Global Petrochemicals Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD3097

December 2024

88

About the Report

Global Petrochemicals Market Outlook to 2028

Global Petrochemicals Market Overview

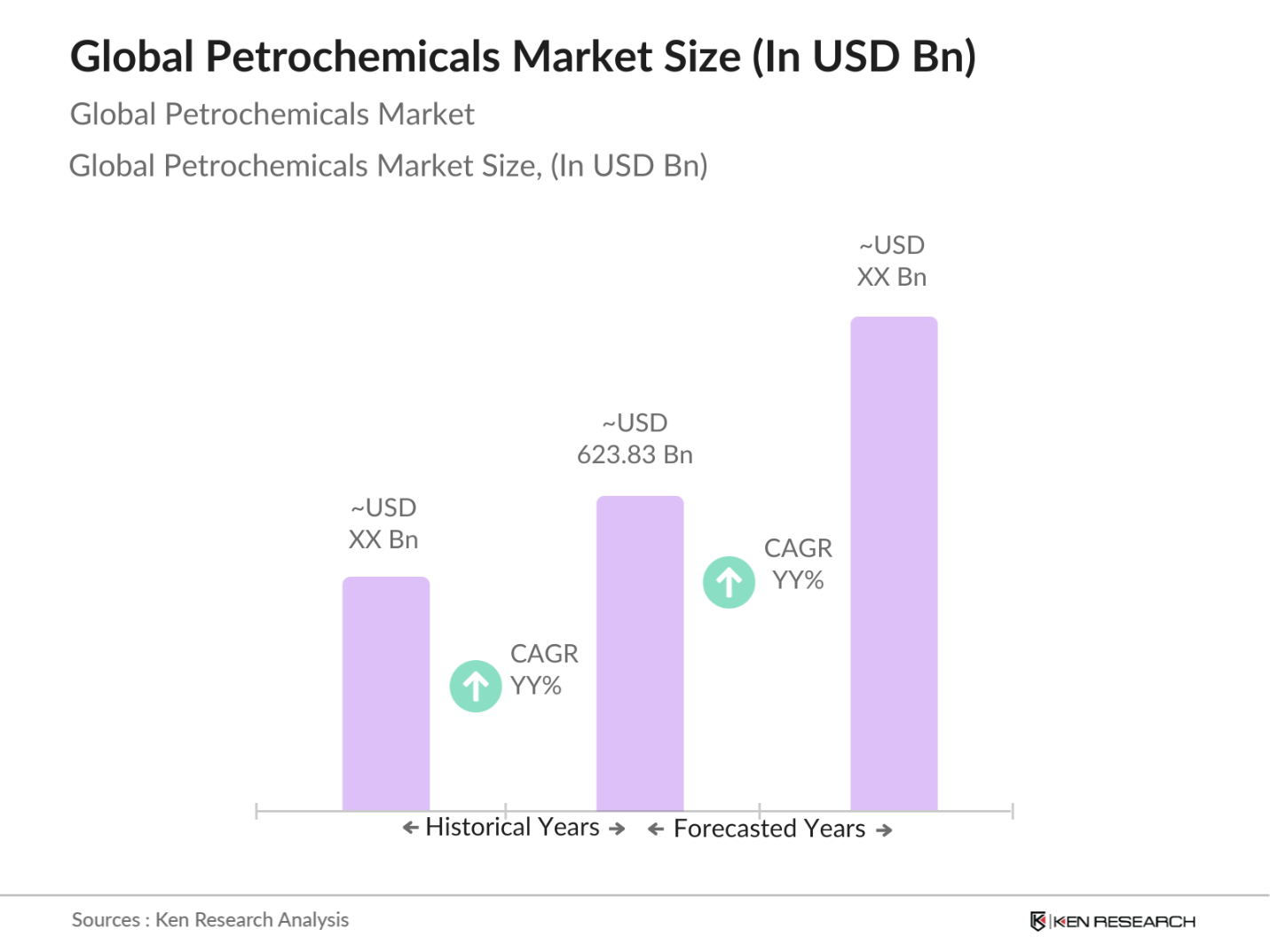

- The global petrochemicals market is valued at approximately USD 623.83billion, driven by the escalating demand across industries such as automotive, construction, and packaging. Key drivers include advancements in petrochemical processing technologies and an increase in consumer demand for plastic products. The markets growth has been steady, bolstered by rapid industrialization in emerging economies and technological innovation, especially in high-demand sectors.

