Global Printers Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD10998

December 2024

96

About the Report

Global Printers Market Overview

- The global printers market is valued at USD 52 billion, based on a detailed analysis over the past five years. The market is driven by advancements in printing technologies such as 3D printing, the growing demand for digital printing solutions across industries, and the increasing application of printers in packaging, advertising, and textile sectors. The surge in demand for eco-friendly printing solutions and the integration of cloud printing services also contribute significantly to the markets expansion. Key players are focusing on innovative solutions to cater to the growing demand for high-quality, cost-effective printing services.

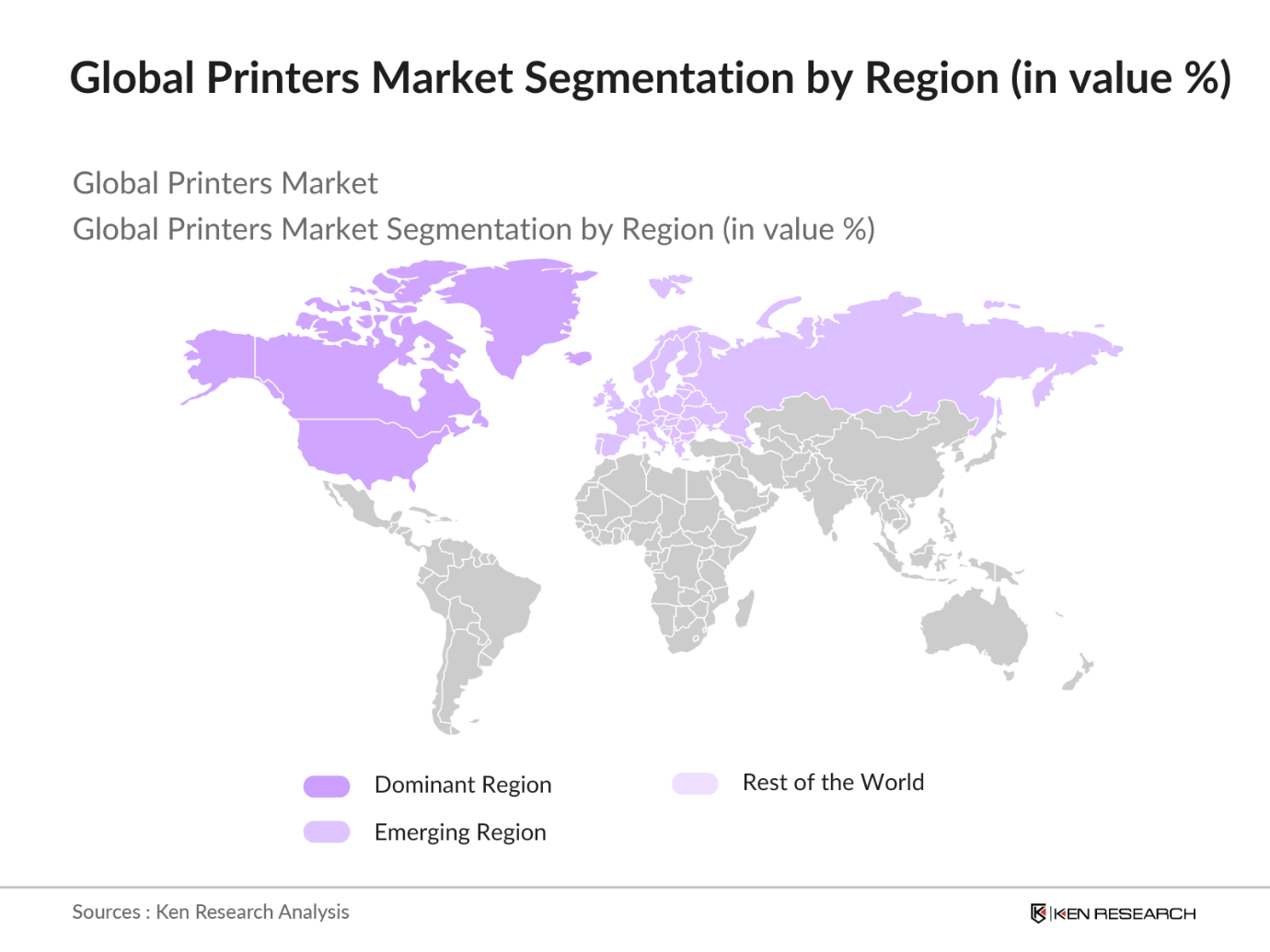

- North America and Europe remain dominant regions in the global printers market due to the presence of advanced technological infrastructure and a strong base of industrial and commercial printing firms. In North America, the U.S. leads the market with substantial investments in research and development, while in Europe, Germany and the UK are prominent due to their strong manufacturing sectors. Asia-Pacific is witnessing rapid growth, driven by the increasing demand for printers in emerging economies like China and India, supported by industrial expansion and digitalization trends.

- Industry standardization is essential for maintaining quality and interoperability across printing devices. Compliance with international standards such as ISO 12647 (for printing) and ANSI standards is increasingly being mandated by governments to ensure product safety and consistency. In 2023, over 60% of printing equipment manufacturers globally adhered to these standards, according to the International Organization for Standardization (ISO). These standards help manufacturers meet global quality benchmarks and ensure smooth operations across international markets, impacting product development and innovation in the printing sector.

