Global Private LTE Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD1788

December 2024

100

About the Report

Global Private LTE Market Overview

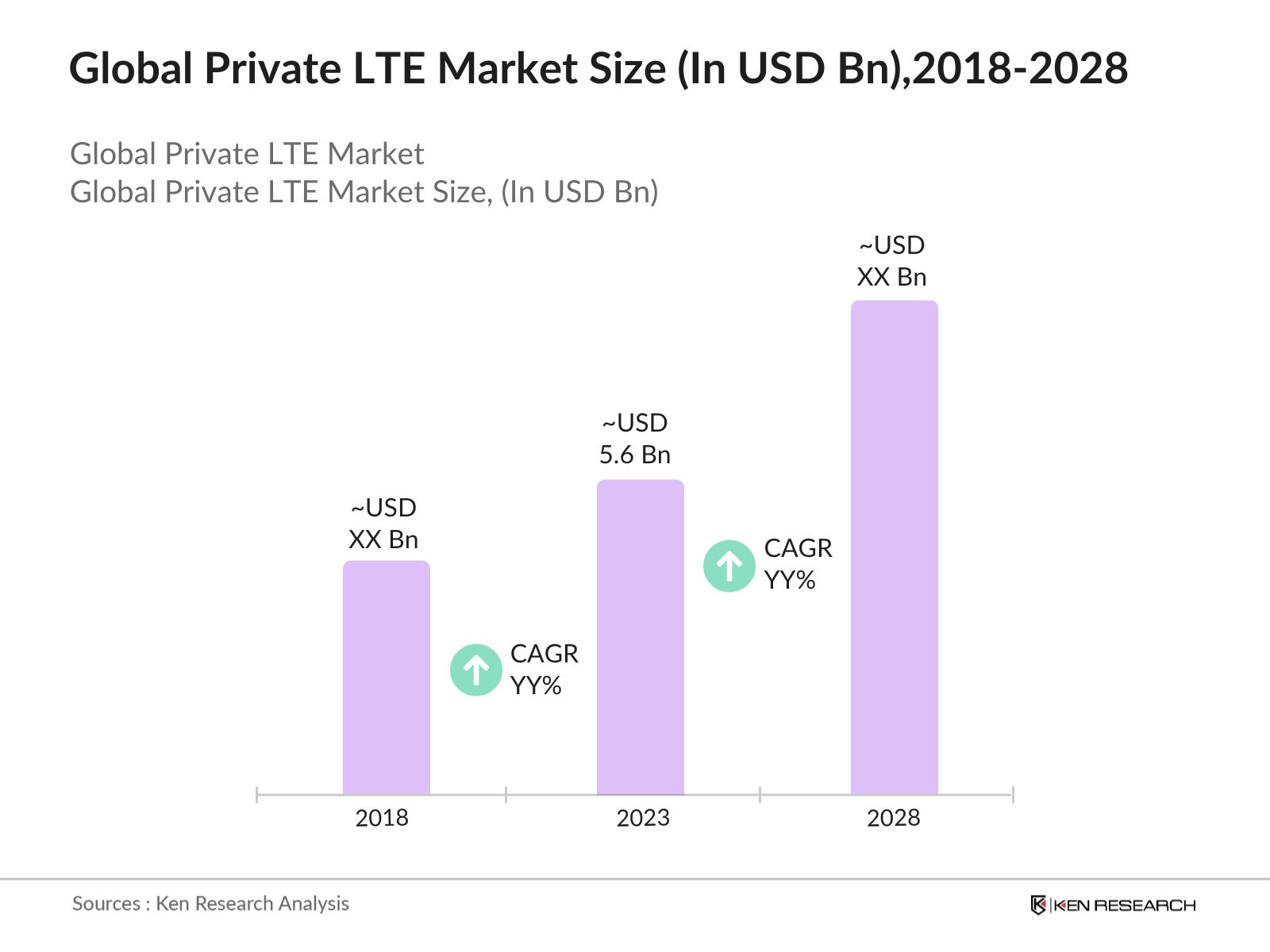

- The Global Private LTE Market has shown significant growth, reaching a valuation of USD 5.6 billion in 2023. This growth is largely driven by the increasing demand for secure and reliable communication networks across various industries, including manufacturing, energy, and transportation. The proliferation of IoT devices, which require low-latency and high-bandwidth networks, has also contributed to the market's expansion, supported by investments from both private and public sectors.

