Global Platinum Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD7451

December 2024

88

About the Report

Global Platinum Market Overview

- The global platinum market, valued at approximately USD 7.9 billion, has experienced steady growth, driven by its extensive use across multiple sectors, including automotive, jewelry, and the rapidly growing hydrogen energy sector. The automotive industry, particularly in catalytic converters, continues to be a primary driver for platinum demand. Additionally, rising industrial applications, such as glass and petroleum refining, further contribute to its growth. The platinum market is also bolstered by the surge in investments linked to clean energy initiatives, especially in hydrogen fuel cells, where platinum plays a critical role.

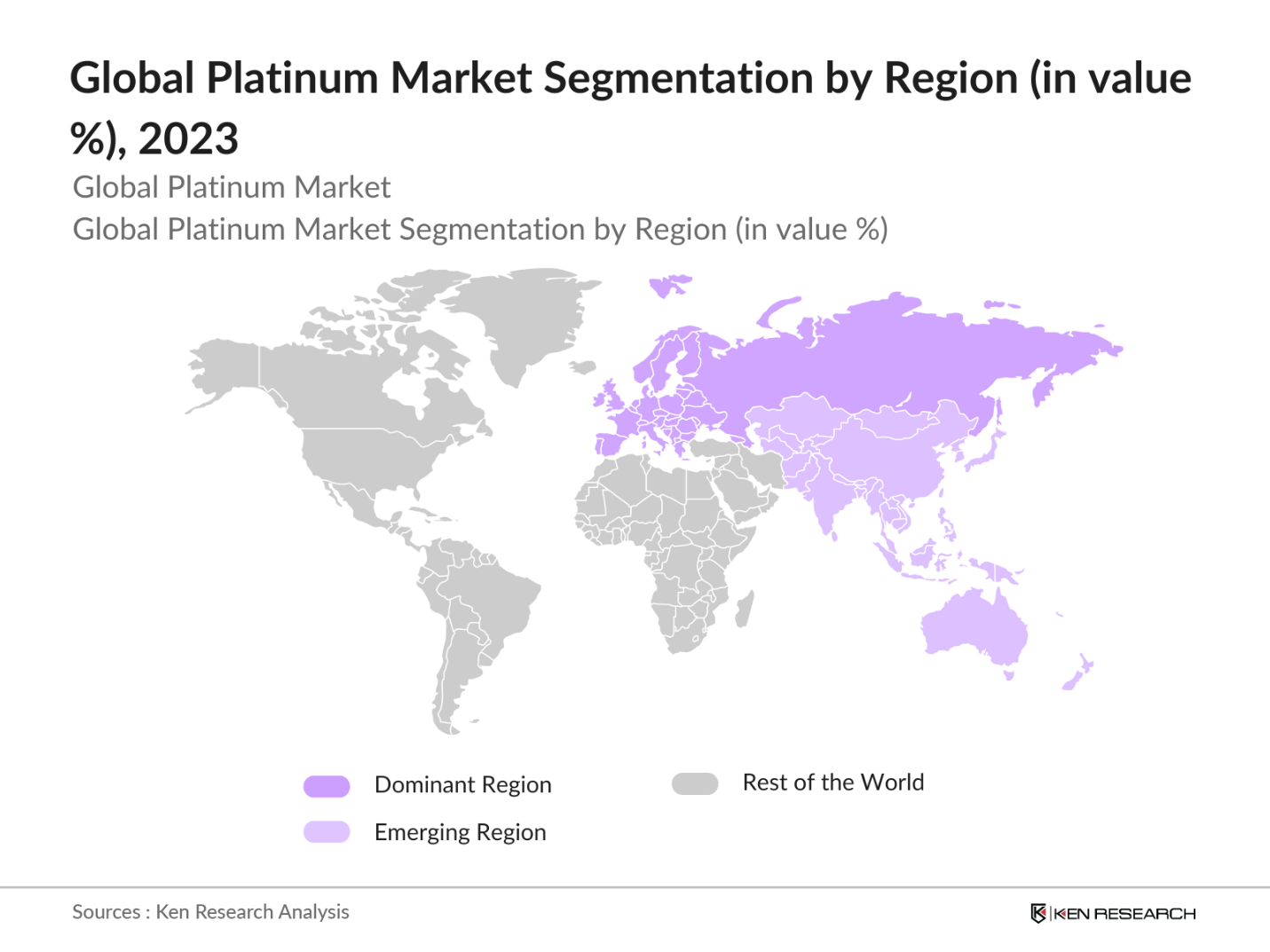

- South Africa dominates the global platinum supply, with Russia also playing a major role. South Africa's dominance is attributed to its vast reserves, accounting for nearly 70% of the world's platinum production, along with its established mining infrastructure. Russia follows with its vast palladium reserves, often producing platinum as a by-product. Despite environmental and logistical challenges, these regions continue to lead due to their resource abundance, coupled with ongoing technological advancements in extraction and refining processes.

