Global Printing Inks Market Outlook to 2030

Region:Global

Author(s):Sanjeev

Product Code:KROD1747

November 2024

98

About the Report

Global Printing Inks Market Overview

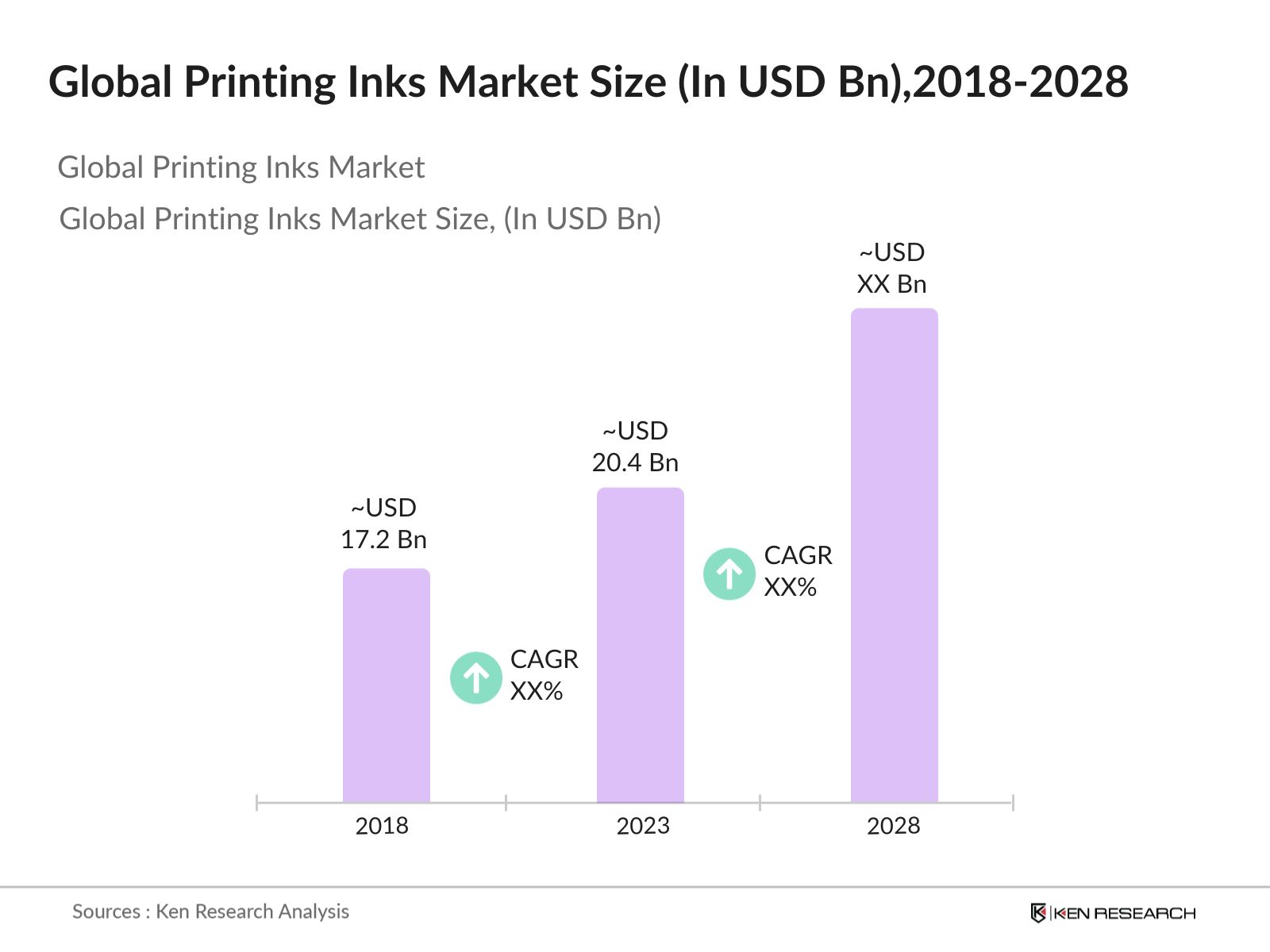

- In 2023, the Global Printing Inks Market was valued at USD 20.4 billion, driven by the increasing demand for packaging, commercial printing, and publications. The market's growth is supported by the expansion of the packaging industry, especially in emerging economies, and the shift towards sustainable and eco-friendly printing solutions.

