Global Silver Mining Market Outlook to 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD8515

November 2024

88

About the Report

Global Silver Mining Market Overview

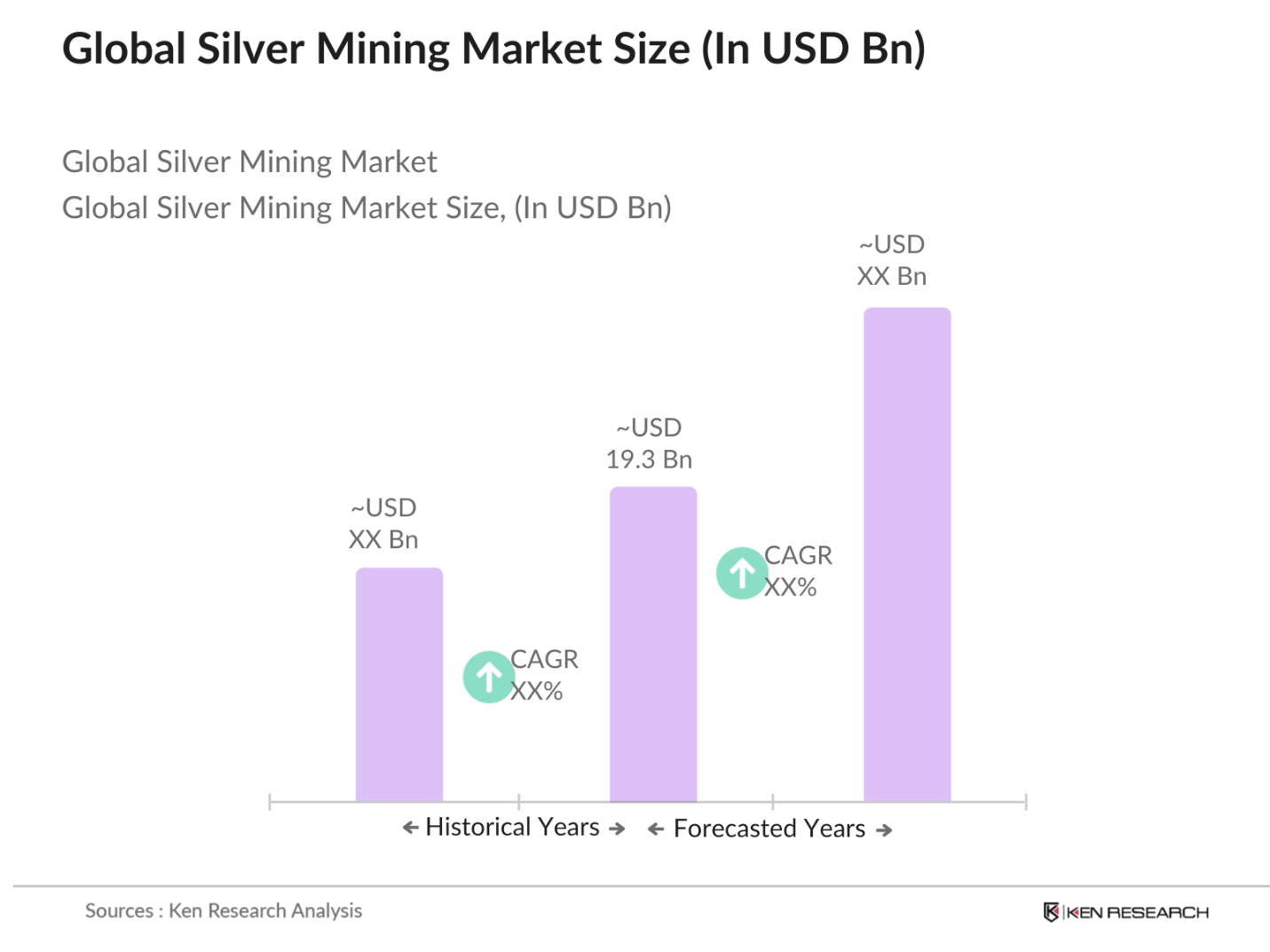

- The global silver mining market is valued at USD 19.3 billion. This market is driven primarily by increasing demand from industrial applications, such as electronics, renewable energy, and photovoltaics, which heavily rely on silver due to its excellent electrical conductivity and reflective properties. Additionally, the rising adoption of silver in emerging technologies such as electric vehicles and 5G telecommunications infrastructure contributes to the market's consistent demand. Silvers dual role as an industrial commodity and a precious metal in investment portfolios also sustains its market growth.

