growth Drivers

Rising Pet Ownership: The global increase in urbanization has led to changing lifestyle patterns, contributing to the rise in pet ownership. According to the United Nations, over 56.2% of the worlds population lives in urban areas in 2024, leading to higher demand for companionship, especially in smaller households. As cities grow, people tend to adopt pets as a source of emotional support. In the U.S., for example, the pet population has seen a steady increase, with 90 million dogs and 94 million cats reported in urban settings in 2023. This shift drives the demand for pet services, including grooming, boarding, and veterinary care.

Increased Spending on Pet Wellness: Pet humanization, where pets are treated as family members, has led to a rise in spending on pet wellness services. A study by the World Bank shows that as global incomes rise, discretionary spending on pets has increased, especially in developed economies like the U.S. and Western Europe. In 2022, pet owners in the U.S. alone spent an average of $1,200 per pet annually on wellness services such as spa treatments, organic diets, and veterinary care. This trend is rapidly growing in middle-income economies, like China and Brazil, further driving demand for premium pet services.

Evolving Consumer Preferences: The pet services market has seen evolving consumer preferences with a shift toward subscription-based models and customized services. With over 4.1 billion global internet users in 2024, online services offering home delivery, subscription boxes, and customizable pet care options have surged. According to the IMF, this shift reflects a growing demand for convenience, especially among younger pet owners. In Europe, the market for pet subscription boxes, such as personalized grooming kits, grew by 8 million users between 2022 and 2023, making customization and convenience key drivers of market expansion. Source: IMF

Global Pet Services Market Challenges

- Fragmented Industry: The pet services industry remains highly fragmented, with competition intensifying between small businesses and large corporations. In North America, more than 70,000 small pet service businesses operate alongside major players like Petco and Chewy. This fragmentation leads to pricing pressures, operational challenges, and customer loyalty concerns. Small players face difficulties in scaling due to limited resources, while larger corporations benefit from economies of scale. The presence of an estimated 5 million independent pet groomers globally by 2023 further complicates market dynamics.

- High Operational Costs: High operational costs are a major challenge for the pet services industry. Logistics costs, particularly for mobile pet grooming and at-home pet care services, have risen by 15% between 2022 and 2024, according to IMF data. Additionally, rising real estate prices in urban centers globally are pushing up rents for pet service facilities, particularly in Asia-Pacific and Europe. Skilled labor shortages further compound these issues, as training and certification for pet care professionals require substantial investment. In Japan, for example, hiring a certified pet groomer costs up to $50,000 annually.

Global Pet Services Market Future Outlook

Over the next five years, the global pet services market is expected to experience steady growth, driven by factors such as rising pet ownership, increasing consumer spending on premium pet care services, and advancements in veterinary technology. The demand for personalized pet care solutions is expected to rise, with a particular focus on wellness services and innovative technologies such as AI-powered pet monitoring and telemedicine. The expansion into emerging markets such as Asia-Pacific is also anticipated to boost growth, as pet ownership becomes more widespread in these regions.

Global Pet Services Market Opportunities

- Expansion into Emerging Markets: The Asia-Pacific and Latin American markets represent growth opportunities for the global pet services industry. With a combined population of over 4 billion people, these regions are experiencing a rise in disposable incomes and changing lifestyles, leading to increased pet ownership. In China, the pet population grew to over 100 million in 2023, with a corresponding rise in demand for grooming, boarding, and veterinary services. Similarly, Brazil saw a 20% increase in pet-related expenditures in 2023, highlighting untapped potential in these regions.

- Technological Advancements: Technological advancements, particularly in AI-powered pet monitoring and telemedicine, are opening new revenue streams in the pet services market. In 2023, over 300 million wearable devices for pets were sold globally, allowing pet owners to track their pets' health, location, and activity levels. This trend is especially pronounced in developed markets like the U.S. and the U.K., where over 40% of pet owners use some form of pet monitoring technology. Telemedicine services, which allow remote consultations with veterinarians, are also growing, with over 20 million pet consultations conducted online in 2023.

Scope of the Report

|

By Service Type |

Pet Grooming Pet Boarding Veterinary Care Pet Insurance Pet Training |

|

By Animal Type |

Dogs Cats Small Pets Exotic Pets |

|

By Distribution Channel |

Online Platforms Brick-and-Mortar Pet Care Centers |

|

By Price Range |

Premium Mid-range Budget |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Global Pet Services Key Target Audience

Pet Owners

Pet Care Service Providers

Veterinary Clinics and Hospitals

Pet Product Manufacturers

Investor and Venture Capitalist Firms

Pet Insurance Providers

Banks and Financial Institutions

Government and Regulatory Bodies (such as the U.S. Department of Agriculture, European Pet Welfare Association)

Retail and E-commerce Companies

Companies

Global Pet Services Major Market Players

Mars Petcare

Petco Animal Supplies, Inc.

Rover

Wag!

Banfield Pet Hospital

PetSmart

Zoetis Inc.

VCA Animal Hospitals

BarkBox

BluePearl Veterinary Partners

The Animal Medical Center

Healthy Paws Pet Insurance

Trupanion

Fetch! Pet Care

Chewy, Inc.

