Global Smart Electric Drive Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD1389

December 2024

92

About the Report

Global Smart Electric Drive Market Overview

- The global smart electric drive market reached a size of USD 1,710.0 million in 2023, driven by the increasing adoption of electric vehicles (EVs) and government incentives. The growing emphasis on reducing carbon emissions has accelerated the shift towards EVs, where smart electric drives play a crucial role. Advanced powertrain technologies and the integration of smart systems into vehicles are key factors propelling market growth.

- Key players in the global smart electric drive market include companies like Bosch (Germany), Continental AG (Germany), ZF Friedrichshafen AG (Germany), Siemens (Germany), and BorgWarner (USA). These companies are leading the market through their advanced electric drive solutions, with a strong emphasis on innovation in power electronics and automotive systems. Their global presence and continuous investment in R&D have positioned them as dominant players, driving the evolution and competitiveness of the smart electric drive market.

- In 2023, Continental announced a collaboration with Munich-based DeepDrive to develop innovative technologies for electric vehicles. The focus of this partnership is to create a combined drive and brake unit that can be mounted directly on the vehicle wheel, enhancing overall efficiency and reducing weight. The dual-rotor electric motors developed by DeepDrive are designed to improve the range of electric vehicles and are characterized as lighter and more resource-efficient, aligning with the goals of improving overall vehicle performance.

- Cities like Shanghai, Stuttgart, and Detroit dominate the global smart electric drive market due to their strong automotive industries and innovation ecosystems. Shanghai leads in production and adoption, driven by Chinas aggressive push towards electric vehicles. Stuttgart, the home of major automotive giants like Mercedes-Benz and Porsche, has been a hub for automotive innovation, particularly in electric drives.

