Global Software-Defined Networking Market Outlook to 2030

Region:Global

Author(s):Shivani

Product Code:KROD408

October 2024

98

About the Report

Global Software-Defined Networking Market Overview

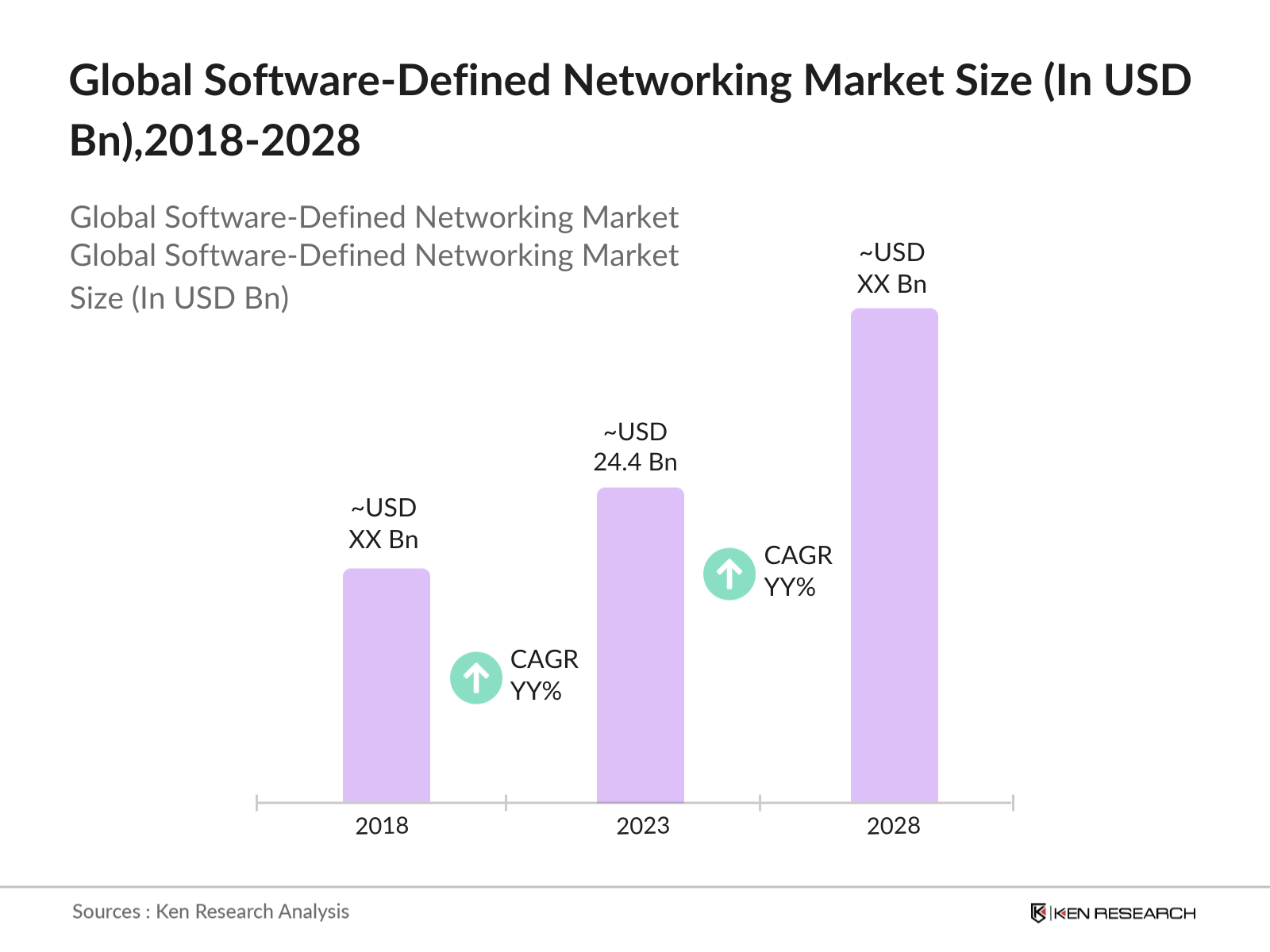

- The global Software-Defined Networking (SDN) market was valued at USD 24.4 billion in 2023, driven by the increasing adoption of cloud computing and the demand for efficient network management. The growth is largely fueled by the need for enhanced network flexibility and reduced operational costs. With the continuous expansion of digital transformation initiatives, the SDN market is set to witness significant growth in the coming years, underpinned by the rising deployment of 5G networks and IoT technologies.

