Global Smart Contract Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD5878

December 2024

88

About the Report

Global Smart Contract Market Overview

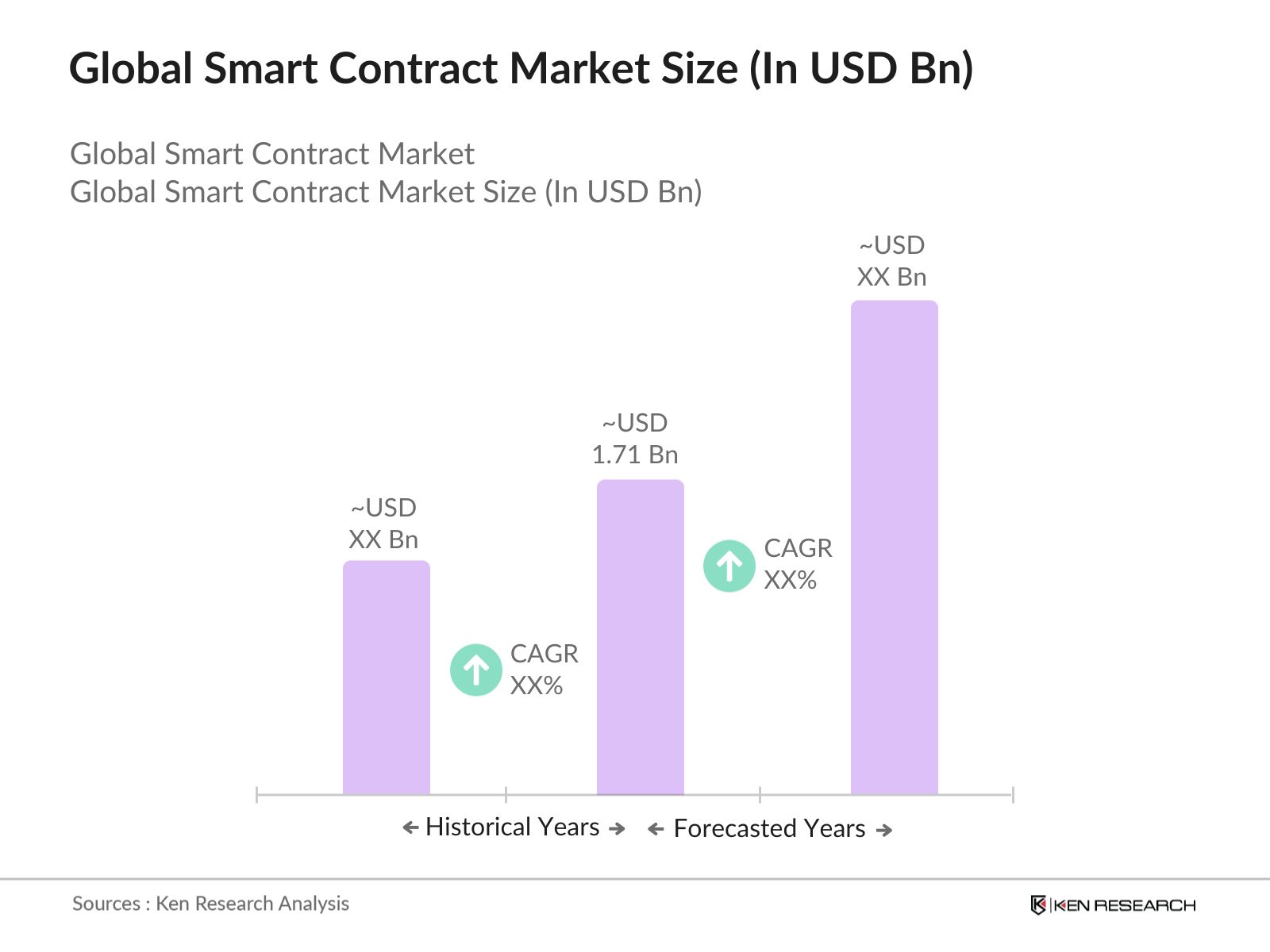

- The global smart contract market is valued at USD 1.71 billion, based on a five-year historical analysis. It is primarily driven by the increasing adoption of blockchain technology across multiple industries, such as finance, healthcare, and supply chain management. The shift towards decentralized applications (dApps) and the rise of decentralized finance (DeFi) have played a major role in propelling market growth. Blockchain enables smart contracts to facilitate secure, transparent, and automated transactions without intermediaries, making them essential in todays digital economy.

