Global Plant-Based Protein Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD4927

December 2024

90

About the Report

Global Plant-Based Protein Market Overview

- The global plant-based protein market is valued at USD 13.7 billion, driven primarily by rising health consciousness and demand for sustainable food sources. Increasing vegan and flexitarian dietary trends have led to higher consumer interest in plant-based proteins as a viable alternative to animal-based proteins. Additionally, advancements in food technology and processing have enhanced the quality and taste of plant-based proteins, encouraging broader consumer adoption.

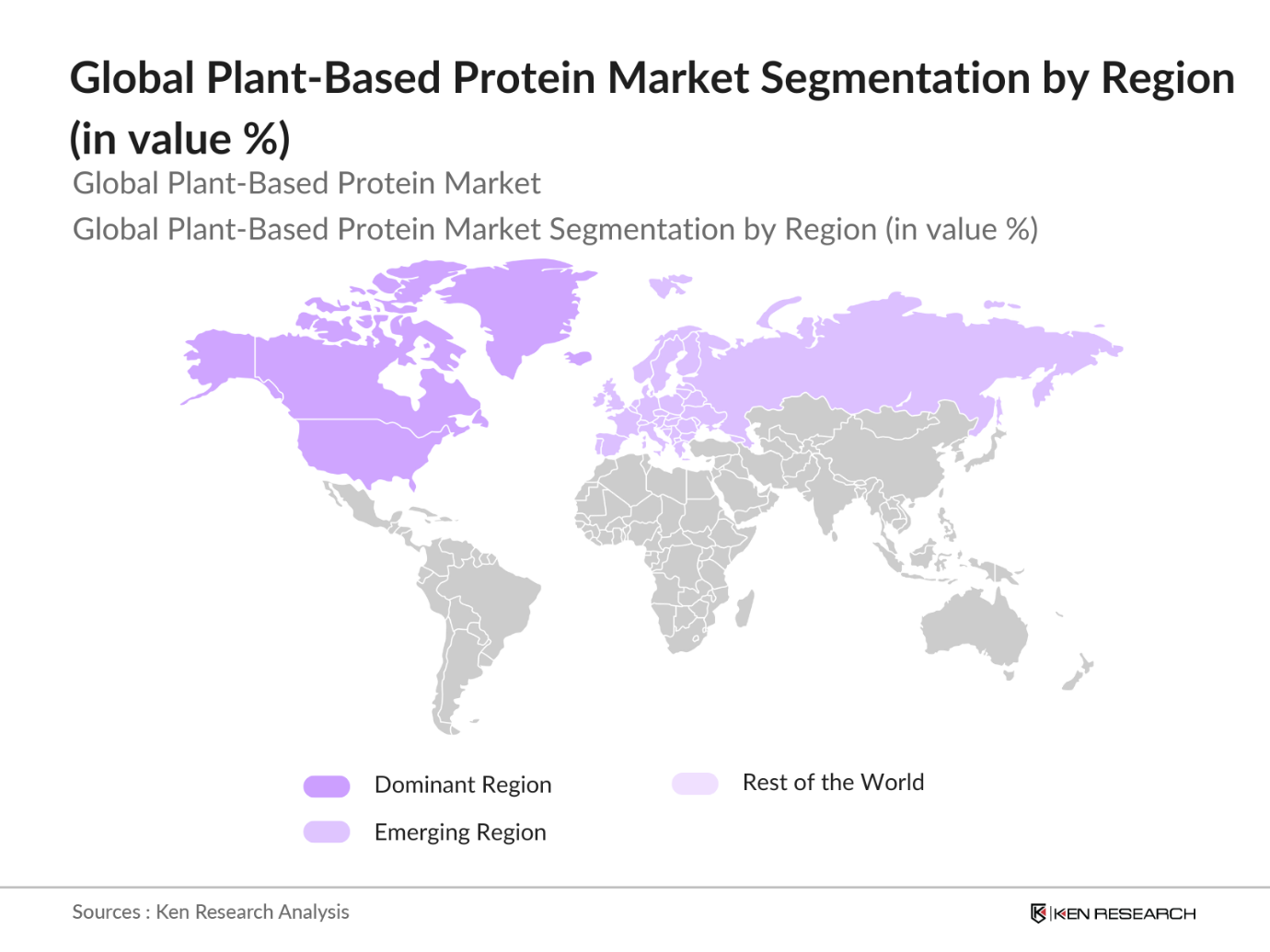

- North America and Europe are leading regions in the global plant-based protein market due to high consumer awareness regarding health and environmental sustainability. These regions also benefit from significant investments in R&D to improve product formulations and expand plant-based offerings across food categories, from snacks to ready-to-eat meals. Moreover, supportive government policies favoring sustainable and plant-based diets contribute to the market's growth.

