Global Radome Market Outlook to 2030

Region:Global

Author(s):Vijay Kumar

Product Code:KROD4912

December 2024

81

About the Report

Global Radome Market Overview

- The global radome market is valued at USD 2.8 billion, based on a five-year historical analysis. This market is primarily driven by the growing demand for advanced communication systems in aerospace and defense, as well as the adoption of lightweight materials in aircraft construction. Increasing investment in SATCOM (Satellite Communication) and radar systems for both military and commercial aviation further contributes to the market's growth, with radomes playing a critical role in protecting antenna systems from environmental conditions.

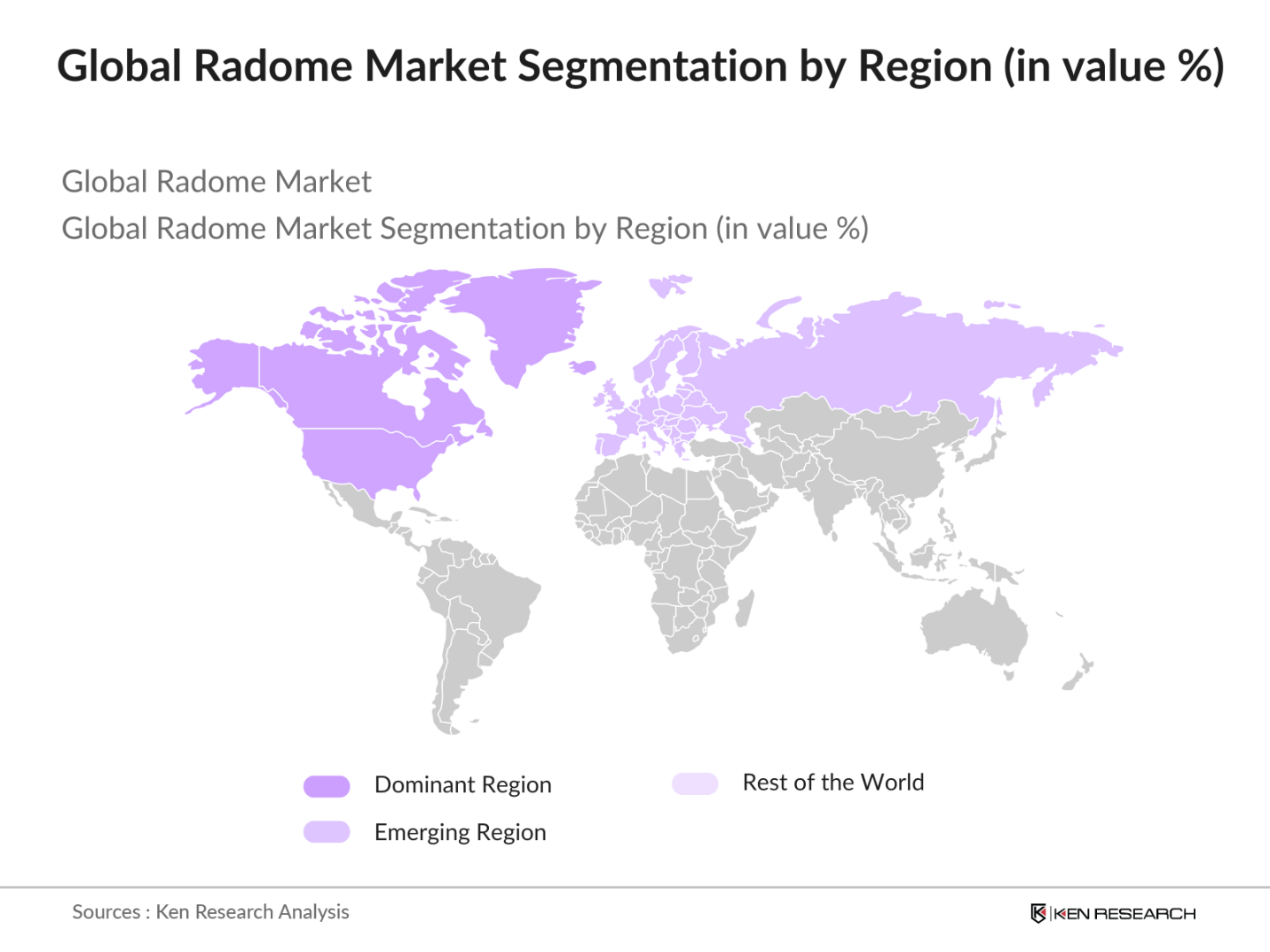

- The radome market is primarily dominated by North America and Europe due to the presence of major aerospace and defense contractors, robust military budgets, and advanced aviation industries. The United States, in particular, leads the market due to its significant investment in defense technologies and the presence of top-tier aerospace companies. Europe follows closely, with strong contributions from the United Kingdom, France, and Germany, driven by military and commercial aircraft production.

- Defense standards for radome materials are critical in ensuring the performance and safety of military aircraft. NATOs Allied Engineering Documentation and Publication (AEDP-3) outlines specific criteria for radome construction, including electromagnetic interference shielding and thermal resistance. In 2023, NATO-member countries implemented stringent testing protocols, requiring all new radomes to meet these updated standards.