- Key players such as Cisco Systems, VMware, Juniper Networks, Huawei Technologies, and Arista Networks. These companies have established a strong market presence due to their advanced product offerings and strategic partnerships. For instance, Cisco Systems, with its robust portfolio of SDN solutions, continues to lead the market, providing cutting-edge technologies that cater to the evolving needs of enterprises and service providers worldwide.

- In 2023, VMware announced the expansion of its SDN solution, VMware NSX, integrating it with multi-cloud environments. This development is significant as it enhances the network agility and security of enterprises operating across diverse cloud platforms. The integration supports seamless operations in hybrid cloud environments, allowing businesses to maintain consistent network policies across different infrastructures. This move by VMware highlights the growing trend of multi-cloud adoption and its impact on the SDN market.

- Cities such as San Francisco, London, and Singapore are key hubs for the SDN market, primarily due to their advanced IT infrastructure and concentration of tech enterprises. In 2023, San Francisco emerged as a dominant city in the SDN market, driven by the presence of leading technology companies and innovative startups focusing on network solutions. The city's robust ecosystem and access to venture capital make it a fertile ground for the growth of SDN technologies.

Global Software-Defined Networking Market Segmentation

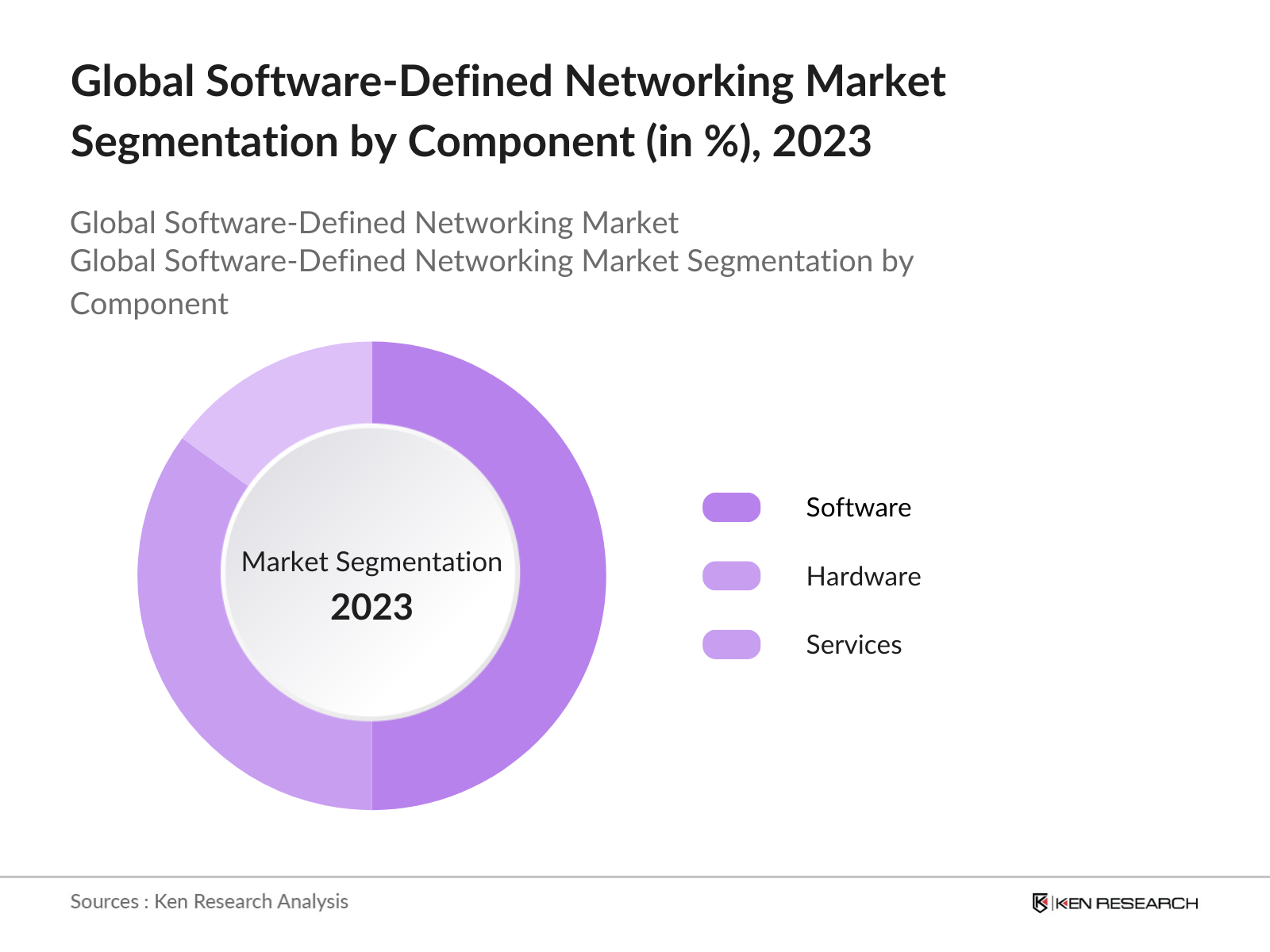

By Component: The global SDN market is segmented by component into hardware, software, and services. In 2023, the software segment held the dominant market share, driven by the increasing demand for SDN controllers and network management software. The software segment's growth is attributed to its critical role in enabling centralized network management and automation, which are key requirements for modern network infrastructures. Companies are increasingly investing in software solutions to enhance network programmability and reduce operational complexities.

|

Component |

Market Share (2023) |

|

Hardware |

35% |

|

Software |

50% |

|

Services |

15% |

By Region: The SDN market is segmented by region into North America, Europe, Asia-Pacific (APAC), Latin America, and the Middle East & Africa (MEA). In 2023, North America held the largest market share, primarily due to the high adoption of SDN technologies in the United States and Canada. The region's dominance is supported by the presence of leading SDN vendors, advanced IT infrastructure, and strong government support for network innovation. The U.S. continues to lead the market, driven by its early adoption of SDN in both the enterprise and telecom sectors.

