Global Polyols Market Outlook to 2030

Region:Global

Author(s):Shivani

Product Code:KROD7468

October 2024

97

About the Report

Global Polyols Market Overview

- The global polyols market is valued at approximately USD 29.51 billion, driven by the robust demand from end-use industries such as automotive, construction, and furniture. The increasing preference for flexible and rigid foams in these industries has been a major growth driver. Polyols are crucial components in the production of polyurethane foams, which find extensive applications in insulation and cushioning materials. The market is further supported by the growing emphasis on energy efficiency, which has increased the demand for rigid foam insulation in construction.

- Countries like China, the United States, and Germany dominate the polyols market. China leads due to its large automotive manufacturing base and rapid industrialization, driving the demand for polyurethanes used in various industries. The U.S. and Germany, with their advanced manufacturing sectors and strict energy efficiency regulations, also contribute significantly to the market. These countries have well-established production capacities and are leaders in the use of polyols for high-performance applications, particularly in automotive and construction sectors.

- The European Union's REACH regulation, aimed at improving the safety of chemical use, continues to evolve. In 2023, the European Chemicals Agency updated its list of hazardous substances, which directly affects the production of certain types of polyols. Compliance with these regulations is critical, as non-compliance could result in substantial fines and operational disruptions for polyol manufacturers.

