Global Psychedelic Drugs Market Outlook to 2030

Region:Global

Author(s):Mukul

Product Code:KROD8432

October 2024

85

About the Report

Global Psychedelic Drugs Market Overview

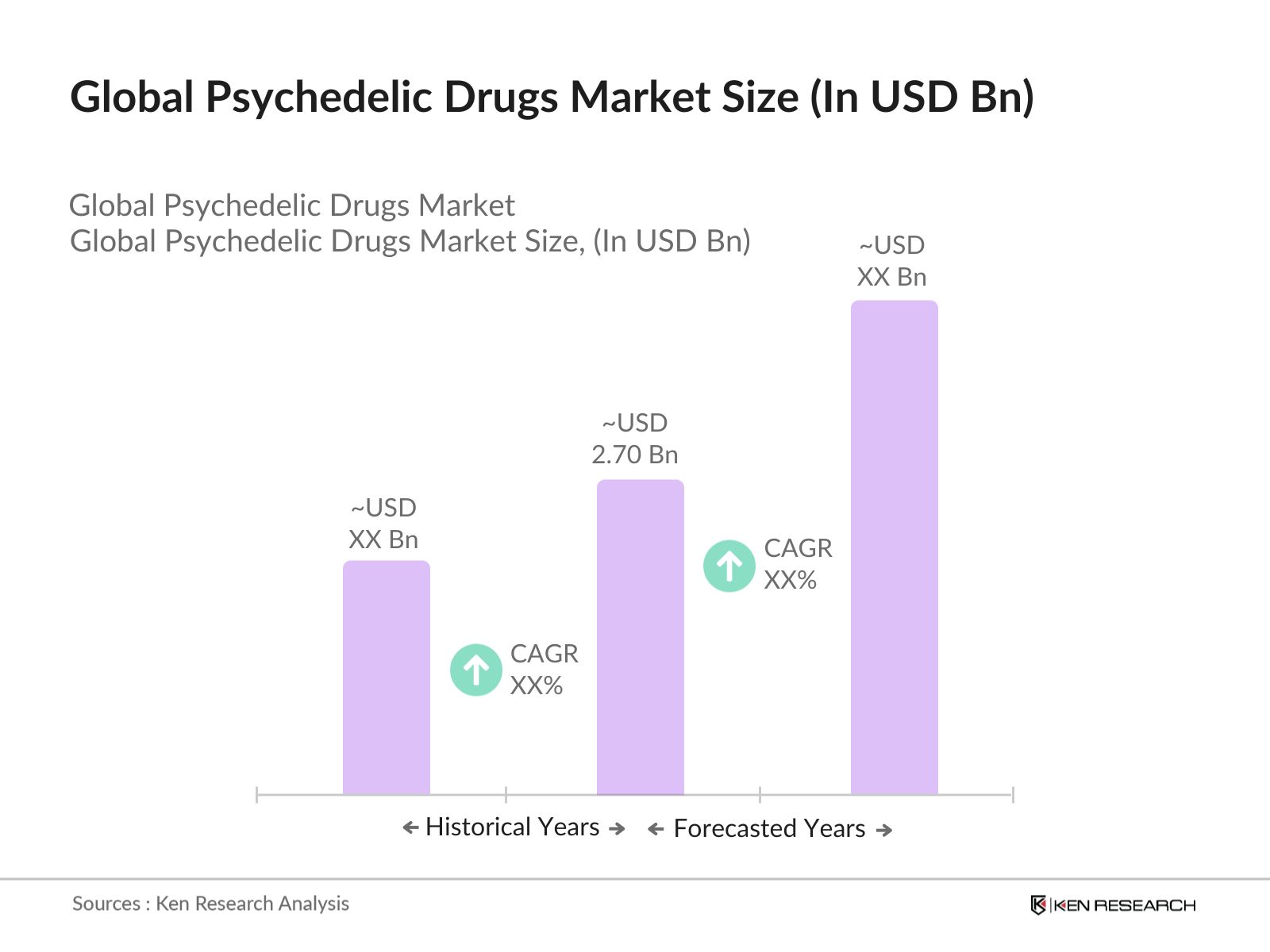

- The global psychedelic drugs market is valued at USD 2.70 billion, driven by rising acceptance of psychedelic treatments for mental health disorders such as depression, PTSD, and anxiety. Increased government support for clinical trials and research into therapeutic applications is further contributing to market growth. Recent clinical studies and medical research, including approval for specific treatments, have led to greater acceptance among medical professionals. The growing prevalence of mental health issues globally has created a heightened demand for alternative therapies, including psychedelics, which are now being increasingly recognized for their therapeutic potential.

