Global Snail Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD5014

December 2024

91

About the Report

Global Snail Market Overview

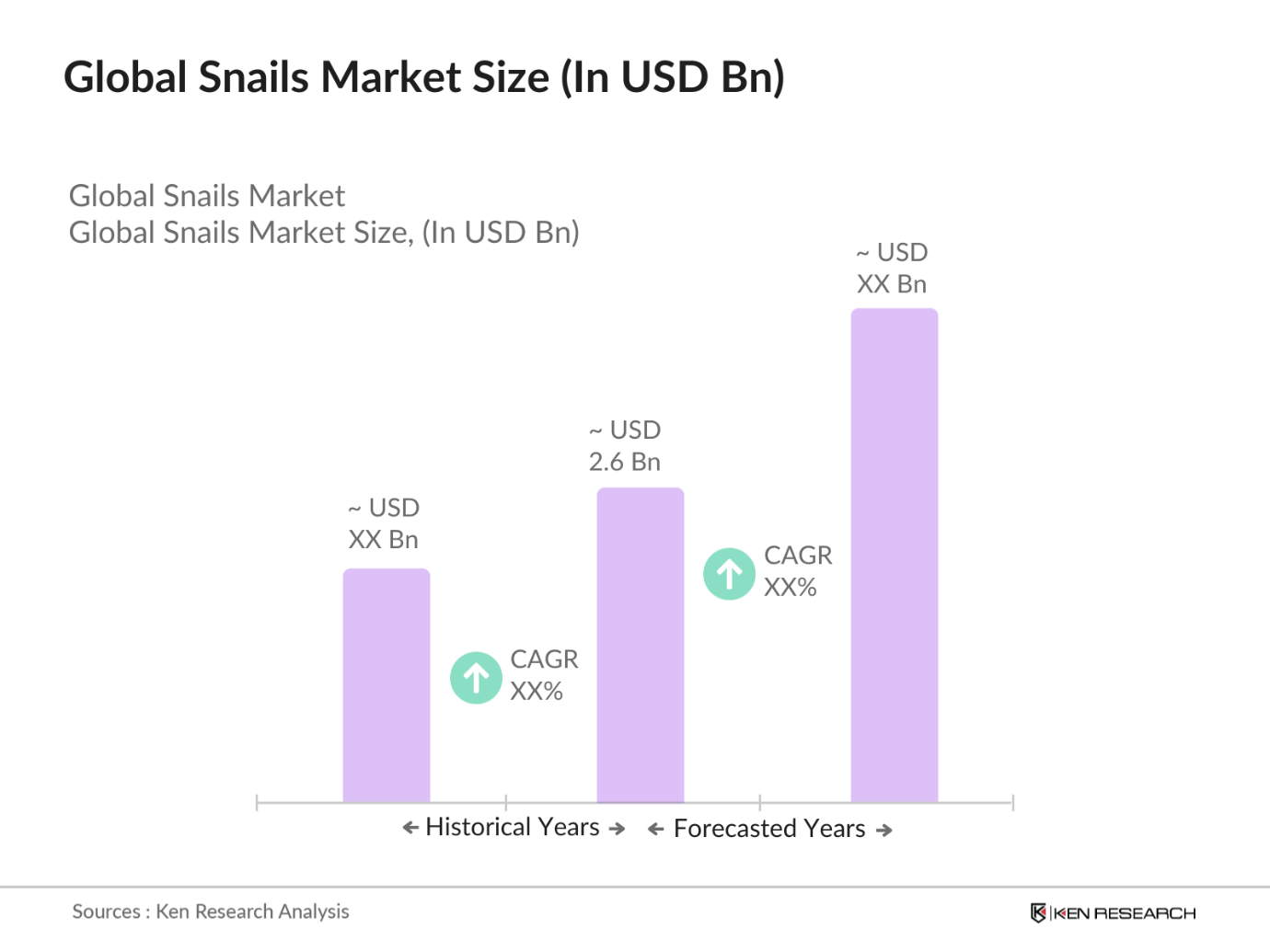

- The global snail market is valued at USD 2.6 billion, with its steady growth driven by the increasing demand for sustainable protein sources and the health benefits associated with snail consumption. Snails are rich in protein, low in fat, and contain essential nutrients, making them an attractive option for health-conscious consumers, particularly in Europe and Africa. The market has also seen the introduction of snail-based cosmetic and pharmaceutical products, which has further fueled its growth in recent years.