|

Region |

Market Share (2023) |

|

North America |

40% |

|

Europe |

30% |

|

Asia-Pacific |

20% |

|

Latin America |

5% |

|

MEA |

5% |

By End-User: The SDN market is segmented by end-user into enterprises, telecom service providers, and cloud service providers. In 2023, the enterprise segment dominated the market, accounting for the largest share. Enterprises are adopting SDN to improve their network agility, reduce costs, and enhance security. The demand for SDN among enterprises is particularly strong in sectors such as finance, healthcare, and retail, where secure and efficient network management is critical to business operations.

|

End-User |

Market Share (2023) |

|

Enterprises |

55% |

|

Telecom Service Providers |

30% |

|

Cloud Service Providers |

15% |

Global Software-Defined Networking Market Competitive Landscape

|

Company |

Established |

Headquarters |

|

Cisco Systems |

1984 |

San Jose, USA |

|

VMware |

1998 |

Palo Alto, USA |

|

Juniper Networks |

1996 |

Sunnyvale, USA |

|

Huawei Technologies |

1987 |

Shenzhen, China |

|

Arista Networks |

2004 |

Santa Clara, USA |

- Cisco Systems: In 2023, Cisco has increasingly focused on intent-based networking, which simplifies network management by allowing administrators to define desired outcomes rather than configuring individual devices. This approach aims to enhance automation, reduce human errors, and improve network agility.

- Juniper Networks: In 2023, Juniper Networks introduced its Apstra intent-based networking platform, which integrates SDN capabilities to automate network operations. Apstra 4.2.0 brought enhancements for operators and developers, including integrations with Terraform and Kubernetes. These integrations ensure private data center infrastructure and operations seamlessly fit into an organization's cloud strategy.

Global Software-Defined Networking Market Analysis

Global Software-Defined Networking Market Growth Drivers

- Increased Adoption of 5G Networks: The SDN market is experiencing significant growth due to the rapid adoption of 5G networks. According to the International Telecommunication Union (ITU), global 5G subscriptions are expected to reach 1.9 billion by 2024, up from 1.6 billion in 2023. SDN is crucial in managing the complex infrastructure of 5G, enhancing network flexibility, reducing latency, and optimizing bandwidth, especially for high-speed data transfer and low-latency applications in smart cities and industrial IoT.

