Global Software Defined Data Center (SDDC) Market Outlook to 2030

Region:Global

Author(s):Sanjeev

Product Code:KROD1601

November 2024

83

About the Report

Global Software Defined Data Center (SDDC) Market Overview

- In 2023, the Global Software Defined Data Center (SDDC) Market was valued at USD 58 billion, driven by the increasing need for agile, scalable, and cost-efficient data center solutions. The market's growth is propelled by the rising adoption of virtualization, cloud computing, and automation technologies to enhance IT infrastructure flexibility and operational efficiency.

- Key players in the SDDC market include VMware, Cisco Systems, Hewlett Packard Enterprise (HPE), Dell Technologies, and Microsoft. These companies are leading the industry with advanced SDDC solutions, including software-defined networking (SDN), software-defined storage (SDS), and virtualization platforms. VMware's vSphere and Ciscos ACI are notable examples of innovative solutions that streamline data center management.

- In North America, the United States is a prominent country in the SDDC market, attributed to its advanced IT infrastructure, high adoption rate of cloud technologies, and substantial investment in data center facilities. The country's tech ecosystem supports the rapid deployment and scaling of SDDC solutions.

- In 2023, VMware introduced a new version of its vSphere platform, incorporating enhanced automation and security features to optimize data center operations. This innovation highlights ongoing advancements within the SDDC market.

Global Software Defined Data Center Market Segmentation

The Global Software Defined Data Center Market can be segmented based on component, deployment type, application, and region:

