Global Relay Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD4965

December 2024

99

About the Report

Global Relay Market Overview

- The global relay market is valued at approximately USD 9.63 billion, driven by the widespread adoption of automation and advancements in power management systems. Relays, essential for controlling circuits in a variety of industries, see growing demand in sectors such as automotive, industrial automation, and energy distribution. The increasing investment in smart grid technologies and the proliferation of electric vehicles (EVs) are pushing demand for more sophisticated relays, especially solid-state and hybrid variants, known for their reliability and efficiency.

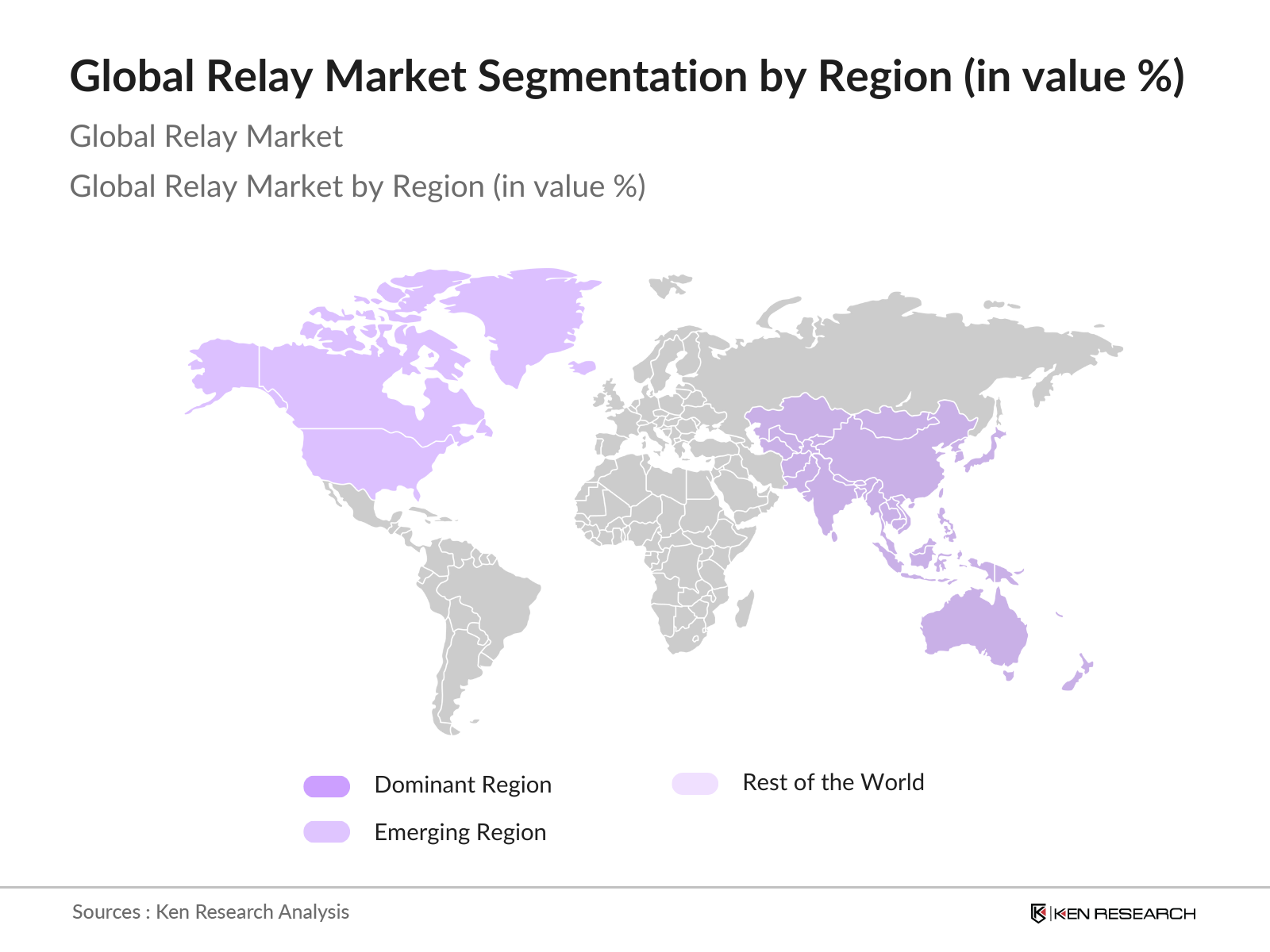

- Countries like the United States, China, and Germany dominate the relay market due to their leadership in industrial automation, renewable energy investments, and advanced transportation infrastructure. The U.S. leads due to its strong automotive industry and technological innovation, while China benefits from its vast manufacturing capabilities and rising adoption of EVs. Germanys dominance stems from its leadership in industrial engineering and renewable energy technologies, particularly in wind and solar power systems.

