Global SDR (Software-Defined Radio) Market Outlook to 2030

Region:Global

Author(s):Naman Rohilla

Product Code:KROD7571

December 2024

85

About the Report

Global Software-Defined Radio (SDR) Market Overview

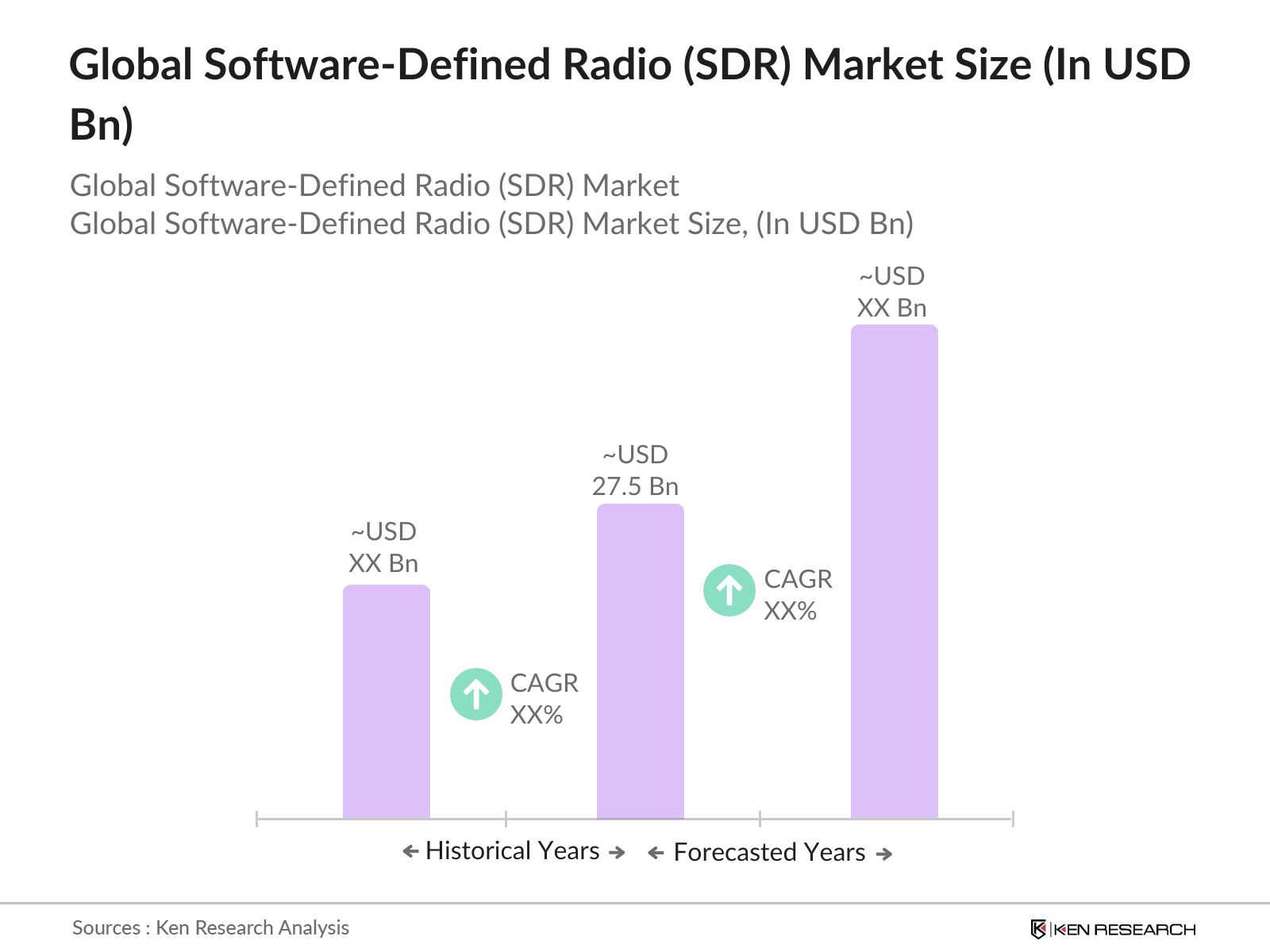

- The global SDR (Software-Defined Radio) market is valued at USD 27.5 billion, based on a five-year historical analysis. This market is primarily driven by increasing demand for flexible, adaptive, and efficient communication systems across the defense and telecommunications sectors. SDR technology enables rapid upgrades and enhancements without requiring hardware modifications, leading to substantial cost savings. The rise in IoT, 5G technologies, and government investments in modernizing military communications further supports this market's growth.

