Global Polypropylene Nonwoven Fabric Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD8406

December 2024

100

About the Report

Global Polypropylene Nonwoven Fabric Market Overview

- The global polypropylene nonwoven fabric market is valued at USD 28.77 billion, driven by the growing demand across industries like hygiene, medical, automotive, and construction. Polypropylene nonwoven fabrics are extensively used in hygiene products such as baby diapers, adult incontinence products, and feminine hygiene due to their lightweight, durability, and bacteria-resistant properties. The surge in demand for hygiene products, especially in emerging markets like India and China, and technological advancements in bio-based polypropylene production are significant growth drivers.

- Asia Pacific, particularly countries like China and India, dominate the polypropylene nonwoven fabric market. This dominance is attributed to the region's growing population, rapid industrialization, and increased awareness of personal hygiene. China leads in the production of hygiene products, while India is experiencing growing use of nonwoven fabrics in agriculture and healthcare applications. The government initiatives promoting sustainable and bio-based polypropylene products further bolster the market's prominence in these regions.

- The Indian government has introduced a comprehensive subsidy program to promote sustainable production practices within the nonwoven fabric industry. In 2023, the government allocated $2 billion to support manufacturers who shift to eco-friendly production methods, focusing on reducing the environmental impact of polypropylene materials. This initiative is part of Indias broader goals to reduce plastic waste and support circular economy practices, which align with global sustainability objectives.

