Global Skincare Products Market Outlook to 2030

Region:Global

Author(s):Lakshyata and Nishika

Product Code:KENGR052

September 2024

85

About the Report

Global Skincare Products Market Overview

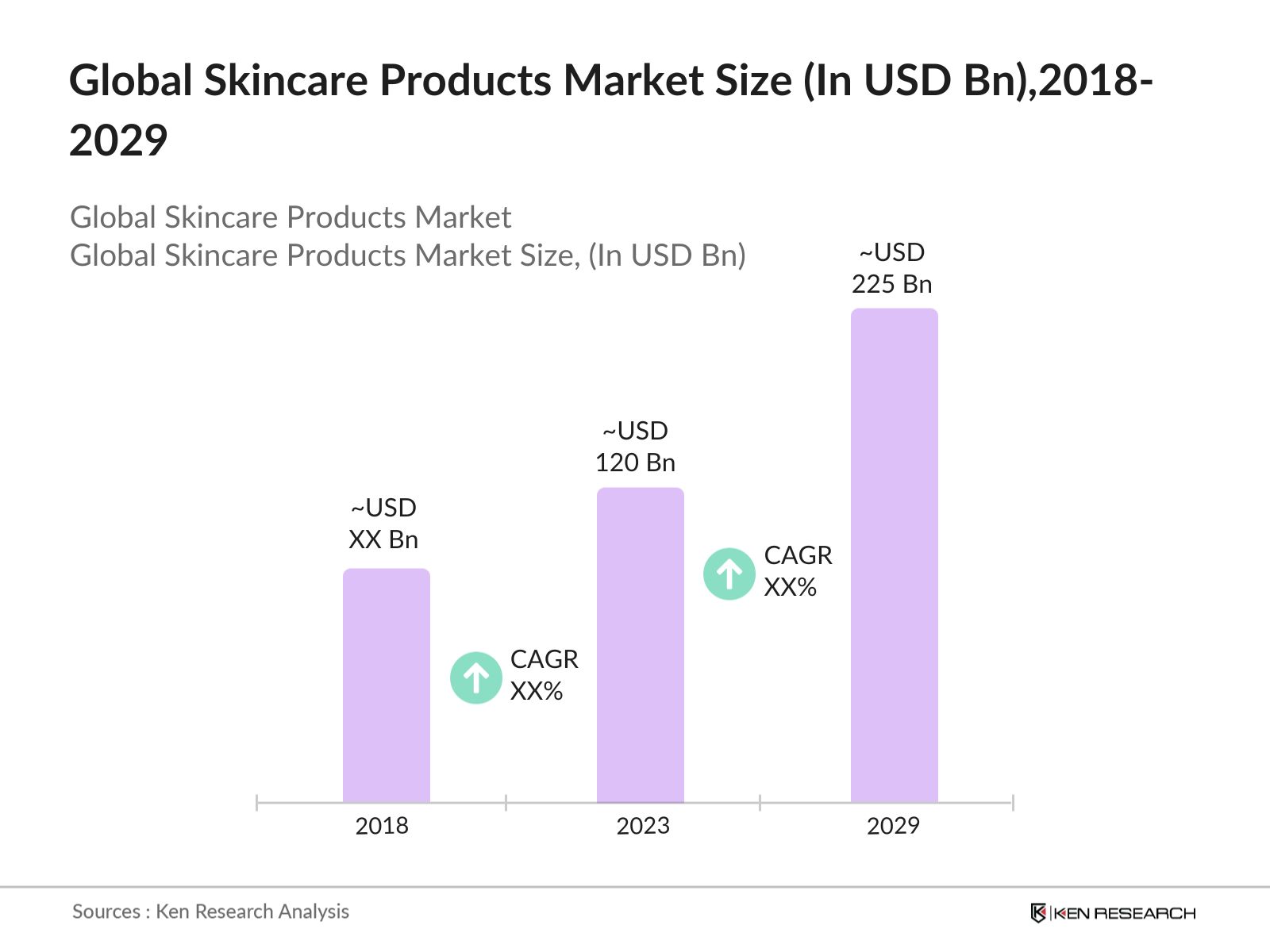

- The global skincare products market has shown significant growth, reaching USD 120 billion in 2023. This growth is primarily driven by increasing consumer awareness of skincare routines, rising demand for anti-aging products, and the growing trend of organic and natural skincare solutions. The market is further bolstered by the expansion of e-commerce platforms, making skincare products more accessible to consumers worldwide.