- Governments worldwide are enforcing strict safety and compliance standards to ensure the reliability and safety of electrical systems. In 2022, the International Electrotechnical Commission (IEC) and the American National Standards Institute (ANSI) established updated guidelines for electrical equipment, including relay systems. These standards ensure that relays meet specific safety and performance criteria, particularly in high-risk industries like energy and transportation. The European Unions Machinery Directive (2006/42/EC) mandates that relay systems used in industrial machinery comply with these standards, significantly boosting demand for compliant relay technologies.

Global Relay Market Segmentation

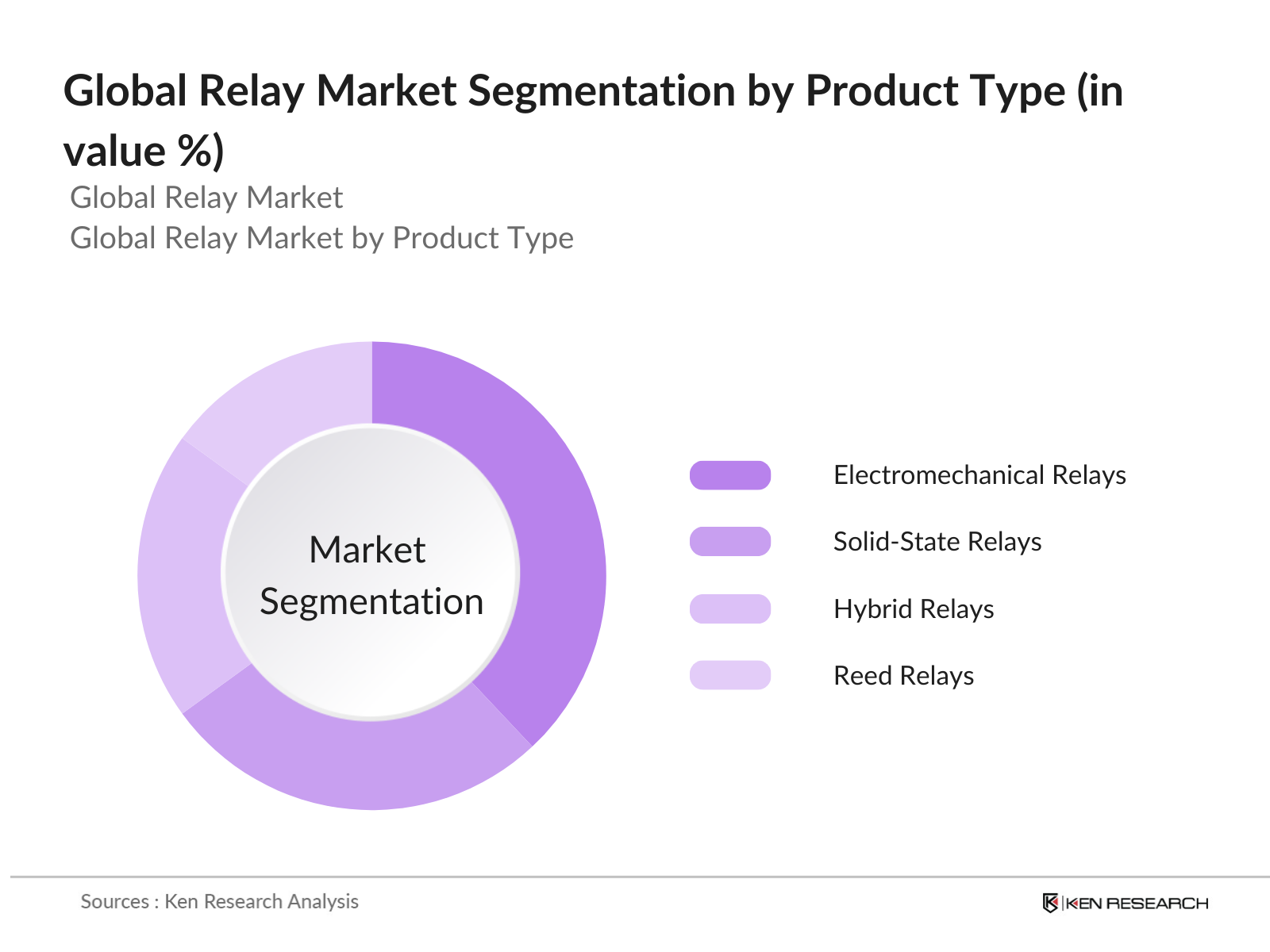

By Product Type: The global relay market is segmented by product type into electromechanical relays, solid-state relays, hybrid relays, and reed relays. Electromechanical relays continue to dominate the market, particularly due to their cost-effectiveness and extensive use in various industrial applications. Their ability to handle high-voltage and high-current applications in sectors such as power generation, transportation, and industrial automation cements their dominance in this segment.

By Region: The global relay market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific leads the relay market with a dominant market share, driven by rapid industrialization, growing energy needs, and the increasing use of electric vehicles. China, Japan, and India are the major contributors to the regions leadership in this segment due to their expanding manufacturing sectors and investments in renewable energy infrastructure.

Global Relay Market Competitive Landscape

The global relay market is highly competitive, with key players driving innovation and market consolidation. The market is dominated by major players such as ABB Ltd., Schneider Electric SE, and TE Connectivity Ltd., who are heavily investing in R&D and expanding their product portfolios to meet evolving industry demands.

|

Company |

Establishment Year |

Headquarters |

Product Innovation |

R&D Investments |

Global Reach |

Manufacturing Capacity |

M&A Activity |

Product Portfolio |

|

ABB Ltd. |

1988 |

Zurich, Switzerland |

||||||

|

Schneider Electric SE |

1836 |

Rueil-Malmaison, France |

||||||

|

TE Connectivity Ltd. |

2007 |

Schaffhausen, Switzerland |

||||||

|

Eaton Corporation |

1911 |

Dublin, Ireland |

||||||

|

Omron Corporation |

1933 |

Kyoto, Japan |

Global Relay Market Analysis

Market Growth Drivers

