Global Phone Accessories Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD10692

December 2024

88

About the Report

Global Phone Accessories Market Overview

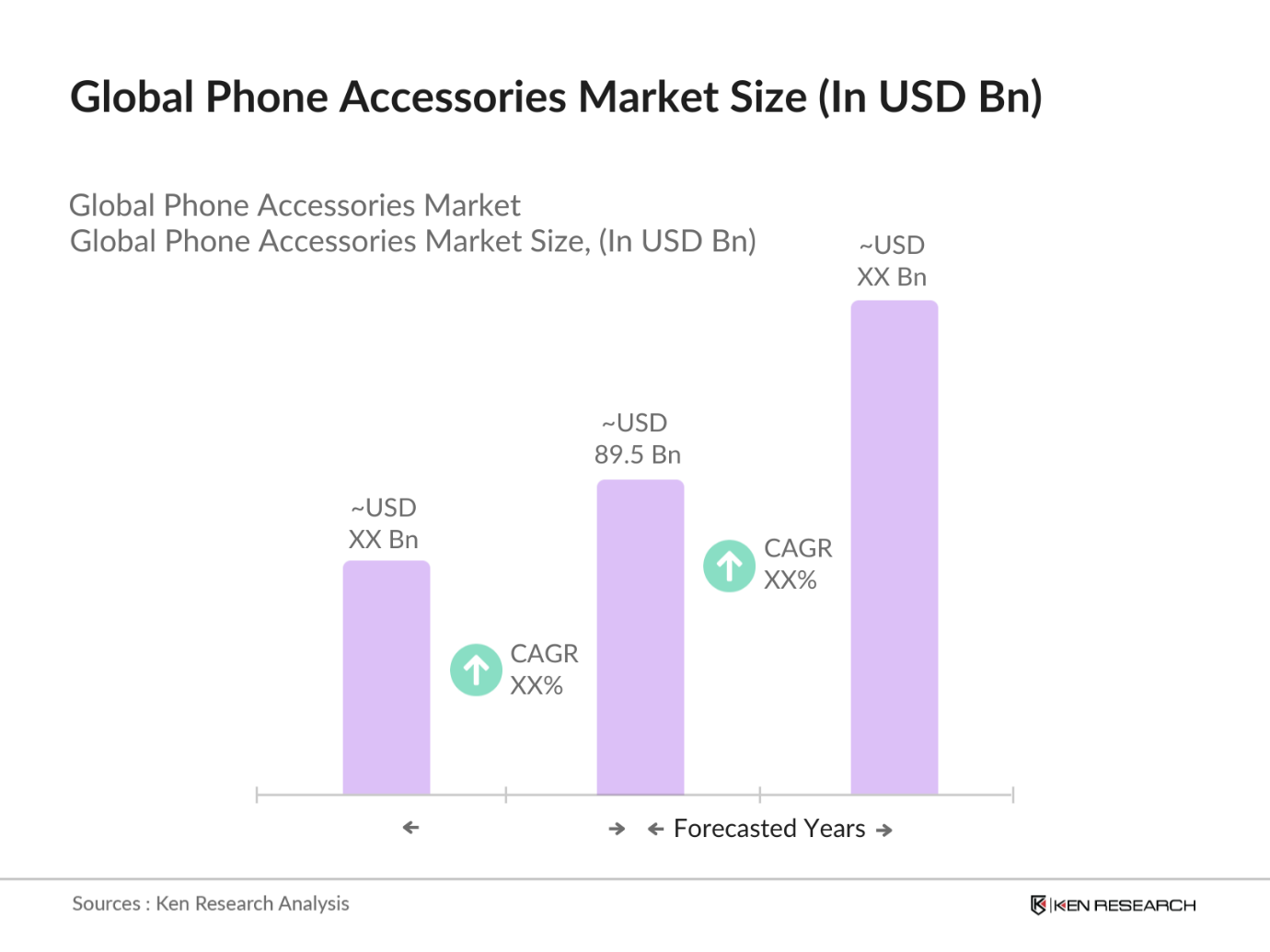

- The Global Phone Accessories Market is valued at USD 89.5 billion based on a five-year historical analysis. The markets growth is primarily driven by the increasing penetration of smartphones worldwide, a higher demand for wireless accessories, and rapid technological innovations. The growing shift toward wireless and fast-charging technologies has played a significant role in boosting the sales of accessories such as earphones, headphones, chargers, and power banks.