- Regions like North America, the Middle East, and the Asia-Pacific dominate the petrochemicals market due to their well-established production infrastructure, rich reserves of raw materials, and significant investments in petrochemical projects. The Middle East benefits from cost advantages due to its abundant oil reserves, while Asia-Pacific leads in consumption, driven by expanding industries in countries like China and India.

- Governments, particularly in regions like the European Union, are providing substantial funding for R&D in green chemistry and sustainable petrochemical processes. Grants and low-interest loans are offered to companies and research institutions focused on developing new, environmentally friendly technologies. This funding enables the petrochemical industry to innovate, improve production efficiency, and reduce environmental impact, which supports long-term industry sustainability.

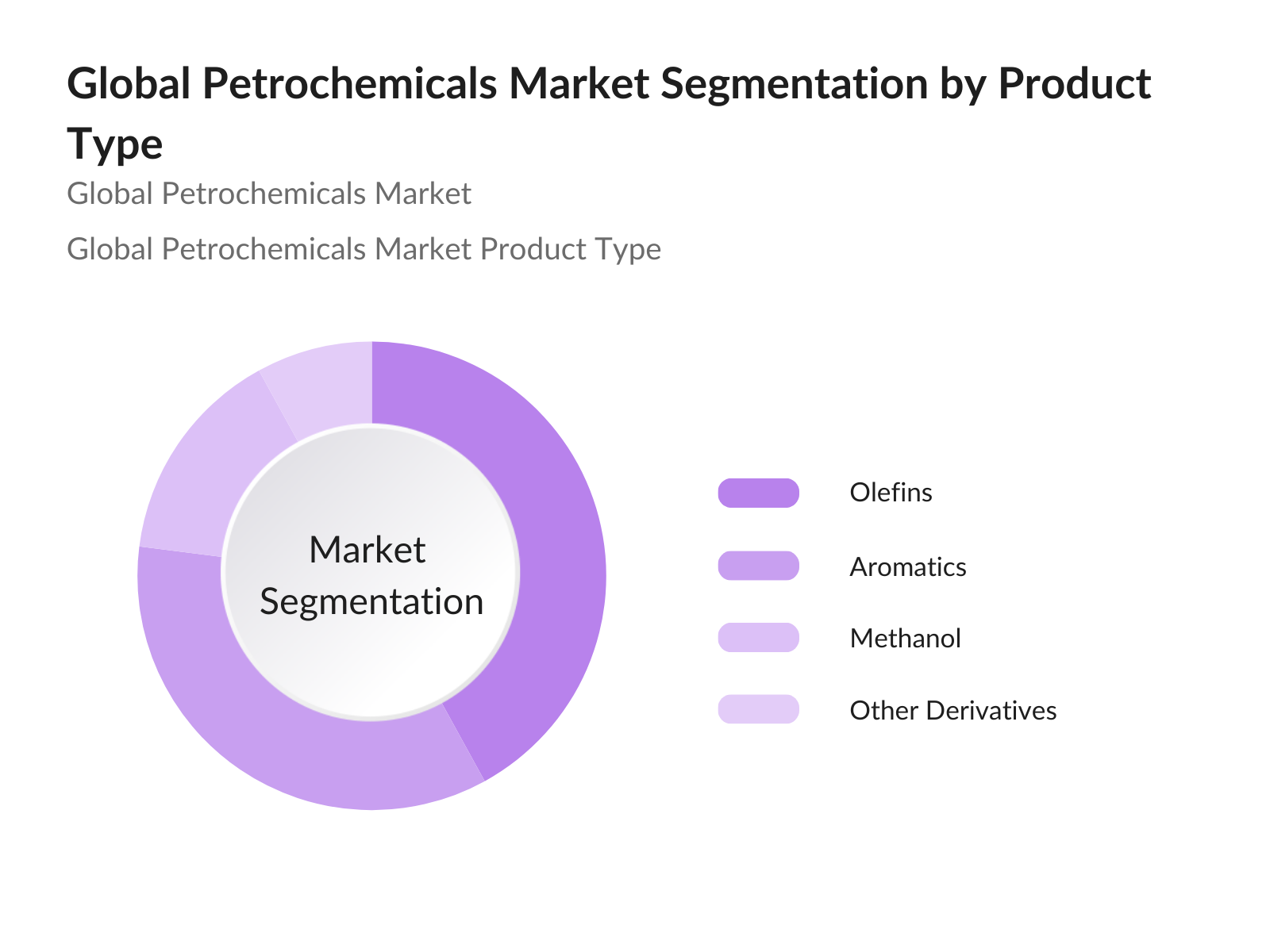

Global Petrochemicals Market Segmentation

By Product Type: The global petrochemicals market is segmented by product type into olefins, aromatics, methanol, and other derivatives. Olefins, which include ethylene and propylene, dominate this segment due to their extensive applications in manufacturing plastics, synthetic fibers, and rubber. The versatile nature of olefins in creating essential everyday products contributes to their substantial market share.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific dominates, largely due to high demand from industrializing countries and an expanding manufacturing sector. Countries like China and India contribute significantly due to their rising consumer markets and supportive government policies for petrochemical industry growth.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. Asia-Pacific dominates, largely due to high demand from industrializing countries and an expanding manufacturing sector. Countries like China and India contribute significantly due to their rising consumer markets and supportive government policies for petrochemical industry growth.

Global Petrochemicals Market Competitive Landscape

Global Petrochemicals Market Competitive Landscape

The global petrochemicals market is dominated by several key players who leverage extensive production capacity, advanced technologies, and robust distribution channels.

