Global Pre-Workout Gummies Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD6422

December 2024

89

About the Report

Global Pre-Workout Gummies Market Overview

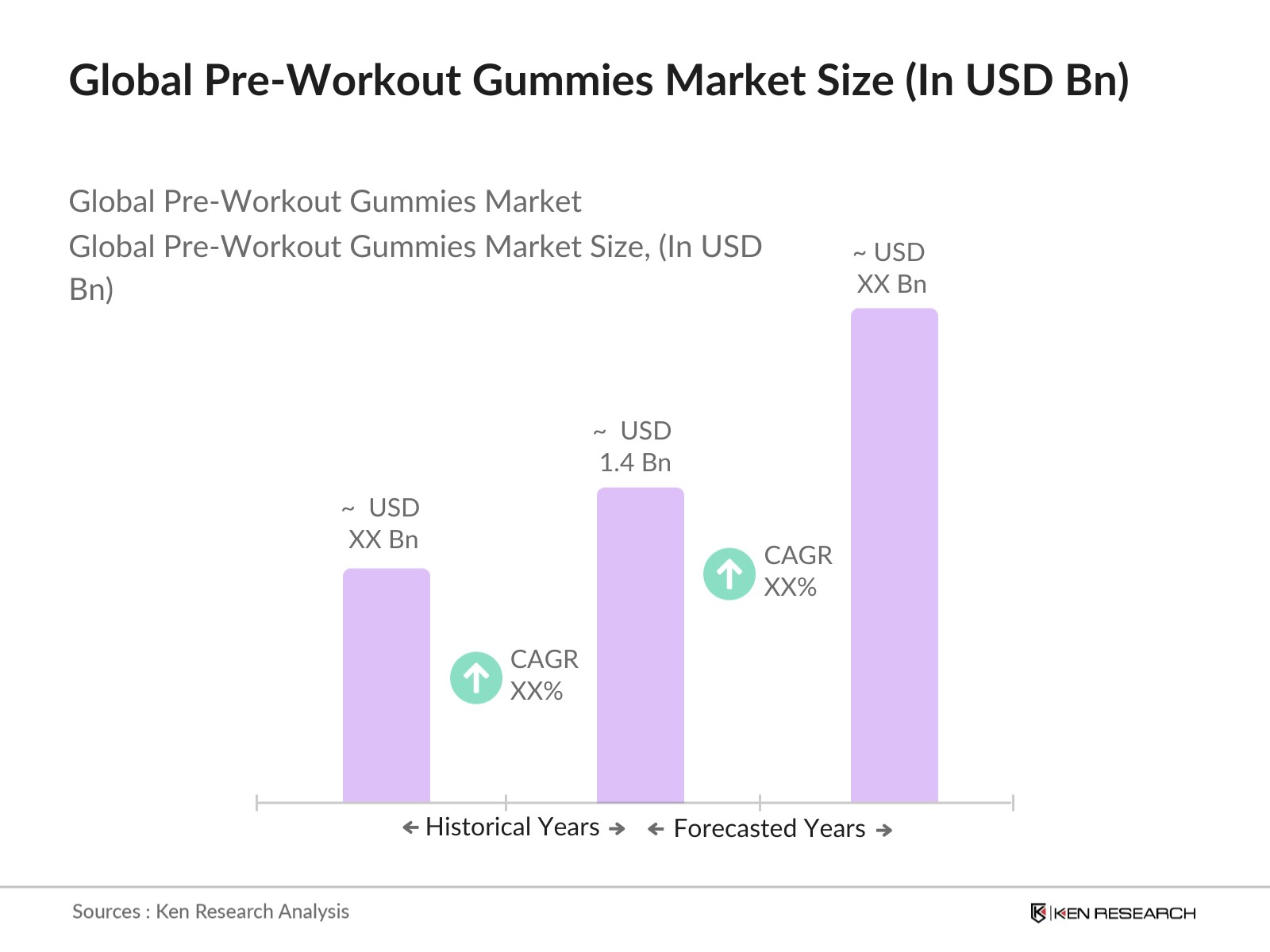

- The Global Pre-Workout Gummies Market, valued at USD 1.4 billion, is driven by rising health consciousness and the increasing demand for convenient, portable supplements for fitness and endurance enhancement. The trend for healthier alternatives to traditional pre-workout products has further stimulated the market, with consumers gravitating toward plant-based and non-GMO options. This market's growth is reinforced by the increasing popularity of functional foods and dietary supplements among fitness enthusiasts, creating a solid foundation for product innovation and expansion.