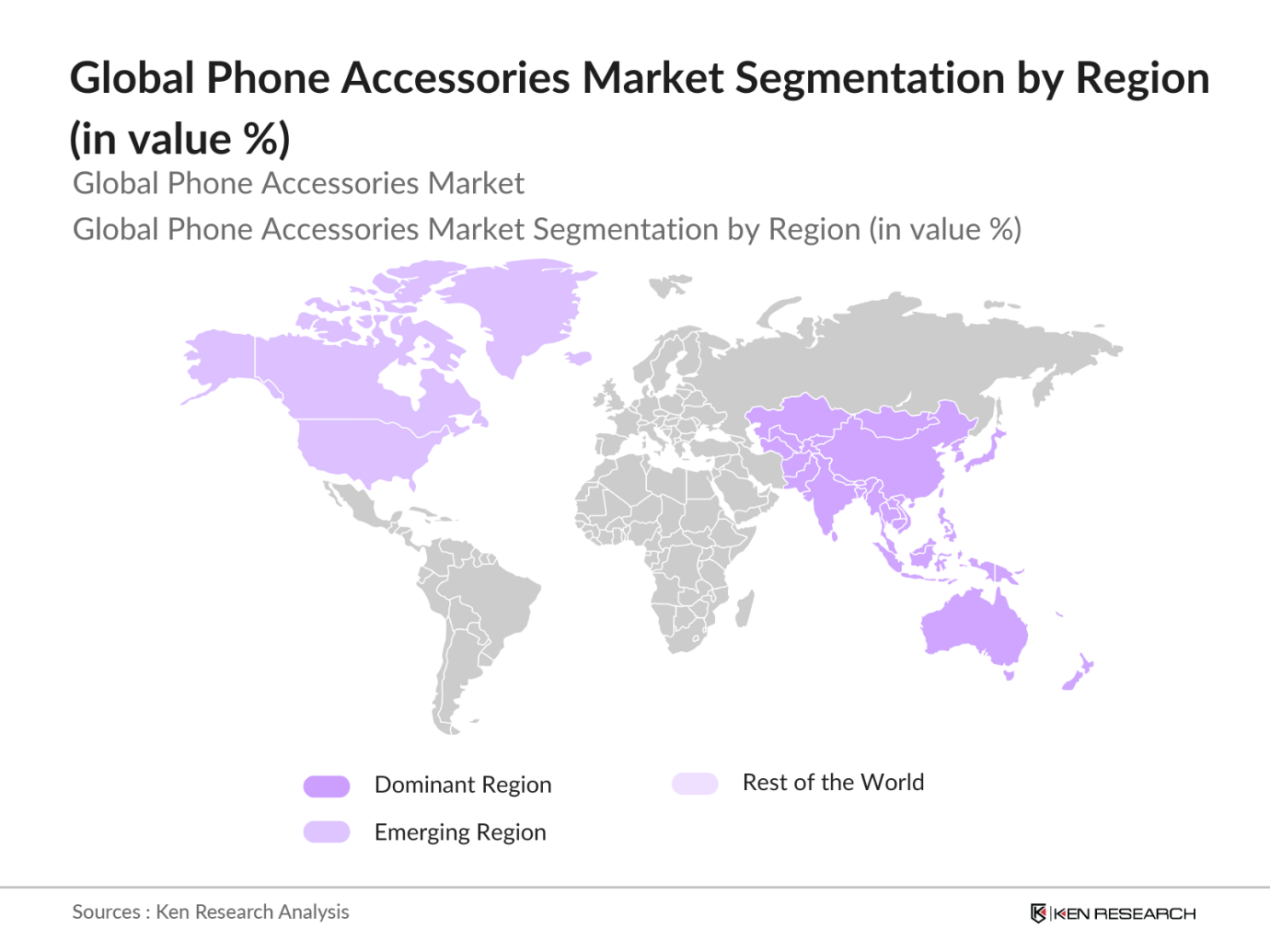

- Key regions dominating the market include the Asia-Pacific, North America, and Europe, with China, the U.S., and India being the most significant contributors. China, in particular, has a vast smartphone manufacturing base and a thriving e-commerce sector, making it a dominant player. The U.S. holds prominence due to the presence of leading brands such as Apple and Samsung, while India's large consumer base and growing smartphone adoption contribute to its growing market significance.

- The imposition of tariffs on electronics, particularly phone accessories, affects pricing and trade in regions like North America and Asia-Pacific. In 2024, North America imposed tariffs on certain imported electronics, impacting prices for consumers and supply chains. These tariffs underscore the importance of localized production to circumvent import duties and maintain market competitiveness.