Global Printers Market Segmentation

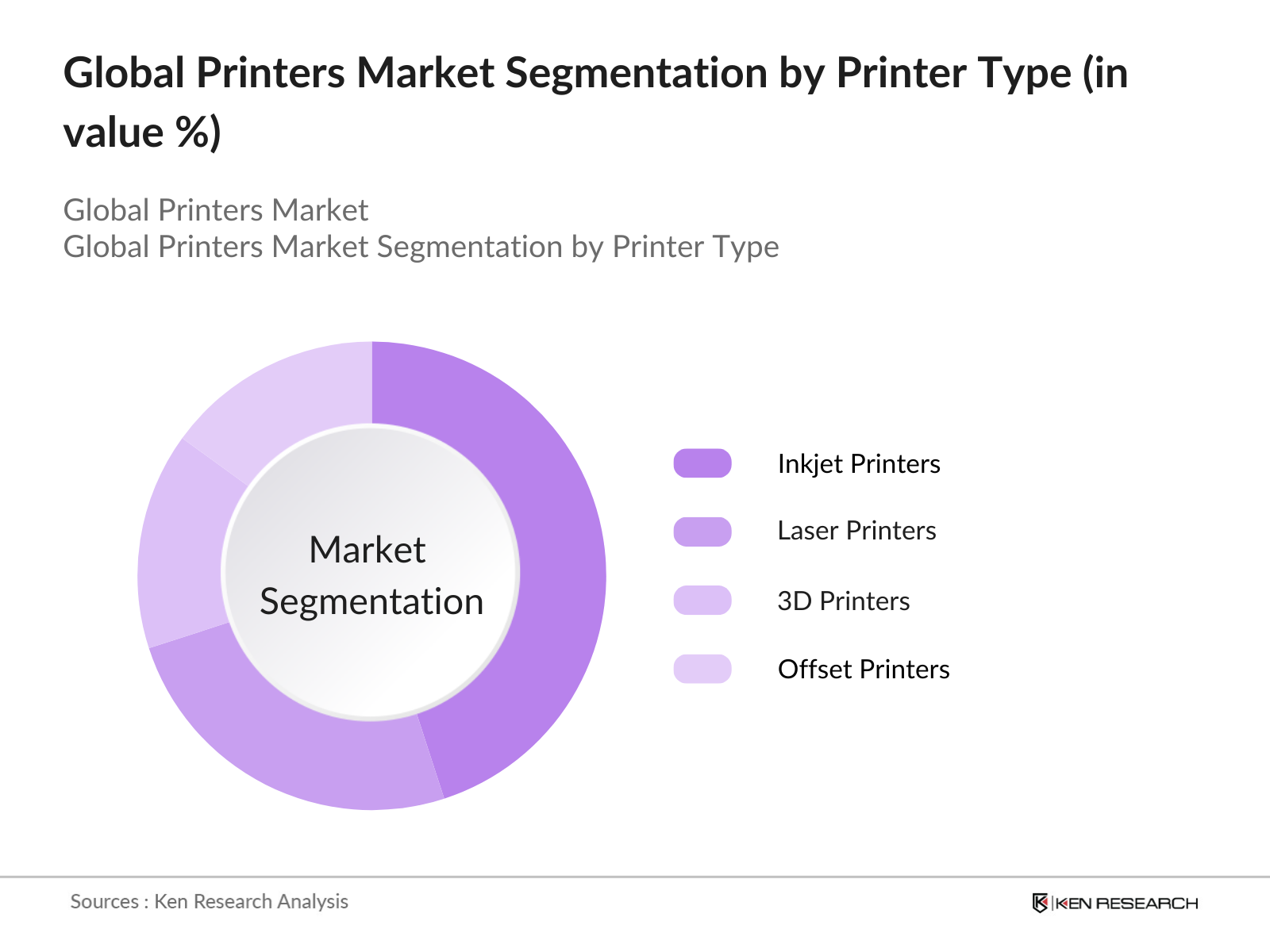

By Printer Type: The global printers market is segmented by printer type into Inkjet Printers, Laser Printers, 3D Printers, Offset Printers, and Flexographic Printers. Among these, Inkjet Printers dominate the market share in 2023, holding 35% of the market. Inkjet printers are widely preferred for their versatility in printing on various surfaces, high-quality output, and cost-effective operation, especially in the commercial and home office segments. The ability to print high-resolution images and text makes them an ideal choice for both personal and business use, contributing to their market dominance.

By Region: The global printers market is geographically segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, contributing 35% in 2023, driven by a high concentration of commercial and industrial printing service providers. The strong technological infrastructure and continued investment in innovation, particularly in the U.S., support this region's market dominance.

By Application: The market is also segmented by application into Commercial Printing, Industrial Printing, Packaging & Labels, Textiles, and 3D Printed Products. Commercial Printing leads the market, accounting for 40% of the total market share in 2023. The dominance of this sub-segment is due to the continuous demand from industries such as advertising, media, and publishing. The increasing shift toward digital printing solutions in commercial advertising and promotional materials has contributed to the sustained growth of this sub-segment.

