Global Rubber Process Oil Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD9147

December 2024

99

About the Report

Global Rubber Process Oil Market Overview

- The global rubber process oil market is valued at USD 2.19 billion. The market's growth is primarily driven by the increasing demand for rubber products in various industries such as automotive, industrial manufacturing, and consumer goods. The expansion of the tire manufacturing sector, particularly in emerging economies, along with a growing emphasis on high-performance rubber materials, contributes significantly to market growth.

- Countries like China, India, and the United States dominate the rubber process oil market due to their well-established automotive and industrial manufacturing sectors. China's large-scale tire manufacturing and technological advancements in rubber processing, combined with India's growing infrastructure and vehicle production, create strong demand for rubber process oils. Additionally, the U.S.'s emphasis on sustainability and innovation in rubber products further strengthens its market position.

- Governments worldwide have implemented stringent environmental regulations governing the use of hazardous chemicals in rubber processing. In 2023, the European Union tightened its REACH regulations to limit the use of PAHs in rubber process oils. These regulations have prompted manufacturers to shift towards environmentally sustainable alternatives, leading to increased use of low-PAH oils in rubber products across the EU. These regulatory changes aim to reduce the environmental impact of rubber production and promote sustainable manufacturing practices, encouraging industries to adopt greener solutions in their production processes.

