Global Scooter Market Outlook to 2029

Region:Global

Author(s):Dev

Product Code:KROD-063

June 2025

80

About the Report

Global Scooter Market Overview

- The Global Scooter Market was valued at USD 68 billion, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, rising demand for eco-friendly transportation, and advancements in electric scooter technology. The market has seen a surge in consumer interest as cities worldwide adopt sustainable mobility solutions to combat traffic congestion and pollution.

- Key players in this market include China, the United States, and several European countries. China dominates due to its large manufacturing base and high consumer adoption rates, while the U.S. and Europe are significant due to their focus on sustainable urban transport solutions and government incentives promoting electric scooters.

- In 2023, several EU member states introduced or updated regulations for scooters, setting safety and environmental standards such as speed limits, helmet requirements, and insurance mandates. While the EU promotes harmonization of these rules to enhance user safety and reduce emissions, a binding, unified regulation for all new scooters sold across the EU is still under development.

Global Scooter Market Segmentation

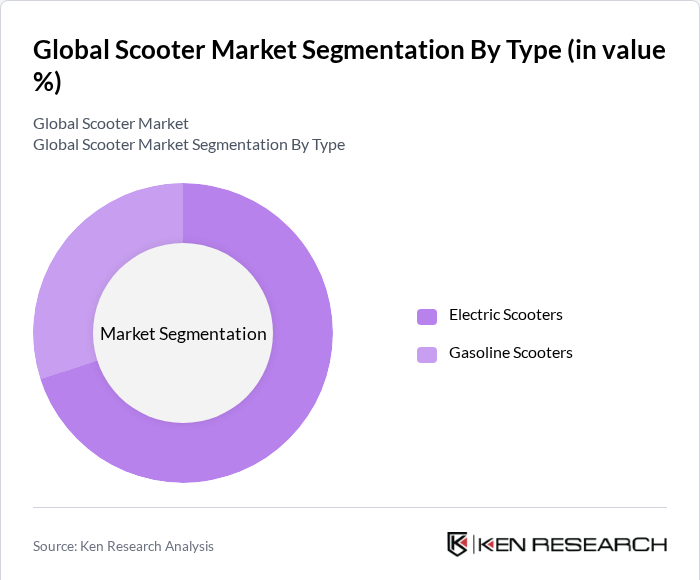

By Type: The market is segmented into electric scooters and gasoline scooters. Electric scooters are dominating the market due to their eco-friendliness, lower operating costs, and government incentives promoting electric mobility. The increasing awareness of environmental issues and the push for sustainable urban transport solutions have led to a significant rise in the adoption of electric scooters. Consumers are increasingly favoring electric models for their convenience and cost-effectiveness, which has resulted in a shift away from gasoline scooters.

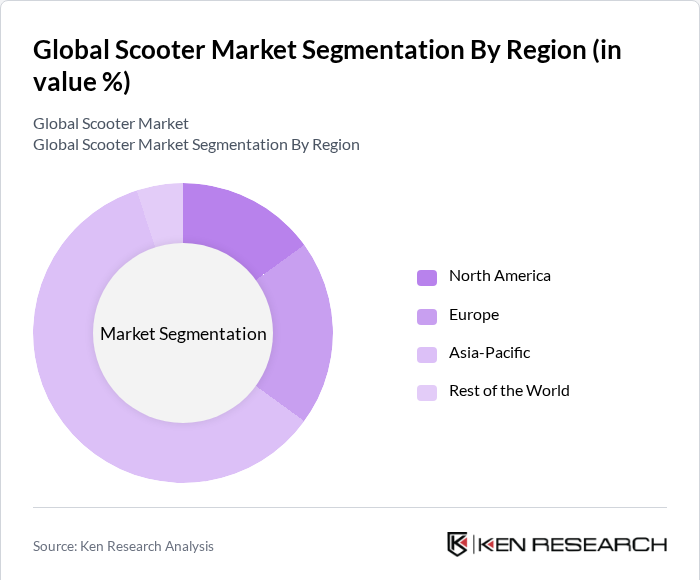

By Region: The market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. The Asia-Pacific region is leading the market, primarily due to the high demand for scooters in countries like China and India, where two-wheeler transportation is a common choice. The rapid urbanization and increasing disposable income in these regions have fueled the growth of the scooter market. Additionally, government initiatives promoting electric vehicles have further accelerated the adoption of scooters in these areas.

