Region:Global

Author(s):Geetanshi

Product Code:KRAA0121

Pages:84

Published On:August 2025

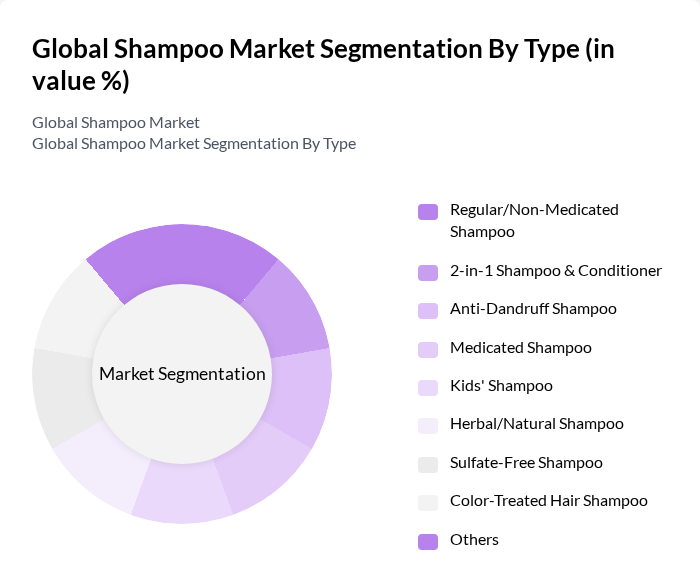

By Type:The shampoo market is segmented into various types, including Regular/Non-Medicated Shampoo, 2-in-1 Shampoo & Conditioner, Anti-Dandruff Shampoo, Medicated Shampoo, Kids' Shampoo, Herbal/Natural Shampoo, Sulfate-Free Shampoo, Color-Treated Hair Shampoo, and Others. Among these, Regular/Non-Medicated Shampoo holds a significant share due to its widespread use and availability. The increasing trend of consumers seeking multifunctional products has also boosted the popularity of 2-in-1 Shampoo & Conditioner. The demand for Anti-Dandruff and Herbal/Natural shampoos continues to rise as consumers become more health-conscious and seek products with fewer synthetic chemicals and more natural ingredients .

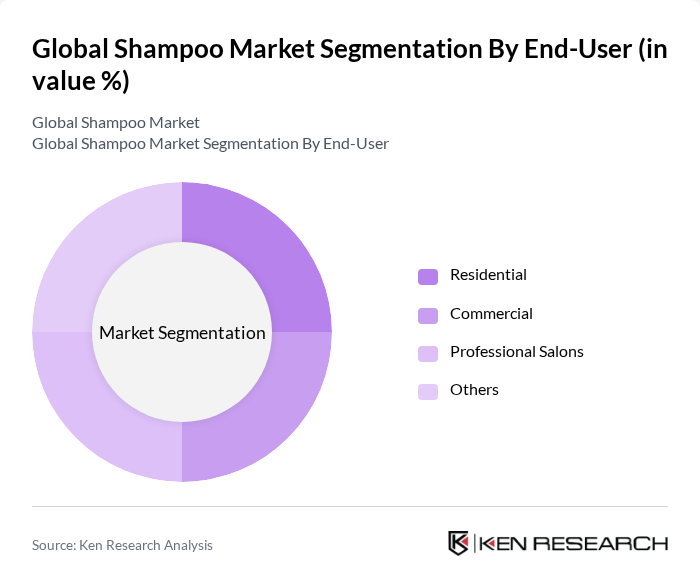

By End-User:The market is segmented by end-user into Residential, Commercial, Professional Salons, and Others. The Residential segment dominates the market, driven by the increasing number of households, growing emphasis on personal grooming, and the widespread availability of shampoos through retail and e-commerce channels. The Commercial segment is also significant, as businesses like hotels and spas require bulk shampoo supplies. Professional Salons are gaining traction as consumers seek expert hair care services, leading to a rise in demand for specialized salon-grade products .

The Global Shampoo Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble (Head & Shoulders, Pantene, Herbal Essences), Unilever (Dove, Sunsilk, Clear, TRESemmé), L'Oréal (Elvive, Kérastase, Garnier Fructis), Johnson & Johnson (OGX, Neutrogena), Colgate-Palmolive (Palmolive, Softsoap), Henkel (Schwarzkopf, Syoss, Dial), Kao Corporation (Asience, Merit, Essential), Shiseido (Tsubaki, Ma Cherie), Beiersdorf AG (Nivea), Estée Lauder Companies (Aveda), Coty Inc. (Clairol, Wella), Revlon (Flex, Almay), Amway (Satinique), Church & Dwight (Batiste, Viviscal), and Himalaya Drug Company (Himalaya Herbals) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the shampoo market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are expected to invest in eco-friendly packaging and formulations. Additionally, the rise of personalized hair care solutions will likely gain traction, with consumers seeking products tailored to their specific hair types and concerns. The integration of AI in product development and marketing strategies will further enhance consumer engagement and brand loyalty.

| Segment | Sub-Segments |

|---|---|

| By Type | Regular/Non-Medicated Shampoo in-1 Shampoo & Conditioner Anti-Dandruff Shampoo Medicated Shampoo Kids' Shampoo Herbal/Natural Shampoo Sulfate-Free Shampoo Color-Treated Hair Shampoo Others |

| By End-User | Residential Commercial Professional Salons Others |

| By Packaging Type | Bottles Sachets Tubes Pumps Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Others |

| By Price Range | Premium Mid-Range Economy Others |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients Organic Ingredients Others |

| By Gender | Male Female Unisex Others |

| By Geography | North America Europe Asia Pacific South America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Shampoo | 100 | Regular Shampoo Users, Eco-conscious Consumers |

| Retail Insights on Shampoo Sales | 60 | Store Managers, Category Buyers |

| Market Trends in Organic Shampoo | 50 | Health and Wellness Influencers, Organic Product Retailers |

| Shampoo Brand Loyalty Studies | 80 | Brand Loyal Consumers, New Users |

| Impact of Marketing on Shampoo Purchases | 40 | Marketing Professionals, Advertising Executives |

The Global Shampoo Market is valued at approximately USD 35 billion, reflecting a significant growth trend driven by consumer awareness of personal grooming, rising disposable incomes, and the shift towards organic and natural ingredients.