Global Plastic Resin Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD10383

December 2024

85

About the Report

Global Plastic Resin Market Overview

- The global plastic resin market is valued at USD 829 billion, driven by increasing demand in key sectors such as automotive, construction, packaging, and consumer goods. This demand is fueled by the lightweight nature of plastic resins, which aids in fuel efficiency in the automotive industry and reduces costs in construction. The market also sees significant contributions from biodegradable and eco-friendly resins as environmental concerns push industries toward more sustainable solutions. Reliable data from industry reports and government bodies underscore the importance of technological innovation in this market.

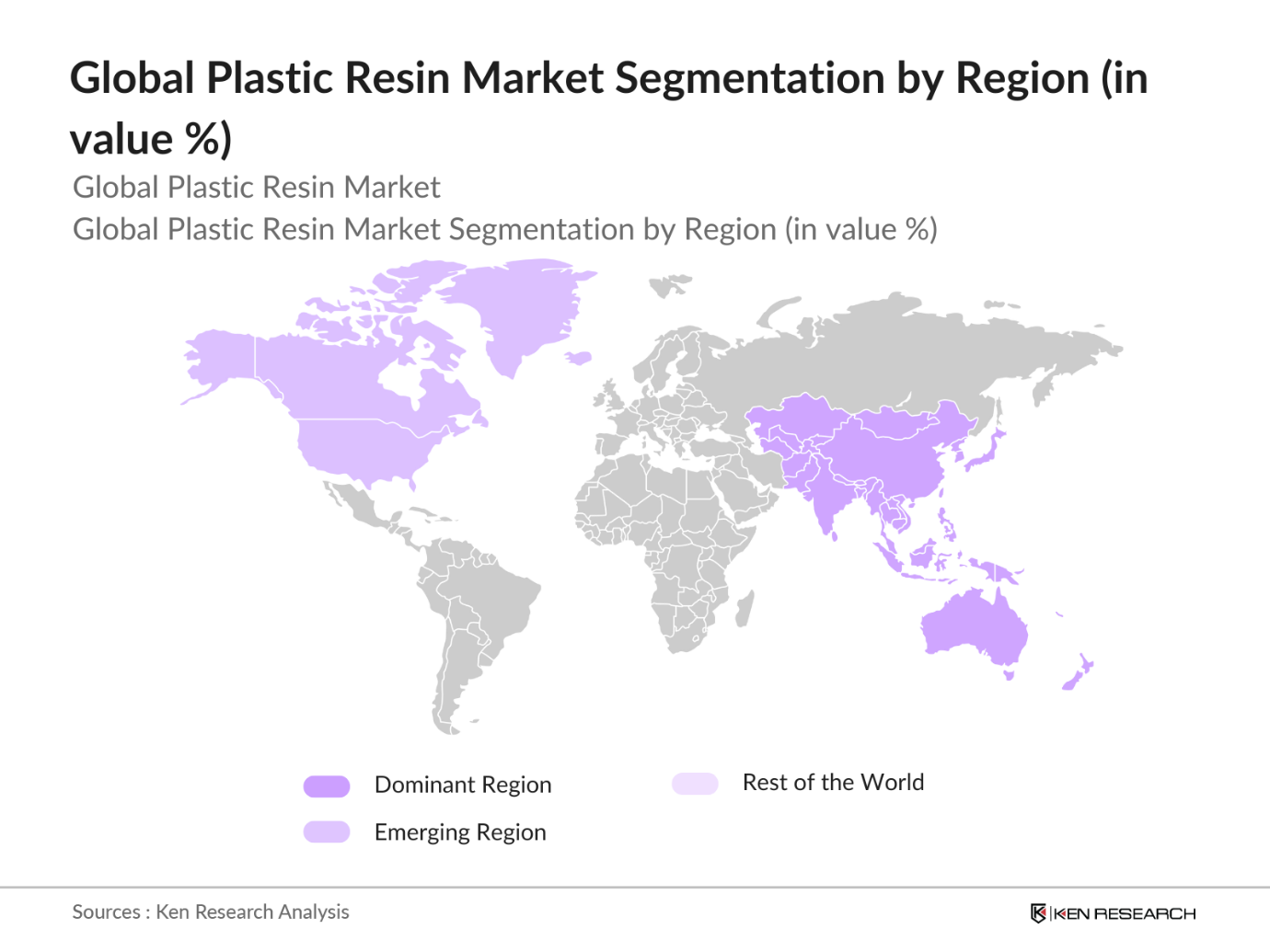

- Countries such as China, the United States, and Germany play dominant roles in the global plastic resin market. China leads due to its massive manufacturing capacity, fueled by domestic demand and strong supply chains for industries like automotive and electronics. The U.S. benefits from its advanced manufacturing technologies and the robust demand for construction and packaging materials. Germany dominates due to its expertise in high-performance plastic resins, driven by its automotive sector and rigorous quality standards.

