Global Rigid Plastic Packaging Market Outlook to 2030

Region:Global

Author(s):Rohit and Nishika

Product Code:KENGR050

October 2024

84

About the Report

Global Rigid Plastic Packaging Market Overview

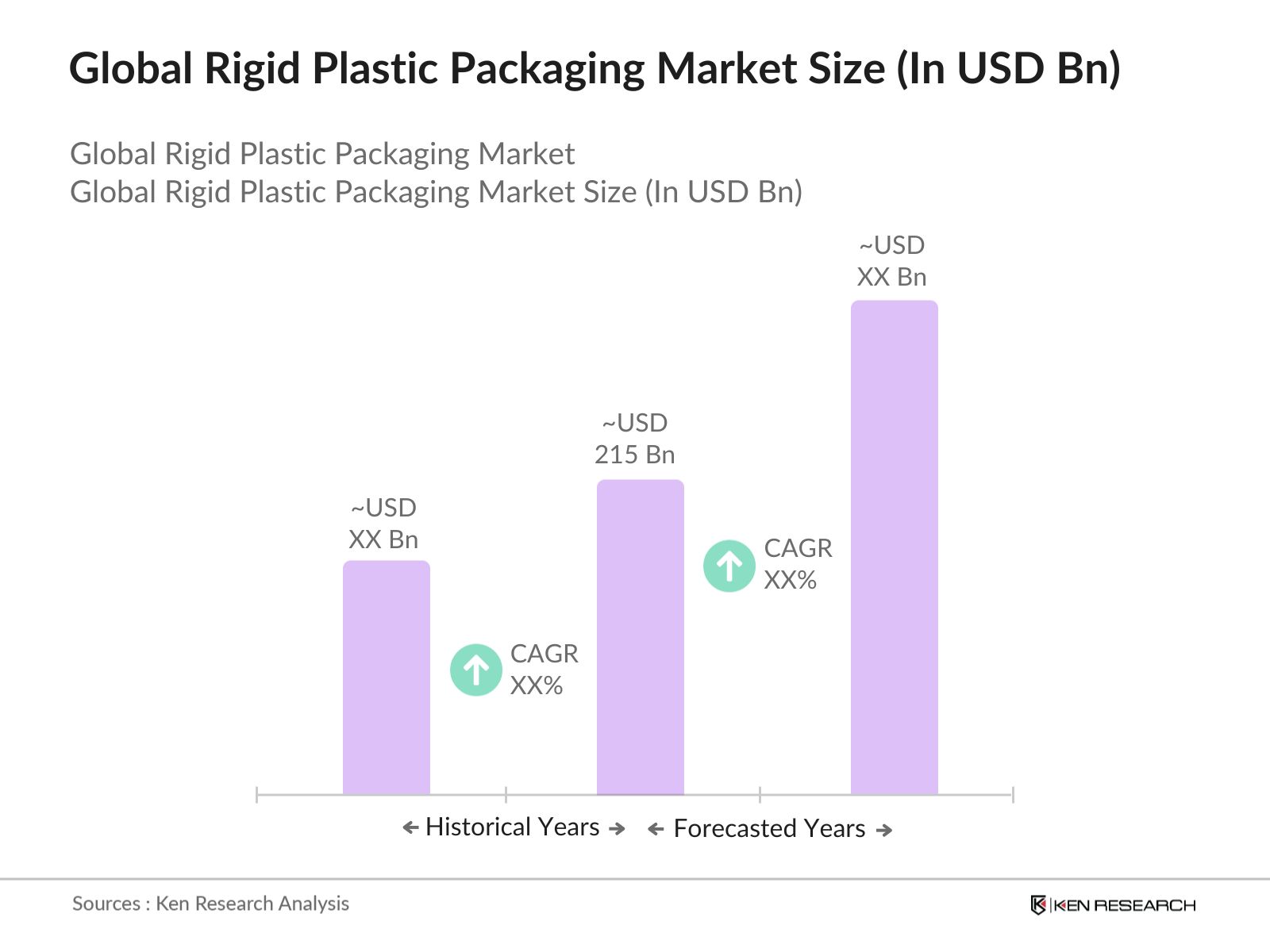

- In 2023, Global Rigid Plastic Packaging Market is valued at USD 215 Bn driven by enhanced product presentation and differentiation, rising popularity of single-serve packaging in the food industry, the affordability of rigid plastics, and rising disposable income.

- The global rigid plastic packaging market is highly fragmented with key players including Berry Global Group Inc, ALPA- Werke Alwin Lehner GmbH & Co KG, Amcor Plc, Aptar Group, Pactiv Evergreen, Sonoco Packaging Company and Huhtamaki Packaging Company.

