Global Roof Rack Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD6080

November 2024

97

About the Report

Global Roof Rack Market Overview

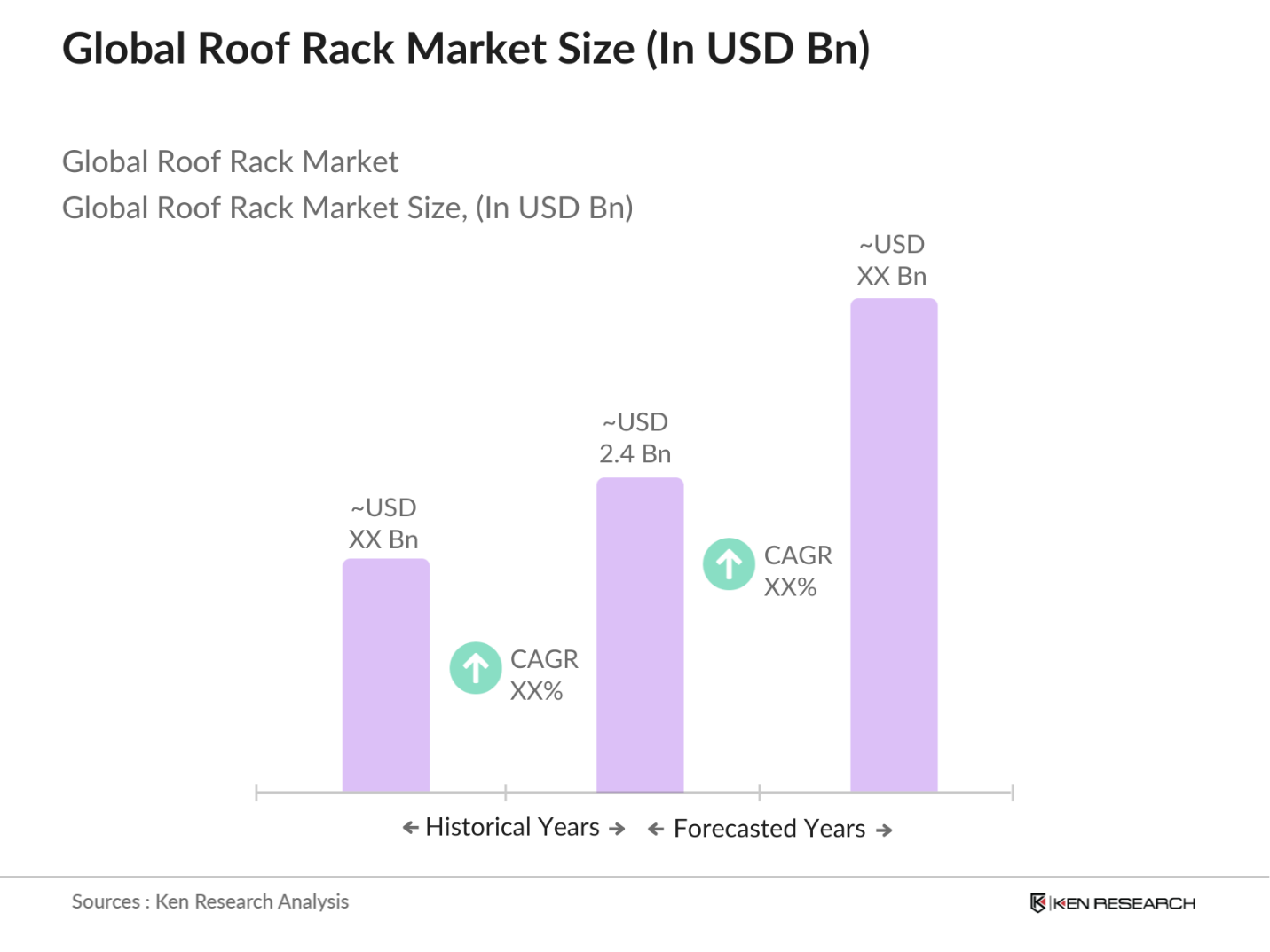

- The global roof rack market is valued at approximately USD 2.4 billion. This market is driven by the increasing demand for vehicles with enhanced storage capacities, particularly from adventurers and outdoor enthusiasts. The rising popularity of SUVs and crossovers has also significantly boosted the demand for roof racks, as these vehicles are well-suited for long trips that require additional luggage space. As consumers seek more customizable and versatile vehicle storage solutions, the roof rack market has expanded steadily over the past five years.