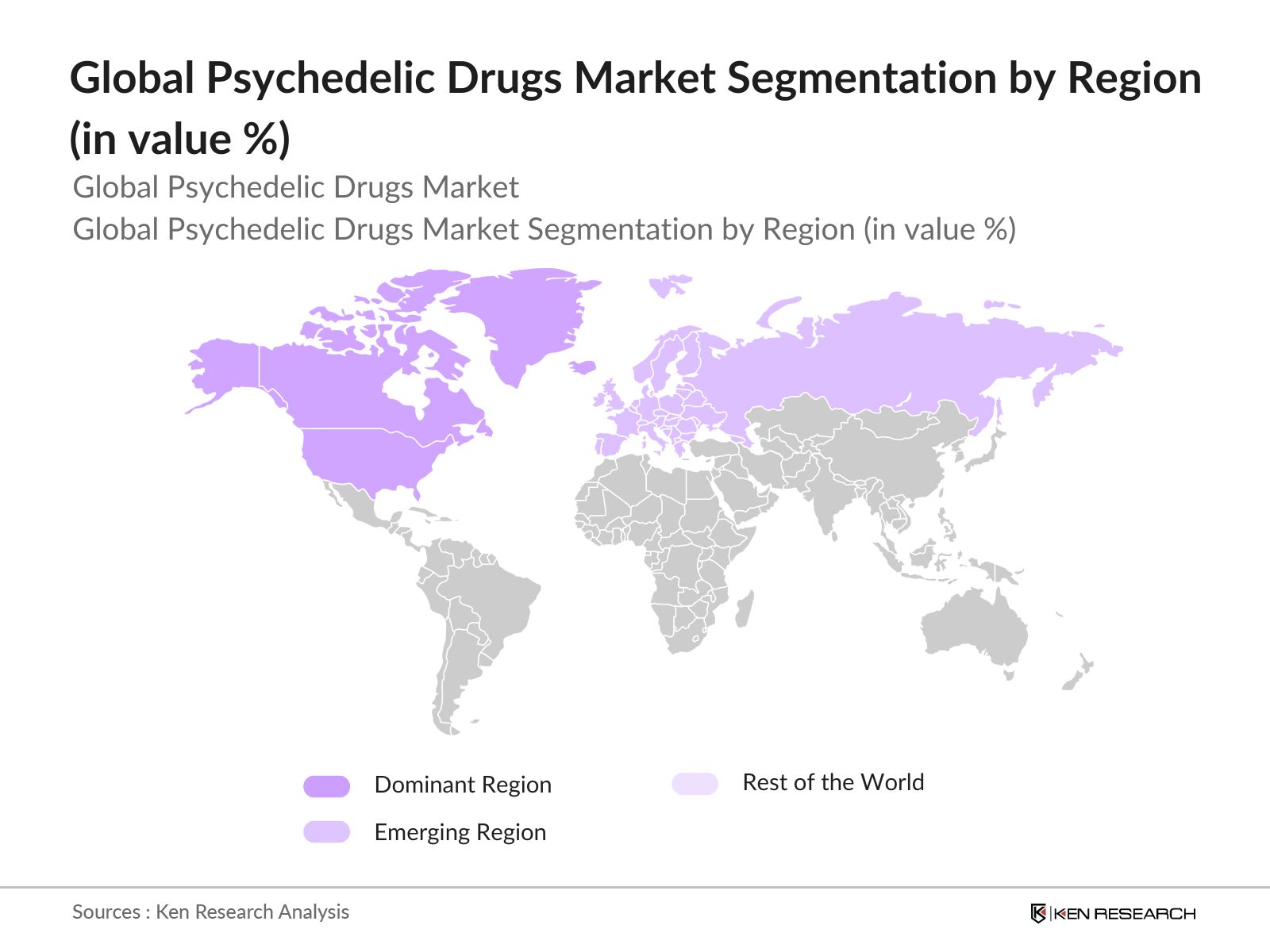

- The market is primarily dominated by North America and Europe, due to regulatory advancements and robust healthcare infrastructure supporting clinical trials and drug development. In North America, the U.S. leads the market due to the rising acceptance of mental health treatments and legalization of psychedelic substances for medical use in several states. Meanwhile, countries like Canada have been early adopters of legal frameworks, allowing for the commercialization and use of psychedelics in medical settings. In Europe, the UK has been a key player, owing to its progressive stance on psychedelic research.