- Key Players in the private LTE market include Nokia, Ericsson, Huawei, Cisco, and Verizon. These players dominate due to their extensive experience in telecommunications, robust product portfolios, and strong customer relationships. Nokia, for instance, has been actively deploying private LTE networks for various sectors, including mining and logistics, while Ericsson has been focusing on partnerships to expand its presence in the industrial IoT market.

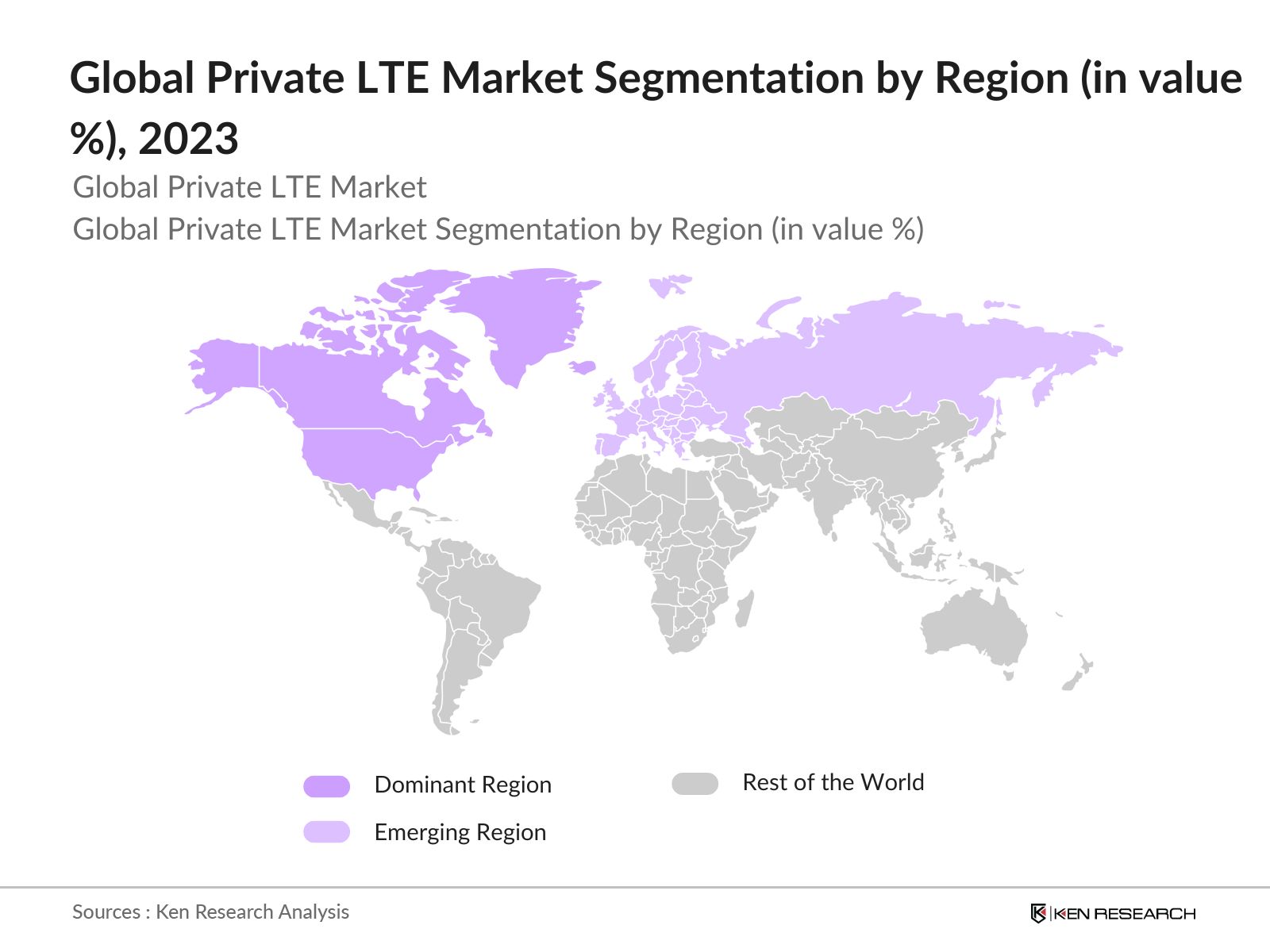

- North America leads the global private LTE market, with major cities like New York, San Francisco, and Dallas being hubs for technological innovation and industrial development. The dominance of this region is attributed to the early adoption of advanced communication technologies, a high concentration of leading telecom companies, and significant investments in private network infrastructure. Moreover, favorable regulatory environments in these cities support the deployment of private LTE networks.

- In 2023, Cisco announced its commitment to expanding its private 5G and LTE solutions to meet the growing demand for secure and reliable connectivity in various industries. This initiative aims to support enterprises in their digital transformation efforts by providing tailored communication solutions that enhance operational efficiency.

Global Private LTE Market Segmentation

The global Private LTE Market is divided into the following segments:

By Region: The private LTE market is segmented regionally into North America, Latin America, Europe, Asia-Pacific, and the Middle East & Africa (MEA). In 2023, North America dominated the market due to its significant investments in communication infrastructure and early adoption of private LTE technologies. The U.S. leads in both technological advancements and commercial deployment of private LTE networks.

