Region:Global

Author(s):Rebecca

Product Code:KRAA2109

Pages:94

Published On:August 2025

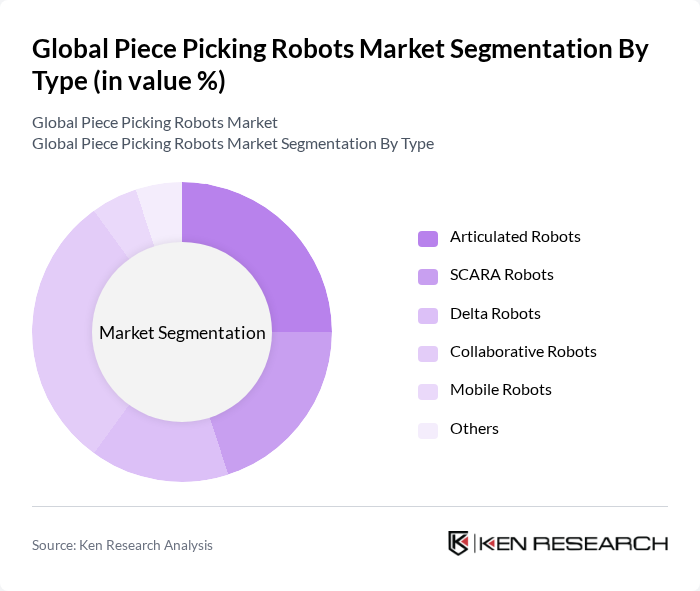

By Type:The market is segmented into various types of robots, including articulated robots, SCARA robots, delta robots, collaborative robots, mobile robots, and others. Each type serves different operational needs and is designed for specific tasks within the automation landscape. Articulated robots are favored for their flexibility and reach, SCARA robots for high-speed pick-and-place, delta robots for lightweight and high-speed applications, collaborative robots for safe human-robot interaction, and mobile robots for dynamic warehouse environments.

Thecollaborative robotssegment is currently dominating the market due to their versatility and ability to work safely alongside human workers without safety barriers. These robots are particularly favored in environments where flexibility and adaptability are crucial, such as e-commerce and manufacturing. The increasing trend towards automation in small to medium-sized enterprises has also contributed to the growth of collaborative robots, as they are often more cost-effective and easier to implement than traditional industrial robots.

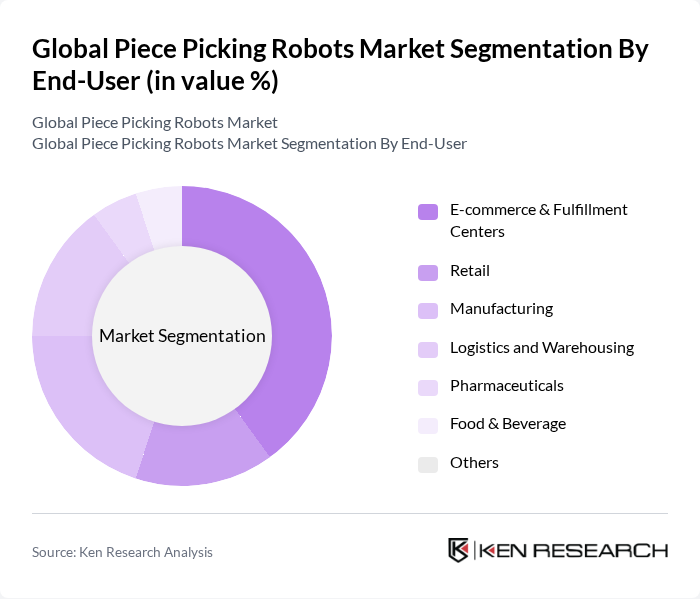

By End-User:The market is segmented by end-user industries, including e-commerce & fulfillment centers, retail, manufacturing, logistics and warehousing, pharmaceuticals, food & beverage, and others. Each sector has unique requirements that influence the adoption of piece-picking robots. E-commerce and fulfillment centers require high throughput and accuracy, manufacturing seeks flexibility and integration, logistics and warehousing focus on efficiency, while pharmaceuticals and food & beverage demand strict compliance and traceability.

Thee-commerce and fulfillment centerssegment is leading the market due to the rapid growth of online shopping and the need for efficient order processing. The demand for faster delivery times and the ability to handle a high volume of orders have made piece-picking robots essential in these environments. Additionally, increasing consumer expectations for quick and accurate order fulfillment have driven investments in automation technologies within this sector.

The Global Piece Picking Robots Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation, Omron Corporation, Universal Robots A/S, Mitsubishi Electric Corporation, Epson Robots, Denso Corporation, Fetch Robotics, Inc., Locus Robotics, RightHand Robotics, Inc., GreyOrange Pte. Ltd., Soft Robotics, Inc., 6 River Systems, Inc., Berkshire Grey, Inc., Plus One Robotics, Inc., Kindred (a part of Ocado Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the piece picking robots market appears promising, driven by technological advancements and increasing automation needs. As companies continue to seek efficiency, the integration of IoT and AI will enhance robot capabilities, making them more adaptable and efficient. Furthermore, the growing emphasis on sustainability will likely lead to innovations in energy-efficient robotic solutions, aligning with global environmental goals and enhancing market appeal across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Articulated Robots SCARA Robots Delta Robots Collaborative Robots Mobile Robots Others |

| By End-User | E-commerce & Fulfillment Centers Retail Manufacturing Logistics and Warehousing Pharmaceuticals Food & Beverage Others |

| By Application | Order Fulfillment Inventory Management Packaging Sorting Kitting & Assembly Others |

| By Payload Capacity | Up to 5 kg kg to 10 kg kg to 20 kg Above 20 kg |

| By Distribution Channel | Direct Sales Online Sales Distributors System Integrators Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Industry Vertical | Automotive Electronics Food & Beverage Pharmaceuticals Third-Party Logistics (3PL) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce Fulfillment Centers | 100 | Warehouse Managers, Operations Directors |

| Manufacturing Automation | 80 | Production Managers, Robotics Engineers |

| Retail Distribution Centers | 60 | Logistics Coordinators, Supply Chain Analysts |

| Food and Beverage Industry | 50 | Quality Control Managers, Operations Supervisors |

| Pharmaceutical Warehousing | 40 | Regulatory Compliance Officers, Warehouse Supervisors |

The Global Piece Picking Robots Market is valued at approximately USD 1.7 billion, driven by the increasing demand for automation in sectors like e-commerce, logistics, and warehousing, where efficiency and accuracy are essential.