- Growing Demand for Network Automation: Network automation is increasingly crucial for enterprises looking to cut costs and boost efficiency. A 2023 report by the European Union Agency for Cybersecurity (ENISA) highlights the rapid adoption of SDN solutions in Europe for automating network management. SDN allows centralized control of resources, enabling automation of tasks like configuration management and fault detection, which is essential for handling the growing complexity of networks, particularly in cloud and multi-cloud environments.

- Rise in Cybersecurity Concerns: As cyber threats grow more sophisticated, the need for secure network architectures is driving SDN adoption. According to the World Economic Forum (WEF), global cybercrime costs are expected to reach $10.5 trillion by 2024, up from $8.5 trillion in 2023. SDN offers enhanced security features like network segmentation and real-time threat detection, making it crucial for protecting sensitive data and dynamically adjusting security policies across networks.

Global Software-Defined Networking Market Challenges

- Interoperability Issues: Despite the benefits of SDN, interoperability between different vendors' solutions remains a significant challenge. These issues stem from the lack of standardization in SDN protocols and interfaces, leading to potential vendor lock-in and increased operational complexity. Addressing this challenge requires greater collaboration among industry stakeholders to develop open standards that ensure seamless integration of SDN solutions.

- High Initial Costs of Deployment: The initial costs of deploying SDN infrastructure can be prohibitively high, especially for small and medium-sized enterprises (SMEs). These costs include investments in new hardware, software, and training for IT staff. While SDN offers long-term cost savings through automation and efficiency gains, the upfront investment remains a significant hurdle for many organizations with limited budgets.

Global Software-Defined Networking Market Government Initiatives

- European Union's Digital Strategy 2024: The European Union's Digital Strategy 2024 includes significant investments over $195.56 million as part of its broader efforts to create a unified digital market. This strategy aims to enhance cross-border data flows, improve network efficiency, and support the rollout of 5G networks. The initiative is expected to drive SDN adoption in industries such as transportation, manufacturing, and public services, contributing to the EU's goal of becoming a global leader in digital innovation.

- China's National 5G Network Plan: As part of its national 5G network plan, the Chinese government is integrating SDN into its telecom infrastructure by 2025. SDN is key to building a scalable 5G network supporting smart cities, autonomous vehicles, and industrial IoT, underscoring China's focus on advanced networking technologies to maintain its global telecom leadership.

Global Software-Defined Networking Market Outlook

The global Software-Defined Networking (SDN) market is poised for significant evolution as it approaches 2028, driven by several key growth drivers that are reshaping the landscape of networking technology. The convergence of SDN with emerging technologies such as 6G, autonomous networks, and quantum networking is expected to transform how networks are managed and optimized, offering unprecedented capabilities in speed, security, and automation.

Future Trends:

- SDN's Role in Enabling 6G Networks: By 2028, SDN will be crucial in the deployment of 6G networks, offering unprecedented speeds and connectivity. SDN will manage the ultra-dense and complex network infrastructures required for 6G, enabling dynamic network slicing, real-time traffic management, and enhanced security. This makes SDN a key enabler for next-generation applications such as immersive extended reality (XR) and holographic communications.

- Expansion of SDN in Autonomous Networks: The future of SDN is closely linked to the rise of autonomous networks, which are expected to become more widespread by 2028. Autonomous networks, leveraging AI and machine learning, will depend on SDN for the flexibility and control needed for self-configuring, self-healing, and self-optimizing operations. This expansion of SDN will lead to significant improvements in network efficiency and reduced operational costs.

Scope of the Report

|

By Component |

Hardware Software Services |

|

By End-User |

Enterprises Telecom Service Providers Cloud Service Providers |

|

By Region |

North America Europe, Asia-Pacific (APAC) Latin America Middle East & Africa (MEA) |

|

By Deployment Type |

On-Premise Cloud-Based Hybrid |

Products

Key Target Audiences

Telecom Service Providers

Cloud Service Providers

Network Equipment Manufacturers

Government and Regulatory Bodies (FCC)

Technology Solution Providers

IT Infrastructure Management Companies

Investments and Venture Capitalist Firms

Data Center Operators

Managed Service Providers (MSPs)

Companies

Players Mentioned in the Report:

Cisco Systems

VMware

Juniper Networks

Huawei Technologies

Arista Networks

Nokia Corporation

NEC Corporation

HPE (Hewlett Packard Enterprise)

Ericsson

Ciena Corporation

Dell Technologies

Extreme Networks

Brocade Communications Systems

Big Switch Networks

Fortinet

Table of Contents

1. Global Software-Defined Networking (SDN) Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Global Software-Defined Networking (SDN) Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Global Software-Defined Networking (SDN) Market Analysis

