Global Potato Protein Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD9134

December 2024

99

About the Report

Global Potato Protein Market Overview

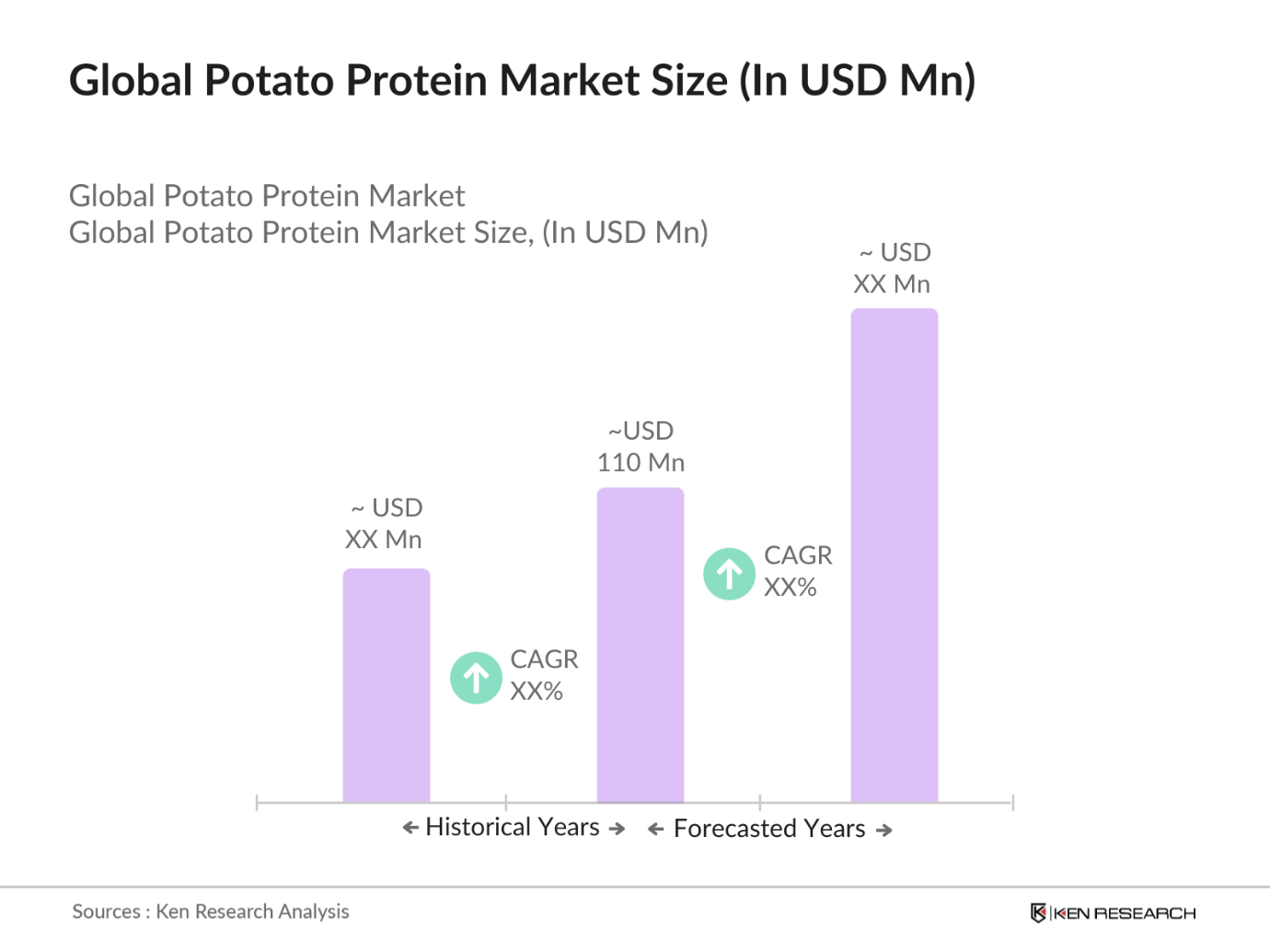

- The Global Potato Protein Market is valued at USD 110 million, based on an in-depth five-year historical analysis. This market is primarily driven by the rising consumer demand for plant-based protein alternatives in food and beverage applications. Potato proteins functional properties, such as emulsification, foaming, and water-binding capacity, make it an attractive ingredient in meat substitutes, dairy alternatives, and sports nutrition products. The market growth is reinforced by the ongoing trend of plant-based diets and increased awareness of sustainability among consumers and food producers alike.