- The global shift towards green hydrogen, driven by the renewable energy transition, is set to increase platinum demand. In 2023, green hydrogen production capacity reached 10 gigawatts globally, with platinum being a key component in electrolysis technologies. The World Bank forecasts continued growth in renewable energy investments, with the hydrogen sector seeing significant expansion as countries aim to meet their net-zero goals.

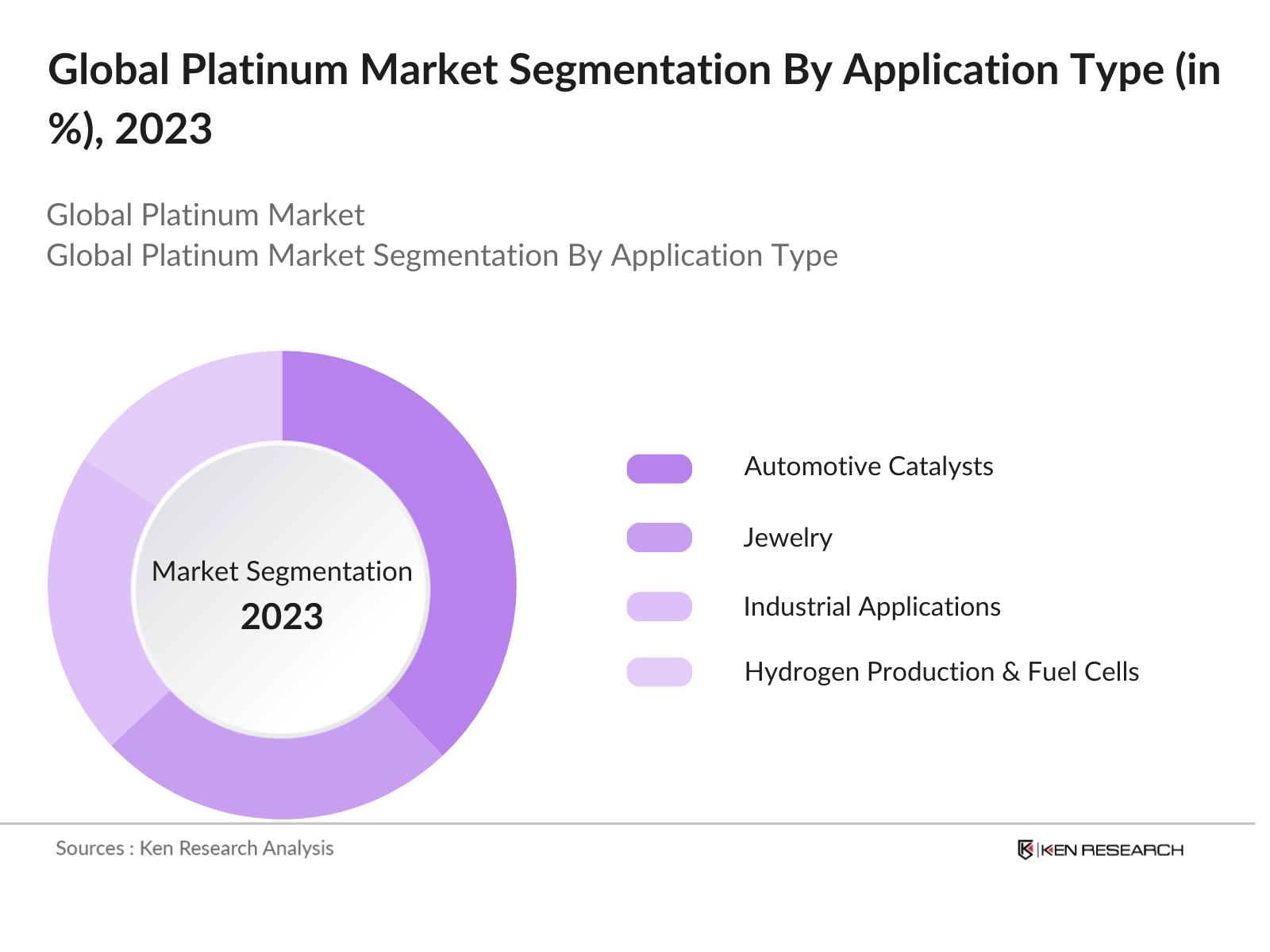

Global Platinum Market Segmentation

By Application: The global platinum market is segmented by application into automotive catalysts, jewelry, hydrogen production and fuel cells, industrial applications, and investment. Automotive catalysts, which utilize platinum in catalytic converters to reduce vehicle emissions, hold the largest share. This is due to increasing emission regulations worldwide, particularly in regions like Europe and North America, where stringent environmental regulations are pushing automakers to use more platinum in reducing vehicle emissions. In emerging economies like China, the rising adoption of electric and hybrid vehicles further accelerates the demand for platinum.

By Region:

The global platinum market is segmented regionally into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. Europe holds the dominant position due to its leading role in automotive manufacturing, particularly in countries like Germany and France. The implementation of strict emission standards has led to an increase in the use of platinum in the automotive sector. In Asia-Pacific, China and Japan also represent significant markets, with a growing focus on hydrogen fuel cells and industrial applications driving demand.

By Source: The platinum market is also segmented by source into primary mining and recycling. Primary mining leads the market, as the majority of platinum is sourced from deep mining operations, particularly in South Africa. The dominance of primary mining is due to its role in supplying raw platinum for various industrial applications. However, the recycling sector is growing, driven by environmental concerns and the high cost of extracting new platinum. Recycling plays a crucial role in sustaining the jewelry and automotive sectors, where platinum can be efficiently reclaimed.

Global Platinum Market Competitive Landscape

The global platinum market is consolidated, with a few key players dominating the space. South African-based companies like Anglo American Platinum and Impala Platinum are global leaders due to their extensive mining operations. Russian firms such as Norilsk Nickel also hold a significant market share, leveraging their palladium operations to drive platinum production. The competitive landscape is shaped by long-term contracts, technological innovation in mining, and corporate investments in clean energy technologies, such as hydrogen fuel cells.