- The market is dominated by major players such as L'Oréal S.A., Unilever PLC, The Estée Lauder Companies Inc., Procter & Gamble Company, and Shiseido Co., Ltd. These companies hold a significant share of the market due to their extensive product portfolios, strong brand recognition, and continuous innovation in skincare technologies. Their global reach and aggressive marketing strategies further solidify their positions in the market.

- In 2024, L'Oréal launched an AI-powered skin diagnostic tool that offers personalized skincare recommendations, further enhancing its digital presence. Similarly, Unilever expanded its plant-based product line, responding to the growing demand for sustainable skincare. Additionally, The Estée Lauder Companies Inc. continued its expansion in Asia, investing in new research and innovation centers to cater to the region's growing skincare market.

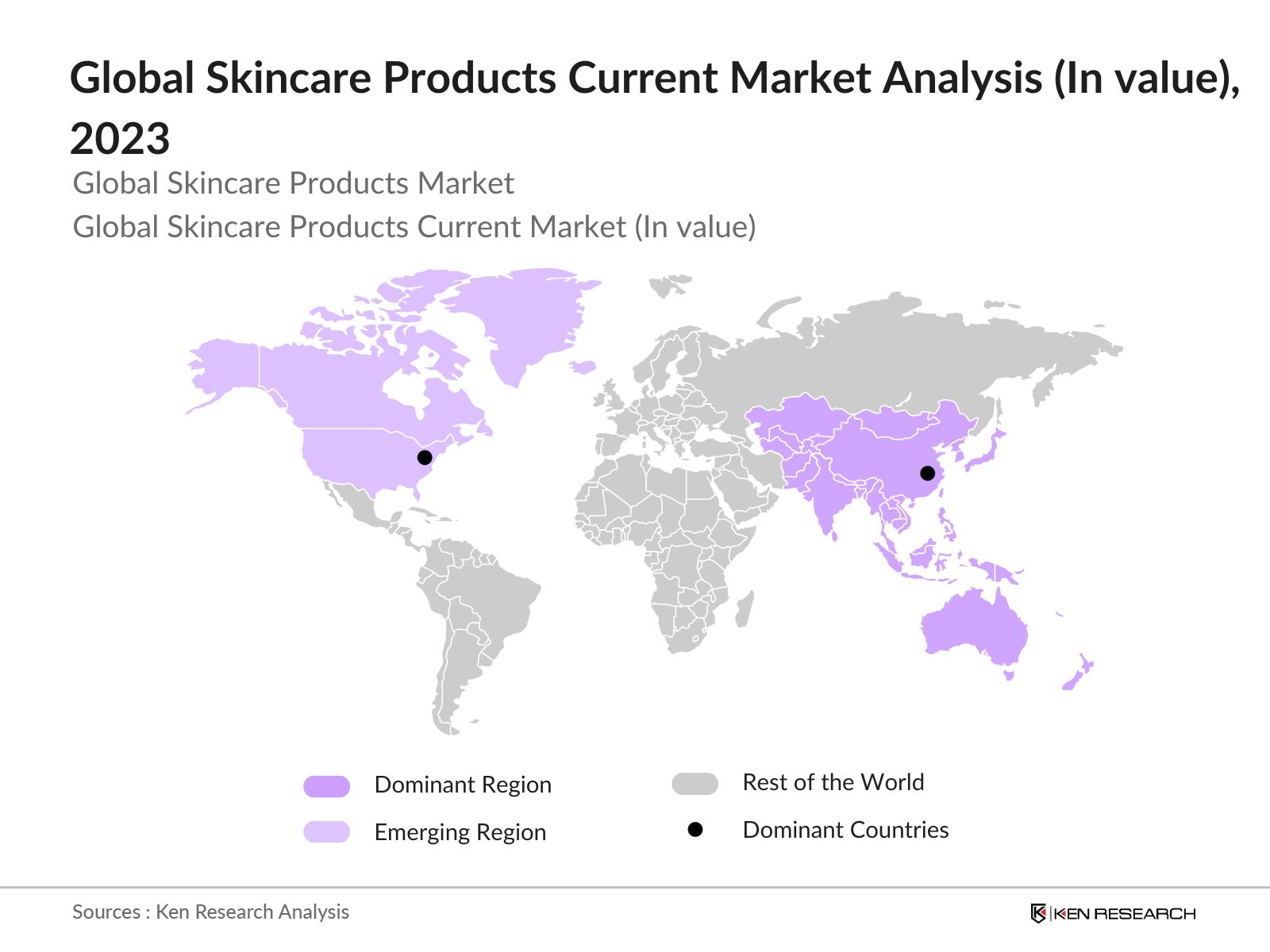

Global Skincare Products Market Current Market Analysis

- Asia-Pacific dominates the global skincare products market, projected to grow at a 5.71% CAGR. China's tier 1 megacities lead in facial care product consumption, while tier 2 and tier 3 cities show rising adoption. The expanding middle class fuels this trend, driving increased consumer spending on skin and personal care items across urban tiers in China, highlighting a broadening market base amidst demographic shifts and economic advancements.

- Despite a slowdown in skin care growth in 2020 and 2021, China's market maintained robust real value, buoyed by a rising consumer emphasis on health-conscious lifestyles. This trend bolstered segments like dermocosmetics, functional skincare, and clean beauty, all witnessing dynamic momentum

- The North America skincare market is poised for an emerging market. Increased disposable income enables consumers to opt for premium and luxury skincare products, driving spending on beauty services like professional treatments and spa services in the US. June 2023 saw robust personal consumption expenditures and disposable personal income growth, indicating a favorable economic backdrop for skincare market expansion in the region. These factors underscore a positive outlook, supported by consumer indulgence and economic indicators driving market dynamics in North America.

- Germany is the dominant country in the global skin care products as German beauty brands are globally recognized for their organic and sustainable approaches, rooted in farm-based manufacturing. This approach resonates with consumers seeking clear outcomes for their skincare concerns. G-Beauty's rise underscores Germany's leadership in combining innovation with natural ingredients, setting a benchmark for transparency and effectiveness in the beauty industry worldwide.