Global Printers Market Competitive Landscape

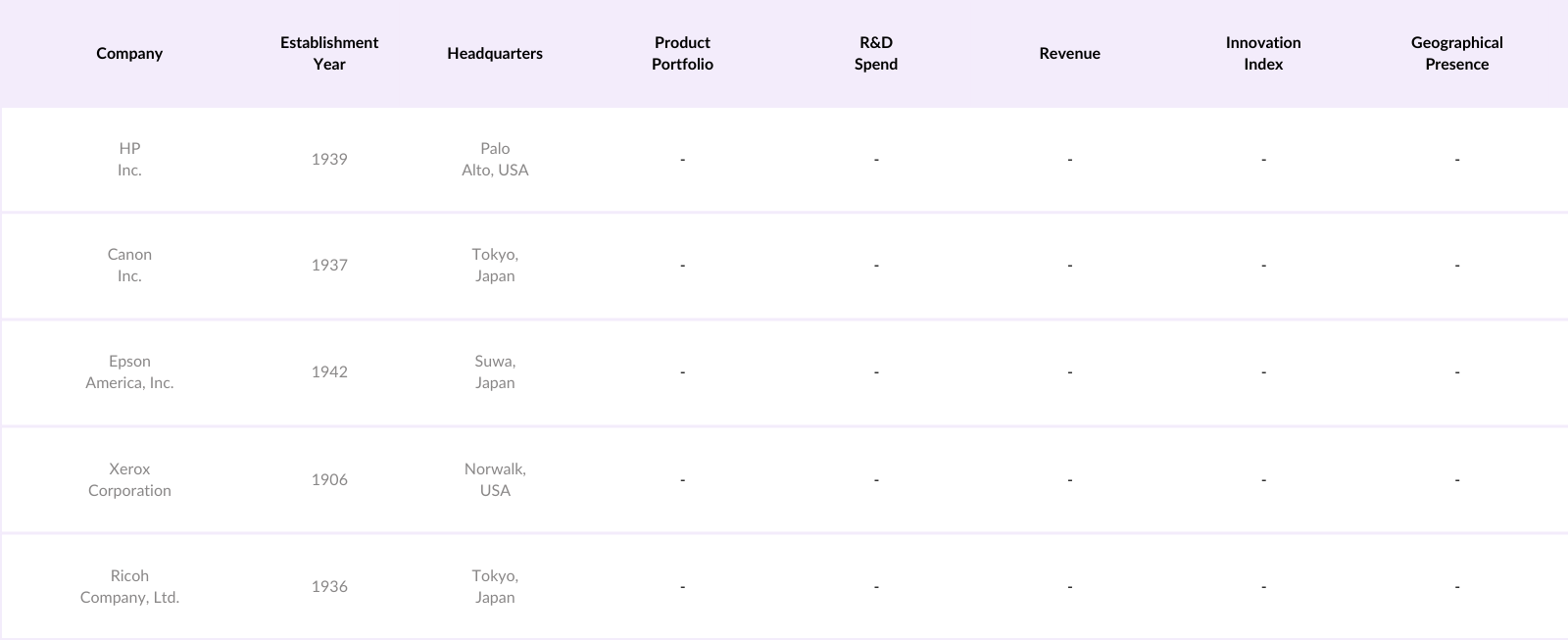

The global printers market is characterized by a few key players dominating the competitive landscape. These companies leverage technological innovations and strategic partnerships to enhance their product offerings and expand their market presence. The market is consolidated, with companies focusing on eco-friendly solutions, cloud integration, and multi-functional devices to stay competitive.

Global Printers Industry Analysis

Growth Drivers

- Advancements in Printing Technologies: The global printers market is experiencing a significant boost from advancements in printing technologies. Innovations in inkjet and laser printing are driving efficiency, with high-speed printing now capable of producing over 150 pages per minute. 3D printing is gaining traction, especially in the automotive and healthcare sectors, where applications like prototyping and medical implants are prevalent. In 2023, over 2 million 3D printers were shipped globally, with over 30% used in medical applications, according to the International Trade Centre (ITC) and Statista. These technological advancements are increasing operational efficiencies in several sectors.

- Increasing Demand for Customization in Printing: Customization in printing, especially for packaging and apparel, has become a pivotal growth driver. Data from Indias Ministry of Commerce highlights a 25% increase in demand for customized packaging solutions from the e-commerce sector. The US apparel industry, supported by the rise of customized labels and digital prints, saw 450 million garments customized through digital methods in 2023 alone. Furthermore, food and beverage industries worldwide are shifting towards variable data printing for better traceability and consumer engagement. Custom printing applications are a rising trend, spurred by these growing sectors.