- Key players in the printing inks market include DIC Corporation, Flint Group, Siegwerk Druckfarben AG & Co. KGaA, and Sun Chemical Corporation. These companies are leading the industry with innovations in ink formulations, focusing on reducing volatile organic compounds (VOCs) and developing bio-based inks. DIC Corporations emphasis on sustainable ink technologies exemplifies the industry's move towards environmentally friendly practices.

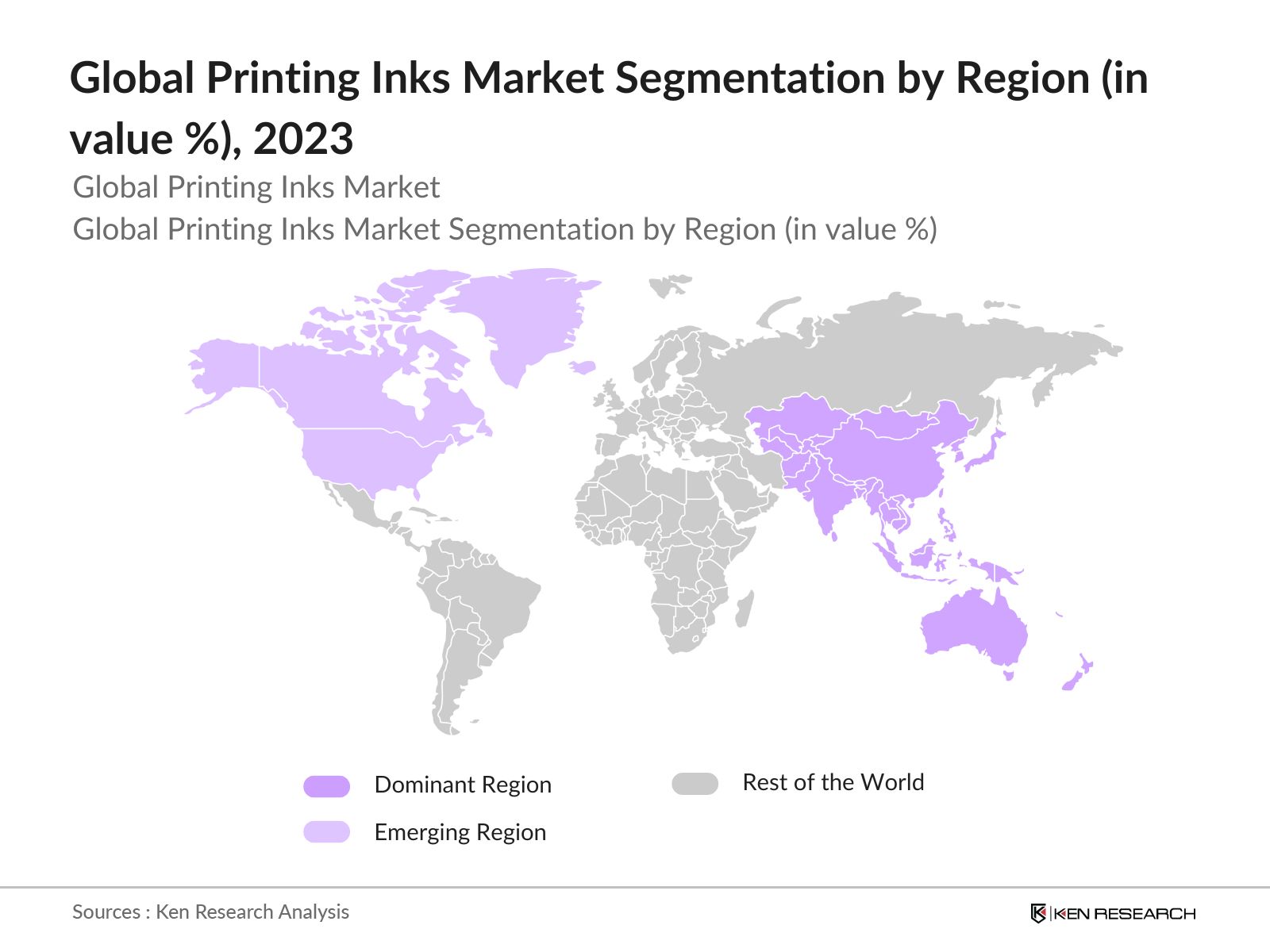

- In Asia-Pacific, China and India are prominent countries in the printing inks market, attributed to their large-scale packaging and printing industries. These countries are characterized by robust growth in the consumer goods sector and significant investments in technology advancements to meet increasing demand for printed materials and packaging solutions.

- In 2023, Sun Chemical Corporation introduced a new range of eco-friendly printing inks designed to reduce environmental impact and improve print quality. This innovation highlights the ongoing technological advancements and the shift towards more sustainable practices in the printing inks market.