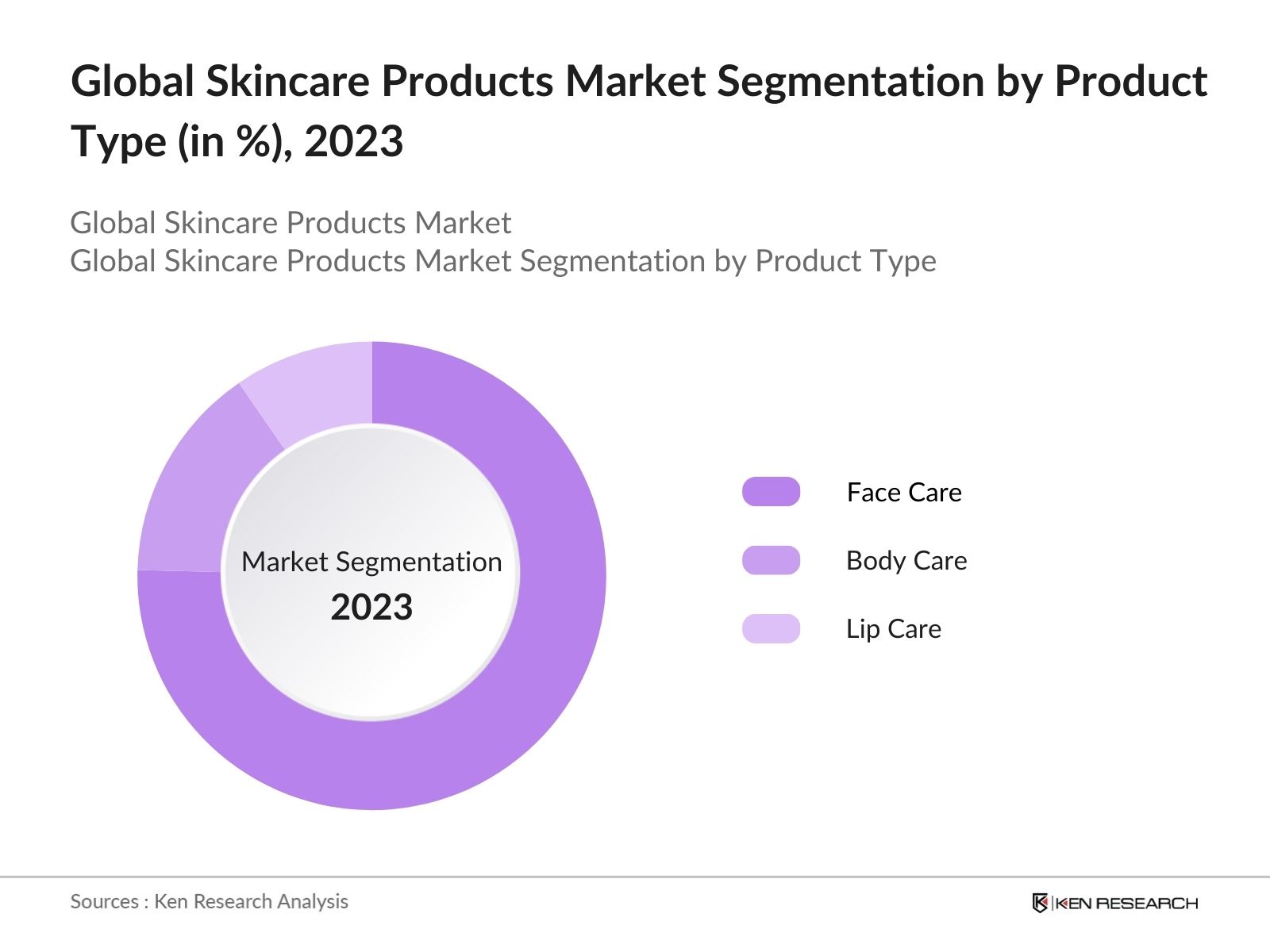

Global Skincare Products Market Segmentation

By Product Type: The global skincare market is segmented by product type into facial care, body care, and sun care. In 2023, face care products held the largest market share due to the high demand for anti-aging creams, moisturizers, and serums. The dominance of this segment is driven by the increasing consumer focus on facial skincare routines, particularly in urban areas where pollution and stress significantly impact skin health.

By Distribution Channel: The market is also segmented by distribution channel into Online Stores, Supermarkets & Hypermarkets, Specialty Stores, Pharmacy & Drugstores and Other Distribution Channel. Online stores dominated the market in 2023. The rise of e-commerce platforms because of the convenience of online shopping, coupled with personalized recommendations and subscription services, has contributed to the growth of this segment.

Global Skincare Products Market Competitive Landscape

|

Name of Company |

Headquarter |

Establishment Year/Vintage |

|

L'Oréal S.A. |

Clichy, France |

1909 |

|

Unilever PLC |

London, United Kingdom |

1930 |

|

The Estée Lauder Companies Inc. |

New York, USA |

1946 |

|

Procter & Gamble Company |

Cincinnati, USA |

1837 |

|

Shiseido Co., Ltd. |

Ginza, Tokyo |

1872 |

|

LVMH (Fresh) |

Paris, France |

1987 |

|

maxingvest AG (Beiersdorf AG) |

Hamburg, Germany |

1882 |

|

Chanel |

London, England |

1910 |

|

Natura & Co |

São Paulo, Brazil |

1967 |

- Estée Lauder’s Expansion in the Asia-Pacific Region: In 2023, Estée Lauder announced the opening of a new research and innovation center in Shanghai, China. This center focuses on developing skincare products tailored to the needs of Asian consumers, particularly in areas such as anti-aging and skin brightening. Estée Lauder’s commitment to expanding its presence in the fast-growing Asia-Pacific market.

- Procter & Gamble’s Investment in AI-Driven Skincare Solutions: In February 2024, Procter & Gamble announced a major investment in the development of AI-driven skincare solutions. This initiative includes the launch of an AI-powered app that provides personalized skincare recommendations based on a user’s skin type and concerns. The app uses data from over 10 million users to offer customized product suggestions, enhancing the consumer experience and driving sales of P&G’s skincare products.

Global Skincare Products Industry Analysis

Global Skincare Products Market Growth Drivers

- The Debut of Innovative Products by Manufacturers: Major players like Procter & Gamble and Estée Lauder launched AI-powered skin diagnostic tools that provide personalized skincare recommendations based on individual skin conditions. These innovations, driven by cutting-edge technologies like AI and biotechnology, are propelling the skincare market forward.