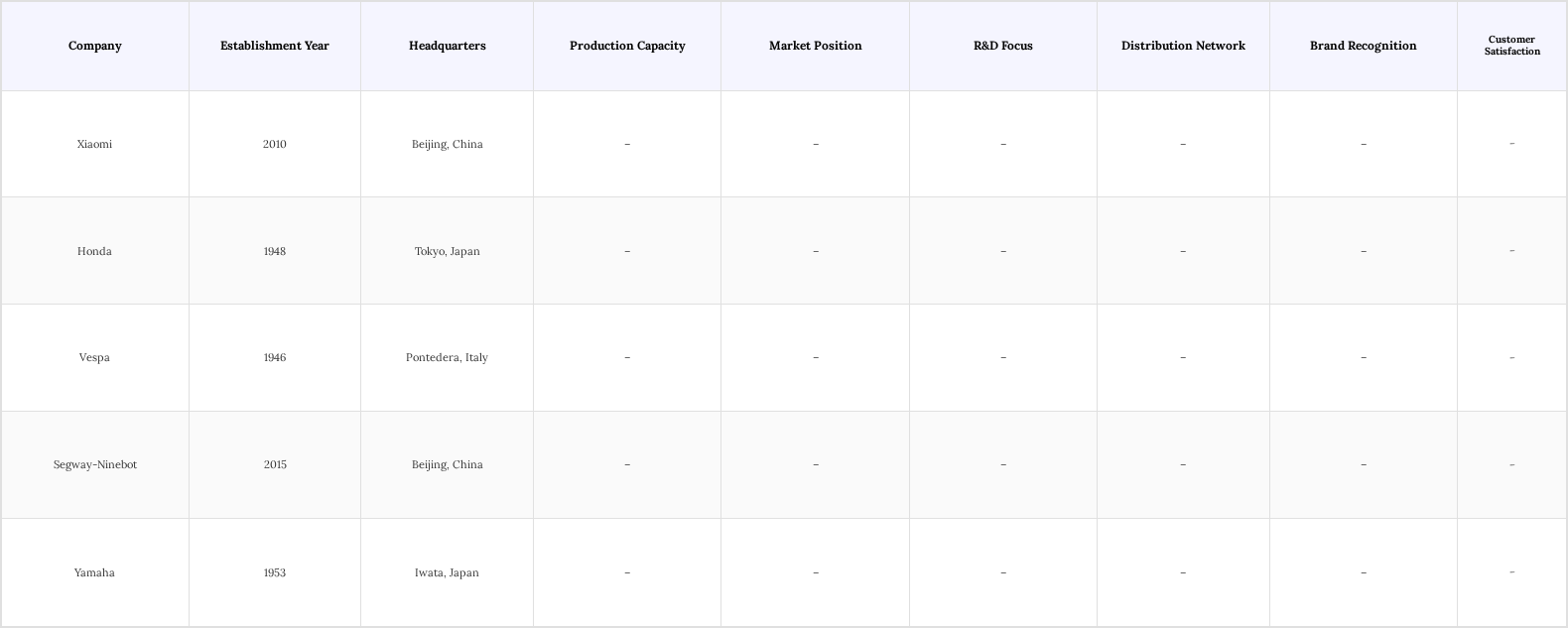

Global Scooter Market Competitive Landscape

The Global Scooter Market is characterized by intense competition among key players such as Xiaomi, Honda, Vespa, Segway-Ninebot, and Yamaha. These companies are focusing on innovation, product differentiation, and expanding their distribution networks to capture a larger market share. The competitive dynamics are influenced by the growing demand for electric scooters and the need for sustainable transportation solutions.