- Rising Demand for Smart Grids and Energy-Efficient Systems: The transition to smart grids globally is significantly boosting relay usage. The U.S. Department of Energy stated that the countrys grid modernization efforts added over 13,000 relay systems in 2023, focusing on enhancing energy efficiency and load balancing. Similarly, the European Unions Clean Energy for All Europeans package aims to upgrade infrastructure, involving an additional $110 billion investment in 2023 in energy-efficient systems, with relays playing a pivotal role in grid communication and protection systems. These numbers showcase the critical role relays play in the energy transition.

- Adoption in Electric Vehicles (EVs): Electric vehicle (EV) adoption is a major growth driver for relay systems. The International Energy Agency (IEA) reported that 10 million electric vehicles were sold globally in 2022, a figure projected to double by 2025. Relays are integral in EV battery management systems, safeguarding against overheating and current overloads. In China alone, the EV market saw a 1.4 million vehicle surge in 2023, necessitating the integration of advanced relays into electric drivetrains, power distribution units, and charging systems, which are critical for safe operation.

- Expanding Telecom and Data Centers Infrastructure: The rapid expansion of 5G and data centers globally has been a significant driver of relay adoption. As of 2023, the global telecom sector saw a $190 billion investment in 5G infrastructure, according to GSMA. Relays play a crucial role in protecting sensitive telecom equipment from power surges and fluctuations. Similarly, the construction of over 1,200 new data centers globally in 2023 has led to a surge in demand for high-performance relays to ensure uninterrupted power supply. These data center infrastructures rely on relays for efficient power distribution and emergency power backups.

Market Challenges

- High Initial Costs for Advanced Relays: Advanced relays, particularly those integrated with programmable and digital features, come with high upfront costs, limiting their adoption in cost-sensitive industries. For instance, in 2023, the cost of installing advanced relays in a mid-sized industrial setup was reported at approximately $40,000 per unit, as per data from the U.S. Bureau of Labor Statistics. These costs can be prohibitive for small and medium-sized enterprises (SMEs) operating on tight budgets. The challenge is particularly prevalent in developing economies, where businesses prioritize low-cost solutions over advanced technology.