- Dominant regions in the pre-workout gummies market include North America and Europe, where the fitness industry is well-developed and the culture of personal health management is strong. In the U.S., factors such as advanced research and development capabilities, high demand for convenience foods, and a large consumer base seeking fitness supplements drive market leadership. Europe also maintains a significant share due to stringent quality standards and a steady demand for health supplements across all age groups.

- Advancements in food technology have allowed manufacturers to develop pre-workout gummies with enhanced nutritional profiles, including sustained energy release and precise ingredient dosing. This innovation aligns with the growing need for products that offer both convenience and functionality in the fitness world. The World Bank highlights that technology adoption in the food processing industry has grown by 7% annually, supporting faster product development and consumer accessibility to health-focused foods, such as pre-workout gummies

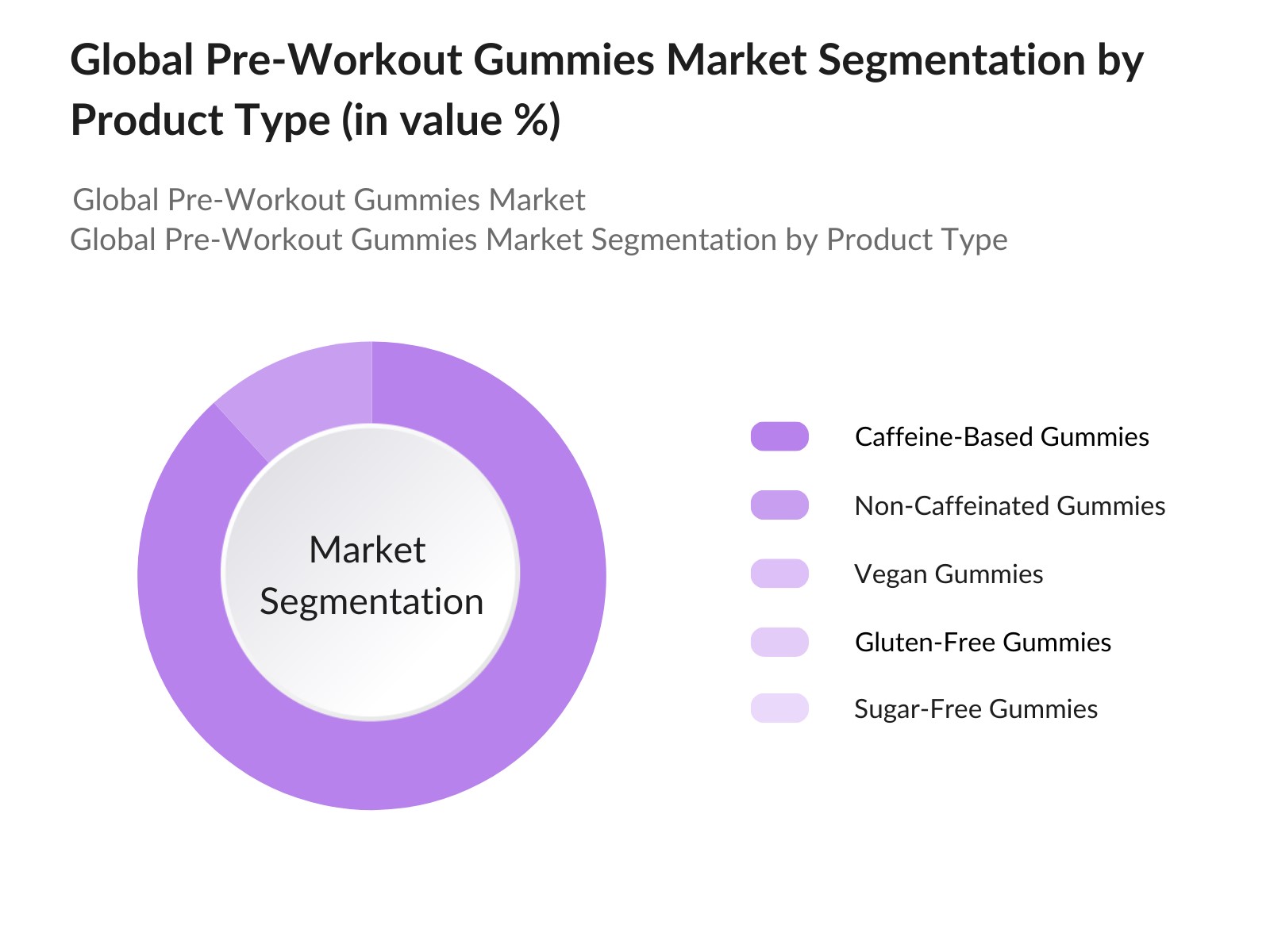

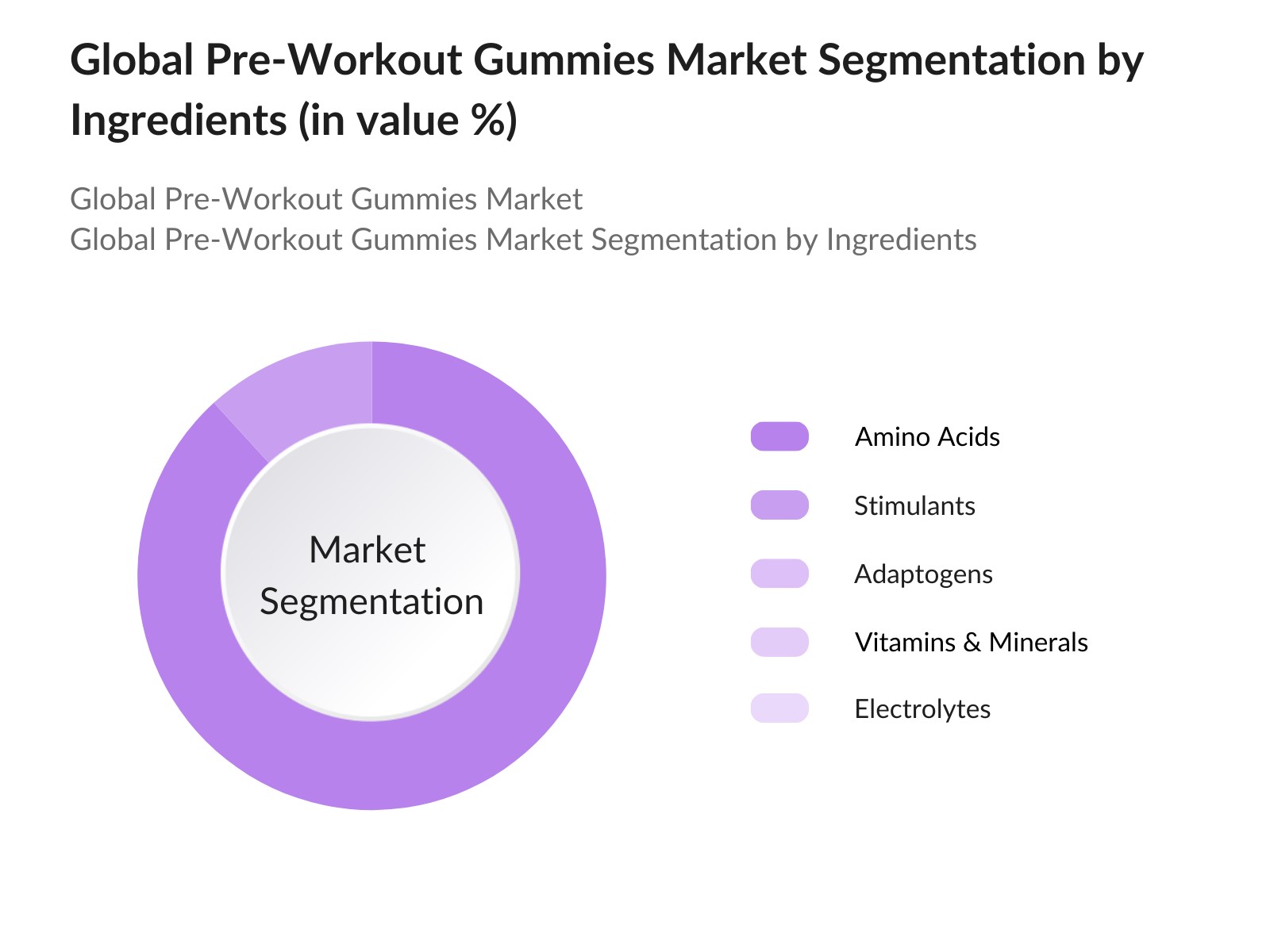

Global Pre-Workout Gummies Market Segmentation

By Product Type: The Global Pre-Workout Gummies Market is segmented by product type into caffeine-based gummies, non-caffeinated gummies, vegan pre-workout gummies, gluten-free gummies, and sugar-free gummies. Recently, caffeine-based gummies have emerged as a dominant segment within the product type category due to their widespread popularity as an energy booster before workouts. The convenience of pre-dosed caffeine in gummies appeals to users who prefer avoiding powdered supplements. Additionally, market players offer varied caffeine levels to cater to specific energy needs, ensuring continued dominance in this segment.

By Ingredients: The market is further divided by ingredients, including amino acids, stimulants, adaptogens, vitamins & minerals, and electrolytes. Among these, amino acids hold the largest share due to their critical role in muscle building and repair, making them a popular choice among bodybuilders and athletes. The demand for amino-acid-based gummies is also supported by the need for quick post-workout recovery, with ingredients like BCAAs (branched-chain amino acids) and citrulline preferred for their functional benefits.