Global Polyols Market Segmentation

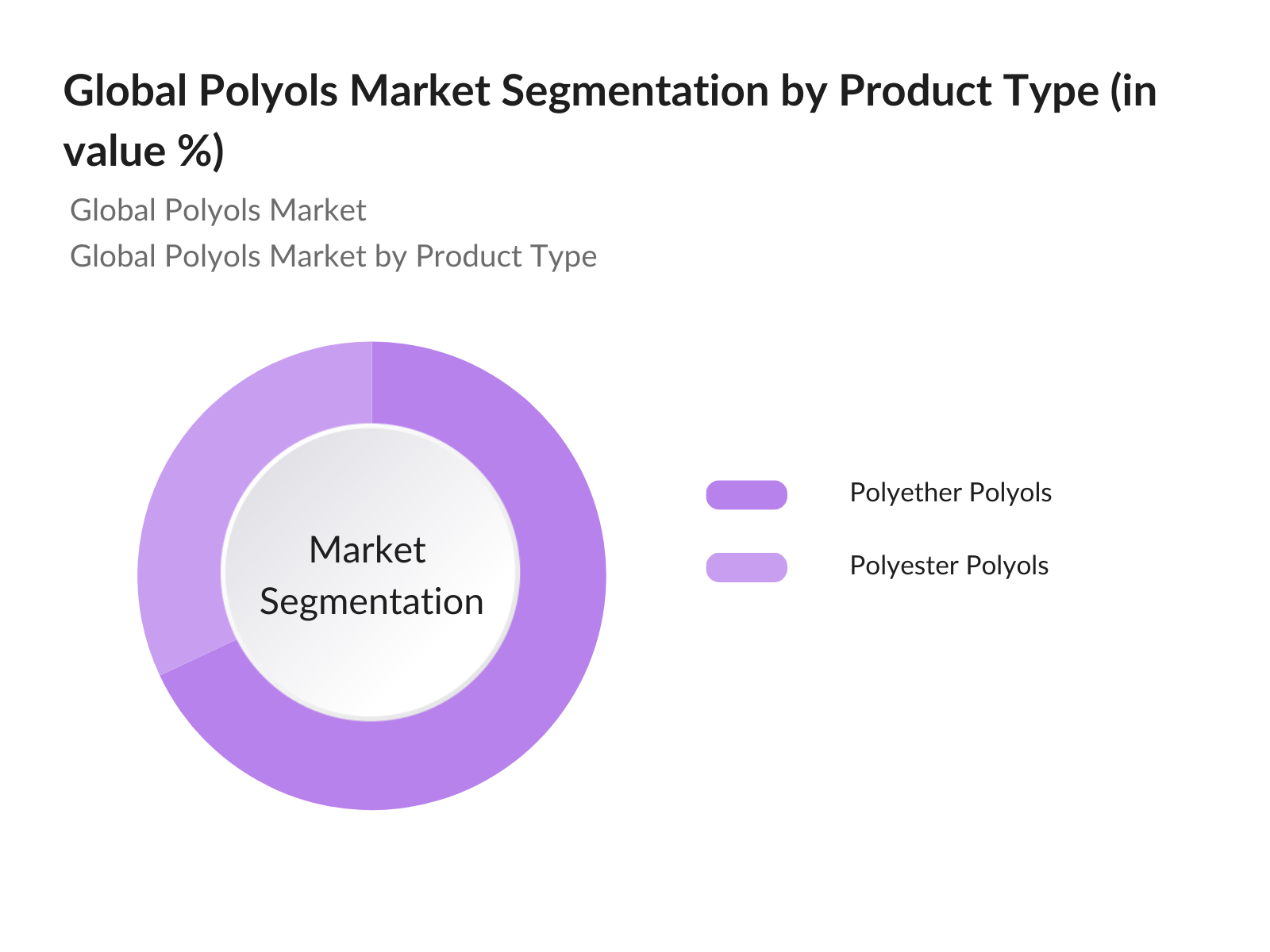

By Product Type: The global polyols market is segmented by product type into polyether polyols and polyester polyols. Polyether polyols have a dominant market share in this segment due to their high demand in the production of flexible foams, which are extensively used in furniture, bedding, and automotive seating. The ease of processing and lower cost of polyether polyols compared to polyester polyols contribute to their widespread use. Polyester polyols, while smaller in market share, are preferred in applications requiring enhanced strength and durability, such as coatings and adhesives.

