Global Precious Metals Market Outlook to 2030

Region:Global

Author(s):Shivani

Product Code:KROD7412

October 2024

97

About the Report

Global Precious Metals Market Overview

- The global precious metals market is valued at USD 205.2 billion based on a five-year historical analysis. This market is driven primarily by industrial demand, particularly for gold, silver, and platinum, which are used extensively in various sectors such as electronics, automotive, and renewable energy. Additionally, the demand for investment in gold and silver remains robust, owing to their traditional role as safe-haven assets during economic uncertainty. A steady rise in consumer interest for jewelry further supports market growth, especially in emerging economies.

- Countries like China, India, and the United States dominate the precious metals market, driven by their substantial industrial activity and strong consumer demand for gold and silver jewelry. China is the largest consumer of gold for both industrial and investment purposes, while India leads the demand for gold in the form of jewelry due to cultural significance. The U.S. also plays a critical role in driving the market with its established mining industry and significant consumer demand for precious metals in electronics and healthcare.

- In 2023, governments have intensified mining regulations, particularly to promote sustainability and ethical practices in precious metals extraction. For instance, Peru and Chile have adopted stricter licensing policies that require mining companies to meet environmental standards before being granted operational permits. In Chile, over USD 500 million in government funding has been allocated to support sustainable mining technologies that reduce carbon emissions and water usage. These regulations aim to make the mining sector more environmentally friendly and socially responsible, boosting investor confidence in ethically sourced metals.