- In 2023, Berry Global Group, Inc. acquired F&S Tool Inc. as part of its strategic initiative to expand its full plastic packaging lifecycle solutions. This acquisition enhances Berry's capabilities in providing comprehensive services that span the entire lifecycle of plastic packaging, from design and manufacturing to recycling and sustainability solutions.

Global Rigid Plastic Packaging Current Market Analysis

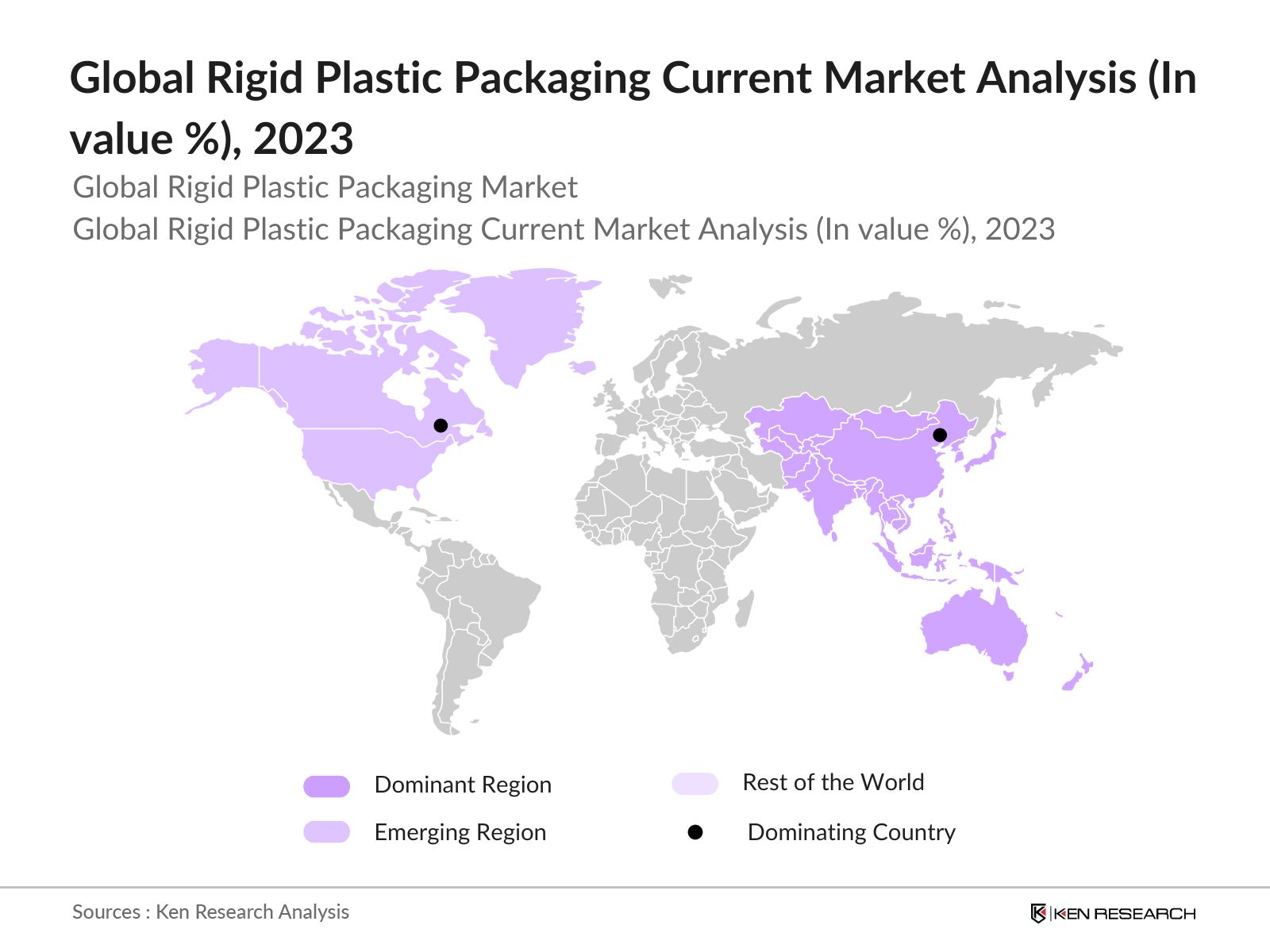

- APAC as a dominant region: APAC remains the largest market for rigid plastic packaging due to its rapid economic growth, burgeoning population, and increasing urbanization. These factors drive substantial demand for packaged goods across sectors like food, beverages, pharmaceuticals, and personal care.The Asian Development Bank projects that China's middle-class population is estimated to increase by 83% by 2030, which will lead to a surge in consumption of packaged goods, further boosting demand for rigid plastic packaging.As of 2020, around 51% of Asia's population lived in urban areas, with projections suggesting that this figure will exceed 55% by 2030, translating to an additional 1.1 billion people moving to cities over the next two decades driving the market for rigid plastic packaging in the region.