- Food safety regulations for plant-based proteins are intensifying address potential contamination and quality issues. In 2023, the Food Standards Australia New Zealand (FSANZ) introduced rigorous testing protocols for plant proteins to ensure they meet quality standards. These protocols enhance consumer confidence by mandating testing for contaminants such as heavy metals, fostering a safer market environment for plant-based products in Asia-Pacific and beyond .

Global Plant-Based Protein Market Segmentation

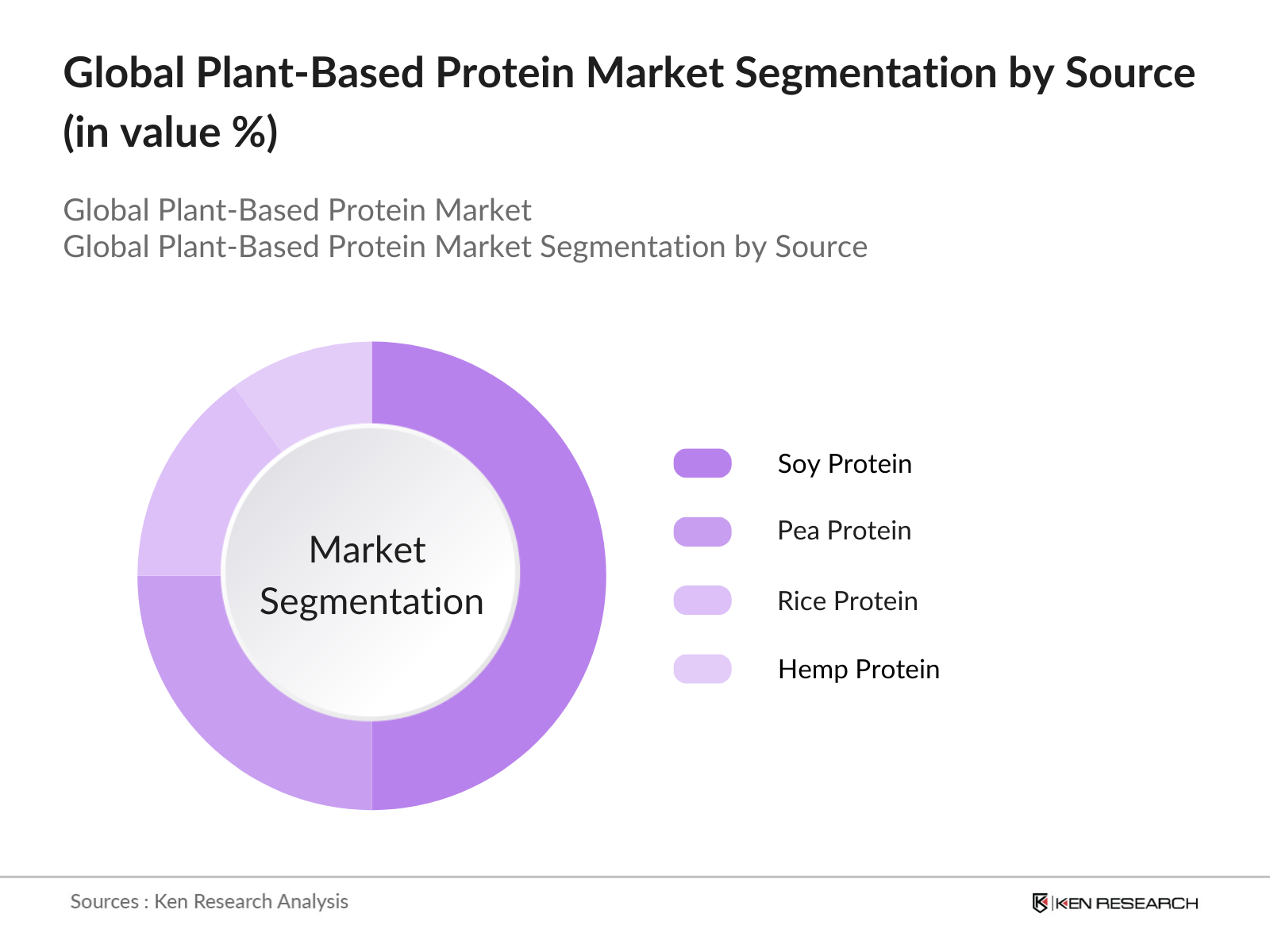

By Source: The plant-based protein market is segmented by source into soy, pea, rice, hemp, and almond protein. Among these, soy protein holds a dominant market share due to its high protein content and versatile applications in various foods and beverages. Soy protein is widely recognized for its nutritional value and is commonly used in meat analogs and protein supplements, which has reinforced its position as a leading source of plant-based protein.

By Region: In terms of regional distribution, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market due to high consumer awareness and strong presence of leading plant-based protein manufacturers. The regions growth is fueled by consumer preference for protein-rich diets and increased accessibility of plant-based options in mainstream grocery stores and restaurants.

By Application: The plant-based protein market is further categorized by application, including food and beverages, dietary supplements, animal feed, and personal care. The food and beverage sector dominates this segment, attributed to the high demand for plant-based alternatives in meat and dairy products. The sector's growth is driven by evolving dietary preferences toward plant-based diets and increased availability of innovative products across retail channels.

Global Plant-Based Protein Market Competitive Landscape

The global plant-based protein market is dominated by key players who have established a strong presence through continuous innovation, product development, and strategic partnerships. Leading companies in the market include ADM, Cargill, and Kerry Group, which have invested heavily in R&D and expanded their product portfolios to cater to the growing consumer demand for plant-based proteins.

Global Plant-Based Protein Industry Analysis

Growth Drivers