Global Phone Accessories Market Segmentation

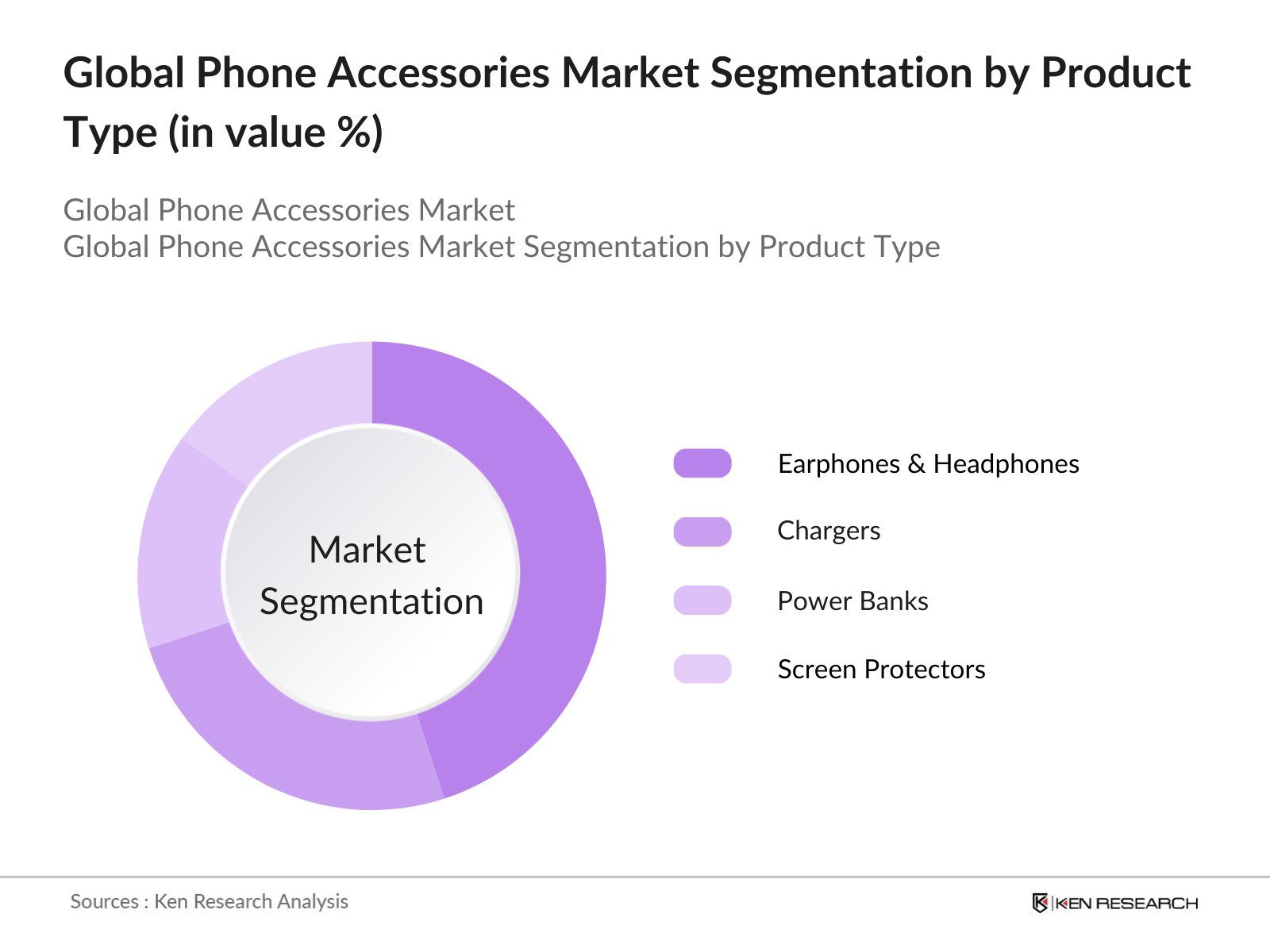

By Product Type: The phone accessories market is segmented by product type into chargers, earphones and headphones, power banks, protective cases, and screen protectors. Earphones and headphones dominate the market, largely due to the increasing demand for wireless Bluetooth models and noise-cancelling features, especially in urban markets. Companies such as Apple (AirPods) and Sony (WH series) lead this category with their innovative, premium offerings that cater to both tech enthusiasts and regular users.

By Region: The market is segmented regionally into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The Asia-Pacific region holds the largest market share, attributed to the vast smartphone user base in countries like China and India, along with the significant presence of manufacturers and affordable accessories in these regions. North America follows due to the dominance of premium accessory brands and high disposable income.

By Distribution Channel: In the distribution channel, the market is split between online and offline retail. Online retail holds the dominant share, driven by the ease of accessibility, wider product variety, and exclusive online deals. Consumers are increasingly shifting toward online platforms like Amazon, Alibaba, and Flipkart for convenience and competitive pricing. The COVID-19 pandemic has accelerated this trend, with e-commerce seeing substantial growth in phone accessories sales globally.

