Global Robo Advisor Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD8641

December 2024

95

About the Report

Global Robo Advisor Market Overview

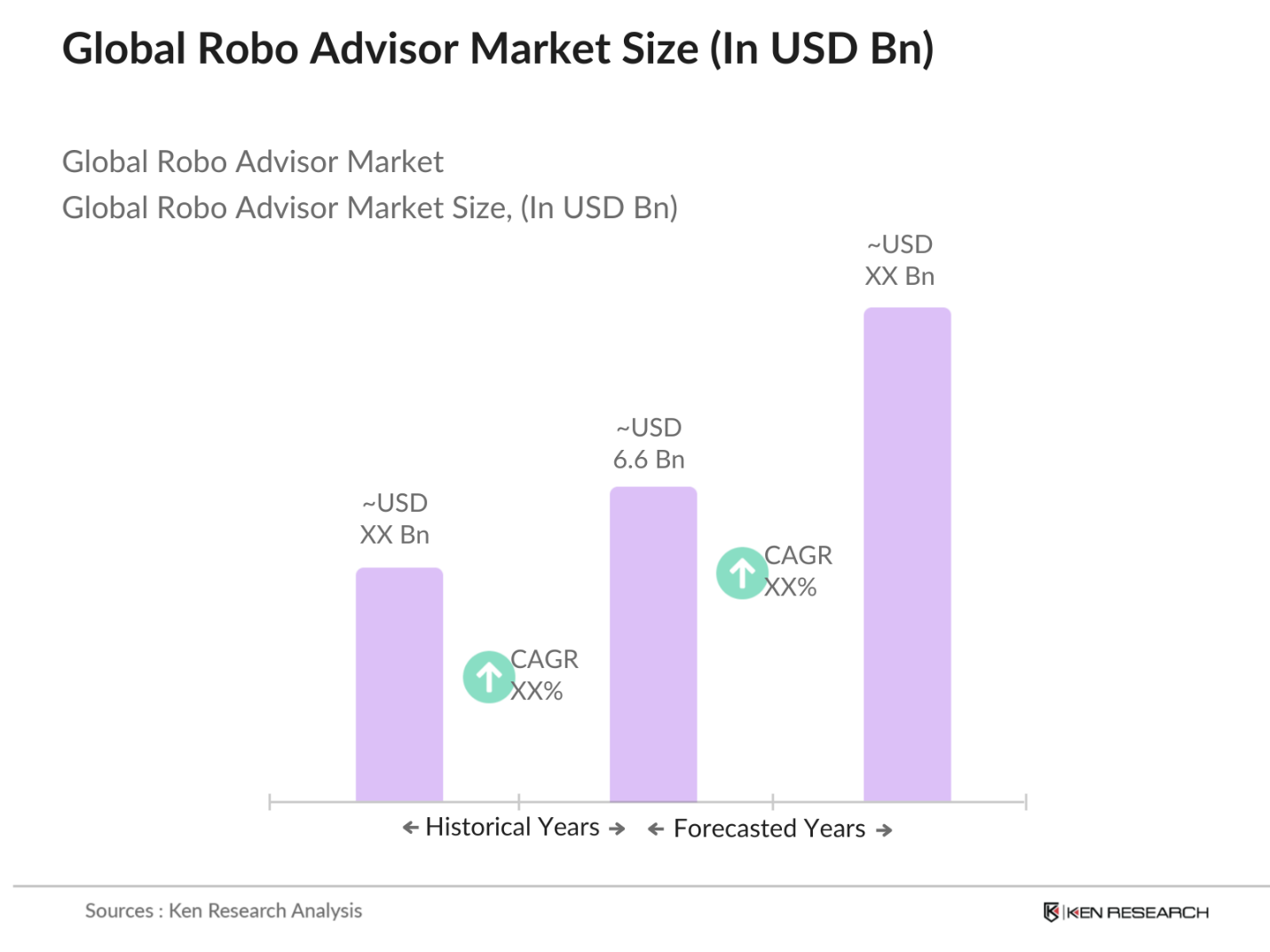

- The global robo-advisor market reached an estimated value of USD 6.6 billion. This growth is significantly influenced by the increasing demand for low-cost, automated financial advisory solutions. Robo advisors leverage algorithms, data-driven insights, and minimal human intervention, which resonates with a broad user base aiming to manage investment portfolios efficiently. The adoption of AI and machine learning further enhances personalization and the ability to handle complex investment scenarios.

