Global Shopping Centers Market Outlook to 2030

Region:Global

Author(s):Paribhasha Tiwari

Product Code:KROD4337

December 2024

90

About the Report

Global Shopping Centers Market Overview

- The global shopping centers market is valued at USD 6 trillion, driven by factors such as increasing urbanization, the rise of e-commerce integration within physical stores, and evolving consumer shopping behaviors. Retailers and developers continue to innovate with experience-based offerings that draw customers beyond traditional shopping, contributing to higher foot traffic and sales. Major developments in mixed-use spaces and smart mall technologies are also influencing growth, particularly in regions where consumer demand for integrated retail, dining, and entertainment experiences is rising.

- Countries like the United States, China, and the United Arab Emirates dominate the global shopping centers market due to high levels of disposable income, robust retail infrastructure, and substantial investments in mega-mall developments. The United States, with its network of established regional and super-regional malls, remains a leader, while China's rapid urbanization and growing middle class bolster its dominance. The UAE stands out for luxury retail spaces, attracting tourists and high-end consumers, further driving the market.

- Governments worldwide have increased their investments in retail infrastructure to stimulate economic growth. In 2024, governments in countries like Saudi Arabia, India, and Brazil allocated billions in funds to support the development of retail spaces as part of national economic development plans. Saudi Arabia's Vision 2030 and India's Smart Cities Mission are examples of initiatives that have encouraged the construction of modern shopping centers, aiming to boost tourism and local economies through retail.

Global Shopping Centers Market Segmentation

By Type of Shopping Center: The global shopping centers market is segmented by type into super-regional malls, regional malls, community malls, and lifestyle centers. Super-regional malls, due to their vast size and capacity to house a large variety of stores, entertainment, and services, dominate the market. These centers are preferred by consumers seeking a diverse shopping experience in one location, and their ability to attract anchor tenants like department stores and entertainment venues makes them a key segment in the market. The trend toward luxury retail, dining, and entertainment hubs contributes to the continued growth of this segment.

