Global Protein Bar Market Outlook to 2030

Region:Global

Author(s):Mukul Soni

Product Code:KROD11118

December 2024

86

About the Report

Global Protein Bar Market Overview

- The global protein bar market, valued at USD 4.70 billion, is driven by rising health consciousness, the popularity of on-the-go nutrition, and increased demand for protein-enriched snacks. An analysis of market dynamics highlights the influence of consumers seeking balanced diets with high-protein content, driven by growing fitness trends. This demand for nutritional convenience has led to an upsurge in new flavors, organic, and clean-label offerings from both established brands and new entrants, boosting market growth.

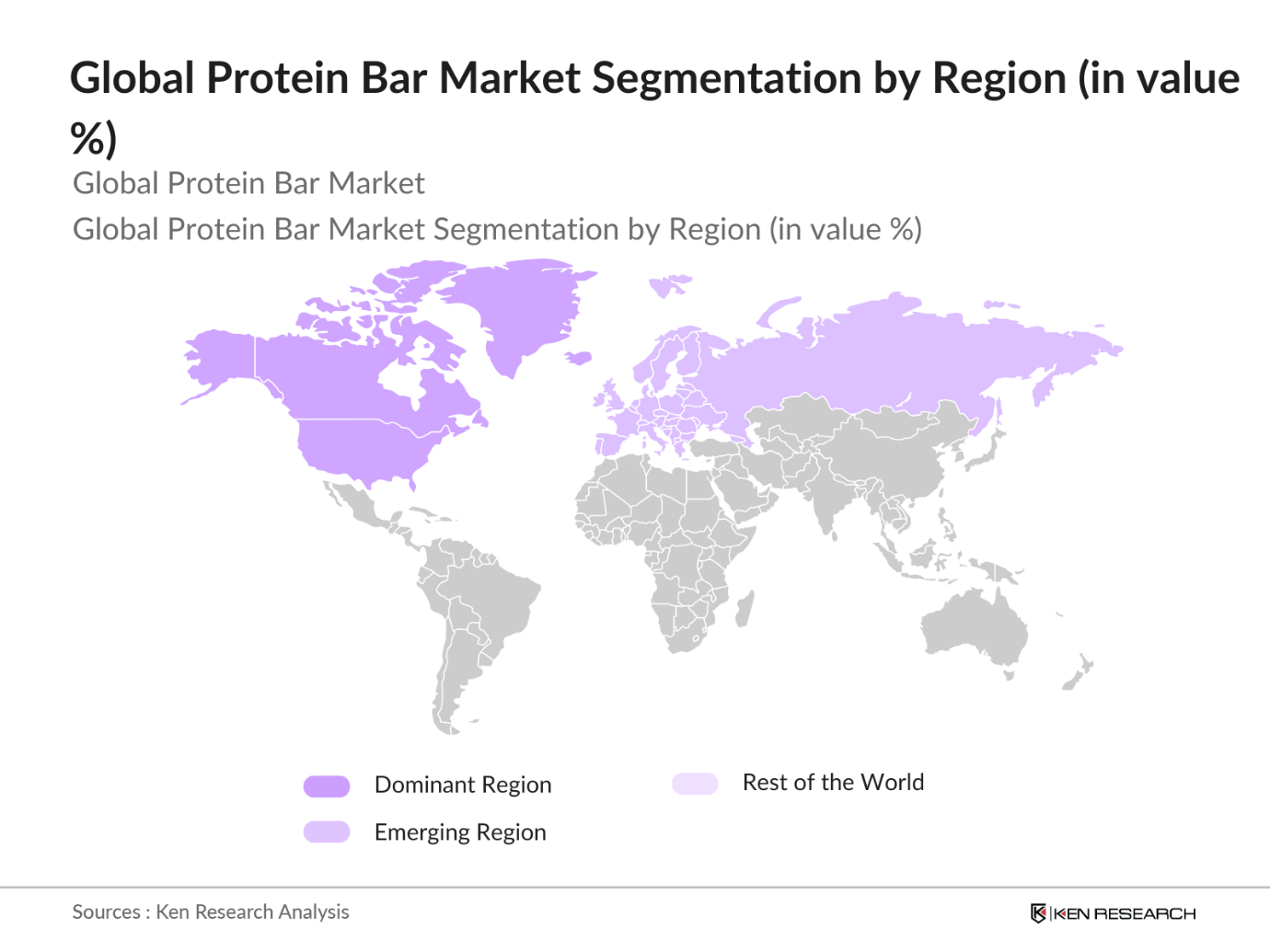

- The market is predominantly led by North America and Europe, driven by high consumer awareness regarding health and fitness, a well-established retail sector, and product innovation. In North America, protein bars have become a staple among fitness enthusiasts and busy professionals, with brands like Clif Bar and Quest Nutrition enjoying widespread recognition. Meanwhile, Europes focus on sustainable, organic products has propelled the popularity of plant-based protein bars, aligning with consumer values around health and the environment.

- In the U.S., the FDA enforces strict guidelines on nutritional labeling for protein bars, requiring manufacturers to disclose exact protein, fat, sugar, and calorie contents. Recent FDA reports indicate that over 1,000 products were re-labeled or recalled in the past two years to ensure compliance with these standards, demonstrating the stringent regulatory environment for food products.

Global Protein Bar Market Segmentation

By Product Type: The protein bar market is segmented by product type into Snack Bars, Meal Replacement Bars, Energy Bars, and Low-Calorie Bars. Snack bars dominate the market due to their versatility, convenience, and widespread popularity among both fitness enthusiasts and general consumers. Major brands offer snack bars in a variety of flavors and protein sources to cater to the growing trend of healthy snacking.

By Region: The regional segmentation covers North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America leads due to a mature market with high per capita consumption and a well-established distribution network. High consumer awareness, along with an increased focus on fitness and health, has positioned North America as the top region for protein bar consumption. Additionally, innovative marketing strategies by companies in this region reinforce this dominant position.