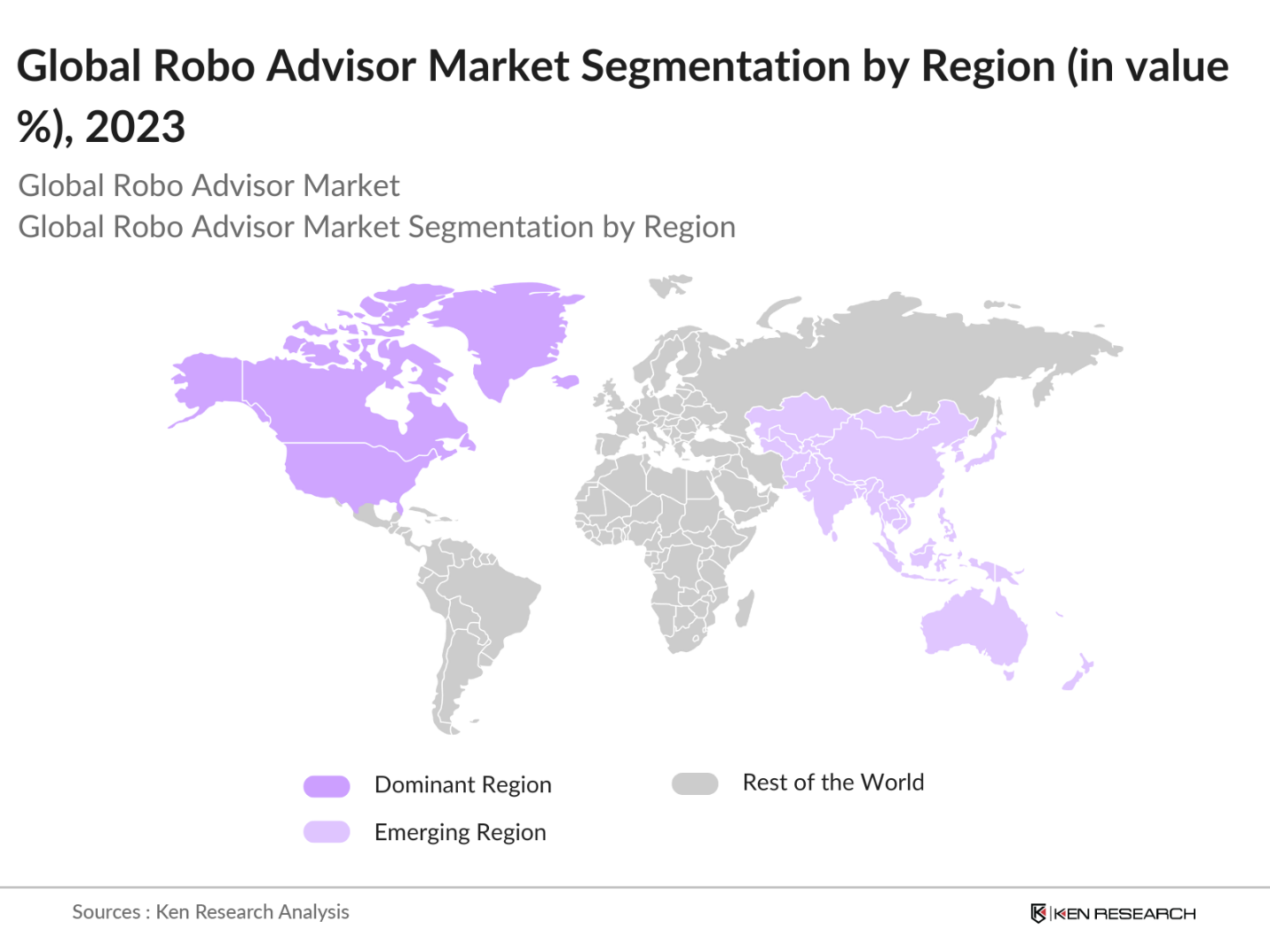

- North America leads the market due to advanced technological infrastructure, robust financial sectors, and consumer trust in digital financial services. The U.S. and Canada show high digital adoption rates, with widespread familiarity with digital banking, automated investment platforms, and fintech solutions, making robo advisors highly appealing. Additionally, Europe and Asia-Pacific are experiencing growing adoption due to financial inclusion initiatives and digital transformation in the banking sector.