Global Printing Inks Market Segmentation

Global Printing Inks Market Segmentation

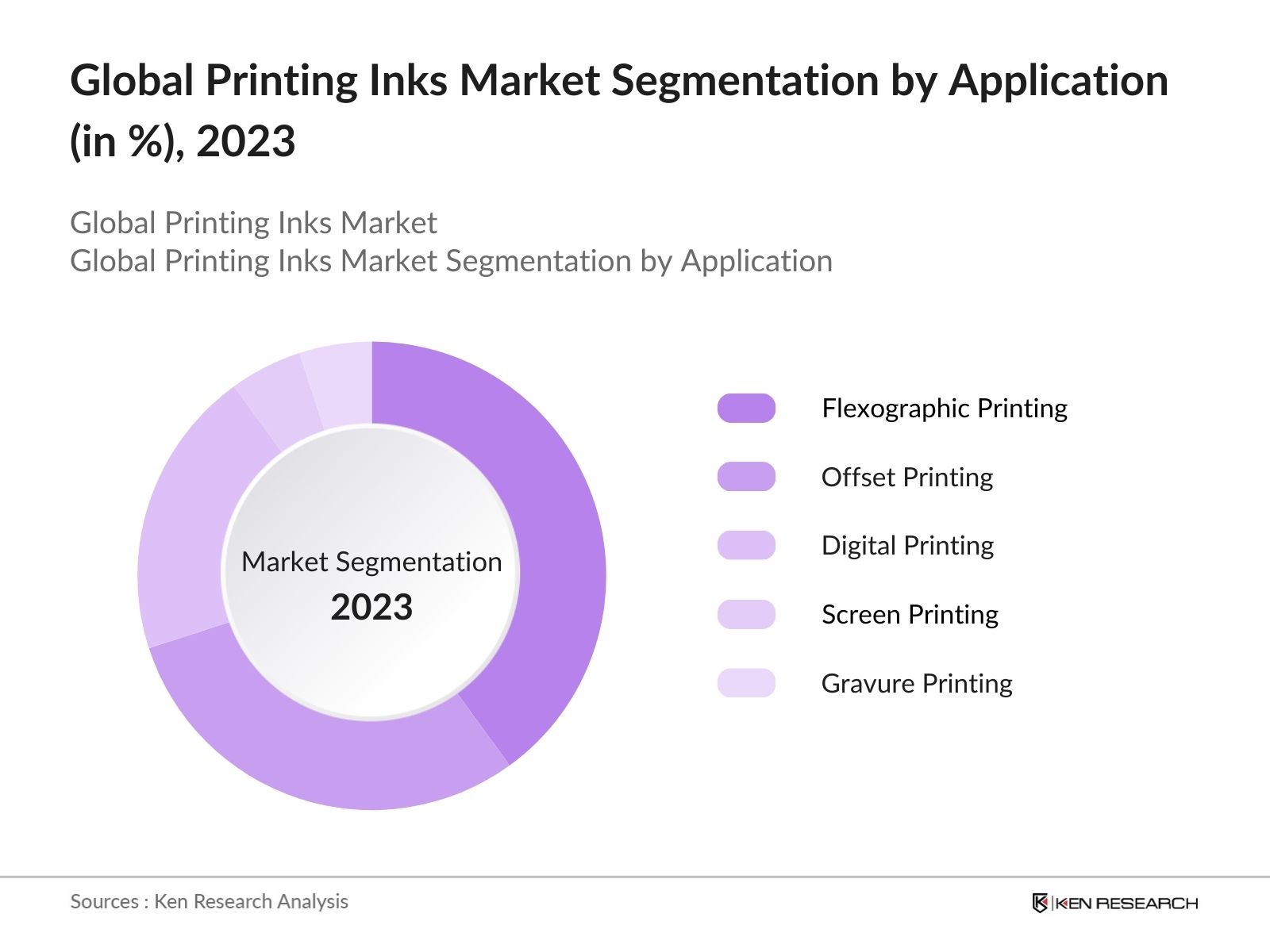

The Global Printing Inks Market can be segmented based on application, ink type, end-user industry, and region:

- By Application: The market is segmented into Flexographic Printing, Offset Printing, Digital Printing, Screen Printing, and Gravure Printing. In 2023, Flexographic printing leads due to its versatility and efficiency in printing on various substrates, including flexible packaging, labels, and cartons.

- By Region: The Global market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. Asia-Pacific led the global market in 2023, holding the largest share due to the high production capacity and consumption in the region.

- By End-User Industry: The market is segmented into Food and Beverage, Pharmaceuticals, Consumer Goods, and Others. In 2023, the Food and Beverage sector led the market owing to the high demand for printed packaging solutions.

Global Printing Inks Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

DIC Corporation |

1908 |

Tokyo, Japan |

|

Flint Group |

2005 |

Luxembourg |

|

Siegwerk Druckfarben AG & Co. KGaA |

1834 |

Siegburg, Germany |

|

Sun Chemical Corporation |

1927 |

Parsippany, USA |

|

Toyo Ink SC Holdings Co., Ltd. |

1896 |

Tokyo, Japan |

- DIC Corporation: In 2023, DIC Corporation continued to lead the printing inks market by focusing on developing sustainable ink solutions and expanding its product portfolio to include water-based and bio-based inks. The company has also made strides in enhancing its global manufacturing capabilities, with new facilities in Asia and Europe to better serve its international customer base.