|

Company |

Establishment Year |

Headquarters |

Platinum Production |

Mine Reserves |

Revenue |

Refining Capacity |

Sustainability Initiatives |

Technological Investment |

Geographical Presence |

|

Anglo American Platinum |

1995 |

Johannesburg, South Africa |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Impala Platinum |

1924 |

Johannesburg, South Africa |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Norilsk Nickel |

1935 |

Moscow, Russia |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Sibanye Stillwater |

2013 |

Johannesburg, South Africa |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Northam Platinum |

1986 |

Johannesburg, South Africa |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

Global Platinum Industry Analysis

Growth Drivers

- Rising Demand in Automotive Catalysts: The adoption of platinum in automotive catalytic converters has been driven by stricter emission regulations worldwide. In 2023, the automotive sector accounted for over 40% of global platinum consumption, as the metal plays a crucial role in reducing vehicle emissions. With the Euro 7 regulations set to enforce more stringent emission limits, the demand for platinum in catalytic converters is expected to remain strong. According to the International Energy Agency (IEA), nearly 90 million passenger vehicles are estimated to be produced globally in 2024, driving the demand for emission control technologies.

- Industrial Application Growth: Platinum is integral to several industrial applications, notably in the petrochemical and glass industries. As of 2023, the global petrochemical industry, valued at approximately USD 5 trillion, continues to drive demand for platinum-based catalysts in refining processes. In glass manufacturing, platinum is used in equipment for producing high-quality glass for electronics and other applications. The World Banks industrial production index indicates a steady increase in demand for platinum across these sectors, supported by an industrial output growth rate of 2.8% in 2023.

- Increased Use in Jewelry: Platinum jewelry continues to thrive, particularly in emerging markets like China and India, where rising disposable incomes are driving consumer demand. In 2023, the World Bank noted an 8% increase in per capita income in China, enhancing consumer spending on luxury goods, including platinum jewelry. Indias jewelry demand, buoyed by cultural preferences for precious metals, has also contributed to this growth. The jewelry sector accounts for about 30% of global platinum consumption, supported by the middle-class expansion in these countries.