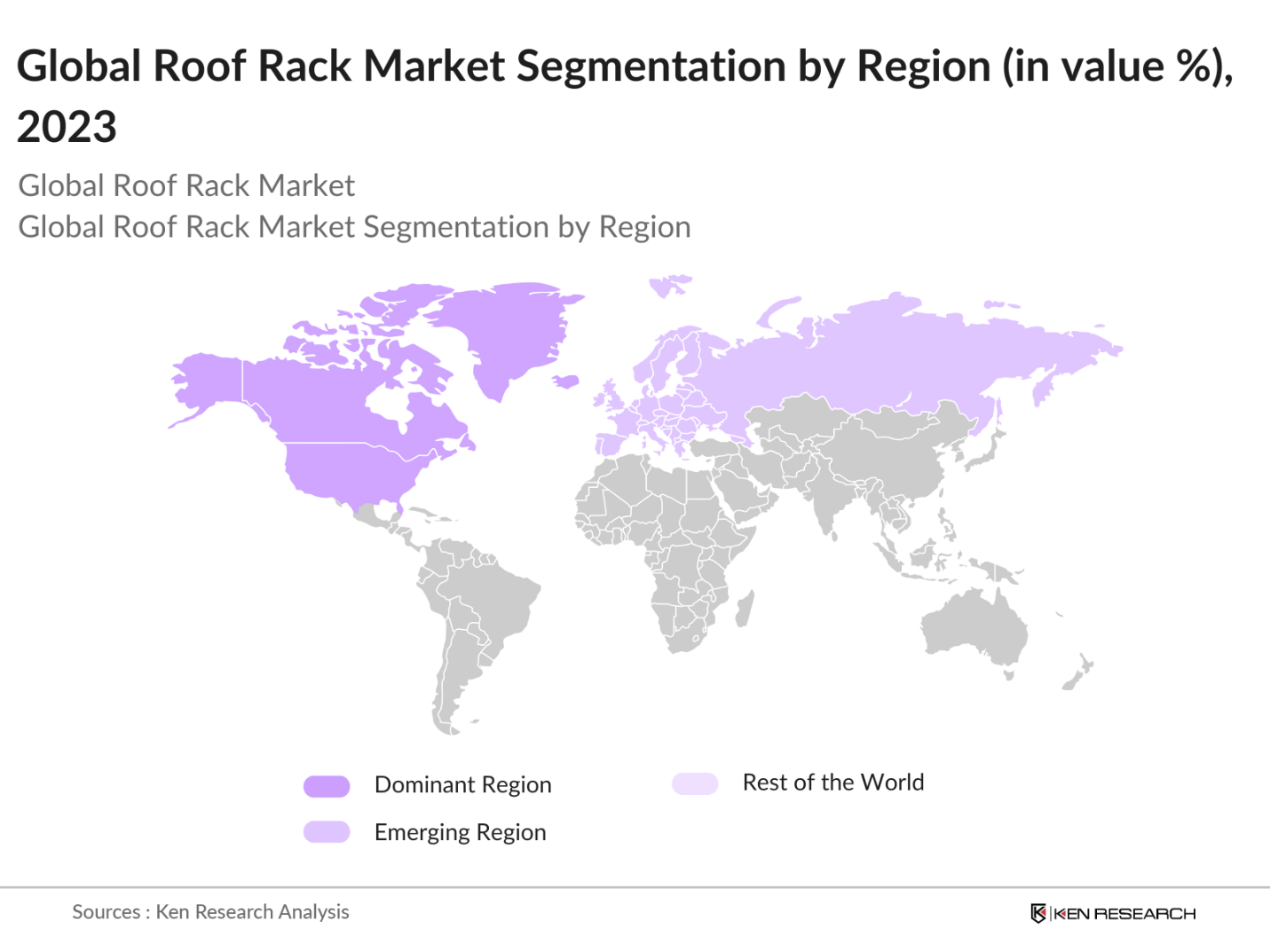

- Key regions such as North America and Europe dominate the roof rack market. In North America, the large SUV and pickup truck segment fuels demand, especially in the U.S. In Europe, countries like Germany and France see high demand due to their robust outdoor recreational cultures and stringent automotive safety standards. Furthermore, the presence of major automotive manufacturers and aftermarket accessory providers in these regions strengthens the market's leadership.