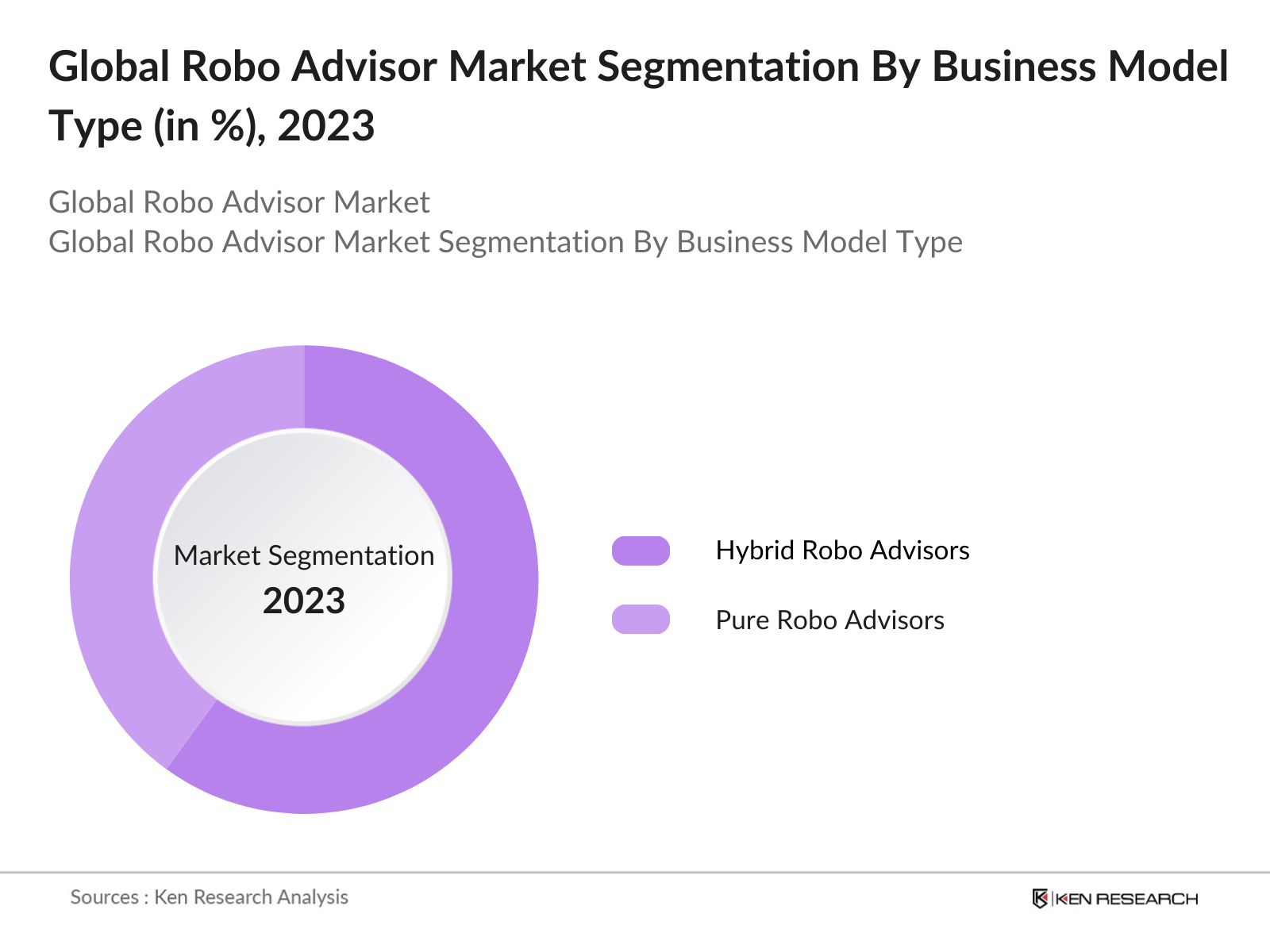

- Hybrid robo-advisors accounted for approximately 55% of new digital advisory services, blending automated advice with human expertise. This model has gained popularity, particularly in North America and Europe, as consumers seek a balance between personal interaction and digital efficiency. Data show hybrid solutions significantly reduce churn rates, appealing to clients requiring complex financial strategies. Hybrid models provide a differentiated service amid the automation shift, attracting diverse user demographics and retaining high-net-worth individuals.

Global Robo Advisor Market Segmentation

By Business Model: The robo-advisor market is segmented by business models into Pure Robo Advisors and Hybrid Robo Advisors. Hybrid models dominate due to the blend of automation with personalized, human-assisted advisory services. This approach meets the needs of investors seeking algorithm-based advice but with added security and guidance from professional advisors.

By Region: The market is geographically segmented into North America, Asia-Pacific, Europe, Latin America, and the Middle East & Africa. North America dominates due to a well-established financial services industry and consumer confidence in technology-driven advisory platforms. The regions high digital literacy and support for fintech innovation also contribute to its leading market share.

By Service Type: Robo advisors provide services segmented into Direct Plan-Based/Goal-Based and Comprehensive Wealth Advisory. Direct plan-based advisors dominate this segment as they offer targeted, goal-specific advice, ideal for retail investors focusing on milestones like retirement or educational savings. This service types simplicity and accessibility appeal to a broad user demographic.