- Countries such as the United States, China, and Germany dominate the global SDR market. The United States leads the market due to its investments in defense modernization and technological advancements in telecommunications. China follows closely, driven by its rapid deployment of 5G infrastructure and initiatives to develop indigenous defense capabilities. Germany stands out in the European market, owing to its robust manufacturing sector and advancements in communication technologies for aerospace and defense industries.

- Spectrum allocation is a critical aspect of SDR deployment, and governments worldwide have been actively revising their spectrum policies. In 2024, the U.S. Federal Communications Commission (FCC) allocated an additional 1.2 GHz of spectrum for unlicensed use, which is expected to benefit SDR applications in both consumer and industrial markets. Similarly, the European Telecommunications Standards Institute (ETSI) is working on harmonizing spectrum regulations across EU countries to promote SDR adoption.

Global Software-Defined Radio (SDR) Market Segmentation

- By Component: The SDR market is segmented by components into hardware, software, and services. Recently, software components have held a dominant market share due to their ability to offer flexibility in adapting to evolving communication protocols and standards. Software-defined functionalities allow seamless integration and easy upgrades in various applications, from defense communication systems to commercial telecommunications. Key industry players are investing heavily in software R&D to create versatile and scalable SDR systems that support multiple waveforms and frequency bands.

- By Application: The SDR market is segmented by application into military and defense, telecommunications, aerospace and aviation, and public safety. Military and defense applications dominate this segmentation due to the critical role of secure, adaptive, and resilient communication systems in modern warfare. The ability of SDR systems to change frequency bands and modulate signal transmission on the fly makes them indispensable in military operations, especially for tactical communication in the field.

- By Region: The SDR market is segmented by region into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share due to its strong defense industry and leading technological advancements in telecommunications and public safety communication networks. The United States is a key player in both defense communication systems and the adoption of SDR in commercial sectors, further reinforcing North Americas dominance in the global SDR market.

Global Software-Defined Radio (SDR) Market Competitive Landscape

The global SDR market is dominated by a mix of large multinational corporations and niche defense communication system providers. The leading companies in this sector are focusing on innovative product development, strategic partnerships, and government contracts to maintain their market position.

|

Company |

Establishment Year |

Headquarters |

Revenue |

Employees |

R&D Spending |

Product Portfolio |

Defense Contracts |

Commercial Contracts |

|

BAE Systems |

1999 |

Farnborough, UK |

- |

- |

- |

- |

- |

- |

|

Northrop Grumman Corporation |

1939 |

Falls Church, VA, USA |

- |

- |

- |

- |

- |

- |

|

Elbit Systems Ltd. |

1966 |

Haifa, Israel |

- |

- |

- |

- |

- |

- |

|

Thales Group |

2000 |

Paris, France |

- |

- |

- |

- |

- |

- |

|

Raytheon Technologies |

2020 |

Waltham, MA, USA |

- |

- |

- |

- |

- |

- |

Global Software-Defined Radio (SDR) Market Analysis

Global Software-Defined Radio (SDR) Market Growth Drivers

- Military and Defense Communication Needs: The demand for software-defined radios (SDR) in military and defense sectors has surged due to increasing modernization efforts across several nations. In 2024, global military expenditure reached $2.24 trillion, according to the Stockholm International Peace Research Institute (SIPRI). With nations like the United States, China, and India focusing on modernizing their communication systems, SDR technology is crucial for enabling secure, adaptable, and real-time communication in challenging environments. For example, the U.S. Department of Defense has heavily invested in SDR systems as part of its Joint Tactical Radio System program, driving growth in the market.

- Increasing Demand for Wireless Connectivity: The rising demand for wireless connectivity in both consumer and industrial sectors has fueled the adoption of SDRs. In 2024, the International Telecommunication Union (ITU) reported that the global number of mobile subscribers surpassed 8.6 billion. As wireless networks continue to expand, SDR technology has become essential due to its ability to adapt to various frequency bands and protocols. This flexibility is critical for enabling high-speed, reliable wireless communication, especially in sectors such as telecommunications and smart cities.

- Integration of IoT and 5G Technologies: The integration of SDR with Internet of Things (IoT) and 5G technologies is a growth driver in the market. According to the GSM Association, there were over 3.6 billion IoT connections globally in 2023, a number projected to grow as 5G networks expand. SDR technology enables devices to switch between various communication protocols, which is critical for IoT ecosystems where devices need to communicate across different network types. The U.S. Federal Communications Commission (FCC) has emphasized the role of SDR in enabling flexible, high-capacity 5G networks that can accommodate IoT growth.