|

Product Type |

Market Share (2023) |

|---|---|

|

Polyether Polyols |

68% |

|

Polyester Polyols |

32% |

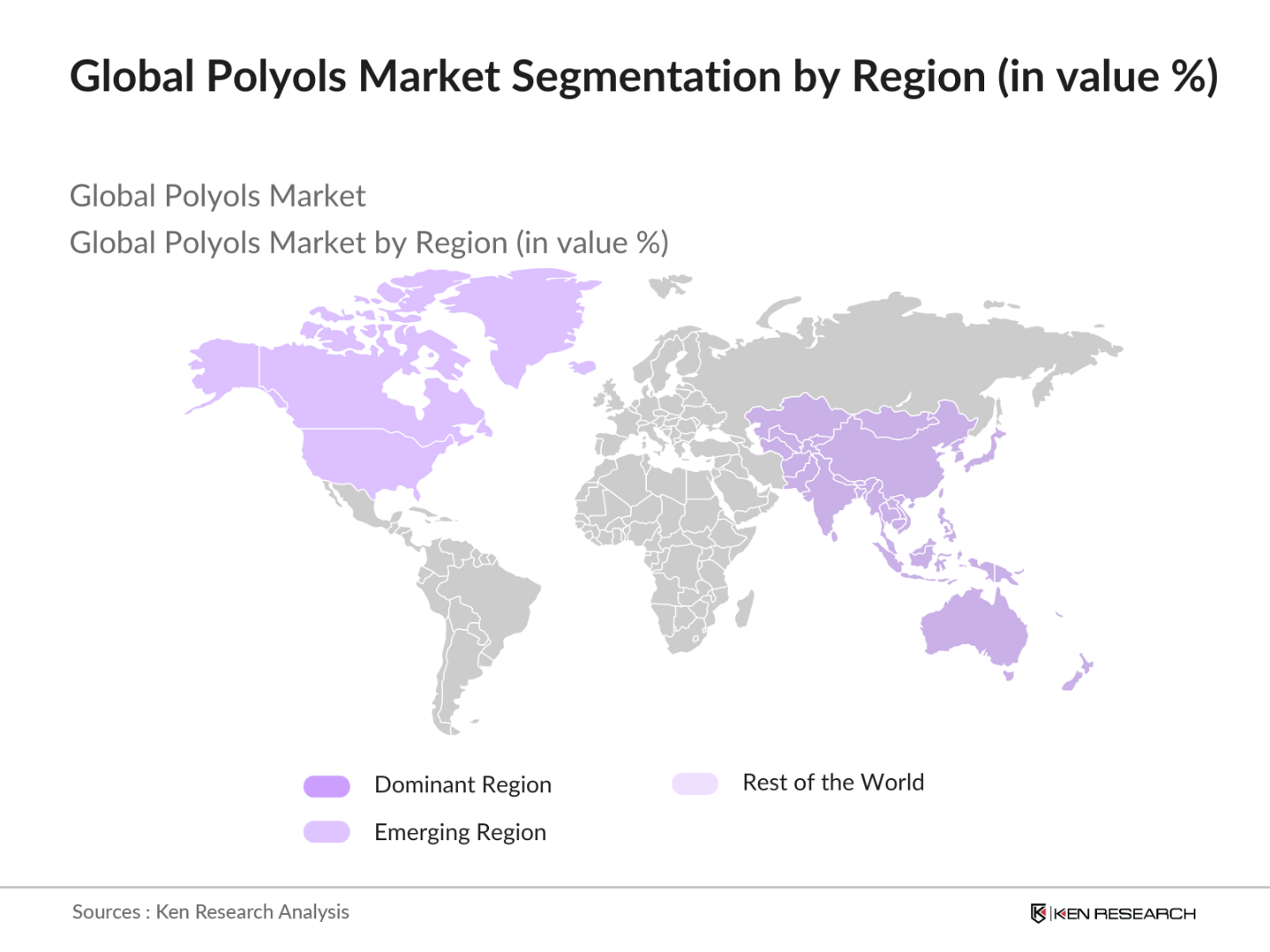

By Region: The global polyols market is geographically segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific dominates the market, led by China and India, where rapid industrialization and urbanization have spurred the demand for polyurethanes in construction and automotive sectors. In North America, the U.S. leads the market due to its stringent energy efficiency regulations that drive the use of polyurethane insulation. Europes market is driven by environmental regulations and the adoption of bio-based polyols, with Germany and France being key contributors.

|

Region |

Market Share (2023) |

|---|---|

|

Asia-Pacific |

40% |

|

North America |

25% |

|

Europe |

20% |

|

Latin America |

10% |

|

Middle East & Africa |

5% |

Global Polyols Market Competitive Landscape

The global polyols market is highly consolidated, with a few major players dominating the market. Companies such as BASF SE, Dow Inc., and Covestro AG hold significant market shares due to their extensive production capacities, strong R&D investments, and established distribution networks. These companies have also been investing heavily in sustainable polyol production, such as bio-based polyols, which aligns with the growing trend towards environmental sustainability.

|

Company |

Establishment Year |

Headquarters |

Polyol Range |

Revenue |

Sustainability Initiatives |

Geographical Presence |

Strategic Partnerships |

R&D Investment |

|

BASF SE |

1865 |

Germany |

Broad |

|||||

|

Dow Inc. |

1897 |

U.S. |

Broad |

|||||

|

Covestro AG |

2015 |

Germany |

Medium |

|||||

|

Huntsman Corporation |

1970 |

U.S. |

Medium |

|||||

|

Mitsui Chemicals, Inc. |

1912 |

Japan |

Narrow |

Global Polyols Market Analysis

Market Growth Drivers

- Rising Demand for Polyurethane Foams: The global polyurethane foam industry is experiencing substantial growth, fueled by the expansion of sectors like automotive, construction, and furniture manufacturing. In the U.S., construction spending increased significantly in 2023, with a large portion allocated to insulation materials, including polyurethane foams. The automotive industry has also embraced these foams for lightweighting in electric vehicles, reducing energy consumption and emissions. The International Energy Agency (IEA) reports a marked increase in electric vehicle sales in 2023, further driving the need for energy-efficient materials such as polyurethane foams.

- Shift Toward Sustainability in the Chemical Industry: The shift toward sustainability in the chemical industry is increasingly evident as governments worldwide push for lower carbon emissions. This transition has driven the demand for eco-friendly materials like sustainable polyols. In 2023, the European Union implemented strict carbon reduction measures, significantly boosting the adoption of bio-based polyols due to their lower environmental impact. Companies in the polyols industry are increasingly reducing their reliance on petrochemicals, aligning their strategies with global efforts to promote greener and more sustainable materials in various applications.