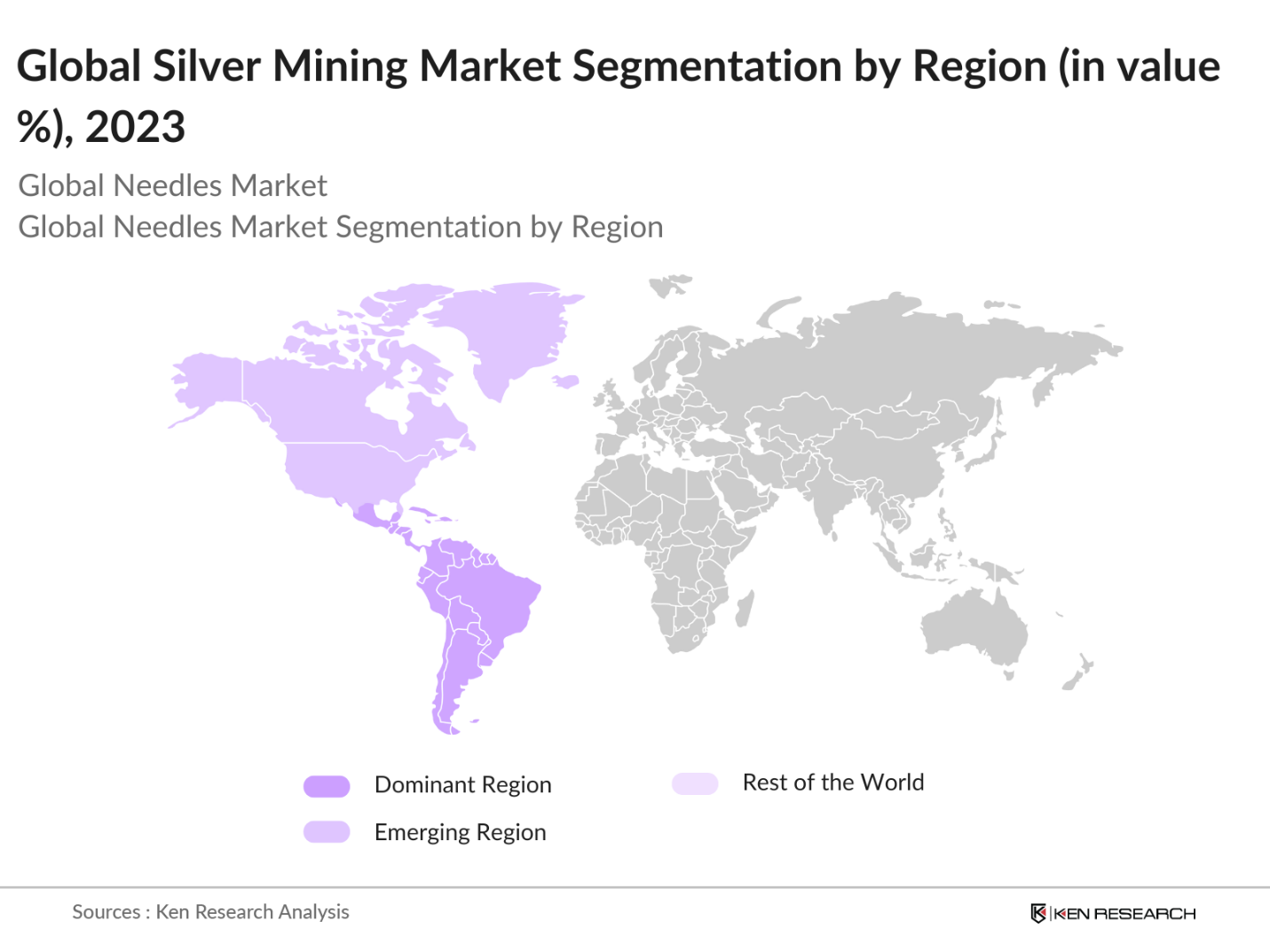

- The silver mining market is dominated by countries such as Mexico, Peru, and China. Mexicos dominance stems from its well-established silver mining industry, which benefits from favorable geological conditions, abundant reserves, and a long history of silver production. Peru and China follow closely due to significant investments in mining infrastructure, their large reserves, and government support for mining activities. These regions offer low operational costs and efficient extraction technologies, making them top players in the silver mining market.