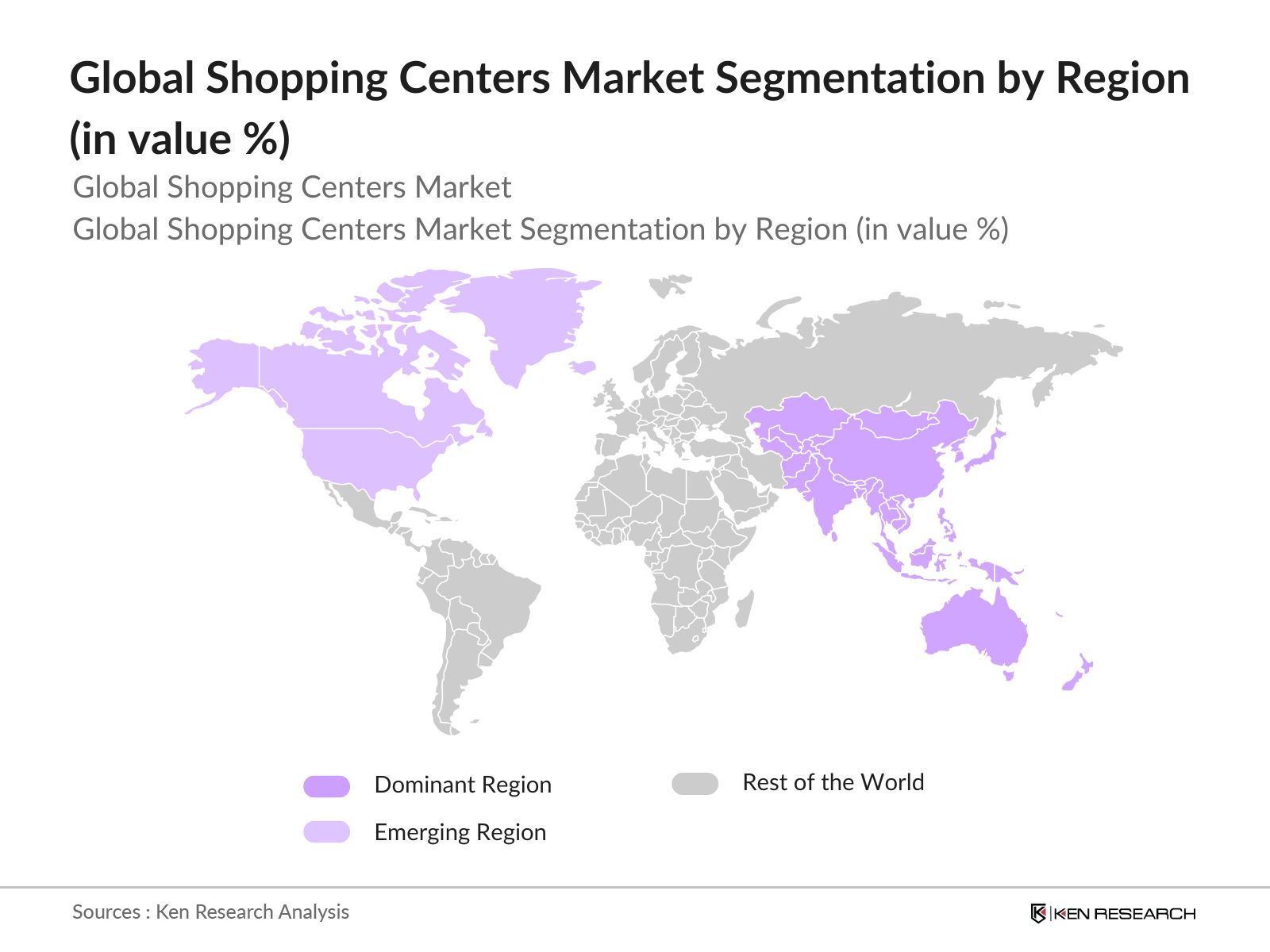

By Region: The global shopping centers market is segmented into several key regions, including North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. Among these, Asia-Pacific stands out as the dominant region due to its rapidly urbanizing population, increasing disposable income, and strong retail growth. Chinas dominance in the region is attributed to its large-scale mall developments, supported by government infrastructure projects and a burgeoning middle class that drives consumer spending.

By Anchor Tenant Type: The market is also segmented by anchor tenant type, including fashion and apparel, food and beverage, and entertainment hubs. Fashion and apparel anchor tenants hold a dominant market share, as they remain a key attraction for shoppers visiting malls. Well-known brands such as H&M, Zara, and Nike contribute significantly to this segments dominance, driving foot traffic and increasing the overall appeal of the shopping centers. These brands have established themselves as essential components of retail spaces, benefiting from high brand loyalty and widespread consumer demand.

Global Shopping Centers Market Competitive Landscape

The global shopping centers market is characterized by the presence of a few key players who dominate the industry through strategic developments, technological innovations, and strong brand portfolios. Major players invest heavily in the construction and refurbishment of malls, as well as the integration of digital solutions to enhance customer experience. The dominance of these companies highlights their ability to influence market trends and expand into new regions.

|

Company |

Establishment Year |

Headquarters |

Retail Space (sq. ft.) |

Revenue (USD Bn) |

Mall Count |

International Presence |

Investment in Technology |

Sustainability Initiatives |

|

Simon Property Group |

1993 |

Indianapolis, USA |

- | - | - | - | - | - |

|

Westfield Corporation |

1953 |

Sydney, Australia |

- | - | - | - | - | - |

|

Brookfield Properties |

1923 |

New York, USA |

- | - | - | - | - | - |

|

Unibail-Rodamco-Westfield |

1968 |

Paris, France |

- | - | - | - | - | - |

|

Majid Al Futtaim Group |

1992 |

Dubai, UAE |

- | - | - | - | - | - |

Global Shopping Centers Market Analysis

Growth Drivers

- Rise of Omnichannel Retail Integration: The integration of omnichannel strategies has transformed shopping centers globally, allowing retailers to blend online and offline experiences. According to macroeconomic data from 2024, global retail sales are expected to reach significant figures, and omnichannel retailing has become a key strategy for retail companies to meet consumer expectations. Countries like the U.S. and China have seen massive investments in omnichannel retail technologies that enhance customer experience within shopping centers, such as click-and-collect services, digital payments, and real-time inventory management.