- The Drug Enforcement Administration (DEA) plays a pivotal role in regulating psychedelic substances under the Controlled Substances Act (CSA). In 2023, the DEA rescheduled certain psychedelics, including MDMA, from Schedule I to Schedule II, allowing for broader medical use under controlled conditions. The shift in classification has encouraged more clinical research while maintaining strict oversight of drug distribution. Legislative controls like the CSA ensure that psychedelic drugs are used safely and ethically in medical settings.

Global Psychedelic Drugs Market Segmentation

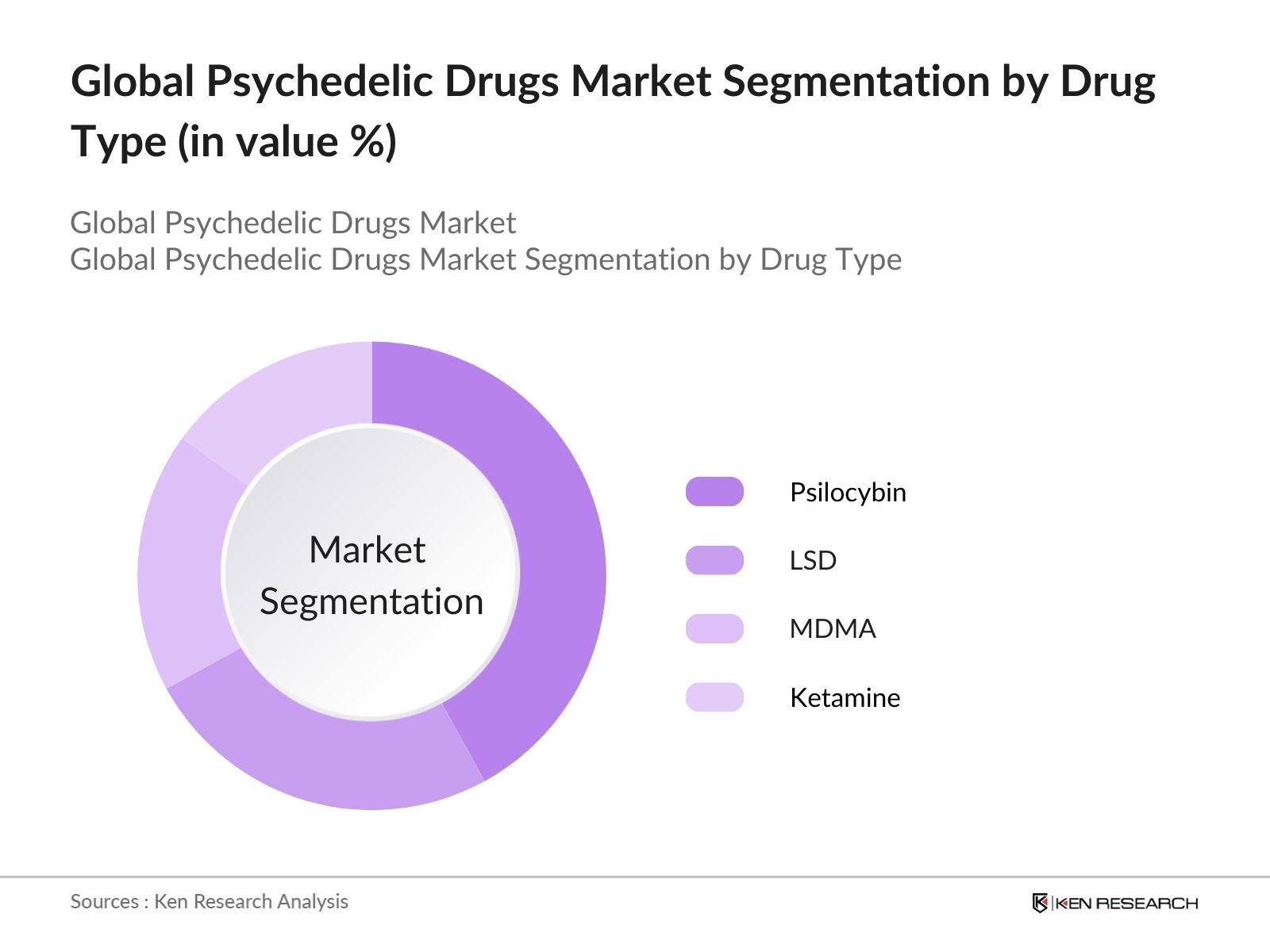

- By Drug Type: The global psychedelic drugs market is segmented by drug type into LSD, Psilocybin, MDMA, Ketamine, and others like DMT and Mescaline. Among these, Psilocybin holds a dominant share in 2023, due to its wide usage in treating depression and anxiety. Recent FDA approvals for clinical trials, alongside ongoing research, have accelerated Psilocybins position in therapeutic treatments. Psilocybin is seen as a safer and more effective option compared to other psychedelics, with a broad range of clinical applications.

- By Region: The market is geographically segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads the market with a significant share due to the supportive legal frameworks, higher investment in psychedelic research, and widespread acceptance of alternative mental health treatments. The U.S. in particular has seen significant advances in clinical trials and is home to many of the key players driving innovation in the psychedelic space.

- By Application: The psychedelic drugs market is segmented by application into depression, PTSD, addiction treatment, anxiety disorders, and others (such as OCD and eating disorders). Depression dominates the application segment in 2023, owing to the increasing prevalence of treatment-resistant depression cases. Psilocybin and ketamine-based therapies have shown significant promise in treating patients who do not respond to traditional antidepressants, leading to its dominance in this segment.

Global Psychedelic Drugs Market Competitive Landscape

The global psychedelic drugs market is dominated by a combination of established pharmaceutical companies and emerging biotech firms, contributing to an increasingly competitive landscape. Key players include COMPASS Pathways, MindMed, and ATAI Life Sciences, all of which are leading clinical trials and drug development. These companies are shaping the market through collaborations with academic institutions and strategic partnerships to advance clinical research and product development.