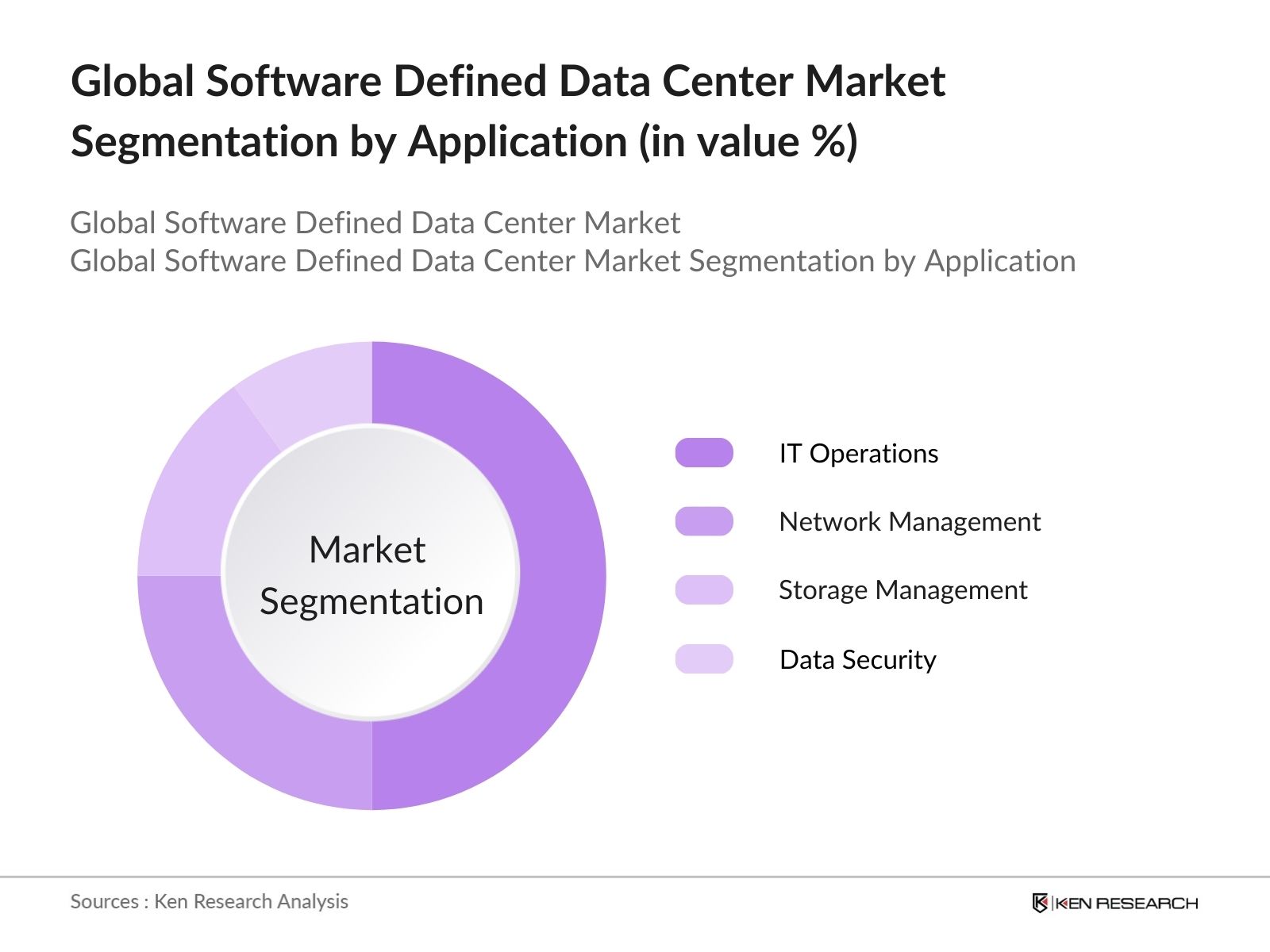

- By Application: The Global Software Defined Data Center market is segmented into IT Operations, Network Management, Storage Management, and Data Security. In 2023, IT Operations led the market as organizations increasingly focus on optimizing their IT infrastructure and operations.

- By Component: The Global Software Defined Data Center market is segmented into Software (SDN, SDS, virtualization platforms) and Services (consulting, integration, and managed services). In 2023, Software dominated the market due to its crucial role in automating and managing data center resources.