Global Polypropylene Nonwoven Fabric Market Segmentation

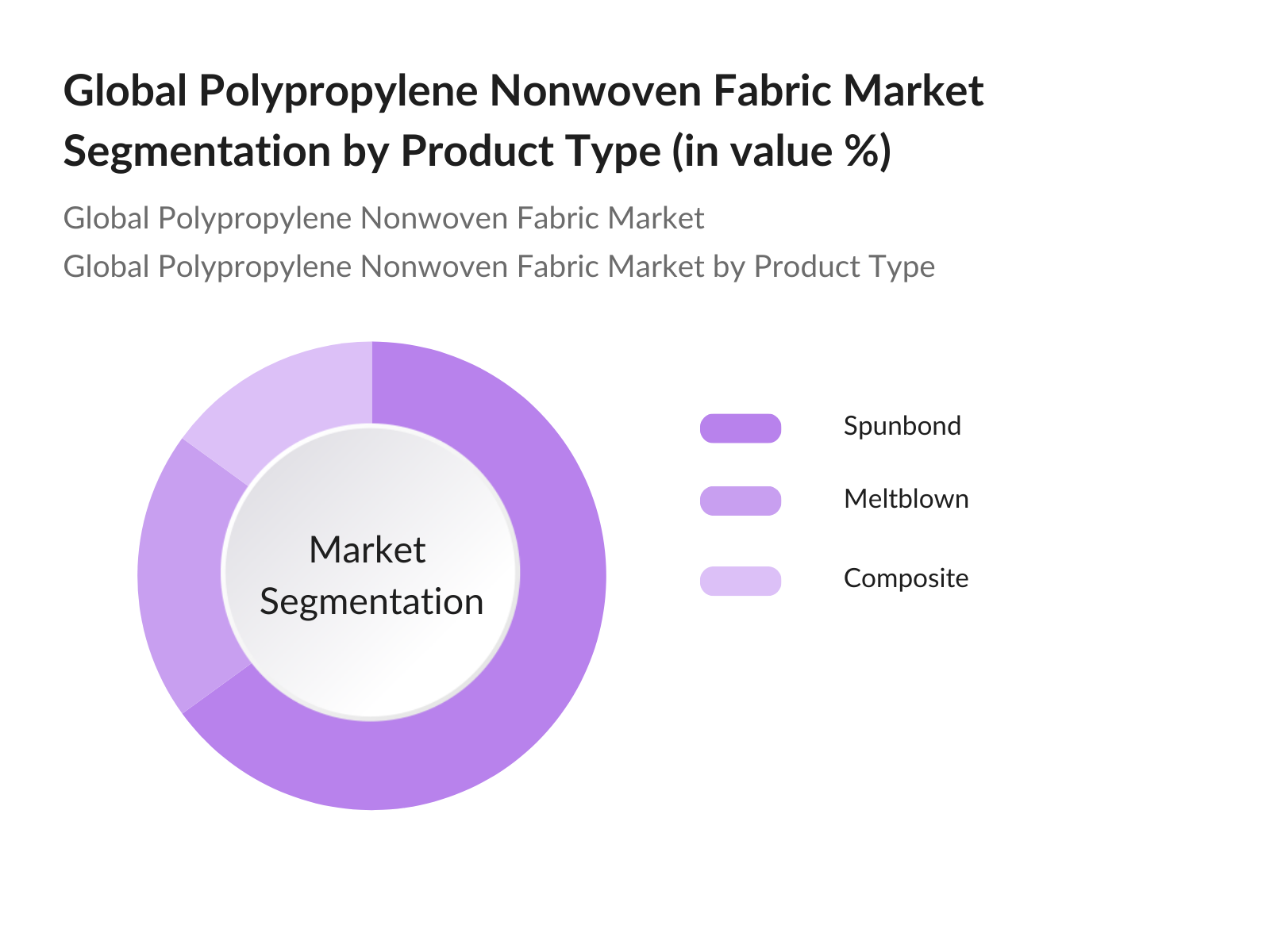

By Product Type: The market is segmented by product type into spunbond, meltblown, and composite fabrics. Spunbond polypropylene nonwoven fabric holds the dominant market share due to its wide application in hygiene products. The cost-effectiveness and production efficiency of spunbond fabrics make it the preferred choice for baby diapers and feminine hygiene products. Additionally, technological advancements in spunbond machinery further fuel its growth across various sectors.

By Region: The market is segmented into Asia Pacific (APAC), Europe, and North America. The Asia Pacific region is the leading market due to the increasing use of polypropylene nonwoven fabrics in hygiene products, agriculture, and automotive industries. The rising population, government support for bio-based polypropylene, and growing industrialization make APAC a key region for the market's growth

Global Polypropylene Nonwoven Fabric Market Competitive Landscape

The global polypropylene nonwoven fabric market is dominated by several key players who lead the market in terms of innovation, sustainability initiatives, and geographical reach. The consolidation of leading companies showcases their significant influence in shaping market trends and driving growth.

|

Company Name |

Established |

Headquarters |

No. of Employees |

Revenue (USD Bn) |

R&D Expenditure (%) |

Manufacturing Facilities |

Sustainability Initiatives |

Geographical Presence |

Major Application Area |

|

Berry Global Inc. |

1967 |

Evansville, IN, USA |

48,000 |

||||||

|

Freudenberg & Co. KG |

1849 |

Weinheim, Germany |

50,000 |

||||||

|

Kimberly-Clark Corporation |

1872 |

Irving, TX, USA |

40,000 |

||||||

|

Toray Industries Inc. |

1926 |

Tokyo, Japan |

46,000 |

||||||

|

Mitsui Chemicals Inc. |

1912 |

Tokyo, Japan |

20,000 |

Global Polypropylene Nonwoven Fabric Market Analysis

Market Growth Drivers:

- Rising Demand in Hygiene and Medical Sectors: The demand for polypropylene nonwoven fabric in hygiene products such as diapers and sanitary napkins continues to rise. In 2023, the global consumption of hygiene products exceeded 12 billion units, driven by the growing population and higher birth rates, particularly in emerging markets like India and China. According to the World Bank, these regions witnessed an increase in infant population by 1.8 million between 2022. The medical sector is also seeing a surge in disposable medical supplies like face masks and gowns, further driving the demand for polypropylene nonwoven fabrics.

- Increased Use in Automotive and Construction Industries: Polypropylene nonwoven fabrics are widely used in automotive applications, including seat covers, filters, and insulation materials. The automotive production in China alone reached 25 million vehicles in 2023, according to the IMF. Additionally, the construction industry is a major consumer of these fabrics for geotextiles, contributing to its high demand. For example, the U.S. construction industry has seen a 6% rise in nonwoven fabric consumption due to increased infrastructure development, as reported by the U.S. Bureau of Economic Analysis.

- Government Support for Sustainable Production: Governments globally are promoting sustainable production of polypropylene nonwoven fabrics through subsidies and eco-friendly initiatives. The European Union, for instance, allocated 150 million in 2023 to support companies shifting to sustainable polypropylene production. Similarly, the Indian government launched a $2 billion subsidy program to encourage nonwoven manufacturers to adopt environmentally friendly processes. These initiatives are part of broader policies to reduce plastic waste and promote recyclable materials.

Market Challenges:

- Environmental Concerns Over Synthetic Polypropylene: Polypropylene is a synthetic polymer that poses environmental challenges, particularly concerning its non-biodegradable nature. Increasing pressure from environmental agencies has led to stricter regulations, such as the European Green Deal, which mandates a reduction in plastic waste and promotes the use of sustainable materials. This creates challenges for manufacturers relying on traditional polypropylene production methods, as they are forced to adapt to new regulations and invest in recycling and alternative technologies.

- Environmental Concerns Over Synthetic Polypropylene: Polypropylene, a synthetic polymer, faces environmental challenges due to its non-biodegradable nature. The pressure from environmental agencies has led to stricter regulations aiming to reduce plastic waste. Initiatives such as the European Green Deal focus on addressing the environmental impact of plastics, including polypropylene, by promoting reduction and recycling measures.