- Growing Demand for Organic Ingredients: The global skincare market is experiencing a significant shift towards organic products. In 2024, the demand for organic skincare products is projected to reach over USD 11 billion, driven by consumers' increasing preference for natural and chemical-free formulations.

- Increasing Cases of Skin Sensitivity and Allergies: In 2023, Google Trends data showed a significant increase in searches for "sensitive skin care," reflecting consumers' heightened concerns. Brands like La Roche-Posay have responded by developing dermatologically tested products that cater to sensitive skin, further fueling market growth.

Global Skincare Products Market Challenges

- High Competition and Market Saturation: The skincare market is highly competitive, with numerous established brands and new entrants vying for consumer attention. This intense competition forces companies to continuously innovate and invest heavily in marketing to differentiate their products, increasing the overall cost of doing business in this sector.

- Adverse Effects of Switching Skincare Brands: The trend of frequently switching between multiple skincare brands and products poses significant challenges in the market. This behavior can stifle innovation and limit the growth potential of new entrants in the market.

Global Skincare Products Market Government Initiatives

- Ban on Harmful Chemicals: The European Union has indeed been active in banning harmful chemicals, adding 29 new ingredients to its ban list in 2023 alone. This brings the total number of banned substances in the EU to over 2,400, significantly more than the U.S., which has banned 11 substances historically. These moves are aimed at protecting consumers from potential health risks associated with these chemicals.

- Campaigns for Sun Protection Awareness: The Australian government launched a USD 1.4 million campaign in 2023 to raise awareness about sun protection and skin health. The campaign promoted the use of the "Five S's" - Slip on sun-protective clothing, Slop on broad-spectrum, water-resistant SPF 30 (or higher) sunscreen, Slap on a broad brimmed hat, seek shade, and Slide on sunglasses - when the UV index is 3 or above.