- Countries like the United States, China, and Switzerland dominate the smart contract market due to their advanced technology ecosystems, favourable regulatory environments, and strong venture capital presence. The U.S. leads with its investments in blockchain infrastructure, driven by major companies and startups alike. Chinas rapid adoption of blockchain for supply chain and governmental uses, alongside Switzerlands position as a blockchain-friendly financial hub, also contributes to their dominance.

- Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations are becoming a standard requirement for blockchain and smart contract platforms. In 2024, the Financial Action Task Force (FATF) reported that over 90% of blockchain-based financial platforms had implemented KYC/AML compliance measures, ensuring that smart contracts are verified and regulated to prevent illicit activities. This regulatory push ensures that smart contracts are not used for money laundering or financing terrorism, enhancing trust among users.

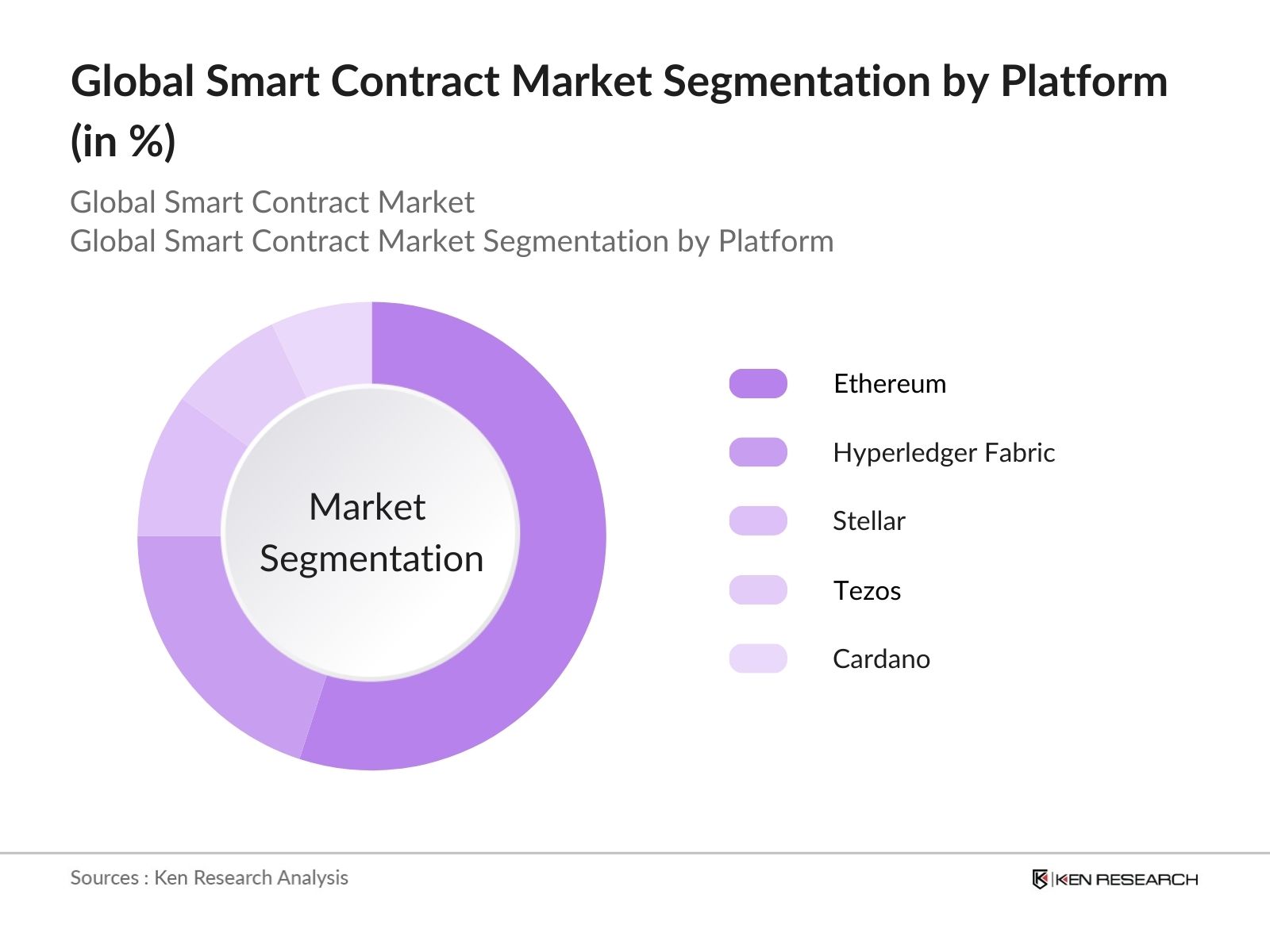

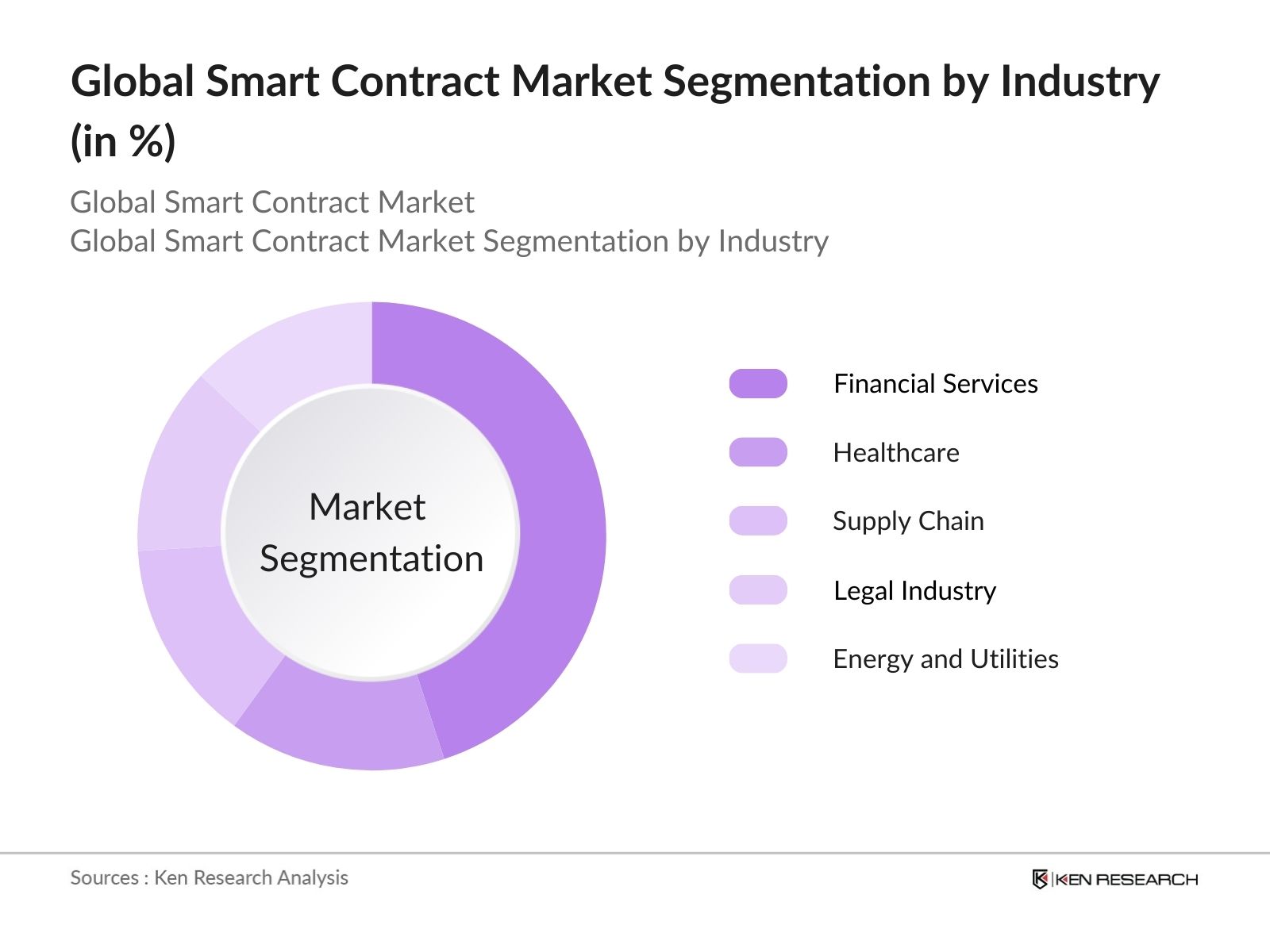

Global Smart Contract Market Segmentation

- By Platform Type: The market is segmented by platform type into Ethereum, Hyperledger Fabric, Stellar, Tezos, and Cardano. Ethereum holds a dominant share due to its pioneering role in enabling smart contract functionality through its decentralized platform. It has built a strong ecosystem of developers and decentralized applications (dApps), which is key to its ongoing leadership. Other platforms, like Hyperledger Fabric, are also gaining traction due to their permissioned blockchain approach, which is ideal for enterprise-level smart contracts.