Global Phone Accessories Market Competitive Landscape

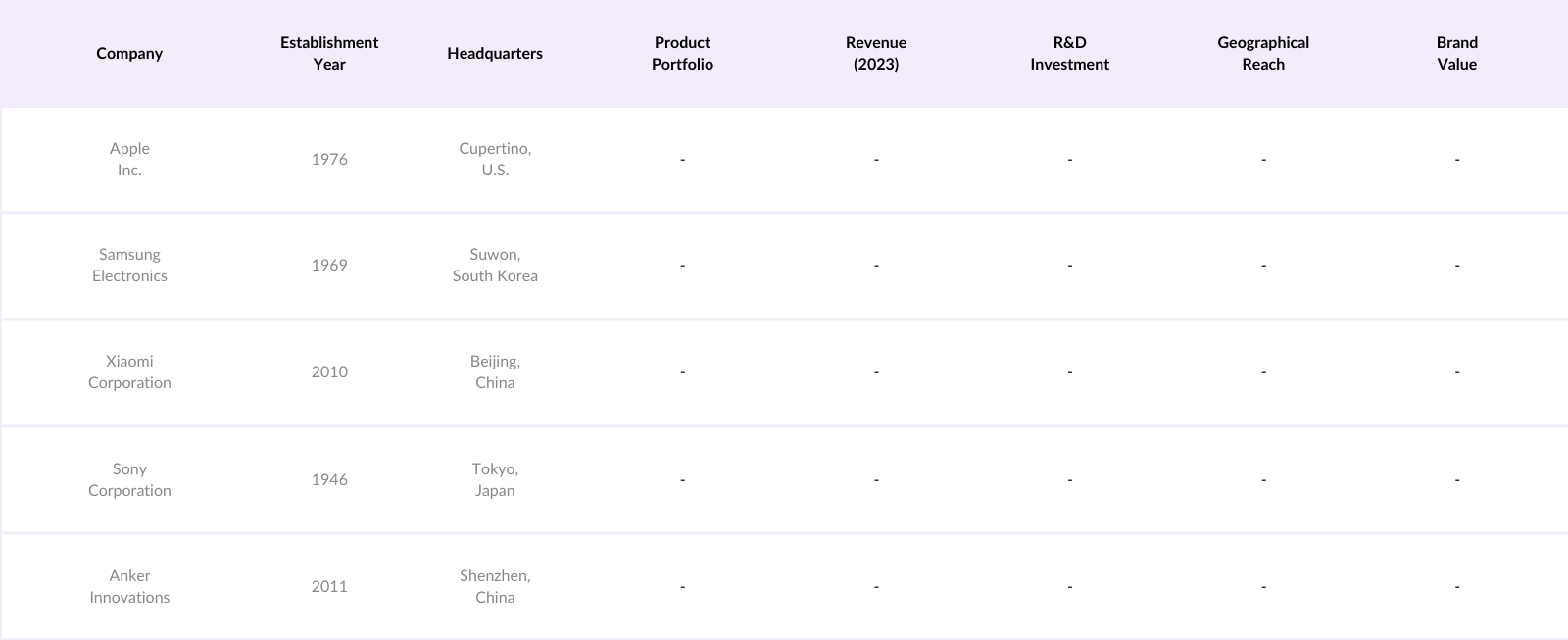

The Global Phone Accessories Market is highly competitive, with a mix of established global brands and emerging local players. Major companies such as Apple, Samsung, and Xiaomi lead the market through innovation, product differentiation, and strong brand equity. These companies have maintained a loyal customer base through cutting-edge technologies, such as fast charging, wireless audio solutions, and eco-friendly accessories. Additionally, some local players focus on affordable accessories, especially in the Asia-Pacific region, where price sensitivity is higher.

Global Phone Accessories Industry Analysis

Growth Drivers

- Rising Smartphone Penetration: The demand for phone accessories is bolstered by increased smartphone penetration, which reached approximately 6.9 billion global users by early 2024, driven by expanding internet access in regions like Southeast Asia and Sub-Saharan Africa. Additionally, government initiatives supporting affordable smartphones in developing regions are contributing to the growing demand for accessories. Notably, smartphone adoption in countries like India reached over 700 million users in 2024, while Sub-Saharan Africa recorded a user base of around 600 million, creating significant market potential for accessories.

- Technological Advancements in Accessories: The rise of wireless and fast-charging technologies has pushed accessory adoption in regions with robust mobile usage. By 2024, over 70% of new accessories produced are compatible with wireless charging, with global adoption rates of fast chargers projected to reach around 1.2 billion units. Governments in North America and Europe are setting safety standards to ensure fast-charging compatibility, while the increased use of smart features in phone cases, earphones, and speakers has become widespread.

- E-commerce and Omni-channel Retail Expansion: The proliferation of e-commerce in regions like Asia-Pacific, where online retail sales exceeded $3 trillion by 2024, is significantly driving the phone accessories market. E-commerce platforms allow consumers to access a variety of accessories, spurring growth. Moreover, omni-channel retail has enhanced distribution, with nearly 65% of retailers in North America and Europe adopting this model. Government support for digital transactions, especially in emerging markets, has further propelled this growth.

Market Restraints

- Rapid Technological Obsolescence: The rapid advancement of phone technologies has made accessories quickly obsolete, impacting both consumers and manufacturers. In 2024, around 40% of accessory products had to be updated or redesigned to support the latest phone models, adding substantial operational costs for manufacturers. This challenge is particularly pronounced in regions with high innovation rates, such as North America, impacting the long-term viability of certain accessories.