Global Petrochemicals Market Analysis

Market Growth Drivers

- Industrialization in Emerging Economies: Industrial growth in emerging markets is driving significant demand for petrochemicals. Countries like India and China, which are experiencing rapid industrial expansion, have seen notable increases in production activity. India, for example, imported 1.3 million metric tons of basic chemicals for industrial use in the first quarter of 2024, reflecting the growing demand for petrochemical inputs in various industries. This increase highlights the petrochemical industrys critical role as a supplier of essential raw materials in rapidly industrializing regions.

- Increased Demand in End-Use Industries (Automotive, Construction): The automotive industry in China produced 21.5 million vehicles in the first half of 2024, utilizing substantial volumes of petrochemical-derived materials. Similarly, construction activities in the Asia-Pacific have risen, with a 6.8% increase in commercial real estate developments in Indonesia from 2023. This drives demand for high-performance polymers and resins essential in construction applications.

- Rising Investments in Chemical Processing Technologies: Global investment in petrochemical technology has increased substantially, with the EU alone contributing EUR 3 billion to green chemical processing R&D in 2024. These investments are directed toward enhancing operational efficiency and minimizing waste, focusing on reducing byproduct emissions. This industry commitment is anticipated to support sustainable petrochemical processing and meet the growing demand in high-consumption regions.

Market Challenges:

- Volatility in Feedstock Prices: The petrochemical industry is highly sensitive to fluctuations in feedstock prices, primarily crude oil and natural gas. These price swings can significantly impact profit margins and complicate budgeting and forecasting for companies, making it challenging to maintain cost stability in operations and pricing.

- Stringent Environmental Regulations: The industry faces increasing pressure from stringent environmental regulations aimed at reducing emissions and waste. Compliance requires investments in cleaner technologies and sustainable practices, which can raise operational costs and impact overall profitability.