Global Software-Defined Radio (SDR) Market Challenges

- High Cost of Implementation: The implementation of SDR technology involves substantial initial costs due to the need for advanced hardware and software. In 2024, the average cost of SDR systems for military-grade applications ranged between $5,000 and $25,000 per unit, depending on functionality and customization. While these systems offer long-term benefits such as flexibility and scalability, the high upfront costs can be a deterrent for smaller organizations and emerging economies, which may lack the necessary financial resources.

- Complexity in System Integration: One of the major challenges for SDR adoption is the complexity involved in integrating these systems into existing communication infrastructures. As SDRs are highly flexible, they require advanced expertise in software development and radio frequency engineering. The U.S. Federal Aviation Administration (FAA) reported that the integration of SDR into its air traffic management system required over 18 months of rigorous testing and modification, underlining the challenges faced by large-scale implementations.

Global Software-Defined Radio (SDR) Market Future Outlook

Over the next five years, the global SDR market is expected to witness growth driven by increased adoption across defense and commercial sectors. The integration of advanced technologies like AI, IoT, and 5G will propel the demand for adaptive communication systems, while governments continue to modernize their military communications infrastructure. The expanding use of SDR in public safety, emergency response, and commercial telecommunications will also open new avenues for market growth.

Global Software-Defined Radio (SDR) Market Opportunities

- Expansion in Commercial and Civil Applications: SDR technology is increasingly finding applications in commercial sectors such as aviation, maritime, and public safety. For instance, the European Unions Single European Sky initiative aims to modernize air traffic management by integrating SDR systems into its communication network. In 2024, the EU allocated 3.5 billion to this initiative, highlighting the growing demand for SDR in civil applications. These systems offer advantages in terms of flexibility and adaptability to various frequency bands, driving opportunities for SDR in non-military markets.

- Development of Cognitive Radio Technologies: Cognitive radio, an advanced form of SDR that can autonomously adapt to its communication environment, is poised to create new growth opportunities in the SDR market. In 2024, the U.S. National Institute of Standards and Technology (NIST) announced funding of $25 million for research into cognitive radio systems. This development is expected to improve spectrum efficiency, particularly in congested urban areas where wireless networks are often overloaded. Cognitive radio is seen as a key enabler for the next generation of communication networks, providing substantial growth opportunities for SDR manufacturers.

Scope of the Report

|

By Component |

Hardware Software Services |

|

By Frequency Band |

HF VHF UHF |

|

By Application |

Military and Defense Telecommunication Aerospace Public Safety |

|

By End User |

Government Commercial Enterprises Research Institutes Emergency Services |

|

By Region |

North America Europe Asia Pacific Latin America Middle East & Africa |

Products

Key Target Audience

Defense and Security Agencies (e.g., U.S. Department of Defense, NATO Communications and Information Agency)

Telecommunication Companies

Aerospace and Aviation Industry

Public Safety and Emergency Response Organizations

Research and Development Institutes

Investor and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (e.g., Federal Communications Commission, International Telecommunication Union)

System Integrators and Technology Providers

Companies

Players Mentioned in the Report

BAE Systems

Northrop Grumman Corporation

Elbit Systems Ltd.

Thales Group

Raytheon Technologies

Harris Corporation

Analog Devices, Inc.

General Dynamics Corporation

Leonardo S.p.A.