- Countries such as the Netherlands, Germany, and France are leading in the potato protein market due to their robust potato farming and processing industries. The established infrastructure and advanced extraction technologies in these regions enable high-quality production of potato protein isolates and concentrates. Additionally, the European Unions stringent regulations on sustainable agricultural practices further contribute to the growth of the potato protein market in these areas, as consumers prefer local, sustainably sourced ingredients.

- In major markets, food safety agencies have mandated stringent labeling and safety standards for plant-based proteins. These standards require accurate ingredient listings and allergen information, especially for products containing potato protein. By 2023, over 18 countries had implemented updated regulations on protein labeling, enhancing consumer trust but also increasing compliance costs for producers.

Global Potato Protein Market Segmentation

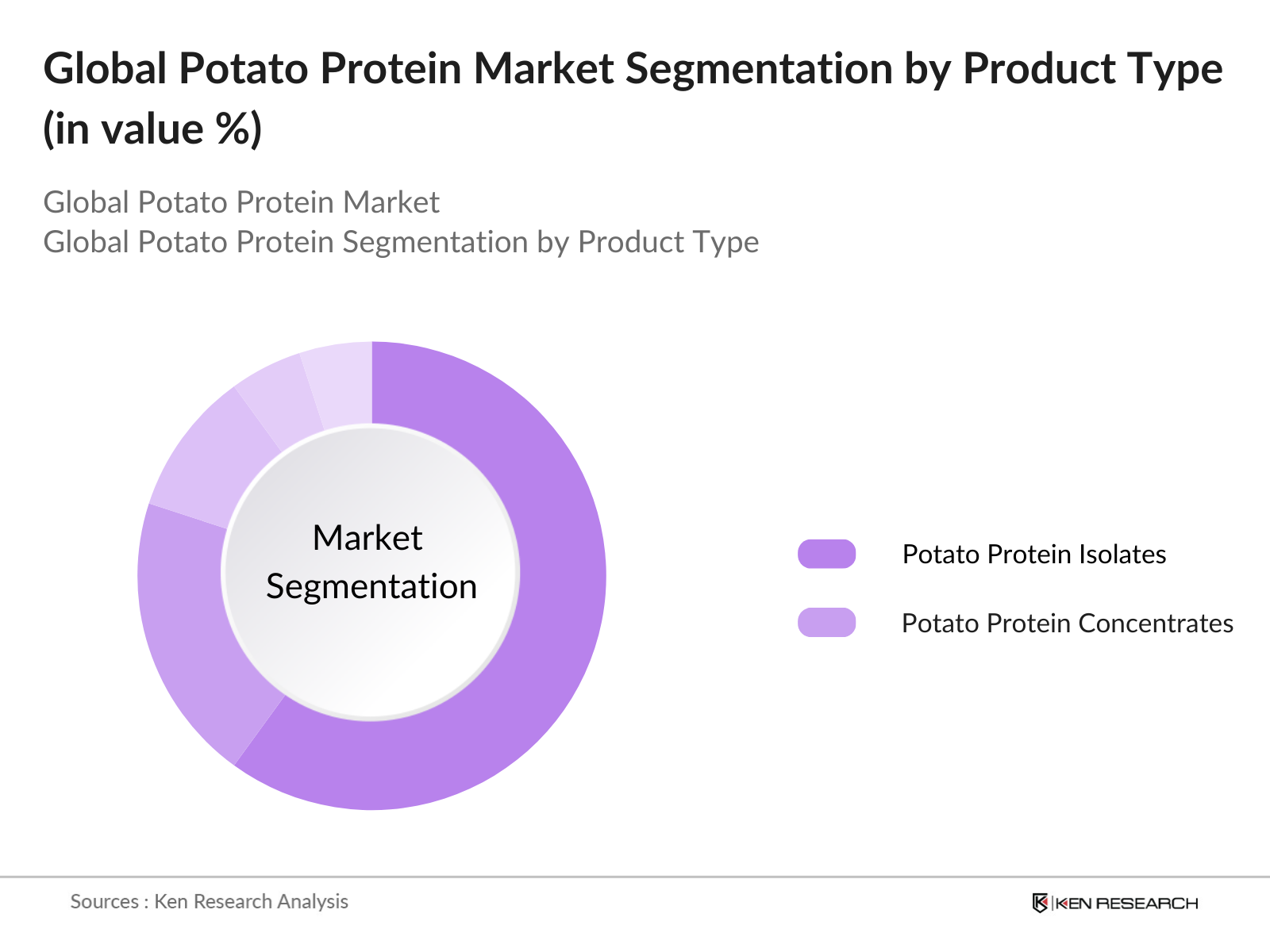

By Product Type: The global potato protein market is segmented by product type into isolates and concentrates. Potato protein isolates hold a dominant market share in this category due to their high protein content and superior functionality, making them suitable for high-protein food formulations and dietary supplements. These isolates are widely used in vegan and vegetarian products as they provide essential amino acids and improve texture and taste, enhancing the appeal of plant-based food products among health-conscious consumers. Concentrates, while less popular, find applications in animal feed and as functional ingredients in lower-protein food items.