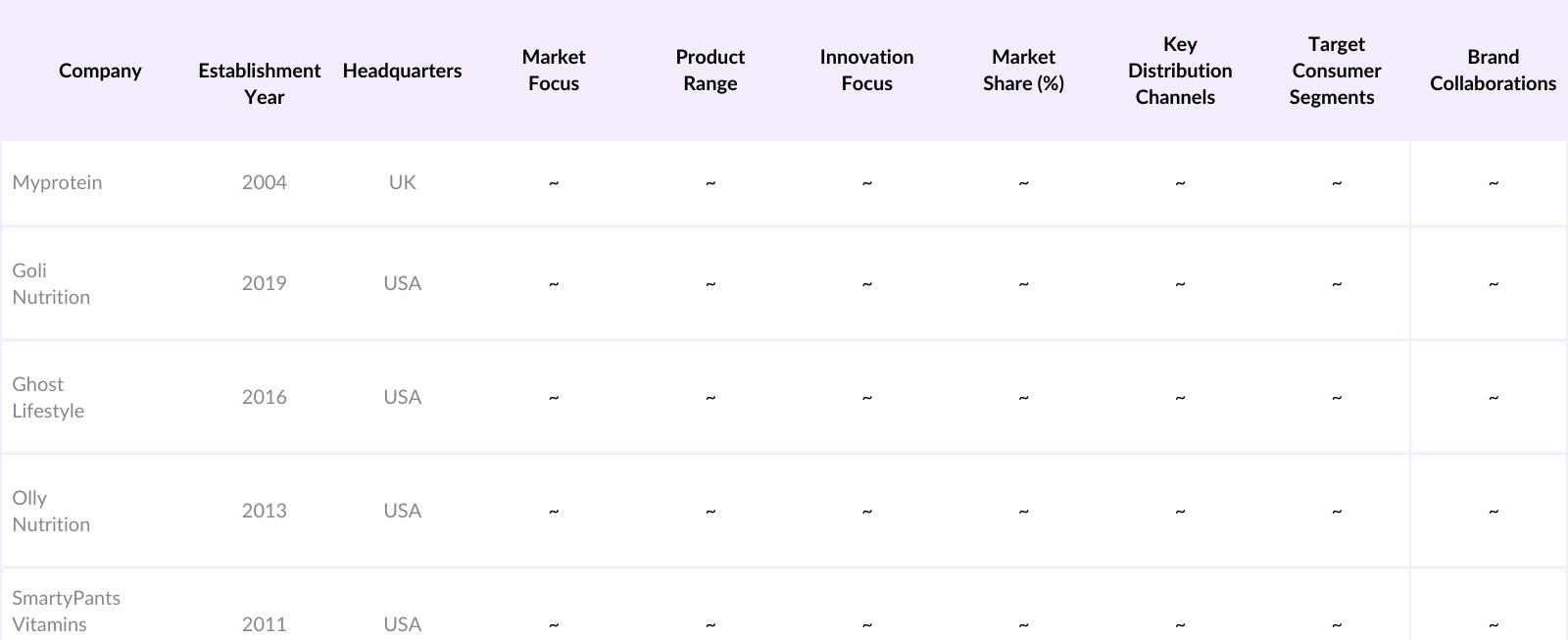

Global Pre-Workout Gummies Market Competitive Landscape

The Global Pre-Workout Gummies Market is dominated by a few key players, including brands with significant R&D investments to cater to specific consumer needs. This competitive structure underscores the strong influence of established brands and highlights the presence of new entrants focusing on natural and vegan product lines.

Global Pre-Workout Gummies Market Analysis

Growth Drivers

- Increasing Demand for Functional Foods: The demand for functional foods has seen a steady increase, with a large segment of the global population shifting towards nutrition-focused products. This shift reflects consumer preferences for items that offer additional health benefits beyond basic nutrition. According to the World Bank, global food expenditure per capita has increased significantly, with higher portions allocated to health-enhancing products. This trend aligns with the growth in dietary supplements and fitness-related products, which include pre-workout gummies. As consumers allocate more disposable income toward products that support fitness and wellness goals, the pre-workout gummy segment benefits from this broader trend in functional foods

- Rising Health Awareness: In recent years, health awareness has grown due to the influence of digital information, which encourages preventative health behaviors and the use of dietary supplements. According to the IMF, global per capita health expenditure rose to USD 1,200, reflecting increased consumer spending on health and wellness products, including pre-workout gummies. This increasing health expenditure highlights consumers willingness to invest in products that contribute to physical fitness, a trend further boosted by social medias role in educating the public on the benefits of health supplements