Global Smart Electric Drive Market Segmentation

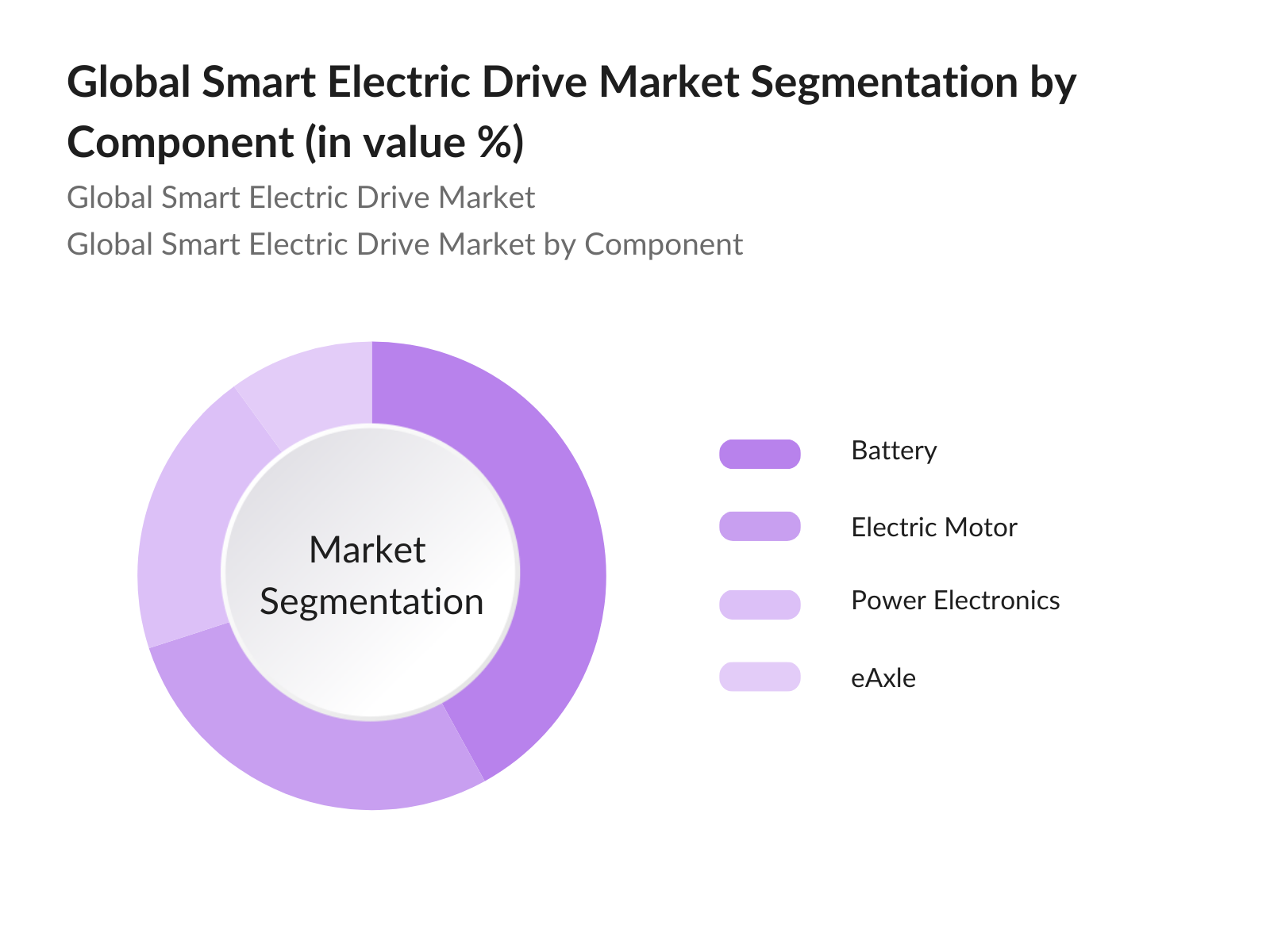

By Component: The global smart electric drive market is segmented by component into Battery, Electric Motor, Power Electronics, and eAxle. In 2023, the Battery segment held the largest market share, driven by the continuous advancements in battery technology, which is critical for improving the range and efficiency of electric vehicles. The focus on developing high-capacity, fast-charging batteries has significantly contributed to the dominance of this segment.

By Drive Type: The global smart electric drive market is segmented by drive type into Front-Wheel Drive (FWD), Rear-Wheel Drive (RWD), and All-Wheel Drive (AWD). In 2023, the All-Wheel Drive segment commanded the largest market share, fueled by its superior traction and handling capabilities, particularly in electric SUVs and high-performance vehicles. The rising consumer preference for electric SUVs and crossover vehicles, which often feature AWD systems for enhanced performance and safety, has significantly driven the demand for smart electric drives in this segment.

By Region: The global smart electric drive market is segmented by region into North America, Europe, Asia-Pacific (APAC), Latin America, and the Middle East & Africa (MEA). In 2023, Europe held the largest market share, driven by the stringent emission regulations and high adoption rate of electric vehicles. The presence of leading automotive manufacturers in countries like Germany, France, and the UK, combined with strong government support for electric vehicle adoption, has solidified Europes dominance in the market. The region's focus on sustainability and innovation continues to drive the growth of smart electric drives.

Global Smart Electric Drive Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Bosch |

1886 |

Stuttgart, Germany |

|

Continental AG |

1871 |

Hanover, Germany |

|

ZF Friedrichshafen AG |

1915 |

Friedrichshafen, Germany |

|

Siemens |

1847 |

Munich, Germany |

|

BorgWarner |

1928 |

Auburn Hills, USA |

- ZF Friedrichshafen AG's Recent Developments: ZF Friedrichshafen AG, in 2023, signed a strategic partnership with a leading Chinese electric vehicle manufacturer to supply smart electric drive systems for their new models. This partnership is expected to boost ZFs presence in the rapidly growing Chinese market. Additionally, ZF has invested in a new R&D center focused on developing next-generation electric drives, with a focus on lightweight and energy-efficient technologies.

- Siemens' Recent Developments: Siemens, in 2023, introduced a new modular electric drive platform designed for a wide range of electric vehicles, from compact cars to commercial trucks. This platform is expected to streamline the production process for automakers, reducing costs and improving scalability. Siemens also announced a collaboration with a leading European automaker to deploy its electric drive solutions in their upcoming electric vehicle lineup, further strengthening its market position.

Global Smart Electric Drive Market Analysis

Global Smart Electric Drive Market Growth Drivers

- Government Incentives for Electric Vehicles: Governments worldwide are implementing initiatives to promote the adoption of electric vehicles (EVs), which directly boosts the smart electric drive market. For instance, in 2021, the U.S. government allocated approximately $7.5 billion towards building a nationwide network of EV charging stations, enhancing the infrastructure necessary for electric vehicle adoption.

- Government Incentives for Electric Mobility: Governments worldwide are providing substantial incentives to promote electric mobility. In 2022, the U.S. government extended its EV tax credit program, offering up to USD 7,500 per vehicle to consumers, significantly boosting EV sales and, consequently, the smart electric drive market. Additionally, China announced a new subsidy scheme for EV manufacturers in 2023, aimed at reducing production costs and making electric vehicles more affordable.

- Advancements in Battery Technology: The rapid advancements in battery technology, particularly in solid-state batteries, are driving the growth of the smart electric drive market. These advancements directly enhance the efficiency and performance of smart electric drives, making them more effective and appealing to manufacturers. The development of more durable and energy-efficient batteries reduces the overall vehicle weight and increases the driving range, further propelling market growth.