- Countries like France, Spain, and Nigeria are dominant players in the global snail market due to their favorable climatic conditions, traditional consumption habits, and well-established snail farming industries. In France, the strong demand for snails (escargots) in the gourmet food sector plays a significant role in its market dominance. Meanwhile, Nigeria leads in Africa due to the countrys large-scale production and farming practices, as well as a growing domestic and export market for snail meat and by-products.

- Government regulations regarding the import and export of snail products are a significant factor in the market. In 2024, the World Trade Organization (WTO) reported that several countries, including the United States and members of the European Union, have imposed strict guidelines on the importation of snail products to ensure food safety and quality standards. These regulations affect market accessibility and create barriers for new entrants.

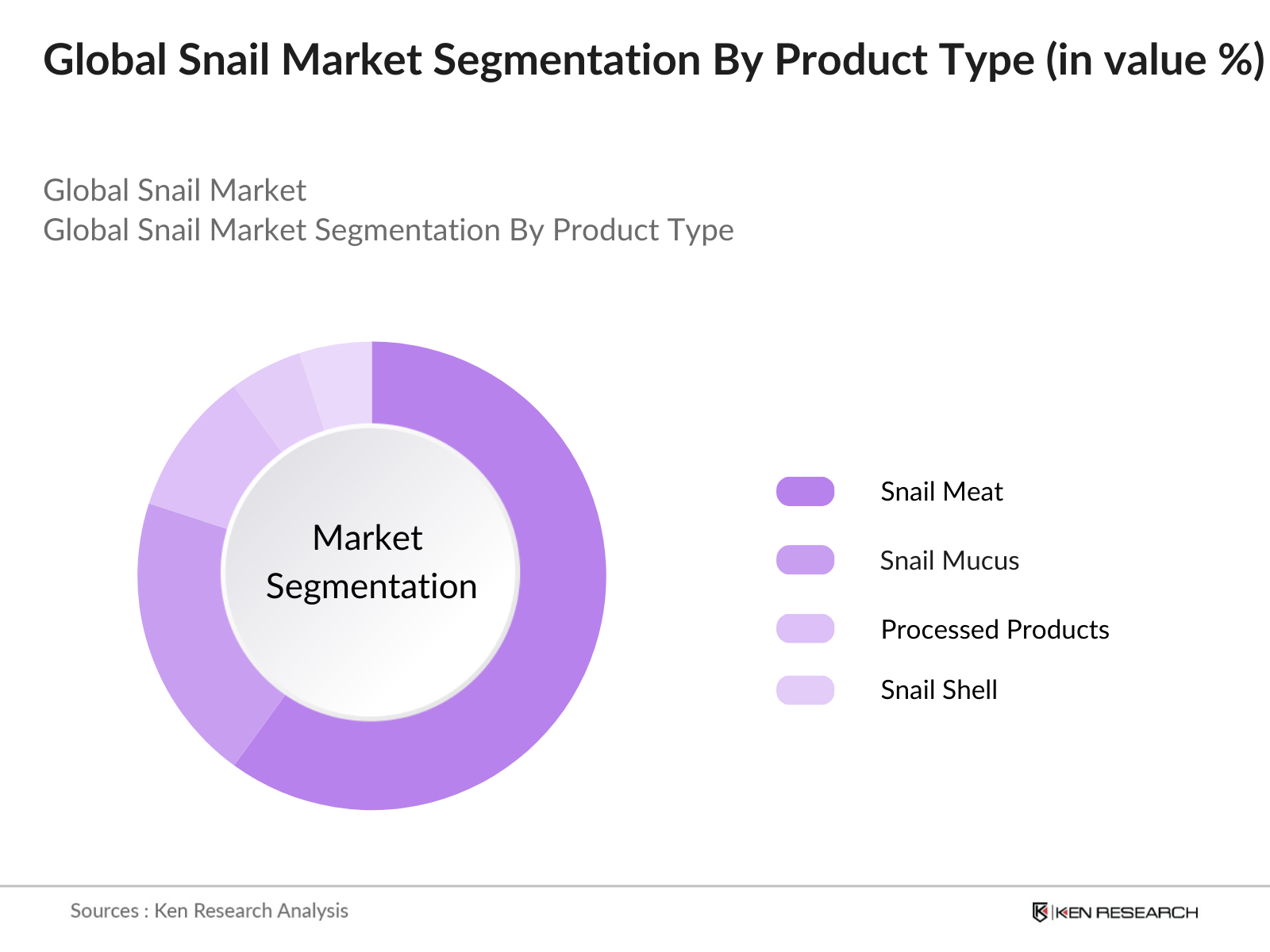

Global Snail Market Segmentation