Global Precious Metals Market Segmentation

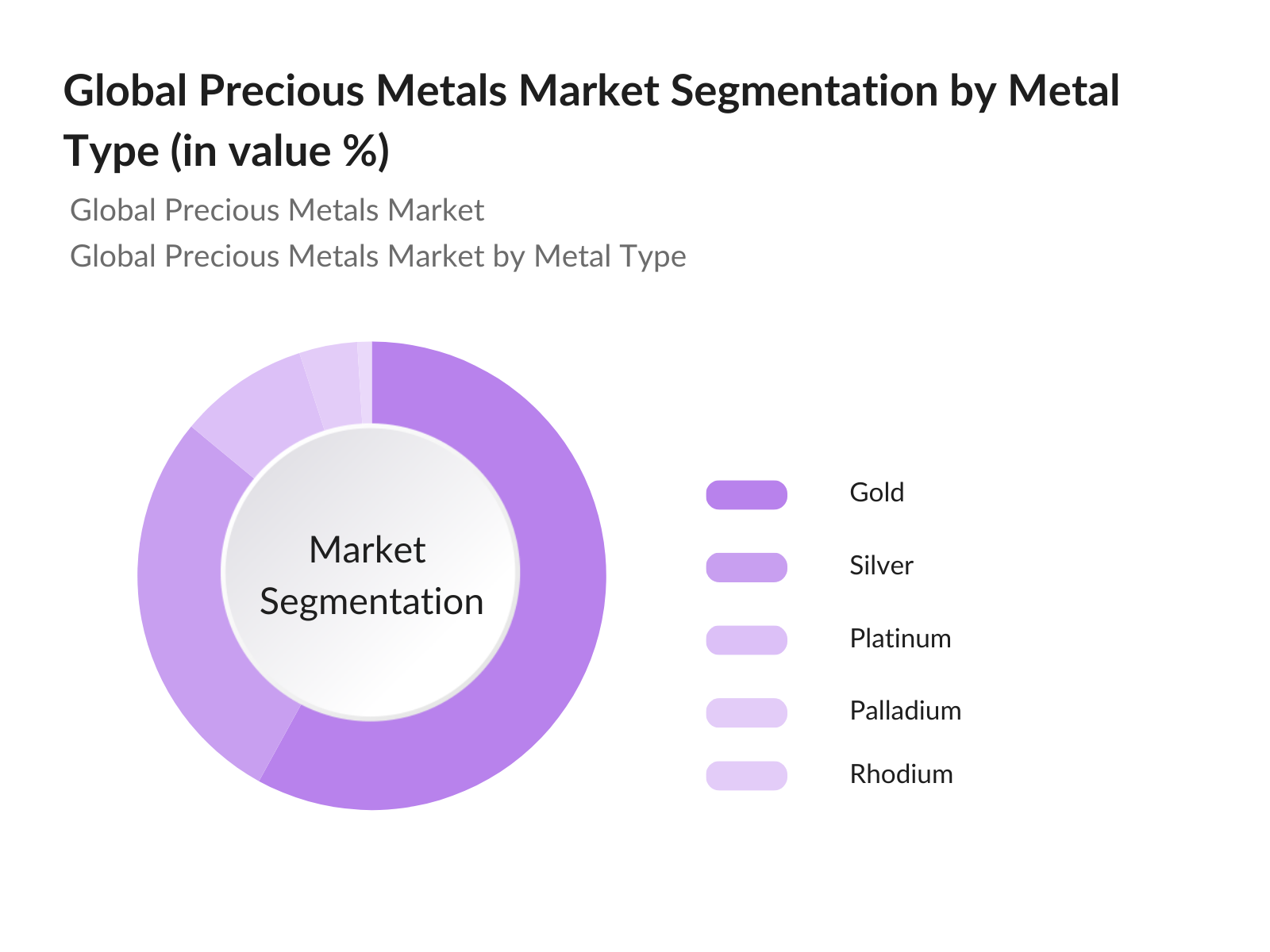

By Metal Type: The global precious metals market is segmented by metal type into gold, silver, platinum, palladium, and rhodium. Gold continues to dominate the market due to its status as a stable investment asset and its significant use in the jewelry industry. Its enduring popularity stems from historical trust, cultural significance in major economies, and its safe-haven status during times of economic instability. Gold is also widely used in industrial applications such as electronics, which adds to its dominance.