- Governments worldwide have introduced stringent regulations on mining operations to limit environmental impact. In 2023, the European Union imposed fines for mining operations, which reduced water consumption in silver mines by 15%. Similarly, emissions regulations in the US required silver mines to invest in cleaner technologies to meet air quality standards. These regulations aim to mitigate the environmental degradation caused by silver mining, ensuring that operations are sustainable and compliant with international environmental standards.

Global Silver Mining Market Segmentation

By Mining Method: The silver mining market is segmented by mining method into open-pit mining, underground mining, and placer mining. Among these, underground mining dominates the market due to its ability to access deeper, high-grade ore deposits. Underground mining also offers enhanced control over environmental impacts, which is increasingly important as regulators impose stricter standards on mining operations. Additionally, major silver mines, particularly in Mexico and Peru, operate primarily underground, which contributes to this segment's dominant market share.

By Region: Regionally, the silver mining market is divided into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa. Latin America, led by Mexico and Peru, dominates the market due to its rich silver reserves, established mining infrastructure, and low production costs. These countries continue to benefit from foreign investments and government initiatives supporting mining expansion. In contrast, North America is growing due to increasing demand for silver in industrial applications, particularly in renewable energy sectors like solar power.

By End-Use Industry: The global silver mining market is segmented by end-use industry into electronics, renewable energy, jewelry and ornaments, and automotive. Electronics is the leading segment, as silvers superior conductivity makes it an indispensable component in semiconductors, circuit boards, and other electronic components. The surge in demand for consumer electronics, 5G networks, and electric vehicles has further reinforced this segments leading position. The growing usage of silver in medical devices and wearables also adds to its dominance in the end-use industry segmentation.

Global Silver Mining Market Competitive Landscape

The global silver mining market is dominated by both local and international companies that have established extensive operations and hold significant market influence. Some major players include Fresnillo PLC, Pan American Silver Corp, and Hecla Mining Company. These companies hold key advantages such as large-scale production capabilities, strategic mine locations, and advanced mining technologies, which enable them to maintain competitive positions in the global market.

Global Silver Mining Industry Analysis

Growth Drivers

- Rising Demand in Industrial Applications: Silver plays a vital role in industrial applications, particularly in theelectronics and renewable energy sectors. The global electronics industry accounted for over 50,000 tons of silver usage in 2023, driven by demand for conductive properties in semiconductors, circuit boards, and sensors. The renewable energy sector also saw a surge in silver use, with solar panel production consuming approximately 30,000 tons in 2023, as photovoltaic cells rely on silver for efficient energy capture. This growing demand in both sectors has fueled the need for silver mining to support ongoing technological advancements.

- Investment in Precious Metals: Precious metals like silver have become key investment assets due to global economic uncertainties and inflationary pressures. In 2023, investment in silver through bullion and coins reached a 10-year high, with around 2,000 tons purchased globally. Central banks and private investors have shifted focus to silver as a safe haven asset amid currency fluctuations and market volatility. This increased demand for silver as an investment is driving more exploration and mining activities to meet the growing interest from investors.

- Stro in Jewelry and Decorative Items: Silver's cultural significance in jewelry and decorative items continues to drive its demand, particularly in regions like India and China. In 2023, the global silver jewelry market consumed approximately 5,000 tons of silver, with India alone accounting for nearly 35% of this demand, supported by festivals and weddings. Decorative items such as silverware also saw strong demand, contributing to increased silver mining activity. The robust consumption in these sectors highlights silver's sustained appeal beyond industrial uses.

Market Challenges

- High Volatile: Silver prices have experienced significant fluctuations, with prices ranging from USD 22 to USD 30 per ounce between 2022 and 2024. This volatility poses a major challenge for mining companies as unpredictable price shifts impact profitability and investment planning. Geopolitical tensions, supply chain disruptions, and currency fluctuations contribute to this price volatility, creating uncertainty in production and investment returns for the global silver mining market.