- The global ban on single-use plastics has accelerated the shift toward sustainable resins. In 2024, over 60 countries enforced bans or restrictions on single-use plastics, including nations like Canada, the United Kingdom, and Kenya. These regulations have spurred demand for alternative resins in packaging and consumer goods industries

Global Plastic Resin Market Segmentation

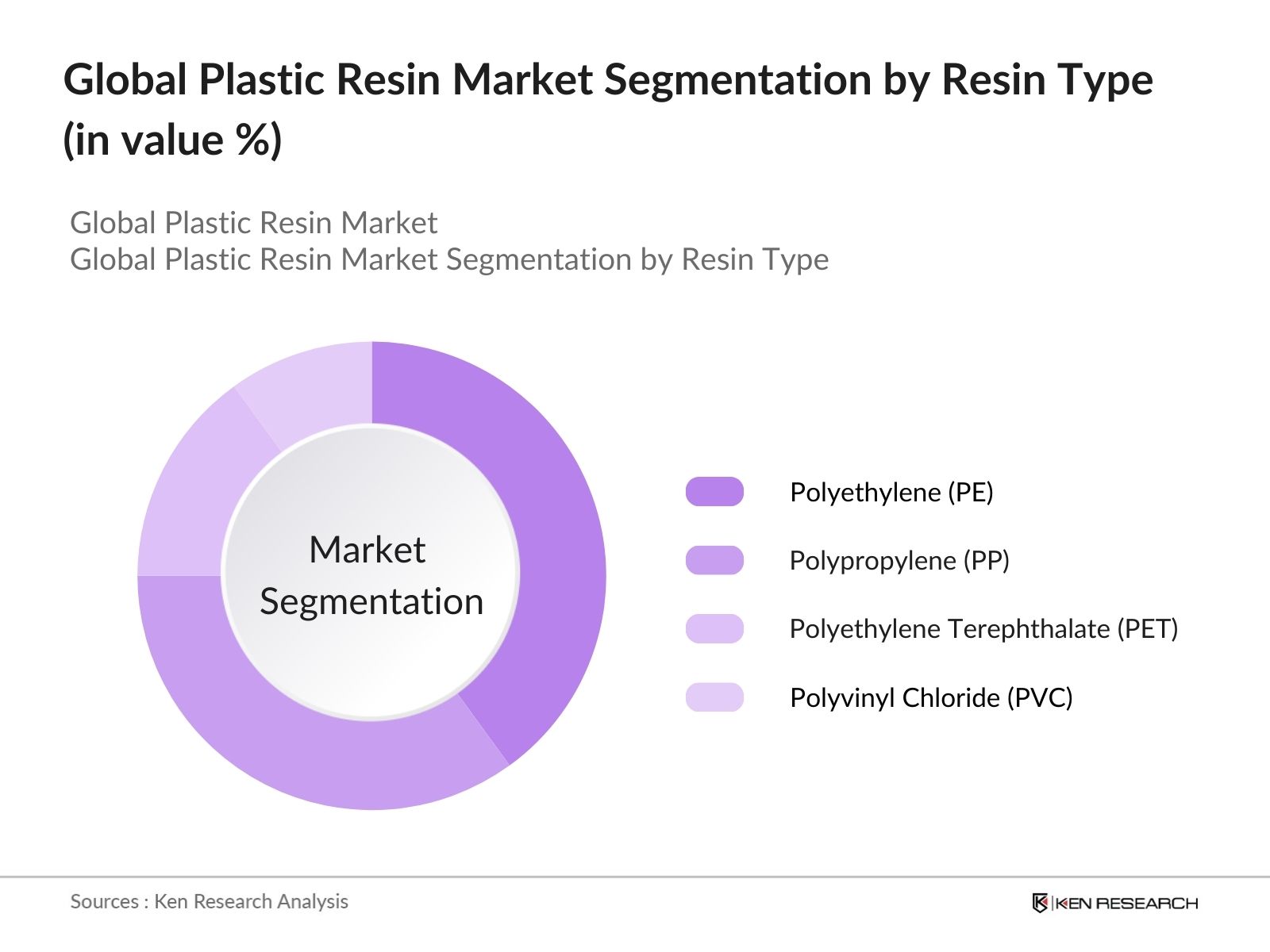

By Resin Type: The global plastic resin market is segmented by resin type into polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), polyvinyl chloride (PVC), polystyrene (PS), and others (including polyamide and polycarbonate). Polyethylene holds the dominant market share because of its widespread use in packaging, particularly in consumer products and flexible packaging. Its low cost, flexibility, and excellent moisture barrier properties make it a preferred material for packaging applications across multiple industries.

By Region: The global plastic resin market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific leads the regional segmentation, driven by strong industrialization, significant demand from automotive, packaging, and construction industries, and the presence of key manufacturing hubs in China, India, and Southeast Asia. The region's dominance is also supported by investments in sustainable plastic solutions and expanding consumer goods industries.

By Application: The plastic resin market is segmented by application into packaging, automotive, construction, consumer goods, electrical and electronics, and medical devices. Packaging dominates the application segment, owing to the rapid growth in e-commerce and the demand for lightweight and durable packaging solutions. The increasing adoption of flexible packaging and the shift toward sustainable packaging materials further strengthen this segment's position in the market.

Global Plastic Resin Market Competitive Landscape

The global plastic resin market is dominated by several key players, with a mixture of international and regional companies leading the charge. The competitive landscape is characterized by innovation in bio-based plastics, expansions in production capacity, and increasing focus on recycling technologies. Companies are strategically investing in R&D and forming partnerships to strengthen their market positions.

|

Company Name |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investment |

Global Presence |

Sustainability Initiatives |

Production Capacity |

Major Clients |

Revenue |

|

LyondellBasell Industries N.V. |