Global Robo Advisor Market Competitive Landscape

The global robo advisor market features major players focused on innovation, automation, and customer-centric services, consolidating their positions with advanced digital tools and strategic partnerships. The markets competitive nature highlights the influence of established brands, innovative technology, and expansion-driven partnerships among key players.

Global Robo Advisor Industry Analysis

Growth Drivers

- Digitalization of Financial Services: The rise of digital finance, especially with 72% of global financial institutions in 2024 prioritizing digital transformation, supports the growth of robo-advisors as demand for streamlined and tech-enabled financial services rises. In 2023, digital banking activity reached approximately 3.5 billion active users globally, a trend paralleled in robo-advisory services, which use similar digital infrastructure. Such digitalization trends allow more efficient processing and accessibility, particularly within developed markets, propelling demand for automated financial solutions. Governmental support for digital finance, such as regulatory sandboxes in countries like the UK, further accelerates this digital shift.

- Adoption of AI and Machine Learning: AI and machine learning (ML) applications in finance saw a rise in allocation, with over $2.2 billion invested in AI research for finance in 2023, enhancing robo-advisor platforms. These technologies improve data analytics, portfolio management, and personalized advice, critical for retaining and expanding client bases in the financial sector. As of 2024, nations like the U.S. and China lead AI-driven finance solutions, contributing over 58% of global AI usage in finance, supporting automation and real-time adjustments in robo-advisor portfolios.

