Region:Global

Author(s):Geetanshi

Product Code:KRAD0021

Pages:94

Published On:August 2025

By Machinery Type:The machinery type segment includes various subsegments such as Primary Packaging Equipment, Secondary Packaging Equipment, Labelling and Serialization Equipment, and Others. Among these, Primary Packaging Equipment leads the market due to the increasing demand for aseptic filling and sealing processes, which are critical for maintaining product integrity and safety. The rise in chronic diseases, the need for efficient drug delivery systems, and the adoption of automation and smart packaging technologies further bolster this segment's growth .

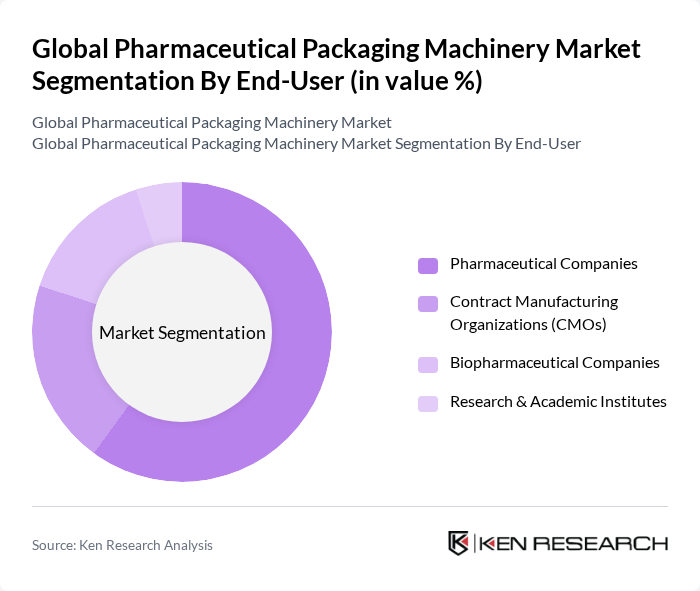

By End-User:The end-user segment encompasses Pharmaceutical Companies, Contract Manufacturing Organizations (CMOs), Biopharmaceutical Companies, and Research & Academic Institutes. Pharmaceutical Companies dominate this segment, driven by the increasing production of generic and branded drugs. The need for efficient packaging solutions that comply with regulatory standards and enhance product shelf life is a significant factor contributing to their market leadership. CMOs and Biopharmaceutical Companies are also experiencing growth due to outsourcing trends and the rise in biologics manufacturing .

The Global Pharmaceutical Packaging Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Syntegon Technology GmbH (formerly Bosch Packaging Technology), IMA Group, Marchesini Group S.p.A., Uhlmann Pac-Systeme GmbH & Co. KG, Krones AG, MULTIVAC Sepp Haggenmüller SE & Co. KG, Romaco Holding GmbH, Optima Packaging Group GmbH, Seidenader Maschinenbau GmbH, ACG Worldwide, Coesia S.p.A., Körber AG (Medipak Systems), MG2 S.r.l., and Marchesini Group S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical packaging machinery market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of automation and artificial intelligence is expected to streamline operations, enhancing efficiency and reducing costs. Additionally, the growing emphasis on sustainability will likely lead to increased demand for eco-friendly packaging solutions, aligning with global environmental goals. Companies that adapt to these trends will be better positioned to thrive in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Machinery Type | Primary Packaging Equipment (Aseptic Filling and Sealing, Bottle Filling and Capping, Blister Packaging) Secondary Packaging Equipment (Cartoning, Case Packing, Wrapping, Tray Packing) Labelling and Serialization Equipment (Bottle & Ampule Labelling, Carton Labelling, Serialization) Others (Pouching, Sachet, Strip Packaging, Overwrapping) |

| By End-User | Pharmaceutical Companies Contract Manufacturing Organizations (CMOs) Biopharmaceutical Companies Research & Academic Institutes |

| By Dosage Form | Solid Dosage Forms (Tablets, Capsules, Powders) Liquid Dosage Forms (Syrups, Injections, Suspensions) Semi-Solid Dosage Forms (Ointments, Creams, Gels) Others (Inhalables, Nasal Sprays) |

| By Technology | Manual Semi-Automatic Automatic |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Material | Plastic Glass Metal Others (Paper, Foil, Laminates) |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Packaging Machinery Manufacturers | 60 | Product Managers, Sales Directors |

| Pharmaceutical Companies | 100 | Procurement Managers, Quality Assurance Officers |

| Regulatory Bodies | 40 | Compliance Officers, Regulatory Affairs Managers |

| Packaging Material Suppliers | 50 | Supply Chain Managers, Business Development Executives |

| Industry Experts and Consultants | 40 | Market Analysts, Industry Advisors |

The Global Pharmaceutical Packaging Machinery Market is valued at approximately USD 6.5 billion, driven by the increasing demand for efficient and safe packaging solutions in the pharmaceutical sector, along with a focus on regulatory compliance and sustainability.