|

Company |

Establishment Year |

Headquarters |

No. of Employees |

Clinical Trials (No.) |

Revenue (USD M) |

Partnerships |

FDA Approvals |

R&D Investments |

Global Reach |

|

COMPASS Pathways |

2016 |

London, UK |

|||||||

|

MindMed (Mind Medicine) |

2019 |

New York, USA |

|||||||

|

ATAI Life Sciences |

2018 |

Berlin, Germany |

|||||||

|

Numinus Wellness |

2019 |

Vancouver, Canada |

|||||||

|

Seelos Therapeutics |

2016 |

New York, USA |

Global Psychedelic Drugs Industry Analysis

Growth Drivers

- Growing Acceptance of Mental Health Treatments (Increase in Mental Health Awareness): The global rise in mental health awareness has increased demand for innovative treatments, including psychedelic drugs. In 2023, 970 million people worldwide were reported to suffer from mental health issues, such as depression and anxiety, based on World Bank data. Mental health disorders are becoming a primary focus of global healthcare systems, with governments allocating significant funding. For instance, the U.S. government increased mental health funding by $4 billion in 2023 to support innovative treatments, including psychedelics, as part of its overall strategy to tackle the mental health crisis.

- Rise in Clinical Trials and Medical Research (Pharmaceutical Advancements): Pharmaceutical advancements in psychedelic drugs are accelerating, with numerous clinical trials underway globally. In 2023, the U.S. National Institutes of Health (NIH) invested over $50 million in psychedelic drug research aimed at mental health treatments, focusing on conditions like PTSD, depression, and substance use disorders. Additionally, the UK initiated over 35 clinical trials focusing on psychedelics in 2023, reinforcing global momentum in this area of drug development. This surge in research funding highlights the growing interest in pharmaceutical advancements in psychedelic drugs.

- Government Regulatory Approvals (FDA Approvals, Legalization Policies): Government regulatory approvals are crucial to the growth of the psychedelic drugs market. In 2023, the U.S. FDA granted breakthrough therapy status to several psychedelic compounds, expediting their research and approval process. Furthermore, in Canada, the federal government authorized more than 300 exemptions for therapeutic use of psychedelics, reflecting a shift towards regulatory acceptance. Legalization policies in countries like Australia, where psychedelic-assisted therapy for PTSD and depression became legal in 2023, are expected to fuel market growth.