Global Polypropylene Nonwoven Fabric Market Future Outlook

Over the next five years, the polypropylene nonwoven fabric market is expected to experience steady growth driven by the increasing demand for sustainable and bio-based materials, especially in the hygiene and medical sectors. Continuous innovation in nonwoven fabric technology, along with expanding applications in industries such as automotive and agriculture, will further fuel the market's growth. Moreover, the shift towards recyclable polypropylene materials will create new opportunities in regions where environmental regulations are tightening.

Market Opportunities:

- Technological Advancements in Nonwoven Fabric Production: Technological innovations haveplayed a critical role in improving the quality and efficiency of polypropylene nonwoven fabric production. In 2023, automated production processes significantly enhanced manufacturing efficiency in Chinas nonwoven fabric industry, as reported by the China National Textile and Apparel Council. Furthermore, innovations in bonding techniques, such as ultrasonic welding, have improved product strength and durability, driving adoption in sectors like automotive and medical.

- Increased Adoption of Recyclable Materials: The shift towards recyclable materials in the polypropylene nonwoven fabric industry is gaining momentum. This trend is being driven by increasing environmental awareness and stricter regulations aimed at promoting sustainability. The industry is adopting advanced recycling technologies to ensure that polypropylene nonwoven fabrics can be reused in various applications, reducing waste and environmental impact. Government initiatives and corporate sustainability goals are encouraging manufacturers to transition towards more eco-friendly practices.

Scope of the Report

|

By Product Type |

Spunbond Meltblown Composite |

|

By Application |

Baby Diapers Feminine Hygiene Adult Incontinence Surgical Masks Gowns Automotive Filtration |

|

By Technology |

Dry-laid Wet-laid Spunmelt |

|

By End-User |

Hygiene Medical Industrial Agriculture Furnishings |

|

By Region |

APAC Europe North America LATAM MEA |

Products

Key Target Audience

Polypropylene Manufacturers

Nonwoven Fabric Manufacturers

Hygiene Product Manufacturers

Medical Device Manufacturers

Automotive Component Manufacturers

Agriculture Product Suppliers

Government and Regulatory Bodies (Environmental Protection Agency, European Commission)

Investment and Venture Capitalist Firms

Companies

Players Mention in the Report

Berry Global Inc.

Freudenberg & Co. KG

Kimberly-Clark Corporation

Mitsui Chemicals Inc.

Toray Industries Inc.

Fitesa S.A.

DuPont de Nemours, Inc.

Glatfelter Corporation

Asahi Kasei Corporation

ExxonMobil Corp.

Indorama Ventures Public Co. Ltd.

TWE Group

Schouw & Co.

Suominen Corporation

Ahlstrom-Munksj

Table of Contents

1. Global Polypropylene Nonwoven Fabric Market Overview

- 1.1 Definition and Scope

- 1.2 Market Taxonomy

- 1.3 Market Dynamics (Drivers, Challenges, and Opportunities)

- 1.4 Market Segmentation Overview

2. Global Polypropylene Nonwoven Fabric Market Size (In USD Bn)

- 2.1 Historical Market Size (Value and Volume)

- 2.2 Year-on-Year Growth Analysis

- 2.3 Key Market Developments and Milestones

3. Global Polypropylene Nonwoven Fabric Market Analysis

- 3.1 Growth Drivers

- 3.1.1 Rising Demand in Hygiene and Medical Sectors

- 3.1.2 Increased Use in Automotive and Construction Industries

- 3.1.3 Government Support for Sustainable Production

- 3.2 Market Challenges

- 3.2.1 UV Degradation of Polypropylene

- 3.2.2 Environmental Concerns Over Synthetic Polypropylene

- 3.3 Opportunities

- 3.3.1 Adoption of Bio-based Polypropylene

- 3.3.2 Expansion in Emerging Economies (APAC, LATAM)

- 3.4 Trends

- 3.4.1 Increased Adoption of Recyclable Materials

- 3.4.2 Technological Advancements in Nonwoven Fabric Production

- 3.4.3 Use in Advanced Filtration and Medical Applications

- 3.5 Government Regulations (Compliance and Environmental Standards)

- 3.5.1 APAC Government Initiatives on Industrial Nonwoven Usage

- 3.5.2 European Regulations on Sustainable Production

- 3.5.3 U.S. Environmental Compliance Guidelines

- 3.6 SWOT Analysis

- 3.7 Porters Five Forces Analysis

- 3.8 Stakeholder Ecosystem

- 3.9 Competitive Landscape

4. Global Polypropylene Nonwoven Fabric Market Segmentation (In Value %)

- 4.1 By Product Type

- 4.1.1 Spunbond

- 4.1.2 Meltblown

- 4.1.3 Composite

- 4.2 By Application

- 4.2.1 Hygiene (Baby Diapers, Feminine Hygiene, Adult Incontinence)

