Global Silicon Carbide Fiber Market Overview

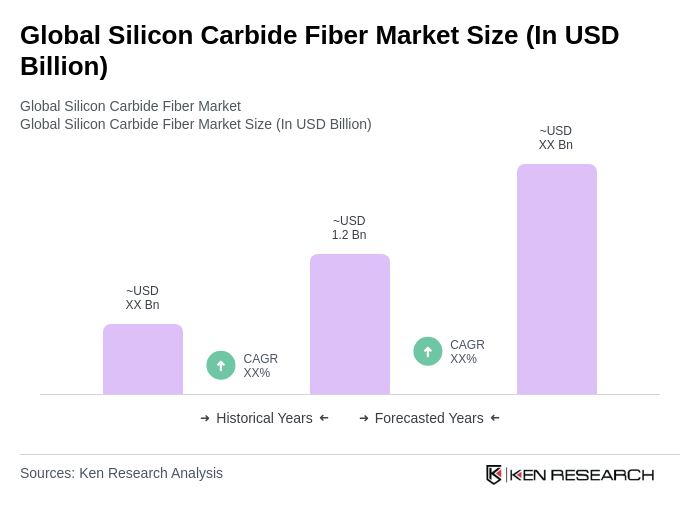

- The Global Silicon Carbide Fiber Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for high-performance, lightweight materials in aerospace, automotive, and energy sectors, where silicon carbide fibers are favored for their superior thermal stability, oxidation resistance, and mechanical strength. The market is further supported by technological advancements in fiber manufacturing, cost reductions, and a growing focus on energy efficiency and sustainability in end-use industries .

- The United States, Germany, and Japan remain dominant players in the silicon carbide fiber market, underpinned by their robust industrial bases, advanced research and development capabilities, and significant investments in aerospace, defense, and energy sectors. These countries lead in innovation, production scale, and the adoption of advanced composite materials for critical applications .

- Recent regulatory initiatives in the United States have emphasized the adoption of advanced materials, including silicon carbide fibers, for defense and aerospace applications. These measures are designed to enhance the performance, durability, and operational efficiency of military and aerospace equipment by increasing the use of lightweight, high-strength, and thermally stable materials .

Global Silicon Carbide Fiber Market Segmentation

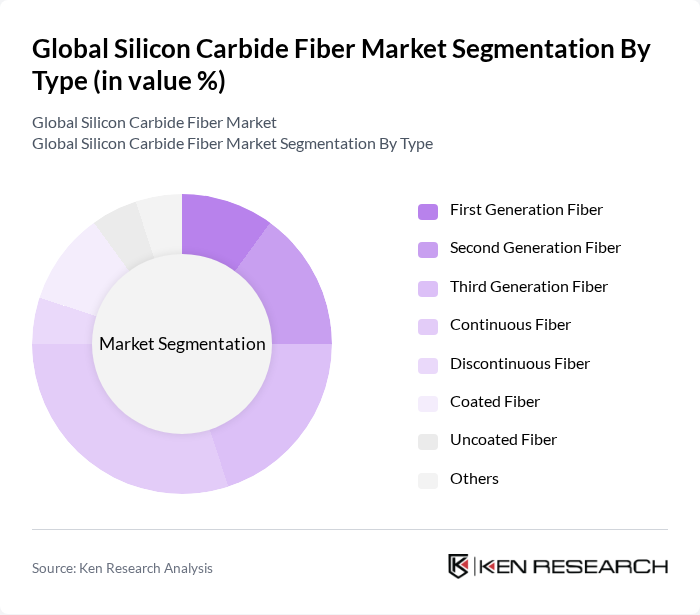

By Type:The silicon carbide fiber market is segmented into First Generation Fiber, Second Generation Fiber, Third Generation Fiber, Continuous Fiber, Discontinuous Fiber, Coated Fiber, Uncoated Fiber, and Others. Continuous Fiber is the leading subsegment, driven by its extensive use in aerospace and defense applications that require high strength, thermal stability, and oxidation resistance. Continuous fibers are preferred for reinforcing advanced composites, enabling superior performance in demanding environments such as jet engines, gas turbines, and space vehicles .