- North America as an emerging region: North America is the second largest region in the global rigid plastic packaging market owing to the high demand from the food and beverage, healthcare, and personal care industries. The region's well-established manufacturing base, coupled with advanced packaging technologies, drives the market's growth.The U.S. manufacturing industry has seen a significant increase in investment, with annual construction spending in manufacturing reaching USD 201 billion as of July 2023, a 70% year-over-year increase, fueling the market for rigid plastic packaging in the region.Additionally, the market is supported by the region's focus on innovation and the presence of key market players who are continually expanding their product offerings.

- China as dominant country: China is poised to remain the largest market for rigid plastic packaging due to its immense population, rapid urbanization, and robust industrial infrastructure. These factors drive significant demand across multiple sectors including food and beverages, pharmaceuticals, electronics, and consumer goods.China's total consumption of plastic products was approximately 75 million metric tons in 2023, which represents a slight decrease of 3% from the previous year, showing its dominance in in global plastic market.China's strong manufacturing capabilities and efficient production processes ensure competitive pricing and supply chain efficiency in the global packaging industry. Government initiatives supporting industrial development and technological innovation further strengthen China's position, fostering advancements in packaging technologies and sustainability practices.

Global Rigid Plastic Packaging Market Segmentation

The Global Rigid Plastic Packaging Market can be segmented based on several factors:

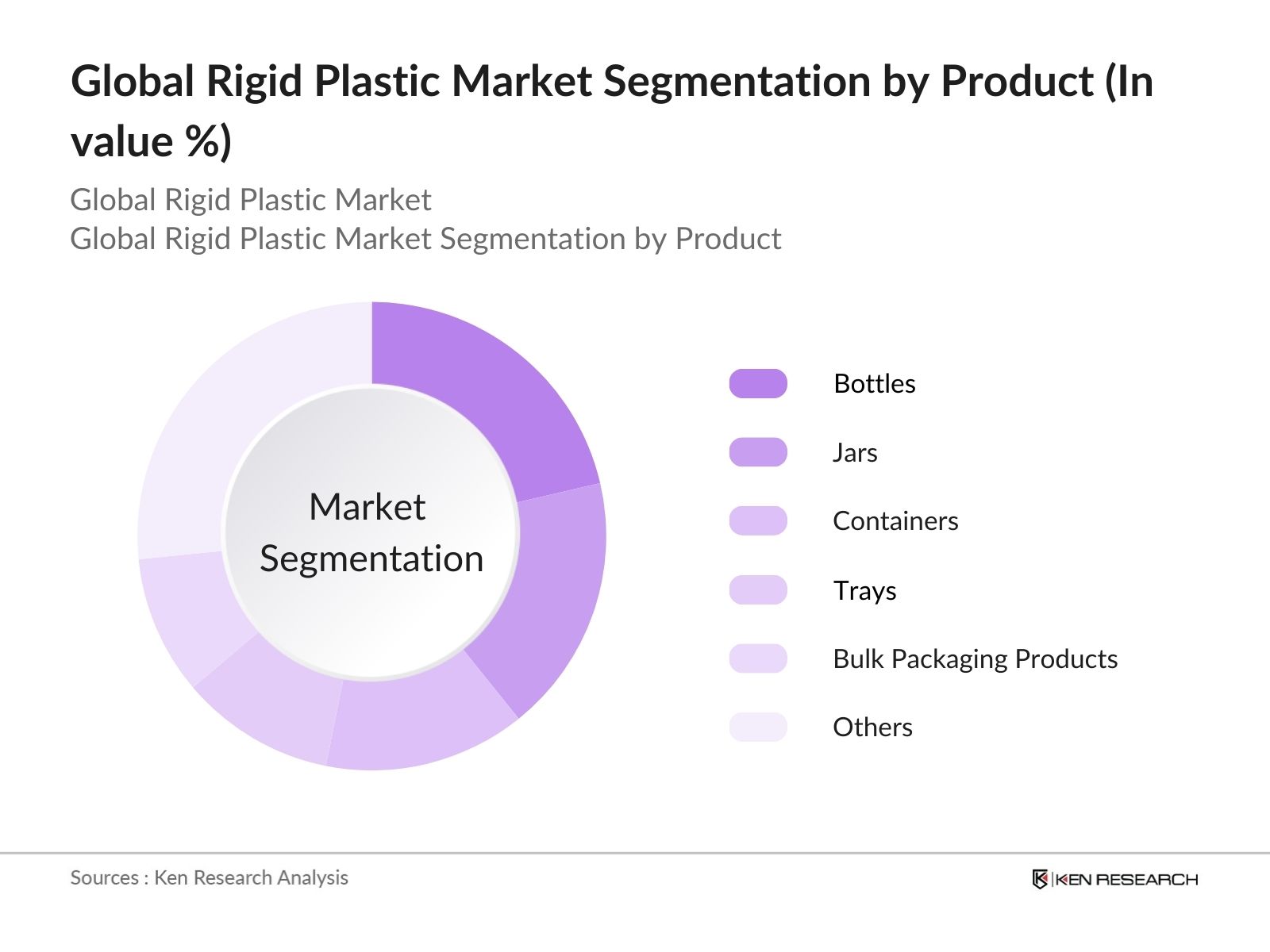

- By Product Type: The market is segmented by product type into Bottles, Jars, Containers, Trays, Bulk Packaging Products, Tubs, Cups & Pots, Caps & Closures, and Others, which include Blisters, Clamshell Packs & Tubes. In 2023, Bottles led the market by product type, capturing the largest market share due to their extensive use across various industries such as beverages, personal care, and household products. This segment's dominance is driven by the versatility and high demand for rigid plastic bottles, which offer durability and protection for a wide range of products.

