Global Smart Warehouse Market Outlook tot 2030

Region:Global

Author(s):Abhinav kumar

Product Code:KROD8529

November 2024

100

About the Report

Global Smart Warehouse Market Overview

- The global smart warehouse market is valued at approximately USD 23.4 billion, driven by the rapid expansion of e-commerce, increased adoption of automation technologies such as IoT and AI, and the need for improved operational efficiency in supply chains. The rise of same-day and next-day delivery services has led companies to invest in automated storage and retrieval systems, advanced robotics, and real-time data monitoring solutions. These developments have been crucial in transforming traditional warehouses into smart, digitally enabled facilities, improving accuracy, reducing costs, and optimizing inventory management.

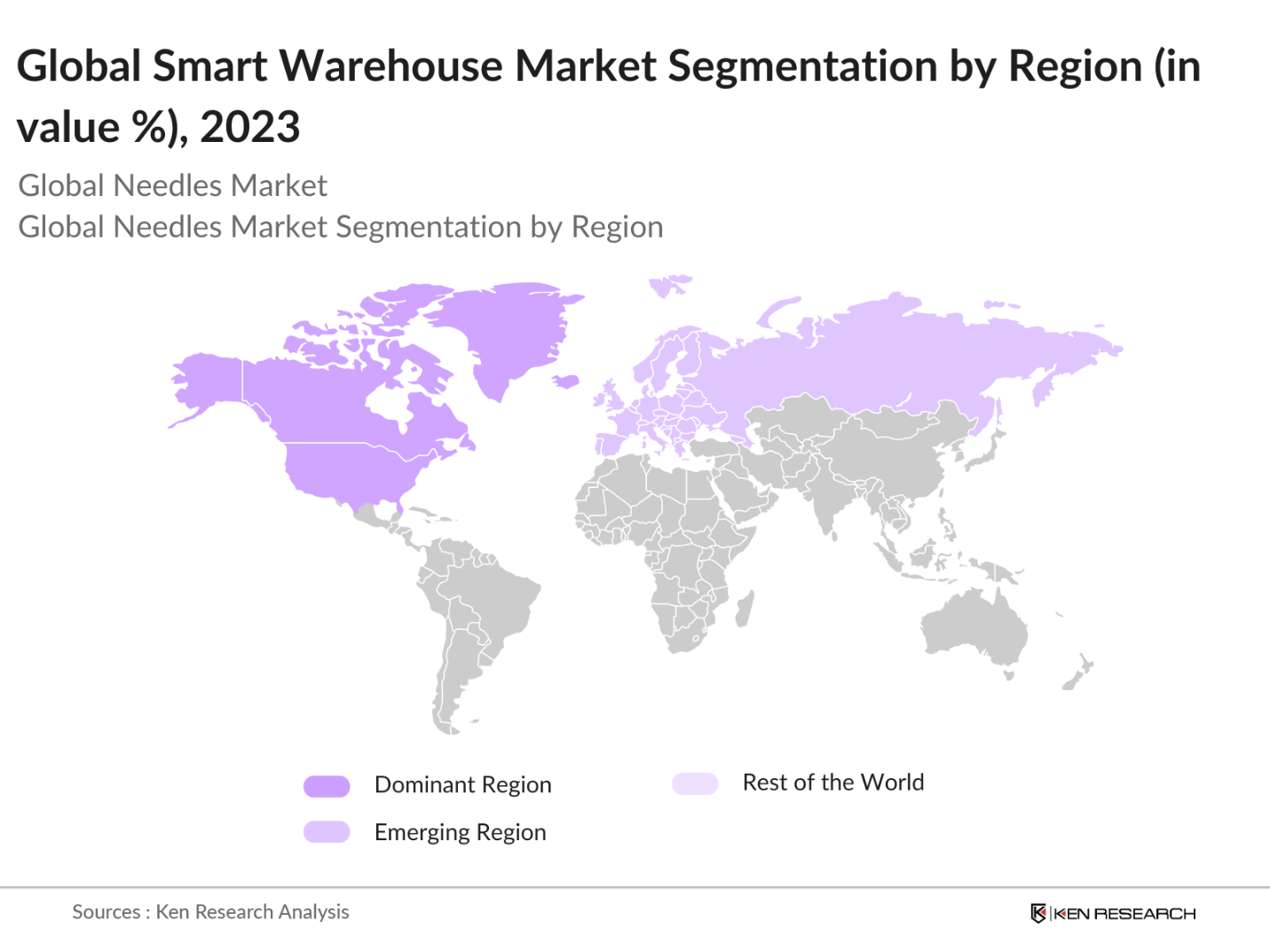

- Dominant regions in the global smart warehouse market include North America, Europe, and Asia-Pacific, particularly the United States, Germany, China, and Japan. The U.S. leads due to its well-established e-commerce infrastructure, high labor costs driving automation demand, and advanced technology ecosystem. China and Japan dominate the Asia-Pacific market, driven by strong government support for Industry 4.0 initiatives and increasing demand for efficient logistics solutions from their massive e-commerce industries. Europe, led by Germany, benefits from advanced manufacturing and logistics technologies, further contributing to its dominance in the market.

- The implementation of stringent data plations is impacting smart warehouses, particularly regarding IoT data. The European Unions General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) impose heavy fines for non-compliance. Warehouses handling sensitive customer data must invest in secure IoT systems that protect user information. Failure to comply can result in fines of up to 20 million or 4% of global annual turnover, which is a major concern for global companies operating smart warehouses .

