Global Precious Metal Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD8418

October 2024

91

About the Report

Global Precious Metal Market Overview

- The global precious metal market, valued at USD 306 billion based on a five-year historical analysis, is primarily driven by the rising demand for gold, silver, platinum, and palladium across multiple industries. Gold, as a safe-haven asset, continues to be the primary contributor to the market size, fueled by geopolitical tensions and inflationary pressures. Silvers industrial applications in solar panels and electronics have also expanded, significantly contributing to the overall market valuation.

- Countries such as China, India, and the United States dominate the precious metal market due to their high demand for gold and silver. China leads the market because of its vast industrial base, particularly in electronics, while India maintains dominance due to its traditional demand for gold in jewelry. The U.S. plays a crucial role with significant investments in precious metals as a hedge against inflation and economic uncertainty.

- Governments are revising taxation policies on precious metal investments to better regulate the market and increase revenue. For instance, in 2023, the United Kingdom introduced a 2% tax on physical gold sales over a certain threshold, affecting high-net-worth investors. Meanwhile, countries like Japan are considering capital gains taxes on precious metal ETFs. These taxation policies are designed to control speculative investments while ensuring that governments benefit from increased trading volumes.

Global Precious Metal Market Segmentation

- By Metal Type: The global precious metal market is segmented into gold, silver, platinum, and palladium. Gold remains the dominant segment under metal type due to its strong demand in investment and jewelry. Its appeal as a safe-haven asset, coupled with rising geopolitical tensions, makes it the preferred choice for investors globally. Additionally, central banks continue to accumulate gold reserves, further cementing its dominance in the market.