|

Metal Type |

Market Share (2023) |

|---|---|

|

Gold |

58% |

|

Silver |

28% |

|

Platinum |

9% |

|

Palladium |

4% |

|

Rhodium |

1% |

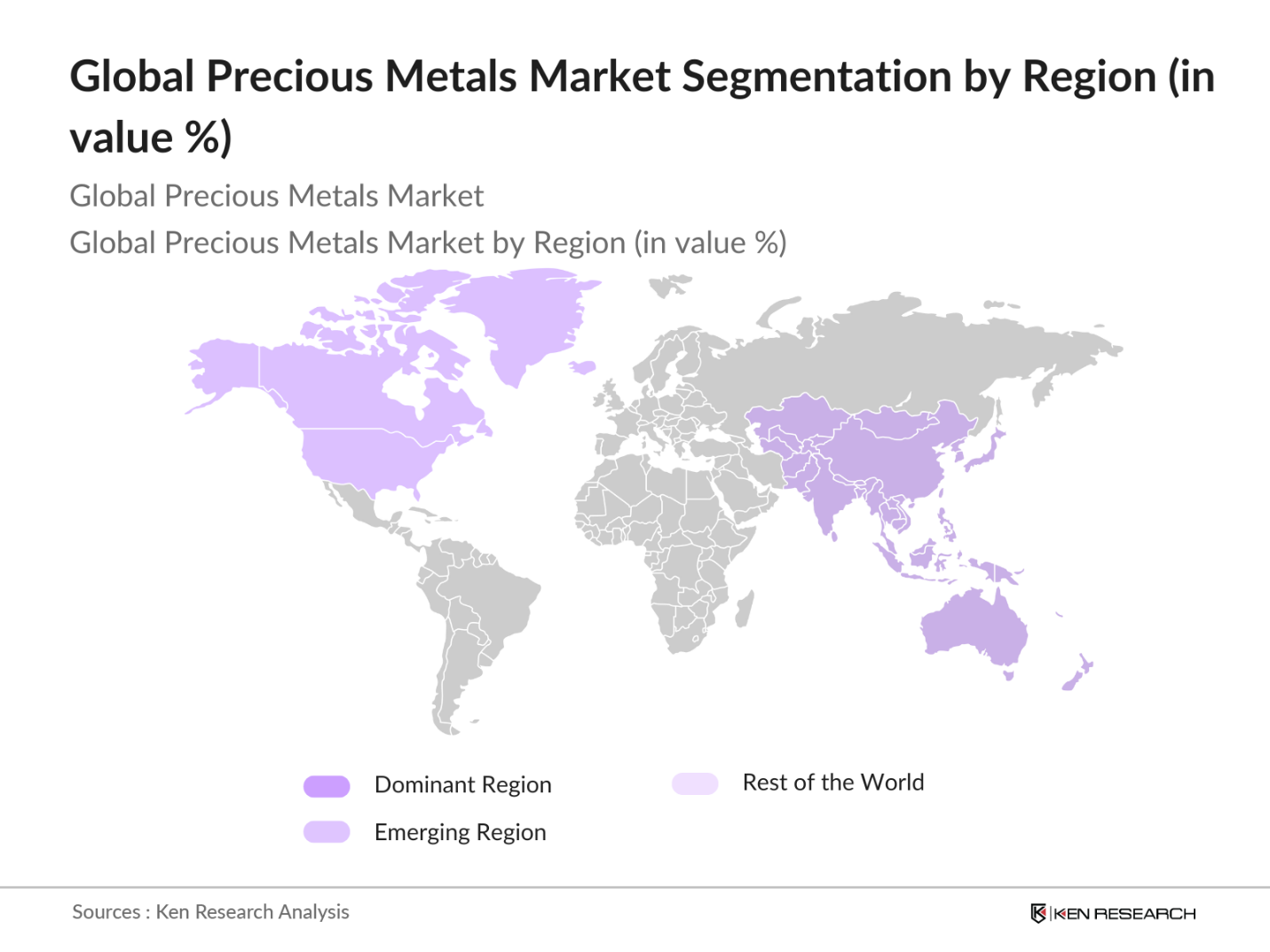

By Region: The global precious metals market is segmented by region into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific holds the largest market share, driven by high demand from countries like China and India. These countries have a long-standing tradition of precious metal consumption, particularly gold and silver for jewelry and investment. In addition, the rapid industrialization of these economies increases demand for metals like platinum and palladium, which are essential for the automotive and electronics industries.

|

Region |

Market Share (2023) |

|---|---|

|

Asia Pacific |

45% |

|

North America |

25% |

|

Europe |

20% |

|

Latin America |

6% |

|

Middle East & Africa |

4% |

Global Precious Metals Market Competitive Landscape

The global precious metals market is dominated by key players that operate across mining, refining, and distribution. These companies have a significant influence due to their extensive operations, technological advancements, and market presence.

|

Company |

Established |

Headquarters |

Production Capacity |

Mining Reserves |

Revenue (USD Bn) |

R&D Expenditure |

Environmental Initiatives |

Sustainability Practices |

Global Presence |

|

Barrick Gold Corporation |

1983 |

Toronto, Canada |

6,000 tons |

||||||

|

Anglo American Platinum |

1995 |

Johannesburg, SA |

4,500 tons |

||||||

|

Newmont Corporation |

1921 |

Colorado, USA |

5,000 tons |

||||||

|

Norilsk Nickel |

1935 |

Moscow, Russia |

3,000 tons |

||||||

|

Vale S.A. |

1942 |

Rio de Janeiro |

2,500 tons |

Global Precious Metals Market Analysis

Market Growth Drivers

- Rising Industrial Applications: Silver, platinum, and palladium are increasingly crucial in sectors like electronics and automotive manufacturing. In 2023, demand for silver in industrial applications grew by 10% globally, largely due to its use in photovoltaic cells for solar panels (World Bank). Platinum, vital for catalytic converters in vehicles, has seen a boost as global automotive production recovers post-pandemic. Meanwhile, palladiums rising demand in hydrogen fuel cell technology further drives growth. The industrial consumption of precious metals continues to be a strong driver of market demand.

- Technological Advancements in Mining and Refining: Technological innovations in mining and refining have significantly increased the extraction efficiency of precious metals. In 2023, the adoption of automated mining systems has contributed to the reduction of operational costs, while AI-driven ore discovery technologies have improved the accuracy of identifying new reserves. Countries like Australia and Canada are at the forefront of implementing these advanced technologies, which have resulted in notable output growth. These advancements are especially impactful in remote mining areas, where labor shortages and logistical challenges had previously limited production capacity.

- Central Bank Policies and Currency Fluctuations: Central banks policies have significantly influenced the precious metals market in 2023. The US Federal Reserves interest rate hikes, coupled with the weakening of the dollar, have increased international demand for gold as a safe-haven asset. Central banks in emerging economies, including Turkey and Brazil, have actively bolstered their gold reserves to protect their currencies from depreciation. These actions have led to central bank gold purchases totaling over 400 tons in the first half of 2024, reflecting the continued reliance on precious metals for monetary stability.

