Region:Global

Author(s):Rebecca

Product Code:KRAA2190

Pages:90

Published On:August 2025

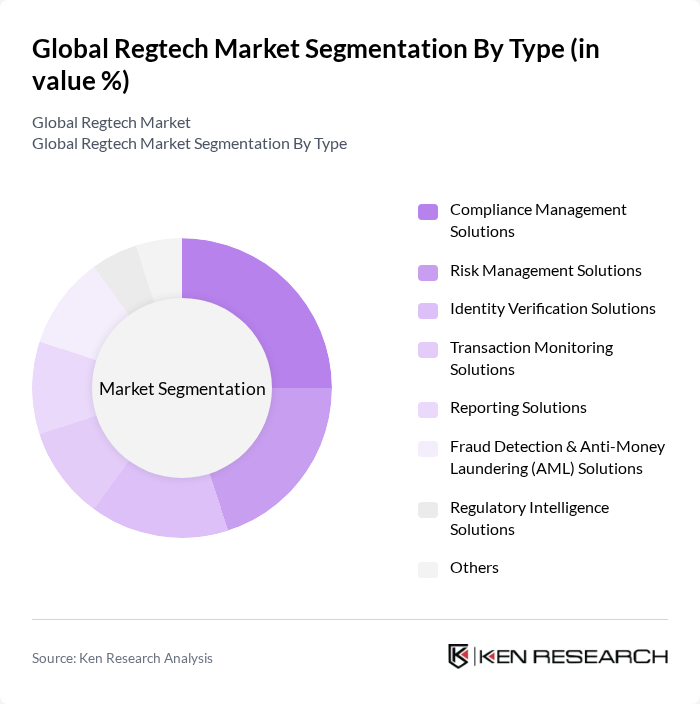

By Type:The market can be segmented into various types of solutions that address diverse regulatory needs. The subsegments include Compliance Management Solutions, Risk Management Solutions, Identity Verification Solutions, Transaction Monitoring Solutions, Reporting Solutions, Fraud Detection & Anti-Money Laundering (AML) Solutions, Regulatory Intelligence Solutions, and Others. Each subsegment plays a critical role in helping organizations meet specific regulatory challenges, with compliance management and risk management solutions leading adoption due to ongoing regulatory scrutiny and the increasing threat of financial crimes .

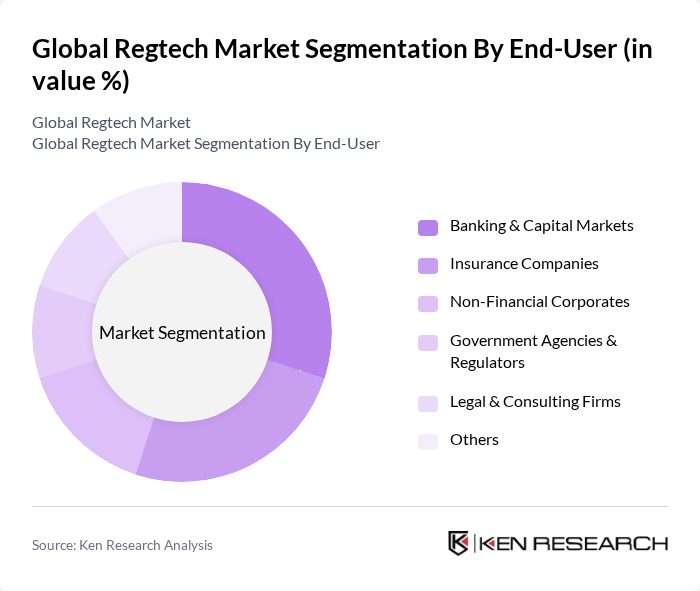

By End-User:The end-user segmentation includes Banking & Capital Markets, Insurance Companies, Non-Financial Corporates, Government Agencies & Regulators, Legal & Consulting Firms, and Others. Each sector faces unique regulatory requirements, driving demand for specialized regtech solutions that improve compliance and operational efficiency. The banking and capital markets segment leads adoption, followed by insurance, as both sectors face heightened regulatory scrutiny and complex compliance obligations .

The Global Regtech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fenergo, ComplyAdvantage, Riskified, NICE Actimize, AxiomSL, SAS Institute, Oracle, Thomson Reuters, Wolters Kluwer, Verafin, Encompass Corporation, Actico, ComplySci, Chainalysis, Trulioo, IBM, MetricStream, Acuant, Ascent, Broadridge Financial Solutions, Deloitte, and FundApps contribute to innovation, geographic expansion, and service delivery in this space.

The Regtech market is poised for significant evolution, driven by technological advancements and increasing regulatory scrutiny. As organizations prioritize compliance and risk management, the integration of AI and machine learning will become more prevalent, enhancing the efficiency of compliance processes. Additionally, the shift towards cloud-based solutions will facilitate scalability and accessibility, allowing firms to adapt quickly to regulatory changes. This dynamic environment presents a fertile ground for innovation and growth in the Regtech sector, particularly in emerging markets.

| Segment | Sub-Segments |

|---|---|

| By Type | Compliance Management Solutions Risk Management Solutions Identity Verification Solutions Transaction Monitoring Solutions Reporting Solutions Fraud Detection & Anti-Money Laundering (AML) Solutions Regulatory Intelligence Solutions Others |

| By End-User | Banking & Capital Markets Insurance Companies Non-Financial Corporates Government Agencies & Regulators Legal & Consulting Firms Others |

| By Application | Regulatory Compliance Risk Assessment & Management Fraud Prevention & Detection Identity Management & KYC Regulatory Reporting & Analytics Transaction Monitoring Data Management Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Customer Size | Large Enterprises Medium Enterprises Small Enterprises |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Institutions Compliance | 100 | Compliance Officers, Risk Managers |

| Fintech Regulatory Solutions | 60 | Product Managers, CTOs |

| Insurance Sector Regtech Adoption | 50 | Regulatory Affairs Specialists, Underwriters |

| AML and KYC Technologies | 70 | AML Compliance Analysts, KYC Officers |

| Data Privacy and Protection Solutions | 40 | Data Protection Officers, IT Security Managers |

The Global Regtech Market is valued at approximately USD 15 billion, driven by the increasing complexity of regulatory requirements and the rapid digital transformation in the financial sector, which necessitates advanced compliance solutions.