- Governments worldwide are implementing stricter safety regulations concerning load-bearing capacities for vehicle accessories, including roof racks. The National Highway Traffic Safety Administration in the U.S. mandates specific guidelines for load limits to ensure consumer safety. In 2022, vehicle safety standards resulted in the recall of over 20 million vehicles due to safety-related defects. Compliance with these regulations is essential for manufacturers to avoid penalties and ensure market access. Failure to adhere can lead to reputational damage and financial losses.

Global Roof Rack Market Segmentation

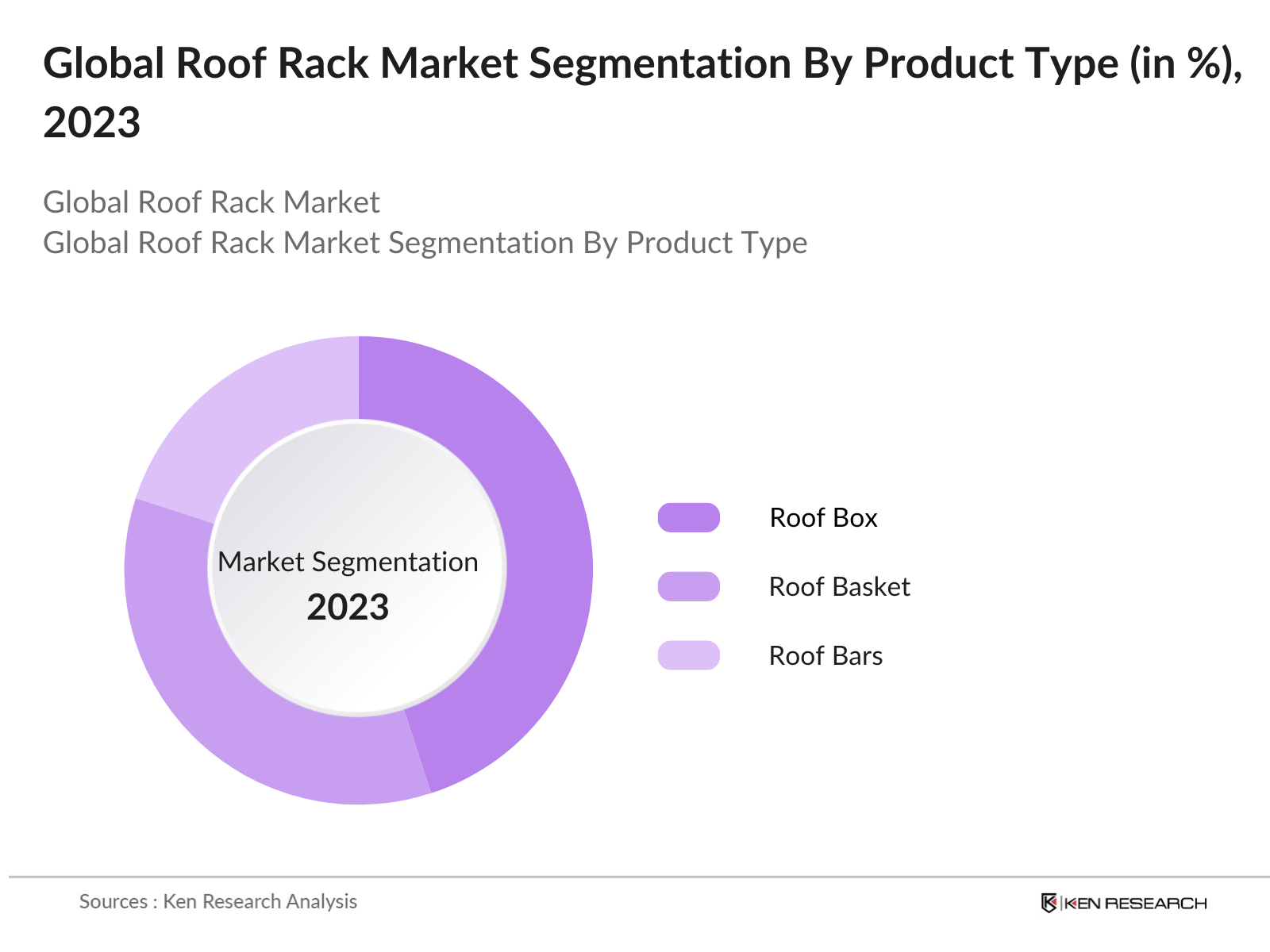

By Product Type: The global roof rack market is segmented into roof boxes, roof baskets, and roof bars. Among these, roof boxes hold a dominant market share. Roof boxes provide secure, enclosed storage, making them ideal for long trips and adverse weather conditions, which appeals to consumers who need safe and weatherproof storage. Additionally, their sleek design minimizes aerodynamic drag, a key selling point for many car owners who are mindful of fuel efficiency during road trips.

By Region: The global roof rack market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America holds the leading share in the market, driven by the strong demand for recreational vehicles (RVs), SUVs, and pickup trucks, particularly in the U.S. and Canada. Consumers in these regions favor roof racks for outdoor trips, which is a significant cultural trend.

By Vehicle Type: The global roof rack market is categorized by vehicle type into passenger cars, SUVs, light commercial vehicles (LCVs), and electric vehicles (EVs). SUVs dominate the market due to their inherent capacity for outdoor use, adventure travel, and their larger size, which accommodates the use of roof racks. Consumers often choose SUVs for recreational activities, which has increased the need for efficient, durable roof storage solutions.