Global Skincare Products Market Future Outlook

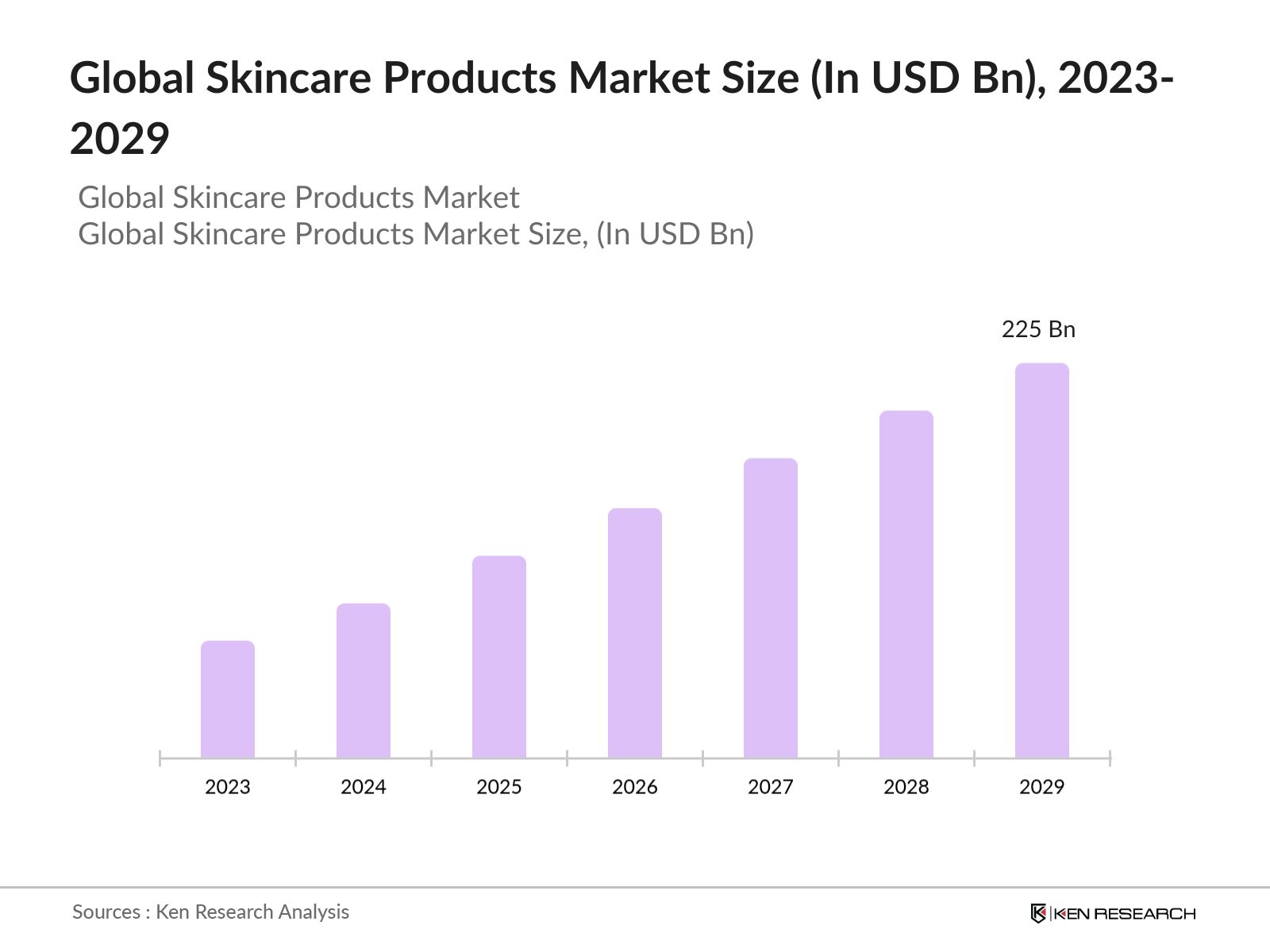

By 2029, the global skincare market is projected to grow exponentially and reach a market size of USD 225 billion, driven by continued consumer interest in health and wellness, advancements in skincare technology, and the rising popularity of clean and organic beauty products. The market is expected to witness further innovation, with companies focusing on personalized skincare solutions powered by AI and biotechnology.

Future Trends

- Adoption of AI in Personalized Skincare: By 2029, AI is expected to be integral to the skincare industry, with increasing consumers using AI-powered tools for personalized skincare recommendations. This trend will drive the development of tailored skincare products, leading to more effective and individualized skincare regimens. Companies will continue to invest in AI technology, enhancing their ability to deliver customized solutions that meet specific consumer needs.

- Growth of Men’s Skincare Market: The men’s skincare market is anticipated to expand rapidly. This growth will be driven by increased awareness among men about skincare, particularly in regions like Asia-Pacific and North America. Brands will develop more men-specific skincare solutions, catering to this growing demographic and driving further market growth.

Scope of the Report

|

By Region |

North America APAC Europe Latin America MEA |

|

By Product Type |

Facial Care Body Care Sun Care |

|

By Distribution Channel |

Online Stores Supermarkets Hypermarkets Specialty Stores Pharmacy & Drugstores Other Distribution Channel |

|

By End User |

Women Men Unisex |

|

By Category |

Mass Premium |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Pharmaceutical Companies

Biotechnology Firms

Pharmacies and Drugstores

Biomanufacturing Companies

Skincare Product Manufacturers

Health Tech Companies

Banks and Financial Institution

Investors and VCs

Government Institutions (Ministries of Health, Food and Drug Administration (FDA)

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2029

Companies

Players Mentioned in the Report:

- Pfizer Inc.

- Johnson & Johnson

- F. Hoffmann-La Roche AG

- Merck Co. & Inc.

- Bayer AG

- Abbvie Inc.

- Novartis AG

- Bristol-Myers Squibb Company

- Sanofi SA

- AstraZeneca PLC

- Takeda Pharmaceutical Company Limited

- Eli Lilly and Company

- Amgen Inc.