- Sun Chemical Corporation: In 2023, Sun Chemical introduced a new series of low-VOC and high-performance inks, enhancing print quality and reducing environmental impact. This development underscores Sun Chemicals commitment to innovation and sustainability. The company also invested in advanced digital printing technologies to offer more versatile and cost-effective solutions for various industries.

Global Printing Inks Market Analysis

Market Growth Drivers:

- Expansion of Oil & Gas Industry: The global oil & gas industry is projected to experience Impactful growth from 2024 to 2030. This expansion is driven by increasing exploration and production activities, particularly in regions such as the Middle East, North America, and offshore fields. The growth in the oil & gas sector is expected to significantly boost the demand for pressure vessels, which are crucial for various applications including drilling, refining, and storage.

- Growth in Chemical Processing: The chemical processing industry is projected to experience Impactful growth from 2024 to 2030. This growth is driven by increasing demand for specialty chemicals and polymers across various sectors, including automotive, pharmaceuticals, and agriculture. Pressure vessels play a crucial role in chemical processing plants, where they are used for reactions, storage, and transport of chemicals under high pressure. In 2023, BASF announced a $10 billion investment to expand its chemical production facilities in Asia. This investment aims to enhance production capacity and integrate advanced technologies, boosting demand for pressure vessels in their operations.

- Advancements in Renewable Energy: The renewable energy sector is experiencing rapid growth, with global investments projected to exceed USD 500 billion annually by 2025. This growth includes substantial investments in wind, solar, and hydrogen energy projects, all of which require pressure vessels for various applications. The hydrogen production, storage, and distribution are increasingly important, and pressure vessels are essential for handling hydrogen under high pressure.