- By Product Type: The global snail market is segmented by product type into snail meat, snail mucus, processed snail products, and snail shell products. Recently, snail meat has dominated the product type segment due to the rising demand for sustainable and nutritious food alternatives. Health-conscious consumers in Europe and Africa are increasingly seeking snail meat as a protein-rich, low-fat substitute for traditional meat products. Additionally, snail meat is gaining popularity in the gourmet food sector, especially in France, where it is considered a delicacy, driving the dominance of this sub-segment.

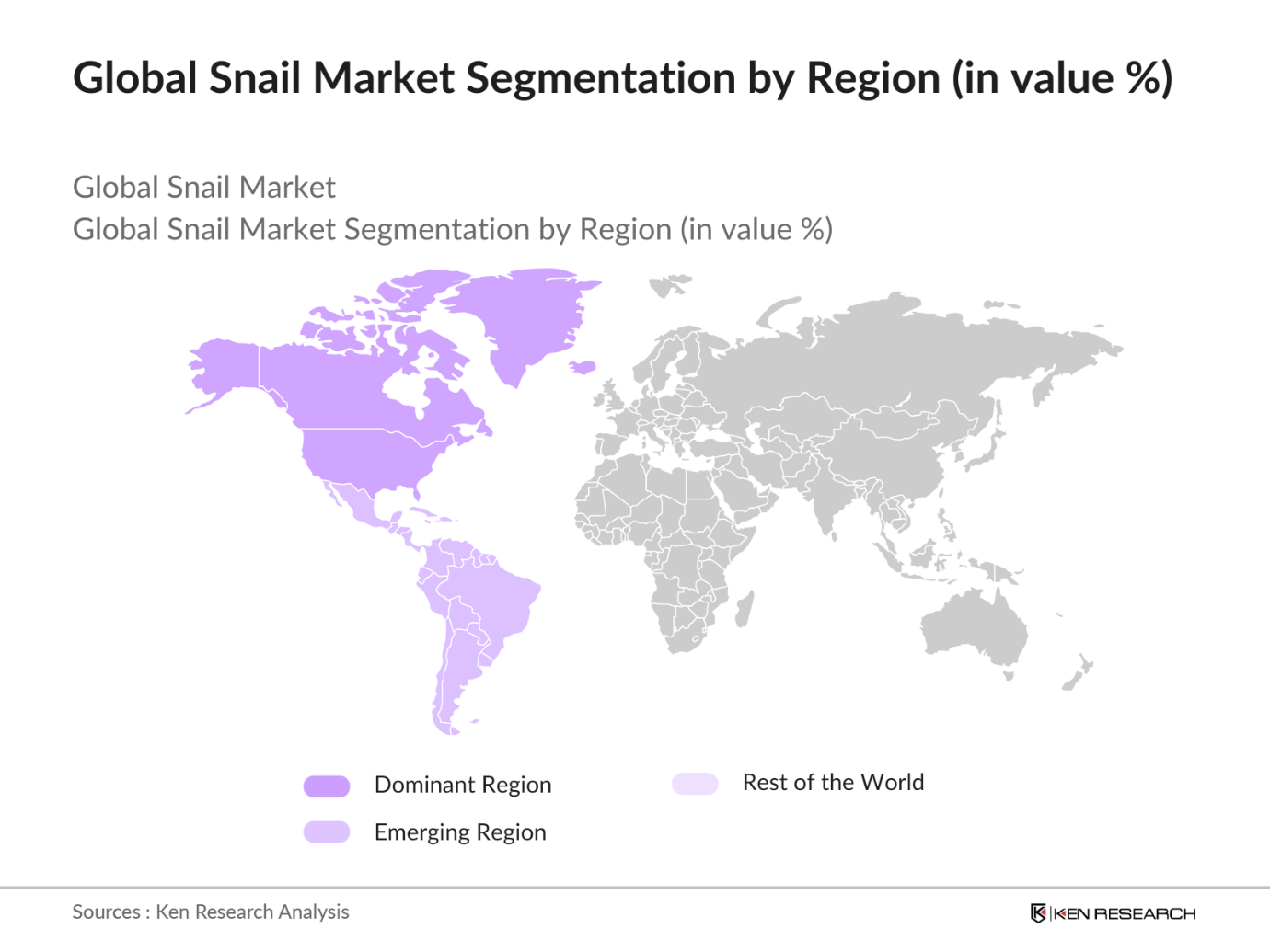

- By Region: Regionally, the global snail market is divided into Europe, Asia Pacific, North America, Africa, and Latin America. Europe leads the market, with France dominating due to its rich culinary tradition involving snails, particularly as part of French gastronomy. Africa, led by Nigeria, is the second-largest market, fueled by local consumption and export demand for snail meat and products. The expansion of snail farming as a source of income in rural communities across Africa has contributed significantly to the market's growth in the region.