- Expanding Fitness Industry: The fitness industrys expansion has been a significant driver of the pre-workout gummies market. According to recent IMF data, the global fitness market's revenue reached USD 95 billion, with increased gym memberships and fitness programs across developed and developing nations. This growth in the fitness industry has created a direct demand for supportive nutrition products like pre-workout gummies, as these products align well with active lifestyles and fitness-oriented consumers seeking convenient and portable supplement options.

Market Challenges

- Regulatory Compliance: The pre-workout gummies market faces stringent regulatory requirements, particularly concerning ingredient safety, labeling, and efficacy. Compliance with standards from agencies like the FDA in the United States and EFSA in Europe is mandatory, impacting production and formulation costs. The FDA has reported increased inspection and compliance initiatives for dietary supplements, reflecting consumer demand for safety and transparency in health products. This compliance requirement is a significant consideration for companies aiming to enter or expand in this market FDA Compliance Initiatives.

- High Production Costs: The production of pre-workout gummies involves high costs, especially when incorporating high-quality ingredients like plant-based amino acids and vitamins. According to the IMF, manufacturing costs in the dietary supplement sector have increased by approximately USD 300 million due to rising ingredient prices and stringent regulatory processes. These costs pose a challenge for manufacturers, especially in regions where raw material sourcing is expensive, directly impacting product pricing and consumer affordability IMF Manufacturing Costs Data.