Global Psychedelic Drugs Market Future Outlook

Over the next five years, the global psychedelic drugs market is expected to see significant growth driven by the increasing acceptance of mental health treatments, expanding clinical trials, and growing governmental support for psychedelic research. The markets trajectory is influenced by advancements in drug development, the relaxation of regulatory barriers, and the increasing availability of treatment options for previously untreatable mental health conditions.

Market Restraints

- Stringent Regulatory Requirements (Drug Approval Processes): Despite advancements in research, stringent regulatory requirements pose challenges to the commercialization of psychedelic drugs. The U.S. FDA requires multiple phases of clinical trials that can take over a decade to complete. On average, drug approval costs range from $1 billion to $2.6 billion due to extensive testing and compliance with safety standards. Similarly, in the European Union, the European Medicines Agency mandates rigorous clinical protocols, making it difficult for companies to bring new psychedelic drugs to market.

- Social and Ethical Concerns (Stigmatization, Ethical Trials): Social stigma and ethical concerns related to psychedelic drugs remain significant barriers to market expansion. Despite increasing acceptance, a 2022 report by the National Institute of Mental Health (NIMH) indicated that over 35% of the U.S. population still viewed psychedelic drugs negatively due to their association with recreational drug use. Furthermore, ethical concerns regarding human trials, especially with vulnerable populations like mental health patients, are prevalent. This hesitancy complicates efforts to integrate psychedelics into mainstream treatment options.

Scope of the Report

|

By Drug Type |

LSD, Psilocybin, MDMA, Ketamine, Others |

|

By Application |

Depression, PTSD, Addiction, Anxiety, Others |

|

By Route of Administration |

Oral, Intranasal, Intravenous |

|

By Distribution Channel |

Hospitals, Clinics, Pharmacies, Research Institutes |

|

By Region |

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Products

Key Target Audience

Mental Health Clinics and Therapists

Pharmaceutical Companies

Psychedelic Research Institutions

Government Agencies (e.g., FDA, DEA)

Hospitals and Medical Centers

Venture Capital Firms and Investors

Healthcare Providers

Regulatory and Licensing Bodies (e.g., EMA, WHO)

Companies

Players Mentioned in the Report:

COMPASS Pathways

MindMed (Mind Medicine Inc.)

ATAI Life Sciences

Numinus Wellness

Seelos Therapeutics

GH Research

Cybin Inc.

Field Trip Health

Beckley Psytech

Awakn Life Sciences

Delix Therapeutics

Small Pharma Inc.

Eleusis Ltd.

Revive Therapeutics

Janssen Pharmaceuticals (Johnson & Johnson)

Table of Contents

1. Global Psychedelic Drugs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Psychedelic Drugs Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Psychedelic Drugs Market Analysis

3.1. Growth Drivers

3.1.1. Growing Acceptance of Mental Health Treatments (Increase in Mental Health Awareness)

3.1.2. Rise in Clinical Trials and Medical Research (Pharmaceutical Advancements)

3.1.3. Government Regulatory Approvals (FDA Approvals, Legalization Policies)

3.1.4. Expanding Therapeutic Applications (Mental Health, PTSD, Addiction Treatment)

3.2. Market Challenges

3.2.1. Stringent Regulatory Requirements (Drug Approval Processes)

3.2.2. Social and Ethical Concerns (Stigmatization, Ethical Trials)

3.2.3. High Research and Development Costs (Capital Investment, ROI Challenges)

3.3. Opportunities

3.3.1. Expansion into Untapped Markets (Emerging Markets in Asia-Pacific)

3.3.2. Collaborations with Universities and Research Institutes (Research Initiatives)

3.3.3. Potential for Drug Reformulations (New Product Development)

3.4. Trends

3.4.1. Growing Interest in Microdosing (Therapeutic Microdosing for Depression)

3.4.2. Integration with Mental Health Therapies (Psychotherapy and Counseling Partnerships)

3.4.3. Use of AI in Drug Development (AI and ML in Drug Discovery)

3.5. Government Regulations

3.5.1. FDA Guidelines for Psychedelic Research (Clinical Trial Framework)

3.5.2. DEA and Controlled Substances Act (Legislative Controls)

3.5.3. International Regulatory Collaborations (WHO, UN Drug Conventions)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Global Psychedelic Drugs Market Segmentation