- Environmental and Regulatory Pressures: Mining faces increasing scrutiny due to its environmental impact. Strict regulations have been implemented, particularly in developed markets like the US and the EU, where emissions, water usage, and biodiversity conservation are closely monitored. By 2024, over 70% of silver mining operations in these regions were required to adopt sustainability standards to minimize their environmental footprint. This regulatory environment presents significant operational challenges, especially for mining companies in emerging markets where infrastructure is less developed.

Global Silver Mining Market Future Outlook

Over the next five years, the global silver mining market is expected to experience significant growth, driven by increasing demand in industrial applications, advancements in extraction and refining technologies, and strong market dynamics in developing countries. The rising utilization of silver in renewable energy technologies, especially solar energy, and growing interest in silver as a store of value will further support market expansion. Moreover, technological advancements in mining, such as automation and the implementation of sustainable mining practices, will continue to shape the industrys future.

Opportunities

- Expansion in Untapped Geographies: Latin America and Africa present ses for silver mining expansion due to untapped reserves. In 2023, Africa's silver reserves were estimated at over 200,000 tons, yet production remained limited due to underdeveloped infrastructure. Similarly, countries like Bolivia and Mexico have substantial reserves but underutilized capacity. With advancements in technology and increased foreign direct investment, these regions are poised to become major players in the silver market. Expansion into these geographies can help meet the rising global demand for silver.

- Technological Advancements in Extraction and Refining Techniques: New technologies such as AI and automation have revolutionized silver micing efficiency and reduced operational costs. In 2023, the use of automated drilling and real-time data analytics in Mexico's silver mines improved ore extraction rates by 15%, reducing both labor and environmental impact. Additionally, advancements in refining techniques, such as hydrometallurgical processes, have improved silver recovery from lower-grade ores, making mining more viable in previously uneconomical areas.

Scope of the Report

|

Mining Method |

Open-Pit Mining Underground Mining Placer Mining |

|

End-Use Industry |

Electronics Renewable Energy Jewelry and Ornaments Automotive |

|

Geography |

North America Latin America Europe Asia Pacific Middle East & Africa |

|

Ore Type |

Sulfide Ores Oxide Ores |

|

Refining Process |

Pyrometallurgical Refining Hydrometallurgical Refining |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Silver Mining Companies

Investors and Venture Capitalist Firms

Precious Metal Trading Companies

Silver-Using Industries

Mining Equipment Manufacturing Industries

Environmental and Sustainability Companies

Government and Regulatory Bodies (e.g., Ministry of Energy and Mines, U.S. Environmental Protection Agency)

Private Equity Companies

Companies

Players Mentioned in the Report

Fresnillo PLC

Pan American Silver Corp

Hecla Mining Company

Coeur Mining Inc.

Hochschild Mining PLC

First Majestic Silver Corp

Fortuna Silver Mines Inc.

Silvercorp Metals Inc.

Endeavour Silver Corp

KGHM Polska Miedz S.A.

Table of Contents

1. Global Silver Mining Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Silver Mining Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Silver Mining Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand in Industrial Applications (Usage in Electronics, Renewable Energy)