- Increasing Urbanization and Real Estate Developments: Globally, urbanization has fueled the development of new retail hubs. In 2024, over 4.5 billion people live in urban areas, and retail infrastructure developments have followed the surge in urbanization. Real estate developments in prime retail locations have received substantial investment, particularly in rapidly urbanizing regions like Southeast Asia and Africa. New shopping centers are being constructed in Tier-1 and Tier-2 cities to meet the growing demand for retail spaces, as evidenced by the construction of over 1,000 new malls in India and China between 2022 and 2024, backed by government initiatives promoting retail growth.

- Government Support for Retail Infrastructure: Governments around the world have introduced policies and grants to boost retail infrastructure. In 2024, governments in markets like Saudi Arabia, the U.A.E., and India have provided extensive support, offering subsidies and tax incentives to promote the construction of shopping centers. In Saudi Arabia, for example, the Vision 2030 initiative has allocated over USD 500 million in funding to promote retail and leisure infrastructure development, resulting in a growing number of high-end malls and mixed-use developments. These initiatives are designed to attract global retailers and enhance tourism revenue through retail.

Market Challenges

- Impact of E-commerce on Brick-and-Mortar Stores: E-commerce continues to impact physical retail stores within shopping centers, leading to a decline in foot traffic for non-essential retail. In 2024, online retail accounted for over USD 6.5 trillion in global sales, and many shopping centers have struggled to adapt to the changing consumer behavior favoring online shopping. This has led to store closures and increased vacancy rates in major shopping hubs like the U.S. and Europe. However, shopping centers with a strong focus on experiential retail and integrating digital technologies have fared better in attracting customers.

- High Maintenance and Operational Costs: Shopping centers face significant financial strain due to high operational costs, including utilities, security, and staffing. In 2024, operational expenses for large shopping malls in developed markets like the U.S. averaged USD 1.5 million annually. Maintenance costs, especially for luxury and high-traffic malls, are escalating due to the need for constant upgrades in infrastructure and technology. Shopping centers that have not modernized their facilities with energy-efficient solutions and smart building management systems are facing an increase in operational expenditure, impacting their profitability.

Global Shopping Centers Market Future Outlook

Over the next five years, the global shopping centers market is expected to experience steady growth, driven by rising urbanization, technological advancements in smart malls, and the continued demand for experiential retail spaces. Shopping centers will increasingly adopt omnichannel retail strategies, blending physical and digital shopping experiences to meet evolving consumer expectations. Additionally, the growing focus on sustainability and eco-friendly practices within shopping centers will further shape the future landscape.

Market Opportunities

- Adoption of Smart Mall Technologies: Shopping centers are adopting smart mall technologies, such as digital foot traffic analytics and IoT-enabled solutions, to enhance consumer experiences and operational efficiency. By 2024, smart mall technologies are expected to be implemented in over 1,000 malls globally, with investments in smart lighting, energy management systems, and digital kiosks increasing. Countries like Singapore and South Korea are leading the way, with malls offering personalized retail experiences based on consumer data, driving higher customer satisfaction and boosting tenant revenues.

