Global PID Controller Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD7107

December 2024

85

About the Report

Global PID Controller Market Overview

- The global PID Controller market was valued at USD 1.6 billion, driven by increasing demand for automation in industrial processes, precision control in HVAC systems, and the need for energy-efficient solutions across multiple industries. Key sectors contributing to this demand include oil & gas, chemical processing, and the automotive industry, which are integrating PID controllers to optimize operational efficiency and reduce costs. Additionally, rapid advancements in AI and IoT technologies have led to the development of smarter and more adaptive PID controllers, further enhancing market growth.

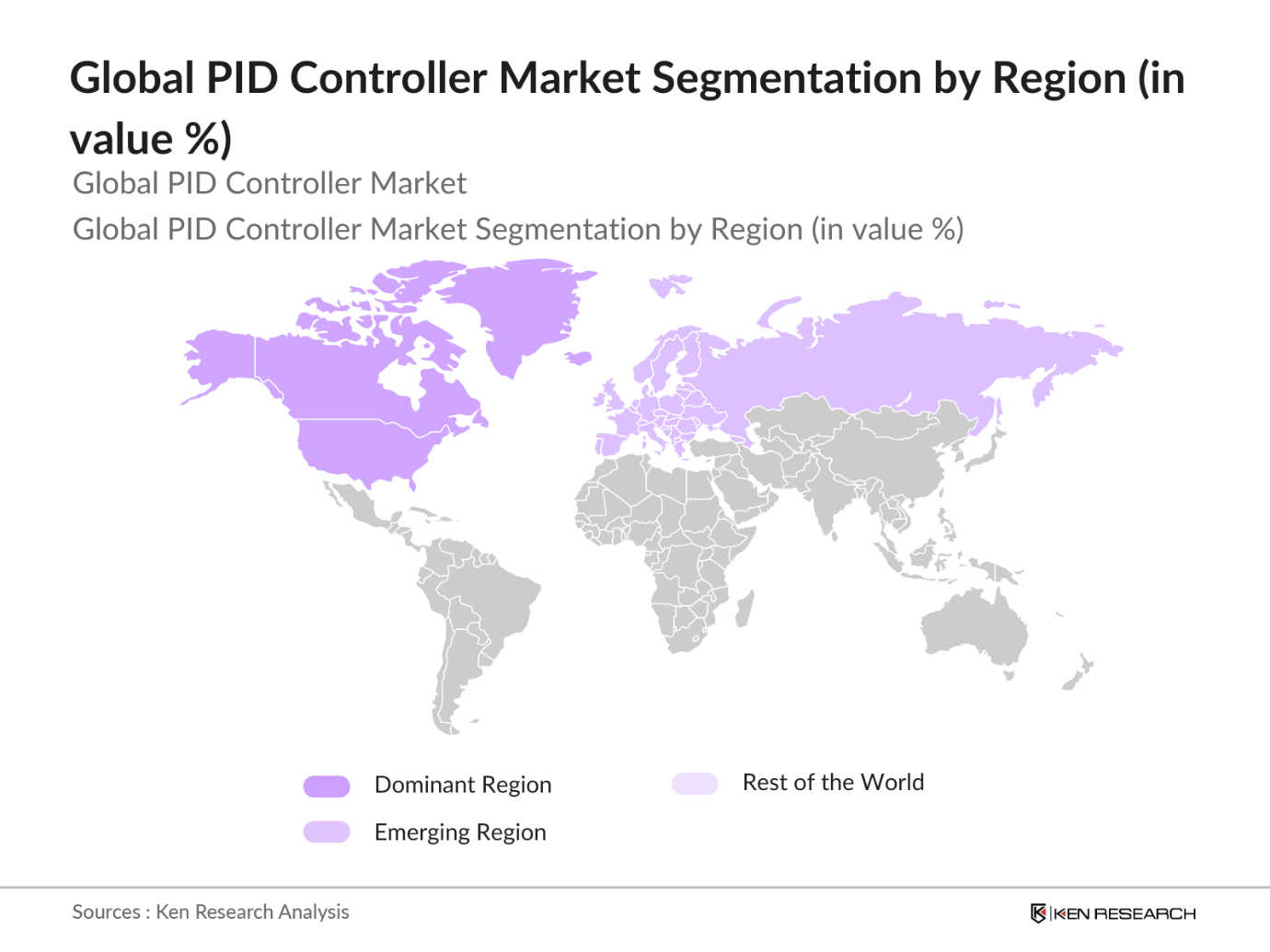

- Countries like the United States, Germany, and Japan dominate the PID controller market due to their well-established industrial automation ecosystems and extensive focus on research and development. These countries are home to many of the key players in the market and have strong industrial bases in sectors such as manufacturing, automotive, and energy. Their advanced infrastructure and high adoption rates of automation technologies provide a fertile environment for the continued growth of the PID controller market.