- By Farming Method: The market is segmented by farming method into indoor snail farming, outdoor snail farming, and greenhouse snail farming. Greenhouse snail farming currently holds the largest market share due to its controlled environment that enhances snail productivity and reduces the risk of diseases. The consistent year-round production offered by greenhouse farming, especially in regions with fluctuating climates, has made it the preferred method for commercial snail producers across Europe and Africa.

Global Snail Market Competitive Landscape

The global snail market is dominated by a combination of well-established and emerging players. Europe houses some of the largest producers, owing to the regions culinary traditions and established snail farming infrastructure. African countries like Nigeria are also growing in importance, with small and medium-sized enterprises playing a crucial role in the market.

The competitive landscape in the snail market showcases strong consolidation in key regions, driven by demand for both food and cosmetic snail-based products. Companies are investing in technological advancements to boost productivity and enhance product quality.

Global Snail Market Analysis

Growth Drivers

- Demand for Sustainable Protein Sources: As global demand for sustainable protein alternatives rises, snails have emerged as a significant source of protein due to their low environmental impact compared to traditional livestock farming. According to the FAO, livestock farming accounts for nearly 14.5% of human-induced greenhouse gas emissions, whereas snail farming produces negligible emissions. The FAO further indicates that protein sources like snails require less water and land. In 2024, with global pressure on reducing carbon emissions, sustainable protein sources such as snails are gaining traction, particularly in regions where alternative protein sources are scarce.

- Nutritional Benefits of Snails: Snails are highly nutritious, offering a rich source of protein, iron, calcium, and essential fatty acids. According to the World Health Organization (WHO), snails contain approximately 16 grams of protein per 100 grams of meat, making them an attractive option for health-conscious consumers. The demand for snail-based food products has grown in line with increasing awareness of these benefits, particularly in developed markets. The nutrient profile of snails positions them as a superfood for 2024, driving consumer preferences towards healthier and sustainable food options.

- Expansion of Gourmet Food Industry: The global gourmet food industry has seen a significant shift towards exotic and sustainable ingredients like snails. In 2024, data from the UN World Tourism Organization (UNWTO) indicates that food tourism has grown by 8% over the last five years, with many travelers seeking unique culinary experiences. Snails, often served as escargot, have found their way into high-end restaurants across Europe and Asia. This expansion into gourmet cuisine has boosted demand for snails in both local and international markets.

Market Challenges

- Disease and Pest Control: Snail farming faces significant challenges from disease outbreaks and pest infestations, which can drastically reduce yields. According to the FAO, in 2024, up to 15% of snail farms in Southeast Asia reported losses due to invasive pests and diseases that spread in poorly managed farms. Without adequate pest control and disease management strategies, snail farmers face financial risks that can affect the overall production and export of snail products globally.

- Lack of Skilled Farmers and InfrastructureL A lack of skilled farmers and underdeveloped infrastructure for snail farming is a critical challenge. In 2024, data from the African Development Bank (AfDB) indicates that more than 60% of prospective snail farmers in Sub-Saharan Africa lack formal training in modern farming techniques, impacting farm productivity and profitability. Additionally, many regions do not have access to the specialized equipment required for efficient snail farming, leading to higher production costs and limiting expansion potential.

Global Snail Market Future Outlook

The global snail market is expected to grow significantly over the next five years, driven by rising consumer awareness about the health benefits of snail-based products and the growing demand for sustainable protein sources. Technological advancements in snail farming, particularly greenhouse techniques, are expected to enhance productivity and product quality, while the increasing popularity of snail-based cosmetics will further fuel market expansion. Additionally, government incentives in countries like Nigeria and the growing trend of sustainable farming are set to support market growth.

