Global Photoresist Market Outlook to 2030

Region:Global

Author(s):Sanjana

Product Code:KROD1043

October 2024

84

About the Report

Global Photoresist Market Overview

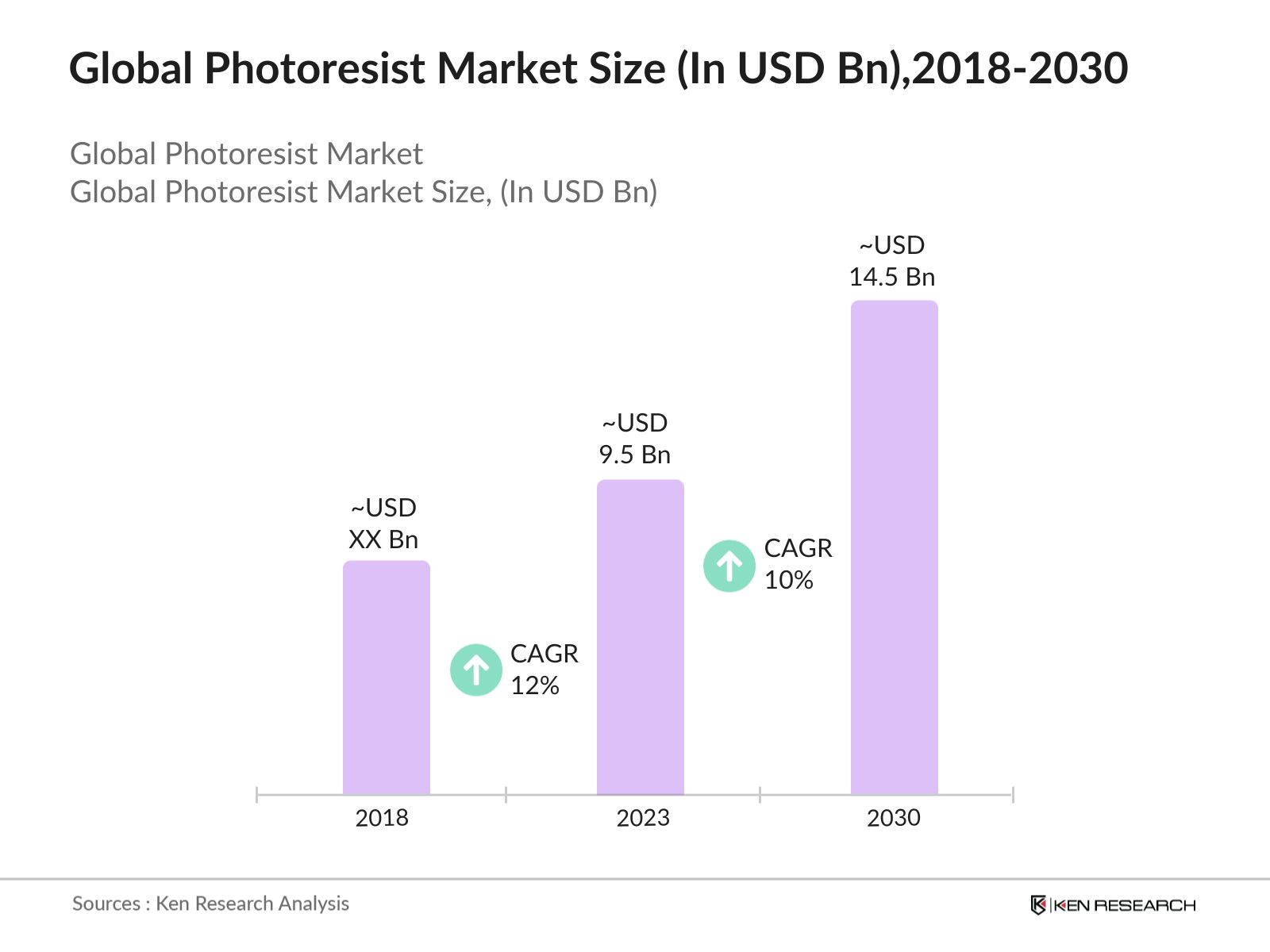

- Global Photoresist Market in 2023 was valued at USD 9.5 billion, driven by the rising demand for semiconductor devices and displays. This market growth is significantly supported by advancements in photolithography technologies, crucial for the production of microelectronic devices.