- Integration of Mixed-Use Spaces: The integration of mixed-use spaces combining retail, hospitality, and entertainment is becoming a key trend in shopping center development. By 2024, over 500 mixed-use developments were launched in markets like India, the U.S., and the U.K., where shopping centers include hotels, residential areas, and recreational spaces. This shift caters to changing consumer preferences, where shopping centers are no longer just retail hubs but destinations for leisure, work, and living. This trend is expected to attract new tenant categories, such as co-working spaces and boutique hotels, generating additional revenue streams for developers.

Scope of the Report

|

By Type of Shopping Center |

Super-Regional Malls Regional Malls Community Malls Lifestyle Centers |

|

By Anchor Tenant Type |

Fashion and Apparel Food and Beverage Entertainment Hubs |

|

By Ownership Model |

REIT-Owned Malls Privately-Owned Centers Institutional Investments |

|

By Tenant Mix |

Retail-Heavy Centers Mixed-Use Centers Service-Oriented Centers |

|

By Region |

North America Europe Asia-Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Retail Developers and Investors

Real Estate Investment Trusts (REITs)

Government and Regulatory Bodies (Zoning Commissions, Urban Planning Authorities)

Shopping Center Operators

Anchor Tenants (Fashion Brands, Entertainment Providers)

Venture Capital Firms and investors

Construction and Facility Management Companies

Technology Providers for Smart Malls

Companies

Players Mentioned in the Report:

- Simon Property Group

- Westfield Corporation

- Brookfield Properties

- Unibail-Rodamco-Westfield

- Majid Al Futtaim Group

- Emaar Malls Group

- The Macerich Company

- Intu Properties

- Hammerson plc

- GGP Inc.

Table of Contents

1. Global Shopping Centers Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Shopping Center Typologies (Super-Regional, Regional, Community, Lifestyle)

1.4 Market Growth Rate (Occupancy Rates, Foot Traffic Metrics)

1.5 Market Segmentation Overview

2. Global Shopping Centers Market Size (In USD Bn)

2.1 Historical Market Size (Revenue from Retail Spaces)

2.2 Year-On-Year Growth Analysis (Rental Revenue Growth, Sales Per Square Foot)

2.3 Key Market Developments and Milestones (Expansion of Mall Spaces, Redevelopment Projects)

3. Global Shopping Centers Market Analysis

3.1 Growth Drivers

3.1.1 Rise of Omnichannel Retail Integration

3.1.2 Increasing Urbanization and Real Estate Developments

3.1.3 Government Support for Retail Infrastructure

3.1.4 Consumer Spending Trends in Retail and Leisure

3.2 Market Challenges

3.2.1 Impact of E-commerce on Brick-and-Mortar Stores

3.2.2 High Maintenance and Operational Costs

3.2.3 Shortage of Prime Real Estate Locations

3.3 Opportunities

3.3.1 Adoption of Smart Mall Technologies (Digital Footprint, IoT Solutions)

3.3.2 Integration of Mixed-Use Spaces (Retail, Hospitality, Entertainment)

3.3.3 Expansion into Emerging Markets (Growth in Tier-2 and Tier-3 Cities)

3.4 Trends

3.4.1 Rise of Experience-Oriented Retailing (Experiential Retail, Pop-Up Stores)

3.4.2 Growth in F&B and Entertainment Anchors

3.4.3 Increasing Investment in Sustainable and Green Mall Initiatives

3.5 Government Regulations

3.5.1 Zoning Laws and Land Use Regulations

3.5.2 Tax Incentives for Retail Developments

3.5.3 Regulatory Framework for Foreign Investments in Shopping Centers

4. Global Shopping Centers Market Segmentation

4.1 By Type of Shopping Center (In Value %)

4.1.1 Super-Regional Malls

4.1.2 Regional Malls

4.1.3 Community Malls

4.1.4 Lifestyle Centers

4.2 By Anchor Tenant Type (In Value %)

4.2.1 Fashion and Apparel

4.2.2 Food and Beverage

4.2.3 Entertainment Hubs

4.3 By Ownership Model (In Value %)

4.3.1 REIT-Owned Malls

4.3.2 Privately-Owned Centers

4.3.3 Institutional Investments

4.4 By Tenant Mix (In Value %)

4.4.1 Retail-Heavy Centers

4.4.2 Mixed-Use Centers

4.4.3 Service-Oriented Centers

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia-Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