By Protein Source: The protein source segment includes Animal-Based, Plant-Based, and Mixed Protein Sources. Plant-based protein bars are gaining a larger share, driven by the rise in vegan and environmentally conscious consumers. Brands are increasingly adopting plant-based ingredients like pea protein, almond, and chia seeds, offering sustainable options that align with shifting consumer preferences toward health and ethical consumption.

Global Protein Bar Market Competitive Landscape

The global protein bar market is highly competitive, with several key players dominating through strong brand loyalty, distribution networks, and continuous product innovation. Key companies leverage consumer trends, introducing new flavors, ingredients, and sustainable options to capture a wider audience.

Global Protein Bar Industry Analysis

Growth Drivers

- Rising Health Awareness: Growing global health consciousness has led to increased demand for protein bars as healthy snack options. According to the World Health Organization, the prevalence of lifestyle-related diseases has risen by over 200 million cases globally, driving individuals toward preventive health measures and balanced diets. Protein bars, with high protein content, align with these health goals, as they offer a convenient nutrient source for individuals aiming to manage their weight and muscle health. This trend is particularly strong in the U.S., where over 150 million people reported actively seeking healthier eating options

- Increasing Demand for Convenience Foods: As global urbanization intensifies, the need for convenient, nutritious foods has surged. The United Nations reports that over 4.4 billion people now live in urban areas, leading to busier lifestyles and higher demand for convenient nutrition sources like protein bars. Moreover, as full-time employment continues to dominate urban areas, demand for on-the-go, nutrient-rich snacks is accelerating. In Japan, for example, approximately 67 million people in the workforce seek convenient meal options regularly, supporting demand for protein bars.

- Growth of Fitness and Wellness Industry: The expanding fitness and wellness industry has been a significant driver for protein bar consumption. World Bank data indicates an 8% increase in global gym memberships since 2022, with over 200 million people now enrolled worldwide. Protein bars offer a practical solution for individuals seeking post-workout protein intake to support muscle recovery and energy replenishment. In regions such as North America and Western Europe, where the fitness industry is well-established, protein bars have become a staple among fitness enthusiasts.