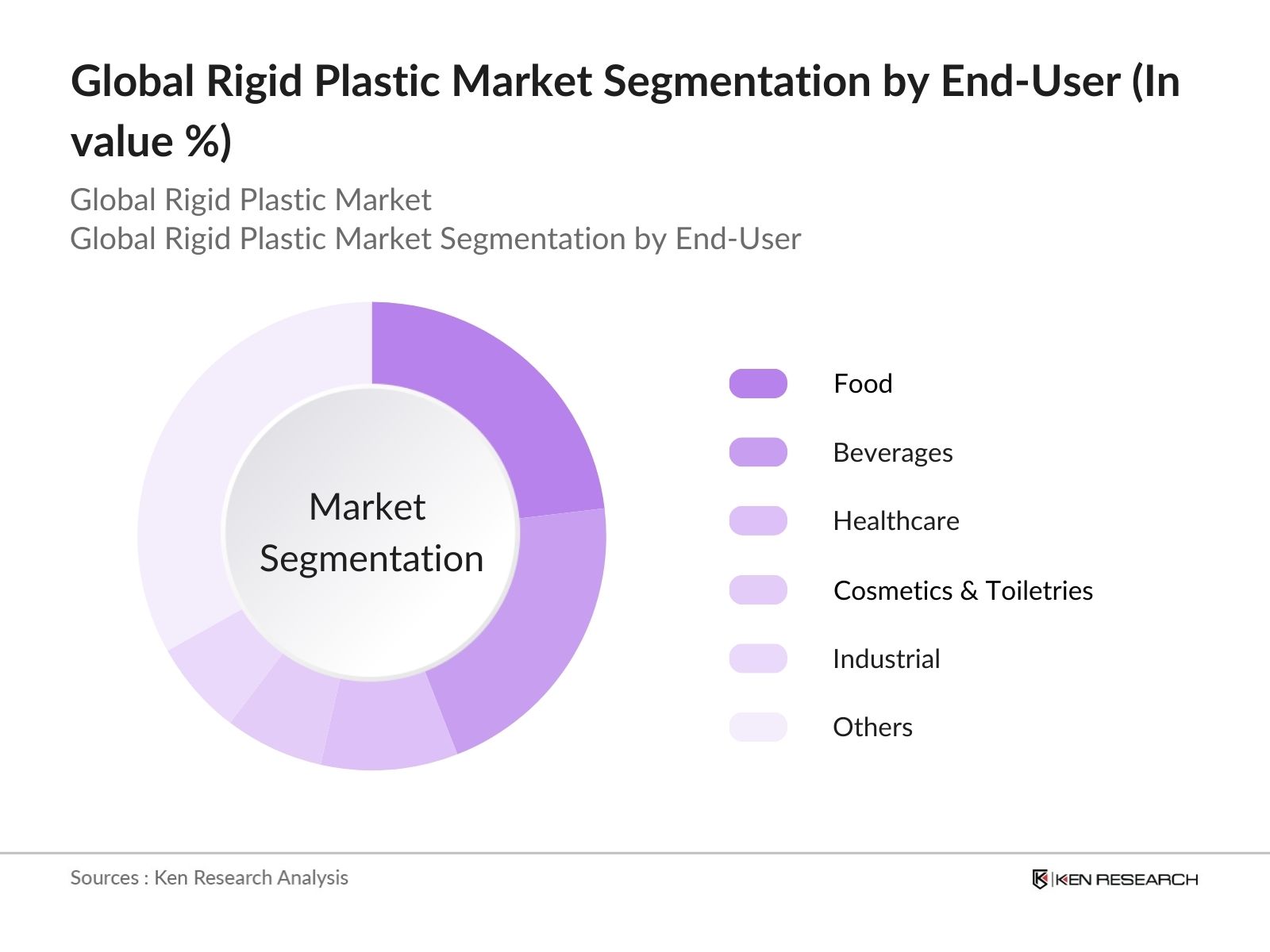

- By End-User: The market is segmented by end-user into Food, Beverages, Healthcare, Cosmetics & Toiletries, Industrial, Personal Care, Consumer Goods, Construction, Automotive, Pharmaceuticals, and Others, which include Electrical & Electronics. The Food segment dominated the market in 2023, reflecting its extensive use of rigid plastic packaging for preserving and protecting food products. The increasing demand for convenience foods and the need for sustainable and reliable packaging solutions have bolstered the market share of the food segment within this industry.

- By Plastic Type: The market is Segmented by plastic type includes PET, PE, PP, PVC, PS, EPS, and Others, which consist of PC and Polyamide. PET (Polyethylene Terephthalate) dominated the market in 2023, capturing the largest share due to its widespread application in packaging bottles, jars, and containers, particularly in the beverage industry. PET's dominance is attributed to its excellent barrier properties, recyclability, and cost-effectiveness, making it a preferred material in the rigid plastic packaging market.

Global Rigid Plastic Packaging Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

Geographical Presence |

|

Berry Global Group Inc |

1967 |

Indiana, USA |

38 |

|

ALPA- Werke Alwin Lehner GmbH & Co KG (Not Listed) |

1955 |

Hard,Austria |

47 |

|

Amcor Plc |

1896 |

Victoria, Australia |

41 |

|

Aptar Group |

1992 |

Illinois, USA |

18 |

|

Pactiv Evergreen |

2020 |

Illinois, USA |

2 |

|

Huhtamaki Packaging Company |

1935 |

Espoo, Finland |

38 |

- ALPA- Werke Alwin Lehner GmbH & Co KG : In 2023, ALPLA Group, a global leader in plastic packaging solutions, has acquired a majority stake in Atlantic Packaging, a prominent packaging company. This strategic move has led to the formation of a joint venture named ALPLA Morocco. The new joint venture aims to strengthen ALPLA's presence in the North African region, particularly in the Moroccan market.

- Amcor Plc: In November 2023, Amcor, a global leader in developing and producing responsible packaging solutions, announced a strategic partnership with Nova Chemicals, a leading producer of sustainable materials. This partnership focuses on the sourcing of mechanically recycled materials to be used in Amcor's packaging products.

- Aptar Group: In August 2019, Aptar Group, a global leader in dispensing systems and active packaging solutions, announced a partnership with Loop, a global circular shopping platform developed by TerraCycle. This innovative platform focuses on reducing waste by delivering consumer products in reusable containers, which can be returned, cleaned, and refilled for future use.

Global Rigid Plastic Packaging Industry Analysis

Global Rigid Plastic Packaging Market Growth Drivers:

- Enhanced Product Presentation and Differentiation: In the competitive landscape of consumer goods, the ability to stand out on the shelf is crucial. Rigid plastic packaging offers superior options for product presentation and differentiation.Its ability to be molded into various shapes, combined with vibrant printing capabilities, allows brands to create visually appealing and unique packaging that attracts consumers. This aesthetic advantage is a key driver for the adoption of rigid plastic packaging across multiple industries, particularly in consumer goods and electronics.

- Cost-Effectiveness: One of the most significant advantages of rigid plastic packaging is its cost-effectiveness. Rigid plastics are generally less expensive to produce compared to alternative materials like glass or metal.The production cost of rigid plastic packaging is typically 30-50% lower than that of glass packaging. For example, producing a glass bottle can cost approximately USD 0.50 to USD 1.00 per unit, while a comparable rigid plastic bottle may cost only USD 0.20 to USD 0.40 per unit.This affordability, combined with the durability and lightweight properties of rigid plastics, makes it an attractive option for manufacturers looking to reduce packaging costs without compromising on quality.

- Rising Popularity of Single-Serve Packaging in the Food Industry: The growing consumer demand for convenience and portion control has led to a surge in the popularity of single-serve packaging, particularly in the food industry.