Global Rubber Process Oil Market Segmentation

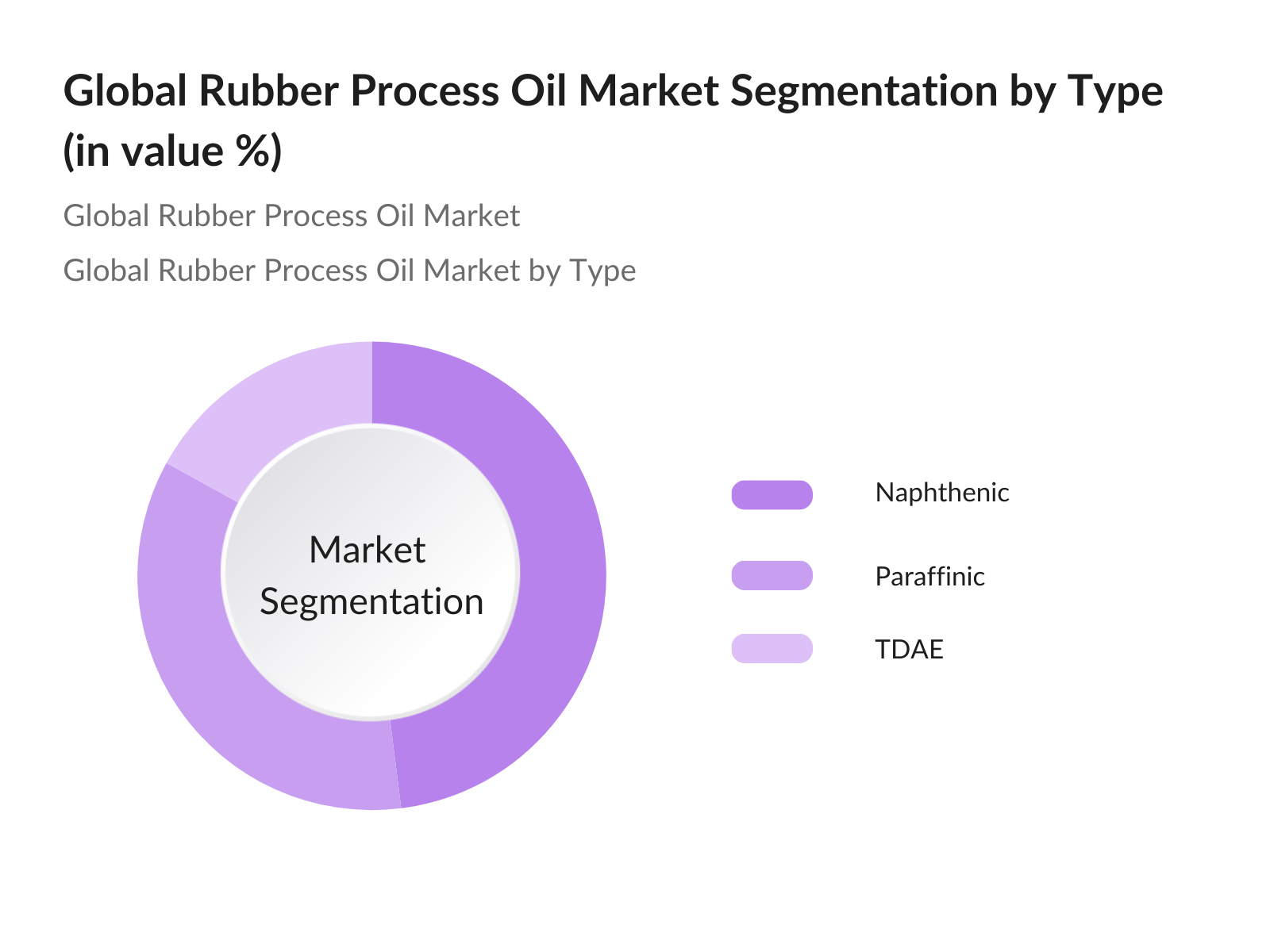

By Type: The rubber process oil market is segmented into Naphthenic, Paraffinic, and Treated Distillate Aromatic Extract (TDAE). Among these, Naphthenic oils dominate the segment due to their high solvency and excellent compatibility with synthetic rubbers, making them essential for tire and non-tire applications. Naphthenic oils are preferred for producing high-performance tires and industrial rubber products, as they improve processability and ensure better dispersion of fillers.

By Region: The market is segmented by regions: Asia Pacific, North America, and Europe. The Asia Pacific region dominates the market due to rapid industrialization and the presence of large-scale automotive manufacturers. China and India are significant players in this region, fueled by their robust automotive and construction industries. The availability of raw materials and favorable government policies further drive market growth.

Global Rubber Process Oil Market Competitive Landscape

The global rubber process oil market is highly competitive, with key players focusing on mergers, acquisitions, and product innovation to maintain their market position. The competition is marked by companies' efforts to meet stringent environmental regulations and develop eco-friendly process oils.

|

Company |

Established Year |

Headquarters |

No. of Employees |

Product Range |

Key Market |

Revenue (USD) |

R&D Investment |

Sustainability Initiatives |

|

Shell Plc |

1907 |

The Hague, NL |

86,000 |

- |

- |

- |

- |

- |

|

Chevron USA Inc. |

1879 |

San Ramon, USA |

47,000 |

- |

- |

- |

- |

- |

|

Nynas |

1920 |

Stockholm, SE |

1,000 |

- |

- |

- |

- |

- |

|

Apar Industries |

1958 |

Mumbai, IN |

1,200 |

- |

- |

- |

- |

- |

|

H&R GROUP |

1919 |

Hamburg, DE |

3,000 |

- |

- |

- |

- |

- |

Global Rubber Process Oil Market Analysis

Market Growth Drivers:

- Rise in Tire Manufacturing Industry: The global tire manufacturing industry has witnessed significant growth due to rising vehicle production and increasing demand for commercial and passenger vehicles. In 2023, global vehicle production reached 86 million units, reflecting a growing demand for tires across automotive sectors. The International Organization of Motor Vehicle Manufacturers (OICA) reported that tire manufacturing contributes significantly to the overall rubber processing industry, with a majority of rubber process oils being consumed by tire producers. As emerging markets such as India and Brazil show growth in automotive production, tire manufacturing is expected to further drive demand for rubber process oils.

- Increasing Demand for Solution Styrene-Butadiene Rubber (S-SBR) in Automotive Tires: S-SBR, known for its low rolling resistance and enhanced fuel efficiency, has seen increased demand, particularly in Europe and North America. It has become a critical material for tire manufacturers, contributing significantly to the reduction of fuel consumption in vehicles. The rising adoption of S-SBR directly boosts demand for rubber process oils, especially environmentally friendly formulations, which are being increasingly incorporated into the production of high-performance tires to meet both regulatory standards and consumer preferences for fuel-efficient automotive solutions.

- Expansion in Industrial Rubber Applications: Industrial rubber products, ranging from conveyor belts to hoses, drive demand for rubber process oils. The World Bank reported a 4% increase in the global industrial output in 2022, with manufacturing sectors relying on rubber applications for heavy machinery and transport equipment. Emerging economies, particularly in Southeast Asia, have increased their investments in industrial infrastructure, resulting in heightened demand for rubber-based products. As industrialization expands, particularly in countries like Indonesia and Vietnam, the demand for rubber process oils in industrial applications continues to grow.