- Environmental regulations are increasingly shaping industrial automation requirements, with many governments enforcing stricter environmental standards. For example, in 2023, the European Union implemented new emissions regulations that forced industries to reduce their carbon footprint by 30%. PID controllers help industries meet these environmental compliance standards by optimizing process efficiency and reducing waste. In the U.S., the Environmental Protection Agency (EPA) introduced stricter regulations for emissions in industrial processes, increasing demand for PID controllers to ensure compliance.

Global PID Controller Market Segmentation

By Product Type: The global PID controller market is segmented by product type into standalone PID controllers, embedded PID controllers, and multi-loop PID controllers. Standalone PID controllers dominate the market as they are widely used in single-loop control applications across industries such as food & beverage and pharmaceuticals. Their ease of use and versatility make them the go-to solution for businesses looking for effective temperature, pressure, and flow control systems.

By Region: Geographically, the market is divided into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America leads the market, particularly driven by the United States, where significant investments in smart manufacturing and energy efficiency initiatives have boosted the demand for PID controllers. Europe follows closely, with countries like Germany and the UK advancing their industrial automation capabilities. The Asia Pacific region, led by China and Japan, is witnessing rapid growth due to increasing industrialization and the implementation of energy management systems.

By Application: The PID controller market is segmented by application into industrial automation, HVAC systems, oil & gas, chemical processing, and renewable energy systems. Industrial automation holds the largest market share, driven by the increasing focus on optimizing production lines, reducing downtime, and ensuring precision in processes. The growing adoption of PID controllers in robotics and manufacturing automation is also fueling this segments dominance.

Global PID Controller Market Competitive Landscape

The global PID controller market is characterized by the presence of major players that dominate the landscape with advanced product offerings, a strong focus on R&D, and extensive distribution networks. Companies such as Siemens, ABB, and Honeywell lead the market by leveraging their expertise in automation technologies, alongside newer players focusing on digital solutions integrated with IoT.

Global PID Controller Industry Analysis

Growth Drivers

- Adoption of Automation in Manufacturing: The adoption of automation in manufacturing is accelerating the demand for PID controllers, particularly in developed economies. For example, in 2023, the U.S. manufacturing sector employed over 12.7 million workers, with over 35% of firms adopting automation technologies. Additionally, China, the largest manufacturing hub, has been aggressively investing in Industry 4.0, with the government allocating $300 billion towards smart manufacturing technologies by 2025. PID controllers, which are crucial for precision and efficiency in automation, are becoming increasingly integrated into these systems. Automation-driven productivity has been shown to increase output by 20% in the automotive sector.

- Increasing Focus on Energy Efficiency:Energy efficiency is a primary concern in industrial processes, and PID controllers play a vital role in regulating energy use in systems such as HVAC and industrial refrigeration. For instance, in 2022, global energy consumption for industrial use was over 50,000 TWh, with nearly 40% of that stemming from manufacturing processes. PID controllers can reduce energy consumption by up to 10% in these systems through better control of heating, cooling, and process regulation. Countries such as Germany and Japan have introduced stringent energy efficiency targets in industrial sectors, driving demand for precision control solutions.

- Expansion of Process Industries: The process industries, including chemicals, pharmaceuticals, and oil & gas, are expanding rapidly in both developed and emerging markets. In 2023, the global chemical industry output exceeded 2 billion metric tons, and the oil and gas sector contributed over 80 million barrels per day in global production. PID controllers are crucial for maintaining operational precision and safety in these high-demand industries. Nations such as India and Brazil are also expanding their refining and chemical production capacities, with India aiming to increase its refinery throughput to 400 million tons per year by 2025.