Global Radome Market Segmentation

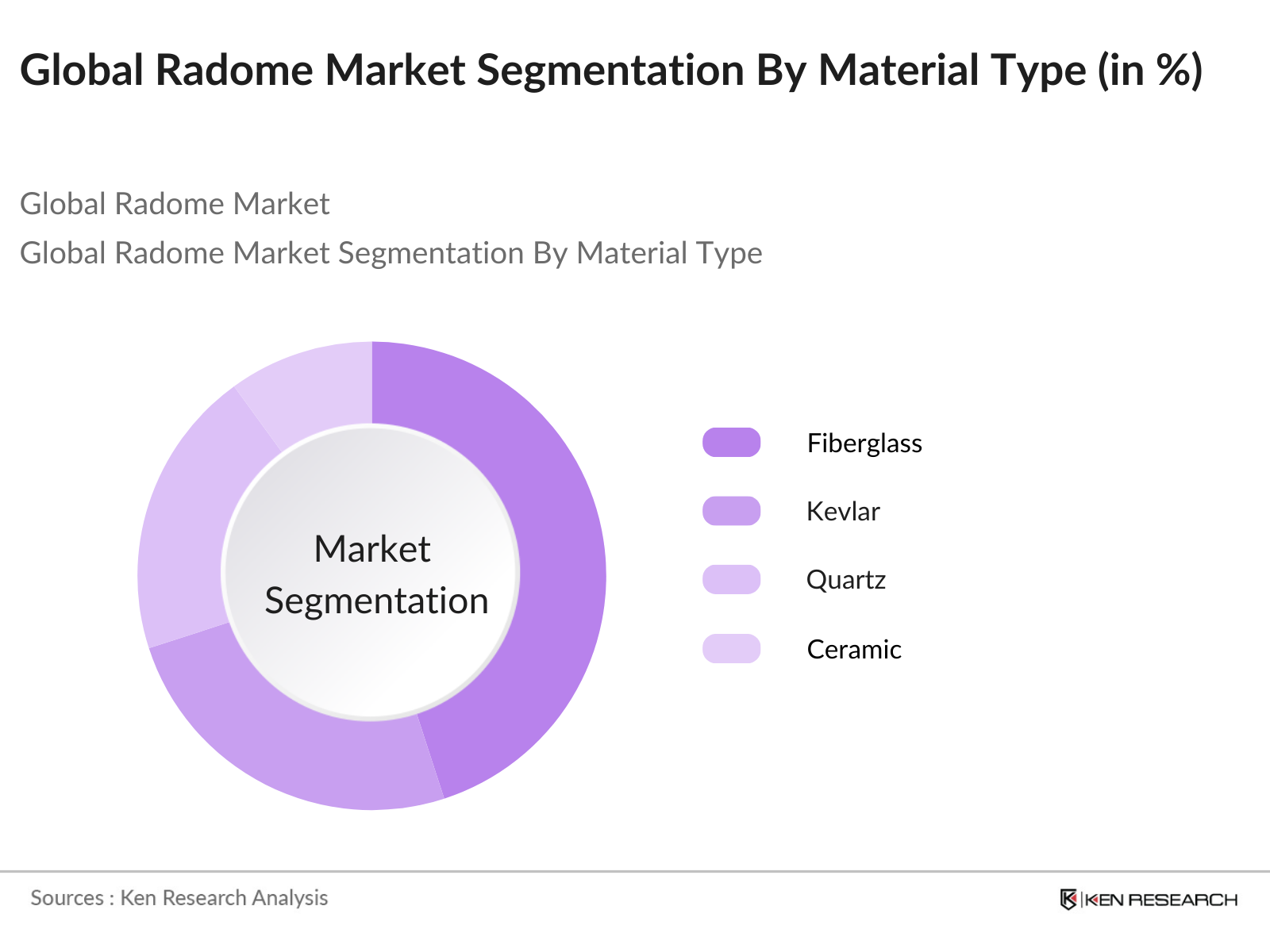

By Material Type: The market is segmented by material type into fiberglass, kevlar, quartz, ceramic, and other composites. Among these, fiberglass holds the dominant market share in 2023 due to its lightweight nature, cost-effectiveness, and widespread use in both military and commercial aircraft radomes. Its ability to withstand high temperatures and electromagnetic interference makes it ideal for aviation applications.

By Application: The market is segmented by application into ground-based radomes, airborne radomes, and maritime radomes. In 2023, airborne radomes dominate the market, driven by the increasing production of commercial and military aircraft, along with the adoption of SATCOM (Satellite Communication) radomes for in-flight connectivity. The growing demand for advanced stealth aircraft has also propelled the usage of radomes in airborne applications.

By Region: The market is segmented by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America. North America leads the market due to significant defense investments and the presence of large aerospace manufacturers such as Boeing and Lockheed Martin. Europe follows as the second-largest region, with key contributors like Airbus and BAE Systems. Asia-Pacific is witnessing substantial growth, primarily driven by increasing defense spending in China and India.

Global Radome Market Competitive Landscape

The global radome market is dominated by a few major players, many of whom specialize in aerospace and defense technologies. The competitive landscape is shaped by innovations in materials and radome designs, as well as strategic partnerships and government contracts.