- A significant 70% of consumers prefer single-serve packaging for its convenience, especially for on-the-go meals and snacks. This preference is particularly pronounced among busy professionals and families looking for quick meal solutions

- Rigid plastic packaging is ideally suited for single-serve applications due to its strength, lightweight, and versatility in design. As a result, the food industry is adopting rigid plastic packaging solutions at an accelerated pace, further driving the growth of this market.

Global Rigid Plastic Packaging Market Challenges:

- Stringent Government Regulations: Stringent government regulations on rigid plastic packaging present significant challenges for businesses. Compliance requires substantial investments in new technologies and processes, impacting operational costs. Supply chains may face complexity in sourcing compliant materials, affecting reliability and cost. Non-compliance risks penalties and market exclusion, while consumer preferences increasingly favor sustainable products, influencing market perception. Navigating these regulations demands proactive compliance strategies, innovation in materials, and adapting to varying global standards to sustain competitiveness and regulatory alignment.

- Fluctuating Raw Material Prices: Fluctuating raw material prices pose a significant challenge for industries relying on rigid plastic packaging. These price fluctuations, influenced by global supply and demand, geopolitical factors, and currency changes, directly impact production costs and profitability. Sharp increases can strain margins, while sudden drops may disrupt supply agreements. Effective risk management strategies, including hedging, diversification of suppliers, and proactive market monitoring, are crucial for mitigating these challenges and maintaining stability in the face of volatile raw material markets.

Global Rigid Plastic Packaging Market Government Initiatives:

- European Union - Single-Use Plastics Directive (2019): The European Union's Single-Use Plastics Directive (2019) is a landmark regulatory initiative aimed at mitigating the environmental impact of specific plastic products, particularly single-use plastics. Recognizing the significant contribution of these products to pollution, especially in marine environments, the directive sets out a comprehensive approach to reduce their usage across member states. Key measures include a ban on certain single-use plastic items where environmentally friendly alternatives are readily available, such as cutlery, plates, straws, and stirrers.

- Japan - Containers and Packaging Recycling Law (1995, amended in 2006): Japan's Containers and Packaging Recycling Law mandates the recycling of containers and packaging, including rigid plastic packaging, to reduce environmental impact and promote sustainability. Under this law, businesses are required to recycle their packaging waste, ensuring that a significant portion of it is diverted from landfills and reintroduced into the production cycle. This regulation encourages manufacturers to design packaging that is easier to recycle, fostering innovation in the development of recyclable and eco-friendly packaging materials.