Market Challenges

- Price Volatility: Platinum prices have been highly volatile due to global supply-demand imbalances and market speculation. The price of platinum fluctuated between USD 900 to USD 1,200 per ounce in 2023, impacted by geopolitical tensions and shifting investor sentiment. The IMF reported that the volatility index for precious metals spiked in 2023, reflecting the uncertainty in global commodity markets. This price instability poses challenges for industries reliant on platinum, as it affects production costs and profitability.

- Supply Chain Disruptions: Platinum production is concentrated in a few countries, with South Africa and Russia accounting for over 75% of global supply in 2023. Geopolitical tensions, labor strikes, and operational challenges in these regions have resulted in supply chain disruptions. The World Bank highlighted that in 2023, mining output in South Africa fell by 7% due to power shortages and labor unrest, exacerbating the global supply shortage of platinum. Such disruptions threaten the reliability of platinum supply for various industries.

Global Platinum Market Future Outlook

Over the next five years, the global platinum market is poised for significant growth, driven by the increasing adoption of hydrogen fuel cells and stringent global emission regulations in the automotive industry. As the world pivots toward cleaner energy sources, platinums role in green hydrogen production and fuel cell technology is expected to expand substantially. Furthermore, rising demand for platinum in jewelry and industrial applications is projected to sustain long-term growth. With technological advancements in platinum recycling, the market will see improved efficiency and sustainability, particularly in developed economies.

Opportunities

- Emerging Markets: China and India are emerging as significant consumers of platinum, driven by industrial growth and increasing demand for jewelry and automotive applications. Chinas GDP growth of 4.5% in 2023, combined with Indias industrial growth of 5.3%, has led to a substantial increase in platinum demand. These markets represent major opportunities for platinum producers, as industrial expansion and rising middle-class income levels continue to fuel consumption.

- Technological Advancements: Technological innovations in catalysis are opening new avenues for platinum demand. In 2023, advancements in automotive and industrial catalysis have increased the efficiency of platinum use, particularly in hydrogen fuel cells and emissions control systems. The World Economic Forum (WEF) reports that these advancements are expected to enhance platinums role in sustainable technologies. In industries such as petrochemicals, advanced catalysis is improving energy efficiency and reducing the environmental impact.

Scope of the Report

|

By Application |

Automotive Catalysts Jewelry, Hydrogen Production & Fuel Cells Industrial Applications Investment |

|

By Source |

Primary Mining Recycling |

|

By End-Use Industry |

Automotive Chemical & Petrochemical Glass Manufacturing Medical & Electronics |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

|

By Form |

Platinum Bars Platinum Coins Platinum Sponge Platinum Powders |

Products

Key Target Audience Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturing Companies

Hydrogen Energy Companies

Jewelry Designers Companies

Industrial Catalyst Producer Companies

Investment Firms & Venture Capitalist Funds

Government & Regulatory Bodies (e.g., EPA, European Commission)

Platinum Mining & Refining Companies

Petrochemical Companies

Companies

Players Mentioned in the Report

Anglo American Platinum

Impala Platinum

Norilsk Nickel

Sibanye Stillwater

Northam Platinum

Lonmin Plc

Vale S.A.

JSC MMC Norilsk Nickel

Aquarius Platinum Ltd.

Glencore Plc

Table of Contents

1. Global Platinum Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Platinum Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Platinum Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand in Automotive Catalysts