5. Global Shopping Centers Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Simon Property Group

5.1.2 Westfield Corporation

5.1.3 Brookfield Properties

5.1.4 GGP Inc. (General Growth Properties)

5.1.5 Unibail-Rodamco-Westfield SE

5.1.6 Intu Properties

5.1.7 Hammerson plc

5.1.8 Taubman Centers

5.1.9 The Macerich Company

5.1.10 CapitaLand Mall Trust

5.1.11 Emaar Malls Group

5.1.12 Majid Al Futtaim Group

5.1.13 Retail Properties of America, Inc.

5.1.14 The Mills Corporation

5.1.15 Ivanho Cambridge Inc.

5.2 Cross Comparison Parameters (No. of Employees, Retail Space, Revenue, Market Presence, Technology Integration, Tenant Mix, Sustainability Initiatives, Regional Footprint)

5.3 Market Share Analysis (By Company)

5.4 Strategic Initiatives (Digital Transformation, New Developments, International Expansion)

5.5 Mergers and Acquisitions

5.6 Investment Analysis (CapEx, Real Estate Investments)

5.7 Venture Capital Funding

5.8 Government Grants and Subsidies for Mall Developments

5.9 Private Equity Investments in Shopping Centers

6. Global Shopping Centers Market Regulatory Framework

6.1 Compliance with International Building Codes

6.2 Environmental and Safety Regulations

6.3 Consumer Protection Laws in Retail Spaces

7. Global Shopping Centers Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Shopping Centers Future Market Segmentation

8.1 By Type of Shopping Center (In Value %)

8.2 By Anchor Tenant Type (In Value %)

8.3 By Ownership Model (In Value %)

8.4 By Tenant Mix (In Value %)

8.5 By Region (In Value %)

9. Global Shopping Centers Market Analysts' Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Market Penetration and Expansion Strategies

9.3 White Space Opportunities

9.4 Customer Engagement and Retention Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping the entire ecosystem of the global shopping centers market. Key variables such as tenant mix, foot traffic metrics, and retail space utilization are identified through secondary research from government reports and proprietary databases.

Step 2: Market Analysis and Construction

Data from historical records is compiled to understand trends in mall occupancy rates, consumer spending patterns, and retail sales per square foot. This data is used to create a robust analysis of the market's revenue generation capacity.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through interviews with mall operators, retail brands, and real estate experts. These consultations provide insights into operational challenges, investment priorities, and consumer behaviors.

Step 4: Research Synthesis and Final Output

Data from interviews and secondary sources is synthesized to produce a comprehensive report, verifying revenue estimates and market segmentation. Insights into regional dynamics and tenant preferences ensure the accuracy of the final analysis.

Frequently Asked Questions

01. How big is the global shopping centers market?

The global shopping centers market is valued at USD 6 trillion, driven by a blend of traditional retail sales and the growing importance of mixed-use developments that integrate shopping, dining, and entertainment.

02. What are the key challenges in the global shopping centers market?

Challenges in the global shopping centers market include competition from e-commerce platforms, rising operational costs, and the need for constant innovation to attract consumers. Additionally, the shortage of prime real estate locations poses a hurdle for new developments.

03. Who are the major players in the global shopping centers market?

Key players in the global shopping centers market include Simon Property Group, Westfield Corporation, Brookfield Properties, and Unibail-Rodamco-Westfield. These companies dominate due to their extensive retail space portfolios and strategic investments in mall technology.

04. What drives growth in the global shopping centers market?

Growth of global shopping centers market is propelled by the rise of experience-based retailing, technological innovations in smart malls, and the increasing popularity of mixed-use developments that combine shopping with entertainment and residential spaces.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.