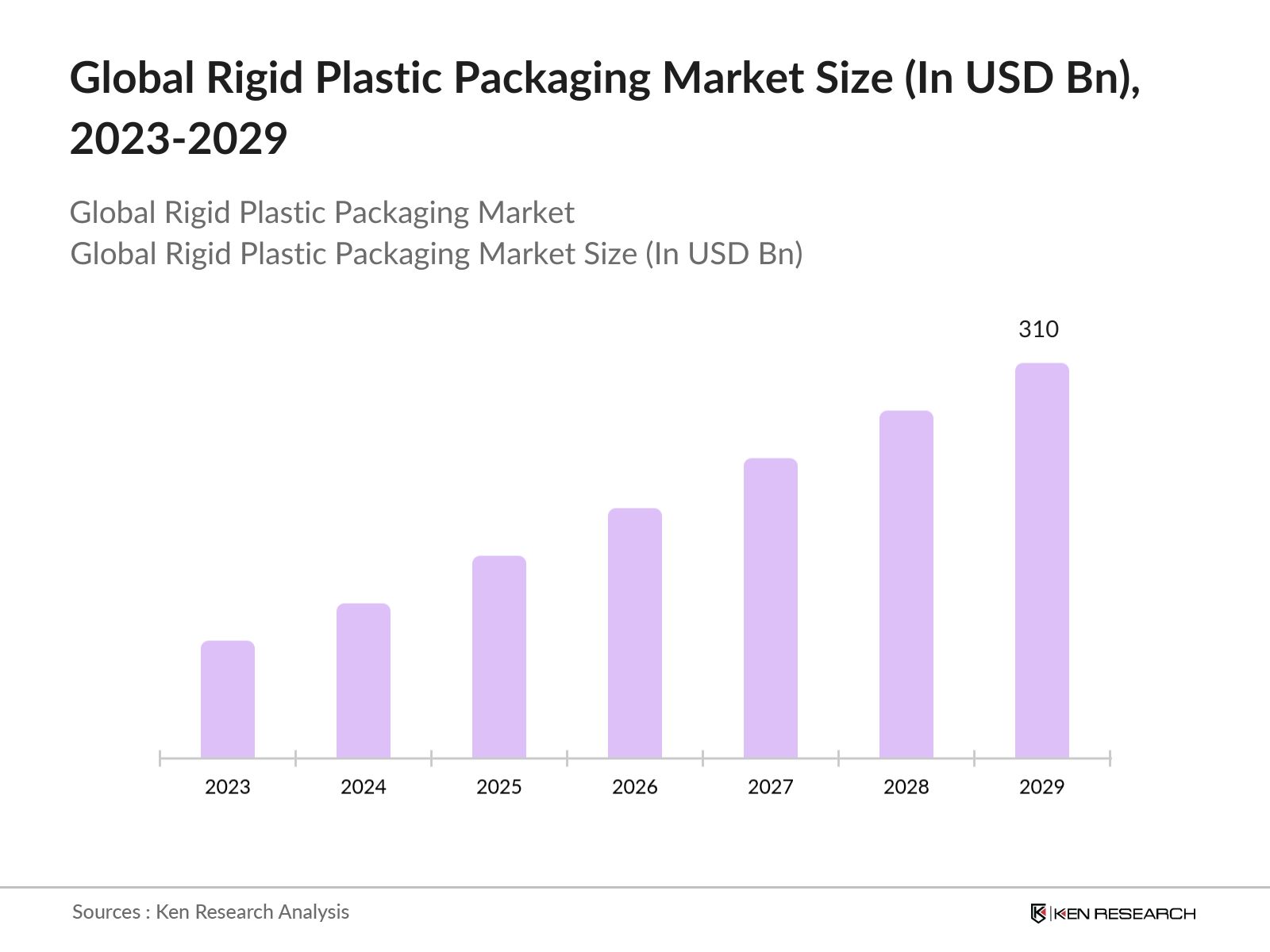

Global Rigid Plastic Packaging Future Market Outlook

The global rigid plastic packaging market is predicted to grow exceptionally in the forecasted period of 2023-2029 reaching a market size of USD 310 Bn driven by increased adoption of sustainable and recyclable materials, advancements in packaging technologies, and growth in e-commerce and demand for durable packaging.

- Increased Adoption of Sustainable and Recyclable Materials: As environmental concerns and regulations continue to intensify, the rigid plastic packaging industry is expected to see a significant shift towards sustainable and recyclable materials. Manufacturers are increasingly investing in the development of eco-friendly packaging solutions, such as bio-based plastics and advanced recycling technologies, to meet the growing consumer demand for sustainable products.

- Advancements in Packaging Technologies: Technological innovation will play a crucial role in shaping the future of the rigid plastic packaging market. The integration of smart packaging solutions, such as QR codes, RFID tags, and temperature-sensitive labels, is expected to enhance product traceability, safety, and consumer engagement. These advancements will not only improve the functionality of rigid plastic packaging but also provide added value for both brands and consumers.

Scope of the Report

|

By Region |

North America Europe APAC Latin America MEA |

|

By Product |

Bottles Jars Containers Trays Bulk Packaging Products Tubs, Cups & Pots Caps & Closures Others ( includes Blisters, Clamshell Packs & Tubes) |

|

By End-User |

Food Beverages Healthcare Cosmetics & Toiletries Industrial Personal Care Consumer Goods Construction Automotive Pharmaceuticals Others (includes Electrical & Electronics) |

|

By Plastic Type |

PET PE PP PVC PS EPS Others (PC, Polyamide) |

|

By Production Technology |

Extrusion Injection Molding Blow Molding Thermoforming |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Rigid Plastic Packaging Manufacturers

Consumer Goods Companies

Retailers and Distributors

Food and Beverage Producers

Healthcare and Pharmaceutical Companies

Cosmetic and Personal Care Brands

Packaging Design and Innovation Firms

Banks and Financial Institutions

Investors and VCs

Government and Regulatory Bodies (EPA, FDA, and MoEFCC)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Berry Global Group Inc

ALPA- Werke Alwin Lehner GmbH & Co KG (Not Listed)

Amcor Plc

Aptar Group

Pactiv Evergreen

Huhtamaki Packaging Company

Albea Group

Bericap

Sonoco Packaging Company

Greiner AG

Silgan Holdings Inc

Winpak Ltd.