- Increasing Use in Flexible Foam Applications: Flexible foams, primarily used in bedding, upholstery, and automotive interiors, are witnessing increased demand. In 2023, global bedding sales increased by 8%, driven by a surge in housing construction and consumer spending. Flexible polyurethane foams, which offer comfort and durability, are extensively used in these applications, contributing to the growth of the polyols market. The rising middle-class income in countries like Brazil, which saw a 6% increase in per capita income in 2023, also supports this growth.

Market Challenges:

- Fluctuating Raw Material Prices: The price volatility of raw materials like crude oil, which is a primary feedstock for petrochemical polyols, poses significant challenges for the industry. In 2023, crude oil prices fluctuated between $70 and $95 per barrel, according to the U.S. Energy Information Administration. This volatility affects production costs and profitability for polyols manufacturers, making it a key challenge for the market.

- Regulatory Restrictions on Chemical Usage: Stricter regulations on the use of chemicals, especially in Europe and North America, are creating compliance challenges for polyol manufacturers. For instance, the European Chemicals Agency (ECHA) updated its list of substances of very high concern (SVHC) in 2023, including several chemicals used in traditional polyol production. Compliance with these regulations requires manufacturers to invest in alternative, sustainable polyols, increasing operational costs.

Global Polyols Market Future Outlook

The global polyols market is expected to experience significant growth over the next five years, driven by increasing demand from the automotive and construction industries. The shift towards energy-efficient buildings and the growing focus on sustainable solutions, such as bio-based polyols, will further drive market expansion. Advancements in polyurethane technology and rising demand for lightweight materials in automotive manufacturing will also contribute to the markets upward trajectory.

Market Opportunities:

- Growth in Bio-Based Polyols: Bio-based polyols are gaining significant traction as both companies and governments emphasize reducing carbon footprints. In 2023, the global bio-based chemicals market expanded significantly, driven by policy initiatives such as the U.S. governments bio-preferred program, which provides incentives for adopting bio-based products. Polyols derived from renewable resources, such as soybean oil and sugar, are emerging as key alternatives to petrochemical-based products, offering lower emissions and better alignment with sustainability goals. These bio-based polyols contribute to a more environmentally friendly production process across various industries.

- Expansion into Emerging Markets: Emerging markets, especially in the Asia-Pacific region, offer significant opportunities for polyols due to increased industrialization and infrastructure development. In 2023, India experienced notable growth in manufacturing output, driven by substantial investments in the construction and automotive sectors. This growth has led to increased demand for polyols, which are widely used in building materials, insulation, and automotive components. As these markets continue to expand, there are further opportunities for polyols, particularly as the region places more emphasis on sustainable growth and eco-friendly materials.

Scope of the Report

|

By Product Type |

Polyether Polyols Polyester Polyols |

|

By Application |

Flexible Foam Rigid Foam CASE Other |

|

By End-Use Industry |

Automotive Construction Furniture and Bedding Electrical & Electronics |

|

By Source |

Petrochemical Polyols Bio-Based Polyols |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Polyurethane Manufacturers

Automotive Industry Suppliers

Furniture Manufacturers

Construction Companies

Electrical & Electronics Manufacturers

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Environmental Protection Agency, European Chemicals Agency)

Polyurethane Foam Producers

Companies

Major Players

-

BASF SE

Dow Inc.

Covestro AG

Huntsman Corporation

LANXESS AG

Mitsui Chemicals, Inc.

Cargill, Inc.

Shell Chemicals

PCC SE

Bayer AG

Perstorp Group

Manali Petrochemicals

COIM Group

Emery Oleochemicals

Mitsui Chemicals, Inc.