Opportunities

- Expansion into Emerging Markets: Emerging markets such as Southeast Asia and Africa present significant opportunities for snail farming expansion. According to data from the International Fund for Agricultural Development (IFAD), in 2024, snail farming was identified as one of the top sustainable agricultural sectors with growth potential in Sub-Saharan Africa, driven by increasing demand for protein-rich foods. Furthermore, governments are encouraging investments in this sector through favourable agricultural policies and subsidies aimed at boosting local production and exports

- Organic Farming Practices and Certifications: Organic farming has become a significant trend in the agricultural sector, and snails are no exception. In 2024, the European Union (EU) reported that organic snail farming grew by 12% over the past three years, driven by consumer demand for environmentally sustainable and chemical-free products. Organic certification of snail farms not only allows producers to command higher prices but also opens up export opportunities to markets with stringent organic standards, such as the EU and North America.

Scope of the Report

|

Segment |

Sub-Segments |

|

Snail Type |

Helix Aspersa, Achatina Fulica, Helix Pomatia, Other Local Species |

|

Product Type |

Snail Meat, Snail Mucus, Processed Products, Snail Shell Products |

|

Farming Method |

Indoor Snail Farming, Outdoor Snail Farming, Greenhouse Snail Farming |

|

Application |

Food Industry, Cosmetics Industry, Pharmaceutical Industry |

|

Region |

Europe, Asia Pacific, North America, Africa, Latin America |

Products

Key Target Audience

Snail Farmers and Producers

Snail-based Cosmetic Manufacturers

Government and Regulatory Bodies (Food and Drug Administration, European Food Safety Authority)

Investors and Venture Capitalist Firms

Snail Product Distributors

Exporters and Importers of Snail Products

Pharmaceutical Companies

Food Industry Manufacturers

Companies

Players mentioned in the report

Helix Biotech

Snails House

Peconic Escargot

Caracol del Sur

Achatina Snails

Odysse Snail

Escargot Worldwide

Gros Gris Snail Farms

Cocoon Snail Farms

EcoSnails

Agri Snails

Ait Kaki Escargot

Snail Ireland

Gastropod Gourmet

Organic Snails Inc.

Table of Contents

1. Global Snail Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Snail Farming Practices (Market-specific parameter: farming techniques, snail breeds, regional practices)

1.4. Market Segmentation Overview

2. Global Snail Market Size (In USD Mn)

2.1. Historical Market Size (In Volume and Value)

2.2. Year-on-Year Growth Analysis (Market-specific parameter: Volume increase per region)

2.3. Key Market Developments and Milestones (Market-specific parameter: global and regional milestones)

3. Global Snail Market Analysis

3.1. Growth Drivers (Market-specific parameters: consumer awareness of health benefits, expansion of snail farming technology)