- Rising Awareness about Environmental Impact: As consumers become increasingly aware of the environmental costs of traditional animal farming, demand for plant-based proteins is rising. Livestock production contributes to nearly 14.5% of global greenhouse gas emissions, impacting climate change significantly. In response, plant-based protein options are perceived as eco-friendly alternatives, reducing emissions and water use. For instance, plant-based protein production uses 77% less water than animal-based proteins. Global environmental initiatives, including the UNs Sustainable Development Goals, underscore the urgency of reducing emissions, further encouraging consumers toward sustainable diets.

- Increasing Vegan and Flexitarian Populations: The global shift toward plant-forward diets is evident in the increasing number of vegans and flexitarians. Approximately 79 million people worldwide identify as vegan, while a broader flexitarian demographic is growing due to health and sustainability concerns. Data from the World Bank indicates a direct correlation between higher income levels and diverse diet choices, aligning with increased demand for plant-based proteins in high-income regions like North America and Europe. This dietary shift reflects changing lifestyle preferences, with growth driven by both health awareness and environmental concerns.

- Investment in Research for Enhanced Nutritional Profiles: Increased funding for plant protein research is enhancing nutritional profiles and taste. Governments in developed regions, notably the EU, have invested over EUR 1 billion in plant-based protein research between 2022-2024, emphasizing sustainability and health benefits. These investments focus on improving protein quality, digestibility, and amino acid profiles. For instance, the European Research Council funds research into pea and soy protein fortification, enabling new products that cater to health-conscious consumers.

Market Restraints

- Higher Production Costs Compared to Animal-Based Proteins: Production costs for plant-based proteins remain high, driven by limited large-scale processing infrastructure and costly raw materials. Processing costs are nearly 10-20% higher than traditional protein sources due to specialized processing for ingredients like soy, pea, and almond. According to the FAO, plant protein production remains resource-intensive and lacks economies of scale achieved by animal protein industries, impacting final product pricing and limiting adoption in emerging economies.

- Consumer Reluctance and Taste Preferences: Despite the health and environmental benefits, consumer skepticism about plant-based proteins persists, particularly around taste and texture. Studies indicate that nearly 30% of consumers are reluctant to switch to plant proteins due to flavor and consistency concerns. In the U.S., efforts are underway to address this through innovation, but widespread adoption faces barriers from consumer preference for traditional flavors and mouthfeel.