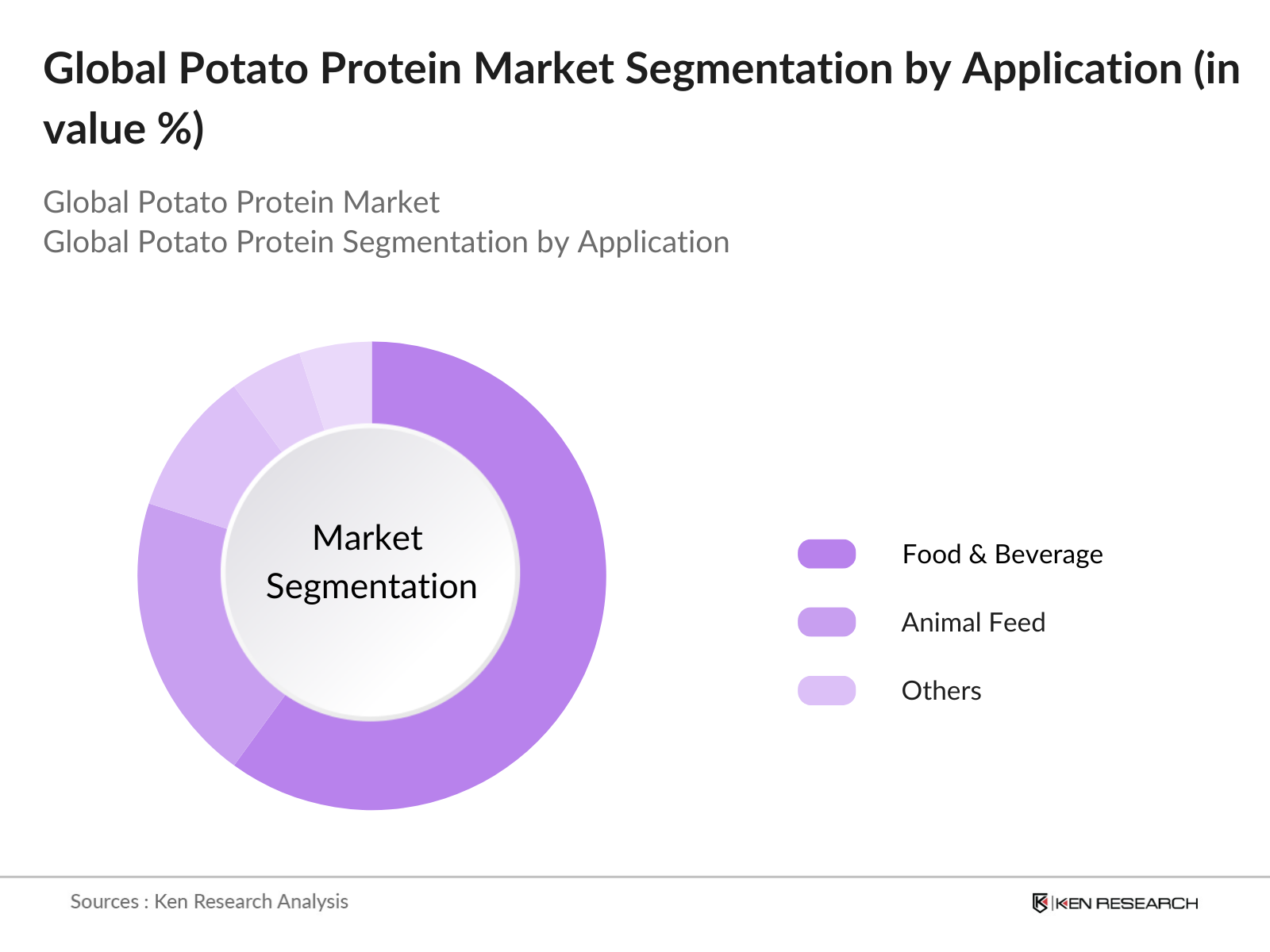

By Application: The market is segmented by application into food and beverage, animal feed, and others. The food and beverage sector dominates due to the growing interest in plant-based diets and protein-enriched products. Potato protein's versatility as a food ingredient, particularly in meat analogues and protein bars, drives its popularity. Animal feed also represents a substantial segment, where potato protein is valued for its digestibility and nutritional content, making it an ideal ingredient for high-quality feed solutions.