Global Radome Industry Analysis

Growth Drivers

- Increased Demand for Aircraft Modernization (Military, Commercial): The global push toward modernizing aging military and commercial aircraft fleets is driving significant demand for radomes. According to the International Civil Aviation Organization (ICAO), there are over 23,000 commercial aircraft in operation globally, many of which require updates to avionics and structural components, including radomes. Additionally, military expenditures worldwide increased to $2.1 trillion in 2023, with over 30% of this allocated to modernizing air fleets in nations like the U.S., China, and India.

- Rising Commercial Aviation Sector: The resurgence of commercial aviation post-pandemic is contributing to radome market growth. Data from the International Air Transport Association (IATA) shows that global passenger numbers hit 4.5 billion in 2023, a 3% increase over the previous year. Fleet expansion by major carriers, such as Emirates and Qatar Airways, has led to the purchase of new aircraft, many of which are equipped with advanced radomes for enhanced communication and navigation.

- Military Aircraft Upgrade Programs: Military forces around the world are investing heavily in aircraft upgrade programs to maintain tactical superiority. In 2023, the U.S. Department of Defense allocated $6 billion for aircraft upgrades, including stealth capabilities and radome replacements. Similarly, the European Unions defense spending rose to 228 billion, with substantial investments in modernizing NATO member air fleets.