Global Smart Warehouse Market Segmentation

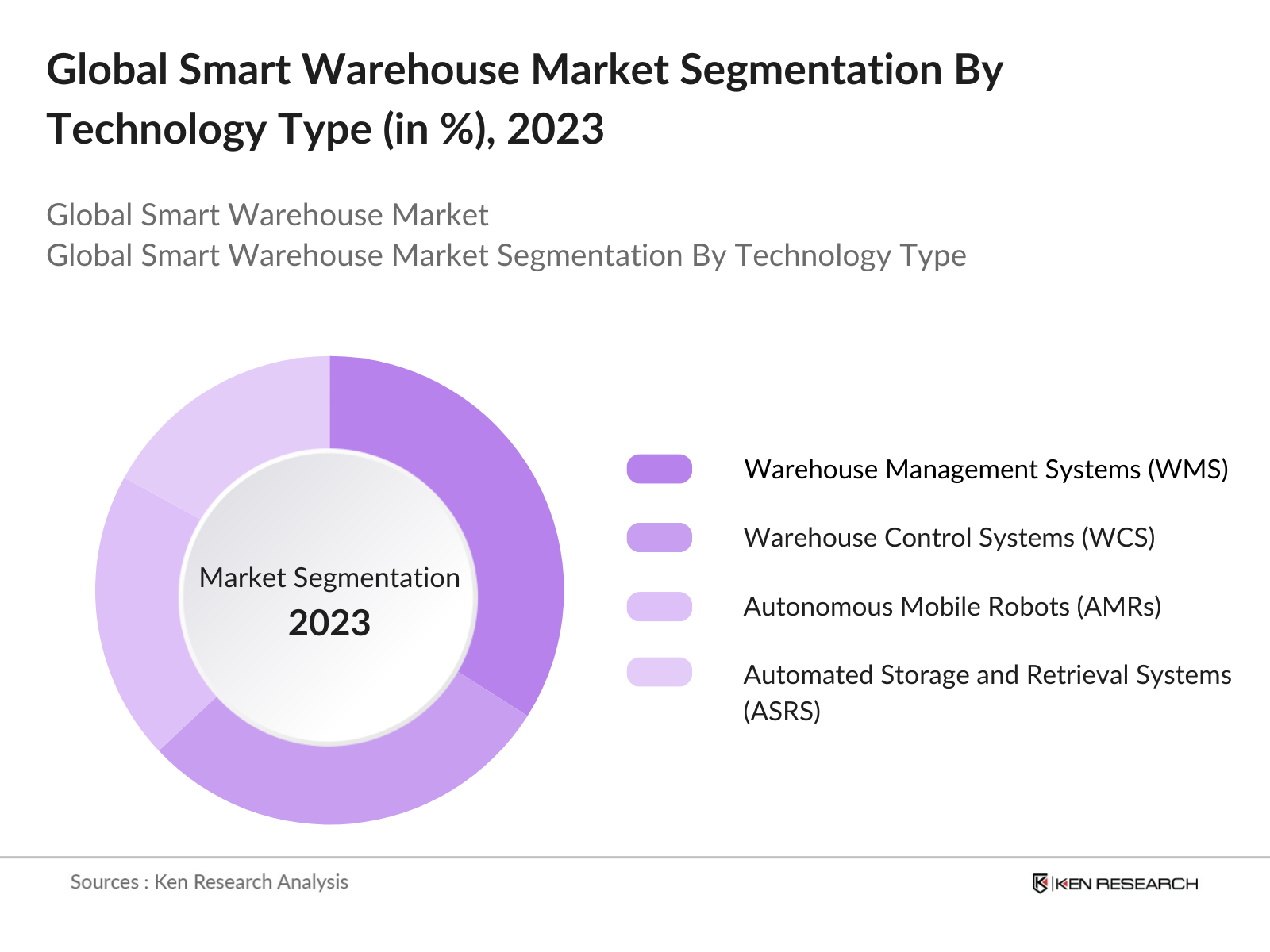

By Technology: The smart warehouse market is segmented by technology into Warehouse Management Systems (WMS), Warehouse Control Systems (WCS), Autonomous Mobile Robots (AMRs), Automated Storage and Retrieval Systems (ASRS), and RFID and IoT sensors. In 2023, Warehouse Management Systems (WMS) held the largest market share due to their critical role in streamlining operations, optimizing labor, and improving inventory accuracy. The growing trend toward real-time tracking and predictive maintenance further contributes to the dominance of WMS, especially in sectors like e-commerce and retail where high efficiency is crucial to meet consumer demands.

By Region

The market is segmented by region into North America, Europe, Asia-Pacific, the Middle East & Africa, and Latin America. North America held the largest share, with 35% of the total market in 2023. The U.S. market is driven by the high adoption of advanced technologies such as robotics and AI, coupled with the growth of the e-commerce sector. Europe follows with 28%, led by Germany's robust manufacturing and logistics sectors. Asia-Pacific, particularly China, is experiencing rapid growth due to its booming e-commerce market and government initiatives aimed at modernizing logistics infrastructure.

By Application: The smart warehouse market is segmented by application into Retail and E-commerce, 3PL and Logistics, Automotive, Pharmaceuticals, and Food and Beverage. Retail and E-commerce currently dominate the market share, accounting for 40% of the total. This is largely due to the increased demand for rapid fulfillment and efficient inventory management. The surge in online shopping and customer expectations for fast delivery has pushed e-commerce giants to integrate sophisticated automation and real-time inventory systems, thus fueling the growth of smart warehouses in this sector.

Global Smart Warehouse Market Competitive Landscape