Global Petrochemicals Market Future Outlook

Over the next five years, the global petrochemicals market is expected to experience notable growth driven by increased demand for petrochemical derivatives in packaging, automotive, and construction industries. Additionally, advancements in sustainable and bio-based petrochemical processes are likely to create significant opportunities for market expansion. Growth is also anticipated from ongoing investments in new production technologies and environmental initiatives, aiming to reduce emissions associated with petrochemical production.

Market Opportunities:

- Advancements in Petrochemical Processing Technologies: Emerging technologies in catalytic and cracking processes offer enhanced efficiency and lower energy consumption in petrochemical production. These innovations allow companies to increase output while reducing emissions, aligning with sustainability goals and regulatory standards. As technology in this field evolves, companies that adopt these advancements can gain a competitive edge and address rising demand efficiently.

- Integration with Renewable Feedstocks: There is a growing opportunity for the petrochemical industry to integrate renewable feedstocks, such as bio-based inputs, into production processes. This shift supports sustainability goals and aligns with increasing global demand for eco-friendly materials, particularly in regions prioritizing renewable resource usage. Companies that innovate in this area can reduce their environmental footprint while appealing to environmentally conscious consumers.

Scope of the Report

|

By Product Type |

Olefins Aromatics Methanol Styrene Butadiene |

|

By Feedstock |

Crude Oil Natural Gas Coal Renewable Sources |

|

By End-Use Industry |

Packaging Automotive Electronics Construction Textiles |

|

By Process Technology |

Steam Cracking Catalytic Reforming Methanol-to-Olefins (MTO) Fluid Catalytic Cracking (FCC) |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Petrochemical Manufacturers

Investments and Venture Capitalist Firms

Automotive Companies

Government and Regulatory Bodies (U.S. Environmental Protection Agency, Ministry of Petroleum and Natural Gas, European Commission)

Packaging and Consumer Goods Companies

Energy and Utility Providers

Oil and Gas Extraction Companies

Chemical Industry Associations

Companies

Players Mention in the Report

ExxonMobil Corporation

SABIC

Dow Inc.

BASF SE

Royal Dutch Shell

Reliance Industries

LyondellBasell Industries

INEOS Group

Chevron Phillips Chemical

Mitsubishi Chemical Holdings

LG Chem

Sumitomo Chemical Co.

China National Petroleum Corporation (CNPC)