Market Restraints

- High Production Costs: The protein bar market faces challenges from high production costs, as the prices of protein-rich ingredients such as nuts and whey have escalated. According to the U.S. Department of Agriculture, the cost of almonds alone rose by 13% over the past two years, impacting the overall production expenses for protein bars. These increased costs strain manufacturers' profit margins and contribute to higher retail prices, potentially limiting demand among price-sensitive consumers

- Regulatory Hurdles: Navigating complex food safety and labeling regulations remains a challenge for protein bar manufacturers. In the EU, the European Food Safety Authority enforces stringent guidelines on ingredient transparency, allergen labeling, and nutrition claims, complicating market entry for new products. The FDA in the United States similarly mandates rigorous testing and approval processes, with recent reports showing over 500 products delayed or rejected due to non-compliance with nutritional labeling standards.

Global Protein Bar Market Future Outlook

The protein bar market is expected to witness strong growth, propelled by expanding health and wellness trends, innovation in flavor and ingredient profiles, and an increase in vegan and plant-based offerings. The expansion of e-commerce is further anticipated to support growth by enabling wider product reach, especially in emerging markets where access to health foods is increasing.

Market Opportunities

- Innovation in Flavor and Ingredients: Opportunities abound in the protein bar market for innovation in flavor and ingredients, appealing to the increasingly diverse consumer base. The USDA notes a 5% annual increase in demand for unique flavors and clean-label ingredients, indicating a substantial market for bars made with natural sweeteners, exotic flavors, and functional additives like fiber and probiotics. Countries such as the U.S. and Germany are showing significant uptake in such innovations, leading to market expansion and consumer satisfaction.

- Expansion in Emerging Markets: Emerging markets, particularly in Asia and Latin America, present substantial growth opportunities for the protein bar industry. The United Nations reports a 12% annual increase in disposable income across several emerging economies, allowing consumers to spend more on health-oriented products. In countries like India, where urbanization is rapidly growing, the demand for convenient, nutritious snacks such as protein bars is expanding due to increased health awareness and changing dietary preferences.

Scope of the Report

|

By Product Type |

Snack Bars |

|

By Protein Source |

Animal-Based |

|

By Distribution Channel |

Supermarkets/Hypermarkets |

|

By Flavor |

Chocolate |

|

By Region |

North America |

Products

Key Target Audience

Health and Wellness Brands

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., FDA, USDA)

Online Retailers and E-commerce Platforms

Gym and Fitness Chains

Food and Beverage Distributors

Specialty Nutrition Retailers

Organic and Plant-Based Food Manufacturers

Companies

Players Mentioned in the Report:

Quest Nutrition

Clif Bar & Company

RXBAR

Kind LLC

Premier Protein

Optimum Nutrition

General Mills

PowerBar

MusclePharm

Kellogg's

PepsiCo Inc.

The Simply Good Foods Company

ThinkThin, LLC

Labrada Nutrition

Abbott Nutrition

Table of Contents

1. Global Protein Bar Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Protein Bar Market Size (in USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Protein Bar Market Analysis

3.1. Growth Drivers

3.1.1. Rising Health Awareness

3.1.2. Increasing Demand for Convenience Foods

3.1.3. Growth of Fitness and Wellness Industry

3.1.4. Shift Toward Plant-Based Proteins

3.2. Market Challenges

3.2.1. High Production Costs

3.2.2. Regulatory Hurdles

3.2.3. Flavor and Texture Limitations

3.3. Opportunities

3.3.1. Innovation in Flavor and Ingredients

3.3.2. Expansion in Emerging Markets

3.3.3. Increasing Online Sales Channels

3.4. Trends

3.4.1. Demand for Clean Label Products

3.4.2. Functional and Nutritional Innovations

3.4.3. Expansion of Vegan and Organic Protein Bars

3.5. Regulatory Landscape

3.5.1. FDA Guidelines on Nutritional Labeling

3.5.2. Allergen Regulations

3.5.3. Labeling Requirements for Protein Claims

3.5.4. Organic and Non-GMO Certifications

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Global Protein Bar Market Segmentation