1985 |

Houston, U.S. |

- |

- |

- |

- |

- |

- |

- |

|

SABIC |

1976 |

Riyadh, Saudi Arabia |

- |

- |

- |

- |

- |

- |

- |

|

BASF SE |

1865 |

Ludwigshafen, Germany |

- |

- |

- |

- |

- |

- |

- |

|

Dow Inc. |

1897 |

Midland, U.S. |

- |

- |

- |

- |

- |

- |

- |

|

ExxonMobil Corporation |

1870 |

Irving, U.S. |

- |

- |

- |

- |

- |

- |

- |

Global Plastic Resin Industry Analysis

Growth Drivers

- Rise in Demand for Lightweight Automotive Materials: The automotive industrys shift toward lightweight materials, driven by fuel efficiency and emissions standards, has increased demand for plastic resins in 2024. For instance, lightweight materials contribute significantly to reducing vehicle weight by approximately 50-70 kg per vehicle, improving fuel economy. In India, government policies promoting electric vehicles and fuel efficiency further drive this trend, with 3 million electric vehicles currently on the road. Plastic resins like polypropylene and polyurethane are preferred due to their strength and lightweight properties.

- Expansion of Packaging Industry: The global packaging industry has experienced a surge in demand for plastic resins, especially polyethylene and polypropylene, due to the rapid growth of e-commerce and increased food packaging needs. In 2024, the packaging industry accounts for 35 million metric tons of plastic resin consumption, making it a key driver. Governments in regions like the EU and India are also introducing new packaging regulations, which influence the use of resins compliant with environmental standards.

- Increasing Usage in Consumer Goods and Electronics: The consumer goods and electronics sector uses a significant amount of plastic resin for manufacturing, with 2024 seeing an estimated 15 million metric tons used in the Asia-Pacific region alone. The rise of smart devices and IoT technologies has led to increased demand for plastic components in electronic casings and accessories. Government programs in countries like China, which produced over 70% of global electronics, further accelerate resin consumption in this sector.

Market Restraints

- Volatility in Crude Oil Prices (Key Raw Material): The plastic resin industry is highly dependent on crude oil, which is a major raw material. In 2024, crude oil prices fluctuated between $70 to $90 per barrel, directly impacting the cost of resin production. The volatility in crude oil prices has caused disruptions in the supply chain, leading to production delays and increased costs for manufacturers.