- 4.2.2 Medical (Surgical Products, Masks, Gowns)

- 4.2.3 Industrial (Automotive, Filtration, Geotextiles)

- 4.2.4 Agricultural (Crop Covers, Root Bags)

- 4.2.5 Furnishings (Furniture Upholstery, Carpets)

- 4.3 By Technology

- 4.3.1 Dry-laid

- 4.3.2 Wet-laid

- 4.3.3 Spunmelt

- 4.4 By End-use Industry

- 4.4.1 Hygiene Products

- 4.4.2 Medical and Healthcare

- 4.4.3 Construction

- 4.4.4 Automotive

- 4.5 By Region (APAC, Europe, North America, LATAM, Middle East & Africa)

5. Global Polypropylene Nonwoven Fabric Competitive Analysis

- 5.1 Company Profiles (Top 15 Competitors)

- 5.1.1 Berry Global Inc.

- 5.1.2 Freudenberg & Co. KG

- 5.1.3 Fitesa S.A.

- 5.1.4 Kimberly-Clark Corporation

- 5.1.5 Mitsui Chemicals Inc.

- 5.1.6 Toray Industries Inc.

- 5.1.7 Glatfelter Corp.

- 5.1.8 Asahi Kasei Corporation

- 5.1.9 DuPont de Nemours, Inc.

- 5.1.10 ExxonMobil Corp.

- 5.1.11 TWE Group

- 5.1.12 Schouw & Co.

- 5.1.13 Suominen Corporation

- 5.1.14 Indorama Ventures Public Company Limited

- 5.1.15 Ahlstrom-Munksj

- 5.2 Cross Comparison Parameters (No. of Employees, Market Share, R&D Expenditure, Manufacturing Facilities, Innovation Strategies, Geographical Presence, Revenue, Strategic Partnerships)

- 5.3 Strategic Initiatives (Mergers, Acquisitions, Expansions)

- 5.4 Market Share Analysis

6. Global Polypropylene Nonwoven Fabric Market Regulatory Framework

- 6.1 Environmental Standards and Certifications

- 6.2 Compliance with International Standards

- 6.3 Sustainability and Bio-based Material Guidelines

7. Future Market Size and Growth Projections

- 7.1 Future Market Size Projections (Value and Volume)

- 7.2 Key Factors Driving Future Market Growth

8. Global Polypropylene Nonwoven Fabric Market Analysts Recommendations

- 8.1 Market Expansion Opportunities

- 8.2 Innovation in Product Offerings

- 8.3 Sustainability and Bio-based Polypropylene

- 8.4 Strategic Partnerships for Global Presence

Research Methodology

Step 1: Identification of Key Variables

This phase involves mapping key stakeholders within the global polypropylene nonwoven fabric market through extensive desk research. Key variables such as production capacity, technological innovations, and regulatory standards are identified to understand market dynamics.

Step 2: Market Analysis and Construction

Historical data is analyzed to understand the trends and growth patterns of the polypropylene nonwoven fabric market. This phase includes the evaluation of market penetration and product adoption across various industries to accurately estimate revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts via structured interviews. This process provides valuable insights into manufacturing trends and product developments from leading market players.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from multiple industry sources and expert consultations to create a comprehensive and validated analysis of the market. This ensures that the market report reflects the latest trends and accurate projections for future growth.

Frequently Asked Questions

01. How big is the global polypropylene nonwoven fabric market?

The global polypropylene nonwoven fabric market is valued at USD 28.77 billion, driven by its applications in hygiene, medical, and industrial sectors. The rising demand for personal hygiene products and industrial advancements continues to propel market growth.

02. What are the challenges in the polypropylene nonwoven fabric market?

Key challenges include the environmental concerns associated with synthetic polypropylene, UV degradation of materials, and rising raw material costs, which could limit market growth in certain regions.

03. Who are the major players in the global polypropylene nonwoven fabric market?

Leading players include Berry Global Inc., Freudenberg & Co. KG, Kimberly-Clark Corporation, Mitsui Chemicals Inc., and Toray Industries Inc., which dominate the market through strong product portfolios and innovation in sustainable nonwoven solutions.

04. What drives the global polypropylene nonwoven fabric market?

The market is primarily driven by the rising demand for hygiene products, increased use of nonwoven fabrics in the medical and automotive sectors, and growing awareness of environmentally sustainable products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.