Global Roof Rack Market Competitive Landscape

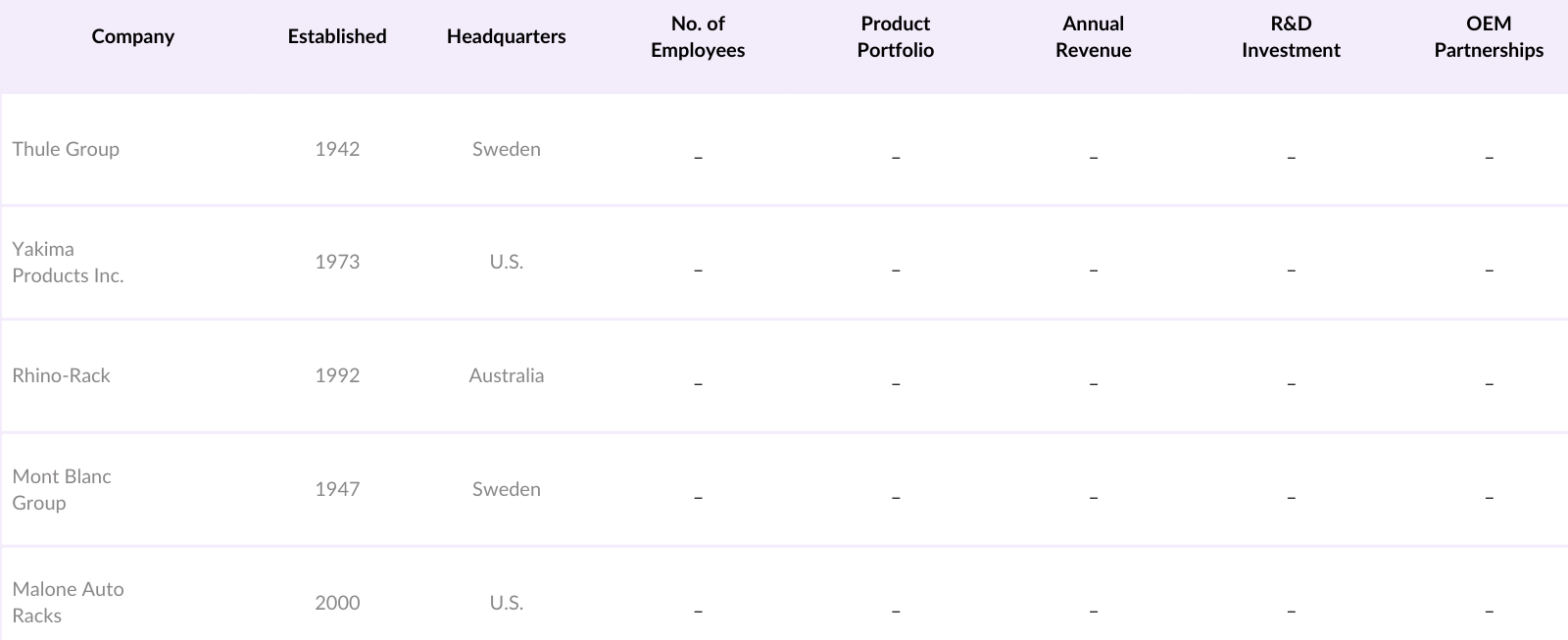

The global roof rack market is consolidated, with a few key players dominating the industry. Companies such as Thule Group, Yakima Products Inc., and Rhino-Rack are well-established, offering high-quality, durable roof racks with a strong focus on innovation and customer satisfaction. The competition in this market centers around innovation, customization options, and partnerships with automotive manufacturers. Many players are investing in R&D to create more lightweight and aerodynamic roof racks to improve vehicle fuel efficiency.

Global Roof Rack Industry Analysis

Growth Drivers

- Increasing Adventure Sports and Tourism: The global adventure tourism market is valued at $683 billion as of 2022, showing substantial growth as more individuals seek outdoor activities. The World Tourism Organization estimates that the number of international tourist arrivals reached 1.4 billion in 2019, with a projected increase in adventure-related trips post-pandemic. Moreover, the adventure sports market is projected to reach $1.8 trillion by 2025, indicating a shift in consumer preferences toward outdoor experiences. This trend correlates with increased demand for roof racks, as outdoor enthusiasts require reliable transportation for gear.

- Rise in SUV and Commercial Vehicle Sales: SUV sales reached 34 million units globally in 2022, representing a significant share of the automotive market. The International Organization of Motor Vehicle Manufacturers reports that global commercial vehicle sales were approximately 25 million units in the same year. The increasing popularity of SUVs and commercial vehicles is directly contributing to the demand for roof racks, which provide additional cargo space for recreational and professional use. As the automotive market expands, particularly in emerging economies, the need for roof accessories like racks is expected to grow significantly.