Global Plant-Based Protein Market Future Outlook

The global plant-based protein market is poised for substantial growth in the coming years. Factors such as increasing consumer preference for healthy and sustainable food options, technological advancements in protein extraction and formulation, and expansion into emerging markets will drive the market forward. Government initiatives promoting plant-based diets as part of sustainable living will further support this growth trajectory. The market is also likely to witness new entrants and innovations catering to evolving consumer needs.

Market Opportunities

- Demand in Nutraceutical Applications: Nutraceuticals represent a rapidly expanding segment for plant proteins, particularly in health-conscious markets like the U.S. and Europe. Nutraceutical sales exceeded USD 230 billion in 2023, with plant-based protein ingredients accounting for a significant share in functional foods and dietary supplements. Consumers are increasingly seeking products that offer health benefits, including improved digestion and reduced inflammation. This trend is anticipated to support the growth of plant-based proteins within nutraceutical applications, addressing both preventative health and dietary preferences.

- Potential for Alternative Protein Sources: As demand grows, opportunities for alternative protein sources like microalgae, hemp, and mycoproteins are emerging, driven by their lower environmental impact and distinct nutritional profiles. Microalgae, for example, can produce proteins with minimal water and land use, a significant advantage over conventional agriculture. Innovations in processing technology have enabled the commercialization of these alternative sources, offering diversified protein options to health-conscious consumers and catering to the growing demand for sustainable choices.

Scope of the Report

|

By Source |

Soy Pea Rice Hemp Almond |

|

By Application |

Food and Beverages Dietary Supplements Animal Feed Personal Care |

|

By Type |

Isolates Concentrates Textured Protein |

|

By Distribution Channel |

Retail, E-commerce Food Service Direct Sales |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Food and Beverage Manufacturers

Nutritional and Dietary Supplement Producers

Animal Feed Companies

Personal Care Product Manufacturers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (FDA, USDA)

Plant Protein Extraction Technology Providers

Retail and E-Commerce Platforms

Companies

Players Mentioned in the Report:

ADM

Cargill, Inc.

Kerry Group

Ingredion Incorporated

Roquette Frres

Glanbia plc

DuPont de Nemours, Inc.

Axiom Foods, Inc.

Growing Naturals, LLC

BENEO GmbH

Emsland Group

Cosucra Groupe Warcoing

AGT Food and Ingredients Inc.

A&B Ingredients

Burcon NutraScience

Table of Contents

1. Global Plant-Based Protein Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate Analysis

1.4. Market Segmentation Overview

2. Global Plant-Based Protein Market Size (in USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Plant-Based Protein Market Analysis

3.1. Growth Drivers (e.g., Demand for Sustainable Protein Sources, Increasing Health Consciousness, Technological Advancements in Processing)

3.1.1. Rising Awareness about Environmental Impact

3.1.2. Increasing Vegan and Flexitarian Populations

3.1.3. Investment in Research for Enhanced Nutritional Profiles

3.2. Market Challenges (e.g., Cost of Production, Consumer Skepticism, Limited Protein Source Diversity)

3.2.1. Higher Production Costs Compared to Animal-Based Proteins

3.2.2. Consumer Reluctance and Taste Preferences

3.2.3. Limited Product Variety in Emerging Markets

3.3. Opportunities (e.g., Expansion into Functional Foods, Growth in Emerging Markets, Product Innovations)

3.3.1. Growing Demand in Nutraceutical Applications

3.3.2. Potential for Alternative Protein Sources

3.3.3. Partnerships and Collaborations with F&B Industry

3.4. Trends (e.g., Clean Label, Organic Plant Proteins, Protein Fortification)

3.4.1. Emphasis on Clean Label Products

3.4.2. Increasing Demand for Organic Plant-Based Proteins

3.4.3. Fortified Protein in Functional Foods and Beverages

3.5. Government Regulation (e.g., Labeling Requirements, GMO Regulations, Health Claims Standards)

3.5.1. Mandatory Labeling and Health Claims for Plant-Based Proteins

3.5.2. Compliance with GMO-Free Standards

3.5.3. Food Safety Regulations in Key Markets

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Plant-Based Protein Market Segmentation