Market Challenges:

- Environmental Impact Concerns: The production and disposal of rubber process oils contribute to environmental degradation. A 2022 study by the United Nations Environment Programme (UNEP) highlighted that improper disposal of rubber products contributes to 12 million metric tons of waste annually. Moreover, some rubber process oils release volatile organic compounds (VOCs) during processing, further exacerbating environmental concerns. The global push toward sustainability has increased scrutiny on the environmental footprint of rubber process oils, with manufacturers facing mounting pressure to reduce emissions and waste.

- Volatility in Raw Material Prices: The rubber process oil market has been affected by fluctuating crude oil prices, as these oils are petroleum derivatives. Crude oil prices saw substantial fluctuations, with Brent Crude averaging $79 per barrel in 2023, as reported by the U.S. Energy Information Administration (EIA). The volatility in oil prices has directly impacted the cost of producing rubber process oils, creating uncertainty for manufacturers and end-users alike. This volatility remains a challenge for rubber processors, especially in regions where oil price fluctuations have been more pronounced.

Global Rubber Process Oil Market Future Outlook

Over the next five years, the global rubber process oil market is expected to experience significant growth, driven by continuous demand in the tire manufacturing and automotive industries. The rising focus on sustainability and the development of eco-friendly rubber process oils will also propel market expansion. Technological advancements in rubber processing and the shift towards green manufacturing practices are likely to shape the future of this industry.

Market Opportunities:

- Growth in Automotive and Aerospace Sectors: The automotive and aerospace industries have witnessed steady growth, spurring demand for rubber-based components such as seals, gaskets, and hoses. The International Air Transport Association (IATA) reported an increase in air travel demand in 2023, which necessitates increased production of aerospace rubber components. Similarly, the global automotive industry produced over 86 million vehicles in 2023. This growth translates into heightened demand for rubber process oils, particularly in regions like the Asia-Pacific, where automotive production is rising significantly, driving the need for specialized rubber materials and oils in manufacturing processes.

- Rising Demand for High-Performance Rubber Compounds: High-performance rubber compounds are in greater demand due to their superior durability, elasticity, and resistance to wear. The global automotive and industrial sectors are increasingly adopting these compounds for use in high-stress applications such as off-road tires and industrial machinery. This trend is driving the development of specialized rubber process oils that enhance the performance and longevity of these high-end rubber products, as manufacturers seek materials that can withstand harsher operating conditions while maintaining efficiency and reliability in demanding environments.

Scope of the Report

|

By Type |

Naphthenic Paraffinic TDAE MES DAE RAE TRAE |

|

By Application |

Tire Manufacturing Non-Tire, Automotive Industrial Consumer Goods |

|

By End-User Industry |

Automotive Aerospace Industrial Construction Energy |

|

By Process Type |

Hot Process Cold Process Hybrid Process |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Automotive Manufacturers

Tire Manufacturers

Industrial Rubber Producers

Aerospace Companies

Construction Companies

Government and Regulatory Bodies (Environmental Protection Agencies)

Investment and Venture Capitalist Firms

Raw Material Suppliers

Companies

Players Mention in the Report

Shell Plc

Chevron USA Inc.

Nynas

Apar Industries

Panama Petrochem

H&R Group

Sunoco Lubricants

Indian Oil Corporation

Hindustan Petroleum Corporation

Total S.A.

Unipetrol Group

Repsol

CPC Corporation

Eagle Petrochem

Idemitsu Kosan

Table of Contents

1. Global Rubber Process Oil Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Rubber Process Oil Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Rubber Process Oil Market Analysis