- Major players in the global photoresist market include JSR Corporation, Tokyo Ohka Kogyo Co., Ltd., DuPont, Fujifilm Holdings Corporation, and Merck Group. These companies have established dominance due to their strong research and development capabilities, extensive product portfolios, and strategic partnerships.

- In 2024, JSR Corporation successfully completed the acquisition of all shares in Yamanaka Hutech, making it a wholly-owned subsidiary. This transaction was finalized on August 1, 2024, and is part of JSR's strategy to enhance its product portfolio in the semiconductor materials industry, particularly in the photoresist market, which is crucial for semiconductor manufacturing processes.

- Tokyo, Seoul, Taipei, and San Francisco are key players in the semiconductor market, serving as major hubs for manufacturing and technological innovation. Their dominance is driven by the presence of industry leaders like Tokyo Electron, Samsung, TSMC, and Intel. Contributing factors include advanced research and development infrastructure, a robust supply chain for raw materials, proximity to major electronics manufacturing plants, and substantial government support for the semiconductor industry.

Global Photoresist Market Segmentation

The Global Photoresist Market can be segmented based on several factors:

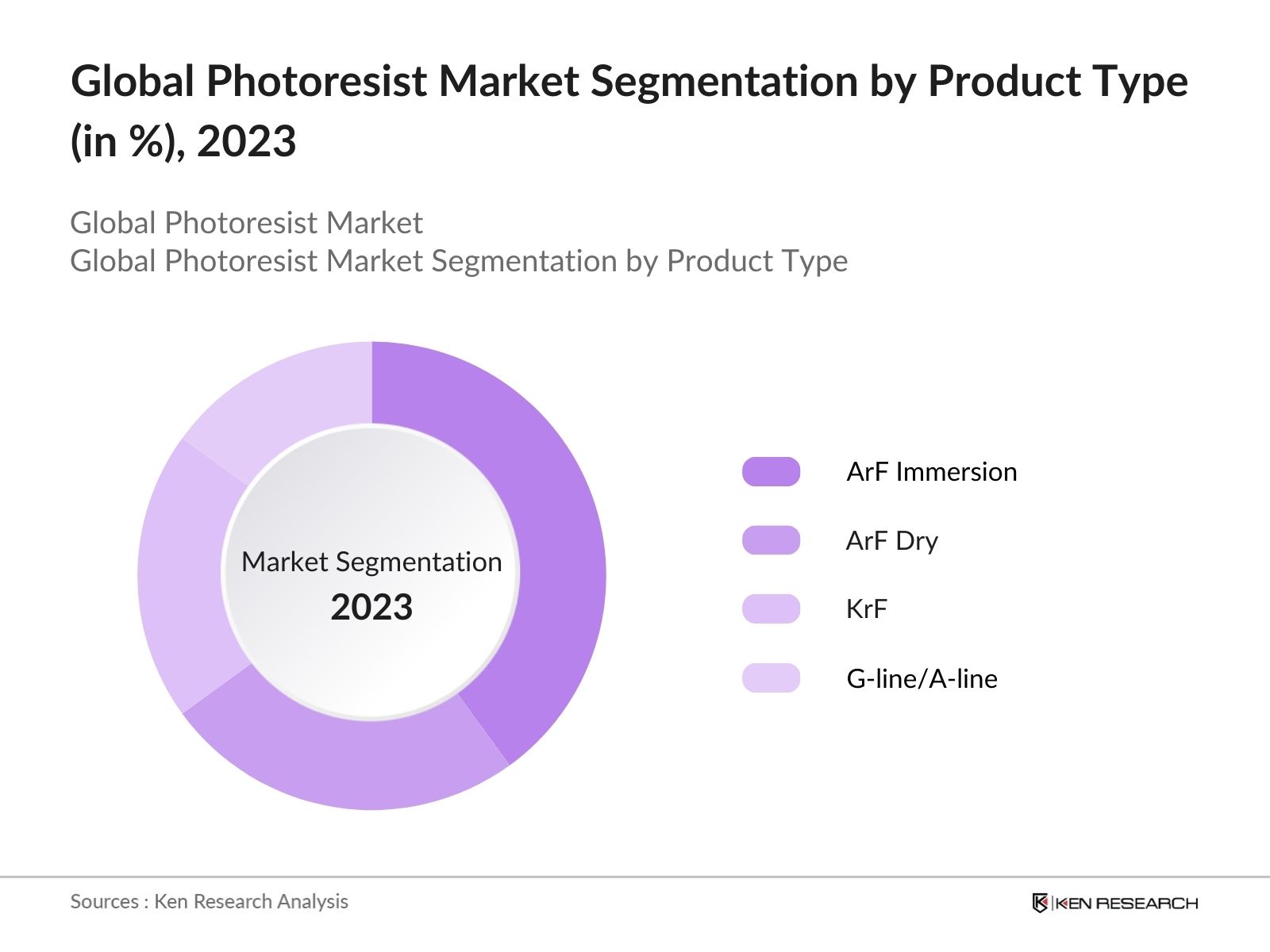

By Product Type: Global Photoresist Market is segmented by product type into ArF immersion, ArF dry, KrF, and G-line/I-line. In 2023, ArF immersion photoresists dominated the market, holding a significant share due to their widespread use in advanced semiconductor manufacturing. The precision and capability of ArF immersion technology to produce finer features make it indispensable for the production of the latest generation of microchips

By Application: Global Photoresist Market is segmented by application into semiconductor and integrated circuits, printed circuit boards (PCBs), and LCDs & OLEDs. In 2023, the semiconductor and integrated circuits segment held the largest market share, driven by the escalating demand for smaller and more efficient electronic devices. The increasing use of semiconductors in various industries has amplified the need for high-quality photoresists, ensuring the dominance of this application segment.