- Competition from Alternative Technologies (Solid-State Relays, Circuit Breakers): Solid-state relays (SSRs) and circuit breakers are posing stiff competition to electromechanical relays due to their higher efficiency, faster response times, and durability. In 2022, the global sales of solid-state relays grew by 7.2 million units, according to data from the International Electrotechnical Commission (IEC). Additionally, circuit breakers are increasingly favored in industrial applications due to their ability to handle higher current loads without mechanical wear. This competition threatens the market share of traditional relay manufacturers, particularly in sectors requiring frequent switching operations.

Global Relay Market Future Outlook

The global relay market is expected to see robust growth over the next five years, driven by the increasing integration of relays in smart grid systems, rising demand for electric vehicles, and rapid industrialization across Asia-Pacific and Latin America. The market will also benefit from advancements in solid-state relay technology, which offers better durability, faster switching times, and greater energy efficiency compared to traditional electromechanical relays.

Market Opportunities:

- Integration of IoT for Remote Monitoring: The integration of Internet of Things (IoT) technology with relay systems is becoming a major trend. IoT-enabled relays allow for remote monitoring and control of electrical systems, which improves efficiency and reduces downtime. In 2023, the International Telecommunication Union (ITU) estimated that over 14 billion IoT devices were connected globally, with significant adoption in industrial and energy sectors. These IoT-enabled relays provide real-time data on electrical loads, fault detection, and system health, offering enhanced capabilities for managing complex electrical networks.

- Development of Environmentally-Friendly, Mercury-Free Relays: There is a growing trend toward the development of environmentally-friendly, mercury-free relays, driven by stricter environmental regulations. According to the European Environmental Agency, mercury-related environmental compliance costs were reduced by over $7.6 billion in 2022 due to the adoption of mercury-free technologies across various industries. Relay manufacturers are responding by developing eco-friendly alternatives that comply with the European Unions Restriction of Hazardous Substances (RoHS) directive. These mercury-free relays are gaining traction in sectors like energy, healthcare, and automotive, where environmental concerns are paramount.

Scope of the Report

|

By Product Type |

Electromechanical Relays Solid-State Relays Hybrid Relays Reed Relays |

|

By Application |

Industrial Automation Automotive and Transportation Energy & Power Telecom and Data Centers |

|

By Voltage |

Low Voltage Medium Voltage High Voltage |

|

By End-User |

Utilities Manufacturing Residential Commercial |

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Relay Manufacturers

Automotive Manufacturers

Industrial Automation Providers

Energy & Power Utilities

Telecom & Data Center Operators

Government & Regulatory Bodies (e.g., International Electrotechnical Commission, IEC)

Investments and Venture Capitalist Firms

Renewable Energy Project Developers

Companies

Players Mention in the Report

ABB Ltd.

Schneider Electric SE

TE Connectivity Ltd.

Eaton Corporation

Omron Corporation

Siemens AG

Rockwell Automation

Mitsubishi Electric Corporation

Honeywell International Inc.

Fujitsu Ltd.

Broadcom Inc.

Legrand SA

Panasonic Corporation

General Electric Company

Xiamen Hongfa Electroacoustic Co., Ltd.

Table of Contents

01. Global Relay Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Growth Projections, Key Milestones)

1.4. Market Segmentation Overview

02. Global Relay Market Size (In USD Bn)

2.1. Historical Market Size (Regional Split, End-User Adoption)

2.2. Year-On-Year Growth Analysis (Market Demand vs. Supply Trends)

2.3. Key Market Developments and Milestones (New Product Launches, Mergers & Acquisitions)

03. Global Relay Market Analysis

3.1. Growth Drivers

3.1.1. Increased Automation in Manufacturing

3.1.2. Rising Demand for Smart Grids and Energy-Efficient Systems

3.1.3. Adoption in Electric Vehicles (EVs)

3.1.4. Expanding Telecom and Data Centers Infrastructure

3.2. Market Challenges

3.2.1. High Initial Costs for Advanced Relays

3.2.2. Competition from Alternative Technologies (Solid-State Relays, Circuit Breakers)

3.2.3. Supply Chain Disruptions Impacting Component Availability

3.3. Opportunities

3.3.1. Growth in Renewable Energy Projects

3.3.2. Expansion in Smart Home Technologies

3.3.3. Innovation in Miniaturized and High-Speed Relays

3.4. Trends

3.4.1. Integration of IoT for Remote Monitoring

3.4.2. Development of Environmentally-Friendly, Mercury-Free Relays

3.4.3. Increase in Digital and Programmable Relays

3.5. Government Regulations

3.5.1. Safety and Compliance Standards (IEC, ANSI)

3.5.2. Energy Efficiency Standards and Incentives

3.5.3. Environmental Policies on Hazardous Materials

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

(Manufacturers, Distributors, End-Users, Regulatory Bodies)