Market Restraints

- High Costs of Advanced PID Controllers: The costs associated with advanced PID controllers pose a significant challenge for many small and medium-sized enterprises (SMEs). For instance, an advanced industrial PID controller can cost upwards of $10,000, which is prohibitive for SMEs operating with limited budgets. Moreover, the global market for industrial control systems, where PID controllers are a significant component, faced a contraction of nearly 5% in budget allocations in 2022, especially in developing economies. This has slowed the rate of adoption among smaller industries that find these controllers too costly for initial investments.

- Integration Challenges in Complex Systems: Integrating PID controllers into highly complex industrial systems, particularly legacy systems, is a technical challenge. As of 2023, over 40% of industrial facilities in the U.S. and Europe still operate with legacy systems that lack the infrastructure to seamlessly integrate with modern control technologies. This leads to increased costs in retrofitting and prolonged downtime during upgrades, which can be detrimental to production cycles. Additionally, process industries report an estimated 15% increase in maintenance costs when integrating new control technologies into older systems.

Global PID Controller Market Future Outlook

Over the next five years, the global PID controller market is expected to experience significant growth, driven by the increasing demand for automation solutions across various industries. As companies move toward smarter manufacturing and the Industrial Internet of Things (IIoT), PID controllers will play a pivotal role in ensuring precision control and optimization of complex systems. Technological advancements, coupled with the growing adoption of energy-efficient systems, will further propel the market. Additionally, government initiatives aimed at reducing energy consumption and carbon footprints are likely to contribute to market growth.

Market Opportunities

- Growing Demand for Smart Control Systems: The global demand for smart control systems, which integrate AI and IoT technologies, is growing, offering a significant opportunity for PID controllers. In 2023, over 15 million industrial robots were operational globally, many of which rely on PID controllers for precision tasks. The integration of AI can improve the accuracy of PID controllers by up to 25%, reducing errors in temperature, pressure, and flow control systems. This is particularly evident in industries such as pharmaceuticals and food processing, where precision control is critical to maintaining quality and regulatory compliance.

- Expansion into Emerging Economies: Emerging economies like India, Brazil, and South Africa are seeing rapid industrialization, presenting opportunities for PID controller manufacturers. In 2023, Indias manufacturing sector grew by over 8%, contributing $400 billion to the GDP. This growth is fueled by government initiatives like "Make in India," which encourages the adoption of advanced manufacturing technologies. Similarly, Brazils industrial output in 2023 exceeded 25 million tons of steel production, with automation technologies becoming increasingly critical. PID controllers are essential in these markets to improve production efficiency and meet growing domestic and international demand.

Scope of the Report

|

By Product Type |

Standalone PID Controllers Embedded PID Controllers Multi-loop PID Controllers |

|

By Application |

Industrial Automation HVAC Systems Oil & Gas Chemical Processing Renewable Energy Systems |

|

By Communication Protocol |

Modbus Profibus Ethernet/IP Profinet |

|

By Controller Type |

Temperature Controllers Pressure Controllers Flow Controllers Level Controllers |

|

By Region |

North America Europe Asia Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Industrial Automation Companies

Manufacturing Plants

HVAC System Providers

Oil & Gas Companies

Renewable Energy Firms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Energy, European Commission)

OEMs (Original Equipment Manufacturers)

Companies

Players Mentioned in the Report:

Siemens AG

ABB Ltd.

Honeywell International Inc.

Yokogawa Electric Corporation

Emerson Electric Co.

Mitsubishi Electric Corporation

Schneider Electric

Omron Corporation

Red Lion Controls

Eurotherm by Schneider Electric

Watlow Electric Manufacturing Company

Fuji Electric Co., Ltd.

Delta Electronics, Inc.

Spirax-Sarco Engineering plc

Hitachi Industrial Equipment Systems Co., Ltd.