Global Pre-Workout Gummies Market Future Outlook

The Global Pre-Workout Gummies Market is projected to experience substantial growth driven by increasing consumer demand for plant-based and clean-label supplements. With more individuals focusing on holistic fitness solutions and personalized health, the shift toward natural and functional ingredients in pre-workout gummies is expected to strengthen. Innovations focusing on ingredient transparency and customizable supplement options will continue to gain traction as brands strive to meet evolving consumer preferences and regulatory demands.

Market Opportunities

- Rising Popularity of Non-GMO and Organic Gummies: The pre-workout gummies market sees substantial opportunity in the growing consumer preference for non-GMO and organic products. According to the World Bank, the market for organic foods is valued at USD 105 billion globally, with significant consumer support for natural ingredients. This demand has spurred manufacturers to introduce pre-workout gummies that align with these preferences, paving the way for growth within the organic and non-GMO segments of the market

- Expansion in Emerging Markets: Emerging markets present a lucrative opportunity for pre-workout gummies, with countries in Asia and Latin America witnessing rapid urbanization and increased disposable incomes. The World Bank notes that urban population growth in these regions has averaged 4% annually, enhancing the adoption of health supplements among fitness enthusiasts. This urban expansion, coupled with rising fitness awareness, positions pre-workout gummies favorably for growth within emerging economies

Scope of the Report

|

Segment |

Sub-Segments |

|

Product Type |

Caffeine-Based Gummies Non-Caffeinated Gummies Vegan Pre-Workout Gummies Gluten-Free Gummies Sugar-Free Gummies |

|

Ingredients |

Amino Acids Stimulants Adaptogens Vitamins & Minerals Electrolytes |

|

Consumer Group |

Athletes Bodybuilders Recreational Users Elderly Fitness Enthusiasts |

|

Distribution Channel |

Specialty Stores Online Channels Fitness Clubs and Gyms Supermarkets/Hypermarkets |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Pre-Workout Supplement Manufacturers

Functional Food & Beverage Producers

Ingredient Suppliers (Amino Acids, Adaptogens)

Fitness & Sports Industry Stakeholders

Consumer Health Brands

E-commerce & Retail Chains

Government and Regulatory Bodies (FDA, EFSA)

Investor and Venture Capitalist Firms

Companies

Major Players in the Market

Myprotein

Goli Nutrition

Ghost Lifestyle

Olly Nutrition

SmartyPants Vitamins

The Vitamin Shoppe

Natures Bounty

BPI Sports

NutraBlast

Performance Lab

ProSupps

Vitafusion

Herbaland

Nordic Naturals

Optimum Nutrition

Table of Contents

1. Global Pre-Workout Gummies Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Pre-Workout Gummies Market Size (in USD MN)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Pre-Workout Gummies Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Demand for Functional Foods

3.1.2 Rising Health Awareness

3.1.3 Expanding Fitness Industry

3.1.4 Technological Advancements in Gummy Formulations

3.2 Market Challenges

3.2.1 Regulatory Compliance (FDA, EFSA Standards)

3.2.2 High Production Costs

3.2.3 Intense Competition from Powder and Capsule Forms

3.3 Opportunities

3.3.1 Rising Popularity of Non-GMO and Organic Gummies

3.3.2 Expansion in Emerging Markets

3.3.3 Brand Collaborations with Fitness Influencers

3.4 Trends

3.4.1 Preference for Plant-Based Gummies

3.4.2 Customizable and Personalized Formulations

3.4.3 Innovation in Flavor Profiles and Textures

3.5 Regulatory Framework

3.5.1 FDA Dietary Supplement Guidelines

3.5.2 EU Compliance for Functional Food Products

3.5.3 Regional Labeling and Packaging Standards

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem (Ingredients Suppliers, Manufacturers, Retailers, End-Users)

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Global Pre-Workout Gummies Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Caffeine-Based Gummies