Global Potato Protein Market Competitive Landscape

The global potato protein market is dominated by a mix of established food ingredient manufacturers and specialized companies. Companies are increasingly focusing on research and development to improve the functional properties of potato protein products, as well as expanding their geographical reach.

The potato protein market is consolidated, with European companies like Avebe and Roquette Frres holding substantial shares due to their established distribution networks and product quality standards.

Global Potato Protein Market Analysis

Growth Drivers

- Rise in Vegan Population: The global vegan population reached approximately 79 million in 2023, driven by health consciousness and ethical concerns about animal welfare. This shift has increased the demand for plant-based protein sources, including potato protein, especially in developed regions. In the US alone, over 10 million individuals identify as vegan, indicating a substantial market for plant-based dietary options, which continues to fuel potato proteins market growth.

- Demand for Plant-Based Proteins: With increasing awareness of health benefits and environmental sustainability, global demand for plant-based proteins has surged. In 2023, over 23% of consumers worldwide incorporated plant-based proteins into their diets, driven by preference for sustainable and health-focused protein sources. This shift has positioned potato protein as an attractive alternative, especially in regions aligning with sustainable dietary preferences.

- Functional Benefits in Food Products: Potato proteins ability to enhance texture, emulsification, and water retention in food products makes it highly sought after in the food processing industry. In Europe, for instance, 21% of food manufacturers incorporated potato protein in 2023 for improved product quality. This trend aligns with consumer demand for clean-label ingredients that deliver functionality without compromising taste or nutritional benefits.

Challenges

- High Processing Costs: The production of potato protein involves high costs due to the specialized equipment and technology required, which limits scalability. Capital expenditures on potato protein extraction technology rose by approximately 15% in 2023, especially impacting producers in North America and Europe. High operational costs hinder affordability and accessibility, making potato protein less competitive compared to other protein sources.

- Limited Awareness in Emerging Markets: Awareness and accessibility of potato protein remain low in emerging economies. In regions like Southeast Asia, only about 7% of the population is aware of potato protein as a viable alternative to animal-based proteins, compared to over 30% awareness in developed areas. This awareness gap has constrained market expansion in high-potential regions, reducing adoption of potato protein in various food products.

Global Potato Protein Market Future Outlook

Over the next five years, the Global Potato Protein Market is anticipated to grow significantly. Key drivers include the increasing demand for sustainable and plant-based protein sources and rising consumer preference for clean-label ingredients. Technological advancements in protein extraction and functional improvements in potato protein will further enhance its application in various food products, animal feed, and nutraceuticals.

Market Opportunities

- Innovation in Product Applications: Advances in food technology have led to new applications for potato protein, particularly in high-protein, gluten-free, and allergen-free products. In 2023, over 35% of new product launches in the plant protein sector featured potato protein, appealing to diverse consumer segments and expanding market applications. This innovation provides manufacturers the chance to diversify product offerings in response to demand for functional and specialized foods.

- Expansion into Animal Feed Market: Potato proteins digestibility and nutrient-rich profile make it a suitable ingredient for animal feed, particularly in sectors like aquaculture and pet food. In 2023, global demand for plant-based proteins in animal feed saw significant growth, with pet food alone accounting for $500 million in spending. This trend highlights the potential for potato protein to expand into alternative markets beyond human food products.

Scope of the Report

|

Segment |

Sub-segments |

|

Product Type |

Concentrates |

|

Application |

Food and Beverages |

|

Function |

Emulsification |

|

End-User |

Food Industry |

|

Region |

North America |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Food and Beverage Manufacturers

Animal Feed Producers

Government and Regulatory Bodies (EU Food Safety Authority)

Nutraceutical Manufacturers

Sustainable Farming Organizations

Plant-Based Protein Product Developers

Ingredient Distributors and Wholesalers

Companies

Major Players

Avebe

KMC Ingredients

Tereos Group

Roquette Frres

PPZ Niechlow

Solanic

Pepees S.A.

Meelunie B.V.