3.1.2. Increasing Investment in Precious Metals

3.1.3. Strong Demand for Silver in Jewelry and Decorative Items

3.1.4. Growing Need for Silver in Clean Energy and Solar Panel Technologies

3.2. Market Challenges

3.2.1. High Volatility in Silver Prices

3.2.2. Environmental and Regulatory Pressures (Mining Sustainability Standards)

3.2.3. Exploration and Operational Risks

3.2.4. Lack of Infrastructure in Emerging Markets

3.3. Opportunities

3.3.1. Expansion in Untapped Geographies (Latin America, Africa)

3.3.2. Technological Advancements in Extraction and Refining Techniques

3.3.3. Growing Applications in Healthcare and Pharmaceuticals

3.4. Trends

3.4.1. Increasing Focus on Sustainable and Ethical Mining

3.4.2. Adoption of AI and IoT in Silver Mining Operations

3.4.3. Rise in Silver as a Strategic Asset in Investment Portfolios

3.5. Government Regulations

3.5.1. Environmental Impact Regulations (Emissions, Water Use)

3.5.2. Taxation and Royalty Structures in Key Regions

3.5.3. National and International Trade Policies

3.6. SWOT Analysis

Strengths, Weaknesses, Opportunities, Threats in Global Silver Mining

3.7. Stakeholder Ecosystem

3.7.1. Key Mining Companies

3.7.2. Local and International Regulatory Bodies

3.7.3. Mining Equipment Manufacturers

3.7.4. Environmental NGOs

3.8. Porters Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. Global Silver Mining Market Segmentation

4.1. By Mining Method (In Value %)

4.1.1. Open-Pit Mining

4.1.2. Underground Mining

4.1.3. Placer Mining

4.2. By End-Use Industry (In Value %)

4.2.1. Electronics

4.2.2. Renewable Energy (Solar, Wind)

4.2.3. Jewelry and Ornaments

4.2.4. Automotive Industry

4.3. By Geography (In Value %)

4.3.1. North America

4.3.2. Latin America

4.3.3. Europe

4.3.4. Asia Pacific

4.3.5. Middle East & Africa

4.4. By Ore Type (In Value %)

4.4.1. Sulfide Ores

4.4.2. Oxide Ores

4.5. By Refining Process (In Value %)

4.5.1. Pyrometallurgical Refining

4.5.2. Hydrometallurgical Refining

5. Global Silver Mining Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Fresnillo PLC

5.1.2. Pan American Silver Corp

5.1.3. First Majestic Silver Corp

5.1.4. Hecla Mining Company

5.1.5. Coeur Mining Inc.

5.1.6. Silvercorp Metals Inc.

5.1.7. Hochschild Mining PLC

5.1.8. Endeavour Silver Corp

5.1.9. Fortuna Silver Mines Inc.

5.1.10. Polymetal International PLC

5.1.11. KGHM Polska Miedz S.A.

5.1.12. Tahoe Resources Inc.

5.1.13. Sumitomo Metal Mining Co., Ltd.

5.1.14. Southern Copper Corp.

5.1.15. Zijin Mining Group

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Total Production Capacity, Market Presence, Exploration Projects, Operational Efficiency)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Private Equity Investments

5.8. Government Subsidies and Support

6. Global Silver Mining Market Regulatory Framework

6.1. Mining Laws and Regulations

6.2. Environmental Compliance Standards

6.3. Health and Safety Regulations

6.4. Licensing and Permits

7. Global Silver Mining Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Silver Mining Future Market Segmentation

8.1. By Mining Method (In Value %)

8.2. By End-Use Industry (In Value %)

8.3. By Geography (In Value %)

8.4. By Ore Type (In Value %)

8.5. By Refining Process (In Value %)

9. Global Silver Mining Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Exploration and Development Strategies

9.3. Strategic Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research process begins with identifying the key variables influencing the silver mining market. This involves conducting extensive desk research and gathering data on key stakeholders, including silver mining companies, industry associations, and regulatory bodies. This step aims to establish an understanding of market dynamics such as production capacities, market demand, and pricing mechanisms.

Step 2: Market Analysis and Construction

In this phase, historical data from the global silver mining market is collected and analyzed. This includes market sizing, supply and demand analysis, and evaluating key market trends. By analyzing the revenue generation from top players and the regional market splits, a comprehensive market structure is constructed to estimate the current market value.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed from the initial data collection are tested through direct consultations with industry experts. These experts provide insights into operational challenges, investment trends, and regional market nuances, ensuring the hypotheses align with industry realities. This validation process guarantees the reliability of market forecasts and segmentations.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing data from multiple sources, including mining company reports, government publications, and expert interviews. This data is then consolidated to create an accurate and validated market report that provides a detailed outlook on future growth opportunities in the global silver mining market.

Frequently Asked Questions

01. How big is the Global Silver Mining Market?

The global silver mining market was valued at USD 19.3 billion, driven by rising demand for silver in industrial applications, particularly in electronics and renewable energy sectors.

02. What are the challenges in the Global Silver Mining Market?

Key challenges in the silver mining market include high volatility in silver prices, environmental concerns regarding mining activities, and regulatory pressures to adopt sustainable mining practices.

03. Who are the major players in the Global Silver Mining Market?

Major players include Fresnillo PLC, Pan American Silver Corp, Hecla Mining Company, Coeur Mining Inc., and Hochschild Mining PLC, all of which have strong global operations and significant production capacities.

04. What are the growth drivers of the Global Silver Mining Market?

The market is driven by increased demand for silver in electronics, solar power technologies, and medical devices, along with rising silver investments as a store of value amidst global economic uncertainties.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.