- Stringent Environmental Regulations on Plastic Usage: Environmental regulations are becoming stricter, especially in Europe and North America, where policies like the European Green Deal and plastic waste management laws are influencing resin usage. The European Union alone aims to reduce plastic waste by 30% in 2024, which has pushed companies to adopt more sustainable alternatives. These regulations challenge the traditional plastic resin market and are creating barriers to the usage of non-biodegradable resins.

Global Plastic Resin Market Future Outlook

The global plastic resin market is expected to experience robust growth over the next five years, driven by the increasing demand for lightweight, cost-effective, and versatile materials across multiple industries. Key drivers for growth include the continued expansion of packaging solutions, advancements in bioplastics, and a surge in demand for recycled plastic resins as governments and industries push for more sustainable practices. Regions like Asia Pacific and North America will continue to lead market growth due to their large industrial base and adoption of new technologies.

Market Opportunities

- Adoption of Recycled Plastics in Packaging: The packaging industry is increasingly adopting recycled plastics, spurred by consumer demand and regulatory pressures. In 2024, over 5 million metric tons of recycled plastic were used in packaging, particularly in Europe and North America, where regulations such as the EUs Packaging and Packaging Waste Directive mandate higher recycling content in packaging materials. The rise of circular economy models further supports this trend.

- Growing Demand for Biodegradable Resins in End-Use Sectors: The demand for biodegradable resins is rising across sectors like agriculture, packaging, and consumer goods. In 2024, global production of biodegradable resins reached 2.5 million metric tons, with the agriculture sector alone using 1.2 million tons. Government initiatives in regions like the European Union promote the use of such resins through subsidies and grants for companies adopting biodegradable alternatives.

Scope of the Report

|

By Resin Type |

Polyethylene (PE) Polypropylene (PP) PET PVC PS Polyamide (PA) Others |

|

By Application |

Packaging Automotive Construction Consumer Goods Electrical & Electronics Medical Devices |

|

By Technology |

Injection Molding Blow Molding Extrusion Thermoforming Rotational Molding |

|

By End-User |

Automotive Construction Packaging Electronics Healthcare |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Automotive Manufacturers

Packaging Companies

Construction Companies

Consumer Goods Manufacturers

Electrical and Electronics Manufacturers

Medical Device Manufacturers

Government and Regulatory Bodies (EPA, European Commission)

Investors and Venture Capital Firms

Companies

Players Mentioned in the Report:

LyondellBasell Industries N.V.

SABIC

BASF SE

Dow Inc.

ExxonMobil Corporation

INEOS Group Ltd.

Formosa Plastics Corporation

TotalEnergies SE

Chevron Phillips Chemical Co.

Reliance Industries Ltd.

Borealis AG

Westlake Chemical Corporation

LG Chem Ltd.

Covestro AG

Arkema S.A.

Table of Contents

1. Global Plastic Resin Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Plastic Resin Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Plastic Resin Market Analysis

3.1.1. Rise in Demand for Lightweight Automotive Materials

3.1.2. Expansion of Packaging Industry

3.1.3. Increasing Usage in Consumer Goods and Electronics

3.1.4. Advancements in Biodegradable and Recyclable Resins

3.2. Market Challenges

3.2.1. Volatility in Crude Oil Prices (Key Raw Material)

3.2.2. Stringent Environmental Regulations on Plastic Usage

3.2.3. High Cost of Raw Materials

3.2.4. Complex Recycling Processes

3.3. Opportunities

3.3.1. Adoption of Recycled Plastics in Packaging

3.3.2. Growing Demand for Biodegradable Resins in End-Use Sectors

3.3.3. Investment in Research for Sustainable Alternatives

3.3.4. Emerging Markets in Asia-Pacific and Africa

3.4. Trends

3.4.1. Shift Toward Sustainable and Eco-Friendly Resins

3.4.2. Innovations in Additives and Fillers for Enhanced Properties

3.4.3. Development of Bio-Based Resins

3.4.4. Circular Economy Initiatives in the Plastic Sector

3.5. Government Regulation

3.5.1. Plastic Waste Management and Recycling Policies

3.5.2. Global Ban on Single-Use Plastics

3.5.3. Carbon Footprint Reduction Programs

3.5.4. Incentives for Sustainable Plastic Manufacturing

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.8.1. Bargaining Power of Suppliers (Oil and Raw Material Suppliers)