- High Counterfeit Product Presence: The phone accessories market faces issues with counterfeit products, particularly in regions like South Asia and Africa, where counterfeit rates have exceeded 30% in recent years. The presence of these low-quality products not only affects revenue for genuine brands but also poses safety risks. Government agencies have increased inspections, leading to the seizure of millions of counterfeit products annually.

Global Phone Accessories Market Future Outlook

Over the next five years, the Global Phone Accessories Market is expected to see significant growth driven by rising smartphone penetration, innovations in wireless technology, and increasing consumer preference for premium and eco-friendly accessories. The growth of 5G smartphones and the shift toward more sustainable and tech-driven accessories are expected to drive further market expansion. Companies are also likely to invest more in developing smarter, environmentally friendly accessories, such as biodegradable phone cases and energy-efficient chargers.

Market Opportunities

- Emerging Markets Penetration: Emerging markets present substantial opportunities, especially as smartphone penetration in Africa and Southeast Asia sees double-digit growth. Countries such as Nigeria and Indonesia have over 400 million combined mobile subscribers, many of whom are first-time smartphone owners. This growth fuels the demand for basic accessories, like protective cases and earphones, as consumers look to personalize and protect their devices.

- Integration with IoT and Wearable Tech: The integration of IoT and wearable technologies is expanding accessory applications, particularly in developed economies. By 2024, there were nearly 3 billion IoT-connected devices globally, driving accessory demand for enhanced connectivity. Smart accessories like health-monitoring earphones and connected cases are increasingly popular, especially in regions like North America and Europe, where tech adoption is high.

Scope of the Report

|

Product Type |

Power Banks |

|

Distribution Channel |

Online Retail |

|

Price Range |

Premium |

|

Technology |

Wired |

|

Region |

North America |

Products

Key Target Audience

Phone manufacturers

Consumer electronics retailers

E-commerce platforms (e.g., Amazon, Alibaba)

Investors and venture capitalist firms

Government and regulatory bodies (e.g., Federal Communications Commission, Ministry of Industry and Information Technology, China)

Mobile network operators

Wireless technology companies

Consumer electronics distributors

Companies

Players Mentioned in the Report:

Apple Inc.

Samsung Electronics

Xiaomi Corporation

Sony Corporation

Anker Innovations

JBL (Harman International)

ZAGG Inc.

LG Electronics

Huawei Technologies

Sennheiser Electronics GmbH & Co.

Bose Corporation

Otter Products

Plantronics

Jabra (GN Audio)

Griffin Technology

Table of Contents

1. Global Phone Accessories Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Lifecycle Stage (Early Growth, Growth, Maturity)