- Aftermarket Growth Due to Consumer Customization Preferences: The global automotive aftermarket is projected to be valued at $1.5 trillion by 2025, driven by consumers increasingly seeking customization options for their vehicles. According to a report from the Automotive Aftermarket Suppliers Association, more than 60% of vehicle owners in North America express interest in modifying their vehicles for enhanced functionality and aesthetics. This trend is reflected in the rising demand for roof racks, as consumers aim to personalize their vehicles for adventure and leisure activities. As disposable income levels rise, particularly in developing countries, the customization market is anticipated to thrive.

Market Challenges

- Fluctuation in Raw Material Costs: In 2022, aluminum prices were approximately $2,400 per metric ton, while steel prices ranged around $700 per metric ton. The World Bank indicates that prices for both metals have seen significant fluctuations due to supply chain disruptions and geopolitical tensions. These volatility issues impact manufacturers cost structures, potentially leading to increased prices for roof racks. As manufacturers navigate these challenges, the overall profitability of the roof rack market may be compromised, affecting consumer prices and market dynamics.

- Regulations on Vehicle Modification: Regulatory frameworks regarding vehicle modifications vary globally, often complicating the market landscape for roof racks. In the United States, the National Highway Traffic Safety Administration (NHTSA) mandates specific safety standards that roof rack manufacturers must comply with. Non-compliance can lead to significant penalties and product recalls, deterring manufacturers from innovating. As regulations tighten, companies must invest in research and development to ensure compliance, which may slow down product releases and increase operational costs.