3.1.1. Demand for Sustainable Protein Sources

3.1.2. Nutritional Benefits of Snails

3.1.3. Expansion of Gourmet Food Industry

3.2. Market Challenges (Market-specific parameters: disease outbreaks, environmental impact, production costs)

3.2.1. Disease and Pest Control

3.2.2. Lack of Skilled Farmers and Infrastructure

3.2.3. Market Entry Barriers

3.3. Opportunities (Market-specific parameters: government incentives, export opportunities)

3.3.1. Expansion into Emerging Markets

3.3.2. Organic Farming Practices and Certifications

3.3.3. Collaboration Between Governments and Farmers

3.4. Trends (Market-specific parameters: innovation in snail farming technologies, new product launches)

3.4.1. Adoption of Advanced Snail Breeding Techniques

3.4.2. Increased Demand for Snail-Based Cosmetics

3.4.3. Rise of Snail Farming in Non-Traditional Regions

3.5. Government Regulations (Market-specific parameters: regional farming laws, export regulations)

3.5.1. Import/Export Restrictions on Snail Products

3.5.2. Food Safety Standards for Snail Consumption

3.5.3. Environmental Regulations Affecting Snail Farming

3.6. SWOT Analysis

3.7. Value Chain Analysis (Market-specific parameter: farm-to-table supply chain)

3.8. Porters Five Forces (Market-specific parameters: bargaining power of buyers, supplier dynamics)

3.9. Competition Ecosystem (Market-specific parameter: regional and global competitors)

4. Global Snail Market Segmentation

4.1. By Snail Type (In Value %)

4.1.1. Helix Aspersa

4.1.2. Achatina Fulica

4.1.3. Helix Pomatia

4.1.4. Other Local Species

4.2. By Product Type (In Value %)

4.2.1. Snail Meat

4.2.2. Snail Mucus (for cosmetics and pharmaceuticals)

4.2.3. Processed Products (canned, dried, frozen)

4.2.4. Snail Shell Products

4.3. By Farming Method (In Value %)

4.3.1. Indoor Snail Farming

4.3.2. Outdoor Snail Farming

4.3.3. Greenhouse Snail Farming

4.4. By Application (In Value %)

4.4.1. Food Industry

4.4.2. Cosmetics Industry

4.4.3. Pharmaceutical Industry

4.5. By Region (In Value %)

4.5.1. Europe

4.5.2. Asia Pacific

4.5.3. North America

4.5.4. Africa

4.5.5. Latin America

5. Global Snail Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. Helix Biotech

5.1.2. Snails House

5.1.3. Peconic Escargot

5.1.4. Caracol del Sur

5.1.5. Achatina Snails

5.1.6. Odysse Snail

5.1.7. Escargot Worldwide

5.1.8. Gros Gris Snail Farms

5.1.9. Cocoon Snail Farms

5.1.10. EcoSnails

5.1.11. Agri Snails

5.1.12. Ait Kaki Escargot

5.1.13. Snail Ireland

5.1.14. Gastropod Gourmet

5.1.15. Organic Snails Inc.

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Farming Capacity, Product Portfolio, Revenue, Export Markets, Certifications, Distribution Channels)

5.3. Market Share Analysis (Market-specific parameter: snail product segments)

5.4. Strategic Initiatives (Market-specific parameters: partnerships, research investments)

5.5. Mergers and Acquisitions (Market-specific parameter: global expansions)

5.6. Investment Analysis (Market-specific parameter: funding for snail farms)

5.7. Venture Capital Funding

5.8. Government Grants (Market-specific parameter: farming subsidies)

5.9. Private Equity Investments

6. Global Snail Market Regulatory Framework

6.1. Food Safety Standards for Snail Meat (Market-specific parameter: food grade certifications)

6.2. Compliance Requirements for Snail Cosmetics (Market-specific parameter: cosmetic safety regulations)

6.3. Export and Import Regulations for Snail Products (Market-specific parameters: export tariffs, international agreements)

6.4. Environmental Farming Standards

7. Global Snail Market Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Global Snail Market Future Market Segmentation

8.1. By Snail Type (In Value %)

8.2. By Product Type (In Value %)

8.3. By Farming Method (In Value %)

8.4. By Application (In Value %)

8.5. By Region (In Value %)

9. Global Snail Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the initial phase, we mapped the global snail market ecosystem, identifying all relevant stakeholders including snail farmers, cosmetic companies, and food manufacturers. Secondary research was conducted using proprietary databases, industry reports, and government publications to identify critical market drivers, challenges, and opportunities.

Step 2: Market Analysis and Construction

We compiled historical data for the global snail market, analyzing trends related to snail farming techniques, production volumes, and consumption patterns. This step also involved segment-wise analysis of the snail products market to ensure the accuracy of the market share and growth estimations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses regarding the future growth of the snail market were tested and validated through interviews with industry experts, including snail farm owners and cosmetic manufacturers. These interviews provided valuable insights into emerging trends and technological advancements within the market.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing the collected data to prepare a comprehensive report, which was reviewed by snail industry professionals to ensure that the market analysis was robust and aligned with real-world conditions. This synthesis phase ensured that the report offered actionable insights for market stakeholders.

Frequently Asked Questions

01. How big is the global snail market?

The global snail market is valued at USD 2.6 billion, driven by growing consumer interest in sustainable and healthy food sources as well as expanding demand for snail-based cosmetics and pharmaceutical products.

02. What are the challenges in the global snail market?

Key challenges include the high cost of snail farming infrastructure, lack of skilled labor in certain regions, and vulnerability to diseases that can impact snail populations and productivity.

03. Who are the major players in the global snail market?

Some of the key players include Helix Biotech, Snails House, Peconic Escargot, Caracol del Sur, and Achatina Snails, each of which has a strong market presence due to their production capacity and market reach.

04. What are the growth drivers of the global snail market?

The market is propelled by factors such as increased consumer awareness of the health benefits of snail meat, the rise of snail-based cosmetics, and growing demand for organic and sustainable farming practices.

05. What trends are shaping the global snail market?

Emerging trends include technological advancements in snail farming, the rise of snail-based skincare products, and increasing international trade in snail products, particularly from Africa to Europe.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.