Global Scooter Market Industry Analysis

Growth Drivers

- Increasing Urbanization: By 2024, the United Nations projects that 56.2% of the global population will live in urban areas, intensifying traffic congestion worldwide. In cities such as Los Angeles, congestion costs reach around $20 billion annually, driving demand for efficient, compact transportation. Scooters offer a practical solution by navigating crowded streets easily, reducing commute times, and lowering emissions, making them increasingly popular as urban populations seek smarter mobility options.

- Demand for Eco-Friendly Solutions: The global push for sustainable transportation is fueling demand for electric scooters, which made up about 8% of all two-wheelers in 2023. Despite a slight dip in electric two-wheeler sales to 9.9 million units in 2023, markets like India saw a 35.8% increase, driven by government incentives and rising environmental awareness. The Asia-Pacific region dominates with over 80% of sales, supported by policies targeting greenhouse gas reductions, encouraging wider adoption of eco-friendly scooters worldwide.

- Technological Advancements: Advances in battery technology are significantly enhancing electric scooter performance. In 2024, next-generation lithium-ion and emerging solid-state batteries offer increased energy density, enabling ranges up to 60 kilometers (about 37 miles) per charge—three times higher than earlier models. Fast-charging tech reduces recharge times to under two hours. Additional features like GPS tracking and mobile app integration improve safety and user experience, appealing to tech-savvy consumers and driving market growth.

Market Challenges

- Regulatory Hurdles: The scooter market faces significant regulatory challenges, with varying laws across regions. Differences in local regulations can lead to confusion among consumers and manufacturers alike. Ensuring compliance often increases operational costs, as companies must invest in legal consultations and modify their products to meet diverse standards. This regulatory fragmentation can ultimately hinder the pace of market growth and expansion.

- Safety Concerns: Safety remains a critical challenge for the scooter market, particularly as adoption rates continue to rise. Increasing incidents involving scooters have raised concerns among regulators and the public, prompting calls for stricter safety norms. This may deter potential users and limit widespread adoption. To address this, manufacturers must invest in advanced safety features and rider education to build consumer confidence and reduce associated risks.

Global Scooter Market Future Outlook

The future of the scooter market appears promising, driven by ongoing urbanization and a shift towards sustainable transportation. As cities continue to expand, the demand for efficient mobility solutions will likely increase. Furthermore, advancements in technology, such as improved battery life and smart features, will enhance user experience. The integration of scooters into public transport systems is also expected to grow, providing seamless connectivity and encouraging more individuals to adopt scooters as a primary mode of transport.

Market Opportunities

- Expansion of E-Scooter Sharing Programs: The rise of e-scooter sharing programs presents a significant opportunity for market growth. Cities are increasingly adopting shared mobility solutions, with the global e-scooter sharing market projected to reach $10 billion by 2025. This trend not only reduces the need for personal ownership but also promotes sustainable urban transport, appealing to environmentally conscious consumers.

- Growth in Electric Vehicle Adoption: The increasing adoption of electric vehicles (EVs) is creating a favorable environment for electric scooters. With global EV sales expected to surpass 25 million units by 2024, the infrastructure supporting electric mobility, such as charging stations, is also expanding. This growth will facilitate the adoption of electric scooters, making them a viable alternative for urban commuters seeking eco-friendly transport options.

Scope of the Report

| By Product Type |

Electric Scooters Gasoline Scooters |

| By Region |

North America Europe Asia-Pacific The Rest of the World |

| By End User |

Individual Users Commercial Users |

| By Distribution Channel |

Online Offline |

| By Engine Capacity |

Below 50cc 50cc - 150cc Above 150cc |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Department of Transportation, Environmental Protection Agency)

Manufacturers and Producers

Distributors and Retailers

Urban Planning Authorities

Public Transportation Agencies

Insurance Companies

Logistics and Delivery Service Providers

Companies

Players Mentioned in the Report:

Xiaomi

Honda

Vespa

Segway-Ninebot

Yamaha

GlideTech Scooters

UrbanRide Mobility

EcoScoot Innovations

SwiftWheel Technologies

Zoomerang Scooters

Table of Contents

1. Global Scooter Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Scooter Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Scooter Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Urbanization and Traffic Congestion

3.1.2. Rising Demand for Eco-Friendly Transportation Solutions

3.1.3. Technological Advancements in Scooter Design and Performance

3.2. Market Challenges

3.2.1. Regulatory Hurdles and Compliance Issues

3.2.2. Safety Concerns and Accident Rates

3.2.3. Competition from Alternative Modes of Transport

3.3. Opportunities

3.3.1. Expansion of E-Scooter Sharing Programs

3.3.2. Growth in Electric Vehicle Adoption

3.3.3. Development of Smart Scooter Technologies

3.4. Trends

3.4.1. Increasing Popularity of Micro-Mobility Solutions

3.4.2. Integration of IoT in Scooter Features

3.4.3. Shift Towards Sustainable Urban Mobility Solutions

3.5. Government Regulation

3.5.1. Local and National Legislation on Scooter Usage

3.5.2. Environmental Regulations Impacting Manufacturing

3.5.3. Safety Standards for Electric and Gasoline Scooters

3.5.4. Incentives for Electric Scooter Adoption

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Global Scooter Market Segmentation

4.1. By Product Type

4.1.1. Electric Scooters

4.1.2. Gasoline Scooters

4.2. By Region

4.2.1. North America

4.2.2. Europe

4.2.3. Asia-Pacific

4.2.4. The Rest of the World

4.3. By End User

4.3.1. Individual Users

4.3.2. Commercial Users

4.4. By Distribution Channel

4.4.1. Online

4.4.2. Offline

4.5. By Engine Capacity

4.5.1. Below 50cc

4.5.2. 50cc - 150cc

4.5.3. Above 150cc

5. Global Scooter Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Xiaomi

5.1.2. Honda

5.1.3. Vespa

5.1.4. Segway-Ninebot

5.1.5. Yamaha

5.1.6. GlideTech Scooters

5.1.7. UrbanRide Mobility

5.1.8. EcoScoot Innovations

5.1.9. SwiftWheel Technologies

5.1.10. Zoomerang Scooters

5.2. Cross Comparison Parameters

5.2.1. Market Share

5.2.2. Product Range

5.2.3. Pricing Strategies

5.2.4. Distribution Networks

5.2.5. Customer Satisfaction Ratings

5.2.6. Innovation and R&D Investment

5.2.7. Brand Recognition

5.2.8. Sustainability Initiatives

6. Global Scooter Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Global Scooter Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Scooter Market Future Market Segmentation

8.1. By Product Type

8.1.1. Electric Scooters

8.1.2. Gasoline Scooters

8.2. By Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia-Pacific

8.2.4. The Rest of the World

8.3. By End User

8.3.1. Individual Users

8.3.2. Commercial Users

8.4. By Distribution Channel

8.4.1. Online

8.4.2. Offline

8.5. By Engine Capacity

8.5.1. Below 50cc

8.5.2. 50cc - 150cc

8.5.3. Above 150cc

9. Global Scooter Market Analysts’ Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Global Scooter Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Global Scooter Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Global Scooter Market.

Frequently Asked Questions

01. How big is the Global Scooter Market?

The Global Scooter Market is valued at USD 68 billion, driven by factors such as increasing demand, technological advancements, and supportive government initiatives.

02. What are the key challenges in the Global Scooter Market?

Key challenges in the Global Scooter Market include intense competition, regulatory complexities, and infrastructure limitations affecting market dynamics.

03. Who are the major players in the Global Scooter Market?

Major players in the Global Scooter Market include Xiaomi, Honda, Vespa, Segway-Ninebot, Yamaha, among others.

04. What are the growth drivers for the Global Scooter Market?

The primary growth drivers for the Global Scooter Market are increasing consumer demand, favorable policies, innovation, and substantial investment inflows.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.