3.1 Growth Drivers

3.1.1 Rise in Tire Manufacturing Industry

3.1.2 Increasing Demand for Solution Styrene-Butadiene Rubber (S-SBR) in Automotive Tires

3.1.3 Expansion in Industrial Rubber Applications

3.1.4 Adoption of Sustainable Rubber Process Oils

3.2 Market Challenges

3.2.1 Volatility in Raw Material Prices

3.2.2 Regulatory Constraints on Aromatic Oil Usage

3.2.3 Environmental Impact Concerns

3.3 Opportunities

3.3.1 Growth in Automotive and Aerospace Sectors

3.3.2 Expansion in Emerging Markets (Asia Pacific and Latin America)

3.3.3 Introduction of Bio-based Rubber Process Oils

3.4 Trends

3.4.1 Shift Toward Naphthenic Rubber Process Oils

3.4.2 Development of Green and Eco-Friendly Formulations

3.4.3 Rising Demand for High-Performance Rubber Compounds

3.5 Government Regulation

3.5.1 Environmental Regulations and Standards on Rubber Processing

3.5.2 Policies Promoting Sustainable Manufacturing

3.6 SWOT Analysis

3.7 Stake Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Global Rubber Process Oil Market Segmentation

4.1 By Type (In Value %)

4.1.1 Naphthenic

4.1.2 Paraffinic

4.1.3 Treated Distillate Aromatic Extract (TDAE)

4.1.4 MES

4.1.5 DAE

4.2 By Application (In Value %)

4.2.1 Tire Manufacturing

4.2.2 Non-Tire Applications (Industrial Rubber)

4.2.3 Automotive

4.2.4 Consumer Goods

4.3 By End-User Industry (In Value %)

4.3.1 Automotive

4.3.2 Aerospace

4.3.3 Industrial Manufacturing

4.3.4 Construction

4.3.5 Energy

4.4 By Region (In Value %)

4.4.1 North America

4.4.2 Europe

4.4.3 Asia Pacific

4.4.4 Latin America

4.4.5 Middle East & Africa

5. Global Rubber Process Oil Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Shell Plc

5.1.2 Chevron USA Inc.

5.1.3 Nynas

5.1.4 Apar Industries

5.1.5 Panama Petrochem

5.1.6 H&R Group

5.1.7 Sunoco Lubricants

5.1.8 Indian Oil Corporation

5.1.9 Hindustan Petroleum Corporation

5.1.10 Total S.A.

5.1.11 Unipetrol Group

5.1.12 Repsol

5.1.13 CPC Corporation

5.1.14 Eagle Petrochem

5.1.15 Idemitsu Kosan

5.2 Cross Comparison Parameters (Number of Employees, Market Share, Product Portfolio, Revenue)

5.3 Strategic Initiatives

5.4 Mergers and Acquisitions

5.5 Investment Analysis

5.6 Government Incentives and Grants

5.7 Private Equity and Venture Capital Investments

6. Global Rubber Process Oil Market Regulatory Framework

6.1 Environmental Standards (Emission Control)

6.2 Compliance Requirements (Product Safety Regulations)

6.3 Certification Processes (Industry-specific Certifications)

7. Global Rubber Process Oil Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Rubber Process Oil Future Market Segmentation

8.1 By Type (In Value %)

8.2 By Application (In Value %)

8.3 By End-User Industry (In Value %)

8.4 By Region (In Value %)

9. Global Rubber Process Oil Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involves mapping the global rubber process oil market ecosystem, focusing on major stakeholders, including tire and rubber manufacturers. We employ secondary research, leveraging proprietary databases to gather relevant industry information.

Step 2: Market Analysis and Construction

This phase includes analyzing historical data on rubber process oil production and consumption, as well as trends in the automotive and industrial sectors. Data validation is ensured by cross-referencing with market participants.

Step 3: Hypothesis Validation and Expert Consultation

To validate our market hypotheses, we engage industry experts via in-depth interviews. Insights from manufacturers and suppliers are used to refine and corroborate our findings.

Step 4: Research Synthesis and Final Output

The final step involves compiling and synthesizing all gathered data. This includes a thorough analysis of product segments, market penetration rates, and overall industry trends, verified through multiple sources.

Frequently Asked Questions

01. How big is the Global Rubber Process Oil Market?

The global rubber process oil market is valued at USD 2.19 billion, driven by increased demand from the automotive and industrial sectors, particularly in Asia Pacific and North America.

02. What are the major challenges in the Global Rubber Process Oil Market?

The market faces challenges such as fluctuating raw material prices and stringent environmental regulations, which impact production costs and the adoption of aromatic process oils.

03. Who are the major players in the Global Rubber Process Oil Market?

Key players in the market include Shell Plc, Chevron USA Inc., Nynas, Apar Industries, and H&R Group, with strong global and regional presence across various segments.

04. What are the growth drivers of the Global Rubber Process Oil Market?

The market is driven by the rising demand for durable and high-performance rubber in the automotive, industrial, and consumer goods sectors. Technological advancements in tire manufacturing also contribute to market growth.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.