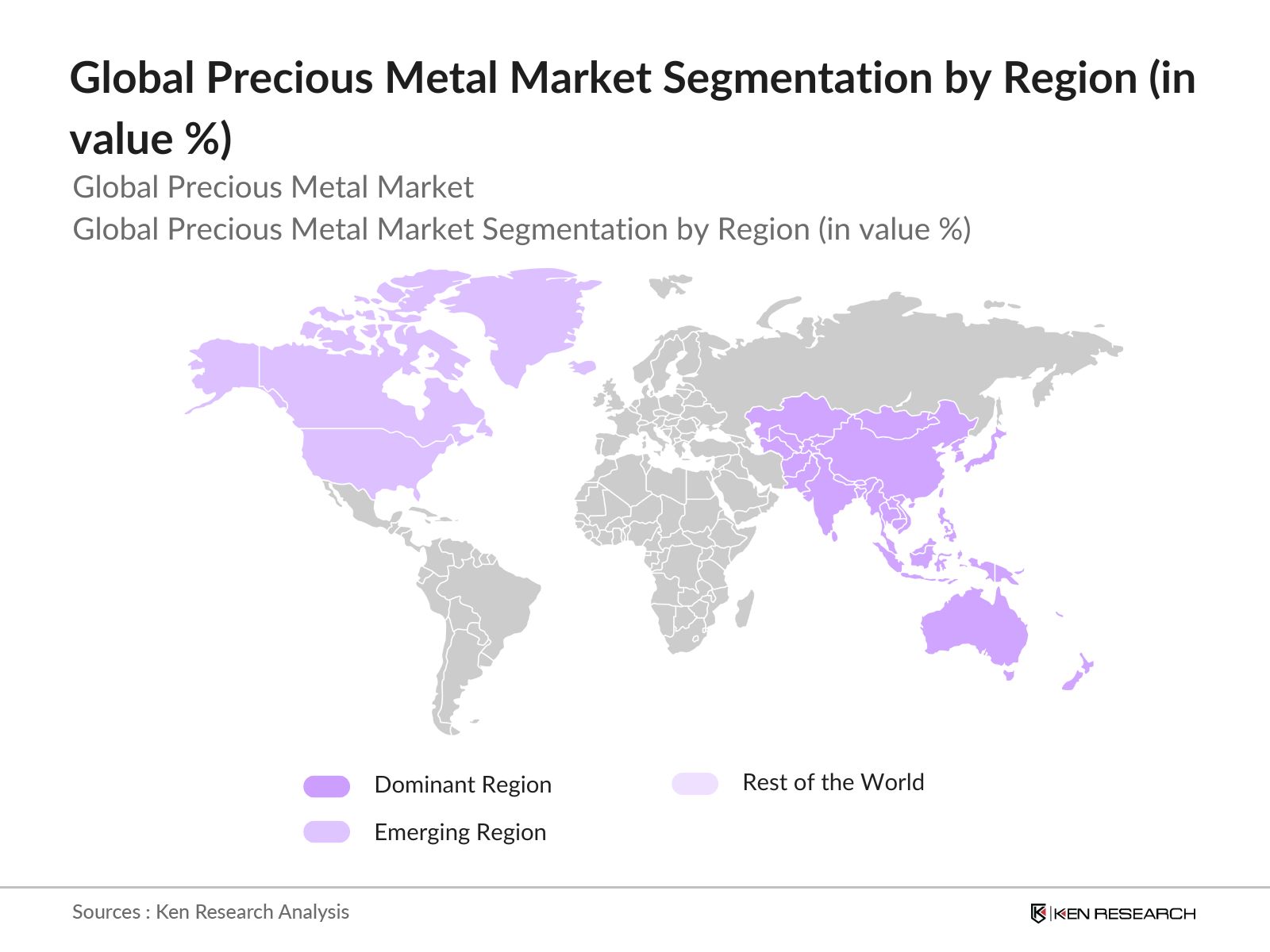

- By Region: The global precious metal market is segmented by region into North America, Europe, Asia-Pacific, the Middle East and Africa, and Latin America. Asia-Pacific remains the largest region for precious metals, led by China and India. China's industrial demand for silver and platinum and India's traditional affinity for gold jewelry are the primary reasons for this regions dominance. In North America, the United States' significant investment in precious metals, particularly gold, continues to drive its market share.

- By Application: The precious metal market is segmented by application into jewelry, investment, and industrial uses. The investment segment holds the highest share, driven by rising concerns about inflation and financial instability. Gold ETFs and other digital forms of precious metal investments have gained significant traction, providing a more accessible avenue for retail investors. Industrial applications of silver and platinum, particularly in the automotive and electronics industries, continue to grow but lag behind the investment segment.

Global Precious Metal Market Competitive Landscape

The global precious metal market is highly competitive, with a mix of major international mining corporations and smaller regional players. The market is dominated by well-established players with extensive mining operations, technological advancements in refining processes, and robust distribution networks. These companies often engage in strategic partnerships and acquisitions to maintain their market position and expand their geographical reach.

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity |

Revenue (2023) |

R&D Investment |

Geographical Presence |

M&A Activity |

Sustainability Initiatives |

|

Barrick Gold Corporation |

1983 |

Toronto, Canada |

||||||

|

Newmont Corporation |

1921 |

Denver, USA |

||||||

|

AngloGold Ashanti |

2004 |

Johannesburg, S.A. |

||||||

|

Polyus Gold International |

2006 |

Moscow, Russia |

||||||

|

Wheaton Precious Metals |

2004 |

Vancouver, Canada |

Global Precious Metal Industry Analysis

Growth Drivers

- Growing Demand for Gold and Silver (Driven by Safe-Haven Appeal): The demand for gold and silver continues to rise, driven by their long-standing reputation as safe-haven assets during economic uncertainty. As of 2024, gold reserves held by central banks globally amounted to over 35,000 metric tons, according to the World Gold Council. In addition, silver demand for investment purposes has grown significantly, with countries like India importing over 8,000 metric tons of silver in 2023, a substantial increase due to heightened economic instability. This increase in demand is further supported by geopolitical tensions and inflation fears, with investors seeking tangible assets as a store of value.

- Industrial Demand for Platinum and Palladium (Automotive and Electronics Industries): Platinum and palladium, key components in catalytic converters and electronic devices, have seen rising industrial demand in 2024. The global automotive industry consumed approximately 7.4 million ounces of palladium in 2023, reflecting the increased production of vehicles with stricter emission controls. Platinum demand from the electronics sector reached 1.1 million ounces during the same period, primarily for use in sensors and connectors. With the shift towards electric vehicles and stricter emission standards, these metals are crucial for reducing pollution, making them essential components in the automotive and electronics industries.

- Increased Investment in Precious Metals (Hedge Against Inflation): As inflationary pressures persist in 2024, investors are increasingly turning to precious metals as a hedge. According to IMF data, inflation rates in developed economies like the United States and Eurozone exceeded 4.5% in 2023, prompting higher allocations to physical gold, silver, and ETFs. Investment in precious metals surged by over $60 billion globally in 2023, with gold alone accounting for $40 billion. This trend is expected to continue as central banks remain cautious about inflation control, pushing demand for metals as a form of financial protection.