- Demand for Low-Cost Financial Solutions: Globally, a trend towards cost-effective financial services has emerged, as reflected in the 14% decrease in fees across digital financial platforms from 2022 to 2024, driving demand for robo-advisors. Rising inflation rates, notably in emerging economies, have increased the appeal of affordable advisory services. This shift has enabled robo-advisors to attract cost-conscious users, particularly among younger demographics seeking economical alternatives to traditional financial advisors. Government data on consumer price index changes show a direct correlation with financial service adoption, as lower-cost options like robo-advisors gain traction.

Market Challenges

Regulatory Complexities: Regulatory landscapes in finance are increasingly complex, with over 150 regulatory updates in digital finance reported globally by 2023, impacting robo-advisor operations. Countries like the European Union implement stringent data handling regulations under GDPR, while the U.S. has enacted specific policies on digital advisory transparency. Compliance costs for AI-driven services are significant, as maintaining transparency and privacy in financial advice can be costly, requiring robo-advisors to continuously adapt to varying global regulatory standards.

Security Concern: Data breaches within the financial sector affected around 2.1 billion records in 2023, underlining thesecurity challenges that digital advisors face. Robo-advisors process sensitive client information, making them susceptible to cybersecurity threats, which escalated by 22% between 2022 and 2023. As robo-advisors continue to grow, securing client data against cyber risks is essential, with governments like the U.S. and Singapore implementing specific cybersecurity frameworks for financial services .

Global Robo Advisor Market Future Outlook

Over the next five years, the robo advisor market is projected to undergo robust growth, driven by increased AI adoption, user-centric technology enhancements, and broadening customer demographics. Expanding applications in emerging economies and rising digital literacy will further catalyze the sector. Additionally, regulatory frameworks are expected to adapt to digital financial advisory, fostering a favorable environment for market growth.

Opportunities

- Emerging Markets: Emerging markets present substantial growth opportunities for robo-advisors, especially as internet access expands. In 2024, digital banking and finance services reached over 1 billion users in Asia-Pacific alone. Additionally, World Bank data indicate increased internet penetration in Sub-Saharan Africa by 11% from 2022, providing a base for digital advisory adoption. Countries like India and Brazil lead this trend, with policies encouraging financial inclusion through digital solutions, making them key growth regions for robo-advisory services .

- Integration with Fintech Innovation: Fintech adoption reached 80% across major economies, opening pathways for integration with robo-advisory platforms. Innovative tools like blockchain and mobile-based financial solutions are enhancing accessibility, allowing robo-advisors to offer sophisticated features like decentralized finance. Nations with fintech-friendly regulations, such as Singapore and the UAE, support robo-advisory growth through innovation. These advancements offer opportunities for hybrid services that combine fintech and robo-advisory, appealing to tech-savvy users.

Scope of the Report

|

Business Model |

Pure Robo Advisors |

|

Service Type |

Direct Plan-Based/Goal-Based Advisory |

|

Provider |

Fintech Robo Advisors |

|

End-User |

Retail Investors |

|

Region |

North America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Retail investor Companies

High net worth individuals (HNIs)

Wealth management Companies

Investments and venture capitalist firms

Fintech service provider Companies

Government and regulatory bodies (e.g., SEC, FCA)

Banking and financial institutions

Companies

Players Mentioned in the Report

Betterment LLC

Wealthfront Corporation

The Charles Schwab Corporation

Vanguard Group Inc.

SigFig Wealth Management LLC

SoFi Technologies Inc.

Ellevest, Inc.