4.1.2 Non-Caffeinated Gummies

4.1.3 Vegan Pre-Workout Gummies

4.1.4 Gluten-Free Gummies

4.1.5 Sugar-Free Gummies

4.2 By Ingredients (in Value %)

4.2.1 Amino Acids (BCAAs, Citrulline)

4.2.2 Stimulants (Caffeine, Guarana)

4.2.3 Adaptogens (Ashwagandha, Rhodiola)

4.2.4 Vitamins & Minerals

4.2.5 Electrolytes

4.3 By Consumer Group (in Value %)

4.3.1 Athletes

4.3.2 Bodybuilders

4.3.3 Recreational Users

4.3.4 Elderly Fitness Enthusiasts

4.4 By Distribution Channel (in Value %)

4.4.1 Specialty Stores

4.4.2 Online Channels

4.4.3 Fitness Clubs and Gyms

4.4.4 Supermarkets/Hypermarkets

4.5 By Region (in Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global Pre-Workout Gummies Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Myprotein

5.1.2 Goli Nutrition

5.1.3 The Vitamin Shoppe

5.1.4 Optimum Nutrition

5.1.5 Ghost Lifestyle

5.1.6 Nordic Naturals

5.1.7 BPI Sports

5.1.8 NutraBlast

5.1.9 Natures Bounty

5.1.10 Performance Lab

5.1.11 SmartyPants Vitamins

5.1.12 Herbaland

5.1.13 Vitafusion

5.1.14 ProSupps

5.1.15 Olly Nutrition

5.2 Cross Comparison Parameters (Headquarters, No. of Employees, Revenue, Product Portfolio, Market Share, Target Consumers, Product Innovations, Brand Collaborations)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Pre-Workout Gummies Market Regulatory Framework

6.1 Nutritional Labeling Requirements

6.2 Dietary Supplement Standards

6.3 Organic and Non-GMO Certification

6.4 Allergen Labeling Standards

6.5 Compliance with Import/Export Regulations

7. Global Pre-Workout Gummies Future Market Size (in USD MN)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Pre-Workout Gummies Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By Ingredients (in Value %)

8.3 By Consumer Group (in Value %)

8.4 By Distribution Channel (in Value %)

8.5 By Region (in Value %)

9. Global Pre-Workout Gummies Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

An extensive mapping of the pre-workout gummies market ecosystem was conducted to identify essential stakeholders, ranging from manufacturers to distribution channels. A combination of secondary research from industry databases and proprietary sources allowed us to pinpoint the most influential market variables.

Step 2: Market Analysis and Construction

This phase involved analyzing historical data to understand the market structure, including penetration levels and revenue generated by each sub-segment. Service quality statistics and consumer demand patterns were evaluated to accurately estimate current market values.

Step 3: Hypothesis Validation and Expert Consultation

Preliminary market insights were refined and validated through direct consultation with industry experts and representatives from key companies. These insights added depth to the operational and financial analysis, ensuring data reliability.

Step 4: Research Synthesis and Final Output

In the final phase, consultations with pre-workout gummy manufacturers provided granular data on product segmentation, sales trends, and consumer preferences. This bottom-up approach ensured an accurate, comprehensive, and validated analysis of the market landscape.

Frequently Asked Questions

01. How big is the Global Pre-Workout Gummies Market?

The global pre-workout gummies market is valued at USD 1.4 billion, driven by rising consumer demand for convenient, health-focused supplements and the shift toward plant-based products.

02. What are the challenges in the Global Pre-Workout Gummies Market?

Challenges include regulatory compliance issues, high competition from powdered supplements, and sourcing quality ingredients that meet consumer expectations for clean labels and transparency.

03. Who are the major players in the Global Pre-Workout Gummies Market?

Key players include Myprotein, Goli Nutrition, Ghost Lifestyle, Olly Nutrition, and SmartyPants Vitamins, each known for their innovation in health-focused, consumer-friendly gummy supplements.

04. What drives the Global Pre-Workout Gummies Market?

The market is propelled by increasing fitness awareness, consumer demand for portable pre-workout solutions, and an interest in plant-based and clean-label products, fueling continuous market growth.

05. Which regions are dominant in the Global Pre-Workout Gummies Market?

North America and Europe dominate due to advanced R&D capabilities, large consumer bases, and a strong focus on health and fitness.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.