AKV Langholt

Sdstrke GmbH

Agrana Group

Aroostook Starch

Ingredion

Cargill

Omega Protein Corporation

Table of Contents

1. Global Potato Protein Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Potato Protein Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Potato Protein Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Vegan Population (Number of Vegan Consumers Globally)

3.1.2. Demand for Plant-Based Proteins (Global Plant Protein Demand)

3.1.3. Functional Benefits in Food Products (Functional Attributes Demand)

3.1.4. Environmental Sustainability (Carbon Footprint Data)

3.2. Market Challenges

3.2.1. High Processing Costs (Production Cost Comparison)

3.2.2. Limited Awareness in Emerging Markets (Market Penetration Data)

3.2.3. Fluctuating Raw Material Prices (Price Variation Analysis)

3.3. Opportunities

3.3.1. Innovation in Product Applications (Innovation Rate in Industry)

3.3.2. Expansion into Animal Feed Market (Animal Feed Demand Increase)

3.3.3. Collaboration with Food and Beverage Giants (Collaboration Rate)

3.4. Trends

3.4.1. Adoption in Sports Nutrition (Sports Nutrition Market Growth)

3.4.2. Clean Label Demand (Consumer Preference for Clean Label)

3.4.3. Focus on Organic Potato Proteins (Organic Ingredient Demand)

3.5. Government Regulations

3.5.1. Labeling and Safety Standards (International Standards)

3.5.2. Import/Export Regulations (Trade Regulation Data)

3.5.3. Environmental Compliance (Environmental Policy Compliance)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Potato Protein Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Concentrates

4.1.2. Isolates

4.2. By Application (In Value %)

4.2.1. Food and Beverages

4.2.2. Animal Feed

4.2.3. Nutraceuticals

4.2.4. Pharmaceuticals

4.3. By Function (In Value %)

4.3.1. Emulsification

4.3.2. Gelation

4.3.3. Foaming

4.4. By End-User (In Value %)

4.4.1. Food Industry

4.4.2. Feed Industry

4.4.3. Cosmetic Industry

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Potato Protein Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Avebe U.A.

5.1.2. Roquette Freres

5.1.3. Tereos Group

5.1.4. KMC Ingredients

5.1.5. Pepees Group

5.1.6. PPZ Niechlow

5.1.7. Royal Ingredients Group

5.1.8. AGRANA Beteiligungs-AG

5.1.9. Emsland Group

5.1.10. Meelunie B.V.

5.1.11. Sdstrke GmbH

5.1.12. Solanic BV

5.1.13. AKV Langholt AmbA

5.1.14. Cyvex Nutrition

5.1.15. Cargill, Incorporated

5.2. Cross Comparison Parameters (Employee Count, HQ Location, Founding Year, Revenue, Global Reach, Product Type, Certification, Manufacturing Plants)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Potato Protein Market Regulatory Framework

6.1. Food Safety Standards

6.2. Compliance and Certifications

6.3. Import and Export Licensing

7. Global Potato Protein Future Market Size (In USD Bn)

7.1. Market Growth Projections

7.2. Future Market Drivers

8. Global Potato Protein Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Function (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global Potato Protein Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Cohort Insights

9.3. Strategic Marketing Recommendations

9.4. Innovation Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial stage involved constructing an ecosystem map, identifying stakeholders within the Global Potato Protein Market. Through extensive desk research, relevant data on production capacity, raw material supply, and product applications were gathered to define critical market variables.

Step 2: Market Analysis and Construction

Historical data analysis covered market penetration, production trends, and demand patterns. Statistical data on consumption rates and sector growth supported revenue estimates, ensuring reliability and accuracy in the projections.

Step 3: Hypothesis Validation and Expert Consultation

To validate market hypotheses, structured interviews with industry experts provided operational insights, particularly from companies with diversified product portfolios. These consultations helped refine market projections and clarify key drivers.

Step 4: Research Synthesis and Final Output

The final stage involved engaging with food and nutraceutical manufacturers to verify product segment growth, consumer preferences, and emerging trends. This ensured a comprehensive, accurate analysis for the Global Potato Protein Market.

Frequently Asked Questions

01. How big is the Global Potato Protein Market?

The global potato protein market was valued at USD 110 million in 2023, driven by increasing demand for plant-based protein alternatives in food and beverage applications.

02. What are the challenges in the Global Potato Protein Market?

Challenges include limited raw material supply, high extraction costs, and competition from other plant-based proteins like soy and pea protein.

03. Who are the major players in the Global Potato Protein Market?

Key players include Avebe, KMC Ingredients, Roquette Frres, Tereos Group, and PPZ Niechlow, which dominate due to their advanced processing capabilities and wide distribution networks.

04. What are the growth drivers of the Global Potato Protein Market?

The market is driven by the shift towards plant-based diets, demand for high-protein functional ingredients, and the growing consumer preference for sustainable food products.

05. Which regions lead the Global Potato Protein Market?

Europe, particularly the Netherlands, Germany, and France, leads the market due to its developed potato farming industry and advanced protein extraction technologies.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.