Market Challenges:

- Volatility in Raw Material Prices: Fluctuations in the prices of key raw materials such as steel, alloys, and composites can impact the cost of production and profitability. Manufacturers must manage these price variations through strategic sourcing and cost control measures.

- Economic Uncertainties and Market Fluctuations: Economic downturns and fluctuations in global markets can impact the demand for pressure vessels. Industries such as oil and gas, chemicals, and power generation, which are major consumers of pressure vessels, are particularly sensitive to economic cycles.

Government Initiatives:

- European Unions Horizon Europe Program: The Horizon Europe program, with a budget of EUR 95.5 billion which is USD 103 billion, aims to support research and innovation across various sectors, including advanced materials and manufacturing technologies. This initiative includes funding for projects related to the development of innovative and sustainable pressure vessel technologies, encouraging collaboration between academia and industry to drive technological advancements and competitiveness.

- Canadas Strategic Innovation Fund (SIF): The Government of Canada launched its Strategic Innovation Fund (SIF) with the aim of spurring and accelerating innovation. Starting in 2021, the SIF has an incremental budget of CAD 7.2 billion over seven years. This includes financial assistance for research, development, and commercialization efforts in sectors such as manufacturing, including new pressure vessel technologies.

Global Printing Inks Market Future Outlook

The Global Printing Inks Market is expected to continue its growth, driven by advancements in technology and increasing demand for sustainable printing solutions.

Future Market Trends:

- Increased Adoption of Sustainable and Eco-friendly Inks: The industry is witnessing a shift towards sustainable and eco-friendly formulations. This trend is driven by heightened environmental regulations and growing consumer demand for green products. Bio-based inks and those with reduced VOC (Volatile Organic Compound) emissions are gaining traction, which is expected to influence market dynamics and drive growth.

- Growth in Packaging and Labeling Applications: The rise in e-commerce and retail industries is fueling the demand for advanced packaging and labeling solutions. Printing inks that offer durability, vibrant colors, and resistance to environmental factors are increasingly being sought. This trend is expected to continue as brands focus on enhancing product presentation and consumer engagement.

Scope of the Report

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

|

By Distribution Channel |

Direct Sales Distributors Online Retail |

|

By Application |

Flexographic Printing Offset Printing Digital Printing Screen Printing Gravure Printing |

|

By Ink Type |

Flexographic Inks Gravure Inks Offset Inks Digital Inks |

|

By End-User |

Food and Beverage Pharmaceutical Consumer Goods Packaging Commercial Printing Publications |

Products

Key Target Audience

Printing Ink Manufacturers

Packaging Companies

Commercial Printers

Publishers

Government and Regulatory Bodies (ECHA, FDA, AIMCAL, NAPIM)

Investors and Venture Capitalists

Environmental and Sustainability Consultants

Packaging Material Suppliers

Consumer Goods Companies

Print Technology Developers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Huber Group

Sakata INX Corporation

Sun Chemical Corporation

Flint Group

Royal Dutch Printing Inks

Tokyo Printing Ink Mfg. Co., Ltd.

Wikoff Color Corporation

DIC Corporation

Nazdar Ink Technologies

Epple Druckfarben AG

Toyo Ink SC Holdings Co., Ltd.

Siegwerk Druckfarben AG & Co. KGaA

INX International Ink Co.

Hexion Inc.

Colour Index International

Table of Contents

1. Global Printing Inks Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Printing Inks Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Printing Inks Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Packaging Industry

3.1.2. Technological Advancements

3.1.3. Increasing Demand for Sustainable Solutions

3.1.4. Growth in E-commerce and Retail

3.2. Restraints

3.2.1. Regulatory Compliance and VOC Emissions

3.2.2. Raw Material Price Fluctuations

3.2.3. Competition from Digital Printing Technologies

3.3. Opportunities

3.3.1. Adoption of Eco-friendly Inks

3.3.2. Expansion in Emerging Markets

3.3.3. Growth in High-performance Ink Applications

3.4. Trends

3.4.1. Increased Focus on Sustainability

3.4.2. Technological Innovations in Printing Inks

3.4.3. Rising Demand for Customized Printing Solutions

3.5. Government Regulation

3.5.1. Environmental Regulations on VOCs

3.5.2. Support for Sustainable Practices

3.5.3. Industry Standards and Compliance

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Global Printing Inks Market Segmentation, 2023