Market Restraints

- Price Volatility of Precious Metals (Gold, Silver, Platinum): The price volatility of precious metals remains a significant challenge in 2024, with prices fluctuating due to macroeconomic factors such as interest rate changes and geopolitical events. In 2023, gold prices ranged from $1,720 to $2,050 per ounce, according to the World Bank, influenced by fluctuating investor demand and changes in global monetary policy. Similarly, platinum prices varied between $900 and $1,200 per ounce during the same period, largely due to supply disruptions in South Africa, the leading producer. These fluctuations create uncertainty for investors and industries reliant on stable prices.

- Supply Chain Disruptions (Global Mining Operations): Global mining operations continue to face significant disruptions due to geopolitical tensions and labor shortages. In 2023, mining output from key gold-producing nations like South Africa and Peru was reduced by nearly 5%, according to the IMF, due to labor strikes and political unrest. Additionally, logistical bottlenecks stemming from the COVID-19 pandemics aftermath still affect the supply chain, increasing shipping costs and delivery times for metals like platinum and palladium. These disruptions have impacted the global supply chain and delayed deliveries of precious metals to industrial users

Global Precious Metal Market Future Outlook

Over the next five years, the global precious metal market is expected to witness significant growth, driven by increasing demand for gold as an inflation hedge, the rising use of silver in solar energy and electronics, and platinum and palladium in the automotive industry. Sustainable mining practices and technological advancements in recycling are expected to further bolster market expansion. Moreover, geopolitical tensions and fluctuating global financial conditions will continue to enhance precious metals' appeal as safe-haven assets.

Market Opportunities

- Advancements in Mining Technologies: Technological advancements in mining offer significant opportunities for enhancing efficiency and reducing environmental impact. In 2024, the adoption of automation and AI in mining increased productivity by up to 15%, according to the International Council on Mining and Metals. New technologies like sensor-based ore sorting and autonomous mining trucks are reducing costs while improving extraction accuracy. Additionally, drone technology is being used to map mining sites more efficiently, reducing the need for manual labor. These technological improvements present significant opportunities for reducing operational costs and increasing output.

- Emerging Markets Demand for Precious Metals: Emerging markets, particularly in Asia and Africa, are driving demand for precious metals in 2024. China and India, the largest consumers of gold and silver, imported a combined 2,400 metric tons of gold in 2023, according to the World Gold Council. This demand is fueled by cultural practices, rising middle-class incomes, and increased industrial use. Additionally, countries like Nigeria and Ghana are increasing their imports of gold for financial reserves and industrial purposes. This growing demand from emerging markets presents a strong opportunity for global suppliers to expand.

Scope of the Report

|

By Type of Metal |

Gold, Silver, Platinum, Palladium |

|

By Application |

Jewelry, Investment, Industrial |

|

By End-User Industry |

Automotive, Electronics, Medical |

|

By Source Type |

Primary Sources (Mining), Secondary Sources (Recycling) |

|

By Region |

North America, Europe, Asia-Pacific, Middle East and Africa, Latin America |

Products

Key Target Audience

Precious Metal Mining Companies

Jewelry Manufacturers and Retailers

Investment Funds (Hedge Funds, Pension Funds)

Automotive Manufacturers

Electronics Manufacturers

Government and Regulatory Bodies (Environmental Protection Agencies, Commodity Regulatory Authorities)

Investors and Venture Capitalist Firms

Sustainable Technology Companies

Companies

Players Mentioned in the Report:

Barrick Gold Corporation

Newmont Corporation

AngloGold Ashanti

Gold Fields Limited

Kinross Gold Corporation

Polyus Gold International

Sibanye Stillwater

Wheaton Precious Metals

Fresnillo Plc

Norilsk Nickel

Platinum Group Metals Ltd.