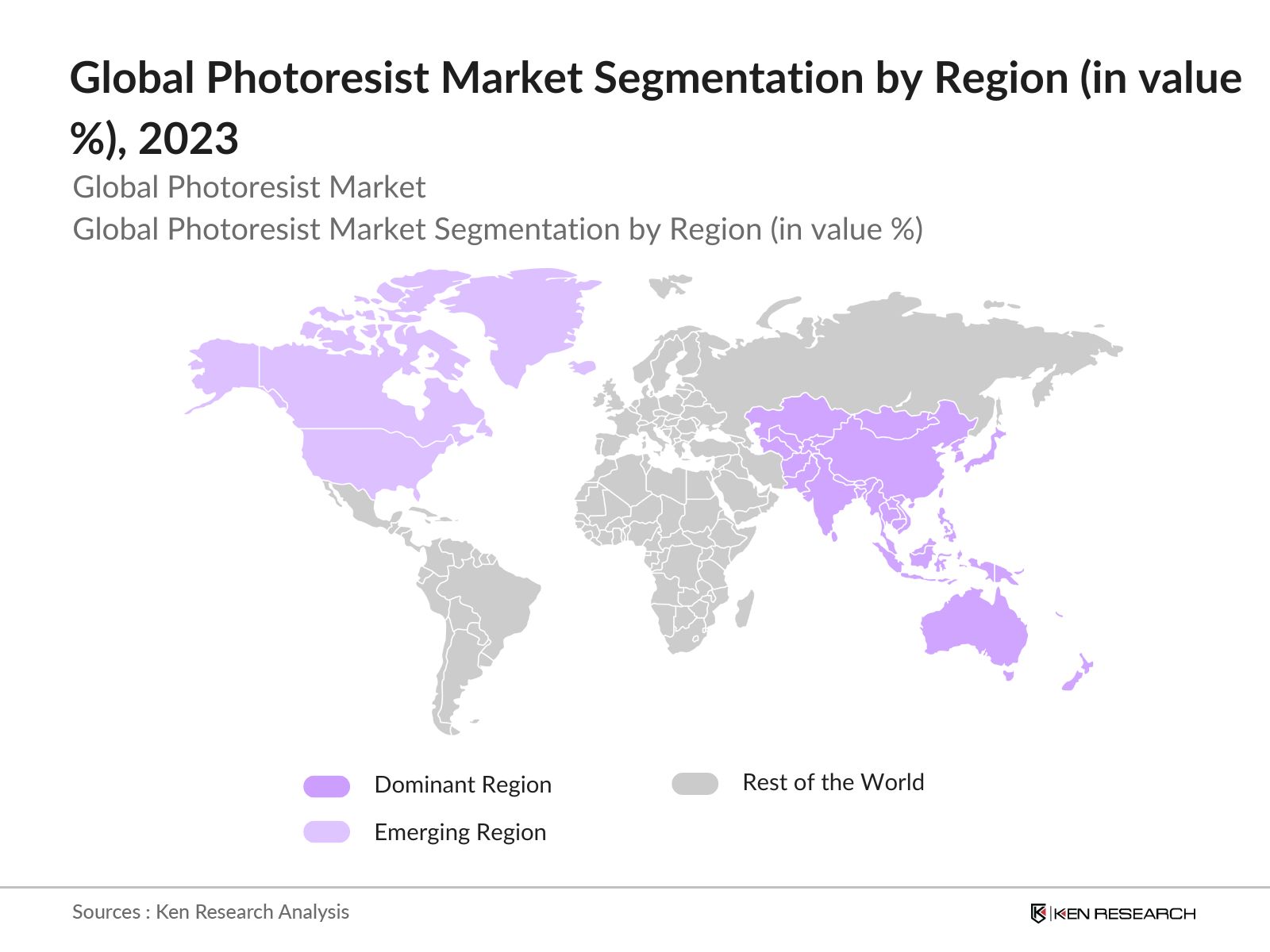

By Region: Global Photoresist Market is segmented by region into North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America. Asia-Pacific held the largest market share in 2023 due to the region's dominance in semiconductor manufacturing, strong presence of key players, and continuous advancements in electronics and display technologies. Furthermore, growing demand for consumer electronics, coupled with government initiatives to boost domestic semiconductor production, further contributed to the market's expansion in these countries.

Global Photoresist Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

JSR Corporation |

1957 |

Tokyo, Japan |

|

Tokyo Ohka Kogyo Co., Ltd. |

1940 |

Kanagawa, Japan |

|

DuPont |

1802 |

Wilmington, U.S. |

|

Fujifilm Holdings Corporation |

1934 |

Tokyo, Japan |

|

Merck Group |

1668 |

Darmstadt, Germany |

- DuPont & YMT Collaboration: In 2023, DuPont announced a collaboration with YMT, a Korean PCB materials manufacturer. This partnership focuses on improving the distribution and service of DuPont's Riston dry film photoresist in Korea. YMT is set to establish a dry film slitting facility in Ansan, which will support this initiative.

- Tokyo Ohka Kogyo Acquisition: In 2023, AIMECHATEC, Ltd. completed the acquisition of the Process Equipment Business from Tokyo Ohka Kogyo Co., Ltd. This move is part of AIMECHATEC's strategy to streamline operations and concentrate on core business areas, particularly in electronic component manufacturing equipment.

Global Photoresist Industry Analysis

Growth Drivers:

- Expansion of Semiconductor Manufacturing Facilities: The expansion of semiconductor manufacturing facilities globally, especially in Asia-Pacific, has significantly driven the demand for photoresists. In 2024, Taiwan Semiconductor Manufacturing Company (TSMC) announced the establishment of a new facility in Japan, valued at USD 8 billion, to increase its semiconductor output. This expansion has directly boosted the demand for advanced photoresists required for photolithography in semiconductor production.