The global smart warehouse market is characterized by the presence of several key players who have established strong footholds through continuous innovation and partnerships. The market is dominated by companies such as Honeywell, Amazon Robotics, and Zebra Technologies, which are leveraging cutting-edge technologies like AI and IoT to enhance operational efficiency and improve customer satisfaction. These companies are constantly investing in R&D to maintain their competitive edge in the evolving market.

Global Smart Warehouse Industry Analysis

Growth Drivers

- Expansion of E-Commerce: The global expansion of e-commerce is significantly increasing demand for warehousing and automation. In 2024, global retail e-commerce sales reached approximately $5.7 trillion, according to World Bank estimates. This surge is straining warehousing operations, leading companies to adopt smart warehouse solutions that optimize space, streamline inventory, and expedite order fulfillment. Smart automation technologies like robotics are crucial for handling the growing volume of packagesUPS alone handles over 25 million parcels daily globally, highlighting the necessity for scalable automation.

- Increasing Demand for Same: Day Delivery Same-day delivery services, driven by consumer expectations, have significantly increased the pressure on warehouses to automate processes. Globally, same-day delivery service revenues are projected to exceed $10 billion in 2024. To meet this demand, warehouses must implement smart systems for faster picking, packing, and dispatching of goods. Advanced automation systems enable warehouse operations to handle 50% more orders per day compared to traditional setups, reflecting the critical role of smart warehouses in supply chain optimization.

- Supply Chain Optimization: Supply chain optimization through smart warehouses is driving operational efficiency. By 2024, efficient supply chains that utilize automated warehouse management systems save companies an average of 15% in operational costs annually. World Bank reports indicate that logistics costs in emerging markets are often 50% higher than in developed markets, creating a substantial opportunity for automation to reduce inefficiencies. Implementing smart systems improves inventory accuracy by over 30%, enabling businesses to meet consumer demand faster while reducing waste.