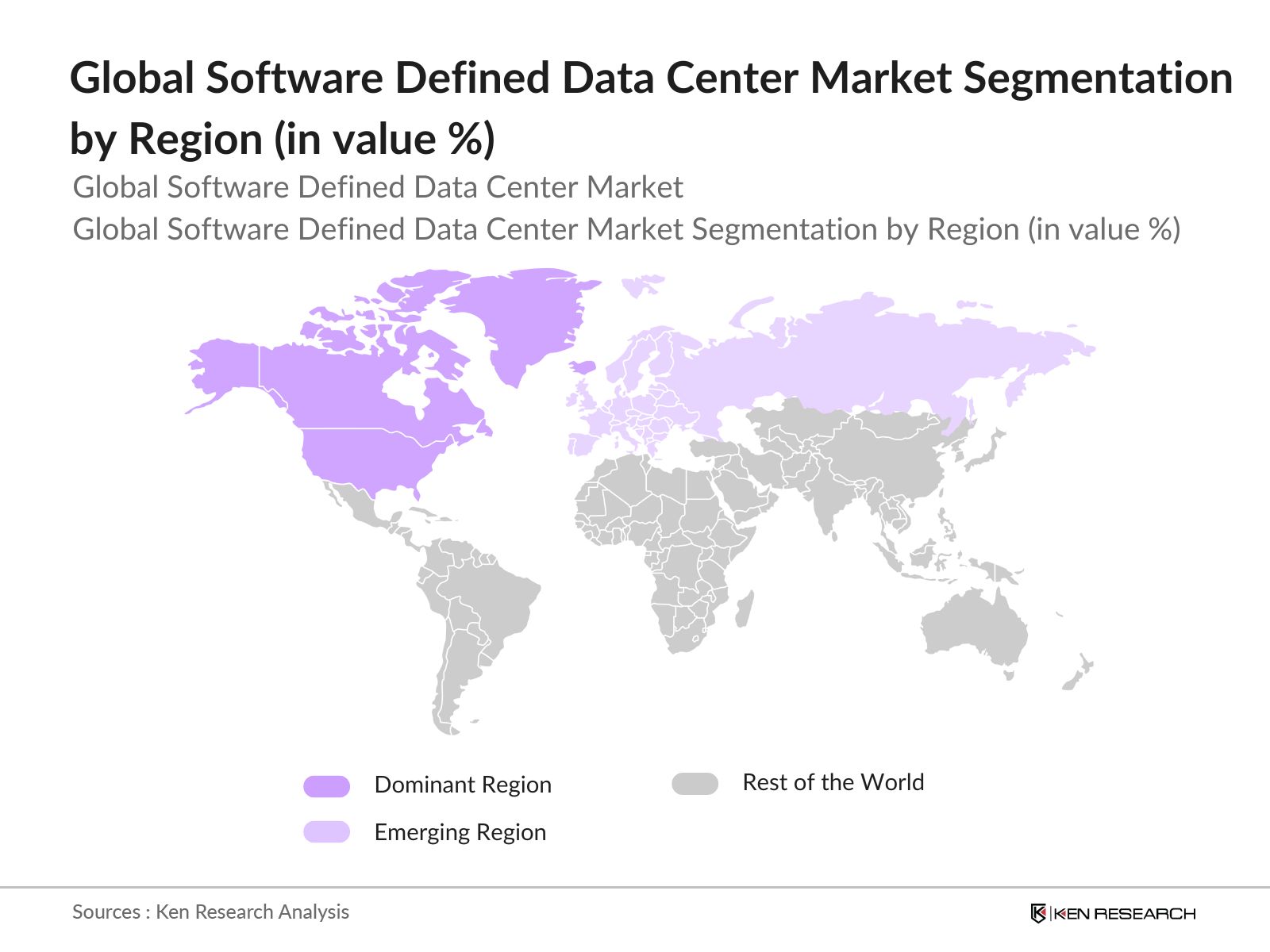

- By Region: The market is segmented into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America led the global market in 2023, holding the largest share due to high technology adoption rates and significant investments in data center infrastructure.

Global Software Defined Data Center Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

VMware |

1998 |

Palo Alto, USA |

|

Cisco Systems |

1984 |

San Jose, USA |

|

Hewlett Packard Enterprise (HPE) |

2015 |

Houston, USA |

|

Dell Technologies |

1984 |

Round Rock, USA |

|

Microsoft |

1975 |

Redmond, USA |

- VMware: VMware is a leading player in the software-defined data center (SDDC) market, offering a comprehensive suite of solutions that includes virtualization software, cloud management, and automation tools. VMwares vSphere, NSX, and vSAN products are pivotal in enabling efficient and scalable SDDC environments. The company's ongoing innovation and investment in cloud-native technologies and automation tools continue to strengthen its position in the market.

- Cisco Systems: Cisco Systems is a major competitor in the SDDC space, providing integrated solutions for data center networking, security, and automation. Ciscos ACI (Application Centric Infrastructure) and UCS (Unified Computing System) technologies are crucial for building and managing software-defined data centers. Cisco's strategic focus on network virtualization and security enhances its market presence and competitive edge.

Global Software Defined Data Center Market Analysis

Market Growth Drivers:

- Rising Demand for Cloud Computing: The increasing adoption of cloud computing solutions is driving the need for flexible and scalable data center management. The global cloud services market reached over USD 500 billion in 2023, pushing organizations to implement SDDC solutions for better resource management and cost control.

- Need for Operational Efficiency: Organizations are increasingly seeking solutions that improve operational efficiency and reduce IT infrastructure costs. SDDC provides the ability to automate data center operations and optimize resource utilization, addressing these needs effectively.

- Technological Advancements: Continuous advancements in virtualization, automation, and AI are fueling the growth of the SDDC market. Technologies like SDN and SDS enable more efficient management of network and storage resources, enhancing overall data center performance.

Market Challenges:

- High Maintenance Costs: While initial implementation costs can be high, ongoing maintenance and management of SDDC environments can also be expensive, particularly for organizations with limited IT budgets. The costs associated with regular software updates, hardware repairs, and system monitoring can add up over time. Additionally, the need for specialized personnel to handle these tasks further increases expenses.