Global Smart Electric Drive Market Challenges

- High Cost of Smart Electric Drive Systems: Despite the growing adoption of electric vehicles, the high cost of smart electric drive systems remains a significant challenge. In 2023, the average cost of a smart electric drive system was estimated to be around USD 3,000 per unit, making it a substantial part of the overall EV cost. This high cost is primarily due to the expensive materials and advanced technologies involved in manufacturing these systems. As a result, the high upfront cost limits the adoption of these systems, particularly in price-sensitive markets like Southeast Asia, where affordability is a key concern for consumers.

- Supply Chain Disruptions: In 2023, the semiconductor shortage led to production delays and increased costs for electric drive systems, as these components are heavily reliant on advanced semiconductors. The ongoing conflict between major semiconductor-producing nations has further strained the supply chain, leading to longer lead times and higher costs. This challenge is particularly acute in regions like Europe, where automakers have faced production halts due to a lack of critical components.

Global Smart Electric Drive Market Government Initiatives

- China's New Energy Vehicle (NEV) Program: China's NEV program, updated in 2023, is a critical government initiative aimed at promoting the adoption of electric vehicles. The program includes subsidies, tax breaks, and research grants for EV manufacturers and suppliers of key components like smart electric drives. This initiative is pivotal in maintaining China's position as the largest market for electric vehicles and their components, driving significant growth in the smart electric drive market.

- U.S. Infrastructure Investment and Jobs Act: The U.S. Infrastructure Investment and Jobs Act, signed into law in 2023, includes a significant focus on electric vehicle infrastructure and technology. The Act allocated USD 7.5 billion specifically for the development of a national EV charging network and the advancement of electric vehicle technology, including smart electric drives. This investment is expected to spur innovation and increase the adoption of electric vehicles across the country, directly benefiting the smart electric drive market by creating a more supportive environment for EVs.

Global Smart Electric Drive Market Outlook

The global smart electric drive market is poised for substantial growth by 2028, driven by a combination of strong government initiatives and rapid technological advancements. As governments worldwide implement stricter emissions regulations and offer incentives to accelerate the transition to electric vehicles, the demand for advanced smart electric drive systems is expected to surge.

Future Trends:

- Widespread Adoption of Modular Electric Drive Platforms: By 2028, the market is expected to see a significant shift towards modular electric drive platforms, which will allow automakers to use the same drive system across different vehicle models. This trend is driven by the need for cost efficiency and scalability, as manufacturers look to streamline production processes. The modular approach will reduce development costs and time-to-market for new electric vehicles, with key players like Siemens and Continental AG already investing in modular platform technologies. This trend is expected to dominate the market as automakers seek to optimize production and reduce costs.

- Integration of AI and Machine Learning in Drive Systems: The integration of AI and machine learning in smart electric drive systems is expected to be a major trend by 2028. These technologies will enable real-time monitoring and predictive maintenance, improving the reliability and lifespan of electric drives. AI-driven systems will also optimize energy consumption and enhance vehicle performance by adapting to driving conditions in real-time. Bosch, for instance, is at the forefront of this innovation, working on AI-enabled drive systems that can predict and prevent potential failures, thereby reducing downtime and maintenance costs.

Scope of the Report

|

By Component |

Battery Electric Motor Power Electronics eAxle |

|

By Drive Type |

Front-Wheel Drive (FWD) Rear-Wheel Drive (RWD) All-Wheel Drive (AWD) |

|

By Region |

North America Europe, Asia-Pacific (APAC) Latin America Middle East & Africa (MEA) |

|

By Technology |

Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Hybrid Electric Vehicles (HEVs) |

Products

Key Target Audience

Automotive Manufacturers

Electric Vehicle Manufacturers

Battery Manufacturers

Electric Motor Manufacturers

Government and Regulatory Bodies (OSHA)

Investors and Venture Capitalist Firms

Electric Vehicle Infrastructure Providers

Automotive Aftermarket Service Providers

Companies

Players Mentioned in the Report:

Bosch

Continental AG

ZF Friedrichshafen AG

Siemens

BorgWarner

Magna International

Schaeffler AG

GKN Driveline

Infineon Technologies

Dana Incorporated

Nidec Corporation

Valeo

Aisin Seiki Co., Ltd.