3.1. Growth Drivers

3.1.1. Increased Adoption of 5G Networks

3.1.2. Growing Demand for Network Automation

3.1.3. Rise in Cybersecurity Concerns

3.2. Challenges

3.2.1. Interoperability Issues

3.2.2. High Initial Costs of Deployment

3.2.3. Complexity of Transitioning from Legacy Systems

3.3. Opportunities

3.3.1. Expansion into Multi-Cloud Environments

3.3.2. Integration with AI and Machine Learning

3.4. Trends

3.4.1. Integration of AI with SDN

3.4.2. Expansion of Multi-Cloud SDN Solutions

3.4.3. Growth of Edge Computing and SDN

3.5. Government Initiatives

3.5.1. U.S. Federal Support for SDN in Critical Infrastructure

3.5.2. European Union's Digital Strategy 2024

3.5.3. China's National 5G Network Plan

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. Global Software-Defined Networking (SDN) Market Segmentation, 2023

4.1. By Component (in Value %)

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. By End-User (in Value %)

4.2.1. Enterprises

4.2.2. Telecom Service Providers

4.2.3. Cloud Service Providers

4.3. By Region (in Value %)

4.3.1. North America

4.3.2. Europe

4.3.3. Asia-Pacific (APAC)

4.3.4. Latin America

4.3.5. Middle East & Africa (MEA)

4.4. By Deployment Type (in Value %)

4.4.1. On-Premise

4.4.2. Cloud-Based

4.4.3. Hybrid

4.5. By Application (in Value %)

4.5.1. Data Center Services

4.5.2. Enterprise Network Services

4.5.3. Service Provider Network Services

4.6. By Solution Type (in Value %)

4.6.1. SDN Infrastructure

4.6.2. SDN Controllers

4.6.3. SDN Security Technologies

5. Global Software-Defined Networking (SDN) Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. Cisco Systems

5.1.2. VMware

5.1.3. Juniper Networks

5.1.4. Huawei Technologies

5.1.5. Arista Networks

5.1.6. Nokia Corporation

5.1.7. NEC Corporation

5.1.8. Hewlett Packard Enterprise (HPE)

5.1.9. Dell Technologies

5.1.10. Ericsson

5.1.11. Extreme Networks

5.1.12. Brocade Communications Systems

5.1.13. Fortinet

5.1.14. Ciena Corporation

5.1.15. Big Switch Networks

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Global Software-Defined Networking (SDN) Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Global Software-Defined Networking (SDN) Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Global Software-Defined Networking (SDN) Market Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Global Software-Defined Networking (SDN) Market Future Market Segmentation, 2028

9.1. By Component (in Value %)

9.2. By End-User (in Value %)

9.3. By Region (in Value %)

9.4. By Deployment Type (in Value %)

9.5. By Application (in Value %)

9.6. By Solution Type (in Value %)

10. Global Software-Defined Networking (SDN) Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on the Global Software-Defined Networking (SDN) Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for The Global Software-Defined Networking (SDN) Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple Software-Defined Networking (SDN) and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Software-Defined Networking (SDN).

Frequently Asked Questions

01. How big is the Global Software-Defined Networking (SDN) Market?

The Global Software-Defined Networking (SDN) market was valued at USD 24.4 billion in 2023, driven by the growing adoption of cloud computing, the need for network automation, and the deployment of 5G networks worldwide.

02. What are the challenges in the Global Software-Defined Networking (SDN) Market?

Challenges in the Global Software-Defined Networking (SDN) market include interoperability issues between different vendors solutions, the high initial costs of deployment, and the complexity of transitioning from legacy systems to SDN infrastructures.

03. Who are the major players in the Global Software-Defined Networking (SDN) Market?

Key players in the Global Software-Defined Networking (SDN) market include Cisco Systems, VMware, Juniper Networks, Huawei Technologies, and Arista Networks. These companies lead the market due to their advanced SDN solutions, extensive R&D, and strong global presence.

04. What are the growth drivers of the Global Software-Defined Networking (SDN) Market?

The Global Software-Defined Networking (SDN) market is propelled by the increased adoption of 5G networks, the growing demand for network automation, and the rising concerns over cybersecurity, which drive enterprises to adopt more secure and flexible network architectures.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.