Market Challenges

- High Manufacturing Costs: Manufacturing radomes is capital-intensive due to the complex materials and technology involved. For instance, fiber-reinforced polymer radomes used in aviation and defense cost an average of $150,000 to produce, according to data from the Aerospace Industries Association (AIA). Additionally, the high cost of raw materials like quartz and ceramics, both of which are essential in advanced radome construction, has further increased production costs.

- Technological Complexity: The technological complexity of modern radomes, particularly those used in stealth and advanced communication systems, is a significant barrier. The integration of low-observable technologies and multi-band signal transmission requires extensive research and development. A 2023 report from the European Space Agency (ESA) highlighted that over 40% of aerospace manufacturers faced delays in radome production due to challenges in material technology.

Global Radome Market Future Outlook

Over the next five years, the global radome market is expected to experience significant growth driven by advancements in stealth technology, rising defense budgets, and increasing demand for SATCOM solutions. Governments across North America, Europe, and Asia are investing heavily in aerospace and defense infrastructure, which is likely to propel the demand for radomes.

Market Opportunities

- Emerging Markets in Asia-Pacific: Emerging economies in the Asia-Pacific region, particularly India and China, present vast opportunities for radome manufacturers. According to the World Bank, Chinas defense budget exceeded $290 billion in 2023, with substantial funds allocated toward modernizing air and space capabilities, including radome technology. India also increased defense spending by $70 billion in 2023, focusing on acquiring advanced radar systems for its air force.

- Advancements in Radome Materials (Ceramic, Quartz): Recent advancements in radome materials, such as the use of ceramic and quartz, offer significant growth opportunities. Ceramic radomes, known for their durability and high-temperature resistance, are becoming increasingly popular in military applications. According to the Defense Advanced Research Projects Agency (DARPA), over 60% of new-generation military aircraft being developed in 2024 are incorporating ceramic radomes.

Scope of the Report

|

Material Type |

Fiberglass Kevlar Quartz Ceramic Other Composites |

|

Application |

Ground-Based Radomes Airborne Radomes Maritime Radomes |

|

Shape |

Spherical Planar Sandwich |

|

End-User Industry |

Aerospace & Defense Telecommunications Automotive Meteorology |

|

Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Aerospace & Defense Contractors

Aircraft Manufacturers

SATCOM and Telecommunications Providers

Government and Regulatory Bodies (FAA, NATO)

Material Suppliers (Composites and Polymers)

Military Procurement Agencies

Investments and Venture Capitalist Firms

Aviation and Telecommunication Equipment Distributors

Companies

Players Mentioned in the Report

General Dynamics Mission Systems

Lockheed Martin Corporation

Saint-Gobain Performance Plastics

Meggitt PLC

Raytheon Technologies Corporation

L-3 Harris Technologies

The NORDAM Group

Cobham PLC

Jenoptik AG

Airbus S.A.S.

Table of Contents

1. Global Radome Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Radome Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Radome Market Analysis

3.1. Growth Drivers

3.1.1. Increased Demand for Aircraft Modernization (Military, Commercial)

3.1.2. Rising Commercial Aviation Sector

3.1.3. Military Aircraft Upgrade Programs

3.1.4. Increased Adoption in 5G and SATCOM (Satellite Communication)

3.2. Market Challenges

3.2.1. High Manufacturing Costs

3.2.2. Technological Complexity

3.2.3. Stringent Certification Regulations

3.3. Opportunities

3.3.1. Emerging Markets in Asia-Pacific

3.3.2. Advancements in Radome Materials (Ceramic, Quartz)

3.3.3. Integration with UAVs (Unmanned Aerial Vehicles)

3.4. Trends

3.4.1. Development of Advanced Stealth Radomes

3.4.2. Increased Use of Composite Materials (Fiber-Reinforced Polymers)

3.4.3. Lightweight Radome Solutions for Commercial Aircraft

3.5. Government Regulations

3.5.1. Defense Standards for Radome Materials (NATO, FAA Regulations)

3.5.2. Certification Requirements for Civil Aircraft Radomes

3.5.3. Spectrum Allocation for SATCOM and 5G Applications

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Global Radome Market Segmentation