3.8. Porters Five Forces

(Supplier Power, Buyer Power, Threat of Substitutes, Industry Rivalry, Barriers to Entry)

3.9. Competition Ecosystem

04. Global Relay Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Electromechanical Relays

4.1.2. Solid-State Relays

4.1.3. Hybrid Relays

4.1.4. Reed Relays

4.2. By Application (In Value %)

4.2.1. Industrial Automation

4.2.2. Automotive and Transportation

4.2.3. Energy & Power

4.2.4. Telecom and Data Centers

4.3. By Voltage (In Value %)

4.3.1. Low Voltage

4.3.2. Medium Voltage

4.3.3. High Voltage

4.4. By End-User (In Value %)

4.4.1. Utilities

4.4.2. Manufacturing

4.4.3. Residential

4.4.4. Commercial

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

05. Global Relay Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ABB Ltd.

5.1.2. Schneider Electric SE

5.1.3. TE Connectivity Ltd.

5.1.4. Eaton Corporation

5.1.5. Siemens AG

5.1.6. Omron Corporation

5.1.7. Fujitsu Ltd.

5.1.8. Panasonic Corporation

5.1.9. Mitsubishi Electric Corporation

5.1.10. Rockwell Automation

5.1.11. General Electric Company

5.1.12. Broadcom Inc.

5.1.13. Legrand SA

5.1.14. Xiamen Hongfa Electroacoustic Co., Ltd.

5.1.15. Toshiba Corporation

5.2. Cross Comparison Parameters (Market Specific: Manufacturing Capacity, Product Portfolio, Regional Presence, R&D Investments, Innovation Index, Sales Channels, Customer Base, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Expansions, Acquisitions)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

06. Global Relay Market Regulatory Framework

6.1. Safety Standards (Product Certifications, Regulatory Guidelines)

6.2. Compliance Requirements (Industry-Specific Standards, Audits)

6.3. Environmental and Energy Efficiency Regulations

07. Global Relay Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Relay Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Voltage (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

09. Global Relay Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. White Space Opportunity Analysis

9.4. Marketing and Sales Strategy Recommendations

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This initial phase focuses on understanding the critical components and dynamics of the global relay market. Extensive desk research is conducted, relying on secondary databases and industry reports to identify key variables that influence market performance.

Step 2: Market Analysis and Construction

Historical market data for the relay market is analyzed to understand key growth trends, market penetration, and the competitive landscape. This step includes calculating the market share of key players and assessing the revenue generated across different regions and application segments.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, industry hypotheses are developed and validated through interviews with leading industry experts and executives from major relay manufacturers. Their insights help refine market estimates and validate growth drivers.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from primary and secondary research, combining it with inputs from relay manufacturers and industry professionals. This process ensures a comprehensive analysis of market trends, competitive dynamics, and future opportunities.

Frequently Asked Questions

01. How big is the global relay market?

The global relay market is valued at USD 9.63 billion, with strong growth driven by the increasing adoption of automation and energy-efficient systems across industries such as automotive, power, and telecom.

02. What are the challenges in the global relay market?

Key challenges include competition from alternative technologies like circuit breakers, high initial costs for advanced relays, and supply chain disruptions affecting the availability of key components.

03. Who are the major players in the global relay market?

Major players include ABB Ltd., Schneider Electric SE, TE Connectivity Ltd., Omron Corporation, and Eaton Corporation. These companies dominate due to their extensive product portfolios, R&D investments, and global reach.

04. What are the growth drivers of the global relay market?

The market is driven by factors such as the increasing demand for smart grids, the growth of electric vehicles, and the rapid expansion of industrial automation. Additionally, investments in renewable energy projects create further demand for advanced relay systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.