TotalEnergies

Formosa Plastics Group

Table of Contents

01. Global Petrochemicals Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate (Demand Growth, Production Expansion)

1.4 Market Segmentation Overview (Product Type, Feedstock, End-Use Industry, Region, Process Technology)

02. Global Petrochemicals Market Size (In USD Bn)

2.1 Historical Market Size (Production Volume, Revenue, Demand-Supply Gap)

2.2 Year-On-Year Growth Analysis (Production Capacity, Consumption Volume)

2.3 Key Market Developments and Milestones (Capacity Expansions, Project Launches, Mergers)

03. Global Petrochemicals Market Analysis

3.1 Growth Drivers

3.1.1 Industrialization in Emerging Economies

3.1.2 Increased Demand in End-Use Industries (Automotive, Construction)

3.1.3 Rising Investments in Chemical Processing Technologies

3.1.4 Strategic Expansion of Production Facilities

3.2 Market Challenges

3.2.1 Volatility in Feedstock Prices

3.2.2 Regulatory Restrictions on Emissions

3.2.3 Sustainability and Environmental Concerns

3.2.4 Competition from Alternative Materials

3.3 Opportunities

3.3.1 Technological Advancements in Petrochemical Processes

3.3.2 Integration with Renewable Feedstocks

3.3.3 Regional Market Expansion in Asia-Pacific and MEA

3.4 Trends

3.4.1 Shift Towards Bio-Based Petrochemicals

3.4.2 Increasing Focus on Circular Economy

3.4.3 Digital Transformation in Production and Logistics

3.5 Regulatory Landscape

3.5.1 Emission Standards (Carbon Emissions, Hazardous Waste)

3.5.2 Safety Compliance and Environmental Impact Assessments

3.6 SWOT Analysis

3.7 Supply Chain Analysis (Raw Material Procurement, Distribution Channels)

3.8 Porters Five Forces Analysis

3.9 Competitive Landscape and Ecosystem

04. Global Petrochemicals Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Olefins

4.1.2 Aromatics

4.1.3 Methanol

4.1.4 Styrene

4.1.5 Butadiene

4.2 By Feedstock (In Value %)

4.2.1 Crude Oil

4.2.2 Natural Gas

4.2.3 Coal

4.2.4 Renewable Sources

4.3 By End-Use Industry (In Value %)

4.3.1 Packaging

4.3.2 Automotive

4.3.3 Electronics

4.3.4 Construction

4.3.5 Textiles

4.4 By Process Technology (In Value %)

4.4.1 Steam Cracking

4.4.2 Catalytic Reforming

4.4.3 Methanol-to-Olefins (MTO)

4.4.4 Fluid Catalytic Cracking (FCC)

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

05. Global Petrochemicals Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 ExxonMobil Corporation

5.1.2 SABIC

5.1.3 Dow Inc.

5.1.4 BASF SE

5.1.5 Royal Dutch Shell

5.1.6 Reliance Industries

5.1.7 LyondellBasell Industries

5.1.8 INEOS Group

5.1.9 Chevron Phillips Chemical

5.1.10 Mitsubishi Chemical Holdings

5.1.11 LG Chem

5.1.12 Sumitomo Chemical Co.

5.1.13 China National Petroleum Corporation (CNPC)

5.1.14 TotalEnergies

5.1.15 Formosa Plastics Group

5.2 Cross Comparison Parameters (Revenue, Feedstock Capacity, Production Facilities, Product Portfolio, Market Share, Investment in R&D, Environmental Compliance)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Expansion, Collaborations, Technology Partnerships)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital and Funding

5.8 Government Grants and Subsidies

5.9 Private Equity Investments

06. Global Petrochemicals Market Regulatory Framework

6.1 International Emission Standards

6.2 Product Quality Standards

6.3 Environmental Compliance Regulations

6.4 Certification and Licensing Requirements

07. Global Petrochemicals Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth (Demand for Light Feedstocks, Advanced Process Technologies)

08. Global Petrochemicals Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Feedstock (In Value %)

8.3 By End-Use Industry (In Value %)

8.4 By Process Technology (In Value %)

8.5 By Region (In Value %)

09. Global Petrochemicals Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Market Expansion Opportunities

9.3 Technology Adoption Strategies

9.4 Emerging Growth Regions Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase includes creating an ecosystem map involving all primary stakeholders in the global petrochemicals market. This is supported by extensive secondary research from industry databases to identify critical factors influencing the market, such as production capacity and consumer demand.

Step 2: Market Analysis and Construction

This phase involves a detailed analysis of historical market data for the petrochemicals industry, assessing production levels and end-use consumption. Key metrics like feedstock availability and processing capacity are analyzed to ensure accurate market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends and growth drivers are validated through interviews with industry experts, including senior managers from leading petrochemical firms. This provides direct insights into operational trends and emerging technologies that impact market dynamics.

Step 4: Research Synthesis and Final Output

The final synthesis phase involves consolidating data gathered from proprietary models and industry insights, ensuring an accurate and verified analysis. Data validation through real-world case studies and production metrics finalizes the report for comprehensive industry coverage.

Frequently Asked Questions

01. How big is the Global Petrochemicals Market?

The global petrochemicals market is valued at USD 623.83 billion, supported by the high demand for petrochemical derivatives across multiple industries.

02. What are the challenges in the Global Petrochemicals Market?

Challenges include fluctuating feedstock prices, regulatory pressure for emission reductions, and competition from alternative, eco-friendly materials.

03. Who are the major players in the Global Petrochemicals Market?

Key players include ExxonMobil, SABIC, Dow Inc., BASF SE, and Royal Dutch Shell, known for their extensive production capacities and technological advancements.

04. What factors are driving the Global Petrochemicals Market?

The market is driven by rising industrial demand, technological advancements in production, and increasing use in end-use industries like automotive and packaging.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.