4.1. By Material Type (In Value %)

4.1.1. Fiberglass

4.1.2. Kevlar

4.1.3. Quartz

4.1.4. Ceramic

4.1.5. Other Composites

4.2. By Application (In Value %)

4.2.1. Ground-Based Radomes

4.2.2. Airborne Radomes

4.2.3. Maritime Radomes

4.3. By Shape (In Value %)

4.3.1. Spherical

4.3.2. Planar

4.3.3. Sandwich

4.4. By End-User Industry (In Value %)

4.4.1. Aerospace & Defense

4.4.2. Telecommunications (SATCOM, 5G)

4.4.3. Automotive

4.4.4. Meteorology

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East & Africa

4.5.5. Latin America

5. Global Radome Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. General Dynamics Mission Systems

5.1.2. Lockheed Martin Corporation

5.1.3. Saint-Gobain Performance Plastics

5.1.4. Meggitt PLC

5.1.5. Raytheon Technologies Corporation

5.1.6. L-3 Harris Technologies

5.1.7. The NORDAM Group

5.1.8. Cobham PLC

5.1.9. Jenoptik AG

5.1.10. Airbus S.A.S.

5.1.11. CPI International

5.1.12. Ball Aerospace

5.1.13. BAE Systems PLC

5.1.14. Kaman Corporation

5.1.15. Airtech International

5.2. Cross Comparison Parameters (Employees, Headquarters, Revenue, Market Presence, Radome Specialization, Recent Contracts, Regional Operations, Material Innovation)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers & Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Radome Market Regulatory Framework

6.1. Aviation and Defense Material Standards

6.2. Compliance Requirements for Telecommunication Radomes

6.3. Certification and Quality Assurance Processes

7. Global Radome Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Radome Market Future Segmentation

8.1. By Material Type (In Value %)

8.2. By Application (In Value %)

8.3. By Shape (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Global Radome Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process begins with mapping out the key stakeholders within the global radome market. Extensive secondary research is conducted using industry databases and proprietary resources to identify the main variables affecting market trends and dynamics.

Step 2: Market Analysis and Construction

In this stage, historical data is gathered and analyzed to assess the market size and growth patterns. The key metrics, such as market penetration rates and technological adoption levels, are evaluated to ensure precise revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through expert interviews using Computer-Assisted Telephone Interviews (CATIs). Industry experts from leading aerospace and defense companies provide insights into market trends and challenges.

Step 4: Research Synthesis and Final Output

Finally, the gathered data is synthesized into actionable insights, with validation conducted through direct engagement with industry stakeholders. This ensures the final report provides a comprehensive and accurate overview of the global radome market.

Frequently Asked Questions

1. How big is the global radome market?

The global radome market is valued at USD 2.8 billion, based on a five-year historical analysis. This market is primarily driven by the growing demand for advanced communication systems in aerospace and defense, as well as the adoption of lightweight materials in aircraft construction.

2. What are the major challenges in the global radome market?

The primary challenges include high manufacturing costs, regulatory hurdles, and the complexity of integrating radomes into advanced stealth aircraft.

3. Who are the major players in the global radome market?

Major players include General Dynamics, Lockheed Martin, Saint-Gobain, Meggitt, and Raytheon Technologies. These companies lead due to their extensive expertise in aerospace and defense radome solutions.

4. What are the key growth drivers of the global radome market?

Key drivers include the rising demand for SATCOM radomes, increased defense budgets, and the development of lightweight, durable materials for radome construction.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.