- Rising Demand for Consumer Electronics: The growing consumer electronics market, particularly in smartphones, tablets, and wearable devices, has been a key driver for the photoresist market. In 2023, global shipments of smartphones reached 1.14 billion units. These devices require intricate semiconductor components, which in turn necessitates high-quality photoresists for their production.

- Adoption of Advanced Photolithography Techniques: The adoption of advanced photolithography techniques, such as Extreme Ultraviolet (EUV) lithography, has driven the need for specialized photoresists. EUV technology is critical for producing smaller, more efficient semiconductor nodes, which are essential for modern electronics.

Challenges:

- High Cost of Research and Development: Developing photoresists that can meet the requirements of cutting-edge technologies like EUV lithography requires substantial investment in R&D. Smaller companies, in particular, struggle to compete with established giants like JSR Corporation and DuPont, who can afford these high costs, leading to a concentration of market power among a few key players

- Environmental Regulations: The European Union (EU) introduced new regulations under the REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) framework, restricting the use of certain hazardous substances in the manufacturing process. Compliance with these regulations has increased production costs, as manufacturers must invest in safer alternatives and waste management systems.

Government Initiatives:

- CHIPS and Science Act: The CHIPS and Science Act, officially signed into law on August 2022 is a significant piece of legislation aimed at bolstering the United States' semiconductor industry and advancing scientific research. The act authorizes $280 billion in total funding, with about $52.7 billion specifically allocated for semiconductor research, development, and manufacturing. The act aims to provide a substantial boost to the photoresist market in the United States.

- Digital Economy Promotion Act: The South Korean government introduced the Digital Economy Promotion Act in 2023, which includes incentives for the development of advanced semiconductor technologies. These incentives are prescribed by various tax-related statutes, including the Restriction of Special Taxation Act and the Restriction of Special Local Taxation Act. South Korea's strategic focus on maintaining its leadership in the global semiconductor industry directly supports the growth of the photoresist market.

Global Photoresist Future Market Outlook

The market is expected to reach USD 14.5 Bn by 2030 driven by the expanding semiconductor industry and the adoption of advanced photolithography techniques. The ongoing digital transformation, characterized by the proliferation of 5G technology, AI, and IoT will continue to fuel the demand for high-performance semiconductors, thereby boosting the need for innovative photoresist materials.

Future Market Trends

- Shift Towards Sustainable Photoresist Technologies Over the next five years, there will be a significant shift towards the development of sustainable photoresist technologies. This trend is driven by increasing environmental regulations and the demand for eco-friendly manufacturing processes in the semiconductor industry. Companies are expected to invest heavily in R&D to create photoresists that minimize chemical waste and energy consumption, aligning with global sustainability goals.

- Increased Adoption of EUV Lithography The adoption of Extreme Ultraviolet (EUV) lithography will accelerate as semiconductor manufacturers strive to produce smaller, more efficient chips. The demand for specialized EUV photoresists will grow, leading to advancements in photoresist formulations that enable higher precision in chip production. This trend will be particularly prominent in leading semiconductor hubs such as Taiwan, South Korea, and Japan.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Product Type |

ArF immersion ArF dry KrF G-line/I-line |

|

By Application |

Semiconductor Integrated Circuits Printed Circuit Boards (PCBs) LCDs & OLEDs |

|

By End Use |

Electronics Automobile Packaging Others |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Semiconductor Manufacturers

Photolithography Equipment Manufacturers

Printed Circuit Board Manufacturers

LCD and OLED Display Manufacturers

Automotive Electronics Manufacturers

Telecommunications Equipment Manufacturers

Investment & Venture Capitalist Firms

Government & Regulatory Bodies (e.g., U.S. Department of Commerce, Ministry of Economy, Trade and Industry Japan)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2030

Companies

Players Mentioned in the Report:

JSR Corporation

Tokyo Ohka Kogyo Co., Ltd.

DuPont

Fujifilm Holdings Corporation

Merck Group

Shin-Etsu Chemical Co., Ltd.

Sumitomo Chemical Co., Ltd.

Avantor Performance Materials

Dongjin Semichem Co., Ltd.