Impala Platinum Holdings

Rand Refinery

Hecla Mining Company

Agnico Eagle Mines

Table of Contents

1. Global Precious Metal Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Precious Metal Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Precious Metal Market Analysis

3.1 Growth Drivers

3.1.1 Growing Demand for Gold and Silver (Driven by Safe-Haven Appeal)

3.1.2 Industrial Demand for Platinum and Palladium (Automotive and Electronics Industries)

3.1.3 Increased Investment in Precious Metals (Hedge Against Inflation)

3.1.4 Government Regulations on Mining and Refining

3.2 Market Challenges

3.2.1 Price Volatility of Precious Metals (Gold, Silver, Platinum)

3.2.2 Supply Chain Disruptions (Global Mining Operations)

3.2.3 Environmental Concerns Related to Mining Activities

3.3 Opportunities

3.3.1 Advancements in Mining Technologies

3.3.2 Emerging Markets Demand for Precious Metals

3.3.3 Green and Sustainable Mining Practices

3.4 Trends

3.4.1 Increase in Recycling of Precious Metals

3.4.2 Rising Use of Blockchain in Precious Metal Transactions

3.4.3 Growing Investment in Precious Metal ETFs and Digital Gold

3.5 Government Regulations

3.5.1 Mining Permits and Environmental Regulations

3.5.2 Import/Export Tariffs on Precious Metals

3.5.3 Taxation Policies on Precious Metal Investments

3.5.4 Sustainability Regulations in Precious Metal Mining

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Global Precious Metal Market Segmentation

4.1 By Type of Metal (In Value %) 4.1.1 Gold

4.1.2 Silver

4.1.3 Platinum

4.1.4 Palladium

4.2 By Application (In Value %)

4.2.1 Jewelry

4.2.2 Investment

4.2.3 Industrial

4.3 By End-User Industry (In Value %)

4.3.1 Automotive

4.3.2 Electronics

4.3.3 Medical

4.4 By Source Type (In Value %)

4.4.1 Primary Sources (Mining)

4.4.2 Secondary Sources (Recycling)

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East and Africa

4.5.5 Latin America

5. Global Precious Metal Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Barrick Gold Corporation

5.1.2 Newmont Corporation

5.1.3 AngloGold Ashanti

5.1.4 Gold Fields Limited

5.1.5 Kinross Gold Corporation

5.1.6 Polyus Gold International

5.1.7 Sibanye Stillwater

5.1.8 Agnico Eagle Mines

5.1.9 Wheaton Precious Metals

5.1.10 Fresnillo Plc

5.1.11 Norilsk Nickel

5.1.12 Platinum Group Metals Ltd.

5.1.13 Impala Platinum Holdings

5.1.14 Rand Refinery

5.1.15 Hecla Mining Company

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Production Volume, R&D Investments, Market Share, Operational Capacity)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Precious Metal Market Regulatory Framework

6.1 Mining Standards and Practices

6.2 Environmental Compliance

6.3 Trade and Export Regulations

6.4 Certification Requirements

7. Global Precious Metal Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Precious Metal Future Market Segmentation

8.1 By Type of Metal (In Value %)

8.2 By Application (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Source Type (In Value %)

8.5 By Region (In Value %)

9. Global Precious Metal Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In this initial phase, we identified and mapped all major stakeholders within the global precious metal market. Extensive desk research was conducted using secondary data from proprietary databases, company reports, and government sources to compile a comprehensive industry-level understanding of market drivers and challenges.

Step 2: Market Analysis and Construction

Historical data pertaining to the global precious metal market was collected and analyzed, including market penetration and revenue figures across the primary metals (gold, silver, platinum, palladium). This phase also involved analyzing production capacities and demand fluctuations based on global economic and political conditions.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were developed based on the analysis and validated through expert consultations via telephone interviews (CATI). These interviews included executives from leading mining companies, financial institutions, and end-use industries like automotive and electronics.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing data and insights from various sources to form a coherent analysis of market trends, challenges, and opportunities. A bottom-up approach was used to finalize market size estimates and validate key statistics through cross-verification from industry stakeholders.

Frequently Asked Questions

01. How big is the global precious metal market?

The global precious metal market is valued at USD 306 billion based on a five-year historical analysis, driven primarily by the rising demand for gold as an investment vehicle and the growing industrial application of silver and platinum.

02. What are the challenges in the global precious metal market?

Key challenges include price volatility of metals like gold and platinum, environmental concerns related to mining activities, and fluctuating global demand due to changing economic conditions.

03. Who are the major players in the global precious metal market?

The major players in the market include Barrick Gold Corporation, Newmont Corporation, AngloGold Ashanti, Polyus Gold International, and Wheaton Precious Metals, who dominate due to their extensive mining operations and technological innovations.

04. What are the growth drivers of the global precious metal market?

The primary drivers are the increasing demand for gold and silver as safe-haven assets, rising industrial use of platinum and palladium in automotive and electronics industries, and technological advancements in mining and recycling.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.