Region:Asia

Author(s):Geetanshi

Product Code:KRAA0110

Pages:96

Published On:August 2025

By Property Type:The property type segmentation includes Apartments/Condominiums, Villas, Townhouses, Landed Houses (Single-Family Homes), Social Housing, Luxury Residences (Penthouses, Estates), and Others. Apartments/Condominiums are currently dominating the market, accounting for the majority of sales volume due to their affordability, convenience, and suitability for urban density. The trend toward vertical living is driven by younger generations seeking modern amenities and proximity to workplaces, with apartments and condominiums representing about two-thirds of total sales .

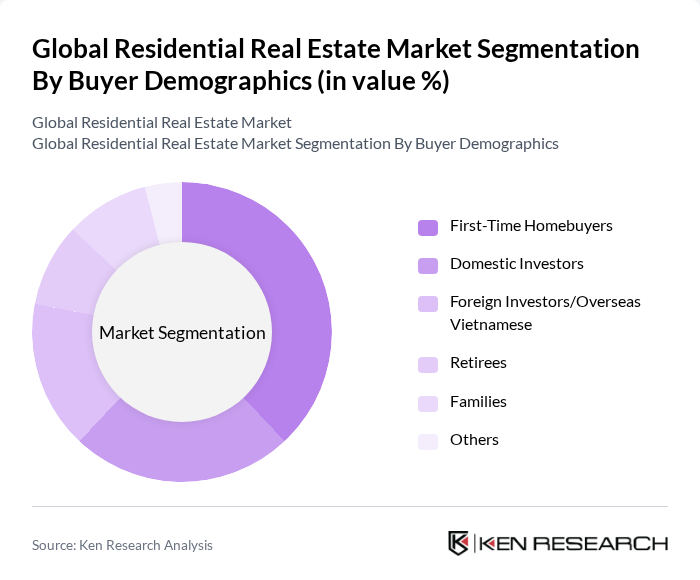

By Buyer Demographics:The buyer demographics segmentation includes First-Time Homebuyers, Domestic Investors, Foreign Investors/Overseas Vietnamese, Retirees, Families, and Others. First-Time Homebuyers are currently the leading demographic, driven by favorable financing options, government incentives, and a growing young population seeking home ownership. This segment is characterized by younger individuals and couples prioritizing affordability and location, with domestic investors and overseas Vietnamese also playing a significant role in market activity .

The Global Residential Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vinhomes (Vingroup), Novaland Group, Phu My Hung Development Corporation, Dat Xanh Group, FLC Group, Him Lam Land, Kinh Bac City Development Holding Corporation (KBC), Nam Long Investment Corporation, Sun Group, Tan Hoang Minh Group, Becamex IDC, An Gia Investment, Ecopark Corporation, Hung Thinh Land, Masterise Homes contribute to innovation, geographic expansion, and service delivery in this space.

The future of None's residential real estate market appears promising, driven by ongoing urbanization and a growing middle class. As the demand for housing continues to rise, developers are likely to focus on innovative solutions, including eco-friendly and smart home technologies. Additionally, the expansion of rental markets and mixed-use developments will cater to diverse consumer preferences, ensuring that the market remains dynamic and responsive to changing demographics and economic conditions.

| Segment | Sub-Segments |

|---|---|

| By Property Type | Apartments/Condominiums Villas Townhouses Landed Houses (Single-Family Homes) Social Housing Luxury Residences (Penthouses, Estates) Others |

| By Buyer Demographics | First-Time Homebuyers Domestic Investors Foreign Investors/Overseas Vietnamese Retirees Families Others |

| By Financing Method | Bank Mortgages Developer Financing Cash Purchases Government-Subsidized Loans Others |

| By Location | Ho Chi Minh City Hanoi Danang Hai Phong Secondary Cities & Provinces Others |

| By Price Range | Affordable Housing Mid-Range Properties Premium/Luxury Properties Others |

| By Property Age | New Developments Recently Renovated Existing/Older Properties Others |

| By Investment Purpose | Owner-Occupied (Primary Residence) Buy-to-Let (Rental Income) Vacation/Second Homes Capital Appreciation/Speculation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 100 | First-time Homebuyers, Investors |

| Real Estate Agents | 60 | Residential Brokers, Real Estate Consultants |

| Homeowners | 80 | Current Homeowners, Landlords |

| Real Estate Developers | 40 | Project Managers, Development Executives |

| Market Analysts | 40 | Economists, Industry Analysts |

The global residential real estate market is valued at approximately USD 33 billion, driven by factors such as urbanization, rising disposable incomes, and government initiatives aimed at increasing affordable housing supply.