1.4. Market Segmentation Overview

1.5. Key Influencing Parameters (Consumer Preferences, Brand Loyalty, Product Compatibility)

2. Global Phone Accessories Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Developments and Milestones

3. Global Phone Accessories Market Analysis

3.1. Growth Drivers

3.1.1. Rising Smartphone Penetration

3.1.2. Technological Advancements in Accessories (Wireless, Fast Charging, Smart Features)

3.1.3. E-commerce and Omni-channel Retail Expansion

3.2. Market Challenges

3.2.1. Intense Market Competition

3.2.2. Rapid Technological Obsolescence

3.2.3. High Counterfeit Product Presence

3.3. Opportunities

3.3.1. Emerging Markets Penetration

3.3.2. Integration with IoT and Wearable Tech

3.3.3. Growing Demand for Eco-Friendly Accessories

3.4. Trends

3.4.1. Adoption of Fast Charging Technologies

3.4.2. Surge in Gaming Accessories Demand

3.4.3. Popularity of Customizable Accessories

3.5. Government Regulations

3.5.1. Environmental Compliance (e-Waste Management)

3.5.2. Quality Standards and Certifications (Safety, Compatibility)

3.5.3. Import/Export Tariffs on Electronics

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

4. Global Phone Accessories Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Power Banks

4.1.2. Chargers

4.1.3. Earphones and Headphones

4.1.4. Cases and Covers

4.1.5. Screen Protectors

4.2. By Distribution Channel (in Value %)

4.2.1. Online Retail

4.2.2. Offline Retail (Specialty Stores, Brand Outlets, Hypermarkets)

4.3. By Price Range (in Value %)

4.3.1. Premium

4.3.2. Mid-Range

4.3.3. Low-Range

4.4. By Technology (in Value %)

4.4.1. Wired

4.4.2. Wireless

4.4.3. Fast Charging

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Phone Accessories Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Samsung Electronics

5.1.2. Apple Inc.

5.1.3. Xiaomi Corporation

5.1.4. Sony Corporation

5.1.5. LG Electronics

5.1.6. Huawei Technologies

5.1.7. ZAGG Inc.

5.1.8. Bose Corporation

5.1.9. Anker Innovations

5.1.10. Sennheiser Electronics GmbH & Co.

5.1.11. Otter Products

5.1.12. Plantronics

5.1.13. Jabra (GN Audio)

5.1.14. JBL (Harman International)

5.1.15. Griffin Technology

5.2. Cross-Comparison Parameters (Revenue, Product Portfolio, Innovation Capacity, Geographical Presence, Brand Perception, Market Share, R&D Investment, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Partnerships, Mergers & Acquisitions, Product Launches)

5.5. Investment Analysis

5.6. Venture Capital Funding

5.7. Government Grants

5.8. Private Equity Investments

6. Global Phone Accessories Market Regulatory Framework

6.1. Environmental Standards

6.2. Product Safety and Compliance Regulations

6.3. Intellectual Property and Counterfeit Protection

6.4. Trade Tariffs and Import/Export Policies

7. Global Phone Accessories Market Future Size (in USD Mn)

7.1. Projected Future Market Size

7.2. Key Drivers for Future Market Expansion

8. Global Phone Accessories Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. Strategic Marketing Insights

8.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involved mapping the entire phone accessories ecosystem, including manufacturers, distributors, retailers, and consumers. This step involved comprehensive desk research from both proprietary and publicly available databases to identify the main factors driving market demand and supply.

Step 2: Market Analysis and Construction

In this phase, we analyzed historical data related to the phone accessories market, focusing on production volumes, sales trends, and consumer behavior. By assessing these parameters, we could accurately project market size and growth.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts from leading phone accessories companies were consulted through structured interviews to validate the market hypotheses. Their insights on product trends, distribution challenges, and revenue drivers were instrumental in shaping the final analysis.

Step 4: Research Synthesis and Final Output

In the final stage, data from primary and secondary sources were compiled to provide a comprehensive view of the market. The findings were reviewed with key manufacturers to ensure accuracy and consistency across the report.

Frequently Asked Questions

01. How big is the Global Phone Accessories Market?

The Global Phone Accessories Market is valued at USD 89.5 billion, driven by rising smartphone adoption and the demand for advanced wireless technologies, such as Bluetooth earphones and fast chargers.

02. What are the challenges in the Global Phone Accessories Market?

Challenges include high market competition, rapid technological obsolescence, and the prevalence of counterfeit products. Environmental concerns around e-waste are also pressuring companies to develop sustainable solutions.

03. Who are the major players in the Global Phone Accessories Market?

Key players include Apple Inc., Samsung Electronics, Xiaomi Corporation, Sony Corporation, and Anker Innovations, each with a significant presence due to their innovative product lines and global reach.

04. What are the growth drivers of the Global Phone Accessories Market?

Growth is driven by technological advancements such as wireless charging, 5G connectivity, and the rising demand for mobile gaming accessories. The increasing smartphone penetration worldwide also plays a pivotal role.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.