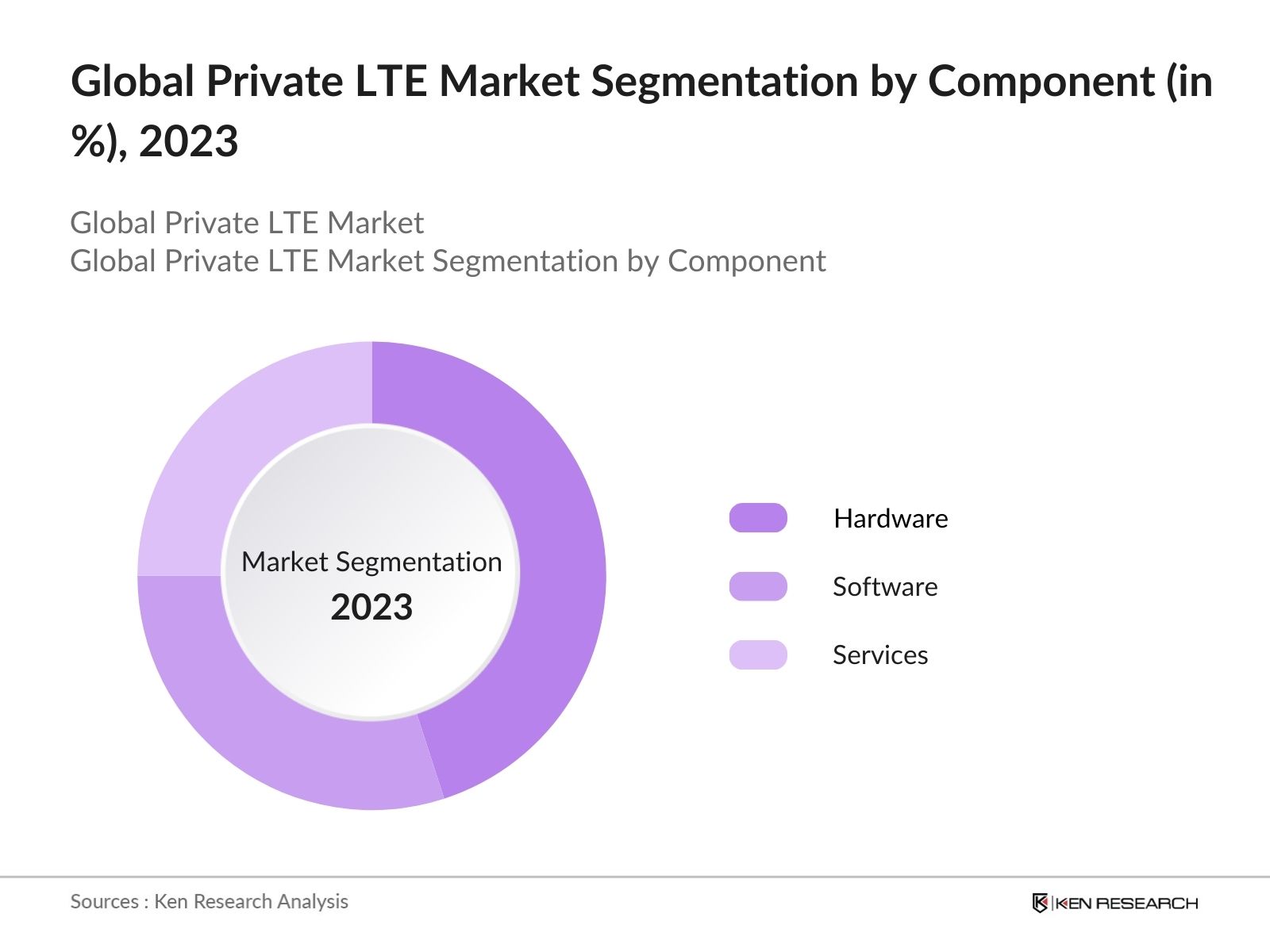

By Component: The global private LTE market is segmented by component into hardware, software, and services. In 2023, the hardware segment held a dominated the market, driven by the high demand for critical network infrastructure such as base stations and access points in industrial applications.

By End-User: The global private LTE market is segmented by end-user into industrial, enterprise, and public safety sectors. The industrial sector dominated the market in 2023 due to the increasing deployment of private LTE networks to support automation, remote operations, and real-time monitoring in industries like manufacturing and energy.

Global Private LTE Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Nokia |

1865 |

Espoo, Finland |

|

Ericsson |

1876 |

Stockholm, Sweden |

|

Huawei |

1987 |

Shenzhen, China |

|

Cisco |

1984 |

San Jose, USA |

|

Verizon |

1983 |

New York, USA |

- Ericsson: In November 2022, Ericsson collaborated with Thales to launch IoT Accelerator Device Connect, the first-ever connection-ready generic eSIMs for enterprises. This partnership aims to simplify the deployment of IoT devices by providing a single connectivity management platform for both public and private cellular networks

- Verizon: In early 2023, Verizonannounced theexpansion ofits private5G solutions, aimedat providingenterprises withenhanced connectivityoptions. Thismove is partof Verizon's strategyto support industriessuch as manufacturing, logistics, andhealthcare intheir digitaltransformationefforts. Theprivate 5G networkis designed tooffer low latency, high reliability, and secure communication, which are essentialfor mission-critical applications.

Global Private LTE Industry Analysis

Global Private LTE Market Growth Drivers

- Increasing Demand for Secure and Reliable Communication Networks: The market is driven by a heightened demand for secure and reliable communication networks across various industries. Traditional networks may not always provide the level of security and performance required for mission-critical applications and sensitive data transfer. Private LTE networks address this challenge by offering dedicated and isolated connectivity, minimizing the risk of cyber threats and ensuring the confidentiality of critical information.

- Growth of IoT and Industry 4.0: The expansion of the Internet of Things (IoT) and Industry 4.0 initiatives is driving the demand for private LTE networks. These networks provide robust connectivity for numerous connected devices in sectors like manufacturing and logistics, enabling enhanced automation and real-time data analytics.

- Customization and Flexibility: Private LTE networks offer the flexibility to customize connectivity solutions to meet specific enterprise needs. Organizations can tailor aspects such as coverage area, device density, and application priorities to optimize network performance and ensure efficient operations. This level of customization is crucial for businesses with unique communication requirements, making private LTE an attractive option.