Global Roof Rack Market Future Outlook

Over the next five years, the global roof rack market is poised for significant growth, driven by the increasing adoption of electric vehicles, the rising popularity of adventure sports, and the demand for vehicle customization options. As governments around the world push for stricter regulations on vehicle emissions, lightweight and aerodynamically efficient roof racks are expected to become a key area of focus for manufacturers. The electric vehicle (EV) segment presents substantial opportunities for roof rack manufacturers, as consumers in this space look for sustainable, low-impact travel solutions that do not compromise on cargo space. Additionally, the growing trend toward modular and smart roof racks, integrated with Internet of Things (IoT) technology, will drive market innovation.

Opportunities

- Growth in Electric Vehicle (EV) Roof Rack Integration: As electric vehicle sales reached 10 million units in 2022, there is a growing demand for specialized roof racks that cater to EVs' unique needs. The International Energy Agency projects that by 2025, electric vehicles will comprise 10% of global car sales. This presents significant opportunities for manufacturers to innovate and create roof racks tailored to EV specifications, such as lightweight designs that complement the vehicles' efficiency. By capitalizing on this trend, companies can position themselves as leaders in the evolving market.

- Potential for Lightweight and Aerodynamic Roof Rack Designs: The global market for lightweight materials is expected to reach $200 billion by 2025, with manufacturers increasingly focusing on developing products that enhance fuel efficiency. Consumers are showing a strong preference for roof racks that improve vehicle aerodynamics and reduce drag. According to research, implementing lightweight materials can result in fuel savings of up to 10% for vehicles. This presents a significant opportunity for manufacturers to invest in research and development for innovative roof rack designs that meet consumer demands for sustainability and performance.

Scope of the Report

|

Product Type |

Roof Box Roof Basket Roof Bars |

|

Vehicle Type |

Passenger Cars SUVs Light Commercial Vehicles Electric Vehicles (EVs) |

|

Application |

Leisure and Adventure Commercial Usage Urban Transportation |

|

Sales Channel |

OEM (Original Equipment Manufacturer) Aftermarket |

|

Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Vehicle OEMs

Roof Rack Manufacturing Companies

Aftermarket Accessory Comapnies

Automotive Dealership Comapnies

Government and Regulatory Bodies (e.g., U.S. Department of Transportation, European Automobile Manufacturers Association)

Investments and Venture Capitalist Firms

Adventure and Outdoor Equipment Comapnies

Electric Vehicle (EV) Manufacturing Comapnies

Companies

Players Mentioned in the Report

Thule Group

Yakima Products Inc.