Table of Contents

1. Global PID Controller Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global PID Controller Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global PID Controller Market Analysis

3.1. Growth Drivers

3.1.1. Adoption of Automation in Manufacturing (Driver)

3.1.2. Increasing Focus on Energy Efficiency (Driver)

3.1.3. Expansion of Process Industries (Driver)

3.1.4. Regulatory Push for Precision Control in HVAC Systems (Driver)

3.2. Market Challenges

3.2.1. High Costs of Advanced PID Controllers (Challenge)

3.2.2. Integration Challenges in Complex Systems (Challenge)

3.2.3. Limited Awareness in Emerging Markets (Challenge)

3.3. Opportunities

3.3.1. Growing Demand for Smart Control Systems (Opportunity)

3.3.2. Expansion into Emerging Economies (Opportunity)

3.3.3. Adoption in Renewable Energy Systems (Opportunity)

3.4. Trends

3.4.1. Use of AI in PID Control Systems (Trend)

3.4.2. Integration with IoT Platforms (Trend)

3.4.3. Cloud-based PID Controllers (Trend)

3.5. Government Regulations

3.5.1. Energy Efficiency Standards (Regulation)

3.5.2. Safety Standards for Process Automation (Regulation)

3.5.3. Environmental Compliance for Industrial Automation (Regulation)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global PID Controller Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Standalone PID Controllers

4.1.2. Embedded PID Controllers

4.1.3. Multi-loop PID Controllers

4.2. By Application (In Value %)

4.2.1. Industrial Automation

4.2.2. HVAC Systems

4.2.3. Oil & Gas

4.2.4. Chemical Processing

4.2.5. Renewable Energy Systems

4.3. By Communication Protocol (In Value %)

4.3.1. Modbus

4.3.2. Profibus

4.3.3. Ethernet/IP

4.3.4. Profinet

4.4. By Controller Type (In Value %)

4.4.1. Temperature Controllers

4.4.2. Pressure Controllers

4.4.3. Flow Controllers

4.4.4. Level Controllers

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global PID Controller Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Siemens AG

5.1.2. ABB Ltd.

5.1.3. Honeywell International Inc.

5.1.4. Yokogawa Electric Corporation

5.1.5. Omron Corporation

5.1.6. Schneider Electric

5.1.7. Mitsubishi Electric Corporation

5.1.8. Emerson Electric Co.

5.1.9. Eurotherm by Schneider Electric

5.1.10. Red Lion Controls

5.1.11. Watlow Electric Manufacturing Company

5.1.12. Fuji Electric Co., Ltd.

5.1.13. Hitachi Industrial Equipment Systems Co., Ltd.

5.1.14. Spirax-Sarco Engineering plc

5.1.15. Delta Electronics, Inc.

5.2. Cross Comparison Parameters

- No. of Employees

- Headquarters

- Inception Year

- Revenue

- Product Range

- Global Market Share

- R&D Investments

- Technological Advancements

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global PID Controller Market Regulatory Framework

6.1. Energy Efficiency Standards

6.2. Compliance Requirements for Industrial Automation

6.3. Certification Processes

7. Global PID Controller Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global PID Controller Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Communication Protocol (In Value %)

8.4. By Controller Type (In Value %)

8.5. By Region (In Value %)

9. Global PID Controller Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This initial step involves constructing a comprehensive framework for the global PID controller market, identifying all major stakeholders, and gathering industry-level information through desk research. Proprietary databases and credible secondary resources are utilized to define the key variables influencing the market.

Step 2: Market Analysis and Construction

In this phase, historical market data is analyzed to assess penetration rates, application areas, and revenue generation. This involves evaluating the proportion of PID controllers across different applications and their corresponding value creation.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, industry experts from leading companies are consulted through interviews. These insights provide a deeper understanding of market dynamics, enabling the validation of research data and hypotheses.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing the collected data to create a cohesive market report. This report is cross-verified through engagement with manufacturers and technology providers to ensure the accuracy of the analysis.

Frequently Asked Questions

01. How big is the Global PID Controller Market?

The global PID controller market was valued at USD 1.6 billion, driven by increasing demand for automation across industries, especially in sectors like manufacturing, oil & gas, and HVAC.

02. What are the challenges in the Global PID Controller Market?

Key challenges include high integration costs, technical complexities in deployment, and limited awareness in emerging markets, which can hinder adoption in certain regions.

03. Who are the major players in the Global PID Controller Market?

The major players in the market include Siemens AG, ABB Ltd., Honeywell International Inc., Yokogawa Electric Corporation, and Emerson Electric Co., among others.

04. What are the growth drivers of the Global PID Controller Market?

The growth of the PID controller market is driven by factors such as the increased need for energy-efficient solutions, rising automation in industrial processes, and advancements in IoT and AI technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.