Market Challen

- High Initial Capital Investment: The high capital expenditure required for smart warehouse automation is a significant barrier. According to data from the IMF, initial investments in automated warehouse solutions often exceed $5 million for mid-sized facilities. Although this investment promises long-term cost savings, the upfront financial burden restricts smaller enterprises from adopting these technologies. This financial challenge is particularly acute in emerging markets, where access to financing is limited and economic instability further heightens investment risks.

- Cyber security: Cyber security remains a pressing concern for smart warehouses. As warehouse operations become increasingly reliant on connected devices, the risk of cyber-attacks escalates. In 2024, over 50% of supply chain-related data breaches stem from vulnerabilities in IoT systems. Protecting these systems requires significant investment in cybersecurity infrastructure, which can increase operational costs by 8-10%. Governments are also imposing stricter regulations on data protection in warehouses, particularly for IoT devices, adding further pressure on companies to comply.

Global Smart Warehouse Market Future Outlook

Over the next five years, the global smart warehouse market is expected to see significant growth driven by continuous advancements in warehouse automation technologies, increased adoption of AI and IoT, and rising demand for efficient supply chain management. The push toward sustainability and green warehousing practices is also likely to drive the adoption of energy-efficient solutions, reducing the carbon footprint of warehouses. Furthermore, the integration of blockchain for enhanced supply chain transparency and the use of autonomous vehicles and drones for last-mile delivery will shape the future landscape of the industry.

Opportunities

- Growth in 3PL market: Third-party logistics (3PL) and fourth-party logistics (4PL) markets offer significant growth opportunities for smart warehouses. The World Bank reported that the global 3PL market grew by 8% in 2023, driven by increased outsourcing of supply chain functions. Companies are now turning to 4PL providers to manage entire supply chain ecosystems, including smart warehouse operations. This trend is expanding the role of automated warehouses in logistics as businesses seek to streamline operations and reduce costs.

- Integration with Autonomous Vehicles and Drones: Vehicles and drones are transforming last-mile delivery and warehousing. The adoption of autonomous delivery vehicles is expected to rise sharply, with over 4 million drones and autonomous vehicles deployed in warehouses globally by 2025. These technologies reduce labor costs and improve delivery times. For example, drone-based inventory management in warehouses can cut cycle count times by 80%, allowing for more efficient and accurate stock management.

Scope of the Report

|

By Technology |

Warehouse Management Systems (WMS) Warehouse Control Systems (WCS) Autonomous Mobile Robots (AMRs) Automated Storage and Retrieval Systems (ASRS) RFID and IoT Sensors |

|

By Application |

Retail and E-Commerce 3PL and Logistics Automotive Pharmaceuticals Food and Beverage |

|

By Deployment Type |

On-premise Cloud-based Hybrid |

|

By Warehouse Size |

Small Warehouses Medium-sized Warehouses Large Warehouses |

|

By Region |

North America Europe Asia-Pacific Middle East and Africa Latin America |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

E-commerce and Retail Companies

3PL and Logistics Service Provider Companies

Automotive Manufacturing Industries

Food and Beverage Companies

Pharmaceutical Manufacturing Industries

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., U.S. Department of Transportation, European Commission)

Technology Provider Companies

Companies

Players Mentioned in the Report

Honeywell International Inc.

Amazon Robotics

Zebra Technologies

Siemens AG

Kion Group AG

Daifuku Co., Ltd.

Oracle Corporation

Manhattan Associates, Inc.

IBM Corporation

Murata Machinery, Ltd.

Table of Contents

1. Global Smart Warehouse Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Smart Warehouse Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Smart Warehouse Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of E-Commerce