3.1.2. Industrial Application Growth

3.1.3. Increased Use in Jewelry

3.1.4. Growing Investment in Hydrogen Energy

3.2. Market Challenges

3.2.1. Price Volatility

3.2.2. Supply Chain Disruptions

3.2.3. Competition from Substitute Materials

3.2.4. Sustainability and Recycling Issues

3.3. Opportunities

3.3.1. Emerging Markets

3.3.2. Technological Advancements

3.3.3. Growth in Hydrogen Economy

3.3.4. Digital Transformation in Mining

3.4. Trends

3.4.1. Shifting Preference to Green Hydrogen

3.4.2. Growing Role in Automotive Electrification

3.4.3. Increased Focus on Sustainable Mining

3.4.4. Adoption of Blockchain for Metal Tracking

3.5. Government Regulation

3.5.1. Emission Regulations

3.5.2. Mining Regulations

3.5.3. Taxation Policies

3.5.4. Environmental Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Platinum Market Segmentation

4.1. By Application (In Value %)

4.1.1. Automotive Catalysts

4.1.2. Jewelry

4.1.3. Hydrogen Production and Fuel Cells

4.1.4. Industrial Applications

4.1.5. Investment (ETF, Physical Bullion)

4.2. By Source (In Value %)

4.2.1. Primary Mining

4.2.2. Recycling

4.3. By End-Use Industry (In Value %)

4.3.1. Automotive

4.3.2. Chemical & Petrochemical

4.3.3. Glass Manufacturing

4.3.4. Medical & Electronics

4.4. By Region (In Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Middle East & Africa

4.4.5. Latin America

4.5. By Form (In Value %)

4.5.1. Platinum Bars

4.5.2. Platinum Coins

4.5.3. Platinum Sponge

4.5.4. Platinum Powders

5. Global Platinum Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Anglo American Platinum Ltd.

5.1.2. Impala Platinum Holdings Ltd.

5.1.3. Sibanye Stillwater Ltd.

5.1.4. Norilsk Nickel

5.1.5. Northam Platinum

5.1.6. Lonmin Plc

5.1.7. Vale S.A.

5.1.8. JSC MMC Norilsk Nickel

5.1.9. Aquarius Platinum Ltd.

5.1.10. Glencore Plc

5.1.11. Platinum Group Metals Ltd.

5.1.12. Royal Bafokeng Platinum

5.1.13. Eastern Platinum Ltd.

5.1.14. Zimplats Holdings Ltd.

5.1.15. Atlatsa Resources Corporation

5.2 Cross Comparison Parameters (Reserves, Refining Capacity, Mine Production, Sustainability Score, Technological Capabilities, Geographic Presence, Workforce Size, Financial Performance)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Platinum Market Regulatory Framework

6.1 Mining Regulations and Permits

6.2 Trade Tariffs and Import-Export Duties

6.3 Environmental Compliance

6.4 Recycling Mandates and Standards

7. Global Platinum Market Future Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Platinum Market Future Segmentation

8.1 By Application (In Value %)

8.2 By Source (In Value %)

8.3 By End-Use Industry (In Value %)

8.4 By Region (In Value %)

8.5 By Form (In Value %)

9. Global Platinum Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

In this phase, we begin by constructing an ecosystem map that includes all relevant stakeholders in the global platinum market, such as mining companies, industrial end-users, and investors. The identification of these stakeholders is driven by extensive desk research, leveraging both proprietary databases and public sources to pinpoint key variables that influence market dynamics.

Step 2: Market Analysis and Construction

This stage involves compiling and analyzing historical market data, focusing on metrics such as mine production, recycling rates, and consumption by industry. Additionally, an assessment of industrial application growth and platinum pricing trends will be conducted to ensure reliable and accurate forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, including mining professionals, automotive manufacturers, and hydrogen fuel cell specialists. These interviews offer firsthand operational insights, helping us refine our market data.

Step 4: Research Synthesis and Final Output

In the final phase, we engage directly with platinum manufacturers to acquire detailed insights into market segmentation, sales performance, and technological innovations. This data is synthesized to provide a validated and comprehensive analysis of the global platinum market.

Frequently Asked Questions

01. How big is the global platinum market?

The global platinum market is valued at approximately USD 7.9 billion, driven by its use in automotive catalysts, industrial applications, and emerging clean energy technologies like hydrogen fuel cells.

02. What are the challenges in the global platinum market?

Challenges include price volatility due to fluctuations in mining output and geopolitical risks in major platinum-producing countries like South Africa and Russia. Competition from palladium and other substitute metals also presents a challenge.

03. Who are the major players in the global platinum market?

Key players in the market include Anglo American Platinum, Impala Platinum, Norilsk Nickel, Sibanye Stillwater, and Northam Platinum, which dominate due to their extensive mining operations and technological advancements in platinum extraction.

04. What are the growth drivers of the global platinum market?

The market is propelled by growing demand in the automotive sector, stricter emission regulations, and the increasing use of platinum in hydrogen fuel cells and industrial applications such as petrochemicals and glass manufacturing.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.