Market Challenges:

- High Market Volatility: The precious metals market has experienced heightened volatility in 2023, influenced by geopolitical conflicts and fluctuating global interest rates. For instance, gold prices peaked at USD 2,050 per ounce during the first quarter of the year amid rising inflation fears (World Bank). However, the price has seen sharp declines in response to central bank rate adjustments, causing significant market fluctuations. Investors risk aversion has increased, leading to erratic trading behaviors, which make price stability a significant challenge for market participants.

- Supply Chain Disruptions: Supply chain disruptions continue to be a major challenge for the precious metals market in 2023. The Russia-Ukraine conflict has severely impacted the global supply of palladium and platinum, causing shortages that have affected the automotive and electronics industries. Russia, a leading producer of palladium, has faced significant export restrictions, which has contributed to a global decline in supply. Additionally, labor strikes in key mining regions such as South Africa have further disrupted the supply chain, exacerbating shortages and affecting downstream industries reliant on these metals.

Global Precious Metals Market Future Outlook

Over the next five years, the global precious metals market is expected to show significant growth, driven by increasing industrial demand and technological advancements. Precious metals are poised to benefit from the rising demand in renewable energy technologies, such as silver in solar panels and platinum in hydrogen fuel cells. Additionally, investment in sustainable and ethical mining practices is likely to increase, in response to both consumer demand and regulatory pressure for environmentally conscious production methods.

Market Opportunities:

- Sustainable Mining Practices and Ethical Sourcing: Sustainable mining practices and ethical sourcing have become key opportunities for the precious metals market in 2023. With heightened consumer awareness about environmental and social issues, companies that adopt ESG (Environmental, Social, Governance) principles are attracting new investments. For instance, the World Banks Climate-Smart Mining Initiative has provided USD 200 million in funding to support low-carbon extraction technologies, which has been embraced by mining firms in countries like Chile and Peru. Ethical sourcing, particularly in gold, has also seen a rise in demand, driven by responsible investment frameworks.

- Integration of Precious Metals in Digital Assets and Tokenization: The integration of precious metals into digital assets, such as tokenized gold, represents a growing opportunity in 2023. Blockchain technology allows for fractional ownership of physical metals, making it easier for investors to access these assets. For instance, tokenized gold transactions have surpassed USD 3 billion globally, offering liquidity and transparency. Governments like Singapore have started integrating blockchain technology into their national gold reserves, further bolstering confidence in digital precious metals. This development has unlocked new pathways for investment, particularly among tech-savvy younger investors.

Scope of the Report

|

By Metal Type |

Gold Silver Platinum Palladium Rhodium |

|

By Application |

Jewelry Investment Industrial Medical & Dental |

|

By Source |

Mined Recycled |

|

By End-Use Industry |

Automotive Electronics Energy Healthcare Aerospace |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Mining Companies

Precious Metals Refiners

Automotive Manufacturers

Electronics Industry

Renewable Energy Providers

Medical Device Manufacturers

Government and Regulatory Bodies (e.g., U.S. Environmental Protection Agency, European Union)

Investment and Venture Capital Firms

Companies

Major Players

-

Barrick Gold Corporation

Anglo American Platinum

Newmont Corporation

Norilsk Nickel

Vale S.A.

Franco-Nevada Corporation

Pan American Silver Corporation

Kinross Gold Corporation

Impala Platinum

Wheaton Precious Metals

Royal Gold, Inc.

China National Gold Group

Johnson Matthey

Harmony Gold Mining Co. Ltd.

