Global Point of Sale (POS) Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD9895

December 2024

89

About the Report

Global Point of Sale (POS) Market Overview

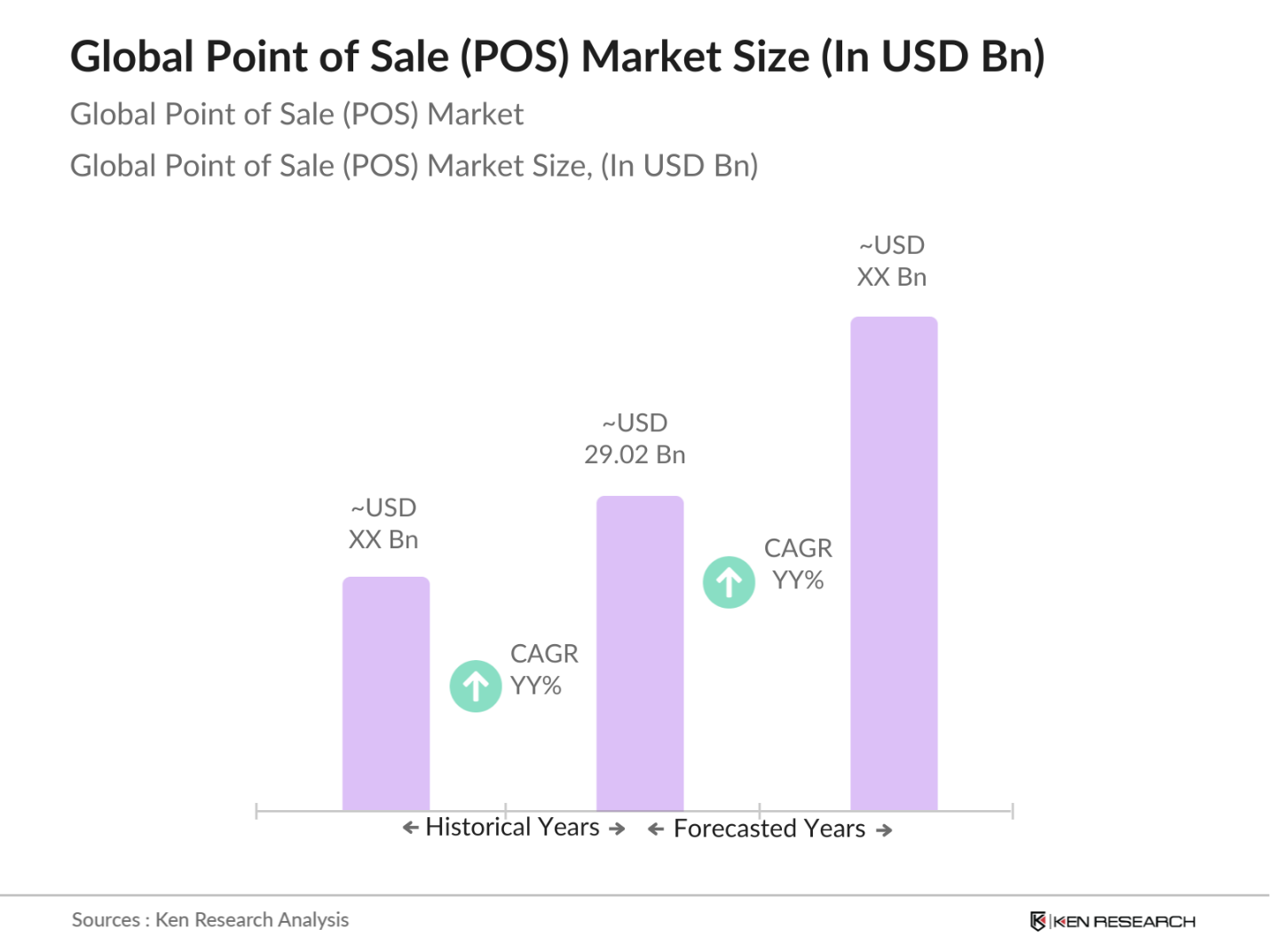

- The global POS market is valued at USD 29.02 billion, driven by rapid technological advancements, increasing consumer preference for digital payments, and the expansion of eCommerce and retail sectors. POS solutions are essential for streamlining transaction processes, optimizing customer experience, and enabling better inventory management, making them indispensable for businesses across industries. The markets growth is also supported by government initiatives promoting digital payments and the rising adoption of contactless payment options among consumers.

- North America and Europe are dominant regions in the global POS market, attributed to their advanced retail infrastructures and widespread digital payment adoption. In North America, the established digital ecosystem and the robust demand for cloud-based POS systems fuel this dominance. In Europe, regulatory support for secure digital payments and significant investments in contactless technologies drive market growth, especially in countries like Germany, the UK, and France.

- In the European Union, General Data Protection Regulation (GDPR) compliance is crucial for POS systems handling customer data. According to the European Data Protection Board, GDPR-related fines have reached over 1 billion in 2023, reinforcing the need for compliance among POS providers operating in the EU. This regulatory landscape necessitates strict data handling protocols, making GDPR-compliant POS systems a priority.