- By Industry: The market is also segmented by industry into Financial Services, Healthcare, Supply Chain, Legal Industry, and Energy and Utilities. Financial services dominate due to the critical role that smart contracts play in decentralized finance (DeFi) and payment automation. Financial institutions are adopting smart contracts for automated trading, escrow services, and reducing the cost of transactions. This segment's growth is bolstered by blockchain's ability to eliminate intermediaries, providing faster, cheaper, and more transparent transactions.

- By Region: Regionally, the market is divided into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America leads the market, driven by a highly developed technology ecosystem, a large number of blockchain startups, and government initiatives promoting blockchain use. In contrast, Asia Pacific is rapidly catching up, with China and Singapore being key players due to strong governmental support for blockchain development, particularly in finance and logistics.

Global Smart Contract Market Competitive Landscape

The global smart contract market is dominated by a few major players, such as IBM Corporation, Microsoft Corporation, Oracle Corporation, ConsenSys, and Chainlink Labs. These companies are at the forefront of technological innovation in blockchain, offering a wide range of solutions that integrate smart contracts across various industries. Their substantial investment in research and development and strategic partnerships has solidified their positions as market leaders. Newer players like Algorand and Polkadot are also gaining market traction, driven by their unique approaches to scalability and interoperability.

|

Company |

Establishment Year |

Headquarters |

Market Capitalization |

Blockchain Protocol |

Smart Contract Throughput |

Consensus Mechanism |

Ecosystem Size |

|

IBM Corporation |

1911 |

Armonk, USA |

- |

- |

- |

- |

- |

|

Microsoft Corporation |

1975 |

Redmond, USA |

- |

- |

- |

- |

- |

|

Oracle Corporation |

1977 |

Redwood City, USA |

- |

- |

- |

- |

- |

|

ConsenSys |

2014 |

Brooklyn, USA |

- |

- |

- |

- |

- |

|

Chainlink Labs |

2017 |

Cayman Islands |

- |

- |

- |

- |

- |

Global Smart Contract Market Analysis

Global Smart Contract Market Growth Drivers

- Increasing Use of Blockchain Technology: Blockchain technology has seen substantial adoption across various sectors, primarily driven by its ability to offer transparency, security, and efficiency in transactions. In 2024, the World Bank reported that over 1.5 billion digital transactions were processed via blockchain systems globally, boosting smart contract deployment. Governments and industries have been actively exploring blockchain integration for supply chain management, healthcare, and public services.

- Rising Adoption of Decentralized Finance (DeFi): DeFi platforms, built on blockchain, have revolutionized financial systems, with smart contracts facilitating autonomous, transparent transactions. As of 2024, the International Monetary Fund (IMF) highlighted that the total value locked (TVL) in DeFi protocols exceeded $200 billion, driven by increased demand for decentralized lending and borrowing solutions. This figure shows a substantial increase from previous years, signifying growing confidence in DeFi solutions. Smart contracts are integral to the DeFi ecosystem, enabling trustless financial services without traditional intermediaries.

- Enterprise-Level Smart Contract Applications: Enterprises are increasingly adopting smart contracts for automation in business processes, particularly in industries like insurance, real estate, and supply chain management. In 2024, the European Commissions Digital Economy Report indicated that over 65% of multinational corporations implemented blockchain-powered smart contracts for automating contractual agreements. This shift towards smart contracts is reducing operational costs and increasing transparency. A specific example includes IBM's Food Trust platform, which managed over 10 million transactions through smart contracts in 2023.

Global Smart Contract Market Challenges

- Security Risks and Vulnerabilities: The decentralized nature of smart contracts, while offering transparency, poses security risks. According to a 2024 report by the World Bank, over $3 billion was lost in hacks and vulnerabilities related to smart contracts on blockchain platforms between 2022 and 2023. The complexity of smart contract coding makes them prone to bugs and exploitation, particularly in DeFi platforms, where a single error can lead to financial loss. These vulnerabilities highlight the need for robust security protocols in smart contract development.

- Regulatory Uncertainty: Regulatory constraints continue to pose challenges to the smart contract market, particularly due to the decentralized and borderless nature of blockchain technology. The Financial Stability Board (FSB) noted in 2024 that only 15% of countries had comprehensive regulations governing blockchain and smart contracts, creating uncertainty for enterprises. In particular, discrepancies in KYC/AML regulations across different regions complicate cross-border smart contract deployment, limiting their full potential.