- Integration Issues: Integrating SDDC technologies with existing IT infrastructure can be complex and may require significant changes to legacy systems. This complexity can delay deployment and increase costs, as it often involves extensive planning, customization, and testing. The process may also require temporary disruptions to current operations, affecting productivity.

- Performance and Latency Issues: Ensuring optimal performance and low latency in a virtualized environment can be challenging, especially as workloads become more complex and diverse. Virtualization can introduce overhead that affects system performance, and maintaining low latency requires careful tuning of the virtual infrastructure.

Government Initiatives:

- EU Digital Single Market Strategy: The European Union's Digital Single Market (DSM) Strategy aims to create a unified digital market across member states to enhance digital infrastructure and technology adoption, including software-defined data centers (SDDCs). The DSM Strategy includes initiatives to promote digital innovation, improve cloud infrastructure, and support advanced IT solutions within Europe. As part of this strategy, the EU has committed over 9 billion in funding through Horizon Europe for digital transformation and technology development from 2021 to 2027. This investment supports the adoption of SDDC technologies and encourages innovation in digital infrastructure across member states.

- Chinas Digital Economy Development Plan: Chinas Digital Economy Development Plan, released by the State Council, outlines strategic goals to advance digital infrastructure and technology adoption, including software-defined data centers. The plan focuses on boosting digital transformation, improving cloud computing capabilities, and fostering innovation in data center technologies. The Chinese government has allocated approximately CNY 1 trillion (about USD 150 billion) for digital infrastructure development and technology upgrades from 2021 to 2025. This funding supports the deployment of advanced SDDC solutions and enhances the countrys digital infrastructure capabilities.

Global Software Defined Data Center Market Future Outlook

The Global Software Defined Data Center Market is expected to continue its growth trajectory, driven by the increasing demand for cloud solutions, advancements in data center technologies, and the focus on operational efficiency.

Future Market Trends:

- Expansion of Cloud-Based Solutions: By 2028, cloud-based SDDC solutions are expected to dominate the market as organizations increasingly shift to cloud environments for their data center needs. These solutions offer greater scalability and flexibility compared to on-premises deployments.

- Growth in Automation Technologies: The adoption of AI and machine learning for automating data center operations is expected to rise. These technologies will further enhance resource management, predictive maintenance, and operational efficiency.

- Growth in Hybrid Cloud Environments: Hybrid cloud adoption will continue to grow as businesses seek to balance on-premises and cloud resources, driving demand for SDDC solutions that facilitate hybrid infrastructure management.

Scope of the Report

|

By Region |

North America Europe Asia-Pacific Latin America Middle East & Africa |

|

By Component |

Software Services |

|

By Application |

IT Operations Network Management Storage Management Data Security |

|

By Deployment Type |

On-Premises Cloud-based |

|

By End-User |

Large Enterprises Cloud Service Providers Telecommunications Providers Financial Institutions |

Products

Key Target Audience:

Data Center Operators

Cloud Service Providers

IT Infrastructure Providers

Telecommunications Companies

Managed Service Providers (MSPs)

IT Consultants and Solution Integrators

System Integrators and OEMs

Government and Regulatory Bodies (FCC, NIST, ISO, FTC)

Technology Integrators and Consultants

Investor and Financial Institutions

Bank and Financial Institutions

Enterprise IT Departments

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

VMware

Cisco Systems

Hewlett Packard Enterprise (HPE)

Dell Technologies

Microsoft

Nutanix

Red Hat

IBM

Huawei Technologies

Lenovo

Juniper Networks

Oracle

NetApp

Broadcom

Arista Networks

Table of Contents

1. Global Software Defined Data Center (SDDC) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Software Defined Data Center (SDDC) Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Software Defined Data Center (SDDC) Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Cloud Computing