Table of Contents

1. Global Pet Services Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Pet Services Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Pet Services Market Analysis

3.1. Growth Drivers

3.1.1. Rising Pet Ownership (Urbanization and changing lifestyle patterns)

3.1.2. Increased Spending on Pet Wellness (Pet humanization and premiumization)

3.1.3. Evolving Consumer Preferences (Subscription services, customization, and convenience)

3.2. Market Challenges

3.2.1. Fragmented Industry (Competitive pressures from small businesses and large corporations)

3.2.2. High Operational Costs (Logistics, real estate, skilled labor)

3.2.3. Regulatory Compliance (Regional variations in pet care regulations)

3.3. Opportunities

3.3.1. Expansion into Emerging Markets (Untapped potential in Asia-Pacific and Latin America)

3.3.2. Technological Advancements (AI-powered pet monitoring, telemedicine)

3.3.3. Pet Health & Wellness (Rising demand for organic and holistic care)

3.4. Trends

3.4.1. Growth in Pet Tech Solutions (Wearables, GPS tracking, smart feeding)

3.4.2. Integration with E-commerce (Online pet care platforms)

3.4.3. Rise of Pet Insurance and Financial Services (Pet health policies)

3.5. Government Regulations

3.5.1. Animal Welfare Laws (Compliance and ethical business operations)

3.5.2. Licensing and Certification (Professional standards in pet grooming and care services)

3.5.3. Import/Export Regulations (Impact of international pet transport and care)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Pet Services Market Segmentation

4.1. By Service Type (In Value %)

4.1.1. Pet Grooming Services

4.1.2. Pet Boarding and Daycare

4.1.3. Pet Training Services

4.1.4. Veterinary Care Services

4.1.5. Pet Insurance and Financial Services

4.2. By Animal Type (In Value %)

4.2.1. Dogs

4.2.2. Cats

4.2.3. Small Pets (Rabbits, Hamsters, etc.)

4.2.4. Exotic Pets (Reptiles, Birds)

4.3. By Distribution Channel (In Value %)

4.3.1. Online Platforms

4.3.2. Brick-and-Mortar Stores

4.3.3. Pet Care Centers and Clinics

4.4. By Price Range (In Value %)

4.4.1. Premium Services

4.4.2. Mid-range Services

4.4.3. Budget Services

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Pet Services Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Mars Petcare

5.1.2. Petco Animal Supplies, Inc.

5.1.3. Rover

5.1.4. Wag!

5.1.5. Banfield Pet Hospital

5.1.6. PetSmart

5.1.7. Zoetis Inc.

5.1.8. VCA Animal Hospitals

5.1.9. BarkBox

5.1.10. BluePearl Veterinary Partners

5.1.11. The Animal Medical Center

5.1.12. Healthy Paws Pet Insurance

5.1.13. Trupanion

5.1.14. Fetch! Pet Care

5.1.15. Chewy, Inc.

5.2. Cross Comparison Parameters (Revenue, Employee Count, Headquarters, Service Offerings, Global Presence, Inception Year, Customer Reviews, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Pet Services Market Regulatory Framework

6.1. Animal Welfare Laws and Compliance

6.2. Licensing and Certification Procedures

6.3. Health and Safety Standards

6.4. Pet Transport Regulations

6.5. International Pet Care Regulations

7. Global Pet Services Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Pet Services Future Market Segmentation

8.1. By Service Type (In Value %)

8.2. By Animal Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By Price Range (In Value %)

8.5. By Region (In Value %)

9. Global Pet Services Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Strategies

9.3. Innovation and Product Differentiation

9.4. Strategic Marketing Initiatives

9.5. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, the research team identified the primary stakeholders and the key drivers of the global pet services market. A combination of secondary data from credible sources, including industry reports and proprietary databases, was used to gather information on market dynamics, including growth drivers, challenges, and future trends.

Step 2: Market Analysis and Construction

The second phase involved an in-depth analysis of historical data to construct the overall market model. This included evaluating market penetration rates, consumer behaviour patterns, and the impact of market trends on various segments. Quantitative data was collected to establish a foundation for forecasting market growth over the next five years.

Step 3: Hypothesis Validation and Expert Consultation

To validate the market hypotheses, interviews with industry experts were conducted using computer-assisted telephone interviews (CATIs). These experts provided insights into consumer preferences, market challenges, and strategic developments within the industry. Their input helped refine the data and ensured the accuracy of market forecasts.

Step 4: Research Synthesis and Final Output

In the final phase, the research findings were synthesized to create a comprehensive analysis of the global pet services market. This included integrating both bottom-up and top-down approaches to ensure the robustness of market estimates and provide actionable insights for stakeholders.

Frequently Asked Questions

01. How big is the Global Pet Services Market?

The global pet services market is valued at USD 28.5 billion, driven by rising pet ownership, increased consumer spending on premium services, and advancements in veterinary technology.

02. What are the challenges in the Global Pet Services Market?

The challenges in the global pet services market include high operational costs, regulatory compliance in different regions, and the fragmented nature of the industry, which sees competition between large corporations and smaller, local businesses.

03. Who are the major players in the Global Pet Services Market?

Major players in the global pet services market include Mars Petcare, Petco Animal Supplies, Rover, Banfield Pet Hospital, and VCA Animal Hospitals. These companies dominate due to their extensive service offerings, strong customer loyalty, and large geographic footprint.

04. What are the growth drivers of the Global Pet Services Market?

The global pet services market growth drivers include increasing pet humanization, rising disposable incomes, advancements in pet healthcare technology, and the growing demand for premium pet services such as grooming and veterinary care.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.