Global Smart Contract Market Future Outlook

Over the next five years, the global smart contract market is expected to grow due to increased adoption of blockchain technology across various industries. The rise of decentralized finance (DeFi), coupled with advancements in blockchain scalability solutions such as layer-2 technologies, will play a pivotal role in expanding the market. Additionally, the use of smart contracts in enterprise-level applications is anticipated to grow as businesses seek to automate and streamline transactions, reducing costs and improving transparency.

Global Smart Contract Market Opportunities

- Advancements in Smart Contract Platforms: Advancements in layer-2 solutions and sidechains present opportunities for overcoming blockchain's limitations, particularly in scalability and efficiency. By 2024, the World Bank noted the integration of over 50 layer-2 solutions on major blockchains, which have substantially reduced transaction costs and improved processing speed. For example, the Lightning Network on Bitcoin processes up to 1,000 transactions per second, offering a major improvement over the base layer. These developments are encouraging the broader adoption of smart contracts across industries, from finance to logistics.

- Opportunities in Cross-Industry Use Cases: Smart contracts are increasingly being adopted across industries such as healthcare, insurance, and supply chain management. In 2023, the European Union Blockchain Observatory reported that smart contracts accounted for 15% of digital supply chain transactions, streamlining operations and reducing fraud. Similarly, the healthcare sector has begun utilizing smart contracts for automating insurance claims and verifying patient data, leading to an increase in transaction efficiency by 10%. Cross-industry use cases continue to expand, making smart contracts a versatile tool in various business environments.

Scope of the Report

|

Platform Type |

Ethereum Hyperledger Fabric Stellar Tezos Cardano |

|

Industry |

Financial Services Healthcare Supply Chain Legal Energy |

|

Application |

DeFi NFTs Supply Chain Management IP Protection Identity |

|

Contract Type |

Multi-Signature Self-Executing Conditional Legal Oracles |

|

Region |

North America Europe Asia Pacific Middle East & Africa Latin America |

Products

Key Target Audience

Blockchain Technology Providers

Banks and Financial Institutions

Government and Regulatory Bodies

Decentralized Finance (DeFi) Platforms

Healthcare Technology Providers

Supply Chain Management Companies

Energy Sector Companies

Investors and Venture Capitalist Firms

Companies

Players Mentioned in the Report

IBM Corporation

Microsoft Corporation

Oracle Corporation

ConsenSys

Chainlink Labs

Algorand

Polkadot (Web3 Foundation)

Solana Labs

Tezos Foundation

Stellar Development Foundation

Table of Contents

1. Global Smart Contract Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Global Smart Contract Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Global Smart Contract Market Analysis