Global Point of Sale (POS) Market Segmentation

By Component: The POS market is segmented by components into hardware, software, and services. Hardware, comprising POS terminals and mobile POS devices, has a dominant market share due to their pivotal role in facilitating seamless transactions in retail and hospitality sectors. High demand for hardware persists due to the necessity for durable and efficient payment processing terminals in high-traffic locations.

By Region: The POS market is segmented regionally into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. North America commands the largest market share, driven by its mature retail environment, high consumer inclination towards digital payments, and the presence of prominent POS solution providers.

Global Point of Sale (POS) Market Competitive Landscape

The global POS market is characterized by significant competition, with key players focusing on innovation, strategic partnerships, and regional expansion to maintain market positioning.

|

Company |

Establishment Year |

Headquarters |

Product Portfolio |

R&D Investments |

Regional Presence |

Market Share |

Key Innovations |

Strategic Partnerships |

Customer Satisfaction |

|

NCR Corporation |

1884 |

Atlanta, USA |

|||||||

|

Square, Inc. |

2009 |

San Francisco, USA |

|||||||

|

Toshiba Corporation |

1939 |

Tokyo, Japan |

|||||||

|

Ingenico Group |

1980 |

Paris, France |

|||||||

|

VeriFone Systems, Inc. |

1981 |

San Jose, USA |

Global Point of Sale (POS) Market Analysis

Market Growth Drivers

- Increased Adoption of Contactless Payments: The adoption of contactless payments has surged significantly in 2023, driven by growing consumer preference for convenient and fast payment methods. According to recent data from the World Bank, the volume of contactless transactions in developing economies increased by over 120 million transactions compared to the previous year, aligning with accelerated urbanization and smartphone penetration. This increase aligns with the global shift toward digital financial inclusion, where governments promote cashless transactions to improve economic transparency and efficiency.

- Rising Demand for Streamlined Payment Processing: Businesses are increasingly prioritizing streamlined payment systems as the global retail sector continues to experience a significant increase in transaction volumes, with millions of new transactions recorded annually, according to the IMF. The International Monetary Fund also reports that digital transformation initiatives across retail chains are focused on reducing payment processing times, achieving an average reduction of 30 seconds per transaction. These efficiency gains are anticipated to drive POS system adoption as retailers aim to enhance customer experience, particularly in high-volume urban centers.

- Expanding Retail and eCommerce Sectors: Retail expansion, particularly eCommerce, has driven POS market growth. The United Nations Conference on Trade and Development (UNCTAD) reports that the eCommerce sector saw a 7 billion transaction increase across Asia and North America in the first half of 2024 alone. This surge highlights the sector's critical demand for advanced POS solutions that can handle high volumes, enhancing the POS markets expansion.

Market Challenges:

- High Cost of Implementation: Implementing advanced POS systems remains costly, with the average setup expenditure exceeding $12,000 per store, according to a recent survey by the U.S. Small Business Administration. The high cost deters smaller retailers in emerging markets, where profit margins are lower, and access to capital is limited. Government incentives in some regions mitigate costs, but financial constraints continue to limit adoption.

- Limited Connectivity in Developing Regions: Connectivity issues in rural and underserved areas significantly hinder POS market growth. According to the World Bank, a substantial portion of rural regions in Sub-Saharan Africa lack stable internet connections necessary for cloud-based POS systems. This limited connectivity restricts POS adoption, particularly for mobile and cloud-based systems that rely on real-time internet access, affecting the ability of businesses in these areas to leverage advanced payment technologies.

Global Point of Sale (POS) Market Future Outlook

Over the next five years, the global POS market is anticipated to experience robust growth, propelled by increasing digital payment adoption, advancements in contactless and cloud-based technologies, and rising demand for integrated POS solutions across diverse industries. The market is also expected to benefit from government initiatives aimed at enhancing financial inclusion and promoting digital economies.

Market Opportunities:

- Growth of Cloud-Based POS Systems: Cloud-based POS solutions have gained traction due to their flexibility and lower infrastructure costs. The European Union Agency for Cybersecurity reports a significant increase in cloud-based POS system installations in 2023, compared to previous years. These systems reduce upfront costs and offer easy scalability, making them especially popular among small and medium-sized businesses looking for efficient, adaptable payment solutions.

- Integration with CRM and Inventory Management: POS systems integrated with CRM and inventory management have become critical for modern retail. Data from the World Bank indicates that retailers using POS-integrated CRM systems report a 22% increase in customer retention rates. These systems allow for real-time inventory updates, streamlined customer interactions, and data-driven insights, enhancing operational efficiency and customer satisfaction.

Scope of the Report

|

By Product Type |

Hardware POS Terminals Mobile POS POS Accessories Software On-Premise POS Cloud-Based POS Hybrid POS Services Installation Maintenance Managed Services |

|

By Deployment Mode |

On-Premise Cloud-Based Hybrid |

|

By Application |

Convenience Stores Supermarkets Specialty Stores Hospitality Restaurants Hotels Cafes Healthcare Transportation and Logistics |

|

By End-User |

Small and Medium Enterprises (SMEs) Large Enterprises Individual and Self-Owned Businesses |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Retailers and eCommerce Platforms

Hospitality and Food Service Chains

Healthcare Providers

Transportation and Logistics Companies

Small and Medium Enterprises (SMEs)

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., PCI Security Standards Council)

POS Hardware and Software Manufacturers

Companies

Players Mention in the Report

NCR Corporation

Square, Inc.