4.1. By Drug Type (In Value %)

4.1.1. LSD (Lysergic Acid Diethylamide)

4.1.2. Psilocybin (Magic Mushrooms)

4.1.3. MDMA (3,4-Methylenedioxymethamphetamine)

4.1.4. Ketamine

4.1.5. Others (DMT, Mescaline)

4.2. By Application (In Value %)

4.2.1. Depression

4.2.2. PTSD (Post-Traumatic Stress Disorder)

4.2.3. Addiction Treatment

4.2.4. Anxiety Disorders

4.2.5. Others (Eating Disorders, OCD)

4.3. By Route of Administration (In Value %)

4.3.1. Oral

4.3.2. Intranasal

4.3.3. Intravenous

4.4. By Distribution Channel (In Value %)

4.4.1. Hospitals

4.4.2. Specialty Clinics

4.4.3. Online Pharmacies

4.4.4. Research Institutes

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Psychedelic Drugs Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. COMPASS Pathways

5.1.2. MindMed (Mind Medicine Inc.)

5.1.3. ATAI Life Sciences

5.1.4. GH Research PLC

5.1.5. Cybin Inc.

5.1.6. Seelos Therapeutics

5.1.7. Janssen Pharmaceuticals (Johnson & Johnson)

5.1.8. Numinus Wellness Inc.

5.1.9. Field Trip Health

5.1.10. Revive Therapeutics Ltd.

5.1.11. Beckley Psytech

5.1.12. Awakn Life Sciences

5.1.13. Delix Therapeutics

5.1.14. Eleusis Ltd.

5.1.15. Small Pharma Inc.

5.2. Cross Comparison Parameters (Headquarters, Research Focus, No. of Employees, Funding Rounds, Year of Establishment, Regulatory Approvals, R&D Investments, Global Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Psychedelic Drugs Market Regulatory Framework

6.1. Controlled Substances Classification

6.2. Clinical Trial Compliance Requirements

6.3. Certification and Licensing Processes

7. Global Psychedelic Drugs Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Psychedelic Drugs Future Market Segmentation

8.1. By Drug Type (In Value %)

8.2. By Application (In Value %)

8.3. By Route of Administration (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Global Psychedelic Drugs Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Strategic Partnerships and Collaborations

9.3. White Space Opportunity Analysis

9.4. Market Expansion Strategies

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the psychedelic drugs market, including stakeholders like pharmaceutical companies, research institutions, and healthcare providers. This phase relies heavily on desk research and proprietary databases to understand market dynamics, key trends, and the influence of regulatory frameworks.

Step 2: Market Analysis and Construction

We compile historical data on drug approvals, market penetration, and revenue generation from sales of psychedelic-based treatments. In addition, we assess the ratio of drug manufacturers to healthcare providers offering these therapies, ensuring the accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Expert interviews are conducted via computer-assisted telephone interviews (CATIs) with key players in the psychedelic drug sector. Insights from these interviews are used to validate market hypotheses and refine the overall market outlook.

Step 4: Research Synthesis and Final Output

We engage with psychedelic drug manufacturers to gather data on product sales, clinical trial outcomes, and customer demand. These insights are cross-referenced with data from healthcare providers to provide a comprehensive view of the global psychedelic drugs market.

Frequently Asked Questions

1. How big is the Global Psychedelic Drugs Market?

The global psychedelic drugs market is valued at USD 2.70 billion, driven by the growing use of psychedelics in mental health treatments, including depression, PTSD, and addiction therapy.

2. What are the challenges in the Global Psychedelic Drugs Market?

Challenges include stringent regulations, high R&D costs, and social stigmas surrounding the use of psychedelic substances. Additionally, the limited availability of approved treatments poses a barrier to widespread adoption.

3. Who are the major players in the Global Psychedelic Drugs Market?

Key players include COMPASS Pathways, MindMed, ATAI Life Sciences, and Numinus Wellness. These companies dominate due to their advancements in clinical trials and strong research capabilities.

4. What are the growth drivers of the Global Psychedelic Drugs Market?

Growth is driven by the increasing prevalence of mental health disorders, advancements in drug development, and growing governmental support for psychedelic research and clinical trials.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.