Eternal Materials Co., Ltd.

Table of Contents

1. Global Photoresist Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Photoresist Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Photoresist Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Semiconductor Manufacturing

3.1.2. Rising Demand for Consumer Electronics

3.1.3. Adoption of Advanced Photolithography Techniques

3.2. Restraints

3.2.1. Supply Chain Disruptions

3.2.2. Environmental Regulations

3.2.3. High R&D Costs

3.3. Opportunities

3.3.1. Growing Demand in Emerging Markets

3.3.2. Advancements in EUV Lithography

3.3.3. Expansion into New Applications Beyond Semiconductors

3.4. Trends

3.4.1. Shift Towards Sustainable Photoresist Technologies

3.4.2. Integration with Smart Manufacturing

3.4.3. Increased Focus on High-Resolution Lithography

3.5. Government Regulation

3.5.1. CHIPS and Science Act (2022)

3.5.2. Digital Economy Promotion Act (2023)

3.5.3. Semiconductor Strategy for 2030 (Japan)

3.5.4. Environmental Regulations in Europe and North America

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Global Photoresist Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. ArF Immersion

4.1.2. ArF Dry

4.1.3. KrF

4.1.4. G-line/I-line

4.2. By Application (in Value %)

4.2.1. Semiconductor & Integrated Circuits

4.2.2. Printed Circuit Boards (PCBs)

4.2.3. LCDs & OLEDs

4.3. By Technology (in Value %)

4.3.1. EUV Lithography

4.3.2. DUV Lithography

4.4 By End-User

4.4.1 Electronics

4.4.2 Automobile

4.4.3 Packaging

4.4.4 Others

4.5. By Region (in Value %)

4.4.1. Asia-Pacific

4.4.2. North America

4.4.3. Europe

4.4.4. Middle East & Africa (MEA)

4.4.5. Latin America

5. Global Photoresist Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. JSR Corporation

5.1.2. Tokyo Ohka Kogyo Co., Ltd.

5.1.3. DuPont

5.1.4. Fujifilm Holdings Corporation

5.1.5. Merck Group

5.1.6. Shin-Etsu Chemical Co., Ltd.

5.1.7. Sumitomo Chemical Co., Ltd.

5.1.8 Avantor Performance Materials

5.1.9 Dongjin Semichem Co., Ltd.

5.1.10 Eternal Materials Co., Ltd.

5.1.11 Hitachi Chemical Co., Ltd.

5.1.12 DIC Corporation

5.1.13 Allresist GmbH

5.1.14 MicroChemicals GmbH

5.1.15 Nissan Chemical Corporation

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Photoresist Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Photoresist Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Photoresist Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Photoresist Market Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By Application (in Value %)

9.3. By Technology (in Value %)

9.4. By End-User (in Value %)

9.5. By Region (in Value %)

10. Global Photoresist Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on photoresist market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for photoresist market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple photoresist providers and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from photoresist providers.

Frequently Asked Questions

01 How big is the Global Photoresist market?

The global photoresist market was valued at USD 9.5 billion in 2023, driven by the growing demand from the semiconductor and electronics industries, advancements in photolithography technology, and the increasing use of photoresists in manufacturing processes.

02 What are the challenges in the Global Photoresist market?

Challenges in the Global Photoresist Market include high production costs, stringent regulatory requirements, and the rapid pace of technological advancements requiring continuous R&D investments. Additionally, supply chain disruptions and the need for high-quality standards can impact market stability.

03 Who are the major players in the Global Photoresist Market?

Major players in the global photoresist market include Tokyo Ohka Kogyo Co., Ltd., JSR Corporation, SUMCO Corporation, and Dow Chemical Company. These companies lead the market due to their advanced technology, extensive R&D capabilities, and strong industry presence.

04 What are the growth drivers of Global Photoresist Market?

The growth of the global photoresist market is driven by advancements in semiconductor manufacturing, increased demand for high-resolution imaging in electronics, and the expansion of the consumer electronics sector. Technological innovations in photolithography and rising investment in R&D also contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.