Toshiba Corporation

Ingenico Group

VeriFone Systems, Inc.

Shopify Inc.

PAX Technology Limited

Lightspeed POS Inc.

Clover Network, Inc.

Revel Systems

HP Inc.

Diebold Nixdorf, Inc.

Oracle Corporation

Fujitsu Limited

Vend Limited

Table of Contents

01. Global Point of Sale (POS) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global POS Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global POS Market Dynamics

3.1. Growth Drivers

Increased Adoption of Contactless Payments

Rising Demand for Streamlined Payment Processing

Technological Advancements (AI and ML Integration)

Expanding Retail and eCommerce Sectors

3.2. Market Challenges

Security and Data Privacy Concerns

High Cost of Implementation

Limited Connectivity in Developing Regions

3.3. Opportunities

Expansion of Mobile POS (mPOS) Solutions

Integration with Omnichannel Retail

Development of AI-Enhanced Customer Analytics

3.4. Trends

Growth of Cloud-Based POS Systems

Rising Preference for Self-Checkout POS

Integration with CRM and Inventory Management

3.5. Government Regulations and Compliance

PCI DSS Compliance

GDPR and Data Security Regulations

National POS System Standards and Certifications

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem Analysis

04. Global POS Market Segmentation

4.1. By Component

Hardware (POS Terminals, Mobile POS, POS Accessories)

Software (On-Premise POS, Cloud-Based POS, Hybrid POS)

Services (Installation, Maintenance, Managed Services)

4.2. By Deployment Mode

On-Premise

Cloud-Based

Hybrid

4.3. By Application

Retail (Convenience Stores, Supermarkets, Specialty Stores)

Hospitality (Restaurants, Hotels, Cafes)

Healthcare

Transportation and Logistics

4.4. By End User

Small and Medium Enterprises (SMEs)

Large Enterprises

Individual and Self-Owned Businesses

4.5. By Region

North America

Europe

Asia-Pacific

Middle East & Africa

Latin America

05. Global POS Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

NCR Corporation

Square, Inc.

Toshiba Corporation

Ingenico Group

VeriFone Systems, Inc.

Shopify Inc.

PAX Technology Limited

Lightspeed POS Inc.

Clover Network, Inc.

Revel Systems

HP Inc.

Diebold Nixdorf, Inc.

Oracle Corporation

Fujitsu Limited

Vend Limited

5.2. Cross-Comparison Parameters

Product Portfolio

Revenue and Market Share

R&D Investments

Geographic Presence

Strategic Initiatives

Digital Transformation Efforts

Customer Satisfaction Ratings

Market Entry Strategy

5.3. Market Share Analysis

5.4. Strategic Initiatives

Partnerships and Alliances

Product Launches

Mergers and Acquisitions

5.5. Investment Analysis

Venture Capital Funding

Private Equity Investments

5.6. Government Grants and Subsidies

06. Global POS Market Regulatory Framework

6.1. Payment Card Industry (PCI) Compliance

6.2. Security and Fraud Prevention Standards

6.3. Consumer Data Protection Laws

6.4. Regional Regulatory Landscape

07. Global POS Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Future Market Segmentation

8.1. By Component (In Value %)

8.2. By Deployment Mode (In Value %)

8.3. By Application (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

09. Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Identification

9.3. Marketing and Positioning Recommendations

9.4. Digital Transformation Insights

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing a comprehensive stakeholder ecosystem within the global POS market. This includes desk research using proprietary databases and secondary sources to identify the critical factors influencing the markets dynamics.

Step 2: Market Analysis and Construction

We analyze historical data on the POS market, focusing on transaction trends, POS hardware and software penetration, and the associated revenue. This phase also includes a review of payment technology innovations and the impacts on market development.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts, including telephonic interviews with executives from major POS solution providers. These insights aid in fine-tuning and corroborating the data collected.

Step 4: Research Synthesis and Final Output

The final phase integrates insights gathered from direct engagements with POS solution providers to confirm the accuracy of our data, ensuring a validated and thorough analysis of the global POS market.

Frequently Asked Questions

01. How big is the global POS market?

The global POS market is valued at USD 29.02 billion, supported by the growing adoption of digital payments and technological advancements in payment solutions.

02. What are the challenges in the global POS market?

Challenges include high implementation costs, data security concerns, and the limited connectivity in developing regions, impacting the scalability of POS solutions.

03. Who are the major players in the global POS market?

Key players include NCR Corporation, Square, Inc., Toshiba Corporation, Ingenico Group, and VeriFone Systems, Inc., leveraging advanced technologies to secure market positions.

04. What drives the global POS market?

The market is driven by the expansion of the retail and eCommerce sectors, increased demand for seamless transaction solutions, and the shift towards contactless payments.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.