4.1. By Application (in Value %)

4.1.1. Packaging

4.1.2. Commercial Printing

4.1.3. Publications

4.2. By End-User Industry (in Value %)

4.2.1. Food and Beverage

4.2.2. Pharmaceuticals

4.2.3. Consumer Goods

4.2.4. Others

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific

4.3.4. Latin America

4.3.5. Middle East & Africa

5. Global Printing Inks Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. DIC Corporation

5.1.2. Flint Group

5.1.3. Siegwerk Druckfarben AG & Co. KGaA

5.1.4. Sun Chemical Corporation

5.1.5. Toyo Ink SC Holdings Co., Ltd.

5.1.6. Huber Group

5.1.7. Sakata INX Corporation

5.1.8. Royal Dutch Printing Inks

5.1.9. Tokyo Printing Ink Mfg. Co., Ltd.

5.1.10. Wikoff Color Corporation

5.1.11. Nazdar Ink Technologies

5.1.12. Epple Druckfarben AG

5.1.13. INX International Ink Co.

5.1.14. Hexion Inc.

5.1.15. Colour Index International

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Printing Inks Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Printing Inks Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Printing Inks Market Future Outlook

8.1. Future Market Size Projections (in USD Bn), 2023-2028

8.2. Key Factors Driving Future Market Growth

9. Global Printing Inks Market Future Segmentation, 2028

9.1. By Application (in Value %)

9.2. By End-User Industry (in Value %)

9.3. By Region (in Value %)

10. Global Printing Inks Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Building an ecosystem of major entities in the Global Printing Inks Market and referencing multiple secondary and proprietary databases to conduct desk research. This includes gathering industry-level information on market drivers, challenges, key players, and technological advancements, as well as understanding regulatory impacts and market dynamics.

Step 2: Market Building

Collecting statistics on the global Printing Inks market over the years, including historical market size, growth rates, production technologies, and adoption of pressure vessels in various industries. We will analyze market share, revenue generated by major players, and emerging trends to ensure accuracy and reliability in the data presented.

Step 3: Validating and Finalizing

Formulating market hypotheses and conducting CATIs (Computer-Assisted Telephone Interviews) with industry experts from leading Printing Inks manufacturing and application companies. These interviews will help validate the collected statistics and provide insights into operational and financial aspects directly from company representatives.

Step 4: Research Output

Our team will engage with multiple Printing Inks manufacturers, end-users, and industry stakeholders to understand the dynamics of market segments, consumer preferences, and sales trends. This process will validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

01. How large is the Global Printing Inks Market?

In 2023, the Global Printing Inks Market was valued at approximately USD 20.4 Billion. The market is driven by the increasing demand for printed materials in packaging, commercial printing, and publications. The growth underscores the essential role of printing inks in various applications and industries.

02. What are the challenges in the Global Printing Inks Market?

Challenges in the Global Printing Inks Market include regulatory compliance related to VOC emissions, fluctuations in raw material prices, and the need for continuous innovation to meet evolving consumer demands and environmental standards. Additionally, the competition from digital printing technologies and sustainability concerns poses significant challenges.

03. Who are the major players in the Global Printing Inks Market?

Major players in the Global Printing Inks Market include DIC Corporation, Flint Group, Siegwerk Druckfarben AG & Co. KGaA, Sun Chemical Corporation, Toyo Ink SC Holdings Co., Ltd., Hubergroup, INX International Ink Co., and Huber Group. These companies are prominent in innovation and production, offering diverse solutions across the industry.

04. What are the growth drivers of the Global Printing Inks Market?

Key growth drivers include the rising demand for high-quality prints in packaging and commercial printing, advancements in digital printing technologies, the expansion of the packaging industry, and increasing consumer preference for personalized and eco-friendly print products. Additionally, technological advancements in ink formulations and applications are fueling market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.