4.1. By Product Type (in Value %)

4.1.1. Snack Bars

4.1.2. Meal Replacement Bars

4.1.3. Energy Bars

4.1.4. Low-Calorie Bars

4.2. By Protein Source (in Value %)

4.2.1. Animal-Based

4.2.2. Plant-Based

4.2.3. Mixed Protein Sources

4.3. By Distribution Channel (in Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Online Stores

4.3.3. Specialty Stores

4.3.4. Convenience Stores

4.4. By Flavor (in Value %)

4.4.1. Chocolate

4.4.2. Fruits

4.4.3. Nuts & Seeds

4.4.4. Mixed Flavors

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Protein Bar Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Quest Nutrition

5.1.2. Clif Bar & Company

5.1.3. RXBAR

5.1.4. Kind LLC

5.1.5. Optimum Nutrition

5.1.6. Abbott Nutrition

5.1.7. General Mills

5.1.8. Premier Protein

5.1.9. PowerBar

5.1.10. MusclePharm

5.1.11. Kellogg's

5.1.12. PepsiCo Inc.

5.1.13. The Simply Good Foods Company

5.1.14. ThinkThin, LLC

5.1.15. Labrada Nutrition

5.2 Cross Comparison Parameters (Production Capacity, Product Range, Nutritional Value per Bar, Revenue, No. of Flavors, R&D Investments, Market Presence, Certification Standards)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Support and Grants

5.9 Private Equity Investments

6. Global Protein Bar Market Regulatory Framework

6.1 Nutritional and Health Claims Regulations

6.2 Labeling and Packaging Standards

6.3 Allergen Labeling Requirements

6.4 Certification and Compliance Procedures

7. Global Protein Bar Future Market Size (in USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Protein Bar Future Market Segmentation

8.1 By Product Type (in Value %)

8.2 By Protein Source (in Value %)

8.3 By Distribution Channel (in Value %)

8.4 By Flavor (in Value %)

8.5 By Region (in Value %)

9. Global Protein Bar Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Consumer Demographic Insights

9.3 Branding and Marketing Strategies

9.4 Innovation and Product Development Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves building an ecosystem map for the protein bar market, identifying key stakeholders such as manufacturers, retailers, and consumers. The process includes in-depth desk research across proprietary databases to map out primary market drivers and barriers.

Step 2: Market Analysis and Construction

We analyze historical market data, focusing on the distribution channels, pricing strategies, and consumer preferences. This step includes data validation to ensure accuracy and comprehensiveness in revenue estimates and market size assessments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through interviews with industry experts, including executives from leading protein bar manufacturers. This expert feedback provides nuanced insights, enhancing data reliability and market understanding.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing insights from extensive qualitative and quantitative research. This includes the consolidation of primary data sources and expert input, ensuring a comprehensive and validated analysis of the global protein bar market.

Frequently Asked Questions

01. How big is the global protein bar market?

The global protein bar market is valued at USD 4.70 billion, driven by increasing consumer health consciousness and demand for convenient nutrition options.

02. What are the primary challenges in the protein bar market?

Challenges in the protein bar market include high production costs, intense competition, and strict regulatory requirements related to nutritional labeling and ingredient sourcing.

03. Who are the major players in the global protein bar market?

Key players in the market include Quest Nutrition, Clif Bar & Company, RXBAR, Kind LLC, and Premier Protein, who lead with strong brand loyalty and wide distribution networks.

04. What factors are driving growth in the protein bar market?

Growth is driven by consumer preference for high-protein snacks, product innovation in flavors and ingredients, and the rising popularity of vegan and plant-based options.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.