Region:Global

Author(s):Shubham

Product Code:KRAC0821

Pages:86

Published On:August 2025

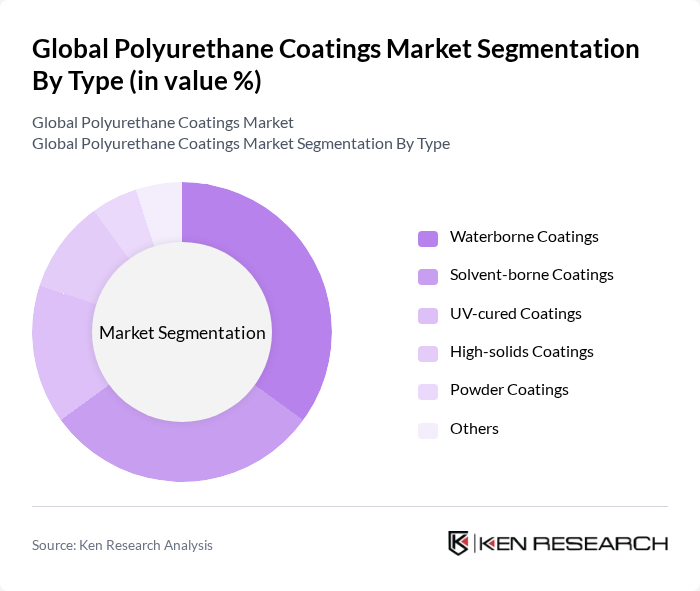

By Type:The polyurethane coatings market is segmented into waterborne coatings, solvent-borne coatings, UV-cured coatings, high-solids coatings, powder coatings, and others. Waterborne coatings are gaining significant traction due to their eco-friendliness and compliance with environmental regulations. Solvent-borne coatings continue to be widely used in industrial and automotive applications for their performance characteristics. UV-cured coatings are preferred for their rapid curing and durability, especially in electronics and wood finishing. High-solids and powder coatings are also experiencing growth, driven by efficiency, reduced emissions, and regulatory compliance .

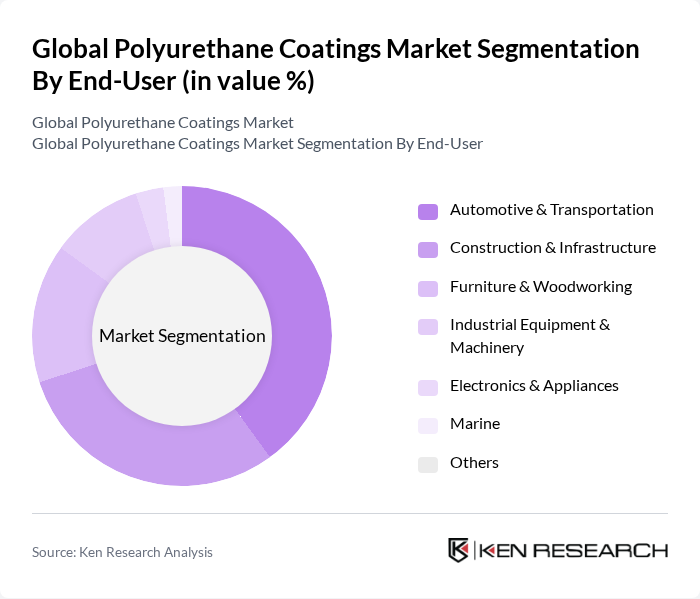

By End-User:The end-user segmentation of the polyurethane coatings market includes automotive & transportation, construction & infrastructure, furniture & woodworking, industrial equipment & machinery, electronics & appliances, marine, and others. The automotive and construction sectors are the largest consumers of polyurethane coatings, driven by the need for protective and aesthetic finishes. The furniture and woodworking segment is also significant, as manufacturers seek durable and visually appealing coatings for their products. The industrial equipment segment is growing due to the increasing demand for high-performance coatings that can withstand harsh environments .

The Global Polyurethane Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, The Dow Chemical Company, Covestro AG, Huntsman Corporation, AkzoNobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, RPM International Inc., Jotun A/S, Axalta Coating Systems Ltd., Valspar Corporation, Eastman Chemical Company, Clariant AG, Solvay S.A., Momentive Performance Materials Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The polyurethane coatings market is poised for significant transformation, driven by the increasing emphasis on sustainability and technological innovation. As industries adopt eco-friendly practices, the demand for low-VOC and bio-based coatings is expected to rise. Furthermore, advancements in smart coatings and digital technologies will enhance application efficiency and customization. These trends indicate a dynamic market landscape, where adaptability and innovation will be key to capturing emerging opportunities and addressing evolving consumer preferences in None.

| Segment | Sub-Segments |

|---|---|

| By Type | Waterborne Coatings Solvent-borne Coatings UV-cured Coatings High-solids Coatings Powder Coatings Others |

| By End-User | Automotive & Transportation Construction & Infrastructure Furniture & Woodworking Industrial Equipment & Machinery Electronics & Appliances Marine Others |

| By Application | Protective Coatings Decorative Coatings Industrial Coatings Marine Coatings Flooring Coatings Wood Finishes Others |

| By Distribution Channel | Direct Sales Distributors/Dealers Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 100 | Project Managers, Architects, Contractors |

| Automotive Coatings Usage | 70 | Manufacturing Engineers, Quality Control Managers |

| Industrial Coatings Demand | 60 | Plant Managers, Operations Directors |

| Furniture and Wood Coatings | 50 | Product Designers, Production Supervisors |

| Consumer Goods Coatings | 60 | Marketing Managers, Product Development Leads |

The Global Polyurethane Coatings Market is valued at approximately USD 20 billion, driven by increasing demand for durable and high-performance coatings across various industries, including automotive, construction, furniture, and electronics.