3.1.2. Increasing Demand for Same-Day Delivery

3.1.3. Adoption of IoT, AI, and Robotics

3.1.4. Supply Chain Optimization

3.2. Market Challenges

3.2.1. High Initial Capital Investment

3.2.2. Cybersecurity Threats

3.2.3. Workforce Resistance to Automation

3.3. Opportunities

3.3.1. Growth in 3PL and 4PL Market

3.3.2. Integration with Autonomous Vehicles and Drones

3.3.3. Sustainability and Green Warehousing

3.4. Trends

3.4.1. Real-time Data Monitoring and Analytics

3.4.2. Implementation of Digital Twins

3.4.3. Blockchain for Supply Chain Transparency

3.5. Government Regulation

3.5.1. Data Privacy Regulations

3.5.2. Industry 4.0 Standards

3.5.3. Environmental Regulations

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape

4. Global Smart Warehouse Market Segmentation

4.1. By Technology (In Value %)

4.1.1. Warehouse Management Systems (WMS)

4.1.2. Warehouse Control Systems (WCS)

4.1.3. Autonomous Mobile Robots (AMRs)

4.1.4. Automated Storage and Retrieval Systems (ASRS)

4.1.5. RFID and IoT Sensors

4.2. By Application (In Value %)

4.2.1. Retail and E-Commerce

4.2.2. 3PL and Logistics

4.2.3. Automotive

4.2.4. Pharmaceuticals

4.2.5. Food and Beverage

4.3. By Deployment Type (In Value %)

4.3.1. On-premise

4.3.2. Cloud-based

4.3.3. Hybrid

4.4. By Warehouse Size (In Value %)

4.4.1. Small Warehouses

4.4.2. Medium-sized Warehouses

4.4.3. Large Warehouses

4.5. By Region (In Value %)

4.5.1. North America

4.5.2. Europe

4.5.3. Asia-Pacific

4.5.4. Middle East and Africa

4.5.5. Latin America

5. Global Smart Warehouse Market Competitive Analysis

5.1. Detailed Profiles of Major Companies 5.1.1. Honeywell International Inc.

5.1.2. Amazon Robotics

5.1.3. Zebra Technologies

5.1.4. Siemens AG

5.1.5. Kion Group AG

5.1.6. Daifuku Co., Ltd.

5.1.7. Manhattan Associates, Inc.

5.1.8. IBM Corporation

5.1.9. Oracle Corporation

5.1.10. Murata Machinery, Ltd.

5.1.11. SSI Schaefer

5.1.12. Swisslog Holding AG

5.1.13. Knapp AG

5.1.14. SAP SE

5.1.15. Dematic

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Product Portfolio, Key Technologies, Major Markets, Partnerships, Key Clients)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Global Smart Warehouse Market Regulatory Framework

6.1. Compliance Standards for Automation and AI

6.2. Data and Cybersecurity Compliance

6.3. Green Certifications and Sustainability Standards

7. Global Smart Warehouse Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Smart Warehouse Future Market Segmentation

8.1. By Technology

8.2. By Application

8.3. By Deployment Type

8.4. By Warehouse Size

8.5. By Region

9. Global Smart Warehouse Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In the initial phase, we create an ecosystem map of all stakeholders in the global smart warehouse market. This involves comprehensive desk research, utilizing secondary sources such as industry reports and proprietary databases to identify and define the critical variables affecting the market.

Step 2: Market Analysis and Construction

This phase focuses on analyzing historical data to understand the penetration of smart warehouse solutions. We examine the relationship between market growth and service providers while analyzing revenue generation from major regions and industry verticals.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through consultations with industry experts using CATI interviews. These experts provide insights into operational challenges and emerging trends, helping us refine our market models and predictions.

Step 4: Research Synthesis and Final Output

We engage with multiple warehouse technology providers to gain insights into product demand, sales performance, and client preferences. This data is cross-verified with our bottom-up market approach to ensure accuracy and reliability in the final market assessment.

Frequently Asked Questions

01. How big is the global smart warehouse market?

The global smart warehouse market was valued at USD 23.4 billion, driven by the growing e-commerce sector and the increasing need for automation to improve warehouse efficiency and reduce operational costs.

02. What are the challenges in the global smart warehouse market?

Key challenges include high initial capital investment, cybersecurity threats associated with the integration of IoT systems, and workforce resistance to automation in various regions.

03. Who are the major players in the global smart warehouse market?

Major players in the smart warehouse market include Honeywell International Inc., Amazon Robotics, Zebra Technologies, Siemens AG, and Kion Group AG. These companies are leaders in automation, robotics, and warehouse management solutions.

04. What are the growth drivers of the global smart warehouse market?

The market is driven by the rising demand for faster order fulfillment, increased efficiency in inventory management, and the integration of AI, IoT, and robotics technologies to optimize warehouse operations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.