By Phase:The market is also segmented by phase into Amorphous and Crystalline fibers. Crystalline fibers dominate this segment due to their superior mechanical properties, high-temperature resistance, and enhanced durability, making them ideal for high-performance aerospace, energy, and industrial applications. The preference for crystalline fibers is driven by their ability to withstand extreme operational environments and maintain structural integrity under stress .

Global Silicon Carbide Fiber Market Competitive Landscape

The Global Silicon Carbide Fiber Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, General Electric Company, Ube Industries, Ltd., NGS Advanced Fibers Co., Ltd., SGL Carbon SE, Dow Inc., Mitsubishi Chemical Corporation, Hexcel Corporation, CeramTec GmbH, Axiom Materials, Inc., Advanced Ceramic Materials (ACM) Corp., Nippon Carbon Co., Ltd., UBE Corporation, Toray Industries, Inc., and Teijin Limited contribute to innovation, geographic expansion, and service delivery in this space.

Global Silicon Carbide Fiber Market Industry Analysis

Growth Drivers

- Increasing Demand in Aerospace Applications:The aerospace sector is projected to require approximately 1,600 tons of silicon carbide fiber in future, driven by the need for lightweight, high-strength materials. The global aerospace market is expected to reach $1.1 trillion, with a significant portion allocated to advanced materials. This demand is fueled by the increasing focus on fuel efficiency and performance, as silicon carbide fibers offer superior thermal stability and strength-to-weight ratios, making them ideal for aircraft components.

- Rising Adoption in Automotive Industry:The automotive industry is anticipated to consume around 900 tons of silicon carbide fiber in future, primarily due to the shift towards electric vehicles (EVs). With the global EV market projected to grow to $900 billion, manufacturers are increasingly incorporating silicon carbide fibers to enhance battery performance and reduce vehicle weight. This trend is further supported by government incentives promoting sustainable automotive technologies, driving the demand for advanced materials in vehicle production.

- Advancements in Manufacturing Technologies:Innovations in manufacturing processes are expected to reduce production costs of silicon carbide fibers by approximately 15% in future. Techniques such as chemical vapor deposition and advanced weaving methods are enhancing the efficiency and scalability of production. As a result, the market is likely to see an increase in the availability of high-quality fibers, which will support their integration into various applications, including aerospace, automotive, and electronics, thereby driving overall market growth.

Market Challenges

- High Production Costs:The production costs of silicon carbide fibers remain a significant barrier, averaging around $95 per kilogram. This high cost is primarily due to the complex manufacturing processes and the need for specialized equipment. As the market grows, companies are under pressure to find cost-effective solutions without compromising quality, which poses a challenge for wider adoption across various industries, particularly in price-sensitive sectors like automotive.

- Limited Availability of Raw Materials:The supply of raw materials necessary for silicon carbide fiber production is constrained, with global silicon carbide production estimated at 1.6 million tons in future. This limitation can lead to supply chain disruptions and increased prices, impacting manufacturers' ability to meet growing demand. Additionally, geopolitical factors and trade restrictions may further exacerbate these challenges, making it crucial for companies to secure reliable sources of raw materials.

Global Silicon Carbide Fiber Market Future Outlook

The future of the silicon carbide fiber market appears promising, driven by technological advancements and increasing applications across various sectors. As industries prioritize lightweight and energy-efficient materials, the demand for silicon carbide fibers is expected to rise significantly. Furthermore, ongoing research and development efforts are likely to lead to innovative applications, enhancing the material's versatility. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to capitalize on emerging opportunities in the market.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific, are projected to see a 20% increase in silicon carbide fiber demand in future. Rapid industrialization and urbanization in countries like India and China are driving the need for advanced materials in construction and automotive sectors, presenting significant growth opportunities for manufacturers looking to expand their footprint in these regions.

- Development of New Applications:The exploration of new applications for silicon carbide fibers, such as in renewable energy technologies, is expected to create substantial market opportunities. With the global renewable energy sector projected to reach $2.5 trillion in future, integrating silicon carbide fibers into solar panels and wind turbines can enhance efficiency and durability, opening new revenue streams for manufacturers.