- Growth in E-commerce and Digital Marketing: The booming e-commerce and digital marketing industries are significantly contributing to the growth of the printing market. In the U.S., the rise of personalized direct mail campaigns saw a 15% increase in use during 2022, as reported by the U.S. Postal Service. Similarly, flyer printing saw a surge, with more than 500 million printed promotional materials delivered in Europe in 2023. These statistics underscore the demand for personalized, printed materials as a critical channel for marketing and customer outreach.

Market Restraints

- Increasing Competition from Digital Alternatives: The shift to digital media poses a formidable challenge to the traditional printing market. Reports from the United Nations show that in 2023, more than 75 million e-books were sold globally, a 5% increase from the previous year. Digital marketing has also seen unprecedented growth, with companies allocating 65% of their marketing budgets to digital channels, significantly reducing demand for printed flyers and brochures. The continued shift towards digital platforms is a major obstacle for the printing industry, requiring adaptation and innovation to stay competitive.

- Volatility in Raw Material Prices: Volatile raw material prices remain a significant hurdle for the printing market. In 2023, global paper production saw a price fluctuation of around 8 dollars per ton due to supply chain disruptions, as reported by the World Trade Organization (WTO). Ink prices also soared, with crude oil pricesone of the key componentsfluctuating between 80 to 100 dollars per barrel, according to the U.S. Energy Information Administration (EIA). These fluctuations directly impact the cost structure of the printing industry, making it harder to maintain stable pricing for end consumers.