Table of Contents

1. Global Polyols Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2.Global Polyols Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Polyols Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Polyurethane Foams (in Value %)

3.1.2. Shift Toward Sustainability in the Chemical Industry (in Value %)

3.1.3. Expansion of the Automotive and Construction Sectors (in Value %)

3.1.4. Increasing Use in Flexible Foam Applications

3.2. Market Challenges

3.2.1. Fluctuating Raw Material Prices

3.2.2. Regulatory Restrictions on Chemical Usage

3.2.3. Environmental Concerns Related to Petrochemical Polyols

3.3. Opportunities

3.3.1. Growth in Bio-Based Polyols

3.3.2. Expansion into Emerging Markets

3.3.3. Increased R&D in Specialty Polyols

3.4. Trends

3.4.1. Transition to Bio-Based Polyols (in Value %)

3.4.2. Circular Economy Initiatives in Polyols Market

3.4.3. Growing Demand for Polyols in the Pharmaceutical Sector

3.5. Regulatory Landscape

3.5.1. Global Emission Standards

3.5.2. EU Regulations on Chemical Safety

3.5.3. Government Incentives for Sustainable Polyols

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Polyols Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Polyether Polyols

4.1.2. Polyester Polyols

4.2. By Application (In Value %)

4.2.1. Flexible Foam

4.2.2. Rigid Foam

4.2.3. CASE (Coatings, Adhesives, Sealants, Elastomers)

4.2.4. Other Applications

4.3. By End-Use Industry (In Value %)

4.3.1. Automotive

4.3.2. Construction

4.3.3. Furniture and Bedding

4.3.4. Electrical & Electronics

4.4. By Source (In Value %)

4.4.1. Petrochemical Polyols

4.4.2. Bio-Based Polyols

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Polyols Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. BASF SE

5.1.2. Dow Inc.

5.1.3. Covestro AG

5.1.4. Mitsui Chemicals, Inc.

5.1.5. Huntsman Corporation

5.1.6. LANXESS AG

5.1.7. Cargill, Inc.

5.1.8. Shell Chemicals

5.1.9. PCC SE

5.1.10. Bayer AG

5.1.11. Perstorp Group

5.1.12. Manali Petrochemicals

5.1.13. COIM Group

5.1.14. Emery Oleochemicals

5.1.15. Mitsui Chemicals, Inc.

5.2. Cross Comparison Parameters (Number of Employees, Revenue, Polyols Product Range, Innovation Capabilities, Strategic Partnerships, Geographical Presence, Sustainability Initiatives, Market Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Polyols Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Polyols Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Polyols Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-Use Industry (In Value %)

8.4. By Source (In Value %)

8.5. By Region (In Value %)

9. Global Polyols Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the entire polyols market ecosystem by identifying all major stakeholders. This process was guided by extensive desk research and secondary data collection, leveraging proprietary and public databases to gather comprehensive insights into industry trends and dynamics.

Step 2: Market Analysis and Construction

We then analyzed historical data to assess market penetration, product demand, and industry revenue trends. This phase included the examination of service and product statistics, which allowed us to ensure the accuracy and reliability of our revenue estimations and forecasts.

Step 3: Hypothesis Validation and Expert Consultation

Our market assumptions were validated through consultations with industry experts and stakeholders. These consultations were conducted through interviews with representatives from leading companies and key institutions, providing both operational and financial insights critical to corroborating the gathered data.

Step 4: Research Synthesis and Final Output

Finally, we engaged directly with polyols manufacturers to gather in-depth insights into product segments, sales performance, and customer preferences. This step ensured the final data was accurate and validated, producing a comprehensive market analysis.

Frequently Asked Questions

1 How big is the global polyols market?

The global polyols market was valued at USD 29.51 billion, driven by its applications in key industries like automotive, construction, and furniture.

2 What are the challenges in the global polyols market?

Challenges in the market include fluctuating raw material prices, environmental concerns regarding petrochemical polyols, and stringent government regulations on chemical safety.

3 Who are the major players in the global polyols market?

Key players include BASF SE, Dow Inc., Covestro AG, Huntsman Corporation, and Mitsui Chemicals, Inc., all of which dominate due to their global production capabilities and strong R&D efforts.

4 What are the growth drivers of the global polyols market?

The market is driven by the increasing demand for polyurethane foams in automotive, construction, and furniture industries, along with the growing trend towards bio-based polyols.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.