Region:Global

Author(s):Geetanshi

Product Code:KRAD0076

Pages:81

Published On:August 2025

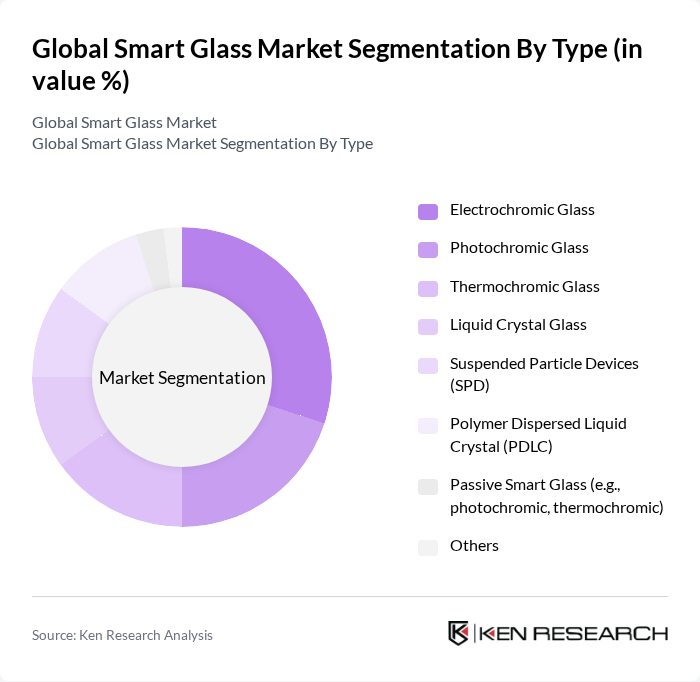

By Type:The smart glass market can be segmented into various types, including electrochromic glass, photochromic glass, thermochromic glass, liquid crystal glass, suspended particle devices (SPD), polymer dispersed liquid crystal (PDLC), passive smart glass, and others. Each type serves different applications and industries, contributing to the overall market dynamics. Electrochromic glass is widely adopted in commercial buildings and automotive sunroofs for its rapid switching and energy-saving properties. SPD and PDLC technologies are increasingly used in transportation and healthcare for privacy and glare control. Thermochromic and photochromic glasses are favored in architectural applications for passive solar control .

By End-User:The end-user segmentation of the smart glass market includes residential, commercial, industrial, automotive & transportation, aerospace & defense, healthcare, and others. Each segment has unique requirements and applications, influencing the demand for smart glass products. The commercial segment leads due to the adoption of smart glass in offices, hotels, and retail spaces for energy efficiency and comfort. The automotive & transportation segment is expanding rapidly with the integration of smart glass in sunroofs, windows, and rear-view mirrors, enhancing safety and user experience. The residential segment is also growing with the rise of smart homes and connected living environments .

The Global Smart Glass Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain S.A., AGC Inc. (Asahi Glass Co., Ltd.), View, Inc., Gentex Corporation, Halio, Inc. (formerly Soladigm, Inc.), Research Frontiers Inc., Hitachi Chemical Co., Ltd. (now Showa Denko Materials Co., Ltd.), EControl-Glas GmbH & Co. KG, Glass Apps, LLC, Polytronix, Inc., Smartglass International Ltd., SageGlass (a Saint-Gobain company), Kinestral Technologies, Inc., ChromoGenics AB, Guardian Glass, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the smart glass market appears promising, driven by increasing demand for energy-efficient solutions and technological advancements. As more consumers and businesses recognize the benefits of smart glass, adoption rates are expected to rise significantly. Additionally, the integration of smart glass with smart home technologies will create new opportunities for innovation. In future, the market is likely to see a surge in applications across various sectors, including healthcare and automotive, further solidifying its position in the construction and design industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrochromic Glass Photochromic Glass Thermochromic Glass Liquid Crystal Glass Suspended Particle Devices (SPD) Polymer Dispersed Liquid Crystal (PDLC) Passive Smart Glass (e.g., photochromic, thermochromic) Others |

| By End-User | Residential Commercial Industrial Automotive & Transportation Aerospace & Defense Healthcare Others |

| By Application | Architectural (Windows, Facades, Skylights) Automotive (Sunroofs, Side Windows, Rear Windows, Mirrors) Aerospace (Cabin Windows, Cockpit Windows) Consumer Electronics (Displays, Wearables) Healthcare (Partitions, Privacy Glass) Solar Power Generation Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Rest of Latin America) Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA) |

| By Price Range | Low-End Mid-Range High-End |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Projects | 120 | Architects, Project Managers |

| Residential Smart Home Installations | 90 | Homeowners, Interior Designers |

| Automotive Applications | 60 | Automotive Engineers, Product Development Managers |

| Energy Efficiency Initiatives | 50 | Energy Consultants, Sustainability Officers |

| Retail and Hospitality Sector | 70 | Facility Managers, Retail Operations Directors |

The Global Smart Glass Market is valued at approximately USD 7.4 billion, driven by the increasing demand for energy-efficient solutions in architecture and automotive sectors, along with advancements in smart glass technology.