3.1 Growth Drivers (Blockchain adoption, Digital transformation, DeFi platforms, Enterprise integration)

3.1.1 Increasing Use of Blockchain Technology

3.1.2 Rising Adoption of Decentralized Finance (DeFi)

3.1.3 Enterprise-Level Smart Contract Applications

3.1.4 Growing Demand for Automation and Efficiency in Business Processes

3.2 Market Challenges (Scalability, Security concerns, Lack of interoperability, Regulatory constraints)

3.2.1 Security Risks and Vulnerabilities

3.2.2 Regulatory Uncertainty

3.2.3 Scalability Issues in Blockchain Networks

3.3 Opportunities (Development of layer-2 solutions, Cross-chain functionality, Smart contract standards)

3.3.1 Advancements in Smart Contract Platforms

3.3.2 Opportunities in Cross-Industry Use Cases

3.3.3 Expansion of DeFi Ecosystem

3.4 Trends (Enterprise blockchain use, Smart contract auditing, Tokenization of assets)

3.4.1 Enterprise-Level Blockchain Adoption

3.4.2 Integration with Internet of Things (IoT)

3.4.3 Tokenization of Real-World Assets

3.4.4 Rise of Smart Contract Auditing Services

3.5 Government Regulation (KYC/AML compliance, Regulatory sandboxes, Data privacy regulations)

3.5.1 Government Initiatives for Blockchain Adoption

3.5.2 KYC/AML Compliance and Smart Contract Verification

3.5.3 Data Privacy and Security Regulations for Blockchain Networks

3.6 SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats)

3.7 Stakeholder Ecosystem (Blockchain developers, Enterprises, Regulators, Auditors)

3.8 Porters Five Forces (Bargaining power of suppliers, Threat of substitutes, Competitive rivalry)

3.9 Competition Ecosystem (Smart contract platforms, dApp developers, Blockchain consortia)

4. Global Smart Contract Market Segmentation

4.1 By Platform Type (In Value %)

4.1.1 Ethereum

4.1.2 Hyperledger Fabric

4.1.3 Stellar

4.1.4 Tezos

4.1.5 Cardano

4.2 By Industry (In Value %)

4.2.1 Financial Services

4.2.2 Healthcare

4.2.3 Supply Chain

4.2.4 Legal Industry

4.2.5 Energy and Utilities

4.3 By Application (In Value %)

4.3.1 DeFi (Decentralized Finance)

4.3.2 NFTs (Non-Fungible Tokens)

4.3.3 Supply Chain Management

4.3.4 Intellectual Property Protection

4.3.5 Digital Identity Verification

4.4 By Contract Type (In Value %)

4.4.1 Multi-Signature Contracts

4.4.2 Self-Executing Contracts

4.4.3 Conditional Contracts

4.4.4 Smart Legal Contracts

4.4.5 Data Feed-Based Contracts (Oracles)

4.5 By Region (In Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Middle East & Africa

4.5.5 Latin America

5. Global Smart Contract Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 IBM Corporation

5.1.2 Microsoft Corporation

5.1.3 Oracle Corporation

5.1.4 ConsenSys

5.1.5 Chainlink Labs

5.1.6 Algorand

5.1.7 EOSIO (Block.one)

5.1.8 Solana Labs

5.1.9 Polkadot (Web3 Foundation)

5.1.10 Hedera Hashgraph

5.1.11 Avalanche

5.1.12 R3 (Corda)

5.1.13 Tezos Foundation

5.1.14 Cardano Foundation

5.1.15 Stellar Development Foundation

5.2 Cross Comparison Parameters (Market Capitalization, Blockchain Protocol, Smart Contract Throughput, Consensus Mechanism, Ecosystem Size, Security Features, Developer Community Size, Transaction Fees)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Global Smart Contract Market Regulatory Framework

6.1 Blockchain Regulation and Compliance

6.2 Legal Framework for Smart Contracts

6.3 Certification and Standardization

7. Global Smart Contract Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Global Smart Contract Future Market Segmentation

8.1 By Platform Type (In Value %)

8.2 By Industry (In Value %)

8.3 By Application (In Value %)

8.4 By Contract Type (In Value %)

8.5 By Region (In Value %)

9. Global Smart Contract Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping the smart contract ecosystem, focusing on key players and industry stakeholders. Extensive desk research, utilizing proprietary databases and secondary sources, is conducted to identify the critical variables impacting market dynamics, such as the adoption rate of blockchain technologies, government regulations, and the development of new applications for smart contracts.

Step 2: Market Analysis and Construction

Historical data regarding the adoption of smart contracts across various industries is compiled and analyzed. The process involves assessing the penetration of decentralized applications (dApps) and the use of smart contracts within financial services, supply chain, and other sectors. The analysis also incorporates market share evaluations to ensure accurate revenue forecasts.

Step 3: Hypothesis Validation and Expert Consultation

The market hypotheses are refined through consultations with blockchain experts, developers, and executives from leading smart contract platforms. These consultations offer crucial insights into real-world challenges and opportunities, enhancing the accuracy of the market forecast.

Step 4: Research Synthesis and Final Output

In the final phase, extensive primary research is conducted through interviews with blockchain developers and smart contract auditors. This is combined with quantitative data to deliver a comprehensive and verified market analysis. The final output is a validated, data-driven report on the global smart contract market.

Frequently Asked Questions

01. How big is the Global Smart Contract Market?

The global smart contract market is valued at USD 1.71 billion, driven by the growing adoption of blockchain technologies across financial services, supply chain, and healthcare sectors.

02. What are the challenges in the Global Smart Contract Market?

Key challenges in the global smart contract market include regulatory uncertainty, security vulnerabilities in blockchain platforms, and interoperability issues across different smart contract platforms.

03. Who are the major players in the Global Smart Contract Market?

Major players in the global smart contract market include IBM Corporation, Microsoft Corporation, Oracle Corporation, ConsenSys, and Chainlink Labs, with their dominance stemming from innovative solutions and extensive blockchain ecosystems.

04. What are the growth drivers of the Global Smart Contract Market?

The global smart contract market is driven by the increasing use of blockchain for decentralized finance (DeFi) applications, the automation of legal processes, and the rising demand for transparency in supply chain operations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.