Rhino-Rack

Mont Blanc Group

Malone Auto Racks

Cruzber SA

VDL Hapro

Kuat Racks

ROLA

INNO Advanced Car Racks

Table of Contents

1. Global Roof Rack Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, Volume Growth, Demand Drivers)

1.4. Market Segmentation Overview (By Product Type, Application, Vehicle Type, Sales Channel, Region)

2. Global Roof Rack Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Volume, Revenue)

2.3. Key Market Developments and Milestones (Innovations, Product Launches, Strategic Initiatives)

3. Global Roof Rack Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adventure Sports and Tourism

3.1.2. Rise in SUV and Commercial Vehicle Sales

3.1.3. Aftermarket Growth Due to Consumer Customization Preferences

3.1.4. E-Commerce Expansion Driving Online Sales

3.2. Market Challenges

3.2.1. Fluctuation in Raw Material Costs (Aluminum, Steel)

3.2.2. Regulations on Vehicle Modification

3.2.3. High Competition from Local Manufacturers

3.3. Opportunities

3.3.1. Growth in Electric Vehicle (EV) Roof Rack Integration

3.3.2. Potential for Lightweight and Aerodynamic Roof Rack Designs

3.3.3. Partnerships with Automotive OEMs for Integrated Solutions

3.4. Trends

3.4.1. Smart Roof Racks (With Sensors and IOT Integration)

3.4.2. Eco-friendly and Recyclable Material Usage

3.4.3. Modular Roof Rack Systems for Versatile Use

3.5. Government Regulation

3.5.1. Safety Regulations on Load Bearing Capacity

3.5.2. Environmental Guidelines for Manufacturing Materials

3.5.3. Vehicle Certification and Compliance Standards for Accessories

3.6. SWOT Analysis

3.6.1. Strengths

3.6.2. Weaknesses

3.6.3. Opportunities

3.6.4. Threats

3.7. Stakeholder Ecosystem

3.7.1. Manufacturers

3.7.2. Distributors and Retailers

3.7.3. OEM Partnerships

3.7.4. Aftermarket Vendors

3.8. Porters Five Forces Analysis

3.8.1. Threat of New Entrants

3.8.2. Bargaining Power of Suppliers

3.8.3. Bargaining Power of Buyers

3.8.4. Threat of Substitutes

3.8.5. Competitive Rivalry

3.9. Competitive Ecosystem

4. Global Roof Rack Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Roof Box

4.1.2. Roof Basket

4.1.3. Roof Bars

4.2. By Vehicle Type (In Value %)

4.2.1. Passenger Cars

4.2.2. SUVs

4.2.3. Light Commercial Vehicles

4.2.4. Electric Vehicles (EVs)

4.3. By Application (In Value %)

4.3.1. Leisure and Adventure

4.3.2. Commercial Usage

4.3.3. Urban Transportation

4.4. By Sales Channel (In Value %)

4.4.1. OEM (Original Equipment Manufacturer)

4.4.2. Aftermarket

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia Pacific

4.5.4. Latin America

4.5.5. Middle East & Africa

5. Global Roof Rack Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Thule Group

5.1.2. Yakima Products Inc.

5.1.3. Rhino-Rack

5.1.4. Mont Blanc Group

5.1.5. Malone Auto Racks

5.1.6. Cruzber SA

5.1.7. VDL Hapro

5.1.8. Kuat Racks

5.1.9. ROLA

5.1.10. INNO Advanced Car Racks

5.1.11. JAC Products

5.1.12. Prorack

5.1.13. Atera GmbH

5.1.14. Uebler GmbH

5.1.15. Front Runner Vehicle Outfitters

5.2. Cross Comparison Parameters

5.2.1. Number of Employees

5.2.2. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Sales Channels

5.2.6. Market Share (%)

5.2.7. Product Portfolio (Diversity of Roof Rack Types)

5.2.8. Innovation and R&D Investments

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Global Roof Rack Market Regulatory Framework

6.1. Vehicle Certification Standards

6.2. Load-Bearing and Safety Standards

6.3. Environmental Regulations for Material Use

6.4. Export and Import Tariffs on Roof Rack Products

7. Global Roof Rack Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Electrification of Vehicles, Emerging Markets, Consumer Lifestyle Changes)

8. Global Roof Rack Market Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Vehicle Type (In Value %)

8.3. By Application (In Value %)

8.4. By Sales Channel (In Value %)

8.5. By Region (In Value %)

9. Global Roof Rack Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involves defining the core parameters that influence the global roof rack market, such as product types, customer preferences, regional demand, and technological innovations. Primary research includes gathering insights from major stakeholders in the automotive industry, including roof rack manufacturers, automotive OEMs, and consumers.

Step 2: Market Analysis and Construction

In this phase, detailed data on market dynamics, including historical trends and regional growth, is analyzed. This process involves examining secondary databases, industry reports, and financial statements of key market players.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding market trends and growth drivers are tested through consultations with industry experts. These consultations help refine market forecasts and validate assumptions.

Step 4: Research Synthesis and Final Output

Finally, insights from all stages are synthesized to provide a detailed and comprehensive report, ensuring that the market projections are accurate and based on a blend of bottom-up and top-down approaches.

Frequently Asked Questions

01. How big is the global roof rack market?

The global roof rack market is valued at approximately USD 2.4 billion, driven by the increasing demand for customizable vehicle storage solutions, particularly for SUVs and light commercial vehicles.

02. What are the challenges in the global roof rack market?

Challenges include fluctuating raw material prices, regulatory restrictions on vehicle modifications, and increasing competition from low-cost local manufacturers, especially in emerging markets.

03. Who are the major players in the global roof rack market?

Key players in the market include Thule Group, Yakima Products Inc., Rhino-Rack, and Mont Blanc Group. These companies have established strong distribution networks and product portfolios that cater to a wide range of vehicles.

04. What are the growth drivers of the global roof rack market?

Growth drivers include the rising popularity of SUVs, increasing consumer demand for adventure and recreational travel, and the growing customization trend in the automotive aftermarket.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.