Global Private LTE Market Challenges

- Complex Regulatory Environment: Navigating the complex regulatory environment is another significant challenge for the private LTE market. In 2023, regulatory approvals for deploying private LTE networks in the European Union took an average of 18 months, delaying projects and increasing costs. The European Telecommunications Standards Institute (ETSI) highlighted that inconsistent regulations across member states create challenges for companies seeking to deploy networks in multiple countries, affecting market expansion and operational efficiency.

- Spectrum Availability Issues: Spectrum availability is a critical challenge for the private LTE market, as the demand for spectrum continues to grow. In 2024, the U.S. Federal Communications Commission (FCC) reported that only 40% of the spectrum allocated for private LTE networks had been auctioned, leading to delays in network deployments. The limited availability of spectrum, particularly in densely populated urban areas, restricts the ability of companies to deploy and expand their private LTE networks, potentially stifling market growth.

Global Private LTE Market Government Initiatives

- European Commission's Digital Decade Policy Program (2023): The European Commission introduced the Digital Decade Policy Program in 2023 to guide Europe's digital transformation. While the program does not mention a specific allocation for private LTE networks, it sets concrete targets and objectives for 2030 in key areas like digital infrastructure and aims to facilitate the launch of multi-country projects combining investments from the EU budget, Member States, and the private sector

- Spectrum Allocation Initiatives: Governments worldwide are taking initiatives to facilitate spectrum allocation for private LTE networks. However, the process can be complex as different regions and countries have varying regulations, licensing frameworks, and spectrum availability. Collaboration between stakeholders, regulators, and policymakers is needed to streamline spectrum allocation and ensure businesses can acquire necessary frequencies in a timely manner

Global Private LTE Market Future Outlook

The global private LTE market is set for robust growth through 2028, driven by the increasing adoption of Industry 4.0 technologies, the expansion of IoT ecosystems, and the growing demand for secure communication networks across various sectors.

Future Market Trends

- Integration with 5G Networks: Over the next five years, private LTE networks will increasingly integrate with 5G technologies, offering enhanced capabilities such as ultra-low latency, higher data speeds, and improved network efficiency. This integration will enable industries to implement more advanced applications, including autonomous vehicles, remote surgery, and smart manufacturing, making private LTE networks a crucial component of the industrial IoT ecosystem.

- Adoption of AI and Machine Learning: Over the next five years, the adoption of AI and ML technologies in private LTE networks is expected to grow, enabling more efficient network management, predictive maintenance, and self-optimization. These technologies will enhance network performance and reduce operational costs, making private LTE networks more intelligent and capable of supporting complex industrial applications.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Component |

Hardware Software Services |

|

By End-User |

Industrial Enterprise Public Safety |

|

By Network Type |

LTE-M NB-IoT Standard LTE |

|

By Application |

Industrial Automation Remote Monitoring Mission-Critical Communications Asset Management |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Telecommunications Companies

Manufacturing Firms

Energy and Utilities Providers

Transportation and Logistics Companies

Public Safety Agencies

Government and Regulatory Bodies (e.g., FCC, EU Commission)

IoT Solution Providers

Network Equipment Manufacturers

Large Enterprises

Investments and Venture Capitalist Firms

Mining and Extraction Companies

Healthcare Providers

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Nokia

Ericsson

Huawei

Cisco

Verizon

AT&T

Samsung Electronics

ZTE Corporation

Motorola Solutions

Qualcomm

Sierra Wireless

Boingo Wireless

Casa Systems

Mavenir

CommScope

Table of Contents

1. Global Private LTE Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Private LTE Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Private LTE Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Secure and Reliable Communication Networks

3.1.2. Growth of IoT and Industry 4.0

3.1.3. Customization and Flexibility in Network Solutions

3.2. Restraints

3.2.1. Complex Regulatory Environment

3.2.2. High Initial Investment Costs

3.2.3. Spectrum Availability Issues

3.3. Opportunities

3.3.1. Expansion into Emerging Markets

3.3.2. Integration with 5G and AI Technologies

3.3.3. Growing Adoption of Private LTE in Public Safety

3.4. Trends

3.4.1. Integration with 5G Networks

3.4.2. Adoption of AI and Machine Learning

3.4.3. Increasing Demand for Mission-Critical Communications

3.5. Government Initiatives

3.5.1. European Commission's Digital Decade Policy Program (2023)

3.5.2. U.S. Spectrum Allocation Initiatives

3.5.3. Japan's Beyond 5G Promotion Consortium (2024)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Global Private LTE Market Segmentation, 2023