Hitachi Automotive Systems

Mahle GmbH

Table of Contents

01. Global Smart Electric Drive Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Global Smart Electric Drive Market Size (in USD Mn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Global Smart Electric Drive Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Electric Vehicle Production and Adoption

3.1.2. Government Incentives for Electric Mobility

3.1.3. Advancements in Battery Technology

3.2. Challenges

3.2.1. High Cost of Smart Electric Drive Systems

3.2.2. Supply Chain Disruptions

3.2.3. Limited Charging Infrastructure

3.3. Government Initiatives

3.3.1. European Green Deal (2023)

3.3.2. Chinas New Energy Vehicle (NEV) Program (2023)

3.3.3. U.S. Infrastructure Investment and Jobs Act (2023)

3.4. Recent Trends

3.4.1. Shift Towards Integrated Electric Drive Systems

3.4.2. Increased Collaboration Between Automakers and Technology Firms

3.4.3. Adoption of Solid-State Batteries in Electric Vehicles

04. Global Smart Electric Drive Market Segmentation, 2023

4.1. By Component (in Value %)

4.1.1. Battery

4.1.2. Electric Motor

4.1.3. Power Electronics

4.1.4. eAxle

4.2. By Drive Type (in Value %)

4.2.1. Front-Wheel Drive (FWD)

4.2.2. Rear-Wheel Drive (RWD)

4.2.3. All-Wheel Drive (AWD)

4.3. By Vehicle Type (in Value %)

4.3.1. Passenger Cars

4.3.2. Commercial Vehicles

4.3.3. Two-Wheelers

4.4. By Propulsion Type (in Value %)

4.4.1. Battery Electric Vehicles (BEVs)

4.4.2. Hybrid Electric Vehicles (HEVs)

4.4.3. Plug-In Hybrid Electric Vehicles (PHEVs)

4.5. By Region (in Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific (APAC)

4.5.4. Latin America

4.5.5. Middle East & Africa (MEA)

05. Global Smart Electric Drive Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Bosch

5.1.2. Continental AG

5.1.3. ZF Friedrichshafen AG

5.1.4. Siemens

5.1.5. BorgWarner

5.1.6. Magna International

5.1.7. Schaeffler AG

5.1.8. GKN Driveline

5.1.9. Infineon Technologies

5.1.10. Dana Incorporated

5.1.11. Nidec Corporation

5.1.12. Valeo

5.1.13. Aisin Seiki Co., Ltd.

5.1.14. Hitachi Automotive Systems

5.1.15. Mahle GmbH

5.2. Recent Developments

5.2.1. Continental AG's Expansion in the U.S. (2024)

5.2.2. BorgWarner's Acquisition of Delphi Technologies (2023)

5.2.3. Schaeffler's Investment in R&D for Electric Drives (2024)

06. Global Smart Electric Drive Market Future Trends (Market Outlook 2028)

6.1. Widespread Adoption of Modular Electric Drive Platforms

6.2. Integration of AI and Machine Learning in Drive Systems

6.3. Increased Focus on Lightweight Materials in Electric Drive Systems

07. Global Smart Electric Drive Market Future Market Size (in USD Bn), 2023-2028

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Global Smart Electric Drive Market Analysts Recommendations

8.1. TAM/SAM/SOM Analysis

8.2. Customer Cohort Analysis

8.3. Marketing Initiatives

8.4. White Space Opportunity Analysis

09. Global Smart Electric Drive Market Government Initiatives

9.1. China's New Energy Vehicle (NEV) Program

9.2. U.S. Infrastructure Investment and Jobs Act

9.3. European Green Deal

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Global Smart Electric Drive Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Global Smart Electric Drive Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple Smart Electric Drive and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Smart Electric Drive.

Frequently Asked Questions

01. How big is the Global Smart Electric Drive Market?

The global smart electric drive market was valued at USD 1,710.0 million in 2023, driven by the growing adoption of electric vehicles, advancements in powertrain technology, and supportive government policies worldwide.

02. What are the challenges in the Global Smart Electric Drive Market?

Challenges in the Global Smart Electric Drive Market include the high cost of smart electric drive systems, supply chain disruptions, particularly in semiconductors, and the limited charging infrastructure in certain regions, which hinders the widespread adoption of electric vehicles.

03. Who are the major players in the Global Smart Electric Drive Market?

Key players in the in the Global Smart Electric Drive Market include Bosch, Continental AG, ZF Friedrichshafen AG, Siemens, and BorgWarner. These companies lead the market due to their strong technological capabilities, extensive product offerings, and global reach.

04. What are the growth drivers of the Global Smart Electric Drive Market?

The in the Global Smart Electric Drive Market is driven by the increasing production and adoption of electric vehicles, government incentives promoting electric mobility, and advancements in battery technology, which enhance the performance and efficiency of smart electric drives.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.