3.8.2. Bargaining Power of Buyers (Automotive, Packaging, Consumer Goods)

3.8.3. Threat of New Entrants (Emerging Bioplastics Players)

3.8.4. Threat of Substitutes (Metal, Glass)

3.8.5. Industry Rivalry (High Competition Among Global Manufacturers)

3.9. Competition Ecosystem

4. Global Plastic Resin Market Segmentation

4.1. By Resin Type (In Value %)

4.1.1. Polyethylene (PE)

4.1.2. Polypropylene (PP)

4.1.3. Polyethylene Terephthalate (PET)

4.1.4. Polyvinyl Chloride (PVC)

4.1.5. Polystyrene (PS)

4.1.6. Polyamide (PA)

4.1.7. Others (Acrylonitrile Butadiene Styrene (ABS), Polycarbonate (PC))

4.2. By Application (In Value %)

4.2.1. Packaging

4.2.2. Automotive

4.2.3. Construction

4.2.4. Consumer Goods

4.2.5. Electrical & Electronics

4.2.6. Medical Devices

4.3. By Technology (In Value %)

4.3.1. Injection Molding

4.3.2. Blow Molding

4.3.3. Extrusion

4.3.4. Thermoforming

4.3.5. Rotational Molding

4.4. By End-User Industry (In Value %)

4.4.1. Automotive

4.4.2. Construction

4.4.3. Packaging

4.4.4. Electronics

4.4.5. Healthcare

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Plastic Resin Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. LyondellBasell Industries N.V.

5.1.2. SABIC

5.1.3. BASF SE

5.1.4. Dow Inc.

5.1.5. ExxonMobil Corporation

5.1.6. INEOS Group Ltd.

5.1.7. TotalEnergies SE

5.1.8. Chevron Phillips Chemical Co.

5.1.9. Reliance Industries Ltd.

5.1.10. Formosa Plastics Corporation

5.1.11. Borealis AG

5.1.12. Westlake Chemical Corporation

5.1.13. Arkema S.A.

5.1.14. Covestro AG

5.1.15. LG Chem Ltd.

5.2. Cross Comparison Parameters

5.2.1. No. of Employees

5.2.2. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Product Portfolio

5.2.6. Global Presence

5.2.7. Recent Developments

5.2.8. Key Partnerships

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Plastic Resin Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Plastic Resin Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Plastic Resin Market Future Segmentation

8.1. By Resin Type (In Value %) 8.2. By Application (In Value %) 8.3. By Technology (In Value %) 8.4. By End-User Industry (In Value %) 8.5. By Region (In Value %)

9. Global Plastic Resin Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial step involved creating an ecosystem map that includes major stakeholders in the global plastic resin market. We utilized a combination of secondary and proprietary databases to gather in-depth industry insights. This stage aimed to pinpoint and define the essential variables that affect the market, including resin types and major applications.

Step 2: Market Analysis and Construction

This phase focused on compiling historical data on the global plastic resin market. Market penetration in key industries such as automotive and packaging was assessed, alongside revenue contributions. Service quality metrics were evaluated to ensure the reliability and validity of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were formulated based on historical data and expert opinions. These were validated through interviews with industry professionals across the resin supply chain. This phase was crucial for gaining operational insights and refining data models for market analysis.

Step 4: Research Synthesis and Final Output

Finally, data from plastic resin manufacturers were gathered to obtain detailed insights into sales performance and consumer preferences. This data was cross-verified with bottom-up approaches to deliver a comprehensive and validated analysis of the global plastic resin market.

Frequently Asked Questions

01. How big is the global plastic resin market?

The global plastic resin market is valued at USD 829 billion, driven by demand from industries like automotive, construction, and packaging. Increasing environmental concerns and the push for recyclable resins are also influencing market dynamics.

02. What are the challenges in the global plastic resin market?

Challenges include price volatility in raw materials such as crude oil, the environmental impact of plastic waste, and stringent regulations on plastic usage. Complex recycling processes also pose significant barriers to market expansion.

03. Who are the major players in the global plastic resin market?

Key players in the market include LyondellBasell Industries, SABIC, BASF SE, Dow Inc., and ExxonMobil. These companies dominate through advanced production technologies, high investments in R&D, and strong global distribution networks.

04. What are the growth drivers of the global plastic resin market?

The market is driven by rising demand for lightweight materials in automotive manufacturing, growth in e-commerce driving packaging demand, and innovations in bio-based and sustainable plastic resins. Additionally, increased consumer awareness about environmental sustainability is boosting demand for recyclable materials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.