FlexRadio Systems

Table of Contents

1. Global SDR Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Evolution

1.4 Market Segmentation Overview

2. Global SDR Market Size (in USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Milestones and Developments

3. Global SDR Market Analysis

3.1 Growth Drivers

3.1.1 Military and Defense Communication Needs

3.1.2 Increasing Demand for Wireless Connectivity

3.1.3 Rising Adoption in Telecommunications Infrastructure

3.1.4 Integration of IoT and 5G Technologies

3.2 Market Challenges

3.2.1 High Cost of Implementation

3.2.2 Complexity in System Integration

3.2.3 Limited Awareness in Emerging Economies

3.3 Opportunities

3.3.1 Expansion in Commercial and Civil Applications

3.3.2 Development of Cognitive Radio Technologies

3.3.3 Rising Demand in Emergency Communication Systems

3.4 Market Trends

3.4.1 Cloud-Based SDR Solutions

3.4.2 AI Integration in SDR Systems

3.4.3 Deployment of SDR in Edge Computing

3.5 Regulatory Landscape

3.5.1 Spectrum Allocation Guidelines

3.5.2 Standards and Compliance (e.g., ETSI, FCC)

3.5.3 Government Policies on Defense Contracts

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competition Ecosystem

4. Global SDR Market Segmentation

4.1 By Component (in Value %)

4.1.1 Hardware (Transceivers, Antennas, RF Components)

4.1.2 Software (Firmware, Modulation, Demodulation)

4.1.3 Services (Installation, Maintenance, Upgrades)

4.2 By Frequency Band (in Value %)

4.2.1 HF (High Frequency)

4.2.2 VHF (Very High Frequency)

4.2.3 UHF (Ultra-High Frequency)

4.3 By Application (in Value %)

4.3.1 Military and Defense

4.3.2 Telecommunication

4.3.3 Aerospace and Aviation

4.3.4 Public Safety

4.4 By End User (in Value %)

4.4.1 Government and Defense Agencies

4.4.2 Commercial Enterprises

4.4.3 Research Institutes

4.4.4 Emergency Services

4.5 By Region (in Value %)

4.5.1 North America

4.5.2 Europe

4.5.3 Asia Pacific

4.5.4 Latin America

4.5.5 Middle East & Africa

5. Global SDR Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 BAE Systems

5.1.2 Northrop Grumman Corporation

5.1.3 Elbit Systems Ltd.

5.1.4 Thales Group

5.1.5 Raytheon Technologies

5.1.6 Harris Corporation

5.1.7 Analog Devices, Inc.

5.1.8 General Dynamics Corporation

5.1.9 Leonardo S.p.A.

5.1.10 FlexRadio Systems

5.1.11 National Instruments Corporation

5.1.12 Rohde & Schwarz GmbH & Co KG

5.1.13 Cobham Plc

5.1.14 Collins Aerospace

5.1.15 L3Harris Technologies

5.2 Cross Comparison Parameters (Headquarters, Global Revenue, Employees, Product Portfolio, Market Presence, Technology Collaborations, Recent Contracts, Defense vs. Commercial Revenue Split)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 R&D Investments

5.8 Government Contracts

5.9 Private Equity and Venture Capital Funding

6. Global SDR Market Regulatory Framework

6.1 Frequency Allocation Policies

6.2 Licensing and Certification

6.3 Defense Contracting Guidelines

6.4 Spectrum Management Standards

7. Global SDR Future Market Size (in USD Bn)

7.1 Future Market Projections

7.2 Key Factors Driving Future Growth

8. Global SDR Future Market Segmentation

8.1 By Component (in Value %)

8.2 By Frequency Band (in Value %)

8.3 By Application (in Value %)

8.4 By End User (in Value %)

8.5 By Region (in Value %)

9. Global SDR Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Business Model Innovation

9.3 Market Penetration Strategy

9.4 Partnership and Collaboration Opportunities

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved mapping the SDR market ecosystem, including stakeholders from defense, telecommunications, and public safety sectors. Extensive desk research was conducted to gather data from secondary and proprietary sources, ensuring the identification of variables influencing the market.

Step 2: Market Analysis and Construction

Historical data regarding SDR market penetration, market-to-service ratios, and revenue generation was compiled and analyzed. Service quality and performance statistics were assessed to ensure accuracy and reliability in estimating revenue projections.

Step 3: Hypothesis Validation and Expert Consultation

Market assumptions were validated through consultations with SDR experts from various industries. CATIS was used to engage experts, providing financial insights and operational data, refining the accuracy of the report.

Step 4: Research Synthesis and Final Output

The final phase involved direct engagement with SDR manufacturers and service providers. Insights into product segments, sales trends, and consumer preferences were used to verify and complement bottom-up data collection methods, producing a validated report.

Frequently Asked Questions

01. How big is the Global SDR Market?

The global SDR market was valued at USD 27.5 billion, driven by growing demand for flexible communication systems across defense and telecommunications industries.

02. What are the challenges in the Global SDR Market?

Key challenges in the global SDR market include the high initial cost of implementation, technical complexity in system integration, and limited awareness in emerging markets. Overcoming these challenges is critical for market expansion.

03. Who are the major players in the Global SDR Market?

Major players in the global SDR market include BAE Systems, Northrop Grumman, Elbit Systems, Thales Group, and Raytheon Technologies, which dominate through their established presence in defense and telecommunications sectors.

04. What are the growth drivers of the Global SDR Market?

Growth drivers in the global SDR market include increasing defense communication needs, the rise of IoT and 5G technologies, and government investments in public safety communication systems.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.