Glencore

Table of Contents

1. Global Precious Metals Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Value Chain Analysis

1.5. Market Growth Rate

2. Global Precious Metals Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Precious Metals Market Analysis

3.1. Growth Drivers (Macroeconomic factors, industrial demand, geopolitical tensions)

3.1.1. Increasing Investment Demand for Precious Metals

3.1.2. Rising Industrial Applications

3.1.3. Technological Advancements in Mining and Refining

3.1.4. Central Bank Policies and Currency Fluctuations

3.2. Market Challenges (Volatility, supply chain, environmental regulations)

3.2.1. High Market Volatility

3.2.2. Regulatory Scrutiny and Environmental Concerns

3.2.3. Supply Chain Disruptions

3.2.4. Competition from Alternative Assets

3.3. Opportunities (Sustainability trends, digital asset integration, exploration innovations)

3.3.1. Sustainable Mining Practices and Ethical Sourcing

3.3.2. Integration of Precious Metals in Digital Assets and Tokenization

3.3.3. Discovery of New Reserves and Exploration Technologies

3.4. Trends (Green technology, recycling, investment diversification)

3.4.1. Growth in Recycling and Circular Economy Initiatives

3.4.2. Increasing Use in Renewable Energy Technologies

3.4.3. Rise of ESG (Environmental, Social, Governance) Investment

3.5. Government Regulation (Trade policies, mining licenses, tariffs)

3.5.1. National Mining Regulations and Licensing Policies

3.5.2. Import/Export Duties and Tariffs on Precious Metals

3.5.3. Environmental Regulations Governing Mining Operations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Mining companies, refiners, investors, regulatory bodies)

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Global Precious Metals Market Segmentation

4.1. By Metal Type (In Value %)

4.1.1. Gold

4.1.2. Silver

4.1.3. Platinum

4.1.4. Palladium

4.1.5. Rhodium

4.2. By Application (In Value %)

4.2.1. Jewelry

4.2.2. Investment

4.2.3. Industrial Applications (Electronics, Automotive, Renewable Energy)

4.2.4. Medical and Dental

4.2.5. Other Applications

4.3. By Source (In Value %)

4.3.1. Mined Sources

4.3.2. Recycled Sources

4.4. By End-Use Industry (In Value %)

4.4.1. Automotive

4.4.2. Electronics

4.4.3. Energy

4.4.4. Healthcare

4.4.5. Aerospace

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Precious Metals Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Barrick Gold Corporation

5.1.2. Anglo American Platinum

5.1.3. Sibanye Stillwater

5.1.4. Norilsk Nickel

5.1.5. Newmont Corporation

5.1.6. Franco-Nevada Corporation

5.1.7. Pan American Silver Corporation

5.1.8. Kinross Gold Corporation

5.1.9. Impala Platinum

5.1.10. Vale S.A.

5.1.11. Wheaton Precious Metals

5.1.12. Royal Gold, Inc.

5.1.13. China National Gold Group

5.1.14. Johnson Matthey

5.1.15. Harmony Gold Mining Co. Ltd.

5.2. Cross Comparison Parameters (Market Share, Revenue, Production Volume, Operational Geographies, Sustainability Initiatives, Innovation Strategies, Mergers and Acquisitions, Workforce Size)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Precious Metals Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Precious Metals Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Precious Metals Future Market Segmentation

8.1. By Metal Type (In Value %)

8.2. By Application (In Value %)

8.3. By Source (In Value %)

8.4. By End-Use Industry (In Value %)

8.5. By Region (In Value %)

9. Global Precious Metals Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunity Analysis

9.3. Customer Cohort Analysis

9.4. Strategic Marketing Initiatives

Research Methodology

Step 1: Identification of Key Variables

In this phase, an ecosystem map of the global precious metals market is developed, highlighting all major stakeholders. A thorough desk research process, involving credible secondary and proprietary databases, is conducted to understand market dynamics and identify critical variables such as supply chain integration and technological trends.

Step 2: Market Analysis and Construction

Historical data is analyzed, including market penetration rates, production volumes, and end-user demand. This step also involves analyzing the operational capacity of major mining companies and refining outputs to project accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market growth, sustainability initiatives, and investment trends are validated through expert consultations. These interviews provide qualitative insights into market operations and strategies used by key players, ensuring data accuracy and industry relevance.

Step 4: Research Synthesis and Final Output

Finally, the research data is synthesized to create a comprehensive report. This stage involves cross-referencing data obtained from primary research with that from proprietary sources to produce a validated market analysis that reflects the most accurate industry trends and projections.

Frequently Asked Questions

01. How big is the global precious metals market?

The global precious metals market is valued at USD 205.2 billion, driven by industrial demand, investment, and rising applications in electronics and renewable energy.

02. What are the challenges in the global precious metals market?

Key challenges include high market volatility, environmental concerns surrounding mining practices, and supply chain disruptions that can affect the availability of raw materials.

03. Who are the major players in the global precious metals market?

Key players include Barrick Gold, Anglo American Platinum, Newmont Corporation, Norilsk Nickel, and Vale S.A., which dominate due to their extensive mining operations and sustainable initiatives.

04. What are the growth drivers of the global precious metals market?

The market is driven by increasing industrial applications, growing investment demand, and the integration of precious metals in renewable energy technologies such as solar panels and hydrogen fuel cells.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.