Global Printers Market Future Outlook

Over the next five years, the global printers market is expected to experience significant growth due to the increasing demand for high-quality, customized printing solutions, particularly in the packaging, textiles, and advertising sectors. The rising adoption of 3D printing technology for industrial applications, such as in the healthcare and automotive industries, will also contribute to the markets expansion. Furthermore, the continued integration of cloud-based and mobile printing solutions is set to boost the efficiency and convenience of printing services across commercial and personal use cases.

Market Opportunities

- Growth in 3D Printing Applications: 3D printing is emerging as a major opportunity within the printers market, particularly in the healthcare, automotive, and aerospace sectors. According to the European Commission, the number of 3D-printed medical devices produced in 2023 surpassed 400,000 units in Europe alone. The automotive industry also saw rapid adoption, with 3D printing utilized for over 1 million automotive parts in 2022. This trend highlights the vast potential for growth as 3D printing technologies expand into more industries, driven by innovation and increasing precision.

- Expansion in Developing Markets: The expansion of the printing market in developing regions like Asia-Pacific and Latin America presents enormous potential. According to the Asian Development Bank, the APAC region saw a 9% rise in demand for printers across SMEs in 2023, driven by expanding e-commerce and the rise of manufacturing sectors. Latin America is also witnessing rapid growth in demand for printed packaging materials, with Brazil alone accounting for over 150 million printed packaging units in 2023. These markets are expected to drive demand for both digital and traditional printing solutions.

Scope of the Report

|

Printer Type |

Inkjet Printers Laser Printers 3D Printers Offset Printers Flexographic Printers |

|

Application |

Commercial Printing Industrial Printing Packaging & Labels Textiles 3D Printed Products |

|

Technology |

Digital Printing Offset Printing Gravure Printing Flexographic Printing Screen Printing |

|

End-User |

Publishing Houses Advertising & Marketing Firms Manufacturing Educational Institutions Government Organizations |

|

Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Printer Manufacturers

Printing Service Providers

Packaging Companies

Advertising & Marketing Agencies

Government and Regulatory Bodies (e.g., EPA, EU Ecolabel, Energy Star)

3D Printing Solution Providers

Educational Institutions (large-scale educational printing)

Investor and Venture Capitalist Firms

Companies

Players Mentioned in the Report:

HP Inc.

Canon Inc.

Epson America, Inc.

Xerox Corporation

Ricoh Company, Ltd.

Brother Industries, Ltd.

Konica Minolta, Inc.

Fujifilm Holdings Corporation

Kyocera Document Solutions Inc.

Riso Kagaku Corporation

Zebra Technologies Corporation

Seiko Epson Corporation

Sharp Electronics Corporation

Toshiba Tec Corporation

Lexmark International, Inc.

Table of Contents

1. Global Printers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Printers Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Printers Market Analysis

3.1. Growth Drivers

3.1.1. Advancements in Printing Technologies (e.g., Inkjet, Laser, 3D, Digital)

3.1.2. Increasing Demand for Customization in Printing (e.g., Packaging, Labels, Apparel)

3.1.3. Growth in E-commerce and Digital Marketing (e.g., Personalized Direct Mail, Flyers)

3.1.4. Environmental Sustainability Initiatives (e.g., Eco-friendly Printing Solutions)

3.2. Market Challenges

3.2.1. High Operating Costs (Ink, Paper, Energy Consumption)

3.2.2. Increasing Competition from Digital Alternatives (E-books, Online Marketing)

3.2.3. Volatility in Raw Material Prices (Paper, Ink, Plastics)

3.3. Opportunities

3.3.1. Growth in 3D Printing Applications (e.g., Healthcare, Automotive, Aerospace)

3.3.2. Expansion in Developing Markets (e.g., Asia-Pacific, Latin America)

3.3.3. Integration with Cloud Printing Solutions

3.4. Trends

3.4.1. Shift to Digital Printing in Packaging (Short-run Printing, Variable Data Printing)

3.4.2. Increasing Adoption of Energy-Efficient Printers (Green Certifications, Lower Carbon Footprints)

3.4.3. Rise of Multi-functional Devices (All-in-One Printers)

3.4.4. On-Demand and Remote Printing Services

3.5. Government Regulation

3.5.1. Environmental Compliance (Emissions Standards, Recyclability)

3.5.2. Import/Export Regulations for Printing Equipment

3.5.3. Industry Standardization (ISO, ANSI Compliance)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.7.1. Printer Manufacturers