4.1. By Source (in Value %) (e.g., Soy, Pea, Rice, Hemp, Almond)

4.1.1. Soy Protein

4.1.2. Pea Protein

4.1.3. Rice Protein

4.1.4. Hemp Protein

4.1.5. Almond Protein

4.2. By Application (in Value %) (e.g., Food and Beverages, Dietary Supplements, Animal Feed, Personal Care)

4.2.1. Food and Beverages

4.2.2. Dietary Supplements

4.2.3. Animal Feed

4.2.4. Personal Care

4.3. By Type (in Value %) (e.g., Isolates, Concentrates, Textured Protein)

4.3.1. Protein Isolates

4.3.2. Protein Concentrates

4.3.3. Textured Protein

4.4. By Distribution Channel (in Value %) (e.g., Retail, E-commerce, Food Service, Direct Sales)

4.4.1. Retail

4.4.2. E-commerce

4.4.3. Food Service

4.4.4. Direct Sales

4.5. By Region (in Value %) (e.g., North America, Europe, Asia-Pacific, Latin America, Middle East & Africa)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Plant-Based Protein Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. ADM

5.1.2. Cargill, Inc.

5.1.3. Kerry Group

5.1.4. Ingredion Incorporated

5.1.5. Burcon NutraScience

5.1.6. Roquette Frres

5.1.7. Glanbia plc

5.1.8. DuPont de Nemours, Inc.

5.1.9. Axiom Foods, Inc.

5.1.10. Growing Naturals, LLC

5.1.11. BENEO GmbH

5.1.12. Emsland Group

5.1.13. Cosucra Groupe Warcoing

5.1.14. AGT Food and Ingredients Inc.

5.1.15. A&B Ingredients

5.2. Cross Comparison Parameters (Revenue, No. of Patents, Protein Sources, Regional Presence, R&D Investment, Market Penetration, Certification Standards, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Plant-Based Protein Market Regulatory Framework

6.1. Food Labeling Regulations

6.2. Health Claims and Nutritional Standards

6.3. Allergen Labeling Requirements

6.4. GMO Compliance and Standards

7. Global Plant-Based Protein Future Market Size (in USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Plant-Based Protein Future Market Segmentation

8.1. By Source (in Value %)

8.2. By Application (in Value %)

8.3. By Type (in Value %)

8.4. By Distribution Channel (in Value %)

8.5. By Region (in Value %)

9. Global Plant-Based Protein Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Analysis

9.3. Go-to-Market Strategies

9.4. Opportunity Assessment

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive ecosystem map of the global plant-based protein market. Extensive desk research and secondary data collection through reputable databases identify the main market dynamics and key influencing variables, such as product types, application areas, and distribution channels.

Step 2: Market Analysis and Construction

In this stage, historical data related to market penetration, supply chain structure, and revenue generation is collected. This includes examining trends in consumer demand, product availability, and regional preferences. Market performance metrics are analyzed to provide accurate insights.

Step 3: Hypothesis Validation and Expert Consultation

Industry hypotheses are validated through expert interviews and consultations. Industry practitioners from various companies provide operational and financial insights via computer-assisted telephone interviews (CATIs), which ensure the data's credibility.

Step 4: Research Synthesis and Final Output

The final phase consolidates the collected data through direct engagement with manufacturers, analyzing product performance, market demand, and growth potential. This bottom-up approach ensures the accuracy of revenue and growth projections, delivering a comprehensive market analysis.

Frequently Asked Questions

01 How big is the Global Plant-Based Protein Market?

The global plant-based protein market, valued at USD 13.7 billion, is driven by consumer demand for sustainable and health-oriented protein sources.

02 What are the challenges in the Global Plant-Based Protein Market?

Challenges include high production costs, consumer reluctance toward taste and texture, and limited product variety in certain regions, which hinder market expansion.

03 Who are the major players in the Global Plant-Based Protein Market?

Key players include ADM, Cargill, Kerry Group, and Roquette Frres. These companies dominate due to their extensive R&D investments, global supply chains, and diverse product offerings.

04 What are the growth drivers of the Global Plant-Based Protein Market?

The market is propelled by factors such as rising health awareness, environmental concerns, and dietary shifts toward veganism and flexitarian diets.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.