3.1.2. Need for Operational Efficiency

3.1.3. Technological Advancements

3.2. Restraints

3.2.1. High Maintenance Costs

3.2.2. Integration Issues

3.2.3. Performance and Latency Issues

3.3. Opportunities

3.3.1. Adoption of AI and Automation

3.3.2. Expansion in Emerging Markets

3.3.3. Integration with Emerging Technologies

3.4. Trends

3.4.1. Expansion of Cloud-Based Solutions

3.4.2. Growth in Automation Technologies

3.4.3. Growth in Hybrid Cloud Environments

3.5. Government Initiatives

3.5.1. EU Digital Single Market Strategy

3.5.2. Chinas Digital Economy Development Plan

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Global Software Defined Data Center (SDDC) Market Segmentation, 2023

4.1. By Component (in Value %)

4.1.1. Software

4.1.2. Services

4.2. By Deployment Type (in Value %)

4.2.1. On-Premises 4.2.2. Cloud-based

4.3. By Application (in Value %)

4.3.1. IT Operations

4.3.2. Network Management

4.3.3. Storage Management

4.3.4. Data Security

4.4. By Region (in Value %)

4.4.1. North America

4.4.2. Europe

4.4.3. Asia-Pacific

4.4.4. Latin America

4.4.5. Middle East & Africa

5. Global Software Defined Data Center (SDDC) Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. VMware

5.1.2. Cisco Systems

5.1.3. Hewlett Packard Enterprise (HPE)

5.1.4. Dell Technologies

5.1.5. Microsoft

5.1.6. Nutanix

5.1.7. Red Hat

5.1.8. IBM

5.1.9. Huawei Technologies

5.1.10. Lenovo

5.1.11. Juniper Networks

5.1.12. Oracle 5.1.13. NetApp

5.1.14. Broadcom

5.1.15. Arista Networks

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Software Defined Data Center (SDDC) Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Software Defined Data Center (SDDC) Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Software Defined Data Center (SDDC) Market Future Outlook

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Software Defined Data Center (SDDC) Market Future Segmentation, 2028

9.1. By Component (in Value %)

9.2. By Deployment Type (in Value %)

9.3. By Application (in Value %)

9.4. By Region (in Value %)

10. Global Software Defined Data Center (SDDC) Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identifying Key Variables

Establishing an ecosystem of major players in the Global Software Defined Data Center Market. This involves reviewing secondary and proprietary databases to gather industry-level data on market drivers, challenges, and key players, as well as understanding technological advancements and regulatory impacts.

Step 2: Market Building

Collecting statistics on the global SDDC market, including historical market size, growth rates, and adoption trends. This step involves analyzing market share, revenue contributions from major players, and identifying emerging trends to ensure the accuracy and reliability of the data presented.

Step 3: Validating and Finalizing

Formulating market hypotheses and conducting Computer-Assisted Telephone Interviews (CATIs) with industry experts from leading SDDC technology companies. These interviews help validate collected statistics and provide insights into operational and financial aspects directly from company representatives.

Step 4: Research Output

Our team will engage with multiple dairy technology providers to understand the dynamics of market segments, consumer preferences, and sales trends. This process will validate the derived statistics using a bottom-to-top approach, ensuring that the final data accurately reflects the actual market conditions.

Frequently Asked Questions

01. How big is the Global Software Defined Data Center Market?

In 2023, the Global Software Defined Data Center Market was valued at USD 58 billion. The market is expanding due to the increasing demand for agile and cost-efficient data center solutions, alongside advancements in virtualization and cloud technologies.

02. What are the challenges in the Global Software Defined Data Center Market?

Challenges in the Global Software Defined Data Center Market include high initial investment costs and the complexities of integrating SDDC technologies with existing IT infrastructure. Additionally, managing and securing data in a dynamic SDDC environment can present difficulties.

03. Who are the major players in the Global Software Defined Data Center Market?

Major players in the Global Software Defined Data Center Market include VMware, Cisco Systems, Hewlett Packard Enterprise (HPE), Dell Technologies, and Microsoft. These companies lead the industry with their innovative SDDC solutions and technologies.

04. What are the growth drivers of the Global Software Defined Data Center Market?

Key growth drivers in the Global Software Defined Data Center Market are the rising demand for cloud computing, the need for improved operational efficiency, and technological advancements in virtualization and automation. These factors collectively contribute to the market's expansion and development.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.