4.1. By Region (in Value %)

4.1.1. North America

4.1.2. Latin America

4.1.3. Europe

4.1.4. Asia-Pacific

4.1.5. Middle East & Africa (MEA)

4.2. By Component (in Value %)

4.2.1. Hardware

4.2.2. Software

4.2.3. Services

4.3. By End-User (in Value %)

4.3.1. Industrial

4.3.2. Enterprise

4.3.3. Public Safety

4.4. By Network Type (in Value %)

4.4.1. LTE-M

4.4.2. NB-IoT

4.4.3. Standard LTE

4.5. By Application (in Value %)

4.5.1. Industrial Automation

4.5.2. Remote Monitoring

4.5.3. Mission-Critical Communications

4.5.4. Asset Management

5. Global Private LTE Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Nokia

5.1.2. Ericsson

5.1.3. Huawei

5.1.4. Cisco

5.1.5. Verizon

5.1.6. AT&T

5.1.7. Samsung Electronics

5.1.8. ZTE Corporation

5.1.9. Motorola Solutions

5.1.10. Qualcomm

5.1.11. Sierra Wireless

5.1.12. Boingo Wireless

5.1.13. Casa Systems

5.1.14. Mavenir

5.1.15. CommScope

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Private LTE Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Private LTE Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Private LTE Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Private LTE Market Future Market Segmentation, 2028

9.1. By Region (in Value %)

9.2. By Component (in Value %)

9.3. By End-User (in Value %)

9.4. By Network Type (in Value %)

9.5. By Application (in Value %)

10. Global Private LTE Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities involved in the Global Private LTE Market, including manufacturers, service providers, and end-users. This step involves referring to multiple secondary and proprietary databases to perform comprehensive desk research around the market to collate industry-level information, including trends, growth drivers, challenges, and key players.

Step 2: Market Building

Collating statistics on the Global Private LTE Market over the years, including the penetration of various components like hardware, software, and services. We will analyze the ratio of private LTE network deployments across different regions and end-user industries to compute the revenue generated for the global market. We will also review service quality statistics and the impact of government regulations to ensure the accuracy and relevance of the data points shared.

Step 3: Validating and Finalizing

Building market hypotheses and conducting Computer-Assisted Telephonic Interviews (CATIs) with industry experts from leading telecommunications companies, equipment manufacturers, and end-user industries to validate the statistics. We will seek operational and financial information from company representatives to ensure the reliability of the market estimates and forecasts.

Step 4: Research Output

Our team will engage with multiple key players in the private LTE industry, including network providers, hardware manufacturers, and large enterprises, to understand the nature of product segments, sales, and consumer preferences. This step will involve cross-verifying the data derived through a bottom-up approach, ensuring the validity of the statistics and insights generated from the research process.

Frequently Asked Questions

01 How big is the global private LTE market?

The Global Private LTE Market has experienced substantial growth, achieving a valuation of USD 5.6 billion in 2023. This expansion is primarily fueled by the rising need for secure and dependable communication networks across multiple sectors, including manufacturing, energy, and transportation.

02 What are the challenges in the global private LTE market?

Challenges in the global private LTE market include high initial investment costs, spectrum availability issues, and navigating complex regulatory environments across different regions.

03 Who are the major players in the global private LTE market?

Key players in the global private LTE market include Nokia, Ericsson, Huawei, Cisco, and Verizon. These companies lead the market due to their extensive experience in telecommunications and strong customer bases.

04 What are the growth drivers of the global private LTE market?

The global private LTE market is driven by the increasing deployment in industrial sectors, rising demand for secure communication in public safety, and the expansion of IoT and smart city initiatives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.