Ginmon Vermgensverwaltung GmbH

Fincite GmbH

Wealthify Limited

Table of Contents

1. Global Robo Advisor Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.4. Value Chain Analysis

1.5. Market Growth Rate

2. Global Robo Advisor Market Size (USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Milestones and Developments

3. Global Robo Advisor Market Analysis

3.1. Growth Drivers

3.1.1. Digitalization of Financial Services

3.1.2. Adoption of AI and Machine Learning

3.1.3. Rise in Demand for Low-Cost Financial Solutions

3.2. Market Challenges

3.2.1. Regulatory Complexities

3.2.2. Security and Privacy Concerns

3.3. Opportunities

3.3.1. Expansion in Emerging Markets

3.3.2. Integration with Fintech Innovations

3.4. Market Trends

3.4.1. Increasing Use of Hybrid Robo Advisors

3.4.2. Inclusion of Alternative Investments

3.5. Regulatory Landscape

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

4. Global Robo Advisor Market Segmentation

4.1. By Business Model

4.1.1. Pure Robo Advisors

4.1.2. Hybrid Robo Advisors

4.2. By Service Type

4.2.1. Direct Plan-Based/Goal-Based Advisory

4.2.2. Comprehensive Wealth Advisory

4.3. By Provider

4.3.1. Fintech Robo Advisors

4.3.2. Banks

4.3.3. Traditional Wealth Managers

4.4. By End-User

4.4.1. Retail Investors

4.4.2. High Net Worth Individuals (HNIs)

4.5. By Region

4.5.1. North America

4.5.2. Asia-Pacific

4.5.3. Europe

4.5.4. Latin America

4.5.5. Middle East and Africa

5. Global Robo Advisor Market Competitive Analysis

5.1. Detailed Company Profiles

5.1.1. Betterment LLC

5.1.2. Wealthfront Corporation

5.1.3. The Charles Schwab Corporation

5.1.4. Vanguard Group Inc.

5.1.5. Fincite GmbH

5.1.6. Ellevest, Inc.

5.1.7. SigFig Wealth Management LLC

5.1.8. SoFi Technologies Inc.

5.1.9. Ginmon Vermgensverwaltung GmbH

5.1.10. Wealthify Limited

5.1.11. Scalable Capital

5.1.12. Acorns

5.1.13. Nutmeg

5.1.14. Personal Capital

5.1.15. Bambu

5.2. Cross Comparison Parameters (Assets Under Management, Market Capitalization, Number of Employees, Revenue Growth, Target Market, Primary Technology Used, Customer Base, Headquarters)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Global Robo Advisor Market Regulatory Framework

6.1. Compliance Requirements

6.2. International Financial Standards

6.3. Regional Regulatory Variations

7. Global Robo Advisor Future Market Size (USD Million)

7.1. Projections and Forecasts

7.2. Key Drivers of Future Growth

8. Global Robo Advisor Future Market Segmentation

8.1. By Business Model

8.2. By Service Type

8.3. By Provider

8.4. By End-User

8.5. By Region

9. Global Robo Advisor Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. White Space Opportunities

9.3. Customer Targeting Strategies

9.4. Innovation and Development Recommendations

Research Methodology

Step 1: Identification of Key Variables

This step involves mapping all major stakeholders within the robo advisor ecosystem and performing a comprehensive desk study to gather industry-level data. This aids in identifying the factors influencing the market.

Step 2: Market Analysis and Construction

Historical data on market performance, service penetration, and revenue generation is compiled and analyzed. Service quality indicators are assessed to refine revenue estimates and market understanding.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts from diverse financial institutions, yielding valuable operational and financial insights.

Step 4: Research Synthesis and Final Output

The synthesis phase involves engaging with multiple robo advisor providers to acquire data on market segments, product offerings, and consumer preferences, enhancing the accuracy of the analysis.

Frequently Asked Questions

01. How big is the global Robo Advisor Market?

The global robo advisor market was valued at USD 6.6 billion in 2023, driven by advancements in AI and a growing need for cost-effective advisory solutions.

02. What are the challenges in the global Robo Advisor Market?

Key challenges include regulatory complexities and concerns around data privacy and cybersecurity, which can impact customer trust and market growth.

03. Who are the major players in the global Robo Advisor Market?

Prominent companies include Betterment LLC, Wealthfront Corporation, The Charles Schwab Corporation, and Vanguard Group Inc., each known for innovation and technological advancements in digital advisory.

04. What drives growth in the global Robo Advisor Market?

Growth drivers include increased digital adoption, AI integration, and demand for low-cost advisory solutions, making robo advisors an attractive alternative to traditional services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.