3.7.2. Consumables Suppliers (Ink, Paper)

3.7.3. Distributors and Retailers

3.7.4. End-Users (Commercial, Industrial, Residential)

3.8. Porters Five Forces

3.9. Competitive Landscape Analysis

4. Global Printers Market Segmentation

4.1. By Printer Type (In Value %)

4.1.1. Inkjet Printers

4.1.2. Laser Printers

4.1.3. 3D Printers

4.1.4. Offset Printers

4.1.5. Flexographic Printers

4.2. By Application (In Value %)

4.2.1. Commercial Printing

4.2.2. Industrial Printing

4.2.3. Packaging & Labels

4.2.4. Textiles

4.2.5. 3D Printed Products

4.3. By Technology (In Value %)

4.3.1. Digital Printing

4.3.2. Offset Printing

4.3.3. Gravure Printing

4.3.4. Flexographic Printing

4.3.5. Screen Printing

4.4. By End-User (In Value %)

4.4.1. Publishing Houses

4.4.2. Advertising & Marketing Firms

4.4.3. Manufacturing

4.4.4. Educational Institutions

4.4.5. Government Organizations

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Printers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. HP Inc.

5.1.2. Canon Inc.

5.1.3. Epson America, Inc.

5.1.4. Xerox Corporation

5.1.5. Ricoh Company, Ltd.

5.1.6. Lexmark International, Inc.

5.1.7. Brother Industries, Ltd.

5.1.8. Konica Minolta, Inc.

5.1.9. Fujifilm Holdings Corporation

5.1.10. Kyocera Document Solutions Inc.

5.1.11. Riso Kagaku Corporation

5.1.12. Zebra Technologies Corporation

5.1.13. Seiko Epson Corporation

5.1.14. Sharp Electronics Corporation

5.1.15. Toshiba Tec Corporation

5.2. Cross Comparison Parameters (Product Portfolio, Innovation Index, Revenue, Market Share, Geographical Presence, R&D Spend, Customer Base, Strategic Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Global Printers Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements (e.g., REACH, RoHS)

6.3. Certification Processes (ISO 14001, FSC, Energy Star)

7. Global Printers Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Printers Future Market Segmentation

8.1. By Printer Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Global Printers Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This step focuses on creating a comprehensive ecosystem map that identifies major stakeholders in the global printers market. Extensive desk research is conducted using secondary and proprietary databases to define critical variables, such as technology trends, raw material pricing, and regional demand.

Step 2: Market Analysis and Construction

We analyze historical data to assess market penetration, revenue trends, and technological advancements. The construction of market models includes detailed analysis of industry-specific data points such as ink consumption rates, energy efficiency, and printer adoption rates across different regions.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts from leading companies. These interviews provide insights into operational challenges, customer preferences, and the adoption rate of advanced printing technologies, allowing us to refine market data and forecasts.

Step 4: Research Synthesis and Final Output

In the final phase, we synthesize data collected from both primary and secondary research to produce a validated, comprehensive market report. Key findings are cross-checked with multiple industry stakeholders to ensure accuracy and relevance, especially regarding product segmentation and regional market dynamics.

Frequently Asked Questions

01. How big is the global printers market?

The global printers market is valued at USD 52 billion, driven by advancements in printing technologies and the rising demand for personalized and sustainable printing solutions.

02. What are the challenges in the global printers market?

Key challenges include the high cost of printer maintenance and consumables, the growing shift toward digital alternatives such as e-books and digital marketing, and the fluctuating cost of raw materials like ink and paper.

03. Who are the major players in the global printers market?

Key players include HP Inc., Canon Inc., Epson America, Inc., Xerox Corporation, and Ricoh Company, Ltd., each dominating the market with their advanced printing solutions and broad geographical presence.

04. What are the growth drivers of the global printers market?

Growth drivers include the increasing adoption of digital and 3D printing technologies, the demand for eco-friendly printing solutions, and the expanding application of printers in packaging and textile industries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.