- Novo Nordisk AS

- GlaxoSmithKline PLC

Table of Contents

1. Executive Summary

1.1 Global Skincare Market Overview

1.2 Key Market Trends and Insights

2. Global Overview

2.1 Overview of Global Economic Environment

2.2 Overview of Global Skincare Industry

2.3 Global Skincare Products Revenue (Face Care, Body Care, Lip Care, etc.)

2.4 Global Skincare Product Distribution Channels

3. Global Skincare Products Market Overview

3.1 Ecosystem: Major Players

3.1.1 Global Skincare Products Market Manufacturers

3.1.2 Global Skincare Products Market Distributors

3.1.3 Global Skincare Products Market Regulatory Bodies & Associations

3.2 Value Chain

3.2.1 Value Chain of Skincare Products Market

3.2.2 Distribution Model of Skincare Products to End Users

3.3 Case Study: Skincare Innovations 3.4 Market Taxonomy

4. Global Skincare Products Market Size (in USD Bn), 2018-2023

5. Global Skincare Products Market Segmentation (in value %), 2018-2023

5.1 By Region (North America, Europe, APAC, Latin America, and MEA) in value %, 2018-2023

5.2 By Product Type (Face Care, Body Care, Lip Care) in value %, 2018-2023

5.3 By Category (Mass, Premium) in value %, 2018-2023

5.4 By End User (Women, Men, Unisex) in value %, 2018-2023

6. Global Skincare Products Market Competition Landscape

6.1 Market Share Analysis

6.2 Market Heat Map Analysis

6.3 Market Cross Comparison

6.4 Competition Overview: Market Share of Major Players Globally

6.5 Comparison Matrix

6.6 Investment Landscape

7. Global Skincare Products Market Dynamics

7.1 Growth Drivers

7.2 Challenges

7.3 Market Trends

7.4 Case Studies

7.5 Strategic Initiatives by Key Players

8. Global Skincare Products Future Market Size (in USD Bn), 2023-2029

9. Global Skincare Products Future Market Segmentation (in value %), 2023-2029

9.1 By Region (North America, Europe, APAC, Latin America, and MEA) in value %, 2023-2029

9.2 By Product Type (Face Care, Body Care, Lip Care) in value %, 2023-2029

9.3 By Category (Mass, Premium) in value %, 2023-2029

9.4 By End User (Women, Men, Unisex) in value %, 2023-2029

10. Analyst Recommendations

11. Research Methodology

11.1 Market Definitions and Assumptions

11.2 Abbreviations

11.3 Market Sizing Approach

11.4 Consolidated Research Approach

11.5 Understanding Market Potential Through In-Depth Industry Interviews

11.6 Primary Research Approach

11.7 Limitations and Conclusion

Disclaimer

Contact Us

Research Methodology

Step: 1 Hypothesis Creation:

The research team framed a hypothesis about the market through an analysis of existing industry factors obtained from company reports, magazines, journals, online articles, ministries, government associations and data from EMIS, WHO, among others.

Step: 2 Market Sizing:

The market size was estimated based on the biopharmaceutical revenue of the major countries constituting a region and hence calculating regional revenue. The regional revenue of the 5 regions ((North America, APAC, Europe, LATAM, MEA) was then summed to arrive at the market size of the Global Biopharmaceutical Market.

Step: 3 Hypothesis Testing:

The research team then conducted CATIs with several industry veterans including decision makers from Abbvie, Amgen, Pfizer and others in the ecosystem to get their insights on market and justify the hypothesis framed by the team.

Step: 4 Interpretation and Proofreading:

The final analysis was then interpreted in the research report by our expert team.

Frequently Asked Questions

01 How big is the Global Skincare Products Market?

The Global skincare products Market, valued at USD 120 Bn in 2023, is driven by the increasing demand for organic products, rising consumer awareness about skincare routines, and advancements in skincare technology.

02 What are the challenges in the Global Skincare Products Market?

Challenges in the global skincare product market include stringent regulatory requirements, high competition leading to market saturation, supply chain disruptions, and the growing problem of counterfeit products that can harm consumer trust and brand reputation.

03 Who are the major players in the Global Skincare Products Market?

Key players in the global skincare product market include L'Oréal S.A., Unilever PLC, The Estée Lauder Companies Inc., Procter & Gamble Company, and Shiseido Co., Ltd. These companies maintain dominance through extensive product portfolios, strong brand recognition, and continuous innovation.

04 What are the growth drivers of the Global Skincare Products Market?

The market in the global skincare product market is propelled by the increasing consumer demand for organic and natural products, the introduction of innovative skincare solutions, rising awareness about the harmful effects of synthetic chemicals, and the expansion of e-commerce channels that provide easier access to products globally.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.