Innovative Plastic Leaders

Nampak

Table of Contents

1. Executive Summary

1.1 Global Rigid Plastic Packaging Market

1.2 Global Plastic Market

2. Global Overview

2.1 Overview of Global Economics

2.2 Overview of Global Rigid Plastic Packaging Industry

2.3 Global Rigid Plastic Packaging Revenue

2.4 Global Rigid Plastic Packaging Infrastructure

3. Global Rigid Plastic Packaging Market Overview

3.1 Ecosystem

3.2 Value Chain

3.3 Case Study

4. Global Rigid Plastic Packaging Market Size (in USD Bn), 2018-2023

5. Global Rigid Plastic Packaging Market Segmentation (in value %), 2018-2023

5.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2018-2023

5.2 By Product (Bottles, Jars, Containers, Trays, Bulk Packaging Products, Tubs, Cups & Pots, Caps & Closures, and Others) in value%, 2018-2023

5.3 By End-User (Food, Beverages, Healthcare, Cosmetics & Toiletries, Industrial, Personal Care, Consumer Goods, Construction, Automotive, Pharmaceuticals, and Others) in value %, 2018-2023

5.4 By Plastic (PET, PE, PP, PVC, PS, EPS, and Others) in value %, 2018-2023

5.5 By Production Technology (Extrusion, njection Molding, Blow Molding, and Thermoforming) in value %, 2018-2023

6. Global Rigid Plastic Packaging Market Competition Landscape

6.1 Market Share Analysis

6.2 Market Heat Map Analysis (By Technology)

6.3 Market Heat Map Analysis (By Offerings)

6.4 Market Cross Comparison

6.5 Comparison Matrix

6.6 Investment Landscape

7. Global Rigid Plastic Packaging Market Dynamics

7.1 Growth Drivers

7.2 Challenges

7.3 Trends

7.4 Case Studies

7.5 Strategic Initiatives

8. Global Rigid Plastic Packaging Future Market Size (in USD Bn), 2023-2029

9. Global Rigid Plastic Packaging Future Market Segmentation (in value %), 2023-2029

9.1 By Region (North America, Europe, APAC, Latin America and MEA) in value %, 2023-2029

9.2 By Product (Bottles, Jars, Containers, Trays, Bulk Packaging Products, Tubs, Cups & Pots, Caps & Closures, and Others) in value%, 2023-2029

9.3 By End-User (Food, Beverages, Healthcare, Cosmetics & Toiletries, Industrial, Personal Care, Consumer Goods, Construction, Automotive, Pharmaceuticals, and Others) in value %, 2023-2029

9.4 By Plastic (PET, PE, PP, PVC, PS, EPS, and Others) in value %, 2023-2029

9.5 By Production Technology (Extrusion, njection Molding, Blow Molding, and Thermoforming) in value %, 2023-2029

10. Analyst Recommendations

Research Methodology

Step 1: Secondary Resources

Objective: Identify players, revenue, product offerings of key players, and average pricing to calculate the market size.

- Government Reports: Ministry of Communications and Information Technology, Federal Communications Commission (FCC), European Commission.

- Official Company Reports and Press Releases: Annual reports, investor presentations, and press releases from major Digital Marketing Software Manufacturers for Product Offerings, Financial Performance, and Market Strategies.

- Public and Proprietary Database: F&S, Euromonitor, Statista, Gartner, IDC for Market Sizing, Industry Analysis & Forecasts.

Step 2 Validate Via Trade Desk Interviews :

Objective: Confirm market revenue, margins, segmentations, distribution, and future projections to gauge insights in the current market trends.

Step 3 Proxy Modelling & Outcomes:

- Bottom-Top Approach: Calculating revenue of major players by analyzing their sales and pricing for different products.

- Disguised interviews with multiple managers to get their viewpoint on their operational and financial performance. This approach has supported the team to validate the information that was shared by their top management to ensure data accuracy.

Frequently Asked Questions

01 How big is the Global Rigid Plastic Packaging Market??

The global rigid plastic packaging market was valued at USD 220 billion in 2023, driven by the rising demand for durable and cost-effective packaging solutions across various industries, including food, beverages, healthcare, and personal care.?

02 What are the challenges in the Global Rigid Plastic Packaging Market??

Challenges in the global rigid plastic packaging market include environmental concerns related to plastic waste, stringent government regulations on plastic use, and increasing competition from alternative packaging materials like flexible packaging and glass.?

03 Who are the major players in the Global Rigid Plastic Packaging Market??

Key players in the global rigid plastic packaging market include Amcor Limited, Berry Global Group, Inc., RPC Group Plc, and ALPLA Werke Alwin Lehner GmbH & Co KG. These companies lead the market due to their innovative packaging solutions, extensive global presence, and strong customer base.?

04 What are the growth drivers of the Global Rigid Plastic Packaging Market??

The global rigid plastic packaging market is driven by factors such as the increasing demand for lightweight and durable packaging solutions, the growing popularity of single-serve packaging in the food industry, and advancements in recycling technologies that promote the use of recycled materials.?

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.